30 Surprisingly Easy Frugal Changes That Helped People Reach Their Financial Goals

InterviewSaving money often sounds easier than it is, even if you have disposable income once the bills are paid. That’s because nowadays, there are so many things that scream ‘buy me’ and the process of buying itself has never been easier – just a few clicks and your cart is paid off.

But what if we postpone paying for the cart and review the things we have in it after a while? Maybe even delete an item or two that we don’t actually need? Reviewing and scaling down the shopping cart was one of the tips netizens of Reddit’s ‘Frugal’ community shared after one of them asked about the easiest frugal changes people have made that helped them save money.

Today, we’d like to shed some light on their tips and tricks that might inspire you to make some frugal changes in life, too. So scroll down to find them on the list below—where you will also find Bored Panda’s interview with the netizen who started the thread, u/Peliquin—and go dust off that piggy bank.

This post may include affiliate links.

Put things in the Amazon cart but don't buy right away. Come back a few days later and realize I don't NEED that, remove. Repeat.

Put things in the Amazon cart but don't buy right away. Come back a few days later and realize I don't NEED that, remove. Repeat.

Done that.. it has worked somewhat but have items which i dont regret... books mostly

I often met up with friends at restaurants, just by default, and that got really expensive, even when they weren't that special. I started volunteering ideas of just meeting for dessert (instead of a drink and meal), going for a hike, or just meeting at a park to sit and chat. The whole point was to just be together, so no one really paid attention to the switch and they were actually a little glad to not have to plan the outings themselves. My budget is happy about it!

I often met up with friends at restaurants, just by default, and that got really expensive, even when they weren't that special. I started volunteering ideas of just meeting for dessert (instead of a drink and meal), going for a hike, or just meeting at a park to sit and chat. The whole point was to just be together, so no one really paid attention to the switch and they were actually a little glad to not have to plan the outings themselves. My budget is happy about it!

Restaurants are too loud to enjoy chatting with friends. They want people to shut up and eat but what they got was my me waving goodbye.

Got rid of sodas. With the prices increasing, and sodas leading to health issues down the road I definitely will save more than just money in the long run.

Got rid of sodas. With the prices increasing, and sodas leading to health issues down the road I definitely will save more than just money in the long run.

We still like a Coke now and then -- but I generally don't keep extras in the fridge, but in a cupboard a good ways away. Is it worth the effort to dig in the cupboard, get a glass, put in ice, etc.? Surprisingly, half the time it isn't. This has helped us minimize pop drinking.

Changing your lifestyle or old habits is not that easy, so going from barely setting any money aside to putting half of your paycheck into savings probably wouldn’t be, either. But the frugal changes redditors discussed in the thread were far from extreme; maybe even something many of us would manage doing. And even baby steps still count as moving in the direction of a more frugal lifestyle and a smaller hole in the wallet.

Finally got a library card and connected to my Kindle via Libby. I haven't bought a single book, ebook or physical, all year.

Finally got a library card and connected to my Kindle via Libby. I haven't bought a single book, ebook or physical, all year.

Not a change this year, but one that all my friends have been shocked by as I've slowly converted them over time! Your local library is your best resource for a lot of things, but especially accessing books, audiobooks, magazines, manga, graphic novels, music, television shows, movies, and so on and so forth. Language learning apps? Many libraries (like mine!) have free subscriptions for their users. Doing genealogy? Tons of free resources, including, often, Ancestry.com. My library has several apps like Libby, Kanopy, and Hoopla. Free online classes, free sessions with lawyers and job search professionals, free internet, hotspots, board games, yard games, video games, puzzles.....

Not a change this year, but one that all my friends have been shocked by as I've slowly converted them over time! Your local library is your best resource for a lot of things, but especially accessing books, audiobooks, magazines, manga, graphic novels, music, television shows, movies, and so on and so forth. Language learning apps? Many libraries (like mine!) have free subscriptions for their users. Doing genealogy? Tons of free resources, including, often, Ancestry.com. My library has several apps like Libby, Kanopy, and Hoopla. Free online classes, free sessions with lawyers and job search professionals, free internet, hotspots, board games, yard games, video games, puzzles.....

Also, many libraries have seed libraries and 'library of things' --> anything from science-y or artsy kits to car/house/etc repair.

In an interview with Bored Panda, the redditor who started the thread, ‘Peliquin’, also emphasized the significance of seemingly minor change. “I often see frugal tips being out of reach for people who are just beginning a frugal journey,” they noted. “People don't go from drinking 3-4 sodas a day to drinking only tap water easily. Downshifting to fewer sodas, or an at home soda maker isn't necessarily pure frugality, but it's an easy step.”

