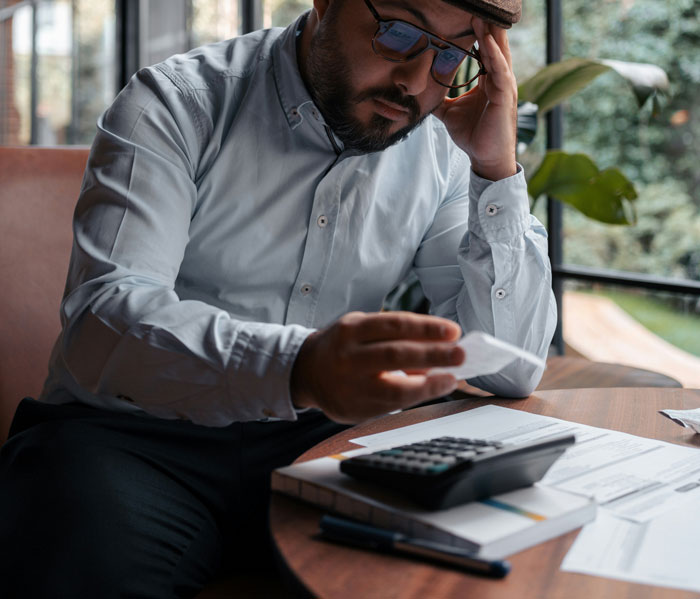

In these economically uncertain times, it’s a good idea to reevaluate your budget and see where you could potentially cut back. That way, you save more cash and can have a bigger emergency fund. However, advice on the internet is a bit of a double-edged sword: some of it can genuinely help you, while other financial hacks can harm your wallet.

In a no-nonsense thread on AskReddit, thrifty and economically savvy internet users shared the things that can actually make people lose more money, instead of helping them save more like they thought. We’ve collected the most egregiously deceptive examples below, so scroll down to check them out. Don’t forget to take notes so you don’t fall into the same pitfalls as others.

This post may include affiliate links.

My in laws would drive all over town chasing grocery sales. Milk is cheaper here, chicken on sale here, bread is buy one get one at this store etc.

My in laws would drive all over town chasing grocery sales. Milk is cheaper here, chicken on sale here, bread is buy one get one at this store etc.

Even if you don’t make additional impulse buys at each store… who the f**k wants to waste that much time, energy, gas and mental bandwidth on groceries?

It was like a weird obsession and was exhausting just hearing about. Like… pick a f*****g store and be done with it. Change it weekly if you want to. But ffs, going to 5 different stores to meal plan is bonkers.

I once had a work colleague who did this. She would drive from one supermarket to another just to save a few pennies on her groceries. I pointed out that it was costing her more in fuel than she was actually saving. This was also somebody who thought nothing of spending £500 on a pair of shoes or a handbag.

If you're an art/crafts person, seeing something you want and thinking, "I can just make it myself and it'll cost me a lot less." That is the devil whispering sweet lies directly into the tender ear of your hubris. If you don't already have nearly all of the necessary supplies on hand, it *will* cost you more to make it yourself.

If you're an art/crafts person, seeing something you want and thinking, "I can just make it myself and it'll cost me a lot less." That is the devil whispering sweet lies directly into the tender ear of your hubris. If you don't already have nearly all of the necessary supplies on hand, it *will* cost you more to make it yourself.

The golden rule of personal finance is to earn more than you spend and to spend less than you earn. No matter the size of your bank account, investment portfolio, zip code, or what tax bracket you’re in, if you spend more money than you bring in, eventually, you’ll run out of funds and you’ll take on debt.

So, you need to make sure that you’re being smart with both your income and savings, as well as your spending.

Broadly speaking, you have two main strategies available to you. The first is to spend less by cutting back on things that aren’t essential, like services or memberships you don’t really use or dining out instead of cooking at home.

The second is to earn more, by asking for a raise, getting promoted, applying to work at a better company, upskilling, taking on a side hustle or second job, etc.

