Fraud has been around for as long as human beings have existed, and surprisingly, some of the scams we may think are recent actually go back centuries. From billion-dollar banking scandals to fake heiresses, every famous case in history has left victims shocked, the public outraged, and the world fascinated. Some fraudsters scammed entire countries, while others carefully targeted their unsuspecting victims, but all of them had a lasting impact. In this list, we’ve compiled 25 of the biggest fraud cases that made headlines and ultimately changed history.

This post may include affiliate links.

The Chinese Milk Scandal (2008)

The Chinese milk scandal is one of the worst food safety crises in history. It began in 2008 when several dairy companies in China decided that watering down milk would be an easy way to cut costs. To make up for decreased protein levels, they spiked the milk with a toxic chemical called melamine. Sadly, this led to over 300,000 children falling ill, and at least six of them passing away.

My degree is in food science and a lot of the most egregiously horrifying studies I read in college concerned food safety in China. Did you know that sewage contamination led to 500,000 people contracting Hepatitis in Shanghai in the '80s? You do now. UNTIL WE MEET AGAIN!

The Wells Fargo Scandal (2016)

From 2011 to 2016, employees at Wells Fargo opened fake bank accounts, forged signatures, and even transferred customer funds without authorization, all in an attempt to meet crazy sales targets. When regulators discovered this misconduct, they fined the bank over $1 billion. Shockingly, even more misconduct was uncovered over the years, and as a result, in 2022, Wells Fargo was ordered to cough up an additional $3.7 billion.

My first bank account was with First Interstate. They got bought up by Wells Fargo in the 90s and went straight to hell. I'm with a local credit union these days because they don't suck like the big banks.

Elizabeth Holmes’ Blood Testing Scam (2014)

Imagine the joy of not having to get countless vials of blood drawn for medical testing. This is exactly what Elizabeth Holmes, founder of the startup Theranos, claimed her company’s revolutionary technology could do: run hundreds of medical tests using a sample of just a few drops of blood. Despite knowing her technology was faulty and unreliable, she used false data to secure millions of dollars in investments, leading to a company valuation of over $9 billion. After extensive investigations into her company, Holmes was charged with fraud and later sentenced to over 11 years in prison in 2022.

