Man Chooses Future Security Over Covering In-Laws’ Debt, Fiancée Flips As He Updates His Spreadsheet

Money can help many people achieve their dreams and safeguard their future, but it can also sometimes cause conflicts between loved ones. This is usually because everyone has a different idea of how to handle their finances, which might lead to miscommunications in certain situations.

This is what happened between a man and his fiancée after she demanded he pay off her parents’ mortgage so that they could keep their home. When he refused to dip into his savings to help them out, it led to a huge argument between them.

More info: Reddit

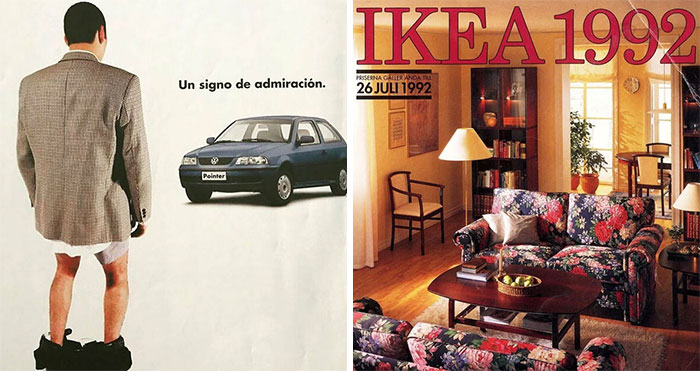

It might be difficult to set financial boundaries with loved ones, especially when they are in desperate need

Image credits: user18526052 / Freepik (not the actual photo)

The poster shared that his fiancée’s parents needed money to pay off their mortgage, or else their home would be foreclosed, which is why she wanted him to help

Image credits: gpointstudio / Freepik (not the actual photo)

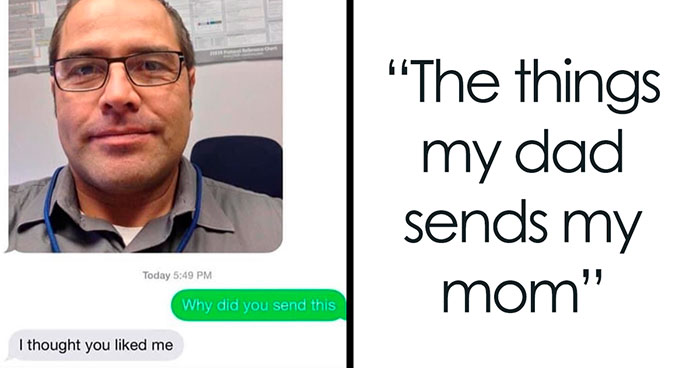

The man wasn’t sure about dipping into his savings to help out his in-laws because he had kept a huge nest egg aside to secure his family’s future

Image credits: freepik / Freepik (not the actual photo)

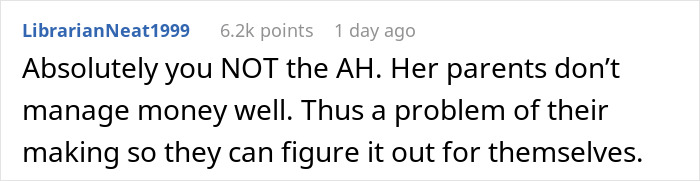

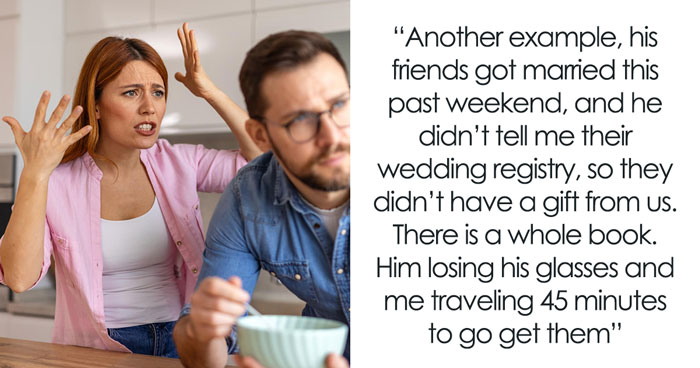

The poster told his fiancée that he didn’t want to bail her parents out by using up 15% of his savings, even though he could “easily” do it

Image credits: Gullible-Display4533

The woman was quite upset about the whole situation because she felt that her fiancé could easily earn back the money again

Since the poster was a musician by profession, he decided to save up as much money as he could in order to secure himself against the ebbs and flows of the industry. He also tried to build a big nest egg so that he could take care of his son and secure the costs of his future college and home.

According to experts, it’s definitely important for people from creative professions to learn how to budget and save, as it can help them when there is less work. They can start being more financially responsible by paying attention to their income level and noting which seasons and events bring the most money in.

It seems like the OP did just that in order secure his savings and live without worry, but this became a problem when his fiancée demanded he bail her parents out of their mortgage. Apparently, even though they owned a fully-paid-off home, they had taken out a loan on it as they needed the money.

