People Compare Their Living Costs In The Past Vs. Now, And The Reality Is Devastating

Economists are warning that as inflation continues to rise across the globe, the United States is on the verge of a cost-of-living crisis.

On the 4th of May, the US Federal Reserve – the country’s central bank – moved to tackle rising inflation by making its biggest interest rate hike in 22 years.

“Inflation is much too high and we understand the hardship it is causing,” Federal Reserve Chairman Jerome Powell said. “We are moving expeditiously to bring it back down.”

But with food and energy prices continuing to increase, it comes as no surprise that 67% of Americans are worried about the amount of money they need just to survive.

So we at Bored Panda decided to take a look at what problems they have been talking about online.

The rising cost of living is becoming a bigger and bigger burden for Americans

Image credits: Gustavo Fring (not the actual photo)

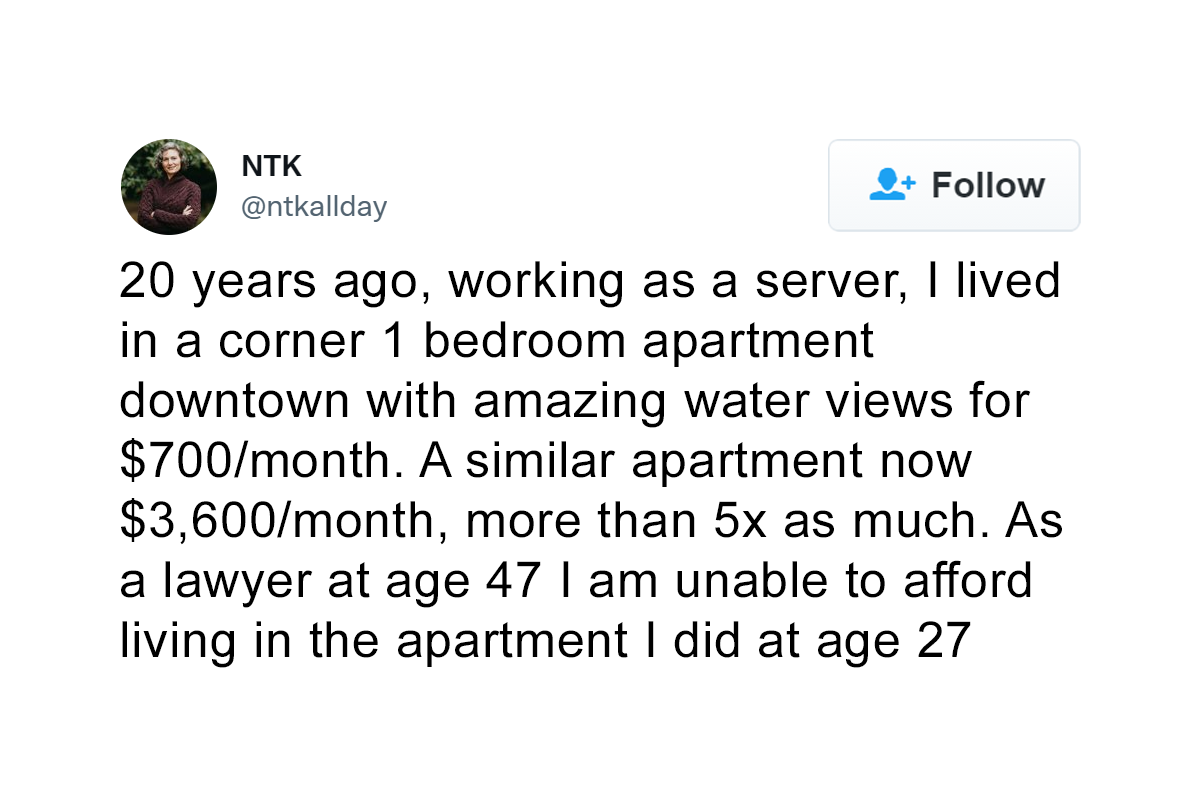

Nicole Thomas-Kennedy, who ran for election for Seattle City Attorney in Washington in 2021, recently compared her current financial situation versus two decades ago