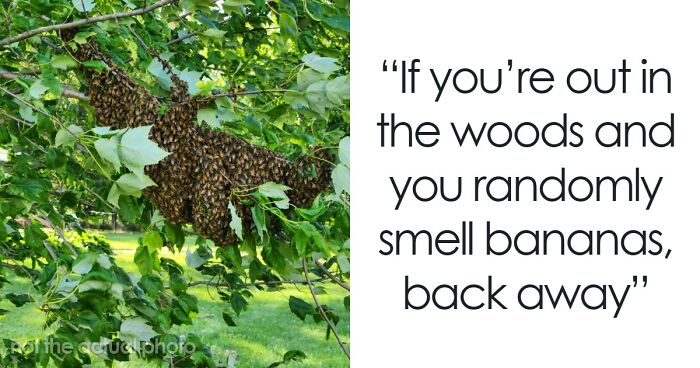

Growing your own food. I garden because I enjoy it, but I’ve always been scared to calculate how much it actually cost for the garden boxes, soil, fertilizer and pest control (not to mention my time) to grow some cucumbers and peppers.

Growing your own food. I garden because I enjoy it, but I’ve always been scared to calculate how much it actually cost for the garden boxes, soil, fertilizer and pest control (not to mention my time) to grow some cucumbers and peppers.

While growing food can be more expensive, it's still a healthier and higher quality source of food. I haven't touched a grocery store in months, and never will.

Buying really cheap stuff. I’m not saying you have to buy top of the line but at least get something semi quality so you don’t have to constantly replace it.

Buying really cheap stuff. I’m not saying you have to buy top of the line but at least get something semi quality so you don’t have to constantly replace it.

Buying stuff just because it's on sale.

Buying stuff just because it's on sale.

Were you going to buy it at full price?

No? Then it's not savings, it's an expenditure.

Among some of the main ways to save more money, HSBC recommends:

- Planning a budget;

- Reducing your grocery spending at the supermarket and looking for discounts;

- Cutting fuel costs;

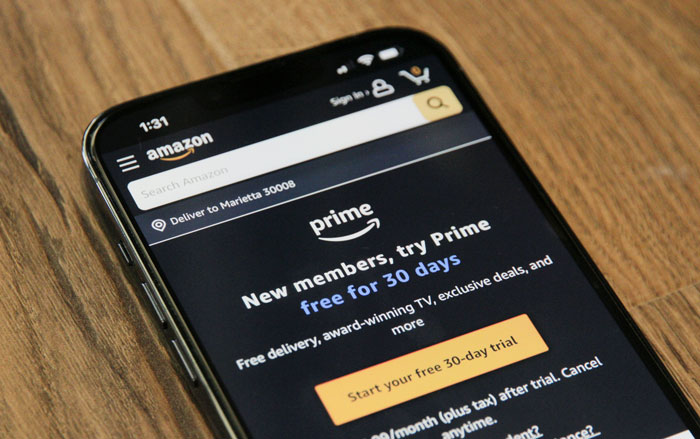

- Canceling unnecessary subscriptions;

- Reviewing your debt;

- Looking into tax relief and benefits that you may be entitled to.

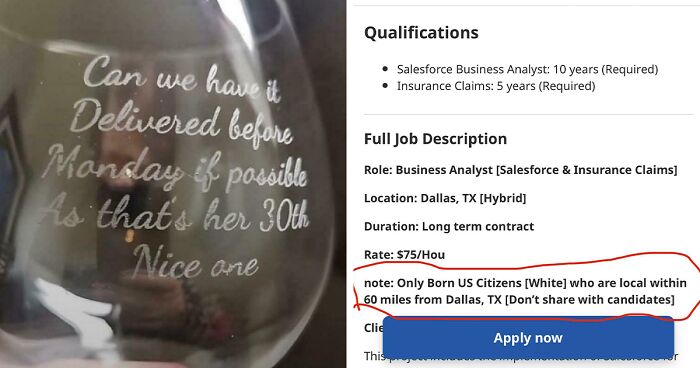

People with basic tax returns paying hundreds of dollars for TurboTax to "maximize" their return.

People with basic tax returns paying hundreds of dollars for TurboTax to "maximize" their return.

freetaxusa.com, thank me later. And don't waste any money on TurboTax. They literally lobby to keep the tax code complicated so they can sell their s**t.