Starting to cook my own meals more and not eating in restaurants.

Starting to cook my own meals more and not eating in restaurants.

Every time you cook a meal, you make it better. I’m at the point now where food served in restaurants isn’t good enough for me.

Go YouTube!

I created a gift bin. Whenever I see a great deal online or in a thrift store, bin store etc. I buy things and store them in my gift bin.

I created a gift bin. Whenever I see a great deal online or in a thrift store, bin store etc. I buy things and store them in my gift bin.

I always have nice gifts handy for kids, family members. I’m ready for Christmas

For example, we are going to a birthday next week and I have 2 brand new boxes of nice legos that I got for very cheap back in January. The kid will be happy with gifts and we only have to worry about wrapping it.

I'd like to add, making your own cute, but simple, gift cards. I bought watercolor pens and a 50pk of cardstock and envelopes for $25 a few years back. Saves me $2-$6 at least a couple times a month. I have a massive Irish family, so it does add up. Bonus; I'm now revered as an artist for my silly doodles paired with dumb jokes.

Stopped using DoorDash etc and started using frozen chicken strips and tater tots when I need a quick fix.

Stopped using DoorDash etc and started using frozen chicken strips and tater tots when I need a quick fix.

OMG... F**k food delivery apps. By the time I checkout, a $10 burrito is $23. And, literally, half the time something goes wrong: like missing items, half the food is spilled in the bag, hot food is cold, cold food is warm, it's missing sauces and dressings. I'm not gonna agree that frozen tater tots serve the same purpose, but I too have sworn off food delivery apps and just gotten over my aversion to eating out by myself in my sweats and headphones.

Peliquin shared that they joined the ‘Frugal’ community because they had seen a good frugal gardening tip there and thought that it might be a good place to learn a few tricks. “I can't really think of something I've picked up, but I do think that being in this subreddit has made me think in more dimensions about how to use common items in more ways,” they said.

Writing down every expense in an actual budgeting notebook. I've tried budgeting apps on/off for years and never stuck with them. Having an actual notebook where I physically write all of my expenditures has made me way more frugal in every aspect of my life. Something about writing it & seeing it made me want to stop spending it!

Writing down every expense in an actual budgeting notebook. I've tried budgeting apps on/off for years and never stuck with them. Having an actual notebook where I physically write all of my expenditures has made me way more frugal in every aspect of my life. Something about writing it & seeing it made me want to stop spending it!

I have been using a budget book for over 20years. It is good to see where your money actually went, and make you think twice over your expenditure. It also allows you to stay within that month's salary and not dip into access funds in your current account

Quitting a 2 pack a day smoking habit. $500/mo.!!

Quitting a 2 pack a day smoking habit. $500/mo.!!

Started shopping at the discount grocery store. Ours has lots of things that are nearing or just past sell by dates, and I was nervous things might not be good. Haven't had a single issue and we're literally saving hundreds per month on groceries.

Started shopping at the discount grocery store. Ours has lots of things that are nearing or just past sell by dates, and I was nervous things might not be good. Haven't had a single issue and we're literally saving hundreds per month on groceries.

Sadly in Canada Loblaws has bought all the cheap grocery store chains and harmonized up the prices. Record all time high profits while claiming inflation/supply chain issues are responsible. You have to really shop around here to find cheap groceries. We had a nation-wide boycott and they reduced prices for a few months, but they've been edging them back up

The redditor admitted that as useful as some tips shared on r/Frugal are, not all of the netizens’ answers to their thread were equally helpful. “I thought that a lot of people just shared their top favorite frugal tip whether or not it was easy to implement. I really had to hunt to find stuff that was more what I was looking for,” they told Bored Panda.

“I think people can [benefit from threads as this one], but I think what people need is more like some sort of six-month frugality boot camp. I wrote a post about that a few years ago, and I wish I could get more people to have read it. It's what I personally did when I was finally making enough money to make real choices, and it has kept me pretty well ahead of all spending.”

Cancelled cable, no one was watching ‘regular’ TV, kept prime and Hulu. No one in the house has noticed.

Cancelled cable, no one was watching ‘regular’ TV, kept prime and Hulu. No one in the house has noticed.

I canceled cable years ago when the talk started about antenaes. Most of the channels (free and paid) show the same thing. There are lots of old shows/reruns that I'm not interested in, because at my age, I've seen most 2-3 times already. And so many of the shows have the same plot. Right now, I pay for Netflix and Max, but I'm seriously thinking of discontinuing both and only reinstate if there's something really interesting and then cancel again.

