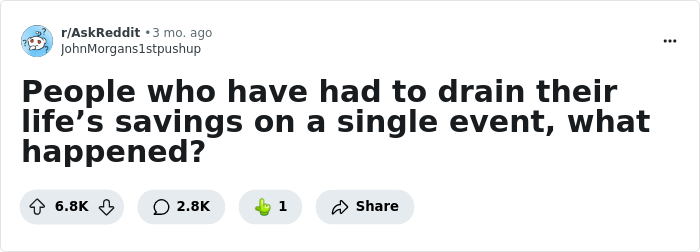

From Sad To Shocking, 31 People Share How They Lost All Their Savings Because Of A Single Event

I once read somewhere that there are three types of people: those who only save, those who never save and only splurge, and lastly, those who find a balance between saving and also having fun with their money. However, just because you have savings doesn’t guarantee anything.

Life happens and anyone can hit rock bottom at any time. Just look at these folks who shared how they drained all their life savings in a single incident. While reading, you might realize that it can also happen to us, which is quite scary, isn’t it? Well, just scroll down and check them out for yourself!

More info: Reddit

This post may include affiliate links.

Cyclone Marcia hit.

Cyclone Marcia hit.

My town is nestled in between a bunch of mountains, it should have been all but impossible for the cyclone to pass over us. But somehow it picked the gap and went right over the top of us.

A 2.5 ton gum tree in the neighbour's yard snapped at the base and landed on the roof of the unit I was renting. At the time, I was sleeping in my bed. I was awoken by the crack of the tree breaking and opened my eyes to watch the lead branch come through the roof right above my bed. All of the windows in my unit imploded and the unit flooded.

I lost 95% of my possessions.

And that's when we found out that our conservative PM Tony Abbott had drained the natural disasters slush fund. I - already broke and now unable to work because all of my gigs would be cancelled until the town had rebuilt - was granted a total of $850 by the government to rebuild my life (had he not misappropriated the money, I should have been eligible for about $10k).

6 weeks later - when I finally had a new unit to rent - I spent that money on a bed. Luckily for me, the owner of the warehouse had heard about what happened, and when that bed was delivered two weeks later, he had gifted me an entire house's worth of furniture and appliances to go with it. Everything I needed to start my life again (except a car, which I had to replace because it died in the cyclone too).

If it weren't for that man's generosity, I would still be rebuilding that life now, ten years on.

I will never forget what he did for me. Just as I will also never forget what the LNP allowed to happen to the natural disaster rebuilding funds.

WOW thats very unlucky. such an amazing thing for people to come together in tough scenarios though.

My wife's cancer. Spent every dollar I had. Leveraged all the credit I had. Now I live in my car.

My wife's cancer. Spent every dollar I had. Leveraged all the credit I had. Now I live in my car.

But she has secure housing and food to eat. So I have absolutely no regrets.

We all know how important it is to have some savings tucked away, because let’s be real, life loves to throw trouble when we least expect it. However, here’s the scary part: about 42% of Americans don’t have an emergency fund at all. This means that a single unexpected bill could throw nearly half the country into panic mode.

Imagine your car breaks down, or you suddenly lose your business. You check your bank account and realize you’re flat out of luck. It’s not just stressful; it can be truly terrifying. We’re talking about real life-or-death situations in some cases.

In fact, a recent study from early 2025 found that 37% of U.S. adults had to dip into their emergency savings in just the last 12 months, and 80% of them used that money for absolute essentials.

CPS brought my grandchildren to me and said sorry we cant pay you as a foster parent and we cant help you get any food stamps or anything but here are you badly a****d grandchildren. If you dont take them we have to send them back to the a****r. $15000 for clothes and furniture and a bigger house and providing basics of life until court, which was $8000, then I finally got a little financial help but I am still supporting three of us on $1600 a month in cash and benefits. Life savings gone, credit score dropped 200 points in a year and as they will be living with me another ten years I am already 60 i know I will never dig myself out of this hole. If you arent able to take care of children DONT HAVE THEM.