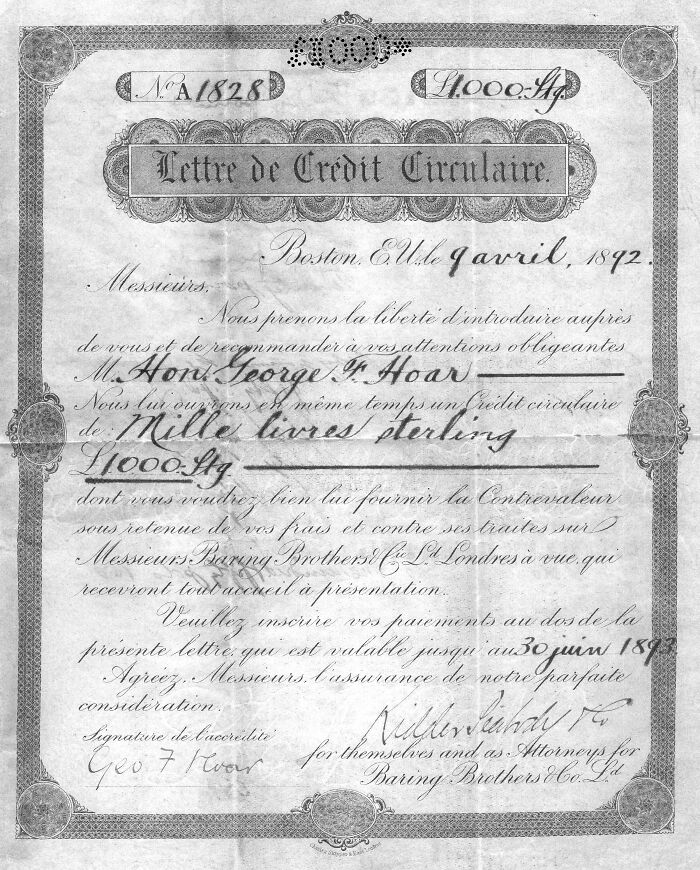

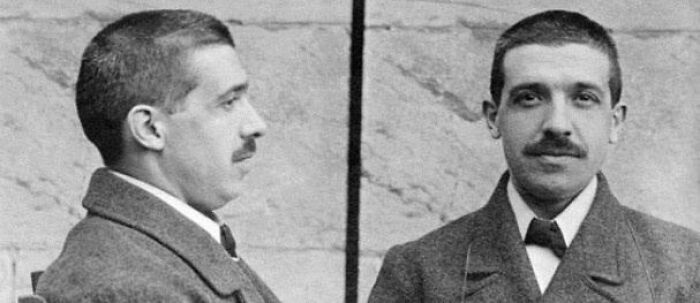

The Charles Ponzi Scheme (1920s)

The infamous swindler Charles Ponzi defrauded investors of millions of dollars in 1919 through fraudulent dealings involving international postal coupons. After promising them massive returns, Ponzi would surprisingly honor the commitments, but not in the way you’re expecting. He would actually pay off earlier investors using the money he had conned from new investors. For his crimes, Ponzi was sentenced to 5 years in federal prison in 1920.

The Wachovia Bank Scandal (2010)

The Wachovia Bank sent shockwaves across the United States in 2010 after admitting that it didn’t have adequate systems to prevent money laundering. As a result of these improper systems, the bank became an accessory in laundering money for drug cartels between 2004 and 2007. For its lack of compliance with the Bank Secrecy Act, Wachovia Bank had to pay over $100 million in forfeitures and a $50 million fine.

The Tinder Swindler (2017)

What better way to start this list than with the infamous Tinder Swindler, who took over our TV screens in 2022. Simon Leviev was exposed for running financial scams on unsuspecting women he’d matched with on Tinder. In 2015, Leviev was convicted of fraud in Finland, and unbelievably, that isn’t where his crimes ended. In 2019, he was sentenced to 15 months in an Israeli prison for scamming women in Europe out of thousands of dollars using a fake identity and shady manipulation tactics.

I hope there is a special circle of Hell reserved for those who prey on the emotionally vulnerable.

The European Horse Meat Scandal (2013)

The horsemeat scandal took Europe by storm in 2013, when the public discovered that what they thought was beef was actually horsemeat sold as “beef”. It was uncovered that horsemeat was in everything, from burgers to meatballs, and at many stores across several countries. Although no major health problems were reported, the incident sparked fierce backlash, forcing European governments to tighten food testing and introduce stricter consequences for those who commit food fraud.

This is why we have the USDA here. At the plant I work at, we have a USDA inspector there every day to insure that we are NOT pulling this sh!t. Because of the shutdown, she's working without pay and still inspecting us every day and god bless her for that dedication. We literally can't produce a single thing without inspection. She calls in sick and another inspector jumps in but what happens when they run out of inspectors? We are effectively shut down.

The Barings Bank Scandal (1995)

Barings Bank, known as the UK’s oldest investment bank, collapsed in 1995 after trader Nick Leeson lost over $1 billion through unauthorized trades in Singapore. Because he had access to both trading and accounting, in an attempt to cover up his mess, he forged financial records and concealed accounts. Unfortunately, his efforts weren’t enough to hide the truth, and by the time his blunder was uncovered, it was already too late to save the bank from bankruptcy.

I still amazes me how one person could have done so much damage. It really was quite remarkable.

Wolfgang Beltracchi’s Art Forgery (2011)

Dubbed one of the world’s most infamous art forgers, Wolfgang Beltracchi pulled off the largest art forgeries in history, pocketing well over $20 million selling fake paintings. With the help of his wife, he created near-perfect replicas of famous artists’ work and sold them to the highest bidder. After their scam fell apart in 2011, the couple, along with their accomplice, were arrested and sentenced to years in prison. Interestingly, after only serving three years of his six-year sentence, Beltracchi began selling his own original artworks.

