35 People Share The Biggest “Money Mistakes” They’ve Made That Changed Their Life For The Worse

InterviewWhen you were a kid, did you ever play the game of “If I had a million dollars, here’s how I would spend it”? Casual conversations would ensue with your friends about mansion with spiral staircases, gorgeous homes on the beach in Hawaii, private jets that would fly in and out of your backyard and the ranches you planned to own and fill with exotic animals. Little did we know at the time that it takes a lot more than a million dollars to own those things, and that it’s much harder to accumulate funds than to lose them.

In the spirit of having a realistic view of money, Reddit users have recently been confessing the worst financial mistakes they’ve ever made, and we thought it might be useful to pass along their knowledge, if it'll help any of you pandas avoid making the same mistakes. From plunging themselves into debt with student loans to trusting that their spouses would be wise with money, we’ve gathered some of the most painful mistakes down below. Keep reading to also find interviews with Reddit user The_guy321, who sparked this conversation in the first place, financial advisor Michael Kitces, and Jen Smith, co-host of the Frugal Friends podcast.

Be sure to upvote any responses that hit home or that you’ll keep in mind for the future, and then feel free to share any financial faux pas that you’re guilty of in the comments below. Then, if you’re interested in checking out a Bored Panda article featuring tips that can help you save a little extra money, look no further than right here!

This post may include affiliate links.

43 years of buying and smoking cigarettes

43 years of buying and smoking cigarettes

For those still smoking here's some tips. First of all: Keep trying, even if you fail a few times, keep in mind that higher and difficult goals may require more than one attempt. I used zyban to quit and whereas it is not scientifically proven, I felt it made a difference. Try mindfulness to learn that you do not have to act upon all thoughts. Try to avoid situations in which you see other people smoking. Don't give up, you can do it too!! Oh also important: Do not think that now that you haven't smoked for a while, you can try one cigarette, because you can't. That is still addiction talking. You can do it! I am cheering for you!!

To hear what sparked this conversation in the first place, we reached out to Reddit user The_guy321. He told Bored Panda, "I recently have been focusing more on my financial health. I am nearly 38, and the weight of long term financial planning is setting in."

"I asked the question for two reasons. First, so I could learn from the collective mind that is Reddit on what to avoid. Second, entertainment value. Some of the answers had me laughing pretty good (hopefully with the commenter)." He added that, thankfully, he's never made any significant financial mistakes himself, but he does wish he had invested more earlier on.

Becoming a doctor. At the end of the day, it’s just a job. It wasn’t worth flushing my 20’s down the drain and accumulating a mountain of debt for this. I’m (finally) in a good spot in life now, but I don’t think the sacrifices I made to get here were worth it. Even from a less self-centered point of view, I don’t really do that much good for others with this job. Modern medicine is so much better at dragging out death than it is at improving life, and I’m tired of being a part of it.

Becoming a doctor. At the end of the day, it’s just a job. It wasn’t worth flushing my 20’s down the drain and accumulating a mountain of debt for this. I’m (finally) in a good spot in life now, but I don’t think the sacrifices I made to get here were worth it. Even from a less self-centered point of view, I don’t really do that much good for others with this job. Modern medicine is so much better at dragging out death than it is at improving life, and I’m tired of being a part of it.

A doctor told me, "Im trying to help you live longer." Woman, I have a chronic condition that puts me in pain every. Single. Day., will eventually cause one or more organs to fail and will be on my death certificate as contributing cause of death. That is my reality and I have learned to deal with it. For the love of God, can we stop trying to get me to live longer in agony and concentrate on quality of life instead of quantity. Thank You! This dr gets it!

We were also curious if The_guy321 learned anything from the responses to his post. "According to the comments, don't get married!" he shared. "I am too late to avoid that, but I have no complaints in making that decision."

He also shared a few tips for anyone who's recently made a financial faux pas or doesn't have the best track record managing their money. "Check out r/personalfinance on Reddit. Tons of great information and helpful people." Some of his top tips were, "Live within your means, avoid credit card debt, build up a 3-6 month emergency fund, then invest in index funds as early and as much as you can until you are nearing retirement age."

And if you make a mistake, don't beat yourself up about it. "Mistakes happen," The_guy321 told Bored Panda. "Learn from them, and move on. Dwelling on the negativity does no good."

Didn't contribute to my 401k for like 15 years. what a doof.

CheesyComestibles added:

I just this year started a retirement account. Nobody taught me about this s**t. I'm 12 years into working. I could have had 12 years of gains, but instead got like 10 bucks interest in my savings account.

Why is money management not mandatory for high school graduation? I was taught nothing. I still know very little and trying to teach myself is like pulling teeth.

Didn't contribute to my 401k for like 15 years. what a doof.

CheesyComestibles added:

I just this year started a retirement account. Nobody taught me about this s**t. I'm 12 years into working. I could have had 12 years of gains, but instead got like 10 bucks interest in my savings account.

Why is money management not mandatory for high school graduation? I was taught nothing. I still know very little and trying to teach myself is like pulling teeth.

I never even had the option of a 401K. Pretty sure I'm going to work until I die.

Agreed to take over my ex gfs bills so that she could pay off her debts. 5 years and over $100,000 of my money later she was in more debt than when we started and cheating on me. Don't ever do this, just make her be an adult or dump her a*s. It's never worth it

Agreed to take over my ex gfs bills so that she could pay off her debts. 5 years and over $100,000 of my money later she was in more debt than when we started and cheating on me. Don't ever do this, just make her be an adult or dump her a*s. It's never worth it

No, you tried to be a good partner. You just kept doing it too long. You should set your limit and if nothing was changing.. then yes leave.

We also reached out to financial advisor Michael Kitces to gain more insight on this topic from an expert. Michael was kind enough to open up about some of the financial mistakes he made in the past that he's not particularly proud of. "I think the highlight is probably in my college years, back in the 1990s," he told Bored Panda. "I had been an avid player of Magic: The Gathering (in its early days!), and had a lot of the really rare unique cards from the early years."

"In 1999, I sold my Magic collection for $2,000 (back then, that was a lot of money!), so that I could put it into an online brokerage account to become a day-trader (the tech stock boom of the 1990s had a day-trading phenomenon similar to the Robinhood era of today!). Within 12 months, I had lost all $2,000," Michael confessed. "Nearly 25 years later, Magic The Gathering remains incredibly popular, and I was able to recently estimate that the cards would be worth well over $50,000 if I had just kept them instead of trying to day-trade stocks."

Getting married to the wrong partner. People like to think about marriage as an emotional and physical commitment and tend to forget that it's a financial commitment as well. If you get entangled with someone who has no clue how financial management works, you're in for a rollercoaster ride straight to hell.

can confirm. First girlfriend - I called off the marriage for this reason.

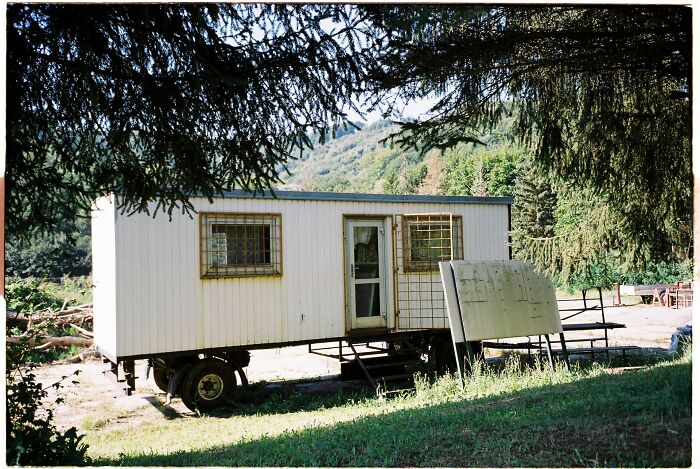

Bought a mobile home as a starter home. No one ever explained to me as a young adult the importance of investment and future planning. Mobile homes of course do not hold nor increase in value so you never build equity. It's akin to renting except you have to cover all your own repair costs too.

