Young Woman Is Surprised After Finding Out That Her Savings Fund Is Minimized Due To Her Parents’ Plan To Retire Early

InterviewCollege is one of the most, if not the most, important investments in everyone’s life. Many parents tend to create a savings account when the kid is born and save up money in there to help the kid in the future as the tuition fees are really insane, especially in the top universities. This way, the kid won’t have to deal with the debt that they will need to pay for the rest of their lives and parents won’t need to worry that they won’t have money to send their kids to college.

More info: Reddit

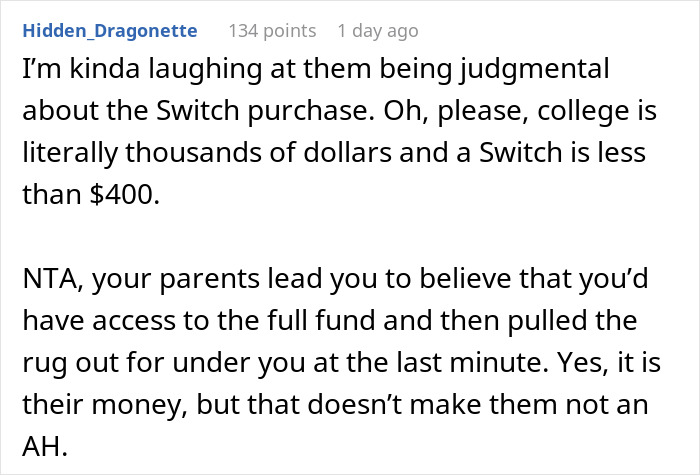

Finding out that your budget is cut into half right before applying for college is not the nicest feeling

Image credits: Pixabay (not the actual photo)

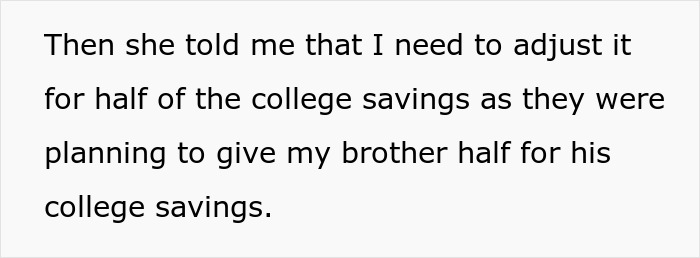

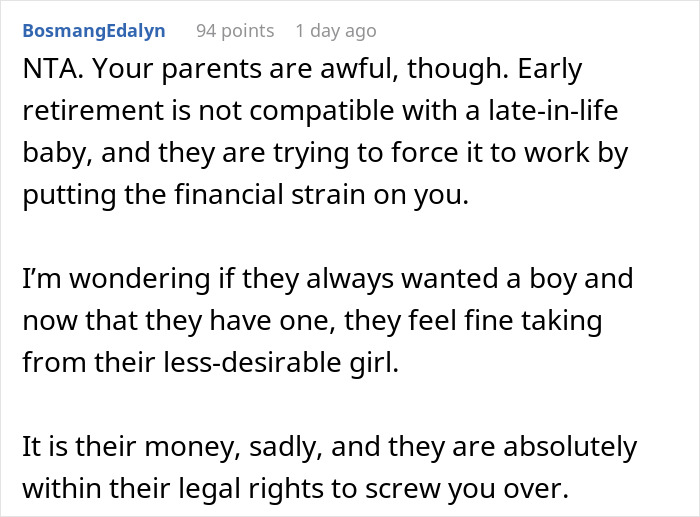

Woman asks community members if she is wrong for not wanting to split the fund with her brother

Image credits: throwawaycollegesav

Image credits: Pixabay (not the actual photo)

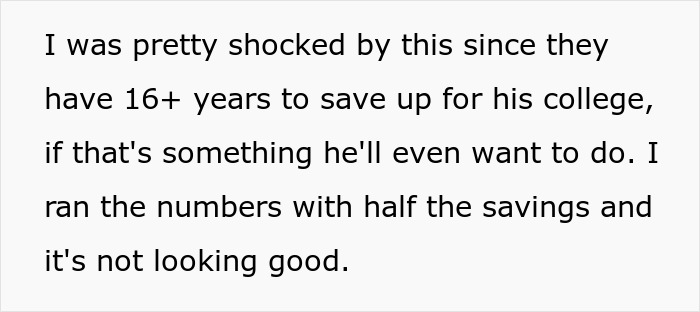

Her parents informed her that they are planning on giving half of her college budget to her baby brother

Image credits: throwawaycollegesav

She is upset as in 15 months, she is starting college and her brother won’t need this college money for over 15 years

3 days ago, a young woman shared her story to one of the most honest communities on Reddit, asking if she is being a jerk for not wanting to share her college fund money with her 1.5-year-old brother. The post went viral and in just 3 days it received almost 6K upvotes and more than 1.1K comments.

