“I Have Saved Thousands Of Dollars”: 30 Unhinged Money-Saving Tips People Swear Actually Work

Interview With ExpertWe all love saving our hard-earned money…unless, of course, you’re a billionaire with more cash than you could ever count. For the rest of us, every little saving counts. You could clip coupons, hunt for discounts, or, better yet, ask people online for clever hacks.

For example, someone on the internet recently asked, “I’m broke. What are the best ways to save money?” And no, they weren’t looking for the usual “practice self-control” tips. They wanted diabolical, genius-level answers that actually work. Naturally, the internet did not disappoint.

Fair warning: some of the tips are totally unhinged and probably won’t work for most of us, but hey, they’re entertaining! And then there are the truly clever ones that might actually help you save a few bucks (or even more). Keep reading to see the full mix of wild, ridiculous, and surprisingly useful money-saving hacks.

This post may include affiliate links.

I compare the price of something to what I get paid hourly, then think "would I work x amount of hours for this?".... it's usually no.

I compare the price of something to what I get paid hourly, then think "would I work x amount of hours for this?".... it's usually no.

That's a very tried & true way to make decisions. I first heard it from a man who'd been in his 20's when the US Stock Market crashed in 1929, and managed to get through the Great Depression better than many others around him. He still followed his own advice up to the day he died! (Hint - once in a great while the answer is "yes, yes, I would".)

I wait until the next day to see if I still want the thing I was about to buy (I usually forget about it forever which means I didn't need it that much anyway).

I wait until the next day to see if I still want the thing I was about to buy (I usually forget about it forever which means I didn't need it that much anyway).

I hate going inside banks. I made a second savings that I can only deposit into not withdraw. if I need that money I HAVE to go inside. I have saved thousands of dollars this way simply bc I refuse.

I hate going inside banks. I made a second savings that I can only deposit into not withdraw. if I need that money I HAVE to go inside. I have saved thousands of dollars this way simply bc I refuse.

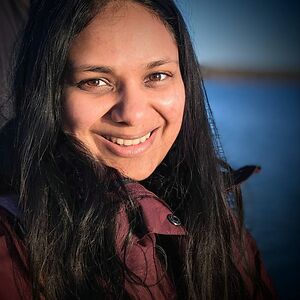

When it comes to saving money, it’s always wise to seek guidance from experienced professionals. To gain deeper insights, Bored Panda spoke with Khushboo Dugar, a seasoned chartered accountant from India who specializes in financial planning and tax advisory.

Her tips are practical and easy to follow, whether you’re just starting out or already managing a household budget. The goal is to make thoughtful, informed decisions that support both short-term needs and long-term goals.

Savings didn’t work cause I would just pull it out whenever I’d go shopping so I got a savings app which will take my money instantly but takes 3-5 days to pull it back out.

Savings didn’t work cause I would just pull it out whenever I’d go shopping so I got a savings app which will take my money instantly but takes 3-5 days to pull it back out.

I’ve had to actually think before withdrawing my savings so I’ve saved enough for a car and all my vacations the last 4 years and 10k on top of that.

Start cooking. For real.

Start cooking. For real.

As a male, I absolutely love to cook, not matter how knackered my frame feels after a long day at work and my wife knows it! And she tells me that her fellow doctors and coworkers at the hospita keep asking her when they can come to our castle for a delicious Mexican meal (my specialty!) She cooks really good too if you want to know

In the state of California dumpster diving is NOT illegal unless 1. There is a sign saying private property 2. There is a sign saying no dumpster diving 3. A person who is employed at the place you are dumpster diving tells you to leave 4. It is a recycling bin for bottles and cans and stuff (bc they technically count that as stealing from the recyclers). Reminder of what places also have dumpsters:

In the state of California dumpster diving is NOT illegal unless 1. There is a sign saying private property 2. There is a sign saying no dumpster diving 3. A person who is employed at the place you are dumpster diving tells you to leave 4. It is a recycling bin for bottles and cans and stuff (bc they technically count that as stealing from the recyclers). Reminder of what places also have dumpsters:

- home furnishing stores

- clothing outlets

- stores for hygiene items (like soap and such)

- children’s stores

And a lot of these places (when they’re companies) throw out a ton of stuff just because it’s “out of season” or “overstock” or whatever.

Khushboo emphasizes that having a savings account is non-negotiable. “Even if the amount seems small at first, regular contributions can grow significantly over time,” she explains.