Terrible financial decision. Don't buy mobile homes kids. Just don't do it

Bought a mobile home as a starter home. No one ever explained to me as a young adult the importance of investment and future planning. Mobile homes of course do not hold nor increase in value so you never build equity. It's akin to renting except you have to cover all your own repair costs too.

Terrible financial decision. Don't buy mobile homes kids. Just don't do it

I'm really happy with my modular home, it allowed us to buy in area we couldn't otherwise afford. It's brand new and we're landscaping from scratch. It won't appreciate at a normal house rate but it's not losing value. We also pay less than apartments in the area without shared walls. For my family it is a good decision.

If you've made some mistakes with your money, don't be too hard on yourself. Michael believes that this is an experience we all go through; sometimes, we just need to learn lessons the hard way. "This money stuff isn’t easy, it isn’t logical for a lot of us, and it has a lot of emotional ties," he told Bored Panda. "I don’t know how anyone will be able to fully learn how to overcome their impulses without some pain and hard lessons along the way."

"The faster/earlier we learn these lessons (the hard way), the more time we have to live a life with those lessons going forward! But the idea of 'you can have more wealth if only you didn’t make all those mistakes' may be literally true, but in practice, is an unrealistic idealistic dream. You can’t learn to build wealth without the learning that comes from mistakes along the way!"

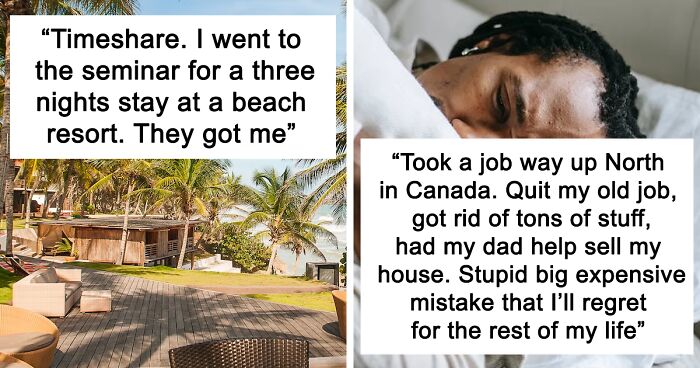

Timeshare. I went to the seminar for a three nights stay at a beach resort. They got me. Phenomenal salesman, but they lie out of their asses. Spent thousands over a few years, only used the timeshare once, paid a lawyer to get us out of the contract (basically a mortgage). Now we’re free!

Timeshare. I went to the seminar for a three nights stay at a beach resort. They got me. Phenomenal salesman, but they lie out of their asses. Spent thousands over a few years, only used the timeshare once, paid a lawyer to get us out of the contract (basically a mortgage). Now we’re free!

My wife and I went to a seminar for holiday apartments and the salesman showed us photos of him and his "girlfriend" at a similar timeshare to the ones they were selling. He was about five foot four, scrawny, and unremarkable. She was six foot , stunning and clearly a posing model. I did my best to stifle my laughter but gave in when my wife, splutter laughed at the obvious set up photos. He got up said something about losing his focus and left us sitting in the room giggling like a pair of kids. We finished our coffee and left quietly soon after.

Well done to you both for being so restrained - Many years ago in the Canary Islands I was holidaying alone at a friends villa just outside Los Cristianos I had just sold a company and needed some down time following a very stressful, if ultimately very profitable few months. Whilst in town (the old town - don't bother with the touristy bits ), I got chatting to a girl who was working as a 'salesperson' for a timeshare company. It was quite an eye opener and she gave me many insights into what these shysters were willing to do to push a sale through. I went to one 'presentation' with her (they don't like single people apparently) and an absurd amount of not so subtle pressure was used to try and get us to buy basically a badly built, badly located and overpriced share in a property (she worked for a rival, but as bad a company btw). I got so annoyed with the slimy little sht who was working on a bunch of quite gullible / naive (and us), that I took him outside for a 'chat' . hey ho.

Load More Replies...Did a timeshare seminar a few years back, was on vacation in St. Ives, Cornwall. Feeling a bit bored and the perk they offered to sit through a four hour presentation was a day trip to the scilly islands, sat through the four hours with coffee and cake and spent the entire next day exploring the scilly´s. Still don´t have a timeshare.

Timeshare is a scam. People convince themselves it’s a great idea because no one like to think they’ve been scammed. Only one I heard of that was worthwhile was a guy who bought one close to him but the deal was he could use the facilities. Pool etc. all year round

Buy from the developer = scam. Buy on ebay for a buck = works out. Stayed in Paris for $600, full kitchen, separate bedroom, etc. Sure the maintenance fee's are just slightly lower than a hotel for the same amount of time. But you do save on food and the bonus time is super cheap.

Why do people still buy these? We've known since the 50's this is a scam.

In 1981 my mom bought into a time share and we went every year up until 2010. Yes she paid a lot into it over the years but no more than any other vacation we would go on. We loved where we were going. We traded time of year several times and destination a few times too.

I went to a seminar for three nights free at a timeshare. I never intended to buy, but I also got a free dinner and a chance to politely call out the promoter on his lies.

Mrs. Ruffensor and I went to a timeshare presentation once, and after refusing the hard sell for at least an hour the guy said, OK, just go through this door now. We found ourselves in the back alley. That was funny. We went and bought a trailer instead, that was a good buy.

If you buy from the developer, you're all correct... it's a scam. BUT if you buy from a reseller, or on eBay from someone just trying to dump it, then it can be a GREAT value. Just make sure that the timeshare is deeded to the actual property that you want to visit. One of the big scams of the developers is that the timeshare property you're shown is often NOT the one on the deed.

I got sucked into a timeshare. I ended up getting counseling (paid) on how to get out of the increasingly costly contract. I’m free. My credit is restored.

I have a friend whose parents do this time-share thing and they love it. They're retired so it's easy for them to plan the days though.

My sister in law and her husband have a timeshare in the lake District, it's gorgeous and family members jockey to be included! They also have money in Holiday Property Bond, which seems a good idea, we go with them to somewhere different every time, and it's very good

As a kid, my parents took us to many timeshare presentations as part of vacation. The company would take my siblings and myself to go do something amazing (seeing elk in Aspen, swimming in the ocean in San Deigo, etc). Mom and dad would get two great meals out of it, a voucher for something cool (I remember one $100 gift certificate for groceries in the 70s. ), and we'd get a free night in the place and leave in the morning. Never bought a timeshare.

2/2. Now, a beloved fathering place for my family is gone, and my parents have passed. We still haven't seen any money yet. All the owners? We voted to fix it , as location, location, location. Look at it online and you will see why..

My parents bought a timeshare on Key Marathon when we were young. We went there every summer for over 20 years. When we married and grandkids started coming, they bought another one in the same week. We all made wonderful memories down there! Sadly, the hurricane in 2017 decimated it and made it unsafe and just awful. It was called Hawk's Nest. The board members voted to tank it completely

I co-signed a loan for my girlfriend at the time. I was 20 and in love. She bought the car, then put it in her mothers name, filled for bankruptcy, and went to live with the guy she was cheating on me with. F**k you Christine. Thank you for teaching me at such a young age how s****y people actually are.