CPS brought my grandchildren to me and said sorry we cant pay you as a foster parent and we cant help you get any food stamps or anything but here are you badly a****d grandchildren. If you dont take them we have to send them back to the a****r. $15000 for clothes and furniture and a bigger house and providing basics of life until court, which was $8000, then I finally got a little financial help but I am still supporting three of us on $1600 a month in cash and benefits. Life savings gone, credit score dropped 200 points in a year and as they will be living with me another ten years I am already 60 i know I will never dig myself out of this hole. If you arent able to take care of children DONT HAVE THEM.

Terminally ill child. I made 6 figures, but as a single mom quit to care for my child in Oct 2013. Cashed out my govt retirement, 200k, all went to medical costs. Nursing care and caregivers were 9k a month. 5k after insurance and Medicaid. My folks spent 300k of their life savings on his care.

Terminally ill child. I made 6 figures, but as a single mom quit to care for my child in Oct 2013. Cashed out my govt retirement, 200k, all went to medical costs. Nursing care and caregivers were 9k a month. 5k after insurance and Medicaid. My folks spent 300k of their life savings on his care.

He passed away July 2022. I have been chipping away at the massive medical debt that I have, have 0 retirement.

Would do it again in a heartbeat. .

The sad part is that you shouldn't have had to do it in the first place.

My son died in Minnesota in 1996, we had state programs that paid past private insurance (my husband I kept working for thee insurance), and in place when we maxed out both insurance policies in 8 mos. Trump makes me fear the future of Medicare and Medicaid

Trump big bogus bill took 10 billion from Medicare /medicaid /food stamps. It'll go for the next 10 years. My anger is also for the future, if we get a Dem potus and majority in again, the people will blame them for their future medicaid etc losses even tho it was 100% trumps doing. Disgusting regime.

Load More Replies...My friend's sister's baby was born with severe birth defects. Months in NICU, then in and out of hospital for 2 years. Parents got a flat near the hospital (paid for by health insurance) and other than that paid only for the coffee they brought along, the parking, and the cake for the nursing staff. Glasgow / Scotland

Age 21. $12k in the bank. Time to backpack around europe. Two thumbs up.

Age 21. $12k in the bank. Time to backpack around europe. Two thumbs up.

Age 26. Was very depressed. Had, idk $6k. Decided to go on the great American road trip. Two thumbs up do recommend.

Age 32. Had $50k in bank account. Had cerebral spinal fluid vein collapsd, 2 years catatonic. Brain surgery helped, but still can't work. Two thumbs down, do not recommend.

As you can see in the list, many people lost their life savings mainly because of medical emergencies. That’s honestly one of the most heartbreaking reasons. Think about it: you’re already dealing with a health crisis, which is scary enough on its own. Then you’re also hit with bills you can’t afford, and next thing you know, your savings are completely drained.

However, the worst part is that when you are out of cash, you’re forced to borrow. Being completely broke and still needing to come up with thousands more just to stay alive or take care of someone you love. Sounds nightmarish, doesn't it?

Want to hear some shocking stats? Around 14 million Americans (6% of adults) owe more than $1,000 in medical debt, but it gets worse, because about 3 million people (1% of adults) are drowning in over $10,000 of medical debt. As wild as it is, it really shows how one medical emergency can turn your entire financial life upside down within the blink of an eye.

Pregnancy conplication led to my wife almost losing her life, our twins being born premature, and ultimately, they didn't survive.

Pregnancy conplication led to my wife almost losing her life, our twins being born premature, and ultimately, they didn't survive.

I have no money, no savings, no kids. Just a wife trying her best to cheer me up on what should have been my first father's day.

Cat emergency surgery. I was 19 and working in fast food, only had $4k in savings.

Cat emergency surgery. I was 19 and working in fast food, only had $4k in savings.

They saved him, but he became a tripod kitty for his last 6 years.