Image credits: ntkallday

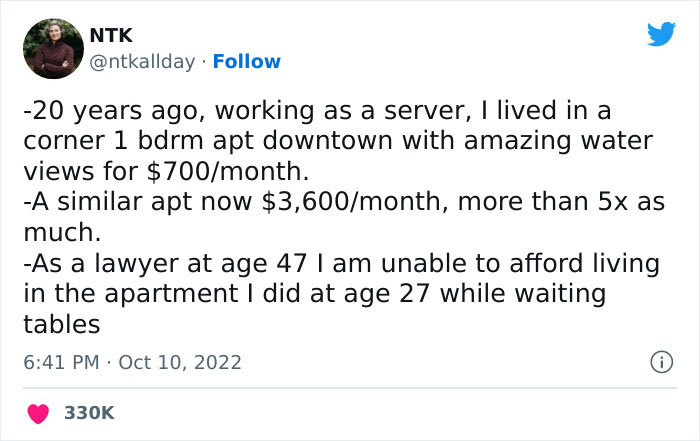

Image credits: ntkallday

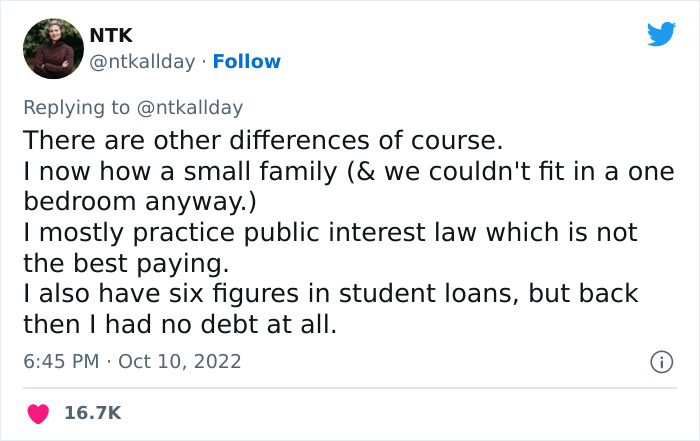

Image credits: ntkallday

Image credits: ntkallday

Image credits: ntkallday

Image credits: pixel parker (not the actual photo)

Home prices are still surging despite higher mortgage rates and a slight increase in housing supply—factors that typically put downward pressure on them.

The numbers, however, show the market is still resilient. Even if it’s expensive.

The median home price has jumped every month this year, reaching a record high of $413,800 in June before falling to $389,500 in August.

But some of that decline may be seasonal as the housing market slows down in the fall. Furthermore, the median home price in August was still nearly 8% higher than a year ago.

These higher housing costs have taken a toll on home shoppers, as mortgage applications remain at their lowest level in 22 years.

It currently takes 35.51% of median income to make the monthly principal and interest payment on the median home with a 30-year mortgage and 20% down.

That’s up marginally from the prior 35-year high back in June, when the payment-to-income ratio climbed to 35.49%.

In the 5 years before interest rates began to rise, that income-to-payment ratio held steady around 20%. Even though home prices surged in 2020 and 2021, record-low interest rates offset the increases.

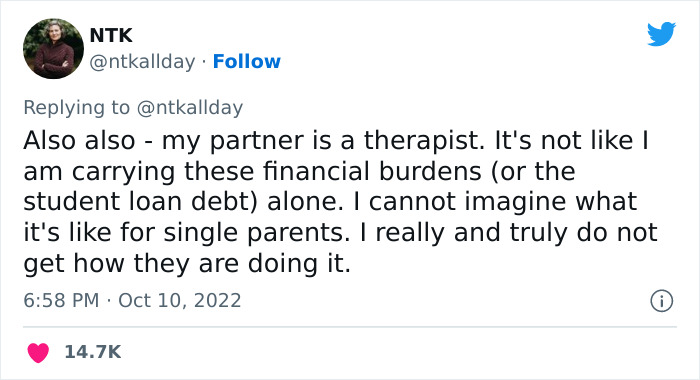

People began digging into household incomes and housing prices

Image credits: mikegalsworthy

With inflation at its highest for decades in many countries, central banks around the world are following the US Federal Reserve and raising interest rates at speed.

For millions of people, this means bigger mortgage payments or higher rents as landlords pass on their own increased costs, while at the same time average wages are falling in real terms, prompting households to run down savings or cut their spending.

The Biden administration has a series of plans for the US, many inspired by the supply chain problems that arose during the coronavirus pandemic that are aimed at making the country more resistant to sudden swings in prices.

The plans include the Inflation Reduction Act – expected to cost $437bn over 10 years. It should lower prescription drug and health care costs and increase spending on green energy technologies. The plan also suggests putting $52bn in boosting domestic production of semiconductors. (Semiconductor shortages led to rises in the price of everything from cars to mobile phones during the pandemic.)