François And Joseph Blanc’s Telegraph Scam (1830s)

In another shocking first for the world, brothers François and Joseph Blanc managed to pull off a telecommunications scam between 1834 and 1836. The pair bribed a telegraph operator to sneak stock market tips into the French government’s telegraph messages, giving them an unfair trading advantage. As it turns out, insider trading wasn’t illegal at the time, so when their scheme was uncovered, they only faced bribery charges and got to keep most of their profits.

It should be noted that the telegraph in question was an *optical* telegraph - that is, a series of semaphore towers which used rotating arms to transmit the messages (the Clacks in Discworld are based on them). They bribed a couple operators in Tours to send messages on the telegraph about the movements on the Paris stock exchange to them in Bordeaux, but the network was only supposed to be for official government communication. The whole scheme is a little complicated, involving deliveries of coloured clothes as coded messages and a bunch more. Tom Scott has a good video on it: How the first telecoms scam worked.

Victor Lustig's Sale Of The Eiffel Tower (1925)

Best known as “the man who sold the Eiffel Tower”, Victor Lustig caused quite a stir with his scam in 1925. Posing as a French government official with fake stationery and seals, he managed to convince dealers that the Eiffel Tower would be dismantled and sold to the highest bidder. Unfortunately, one unsuspecting victim fell for the scheme and paid Lustig a large sum of money, which he then used to flee. As it turns out, he was later captured and imprisoned in Alcatraz for his crimes until he passed away in 1947.

He did it twice! The scam involved soliciting a bribe as the 'Government official in charge of assigning the demolition contract'. When the first victim kept quiet, presumably to hide that he had bribed a government official, Lustig returned and pulled the scam again on a fresh set of marks.

The Brooklyn Bridge Scandal (1880)

The famous phrase “I have a bridge to sell you” comes from George C. Parker’s Brooklyn Bridge scam. Claiming to own the bridge, he repeatedly sold it to unsuspecting buyers over several years. Unfortunately, this wasn’t the only landmark he “sold” at the time: the Statue of Liberty, Madison Square Garden, and even Ulysses S. Grant’s tomb were also used in his scams. In 1928, Parker was sentenced to life in prison for fraud and forgery, remaining in Sing Sing Prison until his passing in 1936.

OMG I didn't know this was a real thing! I always heard the phrase and knew it was linked to the Brooklyn Bridge, but this is the dude who did it for real.

The Theft Of The Mona Lisa (1911)

The 1911 theft of the Mona Lisa is considered one of the world’s most infamous art heists. While handyman Vicenzo Peruggia was the one who actually stole the painting from the Louvre, it’s said that con artist Eduardo de Valfierno was the mastermind behind the plan. Allegedly, he orchestrated the theft just to sell forged copies at exorbitant prices. It wasn’t until 1913 that the Mona Lisa was recovered after Peruggia tried to sell it in Florence.

The Mona Lisa was much less well known (and regarded) before the theft.

The Saudi Prince Scandal (1991)

Anthony Gignac, a Colombian-born con artist, took a page out of Perkin Warbeck’s book when he spent nearly three decades impersonating a Saudi prince. During that time, he used his “royal status” to run elaborate investment and luxury scams, defrauding investors out of millions of dollars. Gignac’s gravy train came to a halt in 2017 when a billionaire business partner grew suspicious of his identity. As a result, he was arrested and sentenced to 18 years in prison for identity theft and wire fraud in 2019.

American Greed has done stories of him and a few others on this list.

The Sir Francis Drake Estate Scam (1916)

Funny enough, we’ve all probably received a text or email that reads “you have unclaimed estate funds”. This popular scam dates back to 1916, when Oscar Hartzell conned thousands of people by claiming they were entitled to a share of the Sir Francis Drake Estate. Over $1 million was collected from the victims in a bid to ”recover” the estate, but sadly, it turned out to be an elaborate lie.