Michael also told Bored Panda that the two biggest mistakes he sees most often are, "Those who spend too much time worrying about what they’re spending without focusing enough on what they’re earning (it’s a lot easier to build wealth by learning to get a raise than trying to cut your expenses to the bone!), and making spending decisions based on the perceptions of others (the most self-destructive spending decisions I see are those who try to buy what other people buy [even if they can’t afford it themselves], or buying what you believe will make you look good in front of others [the 'keeping up with the Joneses' phenomenon]) instead of just trying to spend money on the things that bring you enjoyment. Marie-Kondo your spending!"

Credit card debt. Finally paid everything off when we sold/bought our next house and made the promise to never carry any credit card debt. And we haven't.

Credit card debt. Finally paid everything off when we sold/bought our next house and made the promise to never carry any credit card debt. And we haven't.

Spending money on in-app purchases for mobile games. Bonuses, upgrades, special features…all so I can loose interest in the game a year later. It’s flushing money down the toilet.

If a game gives you enjoyment, if it's not *too* much money I think that's a fine investment. There aren't too many games I've played "forever" (Sotn, yes, and Minecraft to name a few that I've played for many years).

And even after making some financial faux pas, Michael is confident that there's always time to bounce back. "Perhaps the greatest example to me is Warren Buffett," he told Bored Panda. "Warren’s net worth today is over $100 billion, making him one of the richest people in the world. But he was 60 years old before he ever became a billionaire in the first place; which means it took him 60 years to get the first $1B, and the past 30 years to get the other $99 billion."

"When you recognize that even one of the richest people in the world started his first business delivering newspapers at age 14, but accumulated 99% of his wealth only after he turned 60, it gives an appreciation of just how long it takes to build wealth (and how much we can make up for in the later years)!"

If you'd like to gain more financial wisdom from Michael, be sure to check out his website right here!

Kept my money in a bank ($ 150,000) because they were offering high interest rates in a country with questionable economic condition where i lived at the time. The entire system crashed and i can't access my money since 2019 while the bank keeps charging me monthly fees, slowly draining my savings. Welcome to Lebanon.

Kept my money in a bank ($ 150,000) because they were offering high interest rates in a country with questionable economic condition where i lived at the time. The entire system crashed and i can't access my money since 2019 while the bank keeps charging me monthly fees, slowly draining my savings. Welcome to Lebanon.

Offering higher than normal interest rates is a red flag. I present Bernie Madoff.

Going to college right out of high school. College is great if you know why you're there, but not for someone who isn't yet sure.

I can't speak for everyone but when I was fixing to graduate high school back in 2000-2001, everyone thought college was the next step because literally no one ever told us anything different. Parents, teachers, school guidance counselors, and the culture. EVERYTHING was about pushing kids into the college pipeline."

Wolfbeckett added:

I literally thought everyone working trades were living in poverty until I was in like my mid-twenties because no one ever brought it up unless it was to disparage the whole idea of working for a living.

Going to college right out of high school. College is great if you know why you're there, but not for someone who isn't yet sure.

I can't speak for everyone but when I was fixing to graduate high school back in 2000-2001, everyone thought college was the next step because literally no one ever told us anything different. Parents, teachers, school guidance counselors, and the culture. EVERYTHING was about pushing kids into the college pipeline."

Wolfbeckett added:

I literally thought everyone working trades were living in poverty until I was in like my mid-twenties because no one ever brought it up unless it was to disparage the whole idea of working for a living.

If I had it to do over again, I would have dropped out of high school when I was 16 and started attending community college. IMO the last two years of highschool and the first two years of college cover the same material. My BA was an absolute breeze, but it cost way more than it should have. In retrospect, I should have done two years high school, two years community college, and two years university. I'd have been done a lot faster.

Big fat Indian wedding feeding nearly a 1000 judgmental semi-strangers I'll never hear from again!

Sorry I have zero sympathy for people who comply with cultural edicts. My own wedding had 80 people, and in Africa we also traditionally invite hundreds. F**k them. If you do not speak to a person every month, they do not deserve an invitation. Same for funerals. We don't bother in our family. We just burn and discard.

We also reached out to Jen Smith, co-host of the Frugal Friends podcast, to hear her thoughts on this topic. Jen shared with Bored Panda that her biggest financial mistake that she made in the past was maxing out her credit cards. "Thankfully they had low limits, $500 and $2,000, but I didn't have the self-control to not max them out. If the 'money' was available, I was going to spend it," she explained. "Once I maxed out both cards at the same time, I knew I needed to get rid of one. My way out was someone backing into my car in a parking lot. The damage was minor enough that I could still drive the car and use the insurance money to pay off the $2,000 card and cancel it. That dent was a constant reminder of that card."

As f**ked as it is, the financial expense is what got me to quit nicotine. I realized that I was spending $150 a month on disposable vapes and started comparing it to my other bills. I was paying more for my unhealthy addiction than my car insurance, or my utilities. Kinda hard to justify when you look at it like that.

Yet some people still manage to justify it. Look, I don't care about people smoking, it's none of my business. But what absolutely infuriates me is if people complain about their money problems and that they don't have money for essentials... while they're spending a shitton of money on cigarettes.

Took a job way up North in Canada. Quit my old job, got rid of tons of stuff, had my dad help sell my house, etc. This was in 2019/early 2020 just before COVID hit big. I ended up hating the job up North; it was terrible. Went back home, somehow managed to get my old job back, but my house is gone and I can’t afford a new one in the current market. Stupid, idiotic decision on my part, and it keeps me up at night. I hate where I am in life right now. Stupid big expensive mistake that I’ll regret for the rest of my life.

Took a job way up North in Canada. Quit my old job, got rid of tons of stuff, had my dad help sell my house, etc. This was in 2019/early 2020 just before COVID hit big. I ended up hating the job up North; it was terrible. Went back home, somehow managed to get my old job back, but my house is gone and I can’t afford a new one in the current market. Stupid, idiotic decision on my part, and it keeps me up at night. I hate where I am in life right now. Stupid big expensive mistake that I’ll regret for the rest of my life.

If there's one thing I've learned, it's that you can push on through these things. COVID rocked me too. I'm down about 16 grand from where I was in 2020. Right now I have a little over $1000 in savings. It's rough, but I'm climbing my way back up again. $100 per week.

"Whether you learned about money from your parent, school, or nobody at all, everyone makes mistakes with money," Jen told Bored Panda. "And those mistakes teach you more about money than anyone in your life could. Count yourself lucky if you make mistakes when you're young because the stakes are usually lower and the fallout is much less expensive than money mistakes made later in life."

Sold my signed Banksy prints for a couple of grand to fund a new kitchen. Saw the same prints a couple of years later selling for £80,000.

Blurgh. Just swallowed another mouthful of sick thinking about it (and they did a s**t job of the new kitchen floor).

Sold my signed Banksy prints for a couple of grand to fund a new kitchen. Saw the same prints a couple of years later selling for £80,000.

Blurgh. Just swallowed another mouthful of sick thinking about it (and they did a s**t job of the new kitchen floor).

At the height of the pandemic, I had a pretty severe "hidden" mental breakdown due to the trauma of isolation/quarentine and general terror over the whole thing. Combined with my own long-standing battle with Bipolar Disorder, I wound up withdrawing €4,000 from my savings account and going on a massively impulsive shopping spree.

