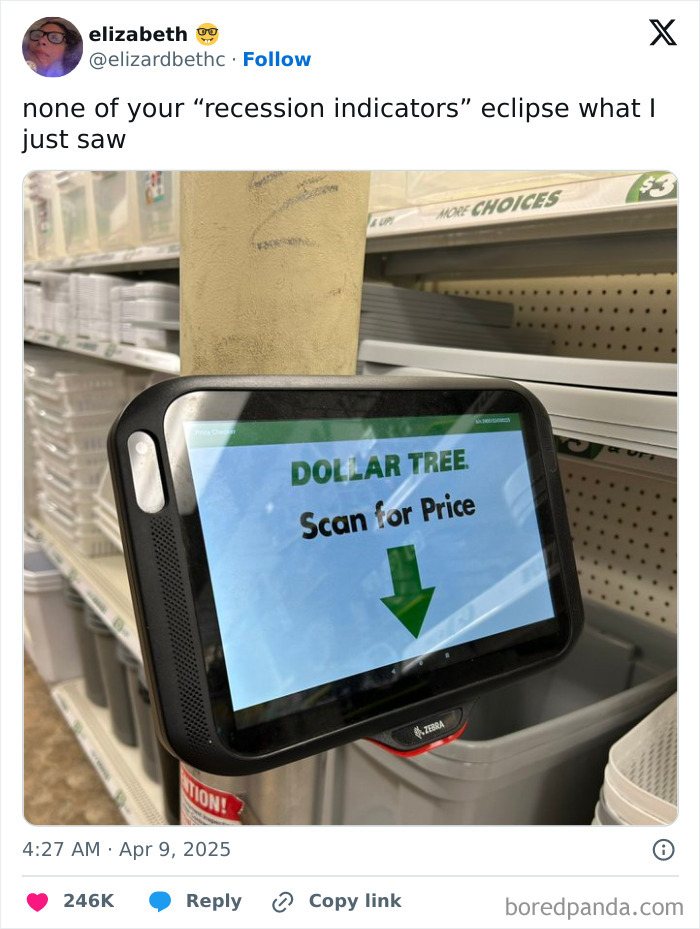

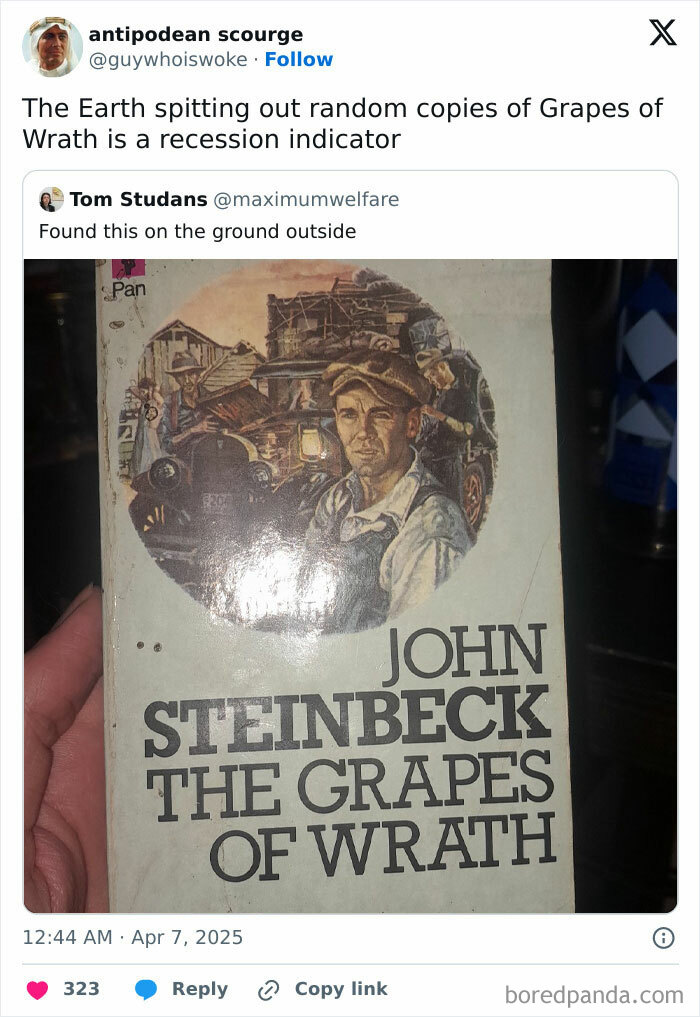

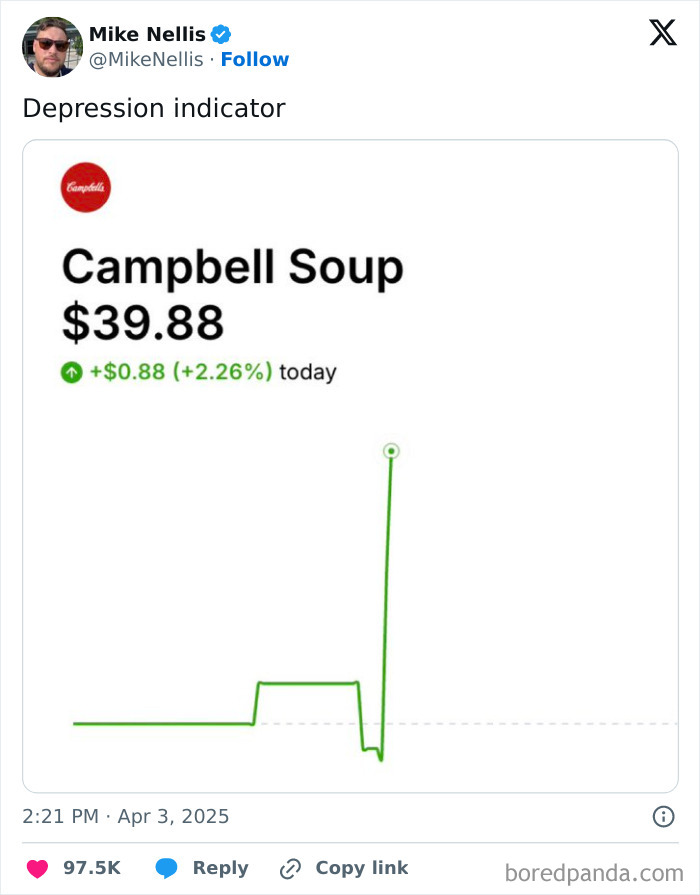

If You Don’t Feel Terrified Enough By The Current World, Here Are 30 Signs Recession Is On The Way

Interview With Expert“Recession” has become somewhat of a buzzword in recent weeks, largely thanks to U.S. President Donald Trump announcing major tariffs that impact not only America but dozens of countries around the world. Economists are divided over whether a recession is, in fact, looming. Some say "definitely!" Others say "absolutely not." But ordinary netizens claim they’re already seeing the signs.