In situations like this, where inherited assets seem to be a drain, lawyers explain that it might be better to sell or give it up rather than dig yourself into a hole. Therefore, if someone has inherited a huge home and can’t afford its upkeep, it might be better to sell it and buy a smaller place, or put it on rent for the foreseeable future.

Image credits: romeo22 / Freepik (not the actual photo)

The woman didn’t seem to understand that her fiancé was uncomfortable using up 15% of his savings to bail her parents out. She felt that it was his duty to do so because he had kept aside a lot of money, and he could easily afford to spend it on them.

Although it might be kind to help loved ones financially, experts also point out that it can sometimes be a way of enabling their bad habits. This might happen more so if family members spend irresponsibly and keep expecting one person to bail them out whenever they get into a tough financial bind.

In this situation, it seems like the woman was so used to coming to her parents’ rescue that she felt it was also her fiancé’s responsibility to do the same. What she didn’t understand was that he didn’t want to risk their financial future to help out her parents, and in fact, wanted to set boundaries with them as soon as possible.

This difference in opinions about money led to a big conflict between the engaged couple, and they weren’t able to come to a resolution. Hopefully, they’re able to talk things through and decide on a compromise that doesn’t drain either of their bank accounts.

What do you think is the right thing for the man to do in this situation? We’d love to hear your opinions on the story.