Biden has also approved releasing 1m barrels of oil a day from the Strategic Petroleum Reserve – the US’s enormous underground stockpile of oil – in an attempt to bring down gas prices.

Hopefully it’ll help.

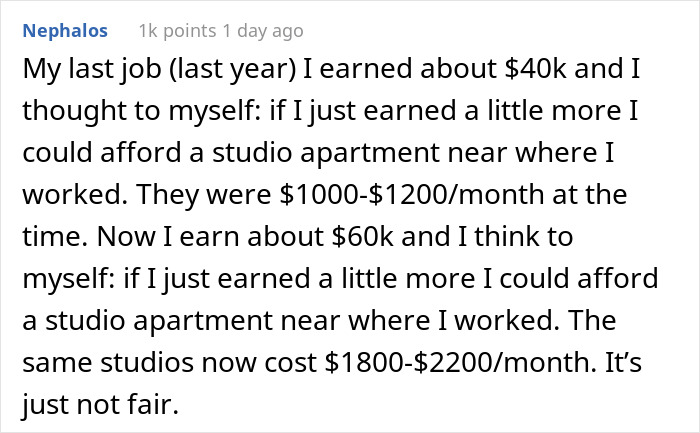

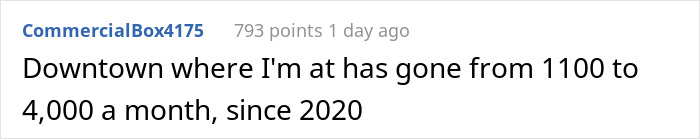

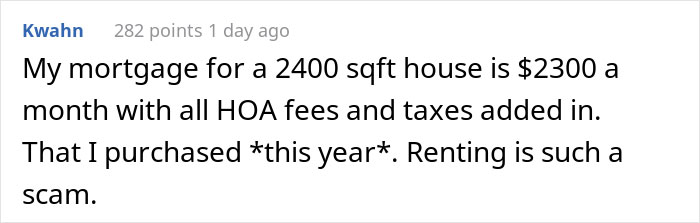

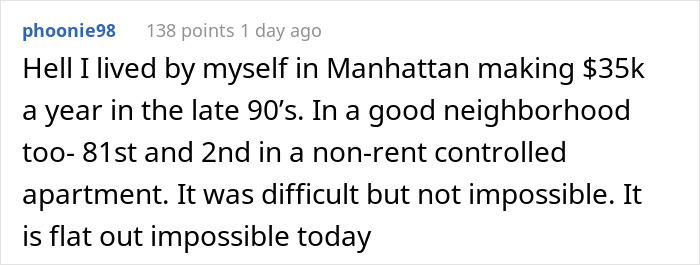

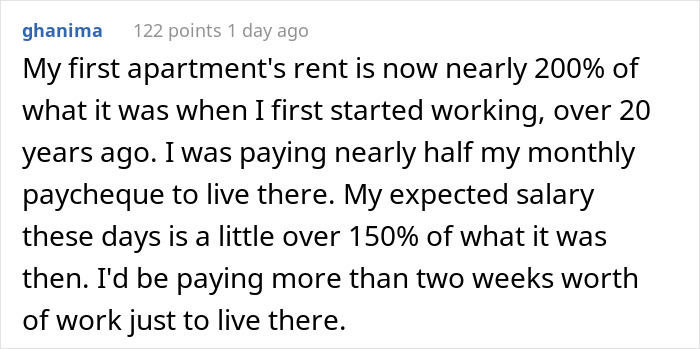

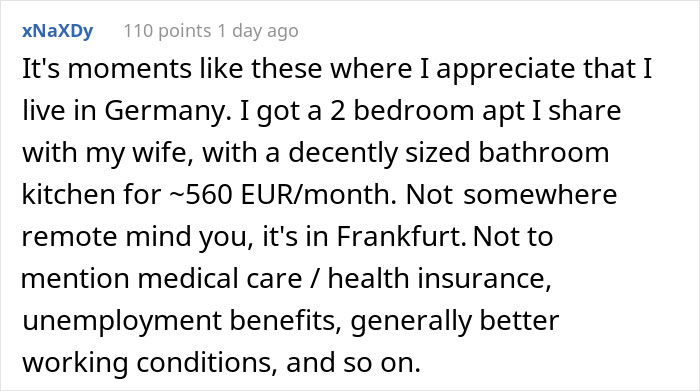

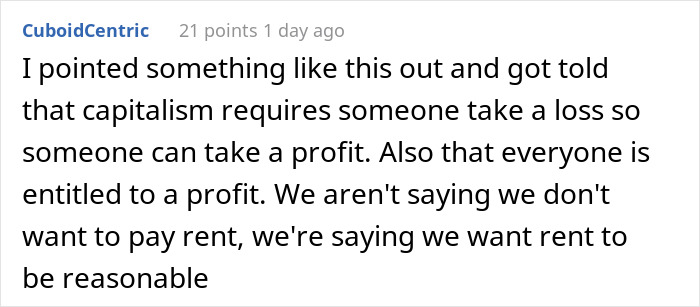

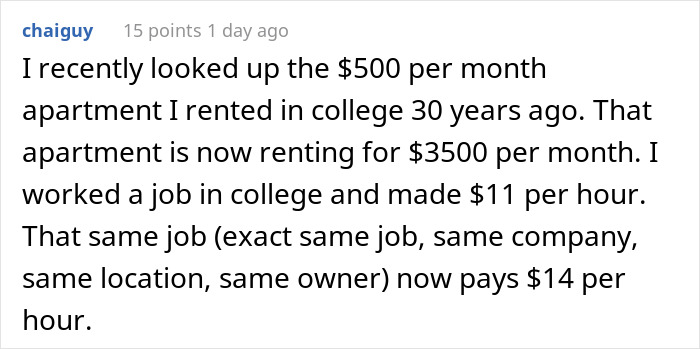

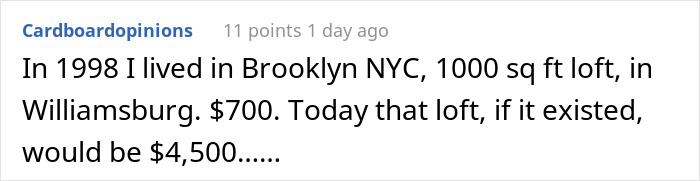

And many shared their own personal experiences and struggles

Image credits: Fly_Sistah

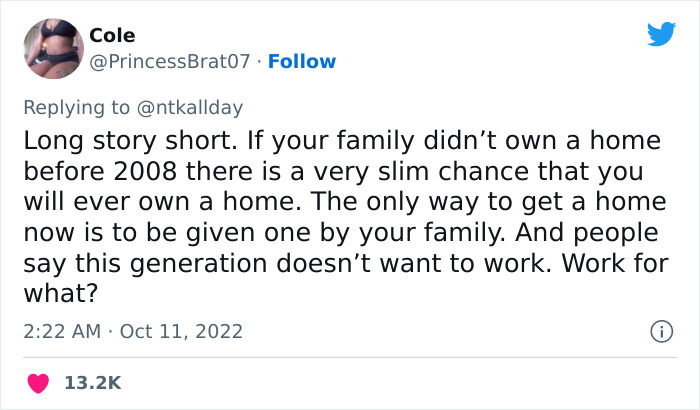

Image credits: PrincessBrat07

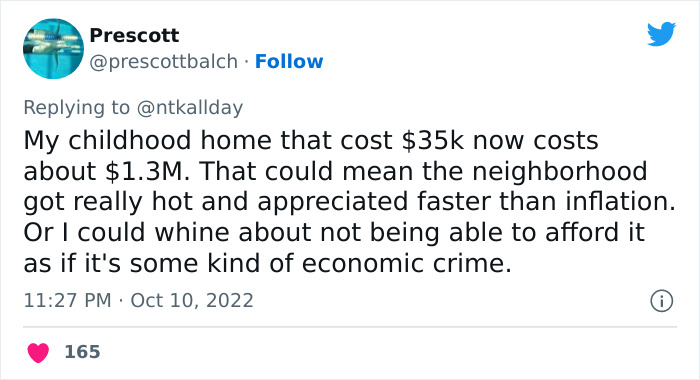

Image credits: prescottbalch

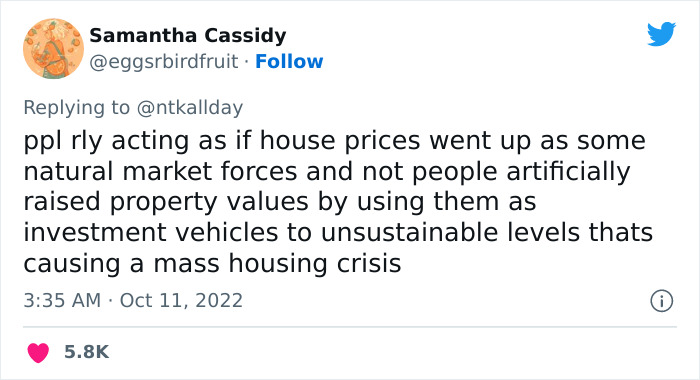

Image credits: eggsrbirdfruit

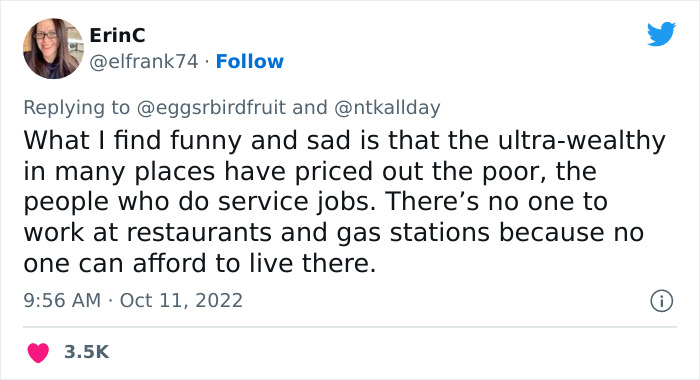

Image credits: elfrank74

Image credits: AmberlyPartridg

Image credits: thepolicyprof

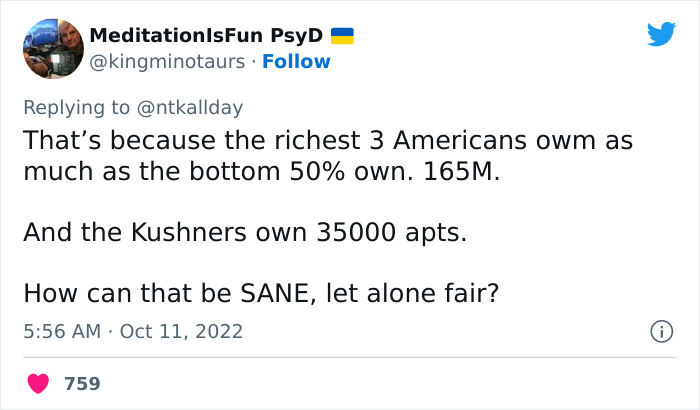

Image credits: kingminotaurs

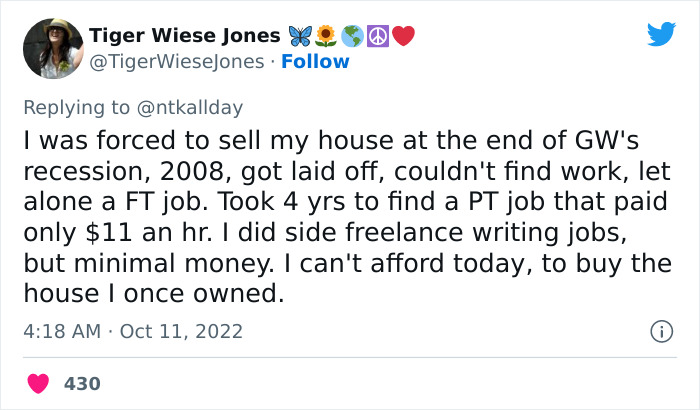

Image credits: TigerWieseJones

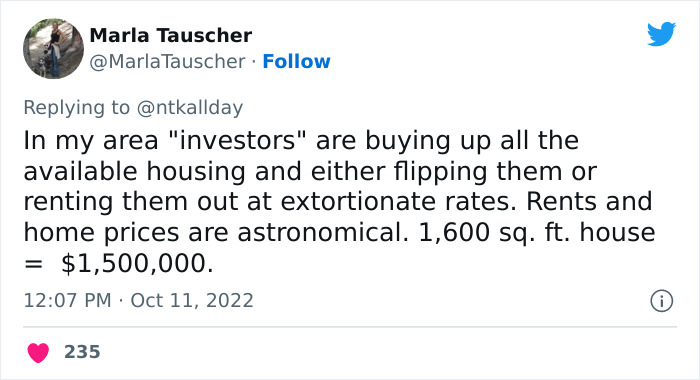

Image credits: MarlaTauscher

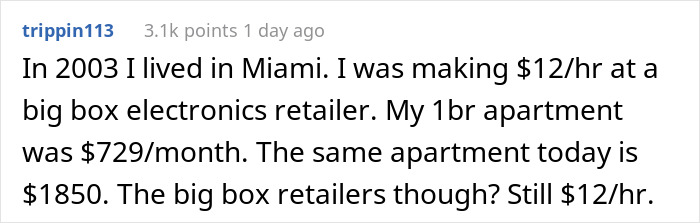

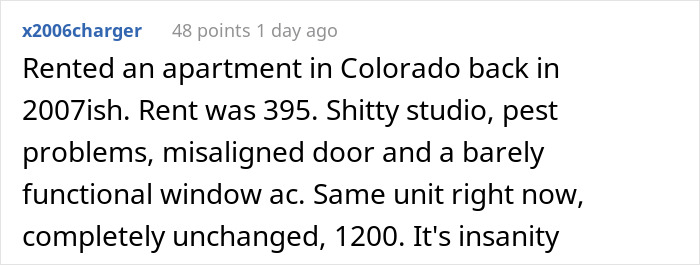

