Unless you have your own business, you’d be a part of the population who hears about investments only in the media and without great detail. This American business reality TV show takes us as close as possible to the world of entrepreneurs without being one yourself. The reality show Shark Tank, which aired in 2009 and is still going strong, allows us to witness start-ups’ rise (or downfall) while also letting us see the people behind them. In this case, we will focus on the success stories of the top Shark Tank products aired on the show.

Who Are the Judges on the Show Shark Tank?

On the show, you’ll see some of the world’s most successful entrepreneurs and investors and the best Shark Tank ideas. Investors spend their time there to discover new ventures to invest in, sometimes even partnering together for a joint effort. The show occasionally hosts guest stars—actors, public figures, and other investors. But the main “Sharks” won’t give up their place so quickly, and they are:

- Lori Greiner

- Mark Cuban

- Kevin “Mr. Wonderful” O’Leary

- Daymond John

- Barbara Corcoran

- Robert Herjavec

Most successful Shark Tank products had to go against this lineup and convince at least one of them to bite, which is a challenging task.

With no further ado, take a deep dive into these shark-infested waters of entrepreneurship. Discover the stories of these Shark Tank companies and get inspired to chase the dreams of your own. Also, take a good look at this list, as all of these Shark Tank products are actually worth buying.

This post may include affiliate links.

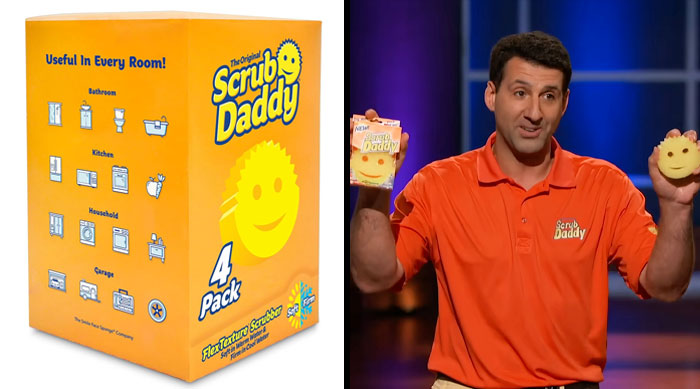

Scrub Daddy Sponge

Episode 407 of Shark Tank comes around, and that’s when one of the most successful Shark Tank products comes to light on the global stage. The story of this enormous success began when Aaron Krause discovered a new use for his company’s left-over car washing sponges.

The Product:

Since the famous Scrub Daddy’s pitch, the company has dramatically expanded its selection. Now, you can get your hands on more than 20 different products. Scouring pads, sink organizers, soap dispensers, etc.; everything you could ever need to care for your kitchen. However, the Scrub Daddy sponge remains the face of the company.

Investor That Took Interest:

Kevin, Daymond, and Lori took an interest in the product. After many negotiations and counteroffers, Aaron Krause took Lori’s offer of $200,000 for 20% of the company’s equity.

Company’s Revenue:

As of 2022, the company made over $100 million in sales, bumping its lifetime sales to over $670 million.

Bombas Socks

Most of the top Shark Tank products intend to make life easier for their consumers. In the case of Randy Goldberg’s and David Heath’s company, their work also helps those less fortunate than us. Revealed to the world on Shark Tank episode 601, the founders stay true to the idea that birthed the company to this day. With the “one bought, one donated” approach, many homeless shelters hold Bombas in very high regard, thanks to socks donated by the company.

The Product:

Their company started with a pair of socks. Since then, Bombas has begun to offer more high-quality socks, T-shirts, slippers, and underwear.

Investor That Took Interest:

With the original goal of $200,000 for 5% equity, the founders got off to a rocky start while pitching the company to the investors. In the end, Bombas accepted Daymond John’s offer of $200,000 for a larger equity stake of 17.5%.

Company’s Revenue:

With annual sales racking up around $120 million, according to CAknowledge, Bombas’ net worth is around $550 million as of 2023. However, as per Techie + Gamers, Bombas is worth $100 million in 2023, so the actual number is unclear.

PhoneSoap

A phone is something that we hold probably the most throughout the day. We wash our hands after a bathroom break, after interacting with railings and objects that aren’t sanitized, but we never stop to think about that one thing that’s always in our hands—our phones. Wesley Laporte and Dan Barnes recognized this problem and devised a device that cleans our phones.

The Product:

UV-powered bath for your phone, with built-in USB and USBC charging ports. Phone Soap offers a wide variety of these baths.