Ruben Oskar Auervaara’s Romance Scam (1940s)

Before the Tinder Swindler became a household name, the “newspaper swindler” was scamming women through personal ads in the 1940s. Ruben Oskar Auervaara, a Finnish conman, would pose as a bachelor seeking marriage to lure in single women, then convince them to give him money before disappearing. His schemes made waves in Finland, so much so that even his last name was adopted as the official expression for a silver-tongued trickster. Sadly, Auervaara’s charm couldn’t keep him out of prison, and he spent 26 years of his life locked up.

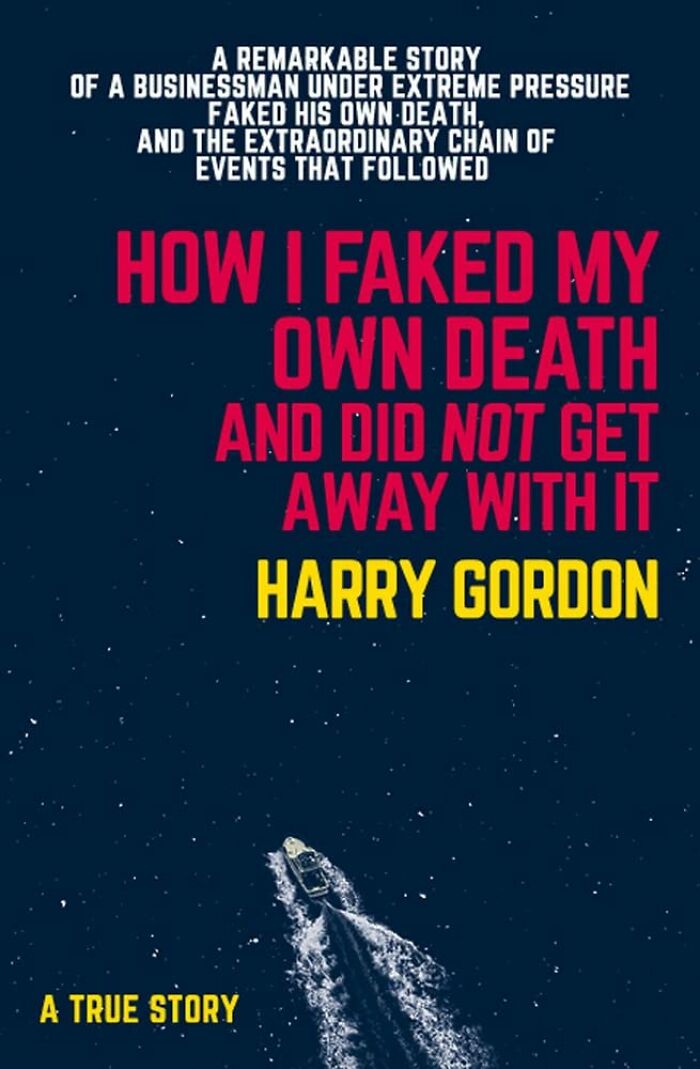

Harry Gordon’s Pseudocide (2000)

After experiencing some financial difficulties, former Australian millionaire Harry Gordon decided the only way out was to fake his own passing in 2000. With the help of his wife and daughter, he actually managed to pull it off, hoping to claim his massive life insurance policy. But Gordon’s ruse finally came to an end in 2005 after he was spotted alive and well in New Zealand, living under the alias Rob Motzel. After spending 15 months in prison for attempting to defraud his insurance company, he detailed his scheme in a memoir that’s still available for sale today.

Anna Delvey’s Heiress Con (2013)

Anna Delvey’s story inspired the hit Netflix series Inventing Anna. In another case of fake identity, she posed as a German heiress to worm her way into New York’s elite circles. From 2013 to 2017, she lived extravagantly and defrauded banks, businesses, and even her own friends out of thousands of dollars. Delvey’s scheming ways eventually led to her downfall in 2018, when she was arrested then later convicted of grand larceny.

I saw a documentary about her. I still can't believe she got away with all of this for four years

Perkin Warbeck’s Identity Theft (15th Century)

It might surprise you that identity fraud dates back to the 15th century, but we have Perkin Warbeck to thank for that. Best known as one of history’s first identity thieves, Warbeck claimed to be Richard, Duke of York, an heir to the English throne. He even went as far as recruiting an army of around 6,000 men to overthrow King Henry VII, but unfortunately, that didn’t go as planned. Initially, Warbeck was spared and kept under guard, but after two escape attempts, the King had no other choice but to end his life

This one is questionable, because there was a fair amount of evidence - including the fact he couldn't speak Latin - that made the entire thing very questionable.