A savings account acts as a safety net for emergencies and provides a structured way to set aside money for future goals, whether it’s a home, education, or investments. Starting early and being consistent is key to building financial security. Over time, small amounts add up, creating a cushion that can make a big difference when unexpected expenses arise.

Sleep for like 10+ hours. If you're only awake for like 8 hours a day, you won't eat that much. Can't eat when you're sleeping. Can't spend money on food when you're sleeping. This is doable if you're depressed!

Sleep for like 10+ hours. If you're only awake for like 8 hours a day, you won't eat that much. Can't eat when you're sleeping. Can't spend money on food when you're sleeping. This is doable if you're depressed!

Got [angry] about the fact that smokers can (here) spend like 15 bucks on a pack per day and live the same way I do so I set money aside for "imaginary smoking."

Got [angry] about the fact that smokers can (here) spend like 15 bucks on a pack per day and live the same way I do so I set money aside for "imaginary smoking."

Worked with a fellow who was always short of money. Got to talking and found he and his wife were chain smokers. Did the math and showed him how much went up in smoke each month which he had never thought about.

Make coffee from home and then “pay yourself” what you would at a coffee shop. Make sure you tip the barista!

Make coffee from home and then “pay yourself” what you would at a coffee shop. Make sure you tip the barista!

Budgeting and planning are equally critical components of financial health. Khushboo advises, “Create a budget and track your income and expenses carefully.” Knowing where your money goes allows you to identify areas where you can cut costs and save more effectively. Budgeting doesn’t mean restricting yourself; it’s about making intentional choices with your money.

Take photos of everything you wanna buy to ‘buy at another time’ you’ll forget about it within hours and never buy it.

Take photos of everything you wanna buy to ‘buy at another time’ you’ll forget about it within hours and never buy it.

I put things in my Amazon account but just leave it there. When I come back a few days later Ikm always like- Why did I want that?

Only every buy things with cash so it’s a real physical loss. Whenever I buy [stuff] with my card my brain tries to go “oh I’m sure we have enough just buy it” where as with cash I can see how much money I’m loosing.

Only every buy things with cash so it’s a real physical loss. Whenever I buy [stuff] with my card my brain tries to go “oh I’m sure we have enough just buy it” where as with cash I can see how much money I’m loosing.

Most of these "hacks" are actually based on making your life quality worse, but here is the thing: get very good at spotting expenses that will or won't actually impact your life quality.

Most of these "hacks" are actually based on making your life quality worse, but here is the thing: get very good at spotting expenses that will or won't actually impact your life quality.

Whenever I want to buy something, think I need to buy something or am tricked into wanting to buy something, I wonder: will this actually make my life any better? And if so, can I obtain the same result from something I already own/can have without buying? This usually puts me off from buying, without leaving me with the feeling of missing out on something, quite the opposite.

Impulse purchases are one of the biggest challenges, especially with online shopping so readily available. Khushboo suggests taking a pause before making non-essential purchases. “Ask yourself if you really need it, or if it’s just a fleeting desire,” she says. Waiting even a day or two can prevent unnecessary spending. Being deliberate about purchases is just as important as earning money itself.

Once you ignore the first urge to purchase something you don't need, it becomes easier.

Once you ignore the first urge to purchase something you don't need, it becomes easier.

1.) pick object up 2.) ‘oh this is cute!’ 3.) put object back.

1.) pick object up 2.) ‘oh this is cute!’ 3.) put object back.

1. Pick object up 2. Oh this is cute 3. Check price 4. Naah not so cute 5. Put object back

From my mom that helped me a lot: When you want something wait five days, if you still want it then, get it. If not, you didn’t really really want it and it would’ve been a waste of money.

From my mom that helped me a lot: When you want something wait five days, if you still want it then, get it. If not, you didn’t really really want it and it would’ve been a waste of money.

Set a goal and write on paper each time you add money. Put it up somewhere as seeing your goal can help motivate you. It’s like a game, and reach that goal, ticking off checkpoints, is like a reward!