Buying things at a sale price without knowing the average price. Stores artificially inflate prices so that they can lower them and advertise something as being ‘on sale’.

Buying things at a sale price without knowing the average price. Stores artificially inflate prices so that they can lower them and advertise something as being ‘on sale’.

Always look under the sales tag for.the original price before making purchases. Even when I splurge at Ross I still Google items to see the prices in other stores.

Meanwhile, Barclays suggests challenging yourself to spend more. For example, you could aim to save more money over the next year by saving one cent on the first day, two cents on the third day, etc.

Or you could try a ‘no spend’ weekend once a month where you focus on free activities. For instance, you could go to museums, do movie nights, play board games, and go on long walks instead of paying for entertainment. Meanwhile, instead of dining out or buying more groceries, you could use up all the leftover food left at home from the week.

Saving money (or, more accurately, spending less on certain things)

Saving money (or, more accurately, spending less on certain things)

Let me elaborate.... Actually, let Terry Pratchett elaborate:

"The reason that the rich were so rich, Vimes reasoned, was because they managed to spend less money.

Take boots, for example. He earned thirty-eight dollars a month plus allowances. A really good pair of leather boots cost fifty dollars. But an affordable pair of boots, which were sort of OK for a season or two and then leaked like hell when the cardboard gave out, cost about ten dollars. Those were the kind of boots Vimes always bought, and wore until the soles were so thin that he could tell where he was in Ankh-Morpork on a foggy night by the feel of the cobbles.

But the thing was that good boots lasted for years and years. A man who could afford fifty dollars had a pair of boots that'd still be keeping his feet dry in ten years' time, while the poor man who could only afford cheap boots would have spent a hundred dollars on boots in the same time and would still have wet feet".

Not working overtime or trying to stay below a certain income threshold because of taxes. They don't understand how taxes work.

Not working overtime or trying to stay below a certain income threshold because of taxes. They don't understand how taxes work.

There are a few people with low incomes where a raise will disqualify them from benefits worth much more. But for the rest of us, remember that the government divides your income into piles, with the tax rate increasing for each pile. That extra pay will go into the last pile and will not affect the taxes you pay on the others

Avoiding doing maintaince on things.

Avoiding doing maintaince on things.

Sure it's cheaper today, and it'll probably all be fine tomorrow, but sooner or later its gonna bite ya.

Cars and central AC units are two of the most expensive things to not keep regular maintenance schedules on. However, one can only do what their financial means allow them to.

What are your best savings tips that genuinely work, dear Pandas? On the flip side, what are some pieces of financial advice that you’ve heard that are beyond delulu and can actually be bad for someone’s budget?

We genuinely can’t wait to hear your thoughts on this. If you have a spare moment, feel free to share your tips and hacks in the comments at the bottom of this post.

Skipping the dentist.

Skipping the dentist.

Taking care of your teeth and you shouldn't have to go to the dentist all that often.

