152Kviews

30 Americans Share Their Student Loans And The Rest Of The World Can’t Understand How This Can Be Real

Higher education is meant to get you ahead of the competition. But if you study in the US and have to pay tens of thousands of dollars for it, in a way, the diploma also sets you back. While the country remains the world's most popular destination for international students, it's also among the most expensive choices. However, the locals have a pretty hard time paying for it too.

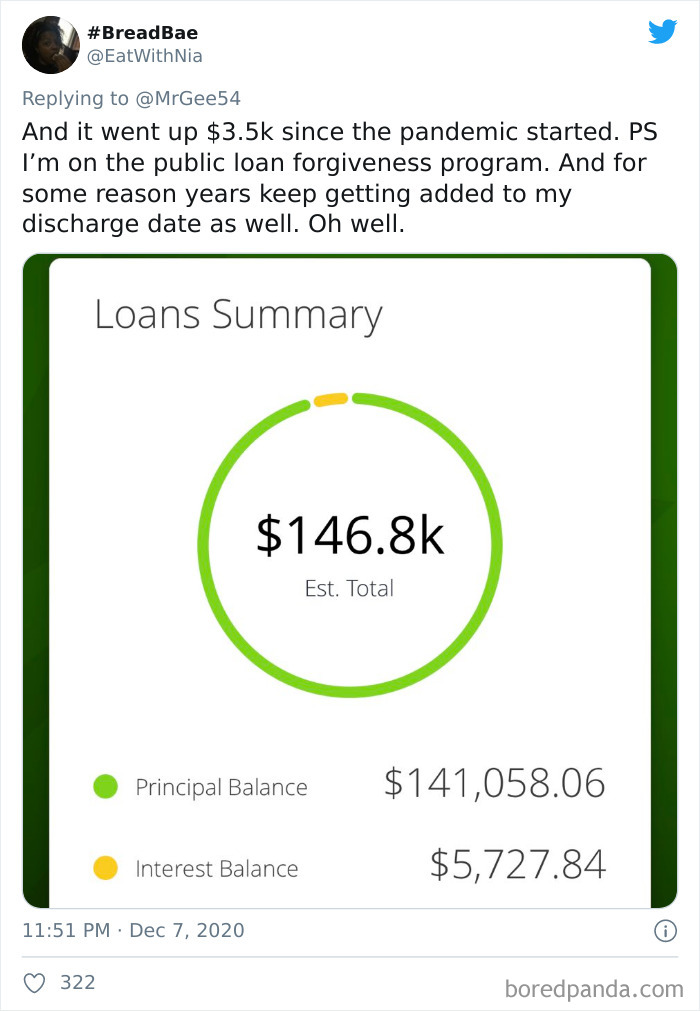

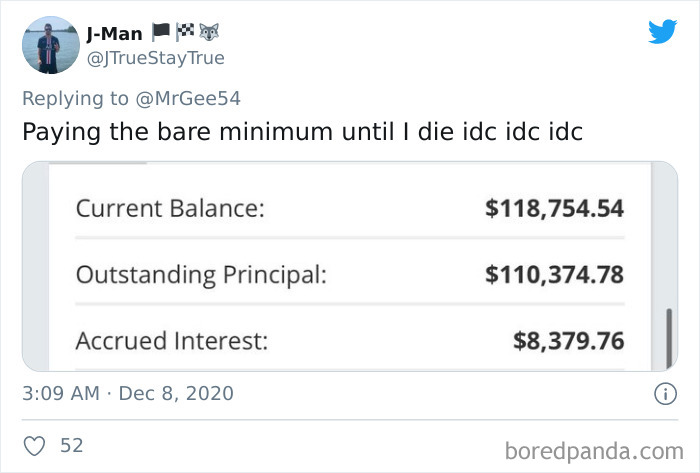

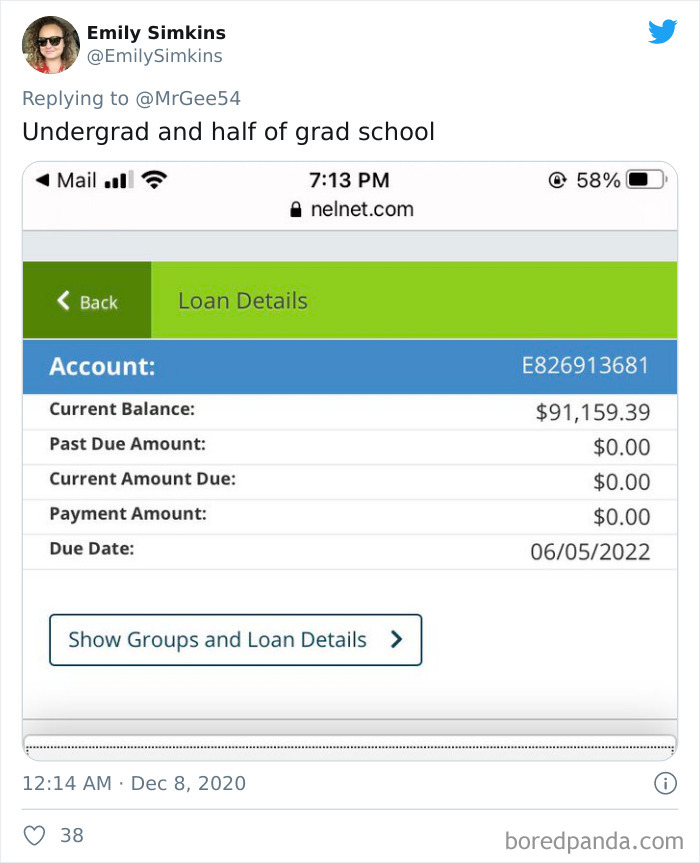

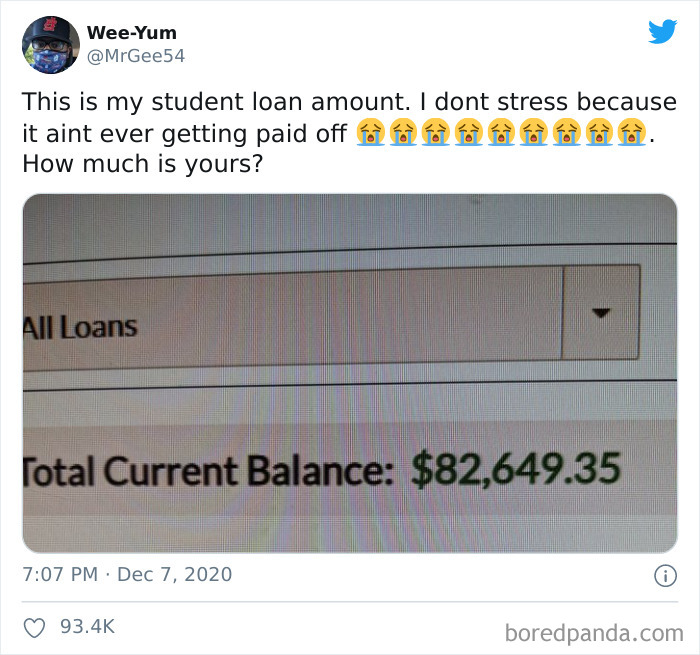

A few days ago, American Twitter user Wee-Yum shared a screenshot of their student debt: $82,649.35. "This is my student loan amount," they wrote. "I don't stress because it ain't ever getting paid off." In order to find solace, Wee-Yum asked others to share their numbers as well.