My mother once heard the idea "put your credit card in a bowl of water and keep it in the freezer. When you want to buy something, take the bowl out. If by the time the ice has melted you still want it, go ahead and buy it!"...and promptly did this with her AmEx. Literally. The same card, by the way, she used to call her "American Distress card". Somehow I don't think the person telling her this meant it literally. But my mom was bip0lar so....#yourMileageMayVary

Reviewing bills regularly is another practical tip. “Check subscriptions, recurring payments, and services you may not be using,” Khushboo advises. Canceling unnecessary expenses can free up money for more meaningful priorities. Additionally, comparing prices and looking for deals ensures that you get the best value for your purchases. Small adjustments like these can have a big impact on overall financial stability, while also creating awareness of spending habits.

When I'm broke I eat super spicy food so it "lasts longer" I feel full for more time than I would if it weren't spicy.

When I'm broke I eat super spicy food so it "lasts longer" I feel full for more time than I would if it weren't spicy.

When I wanted to lose weight, I would drink tomato juice with hot sauce and it was filling.

Not unhinged but I really like Acorns. Whenever you buy something it rounds up to the nearest dollar and puts the extra few cents away and invests it. It's also satisfying for every purchase to be a nice round number.

Not unhinged but I really like Acorns. Whenever you buy something it rounds up to the nearest dollar and puts the extra few cents away and invests it. It's also satisfying for every purchase to be a nice round number.

Move all but a "spending" amount into savings. If you don't have it in checking you don't "have it."

Move all but a "spending" amount into savings. If you don't have it in checking you don't "have it."

Direct deposit $50 per pay, or more if you can into savings. Same with tax returns. I know, getting a refund is poor planning, but it works! 'Extra' 3 grand or so a year

Peer pressure can influence financial decisions more than many people realize. Khushboo warns, “Never spend unnecessarily just to keep up with others.” It’s easy to fall into the trap of trying to match someone else’s lifestyle, whether it’s buying flashy gadgets, cars, or luxury items. Instead, focus on your own goals, priorities, and financial well-being. Protecting your money from external pressures is crucial for long-term stability and peace of mind.

Write down every penny you spend, you become too aware of how much you are spending and that stops you for doing unnecessary purchases. "I can't spend $8 on coffee I already spent 70% of my paycheck and there is 10 more days till my next paycheck."

Write down every penny you spend, you become too aware of how much you are spending and that stops you for doing unnecessary purchases. "I can't spend $8 on coffee I already spent 70% of my paycheck and there is 10 more days till my next paycheck."

I have been tracking every dollar in Microsoft Money 2002 since... 2002!

Watch a documentary or YouTube videos about overconsumption. Follow more Instagram accounts that talk about the environment and capitalism so that it's in your daily feed.

Watch a documentary or YouTube videos about overconsumption. Follow more Instagram accounts that talk about the environment and capitalism so that it's in your daily feed.

If you see something cute in a store that you don't actually need, ask yourself how long it will sit in a landfill after you die. Think about how much space an item will take up in your home.make handmade gifts instead of spending money. Learn how to sew.

Please just don't get me anything. I do not want your hard worked, hand made "gifts." I'd rather you save me and the landfill from more junk. I really don't even like people buying me presents anymore. Bc honestly, if I want something I'll buy it. Please don't waste money buying me a candle or smelly soap. The only gifts I do like are the ones I give my son money to buy. Bc I'm always so curious how his little mind is going to work.

Avoid comparing your lifestyle to others, even subtly. “Just because someone else makes a big purchase doesn’t mean you should,” Khushboo explains. Maintaining perspective and staying true to your personal goals helps you avoid debt and regret. Financial independence is about making choices that benefit you, rather than following trends or succumbing to societal pressure. This mindset fosters long-term security and confidence in your financial decisions.

I have adhd, so I used to my advantage and put all the cash i owned into a drawer. I forgot about that drawer. Never opened it. When it was time for me to move i had almost 1k in cash saved to help with moving costs.

Put all the money you can afford to put into a CD account you cannot touch that money for a set amount of months to years. If you withdraw money before the set date you will be faced with a penalty. Definitely makes you reconsider what you actually need money for.

I wouldn't like that. If something came up and needed money then I would be losing out on money because of the penalty.

Khushboo also stresses the importance of discipline and consistency. Regularly saving, monitoring expenses, and making thoughtful choices form the foundation of a healthy financial life.

Finally, she reminds everyone: “Always remember, it’s your hard-earned money. Treat it with care and respect.” Being intentional, planning carefully, and making thoughtful decisions ensures that your finances support your life goals. Whether it’s saving for emergencies, investing for the future, or managing day-to-day expenses, the right approach helps you achieve stability and freedom. Consistency, awareness, and patience are key to long-term financial success.