One morning when I had some downtime, I went through my email and unsubscribed from basically any email list I was a part of. Wayfair, H&M, Home Depot etc etc. All of it. Not only has this completely cleared up my inbox, I no longer get tempted by sale days, coupon codes etc. It has helped curb impulse spending immensely!

One morning when I had some downtime, I went through my email and unsubscribed from basically any email list I was a part of. Wayfair, H&M, Home Depot etc etc. All of it. Not only has this completely cleared up my inbox, I no longer get tempted by sale days, coupon codes etc. It has helped curb impulse spending immensely!

Drinking. I like a glass of wine or two with dinner or after. Doing it every night is expensive and unhealthy. I have started to replace it with drinking hot tea at night. I’ve never been a tea drinker but it’s fun to explore different options and it’s starting to grow on me a bit.

Drinking. I like a glass of wine or two with dinner or after. Doing it every night is expensive and unhealthy. I have started to replace it with drinking hot tea at night. I’ve never been a tea drinker but it’s fun to explore different options and it’s starting to grow on me a bit.

Here's a tip if you want to make cheap wine taste good: use a blender/magic bullet. It's an old restaurant trick for house wines. The super oxygenation really helps improve the flavour, especially if it's acidic. You can take a $5 bottle of terrible wine, blend it up, and it'll taste MUCH better.

I learned to make my fancy coffee at home. I used a cheap espresso machine we had to make sure i would stay in the habit and after a couple weeks i bought a used nicer model and have made my fancy coffee at home since. I dont have to sacrifice taste for frugality. The $250 i spent on the nice espresso machine has easily been "earned" back not going to coffee shops.

I learned to make my fancy coffee at home. I used a cheap espresso machine we had to make sure i would stay in the habit and after a couple weeks i bought a used nicer model and have made my fancy coffee at home since. I dont have to sacrifice taste for frugality. The $250 i spent on the nice espresso machine has easily been "earned" back not going to coffee shops.

this is always interesting to me - I buy in coffee shops only when travelling. People actually use them regularly :D

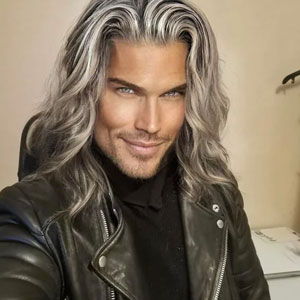

Turned 40 and decided to quit dying my hair. I’m over a year in and have not only saved money, but my hair is the healthiest it’s ever been! I also like my natural gray sparkle!

Turned 40 and decided to quit dying my hair. I’m over a year in and have not only saved money, but my hair is the healthiest it’s ever been! I also like my natural gray sparkle!

Gave my wife 2 choices. Stop dying your own hair to save$$ and go to a proper salon or go gray. She has the most beautiful gray hair on the planet!

I have started to go through all drawers, cabinets wardrobes etc having a clear out. Not only have I discovered things I'd forgotten and organised things in such a way that I know how much of everything that I have, but it's illustrated to me where I was making impulse purchases that I regreted. That's helped me stop repeating those same mistakes. For example, I am done with eyeshadow, I've never really "got" how to do it, I end up looking awful and I've chucked the lot out, it wasn't a matter of finding the "right palette", it's just not for me!

I have started to go through all drawers, cabinets wardrobes etc having a clear out. Not only have I discovered things I'd forgotten and organised things in such a way that I know how much of everything that I have, but it's illustrated to me where I was making impulse purchases that I regreted. That's helped me stop repeating those same mistakes. For example, I am done with eyeshadow, I've never really "got" how to do it, I end up looking awful and I've chucked the lot out, it wasn't a matter of finding the "right palette", it's just not for me!

I love this attitude and wish I had it. It's difficult to throw things out if you've come from a financially unstable background. I earn the money to buy something, you're bloody right I want to keep it. So I've adopted a "one in, one out" system. If I'm going to buy something I have to donate, sell or throw out something first. And I have to do the "out" before the "in". I can't count the number of times it's helped me realise I don't need something, I just want it.

I moved somewhere with an Aldi nearby and my grocery budget is about half of what it used to be.

I moved somewhere with an Aldi nearby and my grocery budget is about half of what it used to be.

I want to upvote this 100 times. Aldi is the best grocery chain. My *only* qualm is planning to buy in bulk when there are special times (I.e. like last week during German week because those frozen potatoes are amazing)

Not this year but during the pandemic... we only ordered from restaurants that let us come and pick up the order. No food delivery services whatsoever. Once we slowed down our eating out from "once a week" to "once a month or two", we started spending way less on takeout.