Initially I told myself that the money was for a PC/laptop upgrade but as my mental health tanked the further the quarentine went on, I just kept spending in a desperate bid to feel something other than the crushing terror and uncertainty, chasing the fleeting dopamine hits that come from impulse purchases.

That was nearly 3 years ago and I'm still trying my damndest to build up my savings again. I hope I ever have another breakdown that bad as it was so embarassing when I eventually told my parents the full extent of the spree.

To add insult to injury, I also got an ill-advised Mohawk so I was both broke and (semi) bald.

Nowadays I've grown my hair out but I'm still struggling to recover my savings. Squirelling a away a few bob each week and hoping for the best. Thankfully, I'm on better medication now but yeah, things were bad for a while.

At the height of the pandemic, I had a pretty severe "hidden" mental breakdown due to the trauma of isolation/quarentine and general terror over the whole thing. Combined with my own long-standing battle with Bipolar Disorder, I wound up withdrawing €4,000 from my savings account and going on a massively impulsive shopping spree.

Initially I told myself that the money was for a PC/laptop upgrade but as my mental health tanked the further the quarentine went on, I just kept spending in a desperate bid to feel something other than the crushing terror and uncertainty, chasing the fleeting dopamine hits that come from impulse purchases.

That was nearly 3 years ago and I'm still trying my damndest to build up my savings again. I hope I ever have another breakdown that bad as it was so embarassing when I eventually told my parents the full extent of the spree.

To add insult to injury, I also got an ill-advised Mohawk so I was both broke and (semi) bald.

Nowadays I've grown my hair out but I'm still struggling to recover my savings. Squirelling a away a few bob each week and hoping for the best. Thankfully, I'm on better medication now but yeah, things were bad for a while.

Oof I feel this one, I've been paying off debt for the past 6 years from reckless overspending when I was in a terrible place mental health wise (BPD, reckless and impulsive behaviour)

Jen also noted that getting into consumer debt is one of the most common financial errors for people to make. "When you're not making enough to afford the lifestyle social media is telling you you need, then people will use credit cards, student loans, or finance necessary things like cars to buy more stuff," she explained. "The only solution is to learn how to discern what it is you want from what advertisers and influencers are telling you to want."

"Nobody wants to believe they're easily influenced, but we all are," Jen added. "But when you know what you value, what your goals are worth to you, and what purchases truly make you happy, you can more easily say no to the things you don't really need or want."

Hate to admit it, but I got nailed by a crypto scam. So dumb.

Hate to admit it, but I got nailed by a crypto scam. So dumb.

Crypto is pure gambling, nothing else. Everyone who invests in Crypto should know this or already knows and still invest in hope of getting quick bucks. There is no shortcut to money ever, if there is one, its definitely a fraud or pure luck like lottery

When I turned 21, I gained full control over my inheritance account. It was how it was written in my grandparents will. At that time, it was only worth $15k.

It was the only time my financial advisor ever met with me. I said I wanted to invest all of it in AAPL.

I still remember the face he made in disgust. "Why would you want to invest in Apple?" I explained that I had just done a college paper on Steve Jobs and I truly believed that now that he was back in charge of the company, he'd turn the stock around. (valued around $1/share at the time, it has split many times since)

He convinced me to stay the course and keep the same investments my parents already had my brokerage invested in. At its peak, it grew to about $70k in value. (I still have the investment today). If I had invested in AAPL at that time like I wanted to, I'd have a cool 10M, and I could retire today.

Trust your gut people.

When I turned 21, I gained full control over my inheritance account. It was how it was written in my grandparents will. At that time, it was only worth $15k.

It was the only time my financial advisor ever met with me. I said I wanted to invest all of it in AAPL.

I still remember the face he made in disgust. "Why would you want to invest in Apple?" I explained that I had just done a college paper on Steve Jobs and I truly believed that now that he was back in charge of the company, he'd turn the stock around. (valued around $1/share at the time, it has split many times since)

He convinced me to stay the course and keep the same investments my parents already had my brokerage invested in. At its peak, it grew to about $70k in value. (I still have the investment today). If I had invested in AAPL at that time like I wanted to, I'd have a cool 10M, and I could retire today.

Trust your gut people.

And if you've recently made any financial mistakes that are haunting you, don't be too hard on yourself. "Remember that you're not alone. No matter what mistake it is, someone before you has definitely made the same one," Jen told Bored Panda. "You may want to forget that it happened and move on as quickly as possible, but every mistake is an opportunity to learn and grow. Reflect on what triggered the choice, what you wanted to get out of it, and how it was a mistake, and consider how you'll handle similar situations differently in the future. Don't miss the opportunity to grow and do better."

If you'd like to hear more encouraging words from Jen about how to use your finances wisely, be sure to check out her podcast Frugal Friends right here! And if you're interested in some reading on the topic, you can find Jen's book The No-Spend Challenge Guide right here and her book Meal Planning on a Budget right here!

5 years ago I bought plane tickets for my ex to come and see me, he cancelled on me 3 days before saying his grandma was on her deathbed (she is currently still alive) I was 16 and I wasted 3 years worth of savings

5 years ago I bought plane tickets for my ex to come and see me, he cancelled on me 3 days before saying his grandma was on her deathbed (she is currently still alive) I was 16 and I wasted 3 years worth of savings

When you buy plane tickets check if they have a cancellation option and what the clauses are. Our airlines let you pay a little extra for a cancellation option so that you can cancel last minute if you have to.

Nearing the end of the dotcom boom (it hadn't busted yet) I had a about s**t ton of stock options to exercise. I was about to do it, when I heard that my Dad was entering the hospital for a cancer operation. I put the stock options exercise on hold for a week and went to be with my Dad (and Mom).

While my Dad was in the hospital, my company released an earnings warning and our stock price got annihilated. When I did eventually exercise my options, I was down about $1,000,000 from where I was before my Dad entered the hospital.

For the record, my Dad is OK. And if faced with the same situation I would make the same decision. It might have been a big *money* mistake, but it was not a mistake.

Nearing the end of the dotcom boom (it hadn't busted yet) I had a about s**t ton of stock options to exercise. I was about to do it, when I heard that my Dad was entering the hospital for a cancer operation. I put the stock options exercise on hold for a week and went to be with my Dad (and Mom).

While my Dad was in the hospital, my company released an earnings warning and our stock price got annihilated. When I did eventually exercise my options, I was down about $1,000,000 from where I was before my Dad entered the hospital.

For the record, my Dad is OK. And if faced with the same situation I would make the same decision. It might have been a big *money* mistake, but it was not a mistake.

I sincerely hope all of you pandas are in a secure place financially, but if you're looking to save a little bit more or start spending more wisely in this new year, I'm sure you can gain some knowledge from the responses on this list. Keep upvoting the answers that might spare you or someone else from making the same mistakes, and let us know in the comments any other financial lessons you've had to learn the hard way. Then, if you're interested in checking out another Bored Panda article that might help you save some extra cash, you can find that right here!

