Interviewer Gives 20 Y.O. A Reality Check After She Jokes About Her $4k Credit Card Debt

Financial literacy isn’t just one of those things that happens by accident, we either learn it from someone in the know or we learn it the hard way, from an empty bank account. So it can be helpful to hear the stories of other’s mistakes to avoid them ourselves.

Financial advice blogger Caleb Hammer went viral on TikTok after interviewing a twenty-year-old who ended up thousands in debt after she didn’t understand the difference between credit limit and debt. We reached out to Caleb via email and will update the article when he gets back to us.

More info: TikTok

Credit cards might not be the most intuitive things to understand for a young person

Image credits: Tima Miroshnichenko / pexels (not the actual photo)

But one twenty-year-old didn’t know the difference between a credit limit and debt, ending up in the latter

Image credits: calebhammercomposer

Rylie: With my credit card, I maxed that out to $4,000.

Caleb: What do you mean you maxed it out? Max it out or maxed it out?

Rylie: I got confused with the credit debt and the credit limit. So my parents got me a credit card. And I ended up getting a max credit limit of $8,000. So I could spend up to $8,000. That’s what that means, right? So I would use it and I would take my boyfriend, we would go out, me, my friends, we would go out and I’d pay for everybody. ‘I got it. Oh, I’ll spend the money, don’t worry about it, it’s just a credit card.’ So I would pay and pay and pay and pay. And then I called my mom one day, and I wanted her to be proud of me. So I was just like, ‘Hey, I’ve got $4,000 credit on my credit card.’ And she’s like, ‘Credit limit or credit debt?’ I was like, ‘What’s debt?’ And she’s like, ‘Oh, that’s bad.’ I’m like, ‘Oh, really? Okay. So it’s $4,000 debt, then.’ She’s like, ‘That’s bad. Why did you do that?’ I’m like, ‘I thought that was good.’ She’s like, ‘No, your credit limit at the time was $8,000.’ So I was like, ‘Okay, well, the credit limit is $8,000. That’s good, right?’ And she’s like, ‘Yes, but you are $4,000 in debt.’

Image credits: calebhammercomposer

Caleb: When was this?

Rylie: Last year.

Caleb: Okay, and then what?

Rylie: And then they’re like, ‘Screw it, you’re not gonna pay this off in time. Give it to me.’ So my parents took it and they’re still currently paying it off right now.

Rylie: They’ve been paying it off from $4,000. They just basically gave up and said ‘You’re not gonna pay this in time. You’re moving out and you have a $4,000 credit card, you’re not going to pay that off in time, you’re gonna get so overwhelmed. So just give it to me. And then we’ll pay it. And then whenever…’

Image credits: calebhammercomposer

Caleb: Listen, I don’t want you to suffer in debt. But is that helping you? Is that teaching you? I don’t think so. I think they’re done. You get it to zero, and over the next couple of years, maybe even when you start making more money and your lifestyle, inflate yourself, you just bring it right up to the $12,500. That sounds like some form of enablement to me.

Rylie: Well, I mean, they said, ‘Whenever we pay it off, over time, you can pay us back that $4,000.’ I’m like, okay, cool. And then like, ‘Well, we’re gonna keep it, but if you need help with like something with your car, or with your cat or with your dog or something, you can just ask us for it. And you can use it, and then you can pay that off.’

Caleb: Why are they just like funding [your life]… You make money?

Rylie: Yeah.

Caleb: Where’s the money going where you can’t take care of yourself as an adult? You wanted to move out, like an adult.

Rylie: Yeah.

Caleb: But you have to rely on them taking care of you? I’m confused. Why can’t you take care of your own s**t?

Rylie: Well, I can. I can. I mean…

Caleb: Then why don’t you?

Rylie: I do, I do. I mean, if…

Caleb: Not from everything you just said…

Image credits: calebhammercomposer

Rylie: My rent currently is $1,400, something like that.

