“We Cannot Accept These Loan Agreements”: Mom Is Very Disappointed At Sallie Mae

Interview With AuthorIn the United States, there is a bit of a skewed perception of the responsibilities that can be placed on an eighteen-year-old. They can’t drink yet and you would be hard-pressed to find a bank willing to give them a mortgage. But six figures worth of college debt? Step right up!

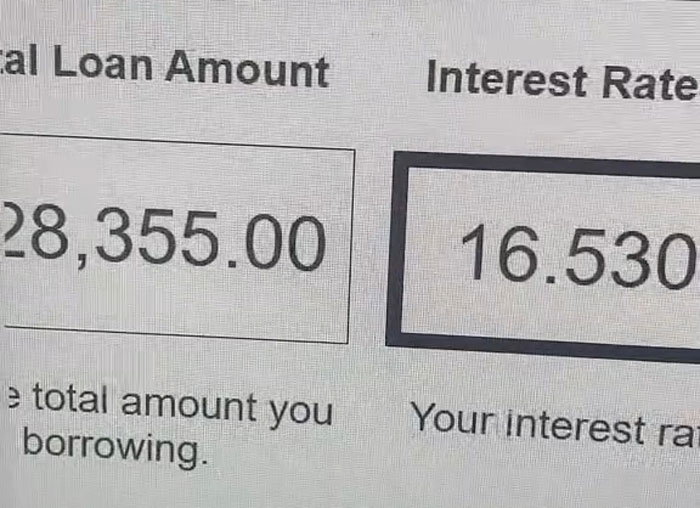

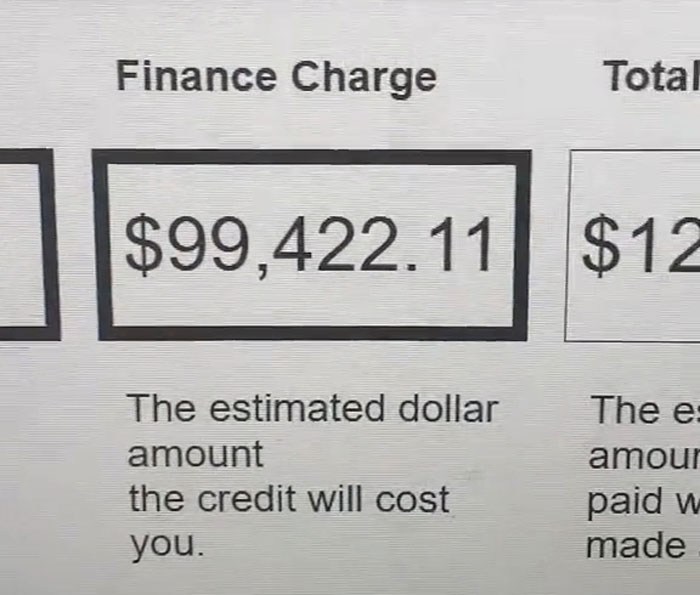

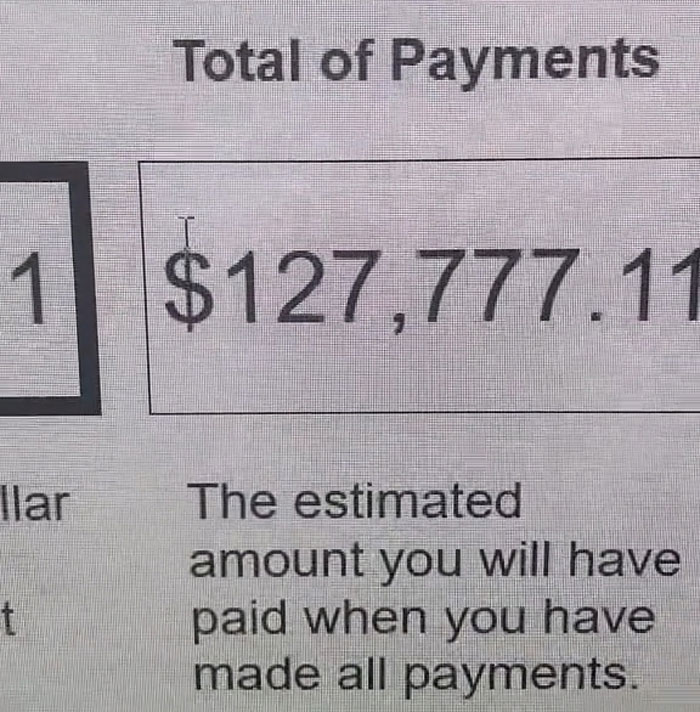

A mom decided to share the absurd, horrible, and downright predatory interest rate student loan provider Sallie Mae offered her daughter. For a $ 28,000 loan, she would end up paying an additional $ 99,000. Fortunately, the mom caught this clause and made sure her daughter did not sign anything. People in the comments shared their takes on student loan debt. We got in touch with Stacy, who made the original video to find out more.