My husband got double pneumonia and was in the hospital in an induced coma for 8 weeks. He did regain consciousness and was transported to a critical rehab center. I had one day with him before he became catatonic and was transported to another hospital. No obvious reason given. Although several large bruises on his arm and stomach. While he was there, I reviewed his charts to find that he was being administered f**tanyl every 3 hours. He said he was in no pain and was hallucinating continuously. I questioned the staff and left messages to the doctors that went unanswered. Later that day, as I hugged him, I noticed that his abdomen was rock hard. The doctor on staff ordered tests and found sepsis throughout his entire system. After much thought, I ordered the life support turned off. Ten minutes later my hubby of 44 years was gone. So. Made a complaint with the bureau of hospitals. And was told they couldn’t find any malpractice. Even though his computer generated charts had many entries at 2, 3, 4 AM stating “ reviewed progress with patient and family”…no, I wasn’t there then and he was in a coma. So, $4.3 million with about 20% not paid by insurance drained 401k, IRA an.

My husband got double pneumonia and was in the hospital in an induced coma for 8 weeks. He did regain consciousness and was transported to a critical rehab center. I had one day with him before he became catatonic and was transported to another hospital. No obvious reason given. Although several large bruises on his arm and stomach. While he was there, I reviewed his charts to find that he was being administered f**tanyl every 3 hours. He said he was in no pain and was hallucinating continuously. I questioned the staff and left messages to the doctors that went unanswered. Later that day, as I hugged him, I noticed that his abdomen was rock hard. The doctor on staff ordered tests and found sepsis throughout his entire system. After much thought, I ordered the life support turned off. Ten minutes later my hubby of 44 years was gone. So. Made a complaint with the bureau of hospitals. And was told they couldn’t find any malpractice. Even though his computer generated charts had many entries at 2, 3, 4 AM stating “ reviewed progress with patient and family”…no, I wasn’t there then and he was in a coma. So, $4.3 million with about 20% not paid by insurance drained 401k, IRA an.

Here’s something a lot of people don’t realize: draining your life savings isn’t just a financial disaster. It can actually affect your health. Basically, losing it can shorten your life. Yeah, you read that right!

There was a study that looked at people in middle to older age, and it found something pretty intense: if someone lost 75% or more of their total wealth within just two years, they were 50% more likely to pass away over the next 20 years compared to those who didn’t. That’s a huge difference.

The thing is, the stress and emotional toll of losing everything is massive. It can adversely impact your mental health. Plus, when people suddenly lose their money, they often start skipping medical care because they just can’t afford it anymore, and that just adds up fast.

Just as I was building a decent savings, I suffered a non work related injury. I was out for a year and medical bills wiped my savings. Started over with $500 in my account.

Just as I was building a decent savings, I suffered a non work related injury. I was out for a year and medical bills wiped my savings. Started over with $500 in my account.

I was 17, depressed as f**k, and decided as a last hurrah I'd take two weeks and drive across the country to see Tool and do a bunch of psychedelics. Stopped at a bunch of tourist traps along the way, because f**k it. Spent every penny I had and went $3500 into debt on my credit card

I was 17, depressed as f**k, and decided as a last hurrah I'd take two weeks and drive across the country to see Tool and do a bunch of psychedelics. Stopped at a bunch of tourist traps along the way, because f**k it. Spent every penny I had and went $3500 into debt on my credit card

Honestly, that trip saved my life. Worth every penny. I'd recommend to anyone thinking of making the final decision to first go on a "f**k it" trip. Worst case scenario, you won't be there to see the repercussions. Best case scenario, it'll change your life. I was in the latter camp.

This doesn't actually work for a large portion of the s******l population. The excess wracks up too much guilt for it to seem like an enjoyable idea, and that's not even considering anhedonia. Hard to plan a 'f**k it' trip when you don't think it'll be enjoyable.

My mom died and my brother was homeless from it. Had to pay for the funeral, which was not cheap, and get my young brother set up. I’m young as well tho so there is time to build it up again.

My mom died and my brother was homeless from it. Had to pay for the funeral, which was not cheap, and get my young brother set up. I’m young as well tho so there is time to build it up again.

How old was the brother, and I'm assuming he lived with the mom, right?

Researchers call this sudden loss of money a "wealth shock," and believe it or not, it's not a rarity at all. In fact, the study that we spoke about before mentioned that more than 1 in 4 Americans (over 25%) experienced a wealth shock over a 20-year period. That's not a few isolated stories, but something that’s affected millions of people, across all walks of life.