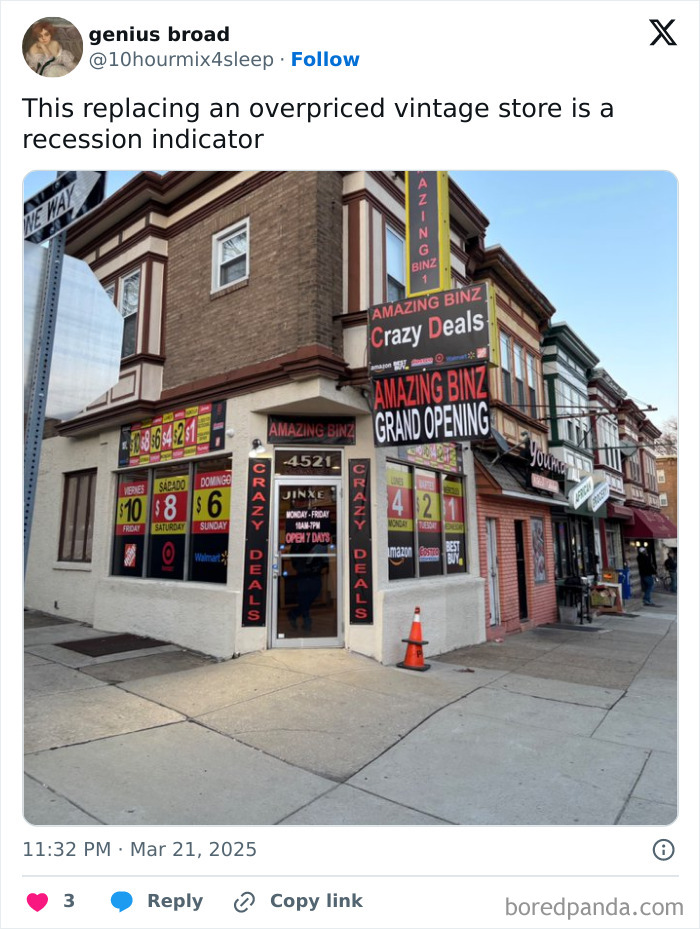

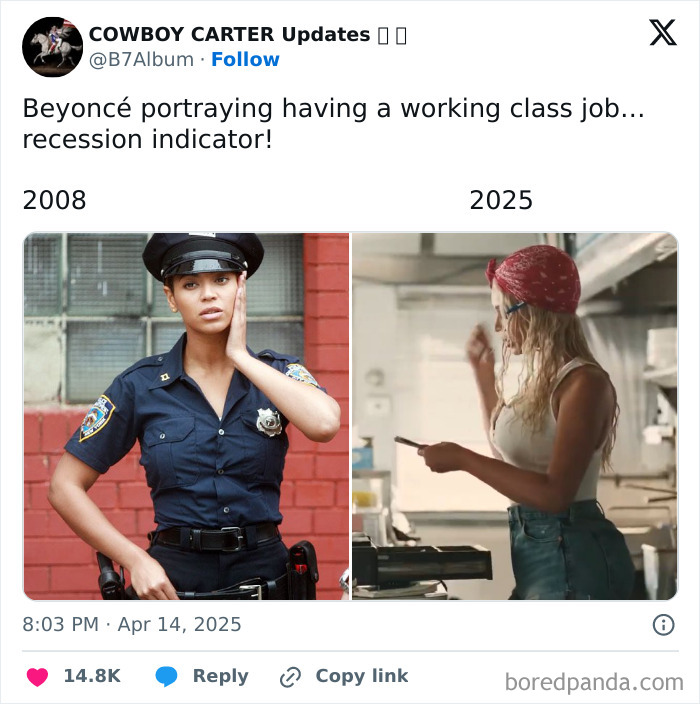

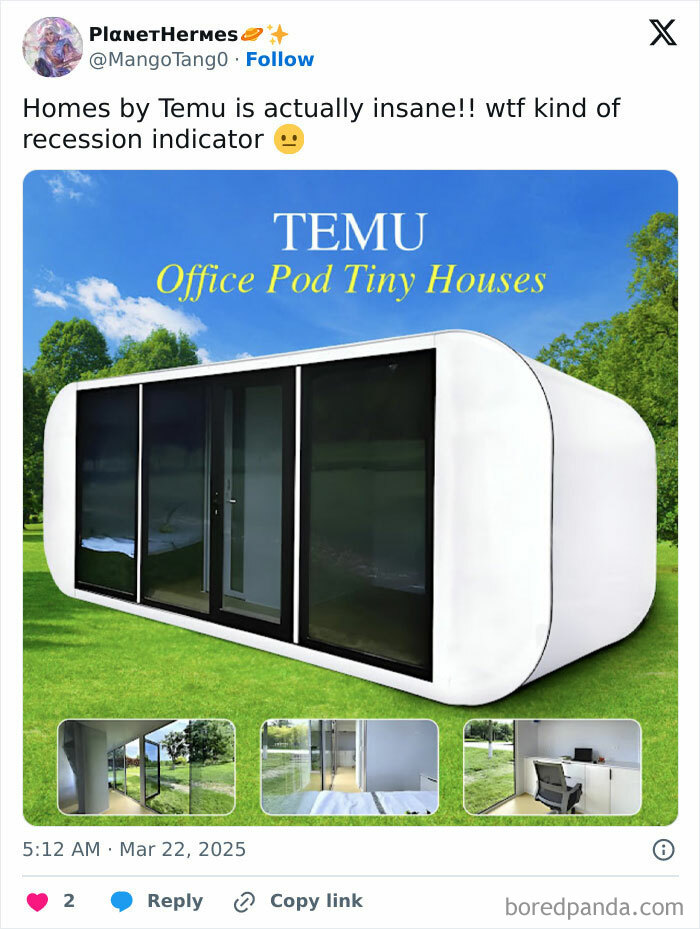

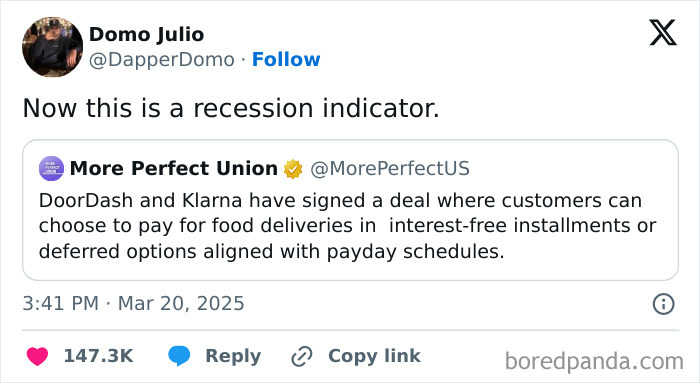

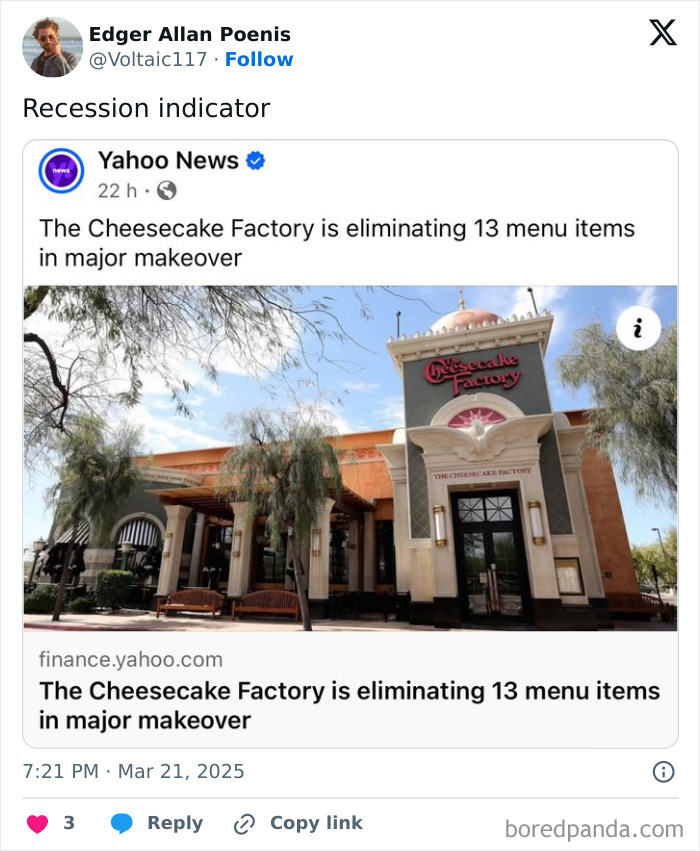

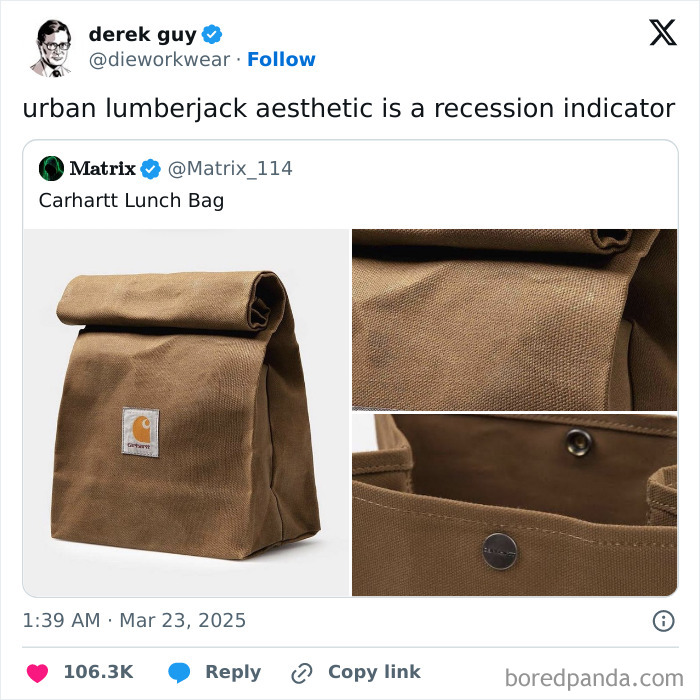

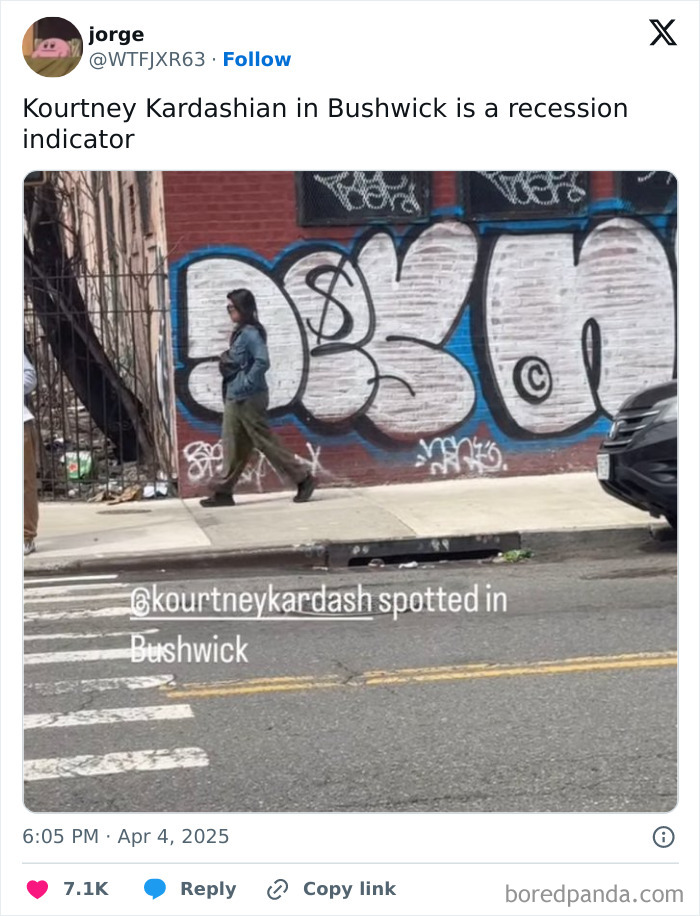

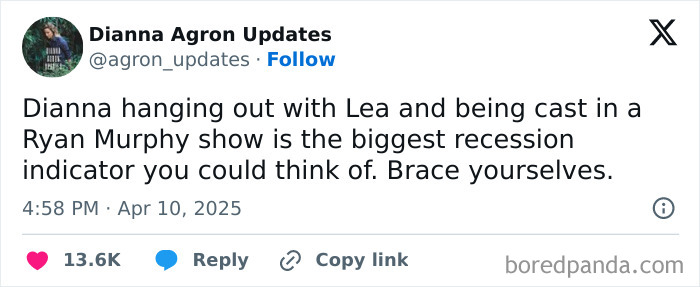

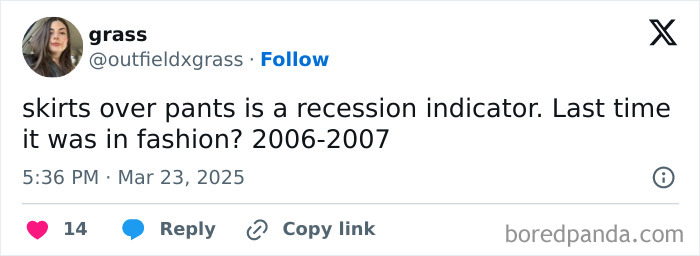

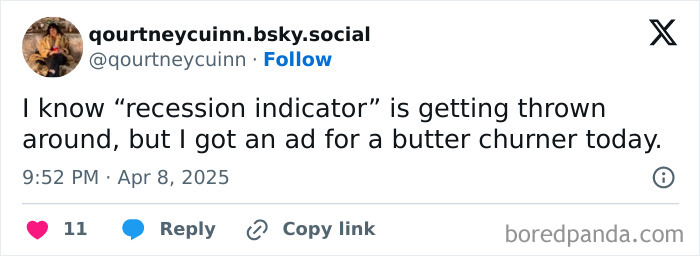

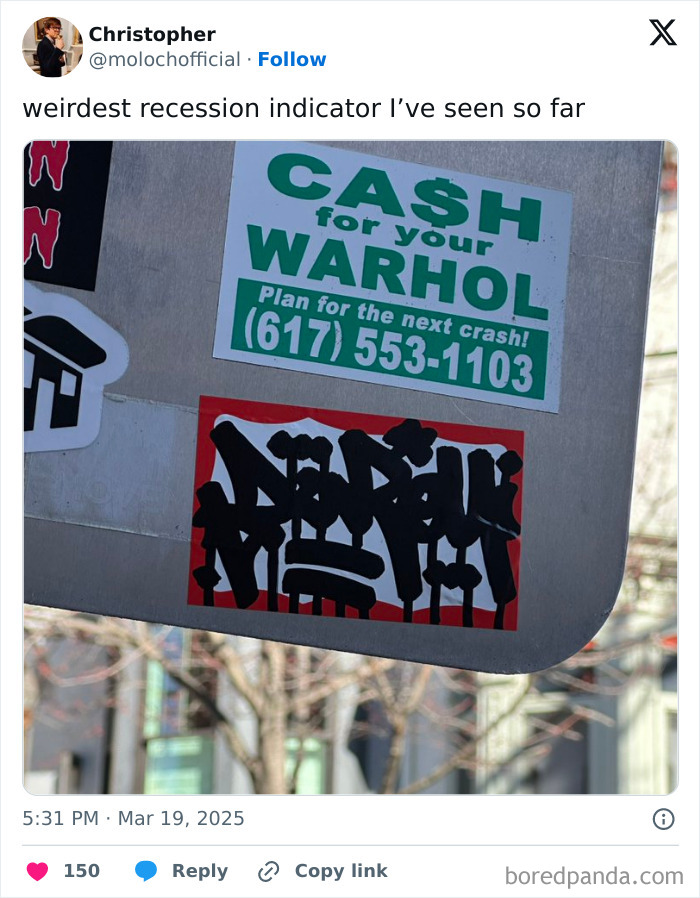

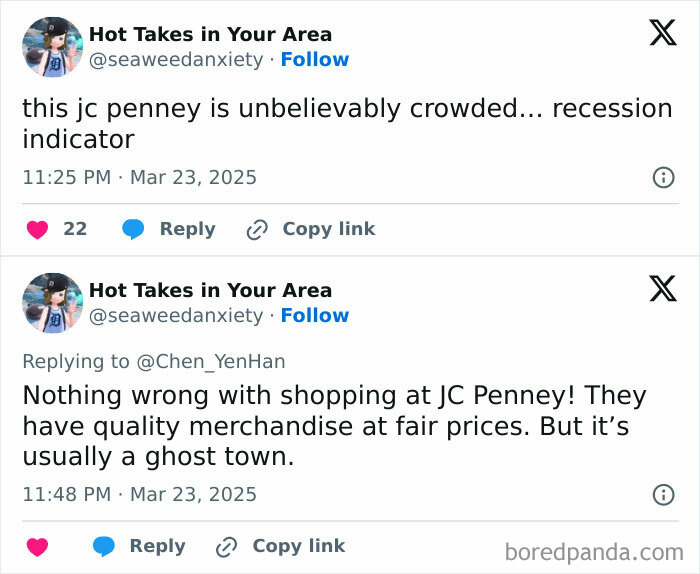

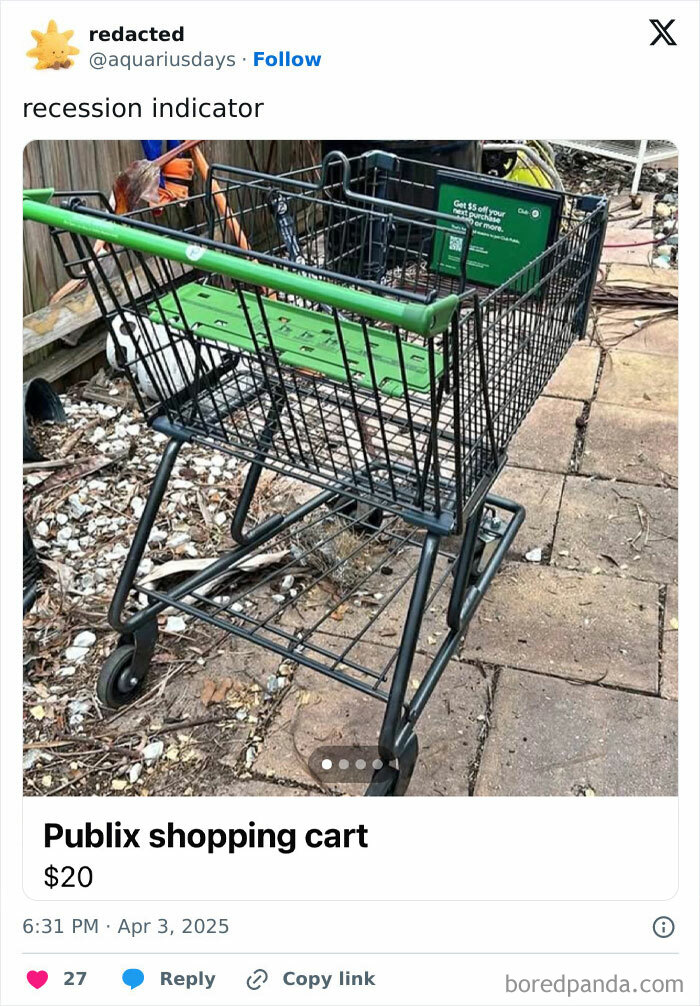

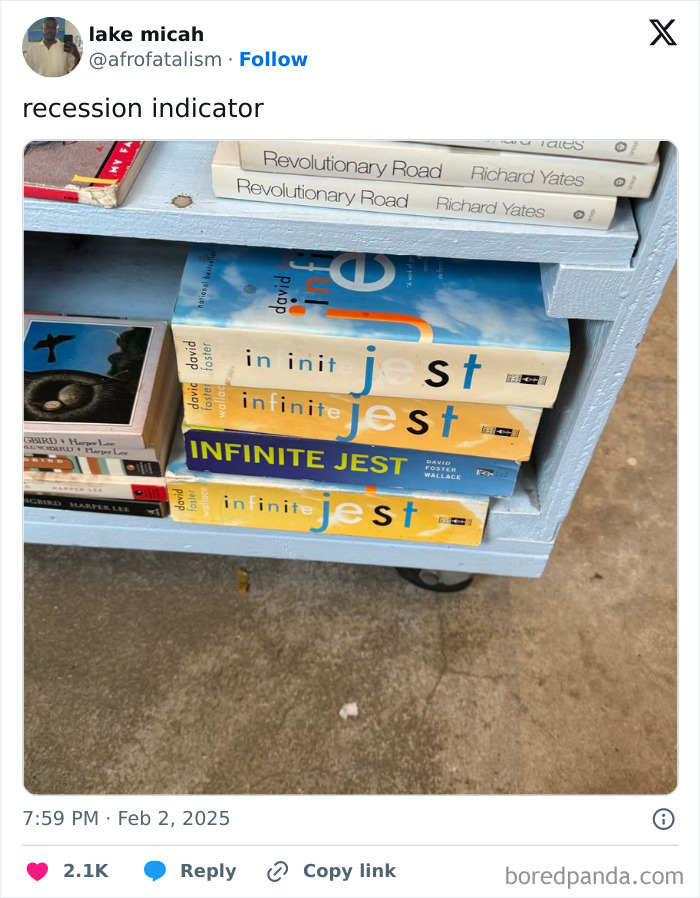

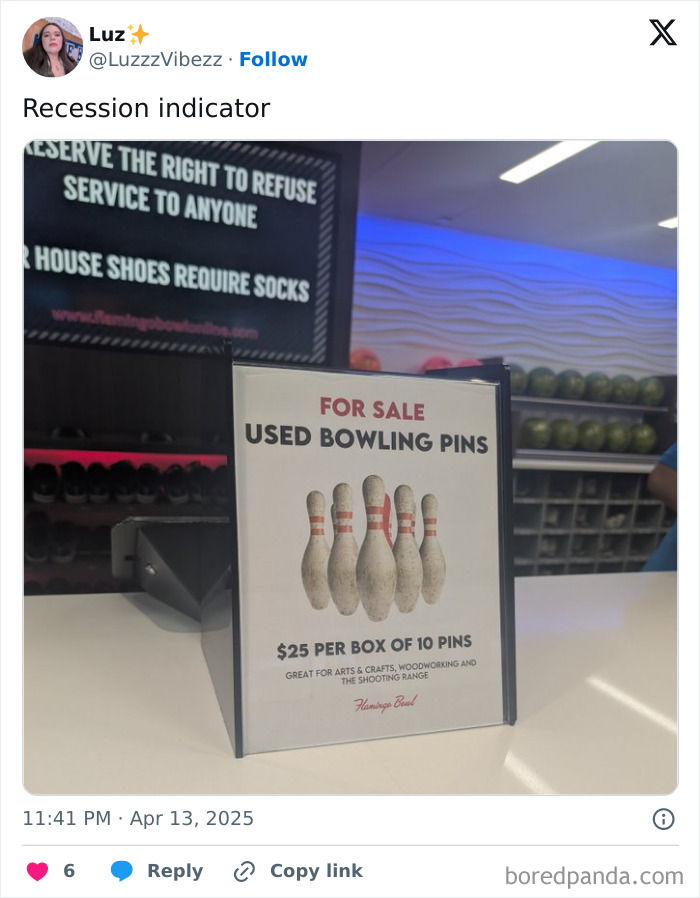

“Recession Indicators” have been flooding X, with people posting the major red flags that they believe point to a global market crash and some super tough times on the horizon. Some of the tweets are tongue-in-cheek, others