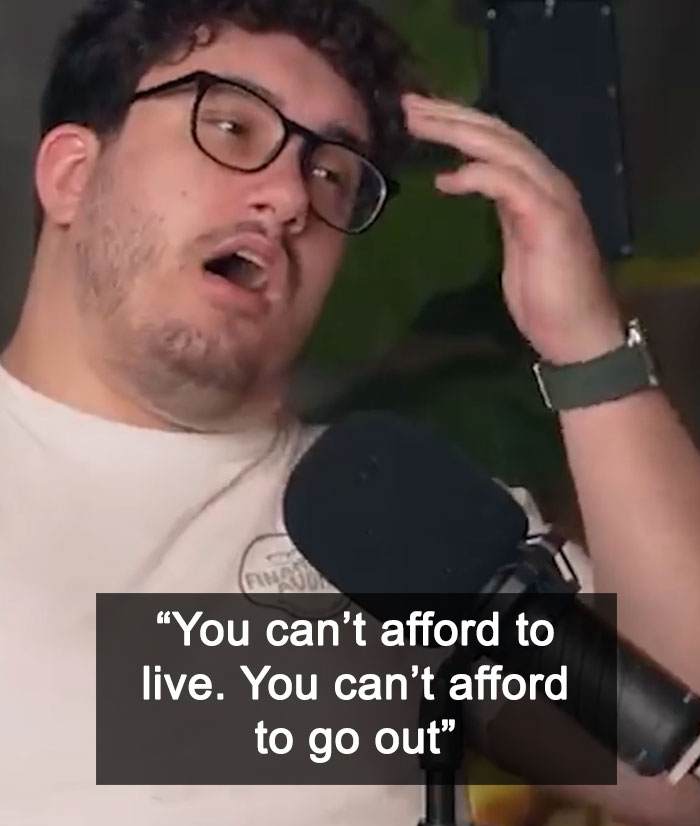

Caleb: That’s insane, you can’t afford to live. You can’t afford to go out.

Rylie: Yes, I can.

Caleb: No, you can’t! The income that came in was $1,600, rent is $1,400. That’s not ‘affording.’ That’s your needs, 80%.

Rylie: Girl math.

Caleb: This is not a joke.

Rylie: I’m not treating it as a joke.

Caleb: *It’s girl math.* Math math says it’s about 80% of your income.

Rylie: Yeah, I mean, we get income from other ways too.

Image credits: calebhammercomposer

Caleb: Okay, I saw $128 came in from Lackland. And $263 came in from Cash App. So $2,000. So even still, your rent of what, again?

Rylie: Almost $1,400

Caleb: Okay. Okay. It’s 70%. You cannot afford it. It shouldn’t be higher than 30%.

Rylie: Well, what I do is I go donate on the side, too.

Rylie: But if like for whatever reason, like I feel like we’re low, a couple hundred dollars on rent, we’ll go donate for the first couple days before rent’s due, we’ll grab the money.

Image credits: calebhammercomposer

Caleb: No offense, you could not move out.

Rylie: I did though.