Not this year but during the pandemic... we only ordered from restaurants that let us come and pick up the order. No food delivery services whatsoever. Once we slowed down our eating out from "once a week" to "once a month or two", we started spending way less on takeout.

also giving up alcohol when my husband needed major surgery. The doctors recommended to not drink 2 weeks before and 2 weeks after... and we just never made it back into a liquor store. Going on 8 months of total sobriety now!

Meal Prep!

Meal Prep!

I prep 5 oatmeal breakfasts, 5 chicken pasta and sauce meals and 5 chicken, rice and black bean meals.

This saves me so much money and time!

I mix in fruit cups for breakfast and lunch. I usually go with pineapple or mandarin oranges. I eat way healthier and I’m saving money.

If, like a dog, you don't mind eating the same thing day in day out ...

Doubled my 401k contributions. Less extra money burning a hole in my pocket.

Doubled my 401k contributions. Less extra money burning a hole in my pocket.

Espresso machine. I was buying a 7 dollar Starbucks drink daily. Now it costs about 25 cents for the same thing.

Espresso machine. I was buying a 7 dollar Starbucks drink daily. Now it costs about 25 cents for the same thing.

Buying bone-in chicken thighs for $0.99/ lb instead of boneless/skinless for over $3/lb. Also bought a cheap boning knife ($10) and YouTube'd how to remove the bone. It's surprisingly easy. Then you keep the bones for stock. Takes me about 15 mins to process about 10 pounds of meat.

Buying bone-in chicken thighs for $0.99/ lb instead of boneless/skinless for over $3/lb. Also bought a cheap boning knife ($10) and YouTube'd how to remove the bone. It's surprisingly easy. Then you keep the bones for stock. Takes me about 15 mins to process about 10 pounds of meat.

Switching auto and home insurance. Our auto went down by two-thirds and our home by half. I don’t even want to think of the money we overpaid over the years.

Switching auto and home insurance. Our auto went down by two-thirds and our home by half. I don’t even want to think of the money we overpaid over the years.

Speaking as a former property restoration technician, don't go for the cheap insurance. Get a bundle from a good company with a good reputation. The best I've ever seen is State Farm. They would pay us to go out and help people unpack, rearrange furniture, anything to make their clients happy. The worst is Dejardains. They would make us itemize every single thing on the claim. Measuring and documenting every single piece of clothing, getting the serial and model number off of every single piece of Tupperware to use up every single penny of a client's deductible and then fighting the clients on a claim. Research the company's reputation, pick one that's been around forever, then stick with them and they will look after you.

I started cutting my own hair. As a guy, paying $50-60 a month for something that only looks good for probably 2 weeks is not ideal. I'll only pay that if I have a special event like a wedding or if I'm going on a memorable trip (once or twice a year). Otherwise, I'll just cut it at home and spend $0.

I started cutting my own hair. As a guy, paying $50-60 a month for something that only looks good for probably 2 weeks is not ideal. I'll only pay that if I have a special event like a wedding or if I'm going on a memorable trip (once or twice a year). Otherwise, I'll just cut it at home and spend $0.

I've been cutting my husband's hair for 25 years, now. Unfortunately, he doesn't own the skill to reciprocate, and I dare not do it to myself.

The only real change that we made was not ordering take out so much. We were ordering 3-4 times a week and going out about once a week. Now we are ordering out once ever other week and not dining out. It’s saving my family of 4 about $1000 a month. Honestly, I miss being able to have all the dining options, but due to certain circumstances we can no longer afford such luxuries.

The only real change that we made was not ordering take out so much. We were ordering 3-4 times a week and going out about once a week. Now we are ordering out once ever other week and not dining out. It’s saving my family of 4 about $1000 a month. Honestly, I miss being able to have all the dining options, but due to certain circumstances we can no longer afford such luxuries.

"all the dining options" ... cook it yourself. It even tastes better because it's fresh and hasn't spent 30 minutes in an isolated box and gone soggy.

Went on a "no-buy." Sounds nuts but gamifying making do with my existing wardrobe, decor, cooking utensils, gardening tool etc has made it so easy. And it simplifies the process of figuring out whether a purchase is worth the money because it DOESNT MATTER- I'm not allowed to buy it anyway.

Went on a "no-buy." Sounds nuts but gamifying making do with my existing wardrobe, decor, cooking utensils, gardening tool etc has made it so easy. And it simplifies the process of figuring out whether a purchase is worth the money because it DOESNT MATTER- I'm not allowed to buy it anyway.