Job losses, medical emergencies, market crashes, bad investments—anything can just unravel your whole life before you know it. The study also found that losing your wealth later in life can be just as damaging to your life expectancy as never having had any wealth at all. Basically, your financial safety net isn’t just about living comfortably; it can literally be the difference between life and your demise.

Double whammy, quit my job to start a business with 1 year of savings. 3 months later... Covid, then skin cancer, then colon cancer. My a*s can never retire.

Double whammy, quit my job to start a business with 1 year of savings. 3 months later... Covid, then skin cancer, then colon cancer. My a*s can never retire.

Taxes, I was young, early twenties, and my folks couldn't afford the taxes on the family farm. Took my entire bank account to get that settled. Happened a few more times throughout my twenties. I often wonder if I just should have let it go.

Taxes, I was young, early twenties, and my folks couldn't afford the taxes on the family farm. Took my entire bank account to get that settled. Happened a few more times throughout my twenties. I often wonder if I just should have let it go.

My teenage son was in a car wreck. He was air lifted in a medical helicopter. He was in ICU for 2 weeks. Had 8 emergency surgeries and was on 10 different IV medications, on Dialysis, was in a medical induced coma, was on a ventilator and was tube feeding! He ended up passing away! We were off work for a couple of months, had his funeral and it took all of our savings to be able to make it through. Life sometimes happens unexpectedly!

My teenage son was in a car wreck. He was air lifted in a medical helicopter. He was in ICU for 2 weeks. Had 8 emergency surgeries and was on 10 different IV medications, on Dialysis, was in a medical induced coma, was on a ventilator and was tube feeding! He ended up passing away! We were off work for a couple of months, had his funeral and it took all of our savings to be able to make it through. Life sometimes happens unexpectedly!

I'm sorry for your loss, and for the unexpected pain in your life. I hope you are OK.

To be honest, that troublesome research sent a shiver down my spine, and I really hope my savings don't drain out like this. It definitely opened my eyes about how careful we have to be when it comes to our finances. Don't you agree? What would you do to ensure you never run out of your savings? Also, were you able to relate to any of the stories in this list? Let us know in the comments!

Maternity leave. Company initially agreed to fully cover it 100%. Then with eight weeks left decided the policy didn’t apply to me on a technicality and said the rest would be unpaid and they’d need to reconcile what I’ve been paid thus far. Our childcare arrangements cannot start earlier than planned, so going back to work ahead of schedule isn’t an option (nor should I have to consider it with a two month old baby, but welcome to America).

Maternity leave. Company initially agreed to fully cover it 100%. Then with eight weeks left decided the policy didn’t apply to me on a technicality and said the rest would be unpaid and they’d need to reconcile what I’ve been paid thus far. Our childcare arrangements cannot start earlier than planned, so going back to work ahead of schedule isn’t an option (nor should I have to consider it with a two month old baby, but welcome to America).

This is idiocy. Why can't a civilized country offer its mothers, who nurture the next generation, a decent maternity leave? We have 4 to 6 weeks before the birth and 10 weeks after the birth with your pay intact. Scandinavian countries offer, I think, almost up to a year.

It wasn’t instant but could have been. Siphoned off my father’s retirement while he went to Assistive Living, then Memory Care. Alzheimer’s can eat a bowl full of d***s.

It wasn’t instant but could have been. Siphoned off my father’s retirement while he went to Assistive Living, then Memory Care. Alzheimer’s can eat a bowl full of d***s.

I had to sell my mom's house to pay for her Alzheimers care. She made too much money to qualify for Medicaid but not enough for the care she needed. Yes. Alzheimers CAN eat a bowl of d i c k s.

I was trying to get a better job, the employee said I was perfect, but they wanted someone local. I emptied my bank account and cashed in what little I had in my 401k to pay for the move.

I was trying to get a better job, the employee said I was perfect, but they wanted someone local. I emptied my bank account and cashed in what little I had in my 401k to pay for the move.