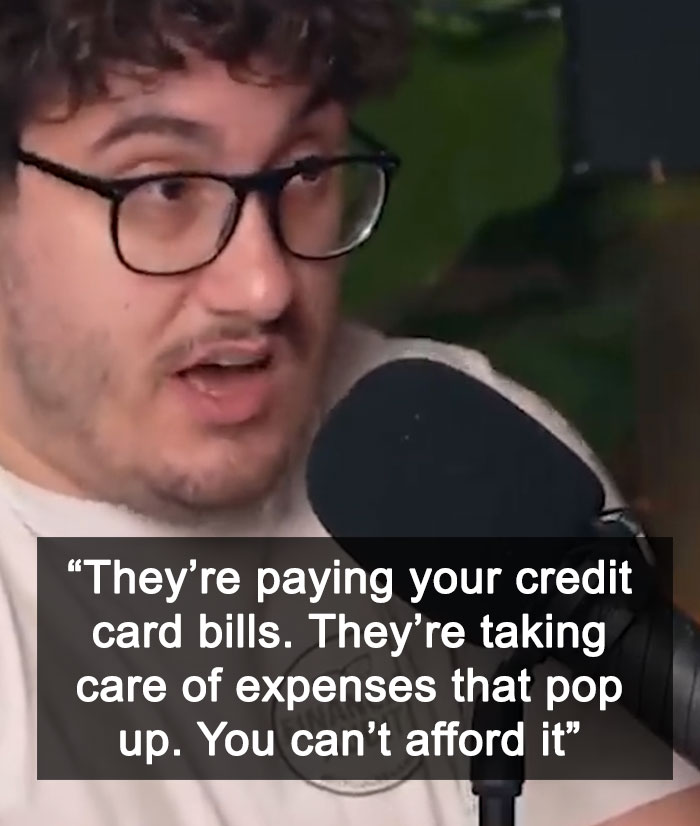

Caleb: Yeah, but you’re not affording it. And don’t say ‘I am affording it,’ because I’ll tell you how you’re not affording it. They’re paying your credit card bills. They’re taking care of expenses that pop up. You can’t afford it. You’re being enabled.

Rylie: I’m not being enabled.

Caleb: Yes. Because your money is going to f**k you.

You can watch the full video here

@calebhammercomposer 20 Year Old Doesn’t Know What DEBT MEANS!!! 🤦♂️🤬 #financialaudit ♬ original sound – Caleb Hammer

Young adults tend to have the worst financial literacy around

Image credits: Karolina Grabowska / pexels (not the actual photo)

As much as money “runs the world,” many people tend to have no idea how to act when they get access to it. To this young woman’s credit, her first impulse was misguided generosity, although it’s worth noting that in this case, it’s not exactly her money. While it might seem ridiculous that the woman being interviewed believed that a credit limit is free money, research suggests that young people in general have the lowest financial literacy among all age cohorts.

Partially, this can be seen as a result of some social taboos around discussing money. While, contrary to the many memes out there, many schools do teach some about taxes and finances, this is all very abstract until the young adult has money in hand. How they spend it is often a reflection of what they have seen their parents do. Some parents spend a lot because they are financially stable, others are frugal, but without clear explanations of why they do what they do, their kids don’t exactly learn any new lessons.

However, generally, most adults don’t exactly discuss their financial decisions with their children and maintain a very different level of income. While it can be easy to mock someone for having no idea what a credit limit is, it might also be worth questioning why her parents gave her a credit card without actually explaining how it works.

There are even organizations that prey on unwitting young folks

Image credits: Craig Adderley / pexels (not the actual photo)

A lack of financial literacy isn’t just some buzzword or abstract concept, it can often be measured in real-world impacts. For example, many young adults, like the woman in this clip, end up in debt that is realistically disproportionate to their income. The fact is that beyond simple misunderstandings about credit cards, there are predatory financial institutions that specifically offer “easy” loans to gullible folks who want an instant dose of retail therapy, leaving them in horrible debt for a long time. It’s not a scam if a willing and “informed” adult signed off on it.

Similarly, once a person is 18, they can gamble in most areas, something betting companies and casinos know very well. Technically, the odds are always “clear” but popular culture has often obfuscated just how intoxicating betting can be, leading people to throw their money away.

One example of this, at least in the US, are the ever-discussed student loans. People who would never qualify for a “normal” loan end up straddled with debt that they pay off for decades to come. There is a segment of society that still blames the loan-takers, but realistically, if we understand that statistically many of them don’t quite understand what they are getting into, can we truly hold them responsible?

Viewers shared their opinions

Poll Question

Thanks! Check out the results:

You May Also Like

Woman Refuses To Chip In For Babysitting Because She Doesn’t Even Have Kids, Asks If She’s A Jerk

Do you think childless individuals should be expected to chip in for group babysitting costs during friend gatherings?

17 Y.O. Is Done Sharing Her Birthday With Her Late Twin, Parents Are Not Having It

Do you think the girl should be allowed to celebrate her birthday without the remembrance of her deceased twin?