I paid for my ex-girlfriend's college tuition for three semesters as she 'just one semester left'-ed me for all three. That was AFTER she got a letter stating she was no longer eligible for the Pell Grant or further loans. So, the banks said, 'No more,' but I paid for another year and a half, while also paying all the household bills and supporting her kid. We broke up, and she had the nerve to talk about what I supposedly OWE her.

i went to america for 10 days to visit a buddy of mine. cost me a fortune and i arrived to find he had been absorbed into his new girlfriend and was not the guy who left. Anytime he was away from her he was miserable and didnt want to do anything when he was with her all they wanted to do was have sex so they tried to get rid of me. massive waste of money and the loss of a friendship

i went to america for 10 days to visit a buddy of mine. cost me a fortune and i arrived to find he had been absorbed into his new girlfriend and was not the guy who left. Anytime he was away from her he was miserable and didnt want to do anything when he was with her all they wanted to do was have sex so they tried to get rid of me. massive waste of money and the loss of a friendship

Student loans

Student loans

For some this is the only way to get into college. I could never get a job in my chosen profession without a Bachelors degree, so there was no question about me going. In high school I made sure to get as many scholarships as I could to make sure my loan amount was as low as possible, but there was no way to avoid taking out a loan.

Not mine, but my dad's. He bought like $500 worth of collectable Star Trek dinner plates in the 80's thinking they'd be worth a ton of money in a few years. They're not.

Not mine, but my dad's. He bought like $500 worth of collectable Star Trek dinner plates in the 80's thinking they'd be worth a ton of money in a few years. They're not.

Procrastination. I have paid so many procrastination fees for late bills, and missed opportunities that the mind boggles.

thought i was just being a generous and kind person helping people out and never really expected them to pay me back. i was an IDIOT

That's ok, no one pays back. So either consider money you hand over to be a gift, or turn it around and ask them for money. That's what I do. If you have someone contact you and they're reluctant to start talking about what they really want, they really want money. So you steer the convo that way and start saying how broke you are etc etc. They will get the hint and go away.

I was not good at checking my company email inbox, nothing important came through there anyway (we mostly used Slack). And that is how I missed the deadline for my company’s IPO. They offered us stock at $10 and it opened at $40.

Now I read my emails.

I was not good at checking my company email inbox, nothing important came through there anyway (we mostly used Slack). And that is how I missed the deadline for my company’s IPO. They offered us stock at $10 and it opened at $40.

Now I read my emails.

I discover bitcoin very early: I bought 100 of them at 63 cents a piece.

Sold the whole bunch for 300 dollars.

I discover bitcoin very early: I bought 100 of them at 63 cents a piece.

Sold the whole bunch for 300 dollars.

i.. never really bothered understanding all the crypto cash stuff so correct me if i’m wrong, but i’m guessing they sold it too early and could’ve sold it for a lot more later on? or the title of the article doesn’t apply to this one and they ended up making a profit?

Spending all my student loan refund checks instead of saving those f*****s to, oh, I don't know - PAY OFF MY STUDENT LOANS.

Spending all my student loan refund checks instead of saving those f*****s to, oh, I don't know - PAY OFF MY STUDENT LOANS.

This! And if they've put your loans on hold, pretend you have to pay them back now anyway --take your "payment" and save it in case you DO have to pay it back someday, or if you don't you'll have money to get on your feet when you graduate.

I invested $890 into a stock and it later became a little over 1.5 million dollars. I did not take the money out because I thought it would go up. I quit my job because I thought I was going to be rich. My stock crashed to worthless, I’m struggling to get by. I could’ve had a house, started a business. Now I have nothing

I invested $890 into a stock and it later became a little over 1.5 million dollars. I did not take the money out because I thought it would go up. I quit my job because I thought I was going to be rich. My stock crashed to worthless, I’m struggling to get by. I could’ve had a house, started a business. Now I have nothing

Sold my MTG collection in 1998. Almost full power9, 40 revised duals, all the playable cards from beta, legends etc. Sold them for $1000 and bought booze and meth.

Would be able to pay for a house with those cards now.

Sold my MTG collection in 1998. Almost full power9, 40 revised duals, all the playable cards from beta, legends etc. Sold them for $1000 and bought booze and meth.

Would be able to pay for a house with those cards now.

same here, but I sold all mine to pay for a divorce.............worth it!

Bought a condo in July of 2007. The timing literally could not have been worse. Could have bought it for virtually half the price if I waited a year. Sold it just last year for less than I bought it (after inflation).

Bought a condo in July of 2007. The timing literally could not have been worse. Could have bought it for virtually half the price if I waited a year. Sold it just last year for less than I bought it (after inflation).

Got divorced. Let my ex keep the vehicle he drove, even though the loan was in my name. He put it in storage for six months, didn't pay the monthly payment during that time, and then called and told me where it was. When I went and got it, it had a window broken out. Luckily, my credit union was awesome. They sold it for me and worked the leftover balance into my current car loan with no reflection of it on my credit at all.

$21,000 car loan in 2016 that i was paying something in the realm of 20% interest on. Only paid that off this year finally... $9000 Credit Card which i got in 2015 and only managed to pay off this year. $3000 on Buy Now Pay Later which i also paid off this year. Basically between 2015 and 2022 i made a lot of stupid money choices. Probably lost close to $50,000 in terms of repayments and interest combined. But now i'm debt free! Next debt i will only accept will be a house loan.

Got asked to invest £10k in a friend of a friends promotions start up for a dragons den style 1/4 of the company. Didn't think the guy behind it would last the course. The company made millions and is still going today with events all over the UK Ibiza and Europe. Very successful. Meanwhile the kitchen that 10k bought will need redoing soon. Some you win some you lose. Good luck to the guy though. He proved a lot of doubters wrong and he showed dedication and maturity to start it and build it to where it is today, Even post covid things still look good.

Not buying a house 10 years ago when s**t was still cheap. Now I’m buying a house but damn it’s the worst time.

I worked at a startup in the mid-2000s. I had great credit and bought a motorcycle for the owner under my name because his credit was horrible. We were making good money so it seemed to make sense. He was going to pay for the entire bike in a few payments over the course of the year, so I figured it was not a big deal. Soon he stopped paying me for the bike loan and then I found out that he had an opioid addition. I let the bike get voluntarily repossessed, it ruined my credit for a bit and I was out a few hundred dollars. The last paycheck I got bounced. I would have loved to take him to court, but he overdosed and died not too long after. TLDR; got a motorcycle for someone else in my name, he stopped paying for it and I had to deal with the repercussions.

my father lend his motorcycle to his friend and he passed away on that day. Later found out my dad was a guarantor on one of his loans...father had to pay it all and it took him so many years..damn never be anyones guarantor

Bought a Passat (Volkswagen) -06~

I was repairing it more than I was driving it. Holy f**k that was the most useless piece of s**t that has ever been constructed. German engineering my a*s.

Bought a Passat (Volkswagen) -06~

I was repairing it more than I was driving it. Holy f**k that was the most useless piece of s**t that has ever been constructed. German engineering my a*s.

Lmao, buy a frikking FIAT then lol, bought mine brand new 0km the Punto MK2 ELX 16v, 3 Doors model, i loved it gorgeous little thing ( for me at least ) 2 and a half years in, i screwd up, did a burn out, broke the differential, the satélite gears, gearbox housing broke, and i had more metal shaves in my gearbox oil than oil it self, total Lost, now Im paying for a car i cant drive, talked to a mechanic dude Said my only hope was either a brand new gearbox 7000€ or a refurbished One around 3500€ the entire car was 12000€ at the time lol, still got the refurbished box, car got fixed, 2 years later i Lost my clutch on the Middle of no where at 2 in the mornig towed it to a mechanic clutch and gear linkage broken, another 460€ ( friends and family price ), after that started doing wierd transmition noises, and Over heating in iddle lol, in sum, it still lasted 7 years and 187 000 km, it needed a new engine when i sold it. Best memóries of my life where in that car...

