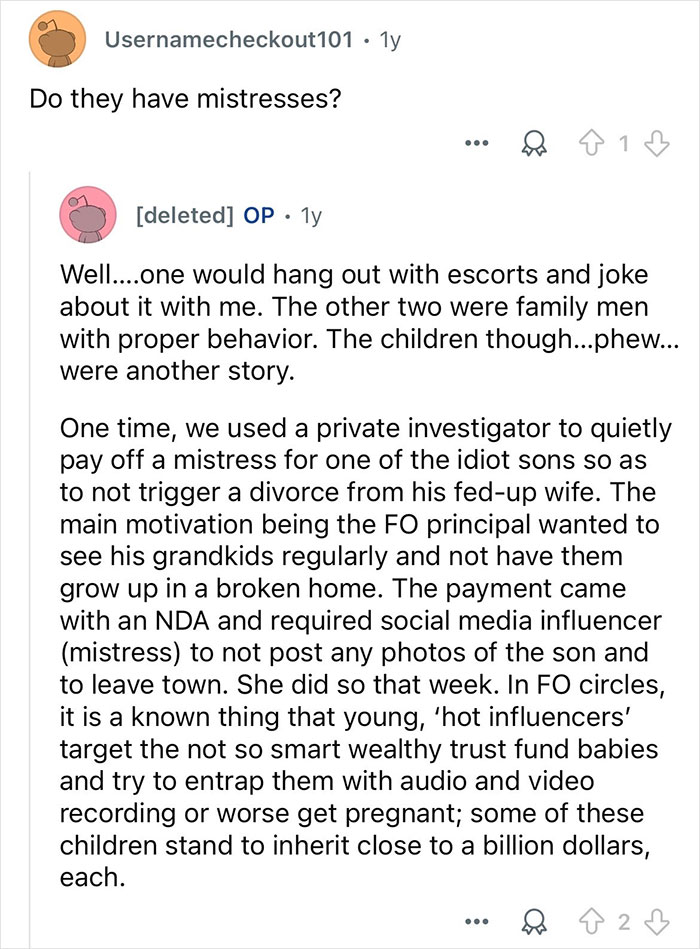

“Do They Have Mistresses?”: Person Who Worked For 3 Billionaires Answers Internet’s Questions

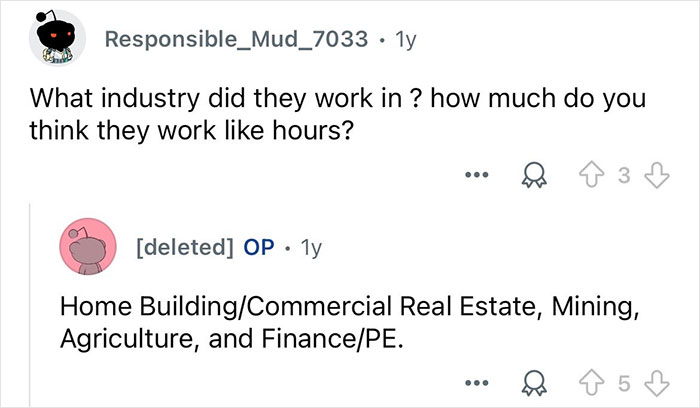

This year has seen a record number of billionaires—3,028 globally. What might be surprising for some is that the majority of them are self-made. This means they earned their wealth with hard work and dedication rather than inheriting it. Of course, such success raises a lot of questions from bystanders that are unfortunately often left unanswered by the billionaires themselves.