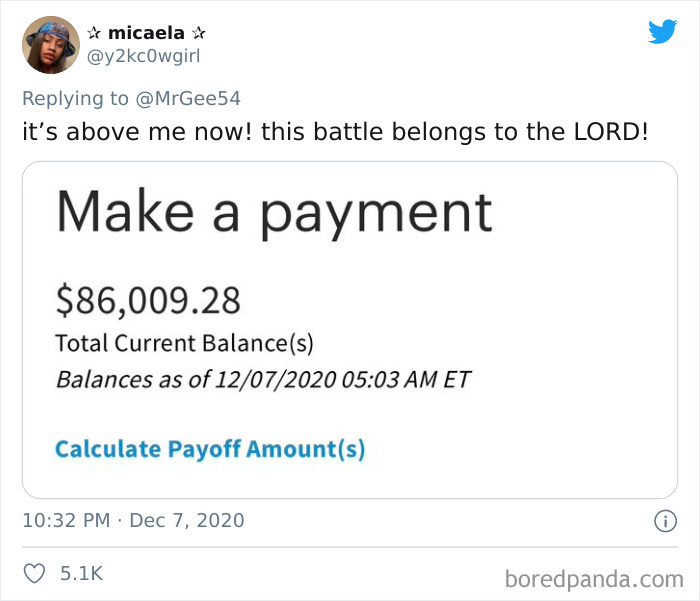

Since this has been such a hot public topic, it didn't take long before the tweet went viral. Generating over 93.4K likes, it has received plenty of replies with staggering dollar amounts. Sadly, you can feel that some of the people who shared them seem pretty hopeless about it.

This post may include affiliate links.

The data on the topic is becoming difficult to comprehend: the total amount of outstanding student loans reached an all-time high in 2020—$1.6 trillion. Based on the current rate of growth, this number can reach $2 trillion by 2024.

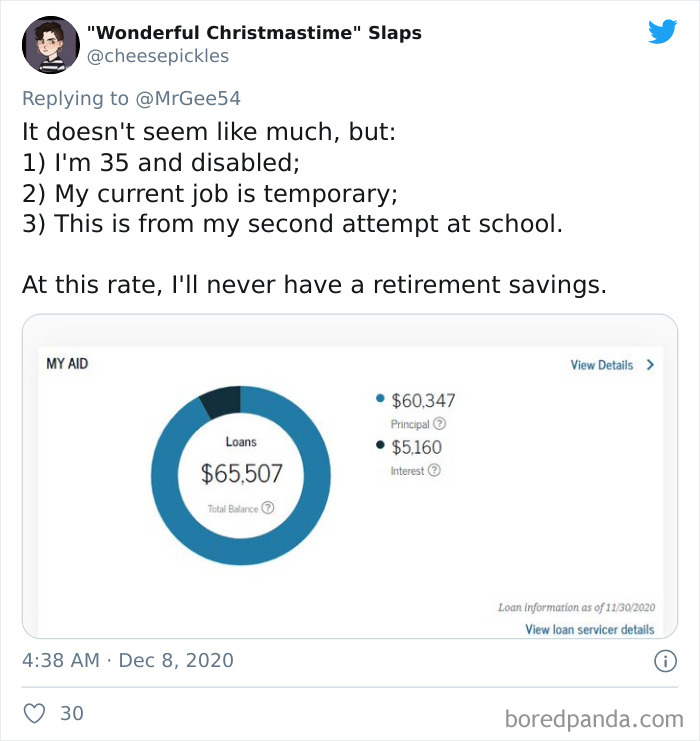

About 43% of Americans who went to college took on some form of debt in order to get through their studies. However, when it comes to today's students, the situation is even worse. Roughly 54% of them need to borrow money to cover their educational costs.

Most of this debt is carried by younger adults. Borrowers between the ages of 25 and 34 carried roughly $498 billion in federal student loan debt as of the second quarter of 2019. Adults ages 35-49 carried even more debt, with student loan balances totaling $558 billion. Meanwhile, those who are 50-61 owe about $230 billion in student loans.

