Mom Asks Her Working Teen Daughter To Start Paying For Household Expenses, Is Left Feeling Like ‘The Worst Mom In The World’

Some parents wonder if it’s ever appropriate to charge their teenager rent. Truth is, there’s no one-size-fits-all answer. It depends. Of course, there are some guidelines, but every situation is different and parents need to feel out what’s best for their household.

Mumsnet (the UK’s biggest website for parents) user Icanflyhigh, for example, thought it was time when her 16-year-old daughter started an apprenticeship and was earning £14.5K (around $20K) per year. She didn’t ask for a lot, too. Just £50 (roughly $70) per week.

However, when she asked the teen to contribute to the household budget, the girl got really angry, really fast. The whole thing grew into such a huge fight, Icanflyhigh started feeling like the worst mom in the world for proposing this idea in the first place.

So, she told her story on the online platform and asked other parents whether or not she was being unreasonable. Continue scrolling to learn how it all went down and what Talya Stone (a former editor-in-chief turned parenting blogger and the woman behind Motherhood: The Real Deal and 40 Now What, thinks about it) and Vicki Broadbent (writer, director, broadcaster, and founder of the parenting blog Honest Mum) thought about it.

Image credits: Highwaystarz-Photography (not the actual photo)

Talya Stone thinks that it’s extremely important to teach kids the value of money. “They need to understand it from early on,” the parenting blogger told Bored Panda.

To help them, Stone suggested giving them pocket money and their own wallet from a fairly young age. “Tell them to bring it along on days out, and holidays, and pay for small bits and bobs they want for themselves even if it’s just a bar of chocolate,” she said. “I think I started doing this with my daughter when she was five but this could even be done before. Understanding money, how much things cost, spending power, and how to save is a vital life skill. If your child wants a new toy, instead of buying it for them every time on demand, you can encourage them to save towards it and tell them you will pay for half so long as they do, for instance. This has never been so important in the increasingly materialistic world we live in.”

Vicki Broadbent agrees. “I believe children should start learning about money as early as possible,” the author of Mumboss (UK) and The Working Mom (the US and Canada) told Bored Panda. “My sons as toddlers would follow me around the grocery store with a shopping list and I would guide them on how much items cost, showing them prices, finding cheaper alternatives, and even having them pay at the checkout. My kids would also play ‘Shop’ from a young age, using a toy till with pretend money and coins so they could learn the basic concept of transactions, moving to a toy credit card around the age of 5.”

Vicki highlighted that financial education and money management are crucial lessons for children, and while these topics are somewhat covered in the school curriculum through math, it’s the parent’s responsibility to make sure the child knows how to live within their means. “If they don’t understand how to create and stick to a budget, they’ll get a shock once they leave for university or college, or find a job, quickly finding themselves in debt,” she said.

Parents should continue teaching their little ones about the different aspects of money as they grow older. “Other things to do is take them along to the bank with you and set up a bank account in their name from a young age and have them deposit some of their pocket money in there,” Talya Stone added. “Talk to them about how much things cost when you are in the shops or buying online. Talk to them about what you earn or how much a family holiday or day out costs. We shouldn’t shy away from these things or be embarrassed by them. Open, age-appropriate communication around these things as with other things in parenting is vital. You can also ask to borrow money from them – a dollar here and there – and pay it back so they understand this concept too.”

“As they become older, looking at case studies of young adults who are both managing money well (e.g. there are example budgets online) as well as sharing stories of those in debt will help to educate your kids,” Vicki Broadbent explained. “Equally, as parents, lead by example, talk and explain how you manage your own money and try not to spoil your children with material goods. Make it a priority to teach your children how to earn money too. Mine had a simple and short chore list from 6 and felt great pride in earning pocket money.”