STFU with 'girl math'. Just because you're sh*t at managing your money and you're sponging off your parents, you don't get to paint your entire gender as inept.

WTF did I just read?! I need a translator! Rylie: "Well, what I do is I go donate on the side, too. But if like for whatever reason, like I feel like we’re low, a couple hundred dollars on rent, we’ll go donate for the first couple days before rent’s due, we’ll grab the money."

Maybe donate blood or plasma? Some places pay for “donations”.

Load More Replies...Is she dumb or is she dumb? I mean there is uneducated and there is dumb. She has mighty dumb wibes, he explains it and she doesn't get it at all.

I think her parents are a big problem: You give a $8000 grenade in your daughter's hand, and don't even know whether she knows what debt is? They've met her, right?

Load More Replies...She sounds like she deliberately does not want to learn or understand how finances works. Weaponised incompetence at it's worst. . How does she hold a job down with that attitude? Girl math? This is toddler math.

(1) if you don't know how something works, don't use it. (2) If you think a bank is giving you $8,000 to use as you please with no commitment, you're dumber than a box of rocks. (3) Using "girl math" to justify your dumbassery is just further proof about my point no 2 and an insult to the entire "girl" population (4) For the love of Pete, enough with the "like" after every couple of words. It's, like, stupid

(1) Fine I'll stop using a computer. And magnets.

Load More Replies...Even that seems like a lot to me. My wife and I's mortgage is less than 10% of our income.

Load More Replies...Ok, I think just the fact that she's at an age old enough to move out (so adult, or last 2 years being teenaged) and "like every other like word is like" seems to indicate she doesn't pay attention in school enough to learn finances in general (we at least learned how to balance and maintain a bank account with basic and the usual expenses). Both school and parents failed their job big time. My youngest, at 11 recently learned about debt when she made a bet/deal with her sister and owed her a bit from her next allowance. When it came time to collect that month's allowance, the 12 told me "wait, I am supposed to get $X from hers", and 11 said "nope, I take back the deal". Oof, lesson time, so, ME: Nope, that's not how real world works, your sister gets her money owed. She tried to fight it "but this is kids world not adult world". She figured she lost when I came back with "but my parent world says I have to teach you to know how to live in adult world."

In case you don't hear it enough: you're doing an amazing job as a parent

Load More Replies...I'm sorry, but I can't read this. I gave up after the first few sentences. "I was like... ", "And they were like...", "And I was like...". No wonder they didn't know what debt was, they're clearly braindead.

A few do; this one's actively skating into problems.

Load More Replies...I know. At least not on any income I've ever had.

Load More Replies...Girl math is spending a refund from an item to get "free" coffee or a package arriving late that you forgot about being a present from amazon, not going 4k into credit card debt 😭😭

I mean normally I'm "Adult kids have to clean up their messes" but in this case it's the parents fault for giving her a credit card without explaining it to her. HOWEVER. If she's moved out and is all independent she should really be paying for her own things. If she can't afford it then she can't afford to move out and she needs to move back in until she can afford it. There's no issue with them helping her out occasionally that's just being a parent but it seems they're paying for everything?

I think the only way for her to really understand debt is when she goes grocery shopping and the cashier takes a huge pair of scissors and cuts her card in half. And then she can’t eat for two whole days.

Someone needs to cut her off. I'm younger than her and I understand that credit cards are NOT free money. Do teachers not go over anything financial in school anymore? Why give someone a credit card when they have the ability to do stupid shït like this

I'm a millennial. We had zero financial education at school. None. I learned everything thanks to my grandmother who was in finance, but she was active before credit cards were a thing. She never had a problem because she's the type of person who will sit in a bank reading all 27 pages of documentation before signing her name on anything. But I know an absurd amount of people in my generation who f****d up due to not understanding the difference between credit and debit. Or what paying in instalments for things they can't actually afford implies. No understanding of overdrafts, student loans, taxes, hidden expenses, nada.