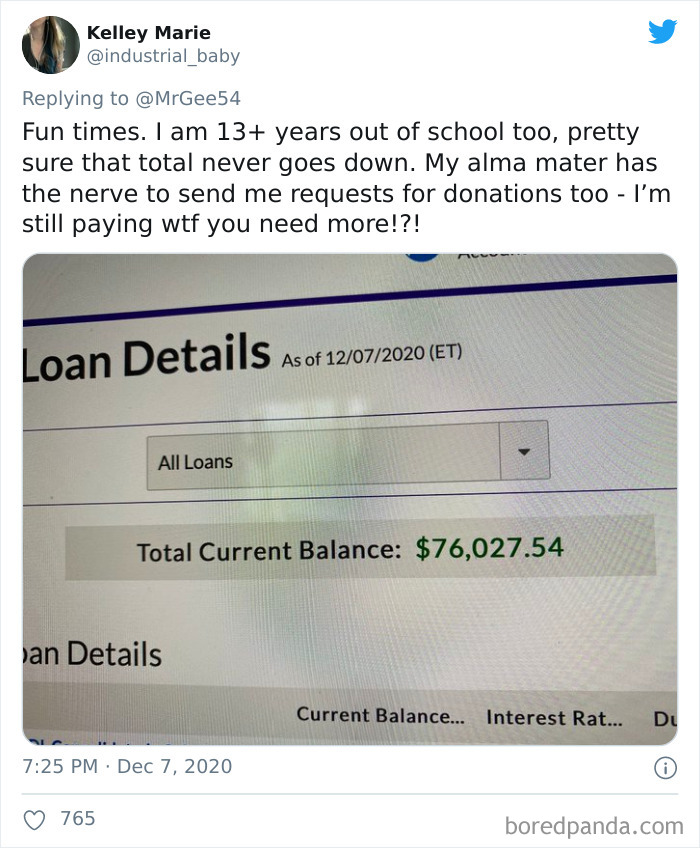

Kelley Marie, one of the people who contributed to the thread, was already a mom when she took her student loan. "I knew I needed to do better for myself, for [my kids'] sake as well as mine. I simply could not afford college on my own, so it was a risk that I simply decided to take," she told Bored Panda.

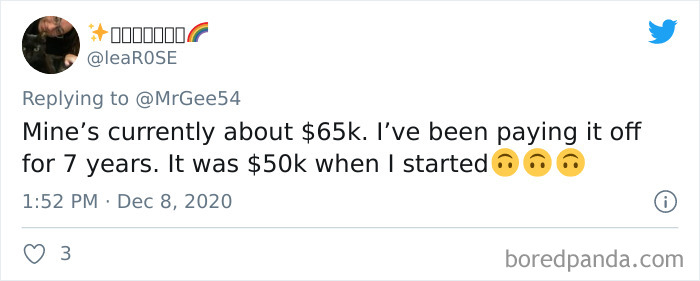

Her total debt at graduation was about $65k. "I have both federal loans and private loans," Kelley said. "When I first graduated the payment was undoable, something like $750+ so I deferred my federal loans and ended up on interest on for my private ones. It piled up for the first several years (my first job out of school only paid about $30k) and at that time I was a single mom to two kids."

The program Kelley wanted was a private university and there wasn't another one in the area where she lived. "I want to say that maybe I would have chosen another field, but that really sucks to be stuck in that situation. I don't know how I could have worked more (I freelanced during college) between full-time classes and being a mother. But that being said, my older girls are now 18 and 16, and I am pushing them to take out as few loans as possible. Me drowning in my own loans kept me from saving for their education. But I can help them navigate the system in a way my parents did not. Searching for jobs that offer grants, and comparing schools."

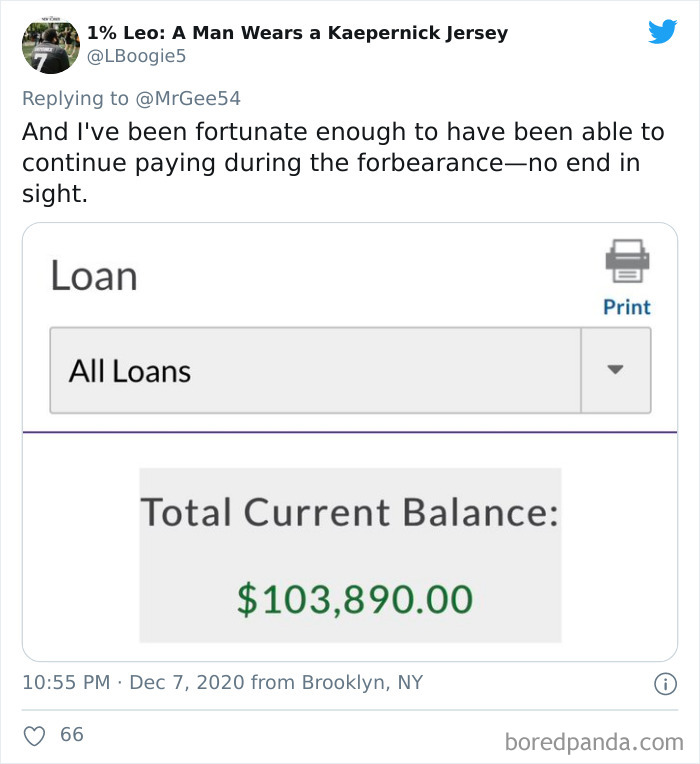

Another Twitter user who shared the details on their situation was @LBoogie5. They said they wanted to complete their dream of going to and finishing college and also didn't have a way to pay for out of state tuition.