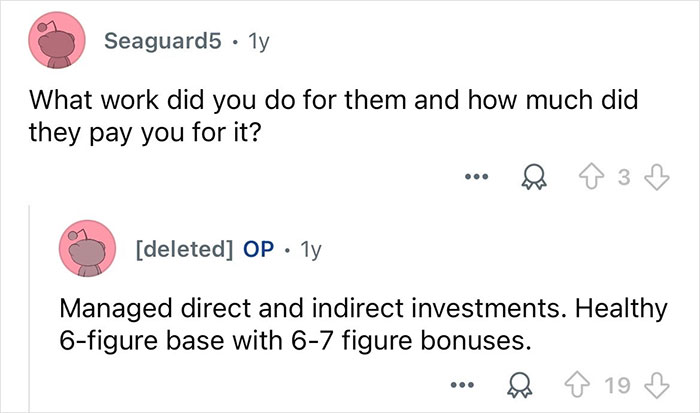

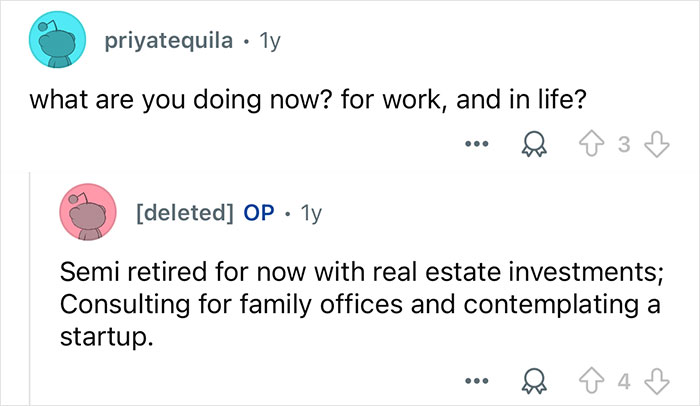

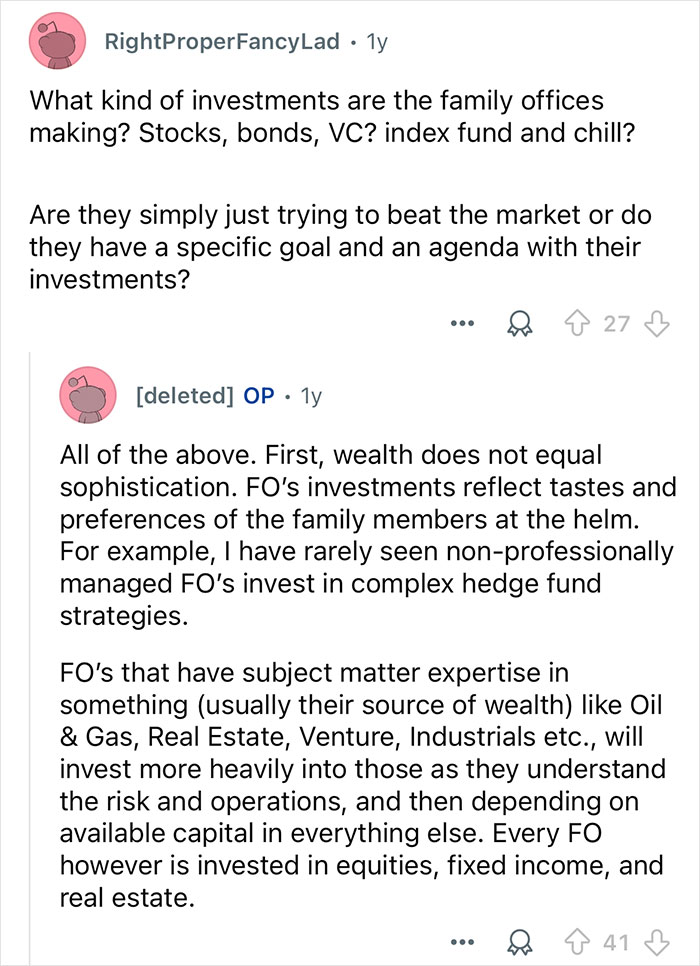

Luckily, this former employee of 3 self-made billionaires stepped forward to respond to those who are curious about what it takes to build such wealth. If you’re interested too, you can find the answers below. It’s all just a scroll away!

This post may include affiliate links.