Load More Replies...I have to think this girl is a "special needs" person because I can't believe she is this oblivious. We were taught finances in school; income, budgeting, check writing, bank balancing, etc... Guess a lot of schools stopped doing this but I read the other day that my state is making this type of class a requirement for graduation starting next year. I am a female and her "girl math" is an insult to all women.

Rent should be 30%? Cute, is this his first day on Earth? Sorry, no matter how little she knows, he has no business telling her off as long as he lives in LalaLand.

I think it depends where and how you live. We pay about 19% of our dual income for a two bedroom. If I only had my income I could do with 25-30% for a studio orr single bedroom and I am not a high earner.

Load More Replies...I think people have pretty thoroughly covered that 1) she is dumb, and 2) her parents failed her. I haven't seen anyone being up the obvious reason her parents decided to pay it off. It's almost certainly to protect their own credit. There is no way a bank is going to extend an $8000 credit limit to someone with no credit history and a $20,000 a year income. Her parents must have opened an account in one of their names and made her an authorized user. Ordinarily it's a good way to help your young adult child build credit and give them access to 'emergency money'. But her parents totally failed her by apparently not explaining anything to her, or at least not double checking she understood, and not monitoring the spending that they were ultimately responsible for.

If this girl has mental problems (and I can't comprehend how anyone without severe mental issues can be soooo dumb), it was very irresponsible and even cruel of her parents to let her have a credit card and live alone...

She looks like that chick who made a video on TikTok saying that out of all of the generations, Gen X is the worst...

Some troll was making fun of me, when I was expressing appreciation for my high school home ec class that taught me how to budget, shop for, and prepare a meal at home- he said that was something out of the 50's. Nope, this is why some young people have insane credit card debt- buying stuff they can't afford, not making a budget, eating out or getting food delivered all the time instead of making food at home...

Sometimes you CAN tell a book by its cover. Undereducated and let down by her parents.

That "girl math" s**t is only cute when you find a couple bucks in the dryer and you're like "ooh, free coffee. Girl Math!"

Stup-id par-ents. Clap, clap, clap clap clap. (lead to) Stup-id chil-dren. Clap, clap, clap clap clap.

You need to understand money, BEFORE you get a credit card. Use play money to do practice rounds of paying bills. No not cash... you are in debt. Flat tire and no cash, you are in debt. No more cash? You eat Ramen noodles for a month. Budget is the key. Do not spend what you do not have. It will put you in "DEBT JAIL".

That system is effed up. Someone like her should not be able to even get a credit card. Not even be able to overdraft her bank account. I can‘t overdraft my bank account. I did this on purpose but I think they would not let me either way, as I don‘t earn enough. Similar with a credit card. I don‘t want to pay a fee but earn too little to get it for free. I don‘t even know what I would use it for other than be able to use the family thing on apple.

70 - 80% of her income just to pay rent, and she sees nothing wrong with it.

This girl can math. And also knows the difference between credit and debit.

Her parents are doing her no favours, like, at all. I couldn't listen to the whole thing. She is so f*cking ignorant. As soon as I started getting pocket money, I learned to budget - I was 10. Wanted the latest record and it cost $20? Well that meant that was all I could get that week, no snacks, no going out. Wanted the fancy flimsy stylish jacket that Mum said barely covered my kidneys? I saved for it since the winter gear my parents got me wasn't "cool". When I finally got a credit card and used it to buy all the Christmas shopping when all I had in my wallet was about 75 cents, I thought "Witchcraft!" and left that puppy at home for the longest time. I only started using the tap payment during the pandemic! How do you not teach your child how to budget?!??!?

Some needs to explain this to her in plainer language. "Using a credit card to pay means you're borrowing money. That means you have to pay it back. It's not free money." Then they need to help her create a budget and show her where every cent of her money goes. And stop paying her bills for her!

Why did this guy interview this woman, just to roast her. I get it she is irresponsible with her money, but that doesn’t mean you have to be a Total jackass to her!

this is weaponized stupidity/dumbness, and her parents gonna pay for it. they literaly paying for her now :D They sew a whip on themself...