The author starts her story by introducing that she is a rising senior at high school and has a 1.5-year-old baby brother. Moreover, she is getting ready for the college application season. Unsurprisingly, it’s a complicated process, thus she prepared a spreadsheet with all the information containing costs and a plan on how well her savings account and general savings will cover expenses.

Now, after OP shared her spreadsheet with her mom, she was told that now she has to adjust the whole budget by half as they are planning to give her baby brother half of this money. The author was shocked as she was hoping to graduate with as little debt as possible; however, after these deductions, that is going to be harder to accomplish.

Moreover, OP mentioned that she tried to negotiate with her parents, but as it’s their money, they can spend it however they want. Additionally, her parents wish to retire early and another college fund would postpone it. The thing that makes her the most upset is that it’s basically right before college and her brother won’t need this money for another 15, if not more, years.

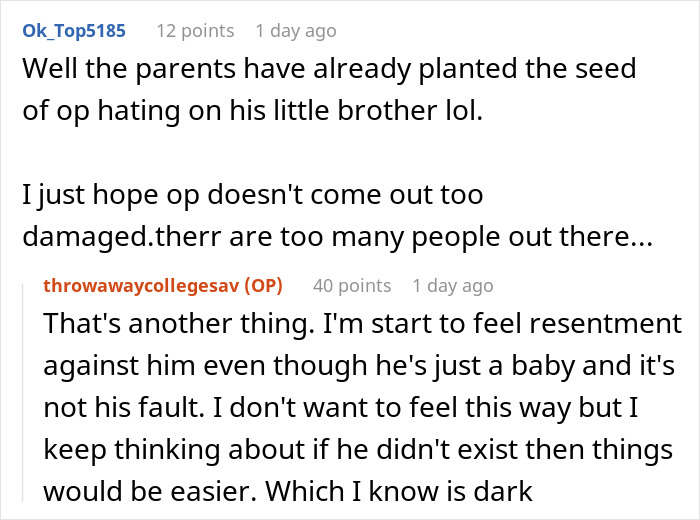

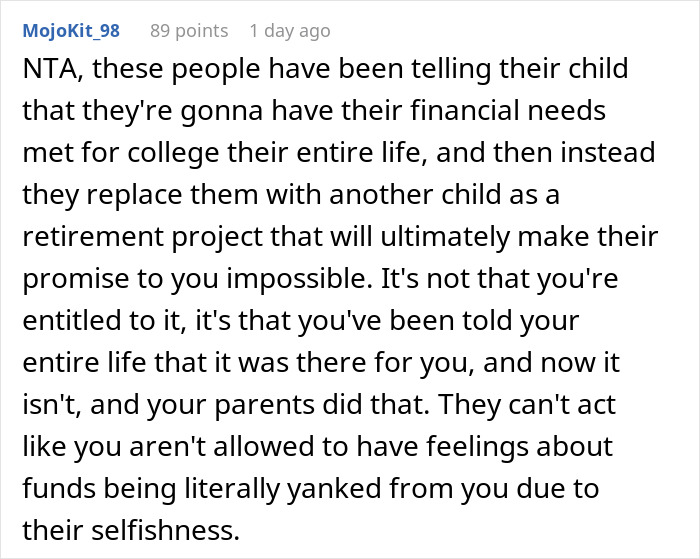

The community members gave the woman the ‘Not the A-hole’ verdict as it was not a nice move from the parents and OP has a valid reason to be upset. However, most folks also agreed that because it’s her parents’ money, there is not much to do. “It’s a real [jerk] move on their part to suddenly take away the funding they had promised you all along,” one user shared. “It’s their money and they can do what they like with it. But it’s still going back on a promise/deal with their child,” another agreed.