I trick myself into thinking I have less than I actually do. I got paid 400? Nah I read that wrong its 300. If I try to go shopping? I think to myself "now you know you only have 150 left" I still buy things but I think about it A LOTTTTT MOREEEE and typically only by things that are cheap that I know I will use again.

I trick myself into thinking I have less than I actually do. I got paid 400? Nah I read that wrong its 300. If I try to go shopping? I think to myself "now you know you only have 150 left" I still buy things but I think about it A LOTTTTT MOREEEE and typically only by things that are cheap that I know I will use again.

I don’t know how people manage to do this kind of “trick”. The real knowledge is right there in my brain, I can’t just ignore it.

1$ into savings every time you say dude.

"Like" or "If you know what I mean". We criticise people for saying 'um' or 'er' because it indicates they haven't fully thought out their sentence before starting it, but we, like, don't mind people, like, saying like all the, like, time. It's infuriating.

I gaslight myself into thinking I'm broke until my next check.

I actually went completely broke about a year ago. Now I'm making much more money. But I keep pretending I'm as broke as I was at my lowest point. It's saving me a lot of money.

While Khushboo’s money-saving tips are practical and effective, some of the suggestions from these posts might seem a bit questionable. What do you think—would you try any of them? And what’s your favorite trick for saving money? Share your tips with us so everyone can benefit!

Get a cute glass piggy bank that doesn’t have a way to open at the bottom or the top so you feel bad for breaking it and wont do it until it feels worth it.

Get a cute glass piggy bank that doesn’t have a way to open at the bottom or the top so you feel bad for breaking it and wont do it until it feels worth it.

Pretend you're having an emergency. Your car isn't broken? It is now, you need $200 to fix it. You need a blood test, it's $100. ONLY THING THAT WORKS FOR ME!

Pretend you're having an emergency. Your car isn't broken? It is now, you need $200 to fix it. You need a blood test, it's $100. ONLY THING THAT WORKS FOR ME!

Only $200 to get by your car fixed? That is pretty cheap unless it is a minor problem.

One time I drove around nice neighborhoods on trash day then turned around and sold the curb scores at my yard sale.

I make people pay me back in cash because I refuse to spend cash…so at the end of the year I just have a bunch of cash.

I make people pay me back in cash because I refuse to spend cash…so at the end of the year I just have a bunch of cash.

What happens at the end of the year? Are you turning into cash-throwing beast?

Buy bonds you pretty much can’t touch the money for a period typically 3 months to 5 years but they can go for any length. Also consider a high yield savings acct at an investment place. Typically it’ll take 24 hours to transfer money to your checking and you be able to use it. This would stop impulsive buying as you’d at least have a small@think it over period. Plus it earns good interest and you can leave your money there risk free.

You want something, think about it for like two months and I mean two months. If it’s something that won’t go away after a while, then use that rule.

You want something, think about it for like two months and I mean two months. If it’s something that won’t go away after a while, then use that rule.

Use all the social services you can get your hands on. There are free meals everywhere if you find them. Particularly at churches and community centres. I didn’t know until I was part of that realm but there’s a lot of help and resources available when you start looking (hopefully).

Use all the social services you can get your hands on. There are free meals everywhere if you find them. Particularly at churches and community centres. I didn’t know until I was part of that realm but there’s a lot of help and resources available when you start looking (hopefully).

Only if you actually need it though. Don’t take resources from other people in genuine need.

Rather than buy and cook a whole meal, I would make a recipe from what's available. I also forage, trade, fish and garden. Lastly, I build and repair my own things. This lifestyle is rewarding for me bc I find it fun but it's also allowed me to live in 11 countries and travel for over 10 years straight!

Sounds like a trust fund may be involved here. That kind of charmed life is awfully hard to achieve around a 40 hour work week

Eat beef and rice, bike everywhere, get rid of music subscription but use YouTube, have 6 outfits can easily be mix and matched but simple.

Remove all cards from your phone and then at the start of each day think to yourself: 'do I need money today?'. If no. Leave any physical cards at home. Can't spend money I didn't bring.

Remove all cards from your phone and then at the start of each day think to yourself: 'do I need money today?'. If no. Leave any physical cards at home. Can't spend money I didn't bring.

I budget my money by day so I'll have a daily budget of like 20 ish dollars depending on how much I make I try to stay in that or I'll save one day to spend more on another.