Investor That Took Interest:

PhoneSoap entered Shark Tank seeking $300,000 for 7.5% of their business. A few investors backed out due to concerns about the product, while Mark and Lori entered a bidding war. Mark offered $300,000 for 30% equity if the product can sanitize a phone in a minute. Lori countered and offered $300,000 for 10% equity if Wesley and Dan accepted immediately, which they did.

Company’s Revenue:

After a successful pitch at Shark Tank, PhoneSoap reportedly reached an annual revenue of $24.4 million.

Squatty Potty

You might be familiar with the debate of how humans should relieve themselves when going for No. 2. Well, Judy and Bobby Edwards realized the benefits of squatting when pooping. And that’s how Squatty Potty came into existence.

The Product:

As the name might suggest, the main product is the simple yet effective stool. Squatty Potty can also provide a bidet add-on, hidden toilet brush, and many more accessories for your toilet.

Investor That Took Interest:

With the company’s goal of $350,000 for 5% equity, numerous Sharks were interested; however, the negotiating process wasn’t easy for Judy and Bobby. Eventually, they accepted Lori’s offer of $350,000 for 10% equity.

Company’s Revenue:

According to Zippia, Squatty Potty’s peak revenue was achieved in 2022 at $1.2 million.

Fiberfix

We all know situations when duct tape is the only viable option to fix something. Occasionally, your regular tape won’t do—but FIBERFIX will. It’s said to be 100 times stronger than the common option, so Spencer Quinn and Eric Child have you covered whatever it is that needs taping.

The Product:

Resin combined with fiber tape makes an extra strong duct tape that sticks to any surface harder than anything else in your inventory.

Investor That Took Interest:

FIBERFIX entered the show’s episode 509 to try and secure $90,000 for 10% of their company. After a long back and forth between the investors and the presenters, Spencer and Eric took the deal of Lori: $120,000 for 12% equity, plus funding for all the purchase orders.

Company’s Revenue:

FIBERFIX was acquired by JB-Weld in 2018 for an undisclosed amount, so the company revenue before that is unknown.

Safe Grabs

Even when taking extra precautions, we all know that hot sensation on our hands when we accidentally touch something that just came out of the oven. Safe Grabs takes it a step further and assures the safety of your fingertips while baking whatever’s on the menu today.

The Product:

Silicone matt that can be used almost to the limit of your imagination. The primary function is to protect you from the heat. Still, it can also act as a:

• Microwave mat

• Splatter guard

• Food cover

• Jar opener

• Pot holder

• Utensil test

• Non-slip mat

• Surface protector

Investor That Took Interest:

Cyndi Lee entered Shark Tank seeking $75,000 for 12% equity. After most of the investors backed out, it left Lori and Cyndi to negotiate. After a bit of back and forth, Cyndi accepted Lori’s deal of $75,000 for 25% equity.

Company’s Revenue:

According to the Shark Tank Blog, Safe Grabs reached $4 million in annual revenue in 2022.

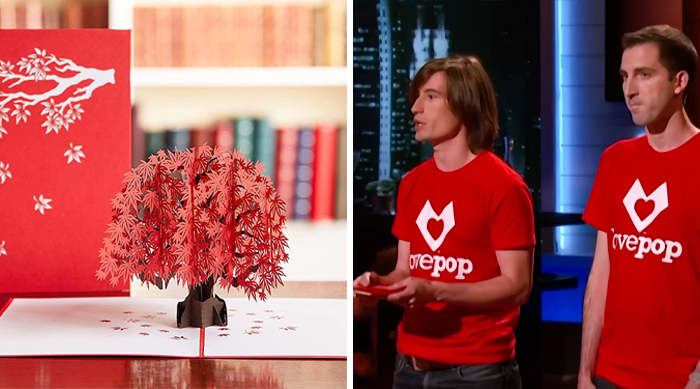

LovePop

Finding a unique design for greeting cards might take a lot of work. Wombi Rose and John Wise recognized this problem and devised their own out-of-the-box solution.

The Product:

The main selling point remains the high-quality pop-up greeting cards for any occasion. However, LovePop expanded its business and now also offers gift bundles and flowers.

Investor That Took Interest:

The episode is a holiday special, so it’s only fitting that the pitch was about greeting cards. John and Wombi entered the show seeking $300,000 for 10% of their business. With other Sharks backing out, Robert and Kevin engaged in a bidding war after Robert refused to partner up. They both offered $300,000 for 15% equity, but with Kevin being closer to the company’s home—Boston, the duo took Kevin’s deal.