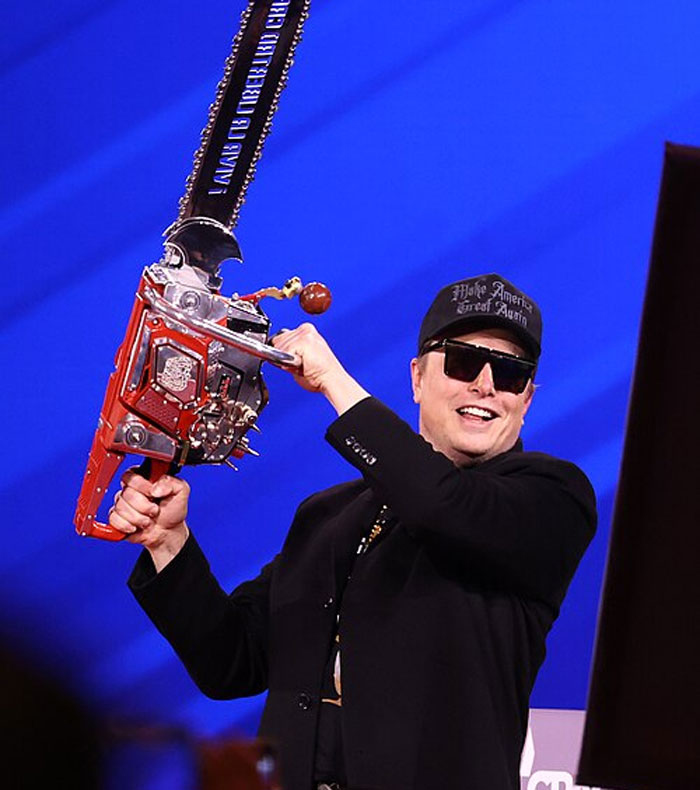

DOGE.

DOGE.

DOGE = shell game. Money went from safety nets for millions into the hands of those who think a plane ticket is $2.00 or that think the average person hasn't felt the price of tariffs.

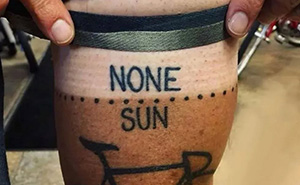

Cheaping out on tires or shoes/boots. You’ll pay dearly if you use them a lot.

Cheaping out on tires or shoes/boots. You’ll pay dearly if you use them a lot.

Tires are crazy expensive, but are necessary for overall safety. In a past life we had to rely on retreads and then white knuckle every time we used the vehicle. But, when you have a hole in the sidewall and only $20, you have to go with your best option at that time.

Buy now pay later/debt for anything that isn't an appreciating asset or generates cash flow. Like a burrito, refrigerator, phone, wedding etc. I interned at a BNPL firm and I'm telling you all from firsthand experience it's a scam.

Buy now pay later/debt for anything that isn't an appreciating asset or generates cash flow. Like a burrito, refrigerator, phone, wedding etc. I interned at a BNPL firm and I'm telling you all from firsthand experience it's a scam.

I'm on the fence with this. On the whole I prefer to pay for things upfront and I hate owing, however, on big expenditures such as a new kitchen or new bathroom, and the firm supplying it are offering 4 years interest free credit, I will go with that because then I can spread the payments out without is costing me any more. It's not that I don't have the money saved up. It's just that something like that would wipe me out and I always like to have money put away in case of an emergency.

“Sales”, oddly enough

“Sales”, oddly enough

I read something like “Something at 30% off seems like a good deal until you realise you were convinced to spend 70% more than you normally planned”

Small thing but it made me more aware of my spending habits and Jfc how much fomo engineering there is.

"Black Friday" sales are not always the best. Certain products have better prices during their season. For instance, TVs have better deals near the Superbowl, plus there are more brands to choose from.

Buying cheaply made or disposable things over and over, throwing them away; instead of buying well-made things just once or twice which can last for decades or a lifetime. .

Buying cheaply made or disposable things over and over, throwing them away; instead of buying well-made things just once or twice which can last for decades or a lifetime. .

Carrying a balance on a credit card to build credit. You don’t need to carry a balance to build credit.

Carrying a balance on a credit card to build credit. You don’t need to carry a balance to build credit.

I don't think I have ever carried a balance on my credit card - I treat it like a debit card and only spend money I already have (with the added benefits of cash back, fraud protection, and 'float', or time between when I spend the money and when I actually have to pay).

91 octane gas if the auto doesn't need it.

91 octane gas if the auto doesn't need it.

In Australia it's 91, 95, 98. My car manual insists on 93, which doesn't exist.

Rent to own is such a scam and so many people do it.

Rent to own is such a scam and so many people do it.

Utilizing rent to own stores like Aarons or the Rent-to- Own namesake is a scam as you pay 3-6 times more for an item than what it would actually cost. An example would be a couch or tv. IMO, we rent to own a lot such as cars and homes. I say this because until those items are paid off and you have a title, they aren't yours as they can still be repossessed or foreclosed on. It may not seem like a rent to own but that is what they basically are. I brought homes up due to the above picture.

Lotteries/gambling, people convince themselves they will be 'winners' but few are.

Lotteries/gambling, people convince themselves they will be 'winners' but few are.