"I took about $80K in federal loans and $50k in private. With compounding daily interest the amount owed ballooned to $195K," they said. "I have since paid off the higher interest (12%) private loans ($70k in total) and some of the federal loans, leaving me with $103K left."

If they were to go back and do it all over again, @LBoogie5 said they would not take out the private loans as they don't have much payment flexibility.

Izeek Onigbiinday said they didn't really think about it when they were applying for their student loan. "I was more focused on school and making sure I had enough money to be able to pay for my classes," Izeek explained.

"I went to a private out of state school so it was pretty expensive, about $40-50k per semester, plus having to borrow to cover my fourth year since it was all rotations which required living in different states and getting an apartment which all had to come out of pocket on top tuition."

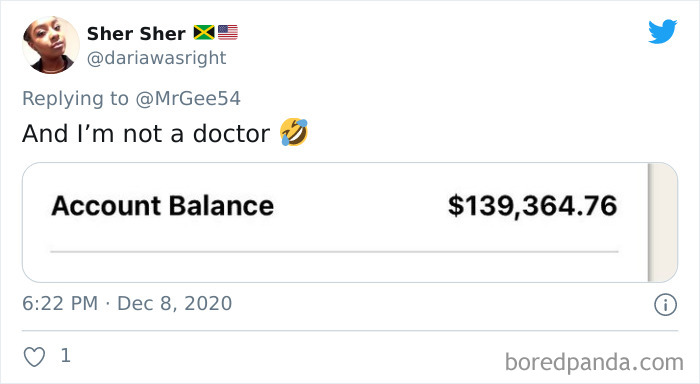

"If I could do it again I would borrow [too] just because the reward of my career now is worth it," Izeek said. "As a pharmacist, I make enough to pay for my loans and not have to paycheck-to-paycheck and I am grateful for that. The only thing I would probably change is deciding to go to medical school, only because I would have the opportunity to specialize and make even more money."

For Scott Quenette, another person whose tweet you can see in the thread, a student loan was the only way to go to college so he took it on as a necessary evil. "[My] loan total is around $150k, including interest," Scott told Bored Panda. "I've paid $18k so far and it's all been interest so I just assume I'll be paying it forever. It's all federal so it's manageable. Just an annoying bill every month."

If he were to go back in time and plan his higher education all over again under the same circumstances, however, Scott would probably make the same decisions. "I might try a few things differently so I could actually pay it off but at this point, it's not breaking me."

"My overall point has not been 'get me off the hook for this' but that I could be putting that money into the economy, this is an economic stimulus more than anything," he said.

Yes, the sheer size of student debt weighs not only on the millions of people who owe it but is a burden on the U.S. economy as well. About 92% of student loan debt is backed by the U.S. government, making it a huge political issue.