Company’s Revenue:

According to Zippia, in 2022, LovePop’s peak revenue was reaching $40 million.

Hug Sleep

Few of us are fortunate enough to sleep well at night regularly. And for those who might struggle, Hug Sleep has a solution—sleep pods. Slotting into a warm sock that makes you feel like a baby that has just been cuddled in for sleep, you’d get that feeling nowhere else in the world. That’s precisely the feeling Matt and Angie Mundt hoped to imitate.

The Product:

The main attraction of the catalog remains the one and only Sleep Pod. However, Hug Sleep now also offers loungewear, perfect for those lazy days.

Investor That Took Interest:

The founders of Hug Sleep entered the Shark Tank show seeking $150,000 for 10% of their company. After an eventful presentation (Robert even fell and injured himself while trying it on), every investor made an offer. Sharks split into two teams and made identical offers of $300,000 for 20%. After some internal discussion, Matt and Angie decided to go with the team of Mark and Lori.

Company’s Revenue:

Hug Sleep’s annual revenue is around $24 million.

EverlyWell

With more than 14 billion lab tests ordered yearly in the U.S., getting one done for your medical diagnosis can be costly and inconvenient. Julia Cheek came up with a solution, making taking lab tests easy and accessible from home.

The Product:

At-home lab test remains the face of the company, but you can also order vitamins and supplements and remote consulting services.

Investor That Took Interest:

On Shark Tank episode 909, Julia Cheek pitched her idea, seeking a $1 million investment for 5% of EverlyWell. Julia accepted Lori’s offer of a $1 million line of credit at 8% interest and 5% equity.

Company’s Revenue:

Zippia reports EverlyWell’s 2022 revenue as $49.9 million.

Kodiak Cakes

You’d think pancakes are like bikes—you can’t invent anything new. Cameron Smith and Joel Clark still surprised the world with their protein-rich baking and instant mixes. While the company was family-founded in 1982, it took off in 2014 when the duo appeared on Shark Tank episode 528.

The Product:

The company offers a wide and flavorful range of pancake and waffle baking mixes while also putting various syrups on the table.

Investor That Took Interest:

Kodiak Cakes entered Shark Tank seeking $500,000 for 10% equity; however, the investors weren’t too eager to jump in on the deal. Kevin O’Leary and Barbara offered to partner with $250,000 for 25% equity each, and Robert Hervajec countered with $500,000 for 35% of the company. Cameron and Joel weren’t too impressed with the options and declined both offers.

Company’s Revenue:

After being acquired by L Catterton in 2021, Kodiak Cakes’ estimated annual revenue is $48.5 million.

FurZapper

Pet hair is something that literally sticks to us all the time. Of course, we came up with different ways to eliminate the problem, but none are as efficient as FurZapper.

The Product:

A small silicone disc that separates pet hair from clothes in the washer and dryer.

Investor That Took Interest:

Michael and Harry entered Shark Tank episode 1215, seeking $600,000 for 10% of their business. This was yet another pitch that sparked a bidding war—Kevin came in with two different offers, Mark undercut him and made an offer of his own, and Lori jumped in with the same offer as Mark. After the Sharks stopped making new offers, they asked Lori if she’d agree to extend a line of credit, to which she agreed, and they took Lori’s offer. However, the deal never materialized.

Company’s Revenue:

According to the Shark Tank Blog, FurZapper earns $5 million in annual revenue.

Lollacup

Parents know the feeling of spilled mess too well. Cups seemingly flipping over on their own, plates flying off to the table as if they’re late for an appointment. Well, Mark and Hanna Lim came up with a solution for this problem. With more BPA-free plastics and an improved design, Lollacup revolutionized the market of the baby industry and sippy cups.

The Product:

A sippy cup made only in the USA, with controlled materials and a design that minimizes spill risk and benefits for the baby’s teething process.

Investor That Took Interest:

Mark and Hanna entered Shark Tank seeking $100,000 for 15% of their business. After negotiations and numerous offers, Lollacup accepted Robert’s offer of $100,000 for 40% equity.

Company’s Revenue:

By changing their name to Lollaland and greatly expanding their catalog, Mark and Hanna’s company generates $2 million annually.

Manscaped

Manscaped might be the only company focusing directly on male grooming. Founders Steve and Josh entered the Shark Tank reality show seeking half a million for 7% of their business. Although getting a slightly different deal, the pitch left a lasting impression on viewers and investors, as their presentation warranted a few chuckles.