I did a no buy month and wondered if I would make it through but wound up breezing through it and found it so helpful and easy I am committing to a year.

Online thrifting for toddler clothes. They are outrageously expensive and the tots grow out of them in a year or less.

Online thrifting for toddler clothes. They are outrageously expensive and the tots grow out of them in a year or less.

Back in the day, if someone in the neighborhood or family just had a baby, especially if it was their first, someone always had a huge box of all the basics, plus some dressy stuff, to ease the expense of buying everything, that was loaned to the new parents. Not the stuff that gets worn out, but the stuff that’s really durable and good quality that can be passed on to someone new. When they were done with it, they’d store it until the next set of new parents needed it. There were always boxes like that making the rounds of every couple in the neighborhood or family.

Setting a budget. I grew up poor and no one taught me about money. I’ve just been winging it my whole life. This year my husband and I sat down to have a come to Jesus and figure out *where was all our money going?*

Setting a budget. I grew up poor and no one taught me about money. I’ve just been winging it my whole life. This year my husband and I sat down to have a come to Jesus and figure out *where was all our money going?*

We just sort of divided our money up into different accounts because we can’t be trusted. The main account is only for bills and gas and groceries, but I only spend a set amount a month on groceries. Then each of us has a fun account that we add money to each pay period. That’s the only money we have to blow. Then there is a family fun money. If we want to buy pizza or go to the movie it comes from there.

It completely changed my relationship ship to money, and I thought I was frugal. I was a single mom who raised two kids on one income before o got married. I was not good with money. I was good with stretching the last few dollars after I wasted all my money.

Money is like toilet paper. Learn to use the full roll like you use the last 3 feet 🤓🤓

NOT renewing Prime.

NOT renewing Prime.

Went back to doing my own manicures. I have such a collection of polish to use up! .

Went back to doing my own manicures. I have such a collection of polish to use up! .

I only had my nails done once - for my wedding. I wish I could be bothered to sit in a smelly room and try to make small talk while people primped me to make me presentable for the outside world, but I just can't.

Removed my saved credit card info from every online store - it’s safer, but also, my want for an item goes down significantly if I have to get off the couch to grab my wallet.

Removed my saved credit card info from every online store - it’s safer, but also, my want for an item goes down significantly if I have to get off the couch to grab my wallet.

And I shop up our local natural food store that has a ton of bulk bins. Buying the exact amount of something that I need for a recipe is way cheaper and cuts down on waste!

I never save my credit card info anywhere in the first place. (Well, except bus card app, but that's not a want, it's a need).

Use the envelope method for groceries and my fun money. It makes me pay attention to how much money I'm spending and what I'm spending it on when I have to count out the cash.

Use the envelope method for groceries and my fun money. It makes me pay attention to how much money I'm spending and what I'm spending it on when I have to count out the cash.

I have a second bank account online, specifically with a bank that has no ATMs or branches anywhere near me. I also requested to NOT have a bank card sent to me. Got to avoid the temptation, you know. I have X amount direct deposited every payday, forget about it, and just live on the balance in your regular account. I only put in an amount that allows me to still pay my bills and other expenses, so I don’t even miss it. Then it’s there if something comes up that I either need or want to use the money for.

Fewer trips to the Grocery Store! After routinely popping in 3-4 times per week for odds and ends forgotten on my primary weekend trip, I started going to the grocery store just once a week . This restricts opportunities for unhealthy impulse purchases, pressures me to use and consume the fresh food and pantry items I already have on hand instead of letting them go to waste, and sometimes saves on fuel for short inefficient car trips to the neighborhood grocer (if I'm desperate, I make myself ride my bike). The main grocery store chain in my area offers a weekly coupon for 4x fuel points on Fridays. By restricting most grocery purchases to Fridays I can also optimize that perk which is a great bonus.

Fewer trips to the Grocery Store! After routinely popping in 3-4 times per week for odds and ends forgotten on my primary weekend trip, I started going to the grocery store just once a week . This restricts opportunities for unhealthy impulse purchases, pressures me to use and consume the fresh food and pantry items I already have on hand instead of letting them go to waste, and sometimes saves on fuel for short inefficient car trips to the neighborhood grocer (if I'm desperate, I make myself ride my bike). The main grocery store chain in my area offers a weekly coupon for 4x fuel points on Fridays. By restricting most grocery purchases to Fridays I can also optimize that perk which is a great bonus.