I have a friend whose mom has been addicted to gambling, in many forms, for at least 40 years. The last 25 years has been mainly scratchcards and other lotto. She has actually hit the 50k jackpot and 100k jackpot once each, in addition to many 100-500$ wins. She spends at least 1000$ a month and gave away most of her windfalls so I think she's still pretty far behind.

The "buy one get one half off or with discount" type of deals. Anything that incentivizes you to buy more by tacking it on as a bonus if you get it.

The "buy one get one half off or with discount" type of deals. Anything that incentivizes you to buy more by tacking it on as a bonus if you get it.

If you're buying in bulk or such intentionally then it's a good deal. But if you just came in for one box of lets say cookies for $5 and it had one of these deals. So you buy a second box too because its discounted and says if you buy two it will cost $8, as opposed to $10. So you get it thinking you're saving money.

Instead what you just spent was $3 more than you had to on a second box you didn't even come in for.

And it repeats throughout the whole store. It's everywhere, especially in food. The flashy colored tickets, the bold letters, emphasis on how much you save, all to bait people to buy more things than they actually need.

Though it depends on what your actual goals and needs are. It might genuinely save you some and be good, but you could also be getting ripped off.

Yep. I never fall for those deals. Now if I see a deal where it says buy one, get a,second free. I will take that deal.

Cutting corners on professional equipment. A few years back I got a made in China arm for my microphone on Amazon. Cost about 1/4th what the German original did. About 9 months later one night it snapped, fell on my computer, and threw everything to the floor. A $100 item nearly cost me $4,000. I then bought the expensive German model and haven’t had any problems.

Cutting corners on professional equipment. A few years back I got a made in China arm for my microphone on Amazon. Cost about 1/4th what the German original did. About 9 months later one night it snapped, fell on my computer, and threw everything to the floor. A $100 item nearly cost me $4,000. I then bought the expensive German model and haven’t had any problems.

And the German brand item wasn't manufactured in China? I'm pretty surprised...

DIY repairs without proper knowledge and skipping regular maintenance.

DIY repairs without proper knowledge and skipping regular maintenance.

I have actually fixed my a/c once, my furnace 3 times, my washer twice and my dryer twice (with no 'proper knowledge') with YouTube and repairclinic.com videos. This is over 15 years on aging appliances.

Shopping based on monthly payments rather than total cost (discounted to present value). Most common with cars and houses.

Shopping based on monthly payments rather than total cost (discounted to present value). Most common with cars and houses.

When purchasing a home, monthly payments should be factored in because additional fees apply such as insurance, taxes, and sadly HOA dues. In my area, a town home costs easily $30K to $50K less than a house but once HOA fees are added, the monthly payments end up being more than a standard home and without the benefit of 4 wall privacy. However, one should never go to a car dealership and say they only want to pay xi amount a month as that allows them to get sneaky. But, one can only do what their budget allows. Many times there isn't a fee for paying things off early.

Some DIY home reno stuff you've never done before. Man I wish I had taken a summer job as a teen with a handyman to learn a bunch of that stuff.

Some DIY home reno stuff you've never done before. Man I wish I had taken a summer job as a teen with a handyman to learn a bunch of that stuff.

Never DIY anything that is dangerous or forces you to buy new tools to complete. There's a ton of used tools at estate sales buy them and learn how they work before starting a project.

Not reading labels on the shelf in stores or reading the information on the labels. It tells you what you’re paying by volume. The bigger box or bottle is not necessarily the cheapest and you can compare brands this way too. Also , the 2 for $ sales b1g1 sales. A little math and time is worth it in savings.

Not reading labels on the shelf in stores or reading the information on the labels. It tells you what you’re paying by volume. The bigger box or bottle is not necessarily the cheapest and you can compare brands this way too. Also , the 2 for $ sales b1g1 sales. A little math and time is worth it in savings.

Over the course of his life my father has change his home heating system numerous times. He went from electric board to electric furnace, then wood stove, then oil stove, back to wood stove and now propane stove. Every single time he tried to convince me he was saving 20% on his energy bill. It cost him so much money that he will never ‘’save’’ enough to pay for just one system.