Image credits: Andrea Piacquadio (not the actual photo)

Moreover, Bored Panda contacted Lucinda O’Brien, who is a savings expert at Money.co.uk. She kindly agreed to answer a few questions regarding savings accounts that may be useful for everybody who plans on opening one!

“Saving for children is a great gift, which can be used in the future to help them put a deposit for a house, pay for college or university, or pay for their wedding. If you’re able to, it’s a good idea to start putting money aside for your child as soon as they are born,” Lucinda started. Additionally “You can save for your child’s future in a number of ways and can choose from a standard child savings account, a regular savings account or a junior individual savings account (ISA).”

Now, speaking about the possibility to open savings accounts for a child to avoid similar situations like the one presented in the story, the expert says that first of all, when opening an account, the name of the parent or guardian will be on the account as well as the child. “If you open an account on behalf of your child, you will have control over the money, and then the account automatically converts into their name when they turn 16 or 18, depending on the account. You will be notified of this change a few months before it happens.”

Moreover, “There are some children’s savings accounts that can be opened solely in your child’s name from the age of seven. If you do this, your child will have control over the money and be responsible for any administration that comes with the account, for example, signing for withdrawals or signing to close the account. You will not be able to access any information on your child’s account without their consent if it is in their sole name.”

And speaking about the tips that may help save up for college, Lucinda shares: “Some general savings tips would be to save little and often; put a standing order in place for every month, as soon as your child is born if you can afford to. This doesn’t have to be a large amount, but will soon build up and by the time they’re 18 could be instrumental in helping them achieve financial goals.”

“Another easy way to boost their savings is to ask for family contributions instead of gifts when they’re young. Often children’s birthdays are filled with too many presents they won’t use, so this is a good way to avoid that,” the expert emphasized.

Folks backed the student up and shared some solutions

Image credits: Theo (not the actual photo)

260Kviews

Share on FacebookWait until you can answer the inevitable "we thought you'd be able to look after sprog" with "I thought I'd have twice as much money for college as I have. Turns out we were both wrong".

Sorry I have to pick up some extra hours to pay off my student loans

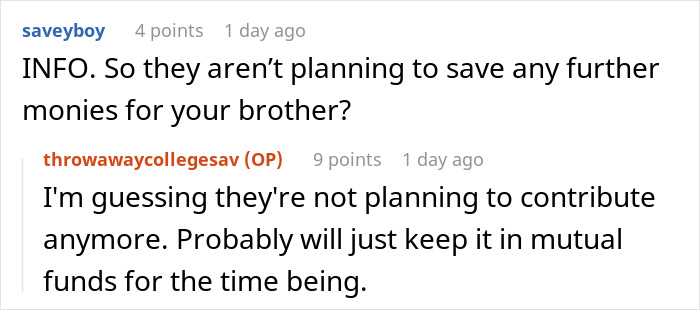

Load More Replies...OP was told for years that this was HER college fund. She's literally applying for colleges now, having formulated all her plans around HER college fund. Now, at the last minute, all her plans have been destroyed. Absolutely NTA.

I'm firmly of the view that parents shouldn't promise stuff like college funds, or cars to their kids too early. Situations change, you lose a job, have another kid, or cost of living goes up and suddenly that money is needed just to live. At which point you end up with an angry teenager who believes that money is theirs for college/car/whatever.

Load More Replies...This will damage their relationship with their daughter. If they hope to have support from her upon their retirement, make plans for this with his cooperation, and shortly before they retire she unilaterally says “Actually, I’m going to keep my money,” then they and they alone will be responsible.

Wait until you can answer the inevitable "we thought you'd be able to look after sprog" with "I thought I'd have twice as much money for college as I have. Turns out we were both wrong".

Sorry I have to pick up some extra hours to pay off my student loans

Load More Replies...OP was told for years that this was HER college fund. She's literally applying for colleges now, having formulated all her plans around HER college fund. Now, at the last minute, all her plans have been destroyed. Absolutely NTA.

I'm firmly of the view that parents shouldn't promise stuff like college funds, or cars to their kids too early. Situations change, you lose a job, have another kid, or cost of living goes up and suddenly that money is needed just to live. At which point you end up with an angry teenager who believes that money is theirs for college/car/whatever.

Load More Replies...This will damage their relationship with their daughter. If they hope to have support from her upon their retirement, make plans for this with his cooperation, and shortly before they retire she unilaterally says “Actually, I’m going to keep my money,” then they and they alone will be responsible.

91

93