are funny. Then there are those that perhaps shouldn’t be taken lightly. Bored Panda has gathered a collection of the best for you to scroll through while you pinch your pennies. Let us know which ones you believe to be true by hitting the upvote button. We also spoke to WalletHub's finance analyst and writer, Chip Lupo, to get some advice about staying sane during a looming recession.

This post may include affiliate links.

The definition of "recession" depends on who you ask... Investopedia defines it as "a significant decline in economic activity that lasts longer than a few months." In 1974, an American economist named Julius Shiskin described it as “two consecutive quarters of declining growth.” That's a definition that many countries still follow.

In the United States, the National Bureau of Economic Research (NBER) defines a recession as “a significant decline in economic activity spread across the economy, lasting more than a few months, normally visible in production, employment, real income, and other indicators."

If you think of it as a graph, the NBER explains that a recession "begins when the economy reaches a peak of activity and ends when the economy reaches its trough."

"A recession is a significant downturn in economic activity that lasts for months, which often results in widespread job losses, decreased consumer spending, and declining business profits. While traditionally defined by two consecutive quarters of negative GDP growth, economists also consider factors like rising unemployment, a drop in consumer spending, and declining industrial production as potential signs of a recession," says WalletHub's finance writer and analyst Chip Lupo. "Other indicators, such as an inverted yield curve and weakening investor sentiment, can also signal trouble ahead."

"A recession can place the average person at higher risk of unemployment and financial instability. At best, ordinary people will need to adjust their budgets to account for changes in income and spending priorities," Lupo told Bored Panda.

"At worst, a recession can cause a cascade of financial problems, forcing people to borrow at high rates to make ends meet, forgo health insurance coverage, and even flirt with bankruptcy."

The one in Post Office Square didn't survive covid. this isn't as big a deal as you're making it to be.

There's a lot of uncertainty at the moment. A few economists say we shouldn't panic, while others are warning us to brace ourselves. According to J.P. Morgan’s chief global economist, a recession is possible in the near future. In March this year, Bruce Kasman put the risk of a recession in the United States at 40% - a 10% jump from January. And in early April, J.P. Morgan Research raised the probability of a recession occurring in 2025 to 60% — up from 40%.

The chief economist at Moody’s Analytics shared the sentiment, saying there's a 35% chance of a recession in the U.S., which is an increase of 15% from the beginning of the year. When Reuters reached out to economists in Canada, Mexico, and America, 95% of them said the risk of recession in their economies had risen.

To prepare for a recession, Lupos says we should consider a few things... "Build an Emergency Fund," he suggests. "Aim for 3-6 months' worth of expenses in a liquid savings account to cover unexpected costs during tough economic times."