LOL. You people think it's bad now just wait and see what the next 5 years brings. The "working homeless" population in the USA has been increasing dramatically BEFORE the pandemic. Unless our politicians in Washington grow a spine and start regulating the rental housing industry to bring down rents to a reasonable level it's going to get much, much worse.

In North America corporations get free money from the government yet the people in need get nothing. Rents go up and the people who no longer able to afford it are blamed for not being prepared.

The problem I have with some of these stories is that people are talking about 20 or 30 years ago and it's giving people the right to say that "well of course, it was 30 years ago. Prices go up." How about we look at as soon as 5 years ago. I had a 2 bedroom apt for 1100 dollars. That same apt is now 2600. And as bad as that is, the problem isn't even rent prices; it's that employers should be required to pay employees an amount that allows them to live within a reasonable distance to where they expect their employees to work. I live near Boston and no who works in Boston can really afford to live there, so they all come down state and rent places that WE should be renting. There are so few apts available and it makes landlords hike up the rents to ridiculous amounts. Someone working in Boston can't afford 5k or more to live there but they can afford 2500-3k which is what it is here so we're stuck living 2-3 hours away from our jobs to commute every day.

I hate hearing people say "well if the company has to pay the employees more, they will pass that money along to the consumer". But I keep arguing that the problem is the CEO's and investors that keep taking more and more millions for themselves, while the workers get nothing! It used to be that even uneducated people could work their way up in a company, and now that absolutely does not exist anywhere! The people at the top usually have NEVER worked in their lower/lowest positions or ever worked a minimum wage job in their entire lifetime!

Load More Replies...LOL. You people think it's bad now just wait and see what the next 5 years brings. The "working homeless" population in the USA has been increasing dramatically BEFORE the pandemic. Unless our politicians in Washington grow a spine and start regulating the rental housing industry to bring down rents to a reasonable level it's going to get much, much worse.

In North America corporations get free money from the government yet the people in need get nothing. Rents go up and the people who no longer able to afford it are blamed for not being prepared.

The problem I have with some of these stories is that people are talking about 20 or 30 years ago and it's giving people the right to say that "well of course, it was 30 years ago. Prices go up." How about we look at as soon as 5 years ago. I had a 2 bedroom apt for 1100 dollars. That same apt is now 2600. And as bad as that is, the problem isn't even rent prices; it's that employers should be required to pay employees an amount that allows them to live within a reasonable distance to where they expect their employees to work. I live near Boston and no who works in Boston can really afford to live there, so they all come down state and rent places that WE should be renting. There are so few apts available and it makes landlords hike up the rents to ridiculous amounts. Someone working in Boston can't afford 5k or more to live there but they can afford 2500-3k which is what it is here so we're stuck living 2-3 hours away from our jobs to commute every day.

I hate hearing people say "well if the company has to pay the employees more, they will pass that money along to the consumer". But I keep arguing that the problem is the CEO's and investors that keep taking more and more millions for themselves, while the workers get nothing! It used to be that even uneducated people could work their way up in a company, and now that absolutely does not exist anywhere! The people at the top usually have NEVER worked in their lower/lowest positions or ever worked a minimum wage job in their entire lifetime!

Load More Replies...

93

47