No one expects a freshly graduated high schooler to just have money for college, so they take loans

Image credits: stacyann370

After seeing an attempt to saddle her daughter with over $100k worth of debt, a mom shared her anger on TikTok

“My daughter’s going to her second year of college. The first year I took the loan out for her, it was a private loan, their rates weren’t bad.

This year to be a cosigner through Sallie Mae to borrow $28,000 at 16%, the finance charge is $99,000. So when we’re done paying back the one year of college of $28,000, we will have paid Sallie Mae $127,000.”

Image credits: stacyann370

“This is sickening, this is predatory. This shouldn’t even be legal. Shame on the government for allowing Sallie Mae to take advantage of young kids like this.

I thankfully saw that I have the right to cancel this without penalty by August 21, which I will be doing, because I’m never going to allow my daughter or myself to have to pay Sallie Mae $127,000.

We would have to pay her $100,000 Just to borrow 28,000. That is absolutely ridiculous. Shame on them. I feel so bad for other college kids that have to deal with this.”

Image credits: stacyann370

Image credits: stacyann370

“You know, I’m 44 I only went to community college. And I’ve heard all through these years people saying about the loans, how it’s predatory and what they’re doing. But I really never realized that it’s this bad.

So if she did this for the next three years, she would have to pay 380,000. And that’s only for three years because I took out all the loans for the first year. So it would be like for $400,000 just to go to college to get a degree.

And we’re not talking like a lawyer or a doctorate. Like come on. This is sickening. Things have to change. This is absolutely crazy.”

Image credits: George Pak (not the actual photo)

“So you know what, Sallie Mae, you can shove this loan because we’re not taking it. I don’t know what we’re gonna do, but I’m not taking this and I’m not allowing my daughter to take this.

She will end up having to work and give you all of her money for probably her whole entire life. This is absolutely insane.

And you know what, to the US government not like they’re gonna watch this, but shame on you guys, too, for allowing this.”

Image credits: Karolina Grabowska (not the actual photo)

“Now don’t get me wrong, of course the banks got to make money. They’re a business. So if they’re gonna let someone borrow $28,000 yeah, I get it, maybe charge them $20,000 or even $30,000 alright, but to charge them $100,000? Shame on you for allowing it. I

t’s like you’re letting them rob people, but it’s a bank. So it’s legal. It’s legal to rob someone, you know?

So thank God I was reading, of course I was going to read through this, but it’s just sickening. It’s absolutely sickening. So yeah, we’re not accepting this.”

You can watch the full video here

@stacyann370 I am sick to my stomach after reviewing this, i dont know how she will attend college this year but we cannot acceot these loan agreements 😭 #collegeloans #struggle #singlemom ♬ original sound – Stacy

Many people are not aware of just how predatory student loans have become

Bored Panda got in touch with Stacy, the mom in the video and she was kind enough to answer some of our questions. Firstly, we wanted to know what steps they took afterward. “We didn’t accept the loan from Sallte Mae and thankfully I ended up getting approved for a parent plus loan but not everyone is as lucky as we are, so many parents & students don’t have choices and have to accept loans like from Salle Mae or just not get an education.”

“I think some people are so quick to defend the banks because they went to college 20 or 30 years ago and they don’t understand or want to understand that it’s not the same playing field, back years ago it was realistic that you could work and pay back these loans within a few years but now college prices have soared, it has increased by 169% over the past 4-decades and it’s crippling our youth in debt, you also have some people defending the banks because they are privileged and come from wealth and they never had to take out loans. I would like to add that so many comments from people have been to just not attend college which I find sad, it’s in our country’s best interest that our youth be educated, it gives our country a competitive edge in various industries including technology, and healthcare,” she shared with Bored Panda.

Sallie Mae does not have the best reputation when it comes to honesty

Sallie Mae is just one of many financial service providers that focus on student loans. Setting aside the ethical question of specifically targeting young adults with monstrous loans just so they can go to college, Sallie Mae and the industry, in general, have been beset with scandals in the past. One prime example, involving the star of the show, Sallie Mae, was in 2007 when the company tried to use the Freedom of Information Act in an attempt to force colleges to hand over student data.

That same year, Sallie Mae was targeted by a class-action lawsuit that alleged it gave African-American and Hispanic students higher interest rates based on their ethnicity. This concern was actually shared by then-New York Attorney General Andrew Cuomo, who indicated that the company was engaged in “redlining,” the practice of limiting financial tools based on where a person was from. Ultimately, the case was settled out of court, with Sallie Mae agreeing to cover the plaintiff’s legal costs and making a donation to a charity.

If the OP felt the loan was predatory, she is in good company, as Sallie Mae has also overcharged the US government. The actual investigation found that multiple companies that operate similarly to Sallie Mae all deliberately overcharged the U.S. Department of Education. Which, to be fair, at least shows a large company picking on something its own size, not just naive eighteen-year-olds.