I inherited money from my mother after she died. Instead of retiring my mortgage I used it to renovate my house to add two bedrooms and a bathroom. My thinking then was that it would be nice for each of my kids to have their own bedroom.

I inherited money from my mother after she died. Instead of retiring my mortgage I used it to renovate my house to add two bedrooms and a bathroom. My thinking then was that it would be nice for each of my kids to have their own bedroom.

This wouldn't have been a mistake for lots of people. Spending money to make a better life for your family isn't bad - unless the mortgage was crushing you at the time.

Bought a stock way back in 2014, it jumped by like 60% in two days. I went to sell, but got a phone call and got distracted. Remembered it the next day, and it was only up 20% from when I got it. I thought to myself "lets just wait and see" hoping it would jump back up. It never did. I eventually sold it at a 60% loss a year later.

Was only a 2k investment, so not a huge loss, but would have netted me a quick 1k in two days if I had just ignored my mothers phone call.

Bought a stock way back in 2014, it jumped by like 60% in two days. I went to sell, but got a phone call and got distracted. Remembered it the next day, and it was only up 20% from when I got it. I thought to myself "lets just wait and see" hoping it would jump back up. It never did. I eventually sold it at a 60% loss a year later.

Was only a 2k investment, so not a huge loss, but would have netted me a quick 1k in two days if I had just ignored my mothers phone call.

Remaining in a religion.

yep waste of time and money (PS, atheist here, but maybe you aren't). If you want to talk to god, do it in private. Matthew 6:5. "And when you pray, do not be like the hypocrites, for they love to pray standing in the synagogues and on the street corners to be seen by men. I tell you the truth, they have received their reward in full. But when you pray, go into your room, close the door and pray to your Father, who is unseen.

Lending my credit card to family

My ex boyfriend did this weird tax scam thing and bullied me into giving him my account details. He basically just used to throw things and call me a b***h and say “you clearly don’t love me then” until I gave in. He had the money from the scam put into my account. After we broke up, my bank notified me that I was under investigation with their fraud department. I gave them his name and details and closed my account with them.

I let her move in with me and then covered all of her living expenses so she could pay off debt. It only cost me a little more money since I was already covering 100% of my living expenses. Some of my bills like water went up a little and I voluntarily covered most groceries. I told her upfront that there are no hard feelings if it doesn't work out in the long run (and it didn't). I would have done the same thing for any close friend. I suggested her first step should be to save an emergency fund to protect herself if we break up because I would expect her to get the f**k out. And if she cheats on me, her stuff will be on the curb the same day. I'm a practical person. We had been discussing moving into together anyway. This way we see how things work out and she ends up with less debt. But I didn't put any money directly towards her debt. That would have felt like I was being taken advantage of. This wasn't completely selfless on my part. It seemed like we may have been headed for marriage and in that case, I would want that debt gone. It didn't happen for us but I'm still glad she got a little further ahead in life

ok then it wasn't a mistake, you helped someone get back on their feet. That's an achievement. Good for you.

One of those bootcamp style gyms opened up walking distance from our apartment. We wanted to get in shape and figured we'd check it out. It was run by a married couple who was really nice. Initial classes were very small but the exercise was great. The husband also did martial arts instruction so I was considering getting into that. They were doing a really reduced special to get a year membership so I went for it and paid half upfront. A few weeks later, I can't remember the conversation but they asked for the remaining payment and I said sure, why not. A little bit after that they called and said, sorry but we opened the gym with a verbal agreement we would be getting a large amount of karate students and that fell through, so we have to shut down. We will get your money back once we get settled after we move back home I foolishly had paid for all this but never had even gotten a written contract or whatever. They just ended up ghosting me and stopped replying to everything.

I bought a vintage guitar from England (I’m in Canada) and had to get it shipped over the pond. Being a somewhat delicate item, I went for some pretty expensive shipping (think it was 200£), which was a lot, but not much compared to the 3100£ I paid for the guitar. I wrote my address wrong, and the item was shipped to Canada, had an invalid address, held at the depot for a couple weeks, then shipped back to the guy in England. I had to cover a fee and once again get it shipped over the pond.

If that's your worst ever money mistake I think you can count yourself lucky!

I spent $300 on an ultra wide monitor before they were popular and before they were good quality. Apparently mine has a terrible refresh rate and it came with a dead pixel slightly off center. If I want to play any older game I’ve got to either run it in windowed mode or mod it to display correctly. If I had known what a hassle it would be I would have stuck with two normal monitors. On the plus side, if it’s cold I can just run a visually intensive game and my PC doubles as a space heater.

Opened a credit card in college, bought...something (I don't even remember what), completely forgot about it. Never got a statement, three years later I suddenly have collections agencies calling me nonstop over a $20 debt with hundreds in 'collection fees'. Took years to get my credit back to 'not s**t' levels.

A friend of mine had the same sort of c**p - but took it to insane levels as she would deliberately sabotage the cashpoints of the bank involved plus damage anything even vaguely connected to that particular bank. She reckoned the £ 200 that they shafted her for probably cost them around £10000 all told. She is now a well respected Doctor, and still loathes HSBC.

Financing a used car and then leasing a new one 🤦♀️ Never again! I bought my current car in like new conditions and paid in full with cash. I love never having to deal with car payments!

I don't understand people who do this. For me only a house is acceptable to buy on finance. For the rest I save the money first

Quitting my job and moving to Las Vegas from San Jose. Emptied my savings, didn't have new work out there, and then right after I arrived, everything shut down because of the pandemic, which meant no real chance of finding work I could physically do. It was also my biggest mistake in several other ways (my health declined severely and visibly, my mental health plummeted, my social connections all dried up, and over a year after leaving Vegas I'm still grappling with the consequences.)

My ex owed me over $5k when we broke up which was all tied up in joint purchases such as furniture since we had just moved in together. She didn't have the dough to just cash me out immediately so we agreed that she would pay me monthly until it was all repaid. I think not even a month went by and I said "f*****g keep it" because I didn't want to hear from her ever again. It was a horrible financial call, but it also took a lot off my mind.

That's ok I also did that twice. Trick is to never buy something and give someone something on the assumption they'll pay for it. Just write it off. Never buy a gift and/or give money away that you can't afford to write off as a gift.

I entered into a group lawsuit against my homebuilder. Even with the homebuilder having lost a previous lawsuit having to do with the issue we were suing them for, and even with lots of visual evidence, they could afford better lawyers. We lost. I had to get a HELOC to pay for my legal fees, and then to pay for the damage to my house that was the whole point of the lawsuit in the first place. I live in the US, and I don't understand the lawsuit-happy culture here. It is NOT easy to sue, win, and get money.

We have a homebuilders council in south africa. If a builder regularly f***s up a project, they are struck from the council register and can't build again. That way you just threaten the builder with an NHBRC report and they wake the f**k up and do the job properly.

Saving 20% for a down payment on a house. I should have bought something I couldn’t afford and paid PMI because in the time it took me to save, the housing market took off.

My mom gave her original, 20+-year-old wedding ring to a jeweler to work it over and improve fitment (since it was too tight I think). The jeweler f**king lost the ring in the mail. They sent it out without insurance and it never arrived at the place that was supposed to do the jeweler's work. She did not get her original wedding ring back, and all they offered her was 'a new one of equal worth.' Honestly, that was the biggest f**k you to her. The best you can get in that situation is at least a ring visually similar to the original one, or one made to be identical to the original. "Don't tell me 'copying an existing ring' is not possible, because the ring itself was very simple. Basically only metal, no diamonds or any other fancy rock, just metal with a groove in it and smooth edges. But no, their only offer to 'make up for it' was to choose a cheap looking one from their stock, basically saying 'we f**ked up but we won't put in any work to replace your ring; this is what we already have.' Let alone the fact that the ring was 20+ years old and had a lot of sentimental value, because unlike my dad, my mom wore that ring all the time.