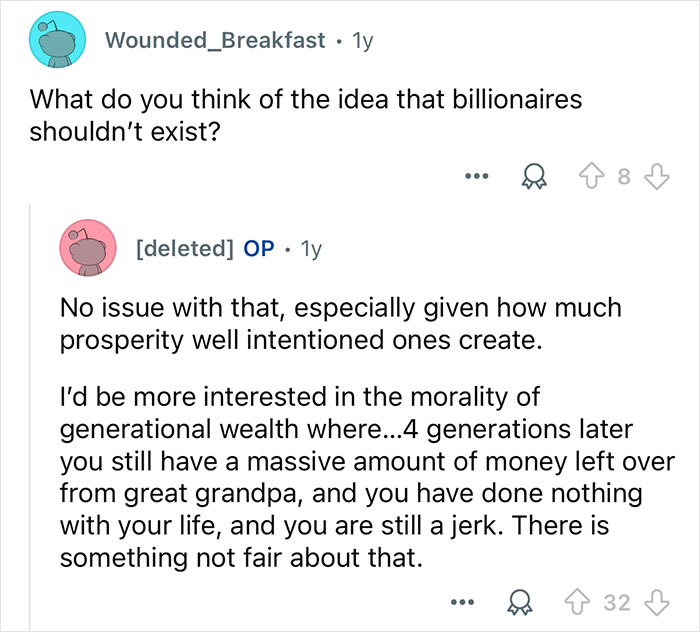

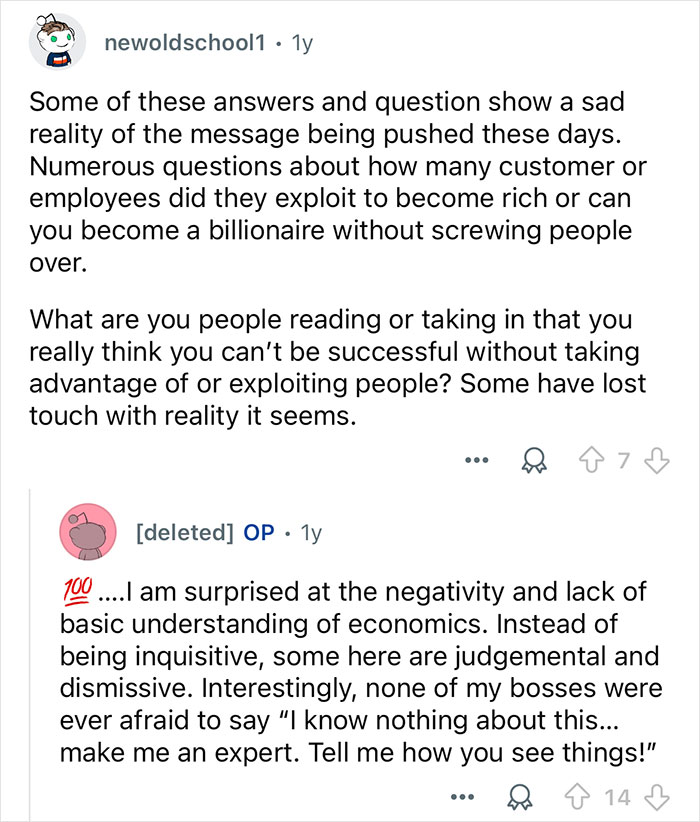

The great grandchild may be a jerk, but if they've done nothing in their life they probably haven't exploited a lot of people to get where they are, except perhaps for the few that choose to work for them directly.