Clip coupons, apply for the store discount card, EAT before shopping, and most of all Shop. From. A. List. Plan your meals—-and allow for snacks if you’re a snacker or you know there will be times when a snack is all you have time to eat—-for the week so you know every ingredient you need to buy, and be sure to check if you already have any of them, and enough for the meals. If I go grocery shopping without a list, not only am I going to forget to buy everything I need, I will also end up wasting money buying a lot of stuff I really do not need, especially if I go to the store hungry.

Every time I wanted to spend money on something useless on Amazon I “pulled myself up by my bootstraps” and transferred it to savings instead. Took me a few months to not break the habit but I have accumulated a little over $500 in savings instead of throwing it away.

Another way that helps: instead of the 'featured' item, do a search --- invariably you'll find exactly the same thing from another seller for less.

Drawing out my household food budget in cash- when it's gone, it's gone. If something edible can't be paid for in cash we don't buy it. It's cut our spending from almost £500 per month (with an embarrassing amount of food wasted) to around £250.

Learning how to cook beans! It seemed intimidating and I've made some mistakes, but now I eat beans for at least one meal a day. My gut, waistline, and wallet are very happy. .

Not easy, but finally took hubby off my Verizon plan - he passed 2 years ago and it took me that long to make myself do it. Meanwhile, he’s like, why didn’t you do that 2 years ago?! Anyway, saved $40/mo.

Sold my truck for a suv and quit nicotine in the same month started saving nearly $100 a month with those two changes.

Sold my truck for a suv and quit nicotine in the same month started saving nearly $100 a month with those two changes.

When you go to trade that SUV in a few years from now, you’ll get way more for it if you never smoked in it. Not only does cigarette smoke make a car interior stink, but the chemicals in it also degrade the glue holding the headliner cloth to the interior ceiling of the car, making it fall of and droop.

Spent way less at restaurants/I don’t go there that much any more. I spent only 21 dollars last month on fast food.

Spent way less at restaurants/I don’t go there that much any more. I spent only 21 dollars last month on fast food.

Make eating out or getting takeout a periodic treat instead of your regular meal every day. Of course there will be days when there’s just NO time to cook, and you didn’t make or have anything to freeze that could be a fast reheat. But that shouldn’t be happening that often. Besides, it makes letting someone else do the cooking and cleaning up feel all that much more special. Plus, if you order enough, you can eat the leftovers for a few days—-another quick reheat.

Using an insurance broker to find the best deals for you every year.

They deal with finding the quotes, talking to vendors, and just present the numbers to you. Every year I end up changing my insurance provider for something cheaper while still getting the same value/protection.

I did my research and found a really good insurance company about 25 years ago, specifically because their policy covers your pets (if they’re in the car with you when you’re involved in an accident) at NO extra cost, and have been with them ever since. If you’ve been a longtime customer, and don’t have tons of tickets and accidents that are your fault, many insurance companies will discount longtime customers’ rates, or drop any fees associated with the policy. I pay way less now than I did when I signed up with them, and they were a good value back then.

Travelling less. I made the decision on July 1 to cut out any domestic travel that requires a rental car, except for going home at Christmas-time. I haven't left North Carolina since mid-June when I visited family in Chicago. I had spent 30 years in travel heavy jobs and still have tons of American and Delta miles to spend, but the rental car and hotel costs were killing my budgeting.

Slowly transitioning to drinking mostly water when at home and rarely buying soda when out. This transition took most of the first eight months of 2024 to break habits and build new ones. I still buy some 8-packs of Polar or LaCroix or a 2L bottle of ginger ale, but only one at a time and only in weeks where I spend $35 or less on other groceries. I also picked up a box of individual Crystal Light packets from Sam's Club to help with transition, and now I use only one or two a week. When I'm out, I have a Panera subscription at $5.75/month for iced coffee and soda, and I use that 4-5 days a week so I don't buy anything if I get breakfast or lunch somewhere else. That along with bringing a water bottle with me also means that I rarely buy combo meals when I am out, and while I do eat out a lot many of the times it's only $2.50-$3.25 instead of $7.50.

There are habits and methods that greatly decrease your spending without being noticeable too much. And there are those which give you small savings while greatly reducing your quality of life. I tend to focus on the former and to avoid the latter. Train instead of car? Hell, yes. Hostel instad of hotel spa? Why not. But to cut out travelling alltogether would be a red line for me.

Honestly removing the exposure to ads/influencing. I deleted tik tok and stopped clicking on the instagram pics/vids of influencers telling me what I need to buy. I also unsubscribed from all email lists (I’m still doing this, each time I get an email I unsubscribe). I also turned off notifications from shopping apps. I’m sure there is more stuff too that I’m not thinking of but genuinely when you’re not always seeing stuff that tempts you to buy, you forget about wanting to buy stuff. Seriously.