The Product:

Male grooming products that include trimmers for “down there,” nose hair, and beard. Everything you’d ever need comes in their best-selling kits: trimmers, lotions, and sprays for aftercare, trousers, and even refill packages on a subscription model.

Investor That Took Interest:

Lori Greiner and Mark Cuban took an interest in the company, and the deal was sealed with an investment of $500,000 for 25% equity. Yet, the deal never materialized. However, there was no need for an investor anyway because after the episode aired, the media exposure was enough for the brand to go global.

Company’s Revenue:

Reaching nearly $300 million in 2021, the company expects a total of $360 million in revenue by the end of 2023.

The Comfy

If you ever wanted to wrap yourself up in a blanket and to be able to get up and get some snacks while still wearing it—The Comfy sure has a solution for you. Brothers Brian and Michael Speciale stormed the world with this incredible comfort solution.

The Product: A blanket and a hoodie in one, perfect for those chilly evenings at home, watching TV and enjoying a mega portion of popcorn.

Investor That Took Interest: The brothers entered the Shark Tank show seeking $50,000 for 20% of their business. After negotiations and some investors backing out, The Comfy secured a deal with Barbara—$50,000 for 30% equity.

Company’s Revenue: In 2021, The Comfy reached $15 million in revenue. However, in December 2022, Forbes reported that the company was drowning in debt.

LARQ

You might be familiar with water filters and other water purification methods, but it’s very likely that they differ from LARQ. The company offers solutions at home and on the go that use the same UV technology as hospitals to sterilize their equipment. They adapted the concept to the everyday world, and so a self-cleaning water bottle was born.

The Product:

Water filtering solutions for making tea, coffee, etc. Both for home and on-the-go use water bottles with built-in UV technology.

Investor That Took Interest:

Justin Wang appeared with his pitch in episode 1218 of Shark Tank, seeking $500 000 for 1% of his company. After much back and forth, Lori and Kevin partnered up and offered a deal of $1 million for 4% equity, which Justin accepted. However, the deal never materialized.

Company’s Revenue:

Zippia reports LARQ’s peak revenue at $2.6 million in 2022.

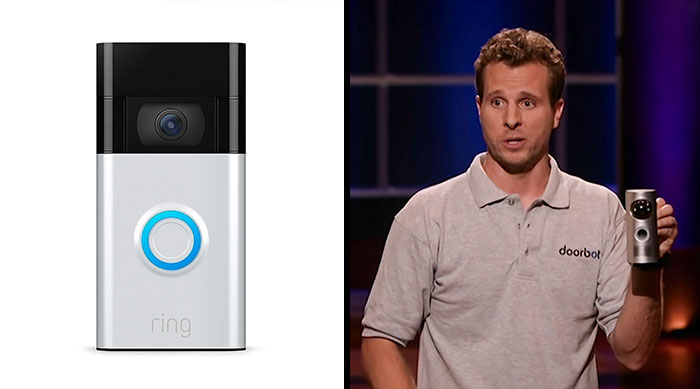

Ring Doorbell (Doorbot)

Because Jamie Siminoff declined an offer from Kevin O’Leary, you might be wondering what this company is doing here in the first place. A not-so-successful pitch on the show didn’t block their road to success, though. The home security company attracted numerous investors after changing its name from Doorbot to Ring. As well as acquiring equity in the company, Shaquille O’Neal became a spokesperson for Ring. And to top it off, in February of 2018, Amazon made an offer of $1 billion, and Jamie Siminoff couldn’t refuse.

The Product:

Home security items: smart video doorbells, cameras, alarms, and automotive security systems.

Investor That Took Interest:

As other Sharks dropped out, Kevin O’Leary was still interested in Jamie Siminoff’s pitch. However, his offer of $700,000 for 10% of all sales until Jamie repaid the loan wasn’t too tempting to the CEO of Ring. Taking the deal also meant O’Leary would get a 7% royalty on all future sales, plus a 5% company equity.

Company’s Revenue:

Zippia reported Ring’s revenue reaching $165 million in 2022, their best year so far.

Boost Oxygen

You might get some The Lorax flashbacks after seeing this product, but it turns out that canned oxygen has various health benefits and can also be used for recreational purposes. Mike Grice and Rob Neuner already had quite a successful company when they appeared on Shark Tank’s episode 1102. The duo combined their efforts and interested Sharks with their canned oxygen.