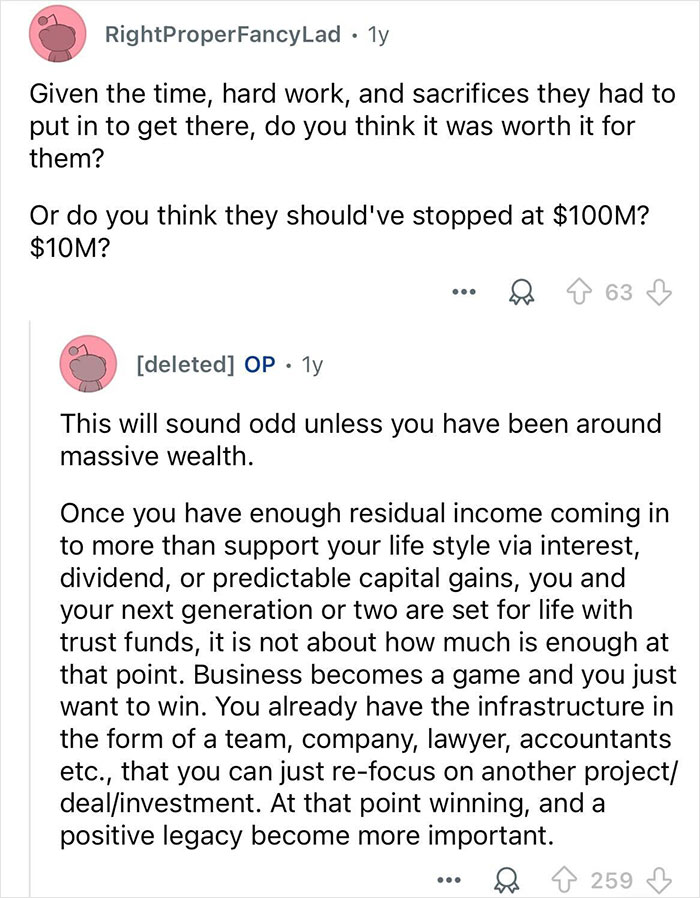

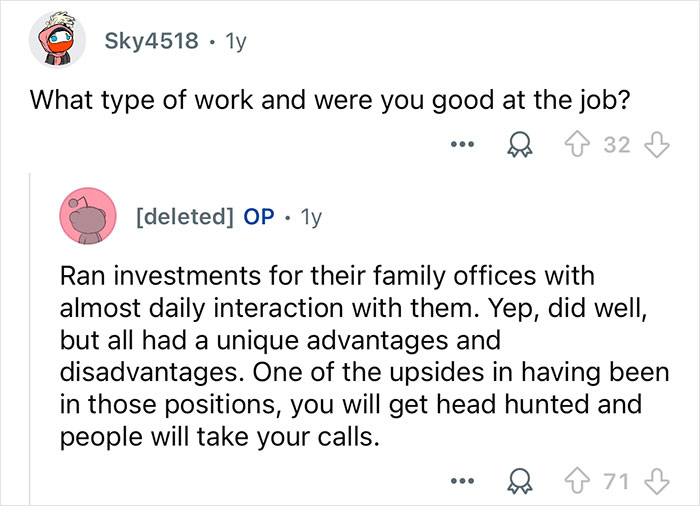

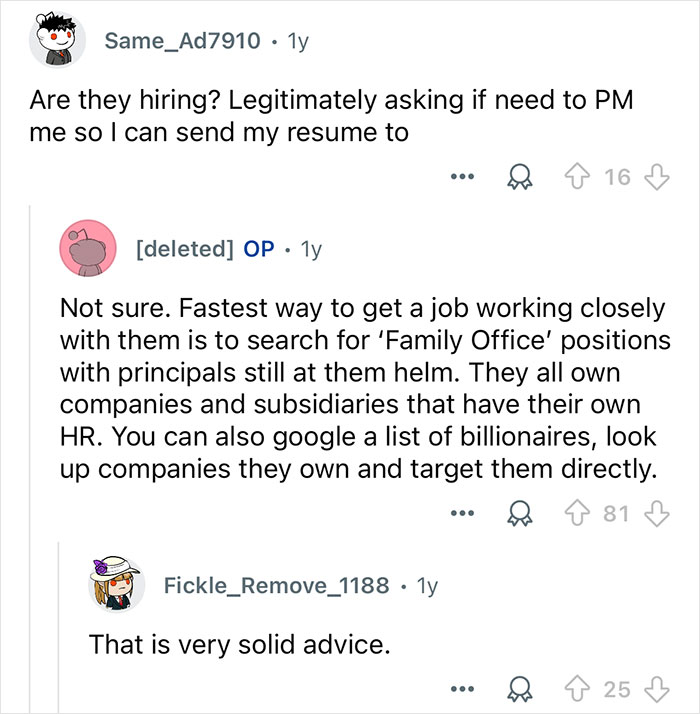

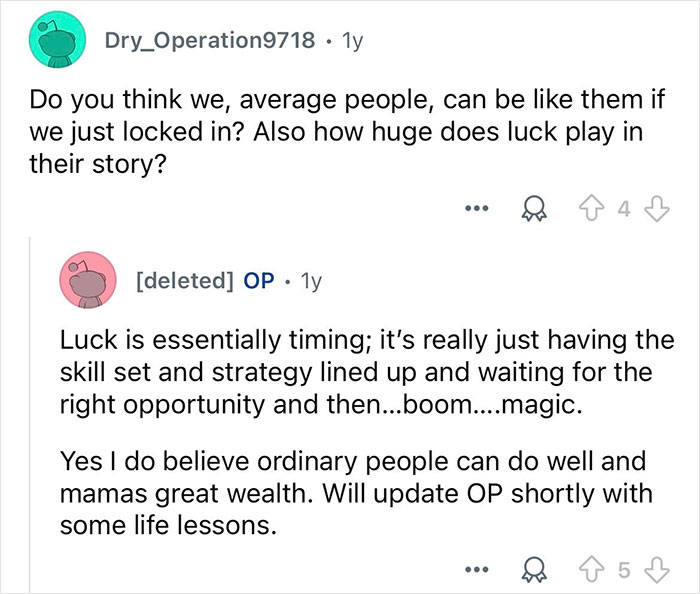

The person who initiated this Ask Me Anything session, a former employee of several billionaires, believes that ordinary people could also amass great wealth if they just lock in. No matter your financial situation, there are some money lessons that just about anyone can learn to increase their income, and who knows, maybe even become billionaires themselves.

Faron Daugs, a certified financial planner, wealth advisor, and founder and CEO of Harrison Wallace Financial Group, shared a few of them that benefit his wealthiest clients and could help the average person, too.