Over the course of his life my father has change his home heating system numerous times. He went from electric board to electric furnace, then wood stove, then oil stove, back to wood stove and now propane stove. Every single time he tried to convince me he was saving 20% on his energy bill. It cost him so much money that he will never ‘’save’’ enough to pay for just one system.

Renting a storage unit.

Renting a storage unit.

This is sometimes an absolute necessity. If your living arrangements are temporary or unstable, a storage unit is a great option.

As a tax accountant, not maintaining a separate bank account for your small business.

As a tax accountant, not maintaining a separate bank account for your small business.

The fees for the account will end up being less every year than what you get charged for the additional work of trying to disaggregate your personal expenses from your business expenses in the bank statements alone.

I've helped launch around 30 sole proprietor businesses and if there was one piece of advice they needed to heed, it was this one. "You will thank yourself come tax time."

Moving to a cheaper state.

Moving to a cheaper state.

It doesnt save you money when your check is less or other things are insanely high.

Not to mention quality of life. I'm comfortable enough as is that I wouldn't move to FL or TX for an extra 50k per year.

Fast food.

Fast food.

Yeah, it's fast and it's food but at what cost?

If I grind my own beef and bake my own buns, it's still a hamburger. But man, it's delicious!

Meal kits like Hello Fresh... they cost as much as your grocery bill but you only get dinner and you still have to go to the grocery store to get other things.

Meal kits like Hello Fresh... they cost as much as your grocery bill but you only get dinner and you still have to go to the grocery store to get other things.

Skipping maintenance on cars.

Skipping maintenance on cars.

Feeding your pets cheap a*s pet food.

Feeding your pets cheap a*s pet food.

Sure, your cat (for example) may happily eat that $18 15lb bag of corn-based kibble every day...but you're gonna be paying a lot more in vet bills when their kidneys fail because of it than you would have paid over time for higher quality food.

Each pet is different. When I had a dog he would turn his nose up at expensive dog food but couldn't get enough of the cheaper varieties. He was in excellent health until he was about 15 when he started to develop age-related problems (arthritis, incontinence). He was 17 when we had to have him put to sleep 😭 I'm currently looking after a dog who prefers cat food over dog food.

Having any kind of car payment and getting a new car every year. I can understand if someone is really struggling and is living paycheck to paycheck but I have always bought my cars in full and keep them until they fall apart. I truly don’t understand why anyone would do anything other than that. It’s the biggest waste of money otherwise.

One can buy a vehicle with monthly payments, pay it off, and then keep it until the wheels fall off thus making it a smart buy for that person. Having payments doesn't mean you can't pay it off early by paying more every month, etc. Many people don't have emergency savings much less the ability to pay cash for a car.

Not paying annually for some subscriptions.

Not paying annually for some subscriptions.

Well, it really depends on the amount of money that's due when you pay once in a year. Let's say, you get an account for 80€ instead of 10€ per month. Okay, I'm in. But if it is something like 400€ instead of 50€, that's not an option because it would be clearly above the budget for one month.

Took me a while to realize that using the dish washer saves me more money than washing dishes by hand.

Took me a while to realize that using the dish washer saves me more money than washing dishes by hand.

Coupons. I knew somebody who drove all over the city so she could save money with coupons. The gas alone was probably more than she saved... let's not even get started about depreciation on the car.

Coupons. I knew somebody who drove all over the city so she could save money with coupons. The gas alone was probably more than she saved... let's not even get started about depreciation on the car.

This one depends on how coupons are used. Going to a store out of the way to save a dollar on an item isn't good but when applied to stores one regularly shops at the savings can make a huge difference.

Telling the healthcare marketplace you only make 30k a year when you actually make 70k+.

Telling the healthcare marketplace you only make 30k a year when you actually make 70k+.

I've heard driving with the windows down consumes more gas than windows up with the AC running.

I've heard driving with the windows down consumes more gas than windows up with the AC running.

A lot of price matching and shopping around ends up wasting more than it's worth.

A lot of price matching and shopping around ends up wasting more than it's worth.

Also my dad read that you saved gas money going slower. So he once added an hour to his commute so that he could save gas.