The Product:

Canned oxygen that helps athletes recover their muscles and has recreational uses. In their catalog, you’ll find portable oxygen tanks varying in size and flavor.

Investor That Took Interest:

Boost Oxygen’s pitch aimed to acquire $1 million for 5% of the company. With some Sharks backing out due to concerns about the product’s steep learning curve, Mike and Rob took Kevin’s offer of a $1 million loan with 7.5% interest and 6.25% equity.

Company’s Revenue:

According to RocketReach, Boost Oxygen’s annual revenue was reported at $82 million in 2021.

Drop Stop

Taking the term “family-owned” to the core of it, this company remembers each person who has helped it become a reality. Marc Newburger and Jeffrey Simon came up with the idea for a Drop Stop in a rather Hollywood-esque way. After Marc almost crashed his car when his phone dropped into the gap between the seat and the console, he dedicated his headspace to developing something that would “protect yourself and your loved ones before you get into an accident.”

The Product:

An accessory that fits between your center console and the driver’s seat to block out the gap many items fall victim to.

Investor That Took Interest:

Marc and Jeffrey entered the show seeking $300,000 for 15% of their business. After a bidding war between Mr. Wonderful and Lori, the best friends leaned toward Lori’s superb storytelling and a promise that she would make them millionaires. Drop Stop secured a deal of $300,000 and 20% equity.

Company’s Revenue:

After significant business expansions and enormous success, Drop Stop now reaches $5 million in annual revenue.

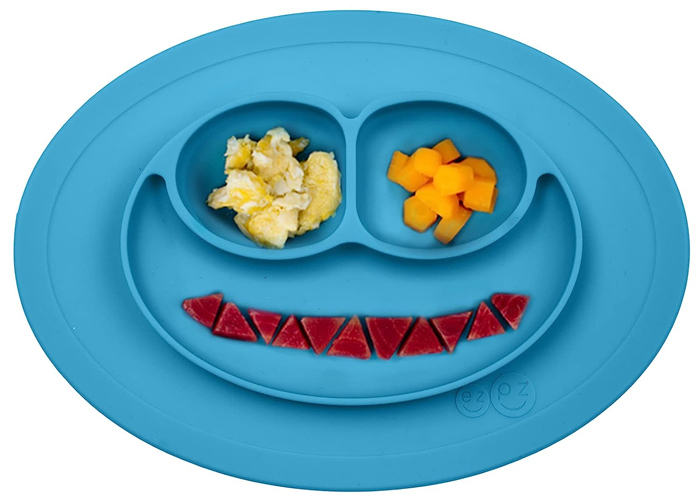

Ezpz

If you have a mini version of you at home who still struggles to take a more “careful” approach to eating, ezpz comes to your aid. Lindsay Laurain created the Happy Mat to cut down the time needed to clean up spilled foods and drinks, as well as improve the mealtime quality of the little ones.

The Product:

Happy Mat is the original product that put ezpz on the map. Now, though, the company offers a plethora of mugs, cups, plates, utensils, etc.

Investor That Took Interest:

Lindsay pitched her company, seeking $1 million for 5% equity. Still, she rejected Barbara and Kevin O’Leary’s offer of the same amount because she “didn’t feel right” about the proposal.

Company’s Revenue:

As of 2023, ezpz is valued at an incredible $20 million and reached $8-$10 million in annual revenue.

Boarderie

A collection of artisan cheese delivered right to our doors sounds like something from a fantasy movie. But Boarderie made it a reality, transferring out of the catering business to the doorstep of your home. The founders, Aaron Menitoff and Rachel Solomon, almost closed down during the pandemic but bounced back stronger than ever.

The Product:

Different combinations of artisan cheese are delivered directly to the customer and ready to consume. The wooden box is perfect for serving, and the variety of cheese will please any taste.

Investor That Took Interest:

The pitch by Aaron and Rachel produced yet another bidding war between the Sharks. Aaron and Rachel came in seeking $300,000 for 5% of their company, and after lengthy negotiations, they accepted Lori’s offer of $300,000 for 9% of Boarderie.

Company’s Revenue:

After the appearance on Shark Tank, the sales of Boarderie skyrocketed, reaching $70 million in annual revenue.

Wicked Good Cupcakes

Baking classes to a multi-million business—mother Tracy Noonan and daughter Danielle Descroches made our world slightly sweeter with their cupcakes. After impressing family and friends, the duo kept on impressing throughout Boston. Unusual shipping method in jars picked up quickly.