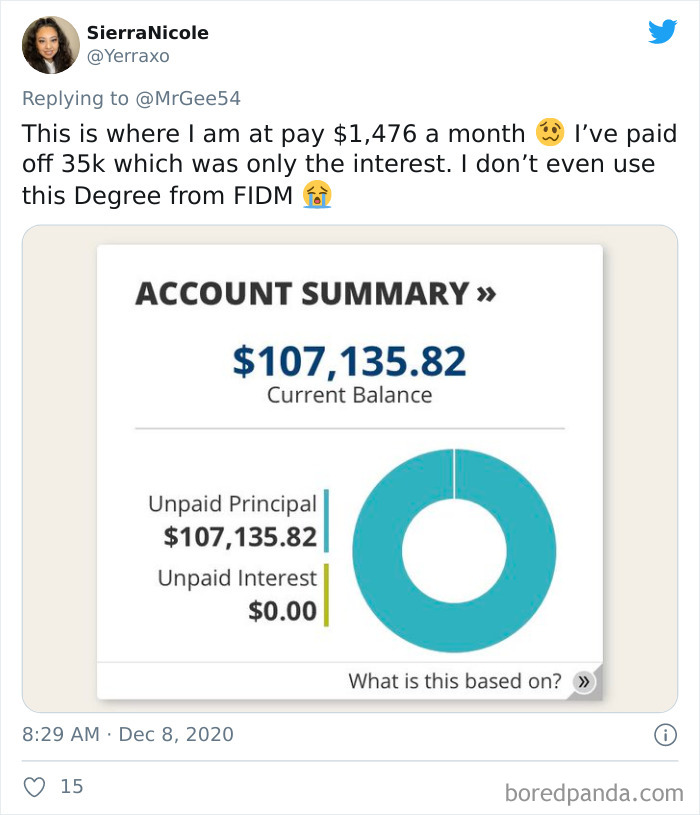

oh dang! that doesn't say a lot about return on your investment!! :(

Not wise. And more sad is that this will affect her ability to buy a home, a car, and even get a job in the finance industry.

I started repaying my loans (I was 1 class short of finishing my bachelors) in 1997. I never defaulted but I did defer and forbear. I originally took out less than $10K, it's now $26k, I've been paying for over two decades

I wanna know what kind of job she has that would pay enough to clear up almost $300K in 2.5 years.

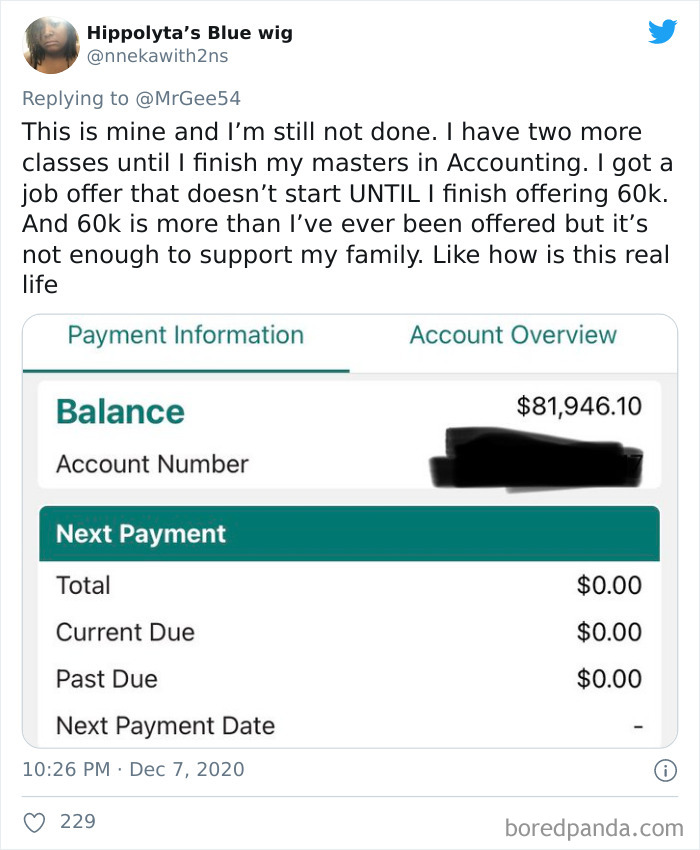

I'm curious where she lives that 60k isn't enough to live on. New York or San Francisco maybe? Or maybe I just live in an area with a way lower cost of living than everywhere else and didn't realize it.