I grew up without money to spend on stuff advertised so, unless it's free, I almost always just tune out the ads. Why bother paying attention if you haven't got money to spend on them? If you're impulsive, an ad blocker (I recommend UBlock Origin; if using Chrome UBlock Origin Lite) helps - you can't be influenced by what you don't see.

I switched my savings from my account I've had literally forever to a high yield savings (4% apy or something). It's not an account I can easily withdraw from, so that money is sitting safe. I went from getting like a single cent from my money every month to $30 or so.

I switched my savings from my account I've had literally forever to a high yield savings (4% apy or something). It's not an account I can easily withdraw from, so that money is sitting safe. I went from getting like a single cent from my money every month to $30 or so.

Getting rid of paper towels at home

Getting rid of paper towels at home

I bought a thing of painter's rags for my art space and brought most of them in the kitchen. they go in a bag to use, into the laundry to wash.

YouTube for home repairs. Even with a home warranty our deductible is $150, for the AC the part was $12 on Amazon. But normal first reaction used to be just call the warranty and have someone come out.

Make coffee from home and bring it to work instead of spending $5 per cup.

I could never be bothered to go to a coffee shop and queue up first thing in the morning. Sod that!

Spending $10 on a candle warmer. Instead of spending a big expense repeatedly buying candles, I can melt them again and again and they still smell amazing.

Meal prep, canceling subscriptions, and starting an impulse buys list where I wrote what I want, how I feel, and if it keeps popping up consistently then I decide to buy it. Much more intentional! (edit: grammar).

Not exactly by me, but local store moved all alcohol to locked display. Now you have to press a button for store clerk to come and open it. I pressed a button, waited 5 minutes and realized that I don’t want to buy the alcohol today.

Not buying a clothes! Recognizing I can live off what I have in my closet and don’t have any NEEDS just wants.

I want a new sweater for fall this year. While shopping on Amazon is easy I realized I could probably find one at my local thrift store that I could try on before I buy it.

I started using the pressure cooker.

I was astonished by how quickly I could cook a whole chicken breast, how juicy/tender it still was, and how fast & easy it was to clean.

I can shred the whole breast in less than a minute and mix it with a microwaved southwest blend (quinoa, rice, peppers, onions, etc), sprinkle a bit of adobo on it and have a healthy cheap quick easy burrito bowl to rival Chipotle's.

The actual labor part of that meal is about 2 minutes. Then I just do something else while the chicken cooks for like 25 minutes and throw the frozen mix in the microwave for the last 5 minutes.

Started making homemade pizza. Fast, easy, cost-effective and always a crowd-pleaser with the family.

I (kitchen-delinquent husband) started doing this on nights my wife had a long/hard day at work instead of opting to eat out.

Buy a used breadmaker off Marketplace/Kijiji and a bag of high protein flour for good homemade pizza dough. Keep a jar of yeast in the fridge. You can add the ingredients, mix, let it rest, then mix again. 2 tbsp of oil in the pan, and stretch the dough, let rest 5 minutes, then fit to pan and add toppings. Cook in at 450 degrees for 10 minutes, then finish under the broiler. Restaurant quality $35 pizza at home for about $5 in costs and only about 10 minutes of actual time in the kitchen while you use the rest of the time for whatever else needs doing so you can relax after dinner. Source: I used to be a kitchen manager of a pizza place

I started making my own yogurt this year.

Love doing that! My kids love it too. Try making your own butter next - it's fun and a workout, and all you need is some full-fat milk and a jar!

Finance hack here. If I need a big power tool for something, I buy it on Facebook Marketplace, use it, and then resell it on Facebook Marketplace. Usually it’s for the same price, but sometimes I get more. For example, my kids wanted an in-ground basketball hoop. I bought an auger for $100, used it, and sold it for $160. I bought a concrete mixer for $150, used it, and sold it for $175. For another project I bought a table saw for $100, used it, and sold it for $100.

Finance hack here. If I need a big power tool for something, I buy it on Facebook Marketplace, use it, and then resell it on Facebook Marketplace. Usually it’s for the same price, but sometimes I get more. For example, my kids wanted an in-ground basketball hoop. I bought an auger for $100, used it, and sold it for $160. I bought a concrete mixer for $150, used it, and sold it for $175. For another project I bought a table saw for $100, used it, and sold it for $100.

Making my own coffee creamer. I used to buy the brown sugar oat milk kind from coffee mate and it was creeping up to over $6 per container each week. Now I buy oat milk, add some brown sugar and vanilla extract, shake it up, and put it in a jar. Lasts me 2 weeks and costs $2-3/week depending on when I need to buy ingredients.