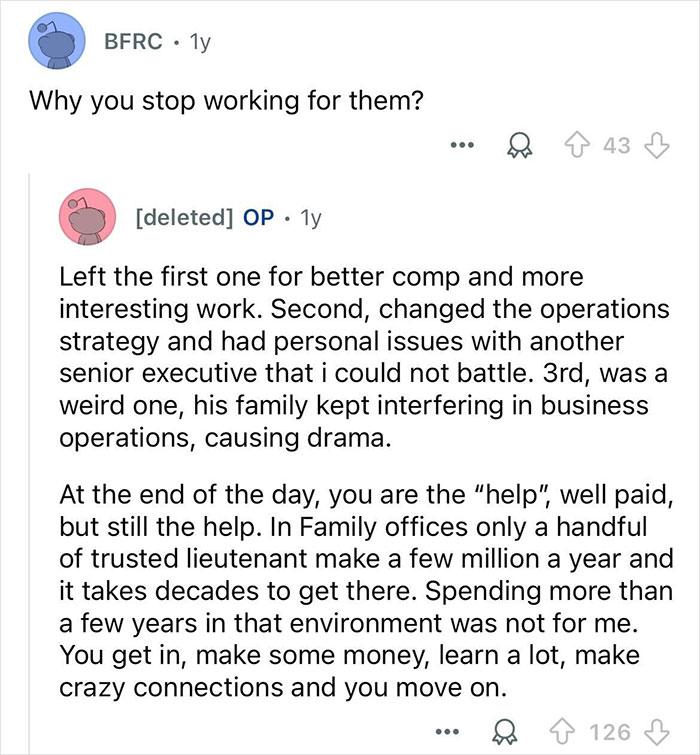

Ooof there goes the "I think I could do this type of work" fantasy

The first one is to avoid debt as much as possible. “If you want to build wealth, you cannot waste money on paying interest on consumer credit, such as credit cards and even car loans,” Daugs says. He advises paying off credit cards in full and on time every month to dodge high interest rates and keep a good credit score.

Next up, Daugs advises keeping bought cars for a long time. “If you need to finance the car, pay it off as soon as you can and plan to keep the car long after that loan is paid off,” Daugs says.

He also urges people to have an emergency fund consisting of three to six months of living expenses. This way, if any emergency happens, you don’t have to charge the expense onto a high-interest credit card or take out a personal loan. “This is one of the first steps someone should do in building a solid financial foundation,” Daugs says.

Once that is done, Daugs suggests investing, whether it's in stocks, bonds, or exchange-traded funds. As a general rule, people should save 20% of their salary to go toward their savings plans, emergency fund, retirement, and investments. “[You] can use those invested savings for future car purchases, vacations or other short- or long-term goals, without incurring additional debt,” Daugs says.

In addition, Daugs advises taking advantage of everything your employer has to offer and even utilizing various tax deductions. He also encourages people to live within their means and try to find other income streams.

“My self-made millionaires started by reducing their debts to increase cash flow and build their ‘rainy day fund,’” Daugs concluded. “Discipline is key and with it you can build the financial future you desire.”

Fantasy writing. Lot of things sound off. Throwaway account speaks volume. This was posted on r/AmA instead of the most reputable r/IAmA; at least the latter actually used to vet the AmA proposals and check people were really what they said they were. r/AmA is mostly unmoderated and full of fakes

Two of my exs dads were, they weren't billionaires or anything like that but they were self made with beautiful homes etc. They both taught me a lot of things. How to look after myself as in being able to do home repairs, an emergency repair if my sink springs a leak. My grandad did too "A lady must be able to look after herself". So it's always been... For myself? You can have as much money in the world but nothing compares to the proud satisfaction of fixing something or putting together a piece of furniture yourself 🙂

Fantasy writing. Lot of things sound off. Throwaway account speaks volume. This was posted on r/AmA instead of the most reputable r/IAmA; at least the latter actually used to vet the AmA proposals and check people were really what they said they were. r/AmA is mostly unmoderated and full of fakes

Two of my exs dads were, they weren't billionaires or anything like that but they were self made with beautiful homes etc. They both taught me a lot of things. How to look after myself as in being able to do home repairs, an emergency repair if my sink springs a leak. My grandad did too "A lady must be able to look after herself". So it's always been... For myself? You can have as much money in the world but nothing compares to the proud satisfaction of fixing something or putting together a piece of furniture yourself 🙂

Dark Mode

Dark Mode

No fees, cancel anytime

No fees, cancel anytime