How is that a money mistake? Or even a mistake? Sue them, you’ll get a lot more than the material value.

Cocaine addiction

Yup, that'd do it - high functioning ex addict here ; didn't entirely ruin my life but it could have been a thousand times better .....

My first girlfriend was unable to live in the Midwest. She gave me the ultimatum "we move to South Florida. Or we break up". So we did both. We had been together about 9 years when it ended. Leaving that job cost me between $500k and $1.5 million over my working career. That's counting lost wages, lost pension and lost retirement savings. Back then, if you had a 401k (and back then, only places that offered traditional pensions were allowed to offer 401k plans), they mailed you a check when you quit - she spent it and it took me 5 years to pay the taxes due (it was more than a decade before I could qualify for an IRA due to tax law quirks). Had I stayed, even with the meltdown of that company in the following decade, I would have retired over 10 years ago.

Never leave a job for a partner. Especially one that pays well. I learnt that the hard way as well. You think you are in love and they are special. No, f**k them. You can find another one on Tinder. Jobs are much harder to get than a new lover. Really. PS I am old, I can guarantee this.

When I was in elementary school, I had a bunch of money saved up. I spent 30 dollars on those rigged mall games that's basically impossible to win.

After spending a few bucks on those stupid claw things for my first girlfriend I just went to the shop owner and said look, she wants the f*****g koala please let me just buy it direct. So he said fine.

My ex-wife was an expert at spending us into a black hole. She was a widow. We got engaged. The very next day, I told her to bring me all her debts, and then I wrote checks to pay them all off. $14,000. That became the pattern. She never saw a dollar she couldn’t spend before we earned it. She looked at things by what they cost each month and not by what they actually cost.

ages ago I lost my job and waited wayyyy too long to sell my luxury car I could no longer afford. Job hunt took much longer than expected and then I sold the car for far less. It was really dumb all totally good now but good learning lesson

Bought a new car. It was basically totalled after just five years due to a motor damage. Drove less than 50k km. FU Mercedes.

Spending unhealthy amounts on league skins.

Psychology degree

only worthless if you didn't go to get registered as a shrink and take it to masters level. Because then you can earn. Undergrad psych degree is mostly useful for arguing with your partner when they get all freudian on you and project their dad.

I've lend someone 3000$ and still haven't got everything back.

you never get loans back, always in your head, tell yourself, this is a gift to this person, and I am not going to get my money back.

Using an unlicensed contractor. Buying properties with a business partner with no written agreement. I could write a list....

i read unlicensed as unalived at first, think i spend too much time on bp 🥶

Destiny 2. Probably about £500 dropped on a game I dont even particularly enjoy. Yes I do regret it and friends still play it and I have to put up with hearing about it.

Never spend enormous amounts of money for a game. 20$ tops, unless you know you're gonna love it. Indie games can get incredibly cheap and the ones I play are all better than pretty much any big-name game.

Put my husband through school and help the business grow thinking that he was going to appreciate it. Raise and provided for our family...yup! Mistake!

well what did he do? cheat or divorce or what? If he is still around, maybe he DOES appreciate it but can't verbalise it because he is a typical caveman.

Three attempts at a Bachelor's degree without having the right headspace, life management skills, or plan for the future to complete one. Over $30,000 of debt, multiple scholarships wasted, and a lot of shame/anger towards myself. I'm in my late 20's, finally have a 2-year degree from a community college, and my first job with engineering in the title with a bright future ahead. However, I would beat the absolute s**t out of who I was 8 years ago for being such a dumba*s who let other people's expectations rule over my decisions. I had to find out the hard way ($$$$$) that I don't function well living on campus.

Invested in a hemp stock ~two years ago, down $9000. Average down every now and then in hopes I can get out eventually.

Not investing asap. Could be my grandmother though: had a chance to invest in Yahoo in the 80s and turned out down

Don't invest in anything except for houses tbh

Electrical Engineering for a Bachelors Degree. Should've done Software Engineering instead.

not really. You just are struggling to find work. You are in the wrong place and not doing networking. Find a place with lots of EE manufacturers, like Taipei, or whatever, some place where they make semiconductor products, and hang out in bars near those businesses/corporate headquarters. Eventually you'll meet and befriend a bigshot who works there and they'll give you a job. Seriously.

I needed (more like wanted) to buy a new car, I have a good reliable steady income, but I didn't have enough, so as bad as it is, I wanted a loan for it. Didn't expect anything to go south, so I advanced it. I've never taken a loan so it's not like I've had unpaid s**t or anything like that, yet despite my steady income they refused to give any money whatsoever. Not wanting to lose the deposit on the car, I had to ask from family. We're good like that, but it's still super uncomfortable. Of course I wanted to pay it back as soon as possible, so I basically sent all my leftover every month. It wasn't necessary, like I said it wasn't a problem from their end, but I wanted to repay it as quickly as possible. It was a really bad few months with no money at all, but I got over it. And I certainly learned to control myself. Also to not trust banks ever.

Nothing so terrible, but still hurt my savings: buying a second hand Yamaha R6. I spent so much in reparations that if I had waited a bit longer I could had afford a brand new one and save me all the trouble. I crashed it and sold it for pennies.

Any sort of collection/hobby. For me it’s guitars. I don’t own any guitars that are particularly expensive, at least as far as guitars go. I think my most valuable guitar is worth around $850-$1000 but I got a stupid good deal from a music shop that didn’t really know what it was worth and they were charging $280. The most expensive guitar I got new was also about $850, which was very recently, and while that’s decently mid-range for guitars, a “nice” guitar easily goes for $1300-$2000. Anything past that, you’re really just paying for the craftsmanship, or in some cases, a mid-range guitar with a big name (Gibson). If you can afford the nicer high end ones, and have the money to spend, by all means. But, as a 25 year old who works a very okay paying job and still has to cover rent in a city that is very quickly becoming more expensive, I am not one of those people. EDIT: I’m 25 not 35, whoops

You have an addiction, get help. Seriously. You need one, precisely one, to play. The rest is nonsense.

I had a full partyhat set on Runescape in 2012. NOT 2004.. 2012, when prices were high but not crazy. Nowadays I could put a very f****n good deposit on a house with the prices they are at now. I sold for GP because I "quit" and ended up playing again 8 years later lol

I was at $1800 per month for alimony and child support for six years, but it was more losing half of the assets (including retirement savings) that was the killer." Oh well. It's in the past now and I'm in a much better place and happy rather than resigned to being miserable like I was for quite a few years until I decided to go through with it. I'm just going to have a late retirement (most likely) instead of early like I had hoped.

Gave a rando like 100-150 for a MacBook and got scammed

$5500 in FTX I'll never see back. Venmo me.

Spent $88,000 on Twitch in the past 2 years. Downvote me all you want. I have an addiction and I wanted to be real with you.

That’s rough…hopefully you can get to a better place!

Load More Replies...Never loan anyone anything without a safety. Never. Lending someone money for a car? Ok but the title will be in my name and you'll have insurance tied to it and we'll make a contract how the money has to be paid back and when you'll get the title. Loaning money for playing the stock market? Hell no.