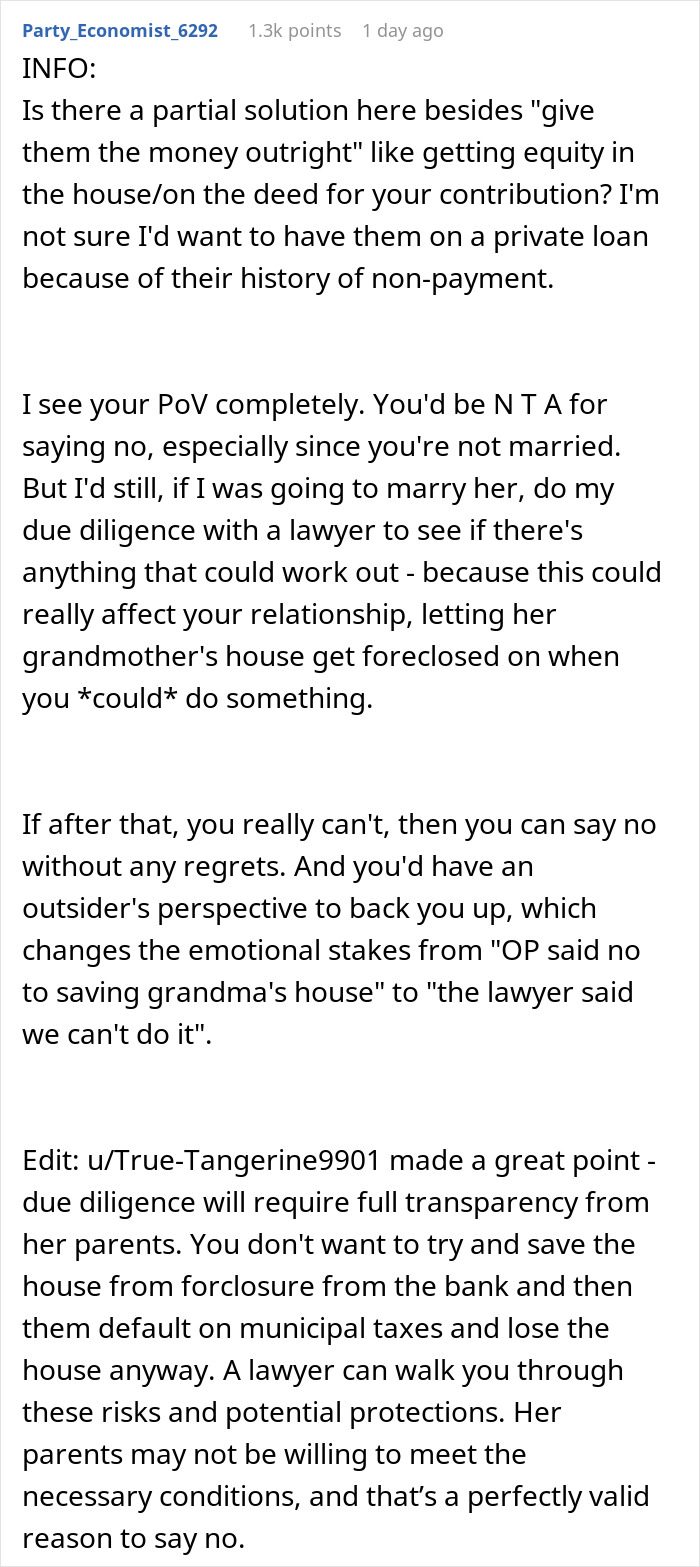

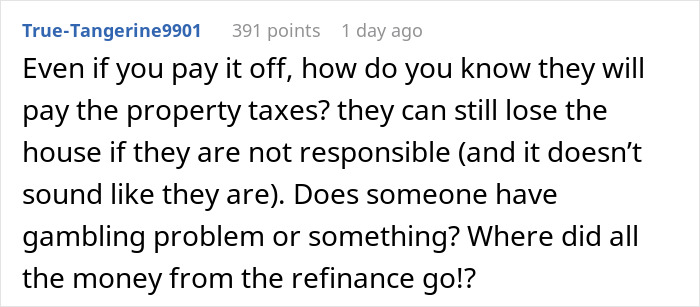

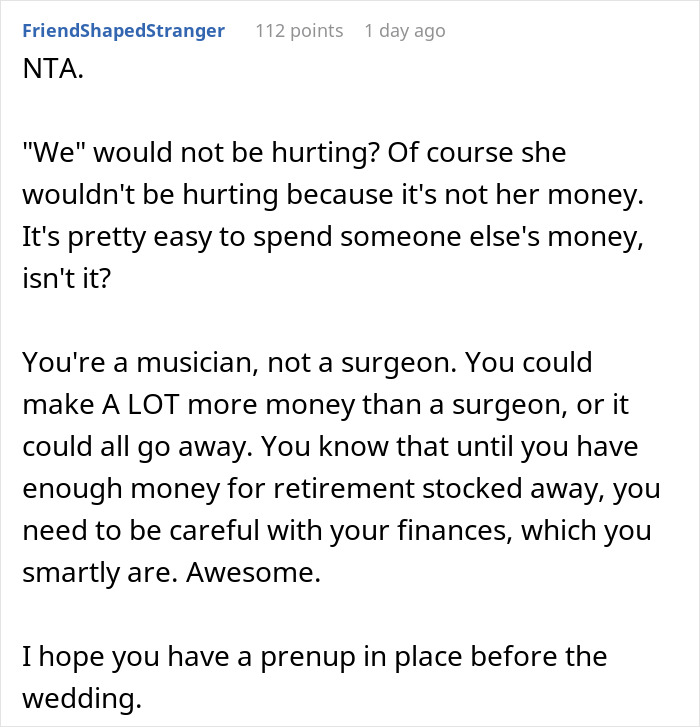

Folks cautioned the poster against giving his money to his in-laws so that they could save their home

Poll Question

Thanks! Check out the results:

Explore more of these tags

Browsing the original post, the house is constantly breaking and needing repairs, governed by a Karen-led HOA, the current equity would take 80% of his savings, and her parents run a couple of restaurants that are perpetually having difficulties (hence why they mortgaged the house). It's a hopeless situation, the parents would be better off losing the house, taking the equity, and moving into an apartment, or somewhere not in an HOA - even if the OP had a guaranteed income.

Yuck! My first thought was: Buy the house and lease it back to the parents. But f HOAs... I wouldn't want to be stuck in that. Plus, if it's 80% of savings, that's an immense difference over 15% - which is still a huge ask. Beyond that, they have overextended themselves for years in a difficult industry. Giving them money won't be "helping them," it will be throwing their money into the same hole as the parents.

Load More Replies...And if OP does pay off the house, every 2 -3 years the in-laws will be demanding *more* money for whatever. OP's smart to not start down that road. Hope he rethinks this engagement since fiancée sounds like "your money is my money and my money is MINE."

Yeah, the only way it works is to buy the house and lease, that way the parents can't take out any more equity loans.

Load More Replies...Unless the fiancée's parents had her very late in life, they should still be in their 40s or 50s. They can both get jobs and work, if they aren't already both working. And what about fiancée's own money/savings, if she's so intent on bailing out her parents and their poor decisions? Can't she contribute? Why is it only OP who has to pay off this debt?

Browsing the original post, the house is constantly breaking and needing repairs, governed by a Karen-led HOA, the current equity would take 80% of his savings, and her parents run a couple of restaurants that are perpetually having difficulties (hence why they mortgaged the house). It's a hopeless situation, the parents would be better off losing the house, taking the equity, and moving into an apartment, or somewhere not in an HOA - even if the OP had a guaranteed income.

Yuck! My first thought was: Buy the house and lease it back to the parents. But f HOAs... I wouldn't want to be stuck in that. Plus, if it's 80% of savings, that's an immense difference over 15% - which is still a huge ask. Beyond that, they have overextended themselves for years in a difficult industry. Giving them money won't be "helping them," it will be throwing their money into the same hole as the parents.

Load More Replies...And if OP does pay off the house, every 2 -3 years the in-laws will be demanding *more* money for whatever. OP's smart to not start down that road. Hope he rethinks this engagement since fiancée sounds like "your money is my money and my money is MINE."

Yeah, the only way it works is to buy the house and lease, that way the parents can't take out any more equity loans.

Load More Replies...Unless the fiancée's parents had her very late in life, they should still be in their 40s or 50s. They can both get jobs and work, if they aren't already both working. And what about fiancée's own money/savings, if she's so intent on bailing out her parents and their poor decisions? Can't she contribute? Why is it only OP who has to pay off this debt?

Dark Mode

Dark Mode

No fees, cancel anytime

No fees, cancel anytime

37

18