The expert also advises that we reduce debt. "Pay down high-interest debt, especially from credit cards, to minimize financial strain if your household income drops," Lupo told Bored Panda.

Cutting unnecessary spending is another step you might want to take. "Review your budget and cut out any non-essential expenses, like subscriptions or impulse buys," he told us.

Diversify investments, adds Lupo. "Rebalance your portfolio with recession-resistant assets (e.g., bonds, dividend stocks) to reduce risk during market downturns."

Lupo says we should also consider adding a few income streams. "If possible, look for side gigs or sources of passive income to serve as a buffer against job insecurity," he explained.

Unemployment rises during a recession. So, it's wise to monitor job stability. "If you're in an at-risk industry, consider learning new skills or improving existing ones to stay competitive in the job market. It’s also a good idea to explore more recession-proof career options," Lupo told us during our chat.

Finally, he suggests staying informed. "Keep track of economic trends and government assistance programs that could help during a downturn," said the expert.

Recessions usually start in one geographical area and spread to another, says McKinsey Senior Partner and McKinsey Global Institute Chair Sven Smit. And there are several reasons a recession might happen ... Like geopolitics or economic cycles.

The International Monetary Fund (IMF) has said that recessions can also be caused by a decline in external demand, especially in countries with strong export sectors. "Adverse effects of recessions in large countries—such as Germany, Japan, and the United States—are rapidly felt by their regional trading partners, especially during globally synchronized recessions," notes the site. So, it's no surprise that U.S. President Trump's tariff announcement has caused much concern.

That said, the IMF doesn't believe we should panic. It recently announced that global share prices have dropped "as trade tensions flared" and also warned of an "erosion of trust" between countries. However, it was added that the "new growth projections will include notable markdowns, but not recession".

"While we are not currently in a recession by the traditional definition, there are growing concerns that one could be on the horizon. Economic indicators such as negative GDP forecasts and declining consumer confidence are raising red flags," said Lupo during our chat.

"Recent trade tensions, fueled primarily by tariff policies, have contributed to this sense of uncertainty. Moreover, top economists’ projections suggest an increased risk of a recession in 2025. While recessions are difficult to predict, it’s clear that consumers should remain vigilant and prepare for worsening conditions," he added.

https://theonion.com/law-school-applications-increase-upon-realization-that-1828464779/