"Girl Math." I hate that stupid term. Not all girls hate math or are poor in Math. This girl needs to take Consumer's Math 101 to learn how to manage her money. At the same time, the parents need to stop enabling her and teach her, instead.

I had a hard time following this but Caleb say a person's rent shouldn't be more than 30% of their income? I want to move to wherever he lives!

That's the usual economic rule that bigger companies apply for vetting renters in my country. If their income isn't 3x the rent, they're automatically discarded. And it IS a good theory in that guarantees both payment and a relative comfort to the tenant (1/3 rent, 1/3 utilities/groceries/leisure, 1/3 othes/savings). Problem is, NOBODY F*****G EARNS 3X RENT ANYWHERE ANYMORE.

Load More Replies...Thick as a brick. So are her parents. Why on Earth haven't they taught her basic housekeeping and financial skills. I mean this only mentions RENT. What about food, water, leccy, gas/oil, clothes, council tax (similar), medicines, transport costs, house insurance and other kinds, plus brain cells....?? I was taught from a very young age that things cost money, credit cards were for the rich only back then anyway. My parents gave me a very small budget each month to buy clothes, shoes, anything I wanted like pencil bags, paints, envelopes, icecream etc. The only thing they paid for was school uniform. It completely taught me how to budget which was incredibly useful as I became disabled mid twenties. I've never been abroad, haven't had a holiday in over three decades, never had a mini breák, and certainly not experienced this happy zero responsibility life style she's leading. I would also like to see her parents interviewed about how they missed teaching herthese vital life skills...

What is she donating? How is she buying groceries? How are the utilities paid?

She's probably donating plasma, its really selling it.

Load More Replies...So her parents got her the card? She didn’t even apply for it herself, they did it for her. That sounds possibly illegal, then they neglected to explain how it works to her so also they’re morons. Then the cherry on top of that brilliant parenting plan, instead of having her work to pay it off so she understands the ramifications of her actions they’re just going to do it for her? They are doing that girl zero favors.

STFU with 'girl math'. Just because you're sh*t at managing your money and you're sponging off your parents, you don't get to paint your entire gender as inept.

WTF did I just read?! I need a translator! Rylie: "Well, what I do is I go donate on the side, too. But if like for whatever reason, like I feel like we’re low, a couple hundred dollars on rent, we’ll go donate for the first couple days before rent’s due, we’ll grab the money."

Maybe donate blood or plasma? Some places pay for “donations”.

Load More Replies...Is she dumb or is she dumb? I mean there is uneducated and there is dumb. She has mighty dumb wibes, he explains it and she doesn't get it at all.

I think her parents are a big problem: You give a $8000 grenade in your daughter's hand, and don't even know whether she knows what debt is? They've met her, right?

Load More Replies...She sounds like she deliberately does not want to learn or understand how finances works. Weaponised incompetence at it's worst. . How does she hold a job down with that attitude? Girl math? This is toddler math.

(1) if you don't know how something works, don't use it. (2) If you think a bank is giving you $8,000 to use as you please with no commitment, you're dumber than a box of rocks. (3) Using "girl math" to justify your dumbassery is just further proof about my point no 2 and an insult to the entire "girl" population (4) For the love of Pete, enough with the "like" after every couple of words. It's, like, stupid

(1) Fine I'll stop using a computer. And magnets.

Load More Replies...Even that seems like a lot to me. My wife and I's mortgage is less than 10% of our income.

Load More Replies...Ok, I think just the fact that she's at an age old enough to move out (so adult, or last 2 years being teenaged) and "like every other like word is like" seems to indicate she doesn't pay attention in school enough to learn finances in general (we at least learned how to balance and maintain a bank account with basic and the usual expenses). Both school and parents failed their job big time. My youngest, at 11 recently learned about debt when she made a bet/deal with her sister and owed her a bit from her next allowance. When it came time to collect that month's allowance, the 12 told me "wait, I am supposed to get $X from hers", and 11 said "nope, I take back the deal". Oof, lesson time, so, ME: Nope, that's not how real world works, your sister gets her money owed. She tried to fight it "but this is kids world not adult world". She figured she lost when I came back with "but my parent world says I have to teach you to know how to live in adult world."