Even aside from the fact that that hour of his life was worth more than the 3 cents it saved him, he had to take a longer route to do it because you can't go under 60 on the interstate.

I usually drive 10% slower than the speed limit on motorways and main roads... It does save you fuel over a long distance.

Monthly payments, i understand not everyone can come up with a large amount at once but things like example braces the monthly payment was cheap but in the end it turned out to be significantly more than paying it up front, i was the dumb one once i turned 18 all these places would say monthly payment options, i got excited then in the end i was like wait a d**n minute! Haha!

While this is good advice it isn't practical or obtainable for everyone. Sometimes, monthly payments is the only way to take care of necessities. Payments are a lifeline for many.

Buying the cheaper and smaller packages of food at the grocery store.

Buying the cheaper and smaller packages of food at the grocery store.

The price for the amount of food is often a lot higher. It’s better to buy the larger sized ones, and then maybe freeze some of it.

Buying bigger packages usually leads to throwing away most of it in my kitchen. I know the small packs are often overpriced but anything else does not make sense for me, as I am living on my own. Unfortunately there are some discounters I can't really use any more as they switched to bigger and bigger packages - which is fine if you are a family of five and doing weekly groceries. But I simply do not have the storage space to buy everything in bulk, and perishable goods go bad long before I can use them.

Saving money in a savings account.

This is another that is just not a good representation. You need to have some cash around that you won't miss for 6 months to a year in order to take advantage of higher yield accounts. I have a few shekels put aside that I invest in 2 accounts. If something drastic happens and I need some money quickly, I can just tap one account (and lose the interest) rather than losing everything I have accumulated. But, there are not a whole lot of people who have that freedom.

Backyard chickens. Gardening. Canning. Making clothes.

We can't keep livestock (we live in a city and is one of the council's stipulations), our back green isn't big, but we grow what we can (short growing season in Scotland because....well it's Scotland lol), home canning isn't really a thing here and the costs are extortionate for supplies. And tbh, I wouldn't make my own clothes (tried to hem a pair of trousers when I was a teen and one leg was 2 inches shorter than the other. So I get why the OP says it's expensive, because it is.

Anything that appreciates at less than the rate of inflation.

Avoiding getting into a higher tax bracket.

Shopping at Costco.

Huh? If you only need a small quantity of an item, then Costco is not the best bet.

The dollar store. You’re paying way more per item, but I understand their utility is to help get by when you can’t afford a full item or to buy in bulk. If you’re not paycheck to paycheck though, it doesn’t make sense to shop there.

How about firing a whole bunch of government employees only to rehire them back with compensation because they were fired unlawfully?

When my son was growing up he played a lot of sports so we usually bought cheap running shoes or sport shoes for him to use while playing these said sports. As well as playing alot of different sports the speed of growing feet meant he went through a lot of shoes. What I came to realise there is a reason that name brands are much more expensive because they just last longer and is much better quality than these cheap makes.

For someone in their growing years, I understand buying cheap shoes because they won't have time to deteriorate as your feet grow to cause pain in your feet. Bad running shoes can cause such terrible pain and strain injuries that you can forget about sports for months and spend your money on painkillers. I also still use (not when I'm exercising) my retired running shoes, even though in reality they shouldn't be anywhere near my feet anymore.

Load More Replies...How about firing a whole bunch of government employees only to rehire them back with compensation because they were fired unlawfully?

When my son was growing up he played a lot of sports so we usually bought cheap running shoes or sport shoes for him to use while playing these said sports. As well as playing alot of different sports the speed of growing feet meant he went through a lot of shoes. What I came to realise there is a reason that name brands are much more expensive because they just last longer and is much better quality than these cheap makes.

For someone in their growing years, I understand buying cheap shoes because they won't have time to deteriorate as your feet grow to cause pain in your feet. Bad running shoes can cause such terrible pain and strain injuries that you can forget about sports for months and spend your money on painkillers. I also still use (not when I'm exercising) my retired running shoes, even though in reality they shouldn't be anywhere near my feet anymore.

Load More Replies...

Dark Mode

Dark Mode

No fees, cancel anytime

No fees, cancel anytime