The Product:

The main selling item still is the cupcake jars. However, the company now also offers gift sets and wine bundles with many different flavors.

Investor That Took Interest:

Most investors backed out due to worries and unfamiliarity with the baking industry, but Mr. Wonderful loved the idea and offered the company $75,000. He didn’t want equity; instead, he asked for $1 per cupcake royalties until his investment was paid back and $0.50 going forward. After some negotiation, Tracy and Danielle met Mr. Wonderful in the middle ground with a $75,000 investment but lowered the post-investment royalty to $0.45 per cupcake jar instead of the initially proposed $0.50.

Company’s Revenue:

As of 2017, according to Forbes, Wicked Good Cupcakes were pulling in roughly $5 million in annual profits.

Dirty Cookie

For many of us, a cookie recipe has already peaked; nothing else could improve it. Shahira Marei managed to reinvent the wonderful gift of cookies and blessed the world with Dirty Cookie. Not only is it a gift for our taste buds, but the founder also made it her mission to donate a portion of each sale’s profit toward children’s education. The idea came after she witnessed how the less fortunate live in Egypt.

The Product:

Besides packs of delicious stuffed cookies, Dirty Cookie also offers Cookie Shots—an eatable cup made from cookies to enjoy whatever drink you want to accompany a cookie.

Investor That Took Interest:

Shahira entered the show seeking $500,000 for 5% of the company. With a bit of a betting war between Robert and Lori, Shahira accepted Robert’s offer of $500,000 for 25% equity, which would go down to 15% if Shahira sold $6 million worth of products. Although the last update was in December 2022, the deal between Robert and Shahira still hasn’t closed.

Company’s Revenue:

With the exact company’s finances being hard to come by, it’s estimated that Dirty Cookie makes up to $5 million in annual revenue.

Long Table Pancakes

Ordering pancakes online might be unheard of for many. However, Samuel Taylor proved to many why it is a great idea. Delivering some of the most exquisite flavors to your table, Long Table Pancakes set out to promote eco-friendly farming while still pleasing your tastebuds.

The Product:

Extremely nutritious and rare mixes of heirloom grains perfect for pancakes and waffles.

Investor That Took Interest:

After tasting the pancakes and waffles, investors had only good words to tell Samuel. Unfortunately, the business side of things wasn’t impressive enough for the Sharks to jump on, so Long Table left without a deal. This evidently didn’t hinder their path to success, as orders flooded in after the airing of their Shark Tank episode, creating a one-month backlog.

Company’s Revenue:

Currently, the company’s worth is estimated at $900,000. According to Techie + Gamers, for 2023, the company should make over $250,000 in sales.

The Bouqs Co.

Ordering flowers online might not be the most pleasurable thing to do. John Tabis recognized the issue and altered the model of online flower ordering with a flat fee, with no delivery costs added. The flowers are produced in Ecuadorian farms that take shelter near an active volcano. Said volcano erupted in 2015 and hindered the business, but it took just a week for The Bouqs Company to return to business.

The Product:

An online flower delivery service that makes purchasing flowers easy for the customer. Flowers from Ecuadorian and US local farms make the service available almost anywhere and anytime.

Investor That Took Interest:

John entered Shark Tank seeking $258,000 for 3% of his company. After the presentation, none of the investors were interested enough to make an offer. However, that didn’t stop The Bouqs Company from reaching success. After millions of sales and several investments were acquired on their own, Robert Hervajec reached out to Tabis and made an order for his company. He liked the service so much that he invested in the company.

Company’s Revenue:

According to Zippia, The Bouqs Company reached its peak annual revenue of $5.4 million in 2022.

Rokblok

If you’re a bit older, you might get some flashbacks from the vinyl killer days. And RokBlok is just like a vinyl killer—just a more advanced and modern version. Logan Riley reinvented the concept and allowed us to enjoy the classic sound with a modern gadget.

The Product:

Portable speaker and playback device meant for vinyl. It also can connect to speakers via Bluetooth. It remains the only product offered by RokBlok.

Investor That Took Interest:

Seeking $300,000 for 15% equity, Logan Riley prepared his pitch, and while Lori and other investors took caution, Robert got ahead and offered $500,000 for 100% of the business. The offer was tempting for Logan, so he took the deal and earned himself a two-year contract with a 6 figure salary.

Company’s Revenue:

When it appeared on Shark Tank, RokBlok was worth around $500,000. With Robert’s investments and knowledge, the company is now valued at $5 million.