In case you don't hear it enough: you're doing an amazing job as a parent

Load More Replies...I'm sorry, but I can't read this. I gave up after the first few sentences. "I was like... ", "And they were like...", "And I was like...". No wonder they didn't know what debt was, they're clearly braindead.

A few do; this one's actively skating into problems.

Load More Replies...I know. At least not on any income I've ever had.

Load More Replies...Girl math is spending a refund from an item to get "free" coffee or a package arriving late that you forgot about being a present from amazon, not going 4k into credit card debt 😭😭

I mean normally I'm "Adult kids have to clean up their messes" but in this case it's the parents fault for giving her a credit card without explaining it to her. HOWEVER. If she's moved out and is all independent she should really be paying for her own things. If she can't afford it then she can't afford to move out and she needs to move back in until she can afford it. There's no issue with them helping her out occasionally that's just being a parent but it seems they're paying for everything?

I think the only way for her to really understand debt is when she goes grocery shopping and the cashier takes a huge pair of scissors and cuts her card in half. And then she can’t eat for two whole days.

Someone needs to cut her off. I'm younger than her and I understand that credit cards are NOT free money. Do teachers not go over anything financial in school anymore? Why give someone a credit card when they have the ability to do stupid shït like this

I'm a millennial. We had zero financial education at school. None. I learned everything thanks to my grandmother who was in finance, but she was active before credit cards were a thing. She never had a problem because she's the type of person who will sit in a bank reading all 27 pages of documentation before signing her name on anything. But I know an absurd amount of people in my generation who f****d up due to not understanding the difference between credit and debit. Or what paying in instalments for things they can't actually afford implies. No understanding of overdrafts, student loans, taxes, hidden expenses, nada.

Load More Replies...I have to think this girl is a "special needs" person because I can't believe she is this oblivious. We were taught finances in school; income, budgeting, check writing, bank balancing, etc... Guess a lot of schools stopped doing this but I read the other day that my state is making this type of class a requirement for graduation starting next year. I am a female and her "girl math" is an insult to all women.

Rent should be 30%? Cute, is this his first day on Earth? Sorry, no matter how little she knows, he has no business telling her off as long as he lives in LalaLand.

I think it depends where and how you live. We pay about 19% of our dual income for a two bedroom. If I only had my income I could do with 25-30% for a studio orr single bedroom and I am not a high earner.

Load More Replies...I think people have pretty thoroughly covered that 1) she is dumb, and 2) her parents failed her. I haven't seen anyone being up the obvious reason her parents decided to pay it off. It's almost certainly to protect their own credit. There is no way a bank is going to extend an $8000 credit limit to someone with no credit history and a $20,000 a year income. Her parents must have opened an account in one of their names and made her an authorized user. Ordinarily it's a good way to help your young adult child build credit and give them access to 'emergency money'. But her parents totally failed her by apparently not explaining anything to her, or at least not double checking she understood, and not monitoring the spending that they were ultimately responsible for.

If this girl has mental problems (and I can't comprehend how anyone without severe mental issues can be soooo dumb), it was very irresponsible and even cruel of her parents to let her have a credit card and live alone...

She looks like that chick who made a video on TikTok saying that out of all of the generations, Gen X is the worst...

Some troll was making fun of me, when I was expressing appreciation for my high school home ec class that taught me how to budget, shop for, and prepare a meal at home- he said that was something out of the 50's. Nope, this is why some young people have insane credit card debt- buying stuff they can't afford, not making a budget, eating out or getting food delivered all the time instead of making food at home...

Sometimes you CAN tell a book by its cover. Undereducated and let down by her parents.

That "girl math" s**t is only cute when you find a couple bucks in the dryer and you're like "ooh, free coffee. Girl Math!"