I went all in, and it paid off in the end, but man I can't tell you how terrified I was that we would could become homeless, and it would have been my fault.

My soon to be ex wife f****d another dude and now im 40k in debt fighting for access to my kids.

My soon to be ex wife f****d another dude and now im 40k in debt fighting for access to my kids.

Sheesh, stories like this make me so mad, talk about a double standard.. the wife here was the homewrecker who knowingly and willingly nuked her family, yet the husband has to fight tooth and claw and suffer life-changing financial debts just to see his own children...

Stroke and divorce. I've had to dip into my IRA. If that wasn't there, I'm not sure what would have happened.

Stroke and divorce. I've had to dip into my IRA. If that wasn't there, I'm not sure what would have happened.

My divorce nearly killed me, Ex wife l left me in so much debt that i was NEARLY blacklisted. 10 years to pay off majority of the debt. Would NOT recommend

Partner’s business failed.

Partner’s business failed.

She borrowed money from my 83 yr old mom, and I emptied out my Roth IRA to save it.

A month after handing over everything, she decided she was poly and wanted to sleep with her coworker.

I tried to handle it all, but it absolutely broke me.

It’s been almost two years and she’s still fighting the divorce. .

I had a few grand saved, but was offered an entry level software developer job on the other side of the country. I used that money to pay for an apartment, pay for the move and other expenses. Getting your first job as a developer is incredibly difficult, particularly for self taught (although it was probably easier 11 years ago when I did it)

I had a few grand saved, but was offered an entry level software developer job on the other side of the country. I used that money to pay for an apartment, pay for the move and other expenses. Getting your first job as a developer is incredibly difficult, particularly for self taught (although it was probably easier 11 years ago when I did it)

It worked out, moved on to a better paying job and the career has never lost steam since.

I'm self learning front end to get into the biz. I'm 52f and hoping to land a remote job doing freelance. I'd love to leave factory and customer service work finally. Goal is full stack dev. :) posts like these give me hope. I live in a cheap area of S. Indiana so it'd really help me save more money by making better money. Self taught FTW!

Happened twice:

Happened twice:

1st time. My wife and I were fostering medically fragile infants. One of three families in Texas, at the time, qualified to do that. We had a nurse living with us and had 24 hour care for two of the infants. We. flat. loved. it. You feel a very strong purpose when you are opening your home to such a complex set of challenges. Needless to say, my per-monthly bills for everything we were doing, exceeded $10k... per month. I was let go from the job I had for 14 years. Bad politics in the office and my whole team was ditched. We were able to make it 2 years on everything we had saved... we ended up having to retire from fostering and had to sacrifice everything but some furniture and personal effects.

2nd time: Wife started uncontrollably throwing up... even drive heaving and we tried to figure it out on our own but after a this coming and going, it was now non-stop. We called and ambulance and my wife was in the hospital for 4 months. Sure insurance was present but my out of pocket drained us down again to just $2k to our names.

I am about $4k away from recovering from that.

Bonus item: My wife had numerous procedures and 5-9 operations. We lost track among all the other tests. She was sent home with basically the same condition and a bunch of meds... and after two days, she stopped the meds cold turkey, so to speak, and slowly popped right out and back healthy. A one day difference. We found out later that it was part of her LUPUS and part medicine combos that triggered the LUPUS reaction. She's strong and mows the lawn just because she gets to prove to herself that she's back and better than ever. She also has a playlist on her iPhone for mowing the lawn that might actually cause unsuspecting victims a shock. :)

To anyone facing this situation. You can and will overcome it and you will have gained so much personal growth. Endure it, have a plan and execute it. The comfort you will get from having a plan and sticking to is it peace of mind and good rest at night. Personal experience I'm sharing with you, here.

Sorry, but why do Americans accept this debt instead of screaming for state health care?

My son passed away at 19. I worked my whole life to raise my family and finally got out of debt and started saving…..now I’m 6k in debt from burying my son. 😞.

My son passed away at 19. I worked my whole life to raise my family and finally got out of debt and started saving…..now I’m 6k in debt from burying my son. 😞.