As long as you do the saving first, The road to Hell is paved with "little treats I'll pay for tomorrow".

Go on night shift, can’t spend money when you’re only awake when everyone is asleep and everywhere is closed.

1 no spending week a month+ planning head has been a money saver without decreasing my life quality.

"But that's $20 you can save for X thing you want" And nearly every time it works.

My method worked. Split all your spending into two categories: Predictable (bills, payments) & Non Predictable (groceries, gas, cash spent, eating out) Spending. From there subtract all predictable spending from your total paycheck, and then divide what’s left with needs first, and then choose one want. The goal isn’t the reach the cap of your paycheck on one category but as little as you can so next paycheck what you didn’t spend on those categories can be saved and you do it again.

Definitely, rolling over whatever is left in your current account the day before payday, into your savings account, is a very powerful tool.

Im also bad at saving so I bought this metal box online for like 10$, and the whole thing is like complete metal and it only has one little slit in it for you to insert bills and the only way you can open it is if you rip it apart with a crowbar or bash it with a hammer so once I put money in there its like a commitment and it stops me from just taking cash out whenever I want.

This is a bad idea. How are you going to get money out without damaging the actual money? I don't think a crowbar would work to open something metal that was welded shut on all sides like that. I think you'd have to cut it out, and that probably means sparks. No bueno with paper money.

Work at a restaurant just for the employee discount.

Work in the food industry.

I separate my income into percentages. i put 30% into savings , 10% emergency savings. i don’t tap into those so it’ll build up slowly!

Watching videos of people with the thing I want so I can satiate my need.

Sounds silly but I play a fashion game on my phone where I can “buy” fancy clothes for my digital models using points in the game. It actually reduced my tendency to buy pretty but impractical clothes because I get another way to “own” them!

It's a false broke advice because you need to have a job where you have to travel, but basically I pay all the travel fees with my own card, so I'm even broker. And the next month the company send me the money to compensate. But I've already had my pay and survived the last month, so I put that monney directly into my savings.

$20 into savings every time some random celebrity posts on instagram, I use sabrina carpenter.

I hide money from myself so whenever I need it I just have to clean my room.

Snything that I contemplate buying, i just put that amount in my savings! its not full-proof but its something thats weirdly helped me!

The 52 weeks challenge :) the 1st week of the year save 1$, the 2nd week save 2$ etc.. up to the 52nd week! (You don't have to do it in this order but it helps ;))

are you +1 or double? In foirst case you will save impressive $1,326... in second, lucky you to earn over nine quintillion

I literally hyperfixate on random documentaries on yt and such to not go out till everything is closed cuz I forget the world exists. This also includes eating. Less shopping = less money spent.

I feel sorry for the ambulance crew who find your emaciated body, though ...

If you buy makeup wipes, buy the cheap Walmart brand ones and cut them into smaller pieces. Saves me loads.

i work in a restaurant, the owner is a close friend to my family so i just told him to keep my paycheck untill i need it, so the money is just coming, i don’t have it, so i can’t spend it, win win.

You better hope that the owner really is your friend, or you could get seriously screwed over. If I read this right, there's parts of, or entire paycheques, that your employer is holding for you, like a bank. If that amount starts to build up, it would be awfully tempting for the employer to start using it for their own needs, with the thought that 'you'll only ever call in part of the debt'. Banks operate that way too.

I don't look at Amazon, or go shopping really anywhere. I get my groceries and that's it.

If you couldn’t buy it twice, you can’t buy it once.

Never carry your wallet with you.

maybe have two wallets, one with money you expect to spend that day, the rest hidden at home. It does annoy muggers, though.

Whenever I need to save money I'm just like "damn, I really want a pack of cigarettes cause I just ran out. But maybe I can buy three if I save 50 bucks." And I force myself to only buy one and then I have the other 35 bucks for the remaining month and I'll just keep doing that until I have like, 100 bucks, then I'll spend enough and stop when I'm like, "damn, I need money for 3 packs of cigs." Works well.

If you stop smoking you'll save a lot more money and improve your health.

I have a shopping [problem] so i go to a retail store, almost fill up my cart, convince myself i don’t actually need any of it and put roughly what i would’ve spent in savings.

And presumably leave the trolley for some poor employee to unload, and throwing away any perishables! Not nice!