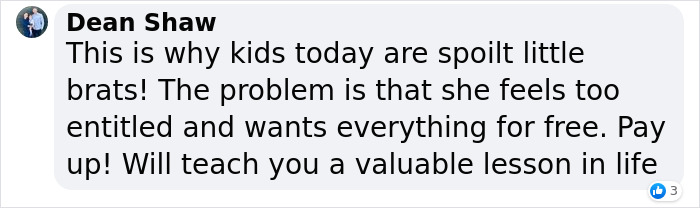

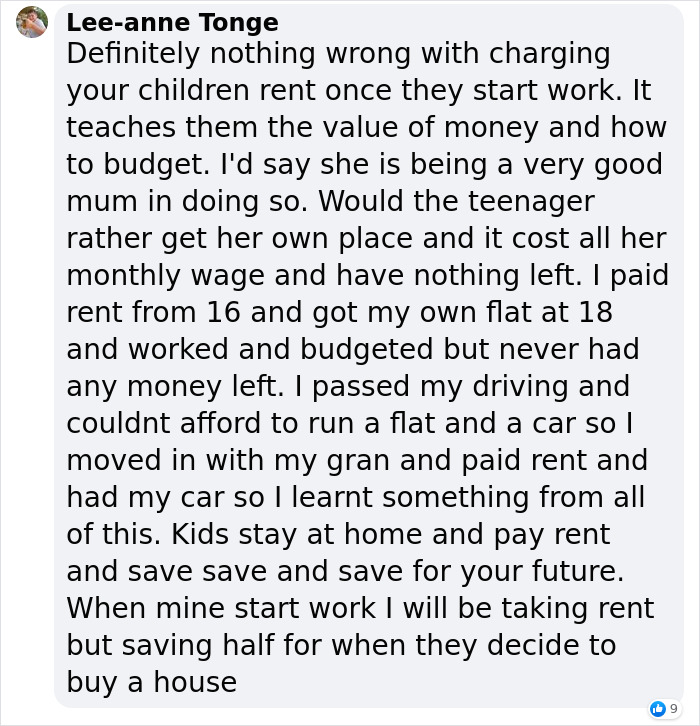

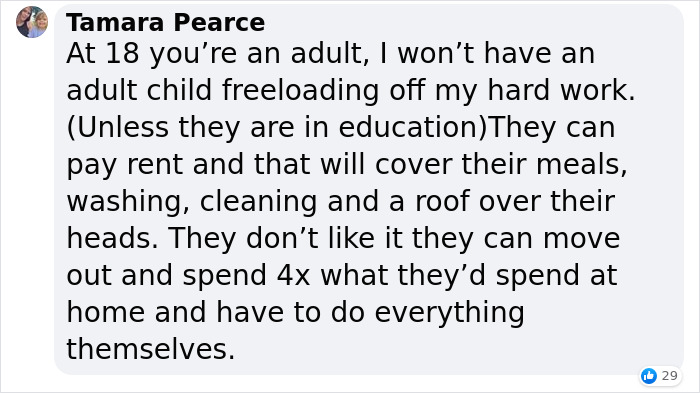

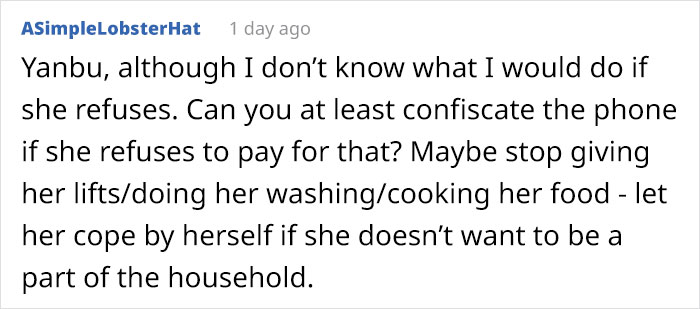

Here’s what people said about the situation

Licensed clinical social worker, psychotherapist, and lecturer at Northeastern University in Boston, Massachusetts, Amy Morin, said that in some scenarios it’s perfectly reasonable for a parent to become their teen’s landlord.

In an article for Verywell Mind, Morin provided these examples:

- Your 16-year-old drops out of high school and says he wants to get a job;

- Your 17-year-old quits school and says she’d prefer to just get her GED;

- Your 18-year-old wants to live at home after he graduates from high school. He plans to find a job, rather than go to college;

- Your 19-year-old drops out of college after one semester.

In this particular case, Talya Stone believes the mom was being reasonable. However, maybe there was a better way to go about it. “The daughter is more than old enough to learn how to pay her way,” she said. “Perhaps the issue here is the mom setting the agenda.”

“Instead, they could sit down and agree on a plan together, taking into consideration the teen’s thoughts, feelings, and expectations. Giving her input and a voice in the decision-making will probably lead to agreement. Right now, the mom’s thinking is correct, but perhaps she needs to be savvier in the way she gets her teen to understand and agree – and that is by involving her in the process.”

Stone highlighted that in these situations, parents need to bear in mind that they’re talking to a teen. “They have very strong attitudes and opinions and quite rightly so! Teenagers can often act hard done by and are a law unto themselves. They feel like the world is against them, so it’s about showing them you are on their side, rather than acting as a threat.”