Student loan debt is particularly underregulated, oppressive, and impossible to escape

Besides trying to get young adults to sign off on crippling debt, student loans have a number of other hidden catches that make them predatory. For example, unlike traditional debt, declaring bankruptcy does not remove the responsibility to pay. So no matter how bad your situation is, you cannot escape repayment. Before 2009, even death and disabilities weren’t enough to get the payment requirements dropped. This was changed after Sallie Mae attempted to collect the debt from the family of a marine who was killed in action.

And instead of making sure students don’t end up six figures deep in debt, universities instead accept kickbacks to direct students to “preferred” lenders. While this practice was limited in the late 2010s, thousands of people are still stuck with this debt. These days, like in OP’s video, it’s more common for a “real” adult to cosign the loan, however, this comes with its own risks. Lenders, fearful of not turning $28,000 into six figures, will sometimes demand the entire sum up front if the borrower dies or goes bankrupt.

Fortunately, for all involved (except Sallie Mae, but we don’t count them), the mom realized just how absurd the interest would be and backed out of signing. While banks do need to turn a profit to operate, the social cost of burying people in debt can not be worth it to society. This is why even in countries that do not offer some degree of free education, loan repayment is “locked” behind the borrower’s income. Until you start making enough money to survive, the bank or lender can’t touch your money. Regardless of the structure of the loan, young adults do need to be safeguarded from lenders who know they don’t have experience with borrowing money.

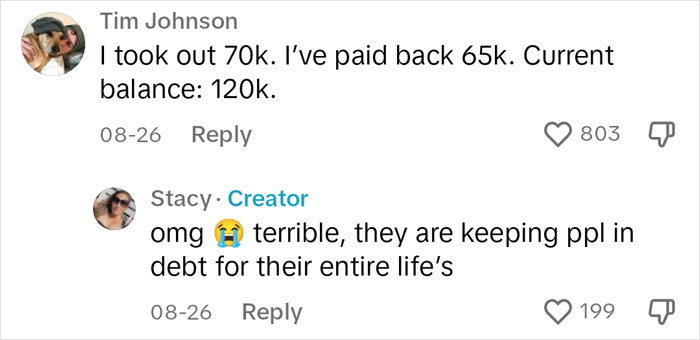

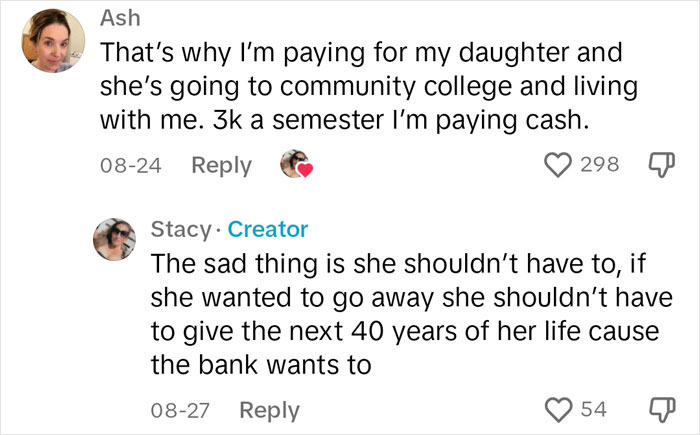

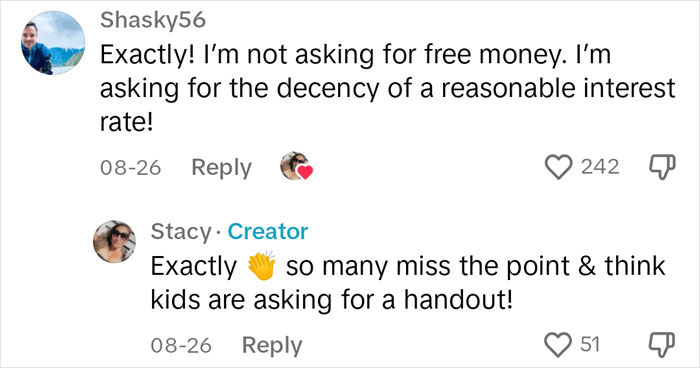

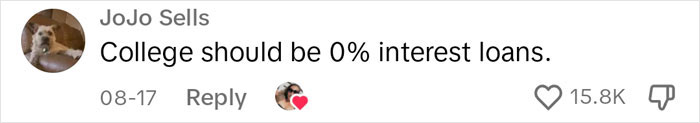

Viewers shared their shock and the mom gave some more thoughts in the comments

Others told their own stories of predatory banks

This is why the scream to cancel student debt is so loud. Its not that "we cant pay for what we used" its thats were getting screwed and thrown into enormous debt well over the loan amount. The US is dumb...

This is why the scream to cancel student debt is so loud. Its not that "we cant pay for what we used" its thats were getting screwed and thrown into enormous debt well over the loan amount. The US is dumb...

38

23