Buy powdered drink mix for my sports-playing kids instead of bottled sports drinks after every practice.

Sparkling apple juice is recommended as a sports drink here in Germany. That might be even cheaper, and would certainly be healthier.

Canceled all streaming services. Been watching tv shows via library dvd 'rentals'. Just watched Westworld season 1, now watching True Detective. I don't miss streaming at all so far. My goal is to exhaust my local library's supply of stuff I want to watch- movies and tv- then maybe sign up again. But it's going to take a good long while.

We signed up for a free trial for Apple + so we could watch Tim Lasso. We canceled the subscription after watching it.

In the past year plus: Reduce monthly charges/subscriptions. Savings sometimes at the click of a button. Marie Kondo that streaming list, and cut cable. No cable TV saved $1000/yr by itself.

Got a Costco membership only to use on gas and protein. I save probably $100/month on a $60 membership.

In our kitchen after washing my hands I now use a hand towel instead of tearing off a sheet on the paper towel roll.

Oh my! People use kitchen roll to dry their hands?!! This one genuinely flummoxed me.

I'm old, from a waste-not-want-not era, so I know how to turn leftovers into something tasty. A useful skill to avoid food waste. I also mostly cook from scratch, but always have some staples in the cupboard (beans, lentils, diced tomatoes, corn, tuna) that can be turned into à meal in a pinch.

You need money to save money. Twice a year, the coffee I like goes on sale for $6.99 instead of the regular price of $10.99. I would buy 2 cases (24 cans), which lasted me until the next sale. The 2 lights rule. I live alone and there's no reason to have 2 lights on in the house, but it sometimes happens. There's no excuse for 3 lights on, ever. My electric usage averages $20 a month (before tax and transportation). To save money, I make meals for under (used to be $1 but with inflation) $3. That means eating a lot of leftovers (pasta, soup, stew) and on buying on sale surprises. I only cook for me, so its easier in some ways, but not in others (BJ's and Costco are not cost effective). Challenge yourself to lower utility and grocery bills by trying to decrease your bill 10 or 15% a month - they're the only bills that aren't fixed.

One of mine has an upfront cost: Bought a freezer. I now buy meat on sale and in bulk. I worked in the food industry before medically retiring and am a bit picky about my meats. So I will go without until that ground beef, steak, roast, bacon, shellfish, or fish is on sale... then I buy three. During the holidays when ham and turkey are on sale for ⅓ of the price, I buy three. I now have a full freezer that I work down and replenish during sales.

Sam's Club. And I'm moving into an apartment with an actual functional kitchen. It's twice the price but I'll be able to properly cook. Worth it.

My biggies are: No spontaneous purchases, everything goes in the cart for 3 days Make my lunches & diners Grow my own weed

I'm old, from a waste-not-want-not era, so I know how to turn leftovers into something tasty. A useful skill to avoid food waste. I also mostly cook from scratch, but always have some staples in the cupboard (beans, lentils, diced tomatoes, corn, tuna) that can be turned into à meal in a pinch.

You need money to save money. Twice a year, the coffee I like goes on sale for $6.99 instead of the regular price of $10.99. I would buy 2 cases (24 cans), which lasted me until the next sale. The 2 lights rule. I live alone and there's no reason to have 2 lights on in the house, but it sometimes happens. There's no excuse for 3 lights on, ever. My electric usage averages $20 a month (before tax and transportation). To save money, I make meals for under (used to be $1 but with inflation) $3. That means eating a lot of leftovers (pasta, soup, stew) and on buying on sale surprises. I only cook for me, so its easier in some ways, but not in others (BJ's and Costco are not cost effective). Challenge yourself to lower utility and grocery bills by trying to decrease your bill 10 or 15% a month - they're the only bills that aren't fixed.

One of mine has an upfront cost: Bought a freezer. I now buy meat on sale and in bulk. I worked in the food industry before medically retiring and am a bit picky about my meats. So I will go without until that ground beef, steak, roast, bacon, shellfish, or fish is on sale... then I buy three. During the holidays when ham and turkey are on sale for ⅓ of the price, I buy three. I now have a full freezer that I work down and replenish during sales.

Sam's Club. And I'm moving into an apartment with an actual functional kitchen. It's twice the price but I'll be able to properly cook. Worth it.

My biggies are: No spontaneous purchases, everything goes in the cart for 3 days Make my lunches & diners Grow my own weed

Dark Mode

Dark Mode

No fees, cancel anytime

No fees, cancel anytime