Vicki Broadbent had similar thoughts. “I agree that the mother in this instance is right to request that her daughter contributes to the family budget considering she is 17 and earning money … Sitting her down to break down her earnings (incomings) and outgoings, listing all the things her mother is still paying for, would provide a useful lesson for the daughter also. It would hopefully encourage gratitude in her too,” the Honest Mum said.

I started working at 15, and started paying 'board' to my parents from when I was 16, even though it was only part-time after school work. I was mad as hell having to pay them, plus things like school uniform and new shoes I had to pay for myself soon as I started working. HOWEVER, they basically saved everything I paid them, and handed it back to me in a cheque when I went to university. They taught me to value money, save for when you need it. This lady says that money is going towards her daughter's driving lessons - this is a good life lesson for her, and she's well within her rights to ask. She's not a bad mum, she's a brilliant mum.

My dad spent it on booze. Glad you had better parents than I.

Load More Replies...Im usually not in favour of asking your underaged children for money. You had them, it´s your job to provide for them. But its also the parents job to parent and not expect kids to just know everything out of the blue when they reach adulthood ............. Im also against it because I´ve seen a couple of parents living way above their actual means and mooching off their children, to the point of trying to undermine their children´s relationships so that they dont move out and keep giving them their complete paycheck. ..................... In this case however, it seemed that the mother is quite reasonable and all the money she´s asking for is basically going to her kid in the first place. Doesn´t seem unfair in the least.

Mom could easily turn this around. Not pay for the phone bill, don't do the laundry and don't cook. Because while you were put on this Earth without being asked for it, so is every generation before you. And we kinda made this deal to raise to independence, and making that amount of money at that age is a great step towards that.

Load More Replies...I don't believe in making your children contribute to house hold expenses until they are 18 but having her pay for transportation to her job and paying for her cell phone seems fair. Thing is, I helped my parents pay their bills for as far back as I can remember. I worked as a groom making $300 a week since the age of 10, $1000 a week when I was 16 as a rider. I dropped out after the 9th grade and worked 3 jobs, all of the money I gave to my parents. I decided to go to college and I gave my parents my student loan check to pay off some of the credit cards and my mother bought shoes. I suffer from massive anxiety and I have a ton of student loan debt. I was suicidal since the age of 6 and I fear phones because of debt collectors. If you have kids, you provide for them, don't put your financial stress on to your children. Fine to have them pay for their own things like their car, clothing, or phone, but household bills shouldn't be their problem, they need that money for their future.

I started working at 15, and started paying 'board' to my parents from when I was 16, even though it was only part-time after school work. I was mad as hell having to pay them, plus things like school uniform and new shoes I had to pay for myself soon as I started working. HOWEVER, they basically saved everything I paid them, and handed it back to me in a cheque when I went to university. They taught me to value money, save for when you need it. This lady says that money is going towards her daughter's driving lessons - this is a good life lesson for her, and she's well within her rights to ask. She's not a bad mum, she's a brilliant mum.

My dad spent it on booze. Glad you had better parents than I.

Load More Replies...Im usually not in favour of asking your underaged children for money. You had them, it´s your job to provide for them. But its also the parents job to parent and not expect kids to just know everything out of the blue when they reach adulthood ............. Im also against it because I´ve seen a couple of parents living way above their actual means and mooching off their children, to the point of trying to undermine their children´s relationships so that they dont move out and keep giving them their complete paycheck. ..................... In this case however, it seemed that the mother is quite reasonable and all the money she´s asking for is basically going to her kid in the first place. Doesn´t seem unfair in the least.

Mom could easily turn this around. Not pay for the phone bill, don't do the laundry and don't cook. Because while you were put on this Earth without being asked for it, so is every generation before you. And we kinda made this deal to raise to independence, and making that amount of money at that age is a great step towards that.

Load More Replies...I don't believe in making your children contribute to house hold expenses until they are 18 but having her pay for transportation to her job and paying for her cell phone seems fair. Thing is, I helped my parents pay their bills for as far back as I can remember. I worked as a groom making $300 a week since the age of 10, $1000 a week when I was 16 as a rider. I dropped out after the 9th grade and worked 3 jobs, all of the money I gave to my parents. I decided to go to college and I gave my parents my student loan check to pay off some of the credit cards and my mother bought shoes. I suffer from massive anxiety and I have a ton of student loan debt. I was suicidal since the age of 6 and I fear phones because of debt collectors. If you have kids, you provide for them, don't put your financial stress on to your children. Fine to have them pay for their own things like their car, clothing, or phone, but household bills shouldn't be their problem, they need that money for their future.

99

97