Get a hospitality job, step 2) get depressed step 3) once you’re depressed you won’t want to go anyplace. No going out= no spending money. Personally tested.

I hope you find a better job, preferably one where you can feel you're helping people. Better pay would be good, too, of course.

Buy the cheapest thing possible for everything you need. Use reusable things. Cut up old clothes and use them as toilet paper and wash them after use (doesn't work for poop). If you have food left over, do not throw it out, make something else out of it or save it for later. Instead of buying chips, season potato peels and bake them, makes for a great snack. Buy second-hand items.

"Buy the cheapest thing possible" is precisely cheap boot theory... not good

My brother started going into supermarkets and purposely slipping over and pretending to hurt his head so he can get free frozen veggies.

My brother started going into supermarkets and purposely slipping over and pretending to hurt his head so he can get free frozen veggies.

there's really only about three things being listed here, then just variations on these themes. 1. Don't buy stuff you don't need. 2. Force yourself to think about whether you need something before you buy it. 3. Make it more difficult for you to access funds to ensure that you really _really_ think about whether you _really_ need something before you buy it.

Yeah I was expecting more. I guess you could add but second hand when possible. Before the pandemic there used to be a lot better discount stores around me too. Big Lots had actual overflow like Snyder pretzels for several dollars cheaper than grocery store. Sierra Trading Post I got some really good deals on brand name items and couldn't find any flaws or super minor. The outlet store mall near us had actual discounts. Not including what good will used to stock some nice cast iron pans and such that were easy to restore. The discount stores now stock a lot of their own brand items and few name brand items .

Load More Replies...Ok, there is saving money, and then there is punishing yourself for being alive and human enough to have wants and needs. If your entire life is going to be lived in a state of misery where you never get anything you want or everything is 10 times harder than it has to be just to save $10, that is just a long miserable life. Save for the future, sure, just remember that no one is guaranteed tomorrow and you can't take it with you.

But also remember that you're going to retire one day. And start saving for it now. So you're not in a panic when you're 50 and having to build your retirement back up.

Load More Replies...I have one! Im an American server/bartender so i get paid primarily cash-in-hand. Its very easy to spend especially bc im not the primary bread winner so my earning really are our families spending money. My $1 bills get put away off to the side immediately. I never even count them. It may be $3 i put in today and $30 tomorrow...idk? Then when the containers full i take it to the bank in a seperate savings account (from emergencies) about 7x a year, i turn in about $500 1s i didnt know i had. Thats how we pay for vacations, big family outings, seasonal passes ect. Put yours aside and see what you end up with (if you can)

there's really only about three things being listed here, then just variations on these themes. 1. Don't buy stuff you don't need. 2. Force yourself to think about whether you need something before you buy it. 3. Make it more difficult for you to access funds to ensure that you really _really_ think about whether you _really_ need something before you buy it.

Yeah I was expecting more. I guess you could add but second hand when possible. Before the pandemic there used to be a lot better discount stores around me too. Big Lots had actual overflow like Snyder pretzels for several dollars cheaper than grocery store. Sierra Trading Post I got some really good deals on brand name items and couldn't find any flaws or super minor. The outlet store mall near us had actual discounts. Not including what good will used to stock some nice cast iron pans and such that were easy to restore. The discount stores now stock a lot of their own brand items and few name brand items .

Load More Replies...Ok, there is saving money, and then there is punishing yourself for being alive and human enough to have wants and needs. If your entire life is going to be lived in a state of misery where you never get anything you want or everything is 10 times harder than it has to be just to save $10, that is just a long miserable life. Save for the future, sure, just remember that no one is guaranteed tomorrow and you can't take it with you.

But also remember that you're going to retire one day. And start saving for it now. So you're not in a panic when you're 50 and having to build your retirement back up.

Load More Replies...I have one! Im an American server/bartender so i get paid primarily cash-in-hand. Its very easy to spend especially bc im not the primary bread winner so my earning really are our families spending money. My $1 bills get put away off to the side immediately. I never even count them. It may be $3 i put in today and $30 tomorrow...idk? Then when the containers full i take it to the bank in a seperate savings account (from emergencies) about 7x a year, i turn in about $500 1s i didnt know i had. Thats how we pay for vacations, big family outings, seasonal passes ect. Put yours aside and see what you end up with (if you can)

Dark Mode

Dark Mode

No fees, cancel anytime

No fees, cancel anytime