OP says his son committed su!cide. I've been su!cidal most of my life and have made two (quite serious) attempts and I can say that, no matter how bad the pain is in THAT moment (and I know exactly how bad it can be), sometimes you have to realize that you will be leaving behind SO MUCH MORE PAIN if you do commit su!cide. Your family/loved ones will suffer pain for the rest of their lives, wondering if they did something wrong, what they could have done differently, if they could have saved you. We know that there sometimes isn't anything they could have done, but THEY won't know that, once we're dead. I'm NOT saying su!cide is always "wrong", but I AM saying... maybe take one breath and think about the people you DO love and ask yourself if you can be strong enough to not cause pain to them. I know my own family wouldn't care, personally speaking, but I have pets who need me, so I am alive for them <3

It was 2 events in rapid succession. My beautiful, sweet, funny son died very suddenly and the funeral needed to be paid for. 2 months later, my much loved dog got sick, needed round the clock care, and that drained the rest of it plus having to use credit cards. He ultimately died horribly.

It was 2 events in rapid succession. My beautiful, sweet, funny son died very suddenly and the funeral needed to be paid for. 2 months later, my much loved dog got sick, needed round the clock care, and that drained the rest of it plus having to use credit cards. He ultimately died horribly.

I was 19 and lost everything I had in a fire except my car and the clothes on my back. My parents abandoned me when I was 16 and my extended family did not want to help me, so I had no support. A week later, my car was totaled and the insurance pay out only covered the value left on the loan. I joined the military the next week. Took me 20 years to rebuild my life.

I was 19 and lost everything I had in a fire except my car and the clothes on my back. My parents abandoned me when I was 16 and my extended family did not want to help me, so I had no support. A week later, my car was totaled and the insurance pay out only covered the value left on the loan. I joined the military the next week. Took me 20 years to rebuild my life.

I suffered a massive bilateral pulmonary embolism in January 2024 at 36 yrs old and was out of work for months. Back to work now but had to start over with my savings. 😖.

I suffered a massive bilateral pulmonary embolism in January 2024 at 36 yrs old and was out of work for months. Back to work now but had to start over with my savings. 😖.

Husband wanted to move to Montana. Sold everything, gave up a fully paid house. I went up first with two kids because I had a job and housing lined up.

Husband wanted to move to Montana. Sold everything, gave up a fully paid house. I went up first with two kids because I had a job and housing lined up.

Husband arrived two months later, declared he hated the town, refused to work or contribute to the family in any way (he wouldn't even babysit.) We gave up two years later, were divorced two years after that.

Divorce. We had significant debt and decided to pay it all off with our savings so we could both walk away scott-free. He got the house and furniture and I was given $2000 to start over. It was really hard to bounce back but now I'm happy that I got all new things and not living with the memories of our martial items.

Divorce. We had significant debt and decided to pay it all off with our savings so we could both walk away scott-free. He got the house and furniture and I was given $2000 to start over. It was really hard to bounce back but now I'm happy that I got all new things and not living with the memories of our martial items.

He got house and furniture, OP got $2000. Ouch. (OP says he argued that he was taking on the debt of the mortgage - but he then sold the house in the housing boom for $150000 more than he owed. Double ouch.)

Roof replacement, unexpected travel for a parent funeral, planning/paying for the other parent funeral, sickness, SO emergency oral surgery.

Roof replacement, unexpected travel for a parent funeral, planning/paying for the other parent funeral, sickness, SO emergency oral surgery.

All in the span of a month.

I've seen "funeral" pop up on this list so many times, I couldn't imagine doing that to my partner or one daughter. Ffs at that point I'd be a slab of meat. By all means donate any useful parts, cremate me in an inexpensive way if for some reason people want my dust or bury me at sea off the coast of Alaska. Could even just be wrapping me in burlap and tossing me overboard 🤣 don't mean to be grim, but I don't want my cessation of life to hinder/ruin any of my loved ones' continuation of life...I should probably get this in legal writing in some way...

Purchasing a home 2 years ago took all my money. 2 years later we're still struggling to save.