I don't buy them myself but I imagine buying lottery tickets can add up after a while. Especially if you never win anything but keep playing.

My mom took out a loan for my stepdad, so he could continue playing the stock market. His only other job was doing random IT work whenever he could get it. Things went to s**t, they broke up. She was trying to get him to pay her back but he started threatening her and now he’s blocked and she has the loan.

Very important warning lessons in these posts. Really useful post, thanks.

To me a big financial mistake is one I never saw coming and really wish I had seen the future. I had gotten a major inheritance from my grandfather when he passed away. It came just in time, hubby had just been fired from his job. It should have been a red flag at the time when he said he wanted to take time before looking for a new job as he had been working for 15 years and wanted a break. It made sense. In reality I ended up supporting both of us, developing a spending habit that I never had before and he took too long of a break. As a result we had to move to a small town where he found a good paying job, now he has a spending habit and our marriage has fallen apart and I no longer want to save it. In hindsight, I wish I had taken that money and moved to another country where nobody would find me again. As it is I'm trying to save so i can move to the other end of the province.

I wish we would not have bought our house. It will probably be nice, when it is done, but with our current progress and financial status, this will take at least 5 years, if not 10. By then the children will be out of the house….. the massive house, we bought, because we wanted 3 children, a room for everyone and a playroom and whatnot. We left friends and family behind for this. This house is a lot of more work then we anticipated. Don‘t get me wrong, we are very hands on, but we planned „only“ to do new floors and plastering. Instead we need to have new plumbing, electricity, a new heating system and screed (floor pavement), so basically we had to strip the house to it‘s core and start from there…. We were comfortable when we rented. After covid and this house our savings are below zero. The only upside is the school and Kindergarten (preschool for you US readers) here. Those are really good and I‘m happy for our kids.

My husband died and we have to get rid of thousands of dollars in comics and toys ("They'll be worth a lot in the future!"). He didn't realize that they're only worth what someone will pay for them. And it's not what he paid for them.

For me, it's not getting a cat earlier, like when I'm just starting to be a professional. Having a cat made me realize I want to buy a house, get a better paid job, be more careful with my finance etc so I can provide a better life for my cat--yes, not for me but for my cat. Well, we get our life goals from different places, what can I say?

If you make loan to a friend or family member, consider it a gift, since you will likely never see it again. "Neither a borrower nor a lender be; For loan oft loses both itself and friend, And borrowing dulls the edge of husbandry." In 1990 I decided to try an experiment and bought complete sets of that year's baseball cards, to see what they would be worth. Of course, now, over 30 years later, they aren't even worth the paper they're printed on. I did get out of crypto in time, though, and doubled my money!

Okay, I do get the mobile home one, I do. But when someone is moving out of their parents for the first time , you can't expect them to be able to afford a full actual house in this market. Depending on the area of the mobile home, it actually CAN be worth more depending on the market. A fixer upper type whose been basically trying to buy up all the trailers in the park offered me 20,000 more for mine then what I paid for it 8 years ago. I didn't consider it, because my trailer is my home, I've spent the last few years making it everything that I've wanted since I was a child. Not to mention even an additional 20,000 isn't gonna put me anywhere near the price of an actual house right now.

We bought our mobile home because of the property it’s on. Two acres of beautiful land far enough outside the city but still close enough to be desirable; we paid more for the land than the house. Next year, only 7 years later, our mortgage will be paid off. At which point, we start saving and then will build brand new on the land we own. It’s not totally ill-advised to buy a mobile home, but typically, it’s not a wise investment.

Load More Replies...Spent $88,000 on Twitch in the past 2 years. Downvote me all you want. I have an addiction and I wanted to be real with you.

That’s rough…hopefully you can get to a better place!

Load More Replies...Never loan anyone anything without a safety. Never. Lending someone money for a car? Ok but the title will be in my name and you'll have insurance tied to it and we'll make a contract how the money has to be paid back and when you'll get the title. Loaning money for playing the stock market? Hell no.

I don't buy them myself but I imagine buying lottery tickets can add up after a while. Especially if you never win anything but keep playing.

My mom took out a loan for my stepdad, so he could continue playing the stock market. His only other job was doing random IT work whenever he could get it. Things went to s**t, they broke up. She was trying to get him to pay her back but he started threatening her and now he’s blocked and she has the loan.

Very important warning lessons in these posts. Really useful post, thanks.

To me a big financial mistake is one I never saw coming and really wish I had seen the future. I had gotten a major inheritance from my grandfather when he passed away. It came just in time, hubby had just been fired from his job. It should have been a red flag at the time when he said he wanted to take time before looking for a new job as he had been working for 15 years and wanted a break. It made sense. In reality I ended up supporting both of us, developing a spending habit that I never had before and he took too long of a break. As a result we had to move to a small town where he found a good paying job, now he has a spending habit and our marriage has fallen apart and I no longer want to save it. In hindsight, I wish I had taken that money and moved to another country where nobody would find me again. As it is I'm trying to save so i can move to the other end of the province.

I wish we would not have bought our house. It will probably be nice, when it is done, but with our current progress and financial status, this will take at least 5 years, if not 10. By then the children will be out of the house….. the massive house, we bought, because we wanted 3 children, a room for everyone and a playroom and whatnot. We left friends and family behind for this. This house is a lot of more work then we anticipated. Don‘t get me wrong, we are very hands on, but we planned „only“ to do new floors and plastering. Instead we need to have new plumbing, electricity, a new heating system and screed (floor pavement), so basically we had to strip the house to it‘s core and start from there…. We were comfortable when we rented. After covid and this house our savings are below zero. The only upside is the school and Kindergarten (preschool for you US readers) here. Those are really good and I‘m happy for our kids.

My husband died and we have to get rid of thousands of dollars in comics and toys ("They'll be worth a lot in the future!"). He didn't realize that they're only worth what someone will pay for them. And it's not what he paid for them.

For me, it's not getting a cat earlier, like when I'm just starting to be a professional. Having a cat made me realize I want to buy a house, get a better paid job, be more careful with my finance etc so I can provide a better life for my cat--yes, not for me but for my cat. Well, we get our life goals from different places, what can I say?

If you make loan to a friend or family member, consider it a gift, since you will likely never see it again. "Neither a borrower nor a lender be; For loan oft loses both itself and friend, And borrowing dulls the edge of husbandry." In 1990 I decided to try an experiment and bought complete sets of that year's baseball cards, to see what they would be worth. Of course, now, over 30 years later, they aren't even worth the paper they're printed on. I did get out of crypto in time, though, and doubled my money!

Okay, I do get the mobile home one, I do. But when someone is moving out of their parents for the first time , you can't expect them to be able to afford a full actual house in this market. Depending on the area of the mobile home, it actually CAN be worth more depending on the market. A fixer upper type whose been basically trying to buy up all the trailers in the park offered me 20,000 more for mine then what I paid for it 8 years ago. I didn't consider it, because my trailer is my home, I've spent the last few years making it everything that I've wanted since I was a child. Not to mention even an additional 20,000 isn't gonna put me anywhere near the price of an actual house right now.

We bought our mobile home because of the property it’s on. Two acres of beautiful land far enough outside the city but still close enough to be desirable; we paid more for the land than the house. Next year, only 7 years later, our mortgage will be paid off. At which point, we start saving and then will build brand new on the land we own. It’s not totally ill-advised to buy a mobile home, but typically, it’s not a wise investment.

Load More Replies...

Dark Mode

Dark Mode

No fees, cancel anytime

No fees, cancel anytime