Jordan Belfort’s Wall Street Con (1999)

You probably recall Jordan Belfort from the 2013 hit film The Wolf of Wall Street. Well, in real life, the former stockbroker and motivational speaker who inspired the movie ran a huge penny-stock scam through his firm in the 1990s. With his crazy sales tactics and market manipulation, Belfort managed to scam investors out of over $200 million. Unfortunately, his extravagant lifestyle put him on the FBI’s radar, and in 1999, he was sentenced to 22 months in prison for fraud and money laundering.

The words “Wall Street” and “con” just go together so well.

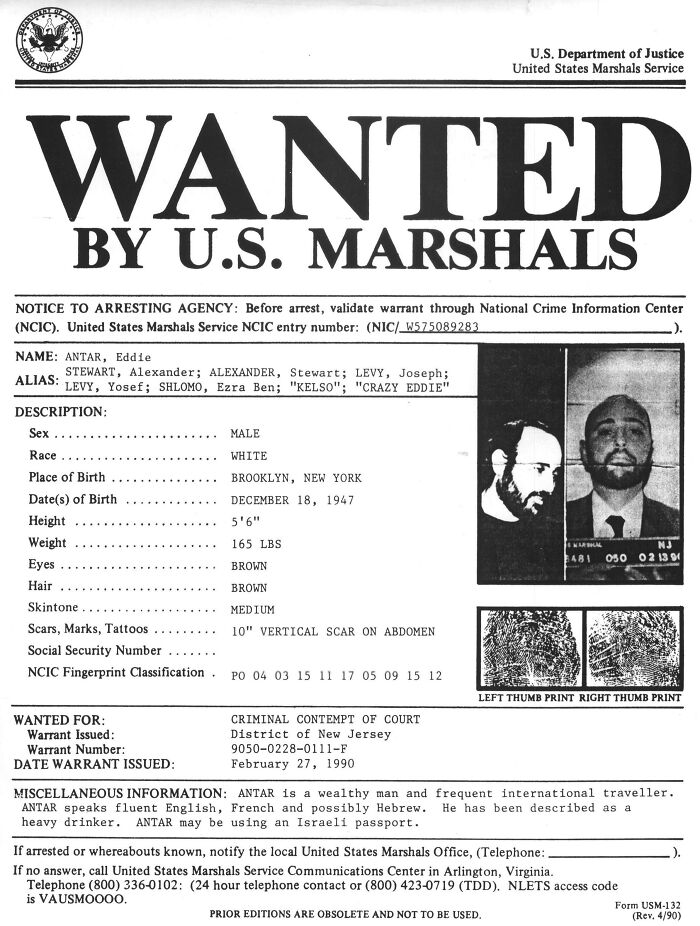

The Crazy Eddie Scandal (1980s)

The founder of the Crazy Eddie electronics retail chain, Eddie Antar, caused a massive scandal in the ‘80s when it was uncovered that he defrauded investors out of millions. Profits were inflated, stock was manipulated, and cash was skimmed from the company accounts for years before auditors caught on to his crimes. Antar fled to Israel to get away from his legal troubles, but was eventually caught and sentenced to 8 years in prison for multiple counts of fraud.

I looked this up. He and his brother started the company in 1969. It didn't say if he and his brother started out as honest but they should have got a year for each year they frauded their investors so they should probably got 20 plus years of prison time.

Edward Davenport’s Advance-Fee Scam (2009)

From 2005 to 2009, this British “businessman” pulled the classic advance-fee scam on unsuspecting victims who needed some extra cash. Edward Davenport promised them huge commercial loans if they paid him initial fees, like deposits and verification fees, but of course, none of them ever received a cent back. Despite spending years behind bars for his schemes, Davenport reportedly got involved in shady property deals soon after his release.