Purchasing a home 2 years ago took all my money. 2 years later we're still struggling to save.

It's really sad reading these to see how may people are bankrupted just because they happen to live in a country with such a complete train-wreck of a healthcare 'system'. Even with insurance it seems that serious illness, in at ;east one case resulting in death of a loved one, can leave someone almost destitute with no savings, no pension, no provision at all for later life. And yet they voted, twice, for someone whose goal it is to make it even worse.

Reading these stories, if I lived in the US I would be making every effort to get the hell out. I was in hospital here for 6weeks and then 8 months as outpatient. I paid for parking, sometimes.

Load More Replies...Many of these are caused because the inhabitants of a certain country have their priorities set differently than in Europe. All our "luxury" services, protecting people, were fought for during the past 200 years. I work for an US company in the Netherlands. A lot of Trump-caused management decisions have their effect here, too. What the US headquarters fail to understand, is our social and health security system. If we loose our job, we still have a monthly income and still a health insurance, because we pay taxes and monthly fees to various national organisations to cover this scenario. Of course we need to find a new job, the income gets lowered after a few months, but health care won't change. So we are less scared of loosing a job, because important things are independent from being employed.

And now you understand. We have been indoctrinated to “not want” universal healthcare or social safety nets so that we work 80 hours a week, or two or three jobs, with minimal holidays because we are left with no income and no healthcare if we seek better employment conditions. Coupled with “at will” employment, no healthcare without a job and no meaningful unemployment payments, most Americans live in fear of losing their job. There are reasons why we have lower life expectancy and higher stress related illnesses than other industrialized nations. But we are fed a diet of “we are the best” so we don’t see it or when we do we think the nations who don’t live this way somehow aren’t ‘“free”.

Load More Replies...These posts making me thankful that 1. I live in a country with universal health care, and 2. I have income protection insurance. Yes, it's expensive, but I'm freelance self-employed and my job is highly physical. If I get injured to a point where I cannot work, I have no support system and I'm totally screwed. My industry is volatile enough anyway that my savings often get wiped out by lack of work

It's really sad reading these to see how may people are bankrupted just because they happen to live in a country with such a complete train-wreck of a healthcare 'system'. Even with insurance it seems that serious illness, in at ;east one case resulting in death of a loved one, can leave someone almost destitute with no savings, no pension, no provision at all for later life. And yet they voted, twice, for someone whose goal it is to make it even worse.

Reading these stories, if I lived in the US I would be making every effort to get the hell out. I was in hospital here for 6weeks and then 8 months as outpatient. I paid for parking, sometimes.

Load More Replies...Many of these are caused because the inhabitants of a certain country have their priorities set differently than in Europe. All our "luxury" services, protecting people, were fought for during the past 200 years. I work for an US company in the Netherlands. A lot of Trump-caused management decisions have their effect here, too. What the US headquarters fail to understand, is our social and health security system. If we loose our job, we still have a monthly income and still a health insurance, because we pay taxes and monthly fees to various national organisations to cover this scenario. Of course we need to find a new job, the income gets lowered after a few months, but health care won't change. So we are less scared of loosing a job, because important things are independent from being employed.

And now you understand. We have been indoctrinated to “not want” universal healthcare or social safety nets so that we work 80 hours a week, or two or three jobs, with minimal holidays because we are left with no income and no healthcare if we seek better employment conditions. Coupled with “at will” employment, no healthcare without a job and no meaningful unemployment payments, most Americans live in fear of losing their job. There are reasons why we have lower life expectancy and higher stress related illnesses than other industrialized nations. But we are fed a diet of “we are the best” so we don’t see it or when we do we think the nations who don’t live this way somehow aren’t ‘“free”.

Load More Replies...These posts making me thankful that 1. I live in a country with universal health care, and 2. I have income protection insurance. Yes, it's expensive, but I'm freelance self-employed and my job is highly physical. If I get injured to a point where I cannot work, I have no support system and I'm totally screwed. My industry is volatile enough anyway that my savings often get wiped out by lack of work

Dark Mode

Dark Mode

No fees, cancel anytime

No fees, cancel anytime