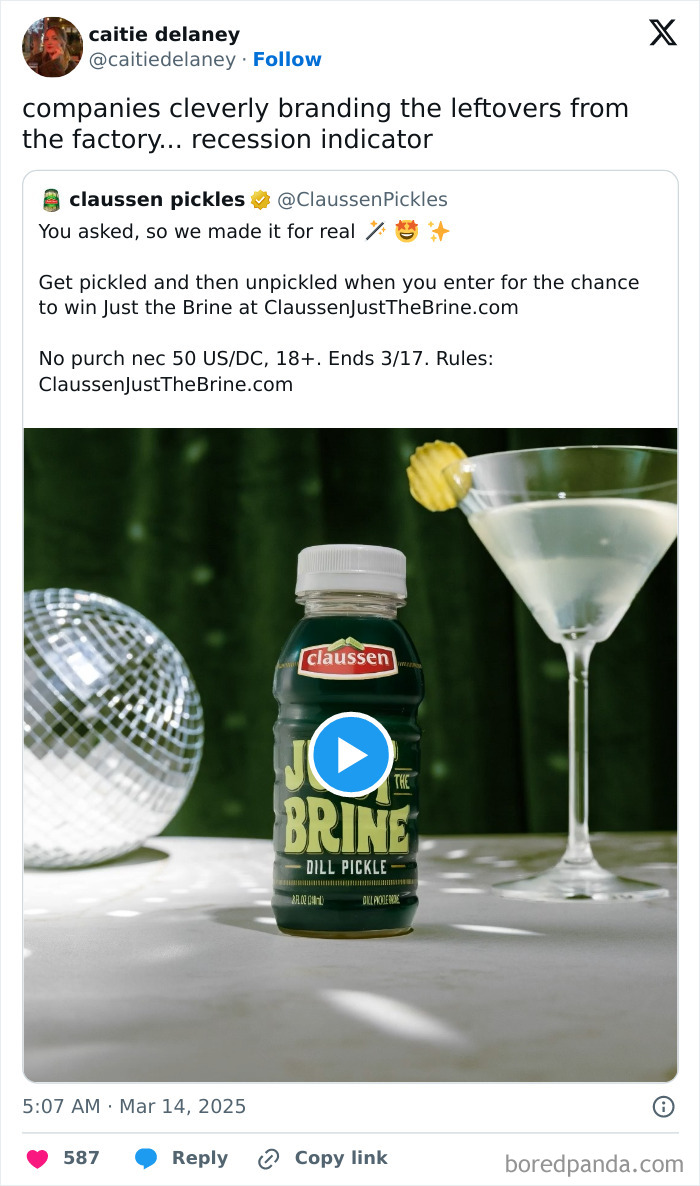

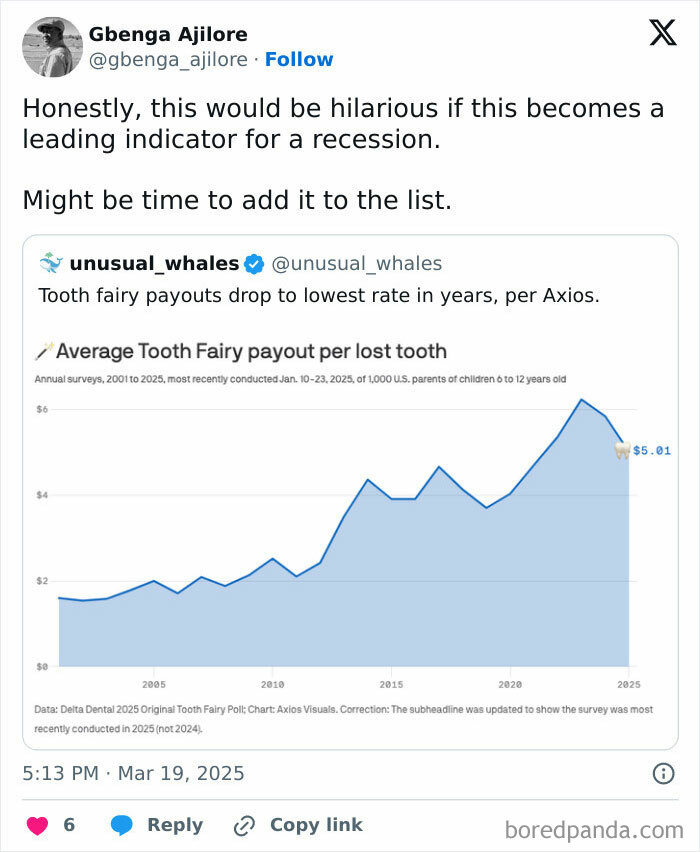

Meanwhile, on social media, ordinary Johns and Janes are throwing their two cents into the mix. X, for one, has been flooded with memes, posts, and photos from people who are convinced the economy is crying out for help and that we're all in for a bumpy ride. Some of their "recession indicators" are funny, and others are strange.

But it wouldn't be the first time we've seen weird indicators of an economic downturn. In 2001, the American economy was in a deep recession, and people were holding onto their money. But a particular beauty product seemed to be flying off the shelves...

The billionaire who's heir to the Estée Lauder cosmetics fortune, Leonard Lauder, let the world know that despite consumers tightening their spending, lipsticks seemed to be in high demand. He came to the conclusion that lipstick sales and the health of the economy were in inverse proportion to one another... And he believed this was because consumers considered lipstick an "affordable luxury." And so, the "Lipstick Index" was born.

No , it's when they drop their partner between Christmas and Valentines day. Money saver.

Another sign of a recession can be found below the belt. Or so argued the former Federal Reserve chair Alan Greenspan. The expert was a big believer in the "men's underwear index."

In a nutshell, when the economy is in decline, men don't buy new underwear because most people won't see what they're wearing down there anyway. Greenspan said when the economic outlook improves, sales of boxers and briefs will follow suit.

Yeah, people drink this as a workout drink to rehydrate and add it to cocktails, it's delicious. I use it to marinate chicken breasts (it's one part of why Chick-fil-A sandwiches are so tasty and juicy).

I know that I should be recession mad, but clicking on the OG link and watching the man cook with balloon animal food has made my morning.

It turns out he wasn't wrong... According to Euromonitor data, men's underwear sales dipped in 2008 and 2009 during the Great Recession. And guys went back to buying briefs and boxers between 2010 and 2015.

Similarly, Bloomberg data found revealed that there was a dramatic decrease in men's underwear sales in America in 2020 during the Covid pandemic, and undies buying came back into fashion again 2021.

If the signs on this list are anything to go by, we might be in for some tough times ahead. And here's what the World Economic Forum (WEF) warns could happen should a recession hit: "Unemployment could rise. Graduates and school leavers may then find it more difficult to find jobs. Companies may struggle to pay their workforce or give their employees pay increases to match inflation..."

WEF adds that investors could also see losses as stock markets fall. "During a recession, we may see an increase in foreclosures, and banks will be less likely to loan money to potential borrowers looking for a mortgage or a personal loan."

In short, brace yourself. And hold onto your precious pennies.

This is more an indication of the open drop of respect for women in general by Maga

You mean your able to be openly racist now. You see more white people. Not suprised much, he is posting on X originally.

Myself and 3 friends buy the 20 piece and have 1 sauce each and 5 nuggets each

So funny but next time I'm spraying it in the toilet I shall walk through it and see how long my 3 euro lavender smell lasts

I've noticed at a lot of restaurants they've stopped asking if you want any desserts before they bring the check. Recently everyone at my table had actually discussed what they wanted for dessert and had asked for to go boxes to save room for dessert and she just brought our checks. So we all ended up going somewhere else down the street for desserts instead.

Remember what happened 100 years ago? A global pandemic. Remember what happened less than ten years later? The Great Depression. History is repeating itself blow for blow and move for move, and yet we do nothing to avoid it. Recession coming? No. Global economic crash.

Except this time around, a major contributor is the group of people who were like "COVID-19 isn't real, even though I've personally seen it, but you know what would be cool? Measles. Oooh, and polio. Eggs are too expensive, let's crash the whole economy and make everything more expensive. And let's get some eugenics going. We'll call autism a 'preventable disease' even though we love preventable diseases."

Load More Replies...I just received email from a business, notifying me of their big pre-recession sale.

Remember what happened 100 years ago? A global pandemic. Remember what happened less than ten years later? The Great Depression. History is repeating itself blow for blow and move for move, and yet we do nothing to avoid it. Recession coming? No. Global economic crash.

Except this time around, a major contributor is the group of people who were like "COVID-19 isn't real, even though I've personally seen it, but you know what would be cool? Measles. Oooh, and polio. Eggs are too expensive, let's crash the whole economy and make everything more expensive. And let's get some eugenics going. We'll call autism a 'preventable disease' even though we love preventable diseases."

Load More Replies...I just received email from a business, notifying me of their big pre-recession sale.

Dark Mode

Dark Mode

No fees, cancel anytime

No fees, cancel anytime