Apologies to his victims but honestly, anyone who would put even a drop of trust in someone who thinks this portrait looks cool needs to have their head examined.

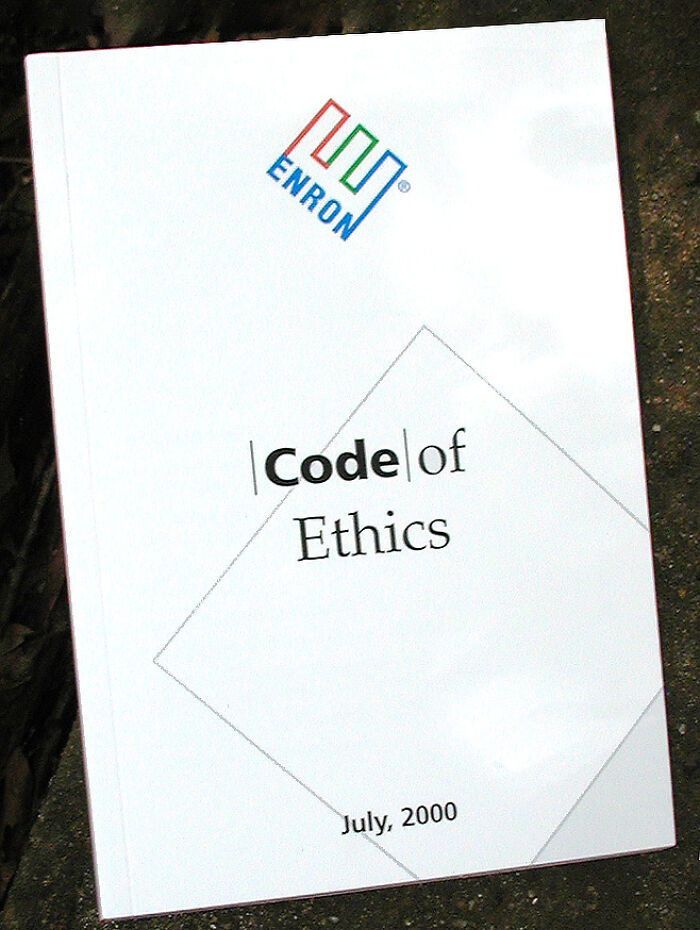

The Enron Bankruptcy Scandal (2001)

Known as one of the biggest corporate crashes in history, the Enron scandal shook the energy industry in 2001. It all began when the U.S. company inflated its success and misled investors by recording forecasted profits as actual earnings. When it came out that the company was actually drowning in debt, stock prices plummeted, leading it straight into bankruptcy. Thousands of employees lost their livelihoods, and the accounting firm responsible for the cover-up had its license to practice revoked.

One of my former students was briefly an auditor at Enron. She took half a look around and got out.

Frank W. Abagnale’s Workplace Fraud (1969)

The inspiration behind the bestselling novel and hit film Catch Me If You Can was none other than con artist Frank Abagnale. Prolific in the ‘60s, he created fake identities in multiple countries and even forged checks. If that wasn’t bad enough, Abagnale also pretended to work in a variety of professions, actually posing as a pilot, doctor, and many more. His crimes and falsehoods eventually landed him in prison in 1969, and surprisingly, after serving his time, he went on to make claims about working with the FBI.

The BANINTER Banking Scandal (2003)

In 2003, Ramón Báez Figueroa, president of the Dominican Republic’s Banco Intercontinental (BANINTER), was at the center of what is considered one of the largest fraud cases in the Caribbean. He cooked the books so he could skim cash off the top without drawing attention from the bank’s auditors and industry regulators. When the staggering amount of money ($2.2 billion) he had stolen was revealed, it pushed the country into a state of national emergency and economic crisis. For the fraud, Báez Figueroa was sentenced to ten years in prison, and sadly, the BANINTER did not survive the scandal.

Former American Congressman George Santos is missing from this list.

Former American Congressman George Santos is missing from this list.

Dark Mode

Dark Mode

No fees, cancel anytime

No fees, cancel anytime