People who always have to one up each other on the dumbest shït

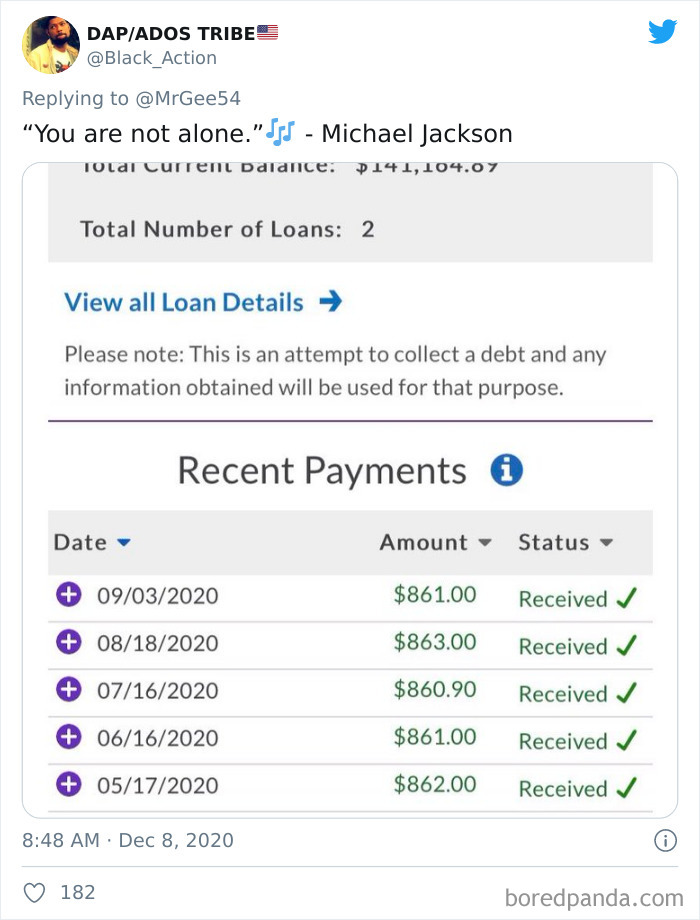

It will go down once you finish that little program. After that, this person should never contact Navient or whoever again.

Bloody hell, if I had to pay that out of my monthly wages I'd have nothing left after all my bills were paid. I mean literally nothing. And I have a decent job as well.

THIS! Be a student your entire life. Put all of your earnings into an irrevocable trust so when you die the money passes to someone other than these pieces of shirt banks.

If you're expecting a CONgress that only gave $1200 one time to help people with COVID to do anything to help you, you are going to be GREATLY disappointed. They couldn't care less about you if they tried.

Note: this post originally had 58 images. It’s been shortened to the top 30 images based on user votes.

They should have answered the most important question, what degree did they pursue with their loans.

Exactly!!! Or what college did they go to. You dont have to go a state school to get your degree in most things.

Load More Replies...education in America is a scam since even with a degee people still can't find job that has a decent wage.

True. Universities should mostly take the blame, since they spread lies about how important a college degree is when the best course for one to go is to enroll in a trade school.

Load More Replies...I still don't get this ... and the entire misconception about freedom. The absence of rules is not equal to maximized freedom, but in reality translates into the right of the stronger. If companies don't have to obey rules regarding how to treat their employees, these employees are free to be disposed of pretty quick. If you have to worry about being broke for the rest of your life because you got sick, you are not free to decide what you do. A lot of similar things come to my mind - I don't get why a company spying on me isn't any of a severe issue, but the state doing so is ... I dislike both ways (and avoid them as far as I can) ... the american definition of freedom is pretty much effed up, and this is one of the worst outcomes of it - you're not free if you have to pay a year's salary each year to go to university, you don't decide what to do then, and a lot of talent is wasted because of this - and a lot of people are made unhappy for decades to come by this shitty system...

They should have answered the most important question, what degree did they pursue with their loans.

Exactly!!! Or what college did they go to. You dont have to go a state school to get your degree in most things.

Load More Replies...education in America is a scam since even with a degee people still can't find job that has a decent wage.

True. Universities should mostly take the blame, since they spread lies about how important a college degree is when the best course for one to go is to enroll in a trade school.

Load More Replies...I still don't get this ... and the entire misconception about freedom. The absence of rules is not equal to maximized freedom, but in reality translates into the right of the stronger. If companies don't have to obey rules regarding how to treat their employees, these employees are free to be disposed of pretty quick. If you have to worry about being broke for the rest of your life because you got sick, you are not free to decide what you do. A lot of similar things come to my mind - I don't get why a company spying on me isn't any of a severe issue, but the state doing so is ... I dislike both ways (and avoid them as far as I can) ... the american definition of freedom is pretty much effed up, and this is one of the worst outcomes of it - you're not free if you have to pay a year's salary each year to go to university, you don't decide what to do then, and a lot of talent is wasted because of this - and a lot of people are made unhappy for decades to come by this shitty system...