Stup-id par-ents. Clap, clap, clap clap clap. (lead to) Stup-id chil-dren. Clap, clap, clap clap clap.

You need to understand money, BEFORE you get a credit card. Use play money to do practice rounds of paying bills. No not cash... you are in debt. Flat tire and no cash, you are in debt. No more cash? You eat Ramen noodles for a month. Budget is the key. Do not spend what you do not have. It will put you in "DEBT JAIL".

That system is effed up. Someone like her should not be able to even get a credit card. Not even be able to overdraft her bank account. I can‘t overdraft my bank account. I did this on purpose but I think they would not let me either way, as I don‘t earn enough. Similar with a credit card. I don‘t want to pay a fee but earn too little to get it for free. I don‘t even know what I would use it for other than be able to use the family thing on apple.

70 - 80% of her income just to pay rent, and she sees nothing wrong with it.

This girl can math. And also knows the difference between credit and debit.

Her parents are doing her no favours, like, at all. I couldn't listen to the whole thing. She is so f*cking ignorant. As soon as I started getting pocket money, I learned to budget - I was 10. Wanted the latest record and it cost $20? Well that meant that was all I could get that week, no snacks, no going out. Wanted the fancy flimsy stylish jacket that Mum said barely covered my kidneys? I saved for it since the winter gear my parents got me wasn't "cool". When I finally got a credit card and used it to buy all the Christmas shopping when all I had in my wallet was about 75 cents, I thought "Witchcraft!" and left that puppy at home for the longest time. I only started using the tap payment during the pandemic! How do you not teach your child how to budget?!??!?

Some needs to explain this to her in plainer language. "Using a credit card to pay means you're borrowing money. That means you have to pay it back. It's not free money." Then they need to help her create a budget and show her where every cent of her money goes. And stop paying her bills for her!

Why did this guy interview this woman, just to roast her. I get it she is irresponsible with her money, but that doesn’t mean you have to be a Total jackass to her!

this is weaponized stupidity/dumbness, and her parents gonna pay for it. they literaly paying for her now :D They sew a whip on themself...

"Girl Math." I hate that stupid term. Not all girls hate math or are poor in Math. This girl needs to take Consumer's Math 101 to learn how to manage her money. At the same time, the parents need to stop enabling her and teach her, instead.

I had a hard time following this but Caleb say a person's rent shouldn't be more than 30% of their income? I want to move to wherever he lives!

That's the usual economic rule that bigger companies apply for vetting renters in my country. If their income isn't 3x the rent, they're automatically discarded. And it IS a good theory in that guarantees both payment and a relative comfort to the tenant (1/3 rent, 1/3 utilities/groceries/leisure, 1/3 othes/savings). Problem is, NOBODY F*****G EARNS 3X RENT ANYWHERE ANYMORE.

Load More Replies...Thick as a brick. So are her parents. Why on Earth haven't they taught her basic housekeeping and financial skills. I mean this only mentions RENT. What about food, water, leccy, gas/oil, clothes, council tax (similar), medicines, transport costs, house insurance and other kinds, plus brain cells....?? I was taught from a very young age that things cost money, credit cards were for the rich only back then anyway. My parents gave me a very small budget each month to buy clothes, shoes, anything I wanted like pencil bags, paints, envelopes, icecream etc. The only thing they paid for was school uniform. It completely taught me how to budget which was incredibly useful as I became disabled mid twenties. I've never been abroad, haven't had a holiday in over three decades, never had a mini breák, and certainly not experienced this happy zero responsibility life style she's leading. I would also like to see her parents interviewed about how they missed teaching herthese vital life skills...

What is she donating? How is she buying groceries? How are the utilities paid?

She's probably donating plasma, its really selling it.

Load More Replies...So her parents got her the card? She didn’t even apply for it herself, they did it for her. That sounds possibly illegal, then they neglected to explain how it works to her so also they’re morons. Then the cherry on top of that brilliant parenting plan, instead of having her work to pay it off so she understands the ramifications of her actions they’re just going to do it for her? They are doing that girl zero favors.

-5

108