“They’re Paying Roughly 24% Of Their Income”: 1950s Mortgage Slip Goes Viral, Sparks Debate

The dream of homeownership has long been a cornerstone of the American and many other societies’ ideals, but in recent years, that dream has increasingly slipped through the fingers of aspiring first-time buyers.

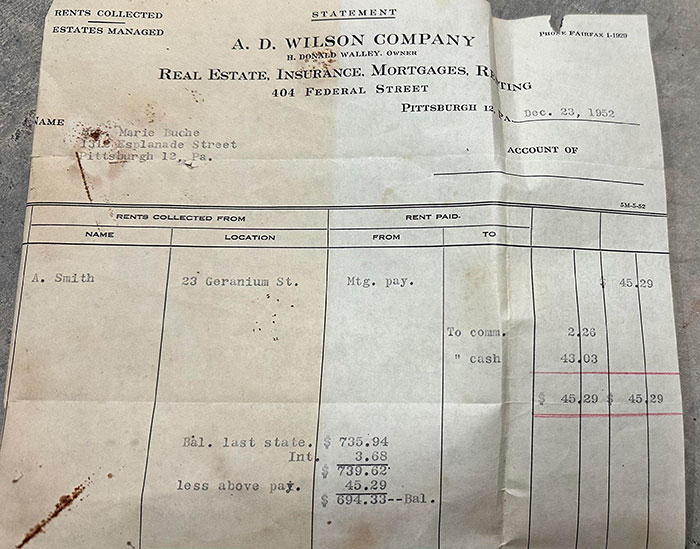

A Reddit post unveiling a mortgage payment slip dating back to 1952 really rubbed salt into the wound, as it showed just how much cheaper owning property was back in the good old days.

Amidst a housing rate crisis in the US, a Reddit post went viral after showing a relatively cheap 1952 mortgage slip

Image credits: Aubrey Odom (not the actual photo)

The picture in question revealed that a property owner in Pennsylvania made a monthly payment of merely $45.29 for their mortgage.

For perspective, recent research revealed that to secure a mortgage in a majority of regions across the United States, individuals now require a minimum six-figure income.

According to a report by real estate site Redfin, San Francisco and San Jose, California, are the top two metros that require the highest salaries, of $404,332 and $402,287, respectively.

“The Bay Area has consistently been one of the most expensive markets in the country,” Daryl Fairweather, chief economist at Redfin, said.

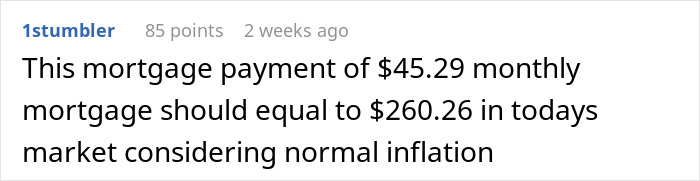

Due to a certain “A.Smith”’s remarkably low-cost mortgage displayed in the now-viral photograph, Redditors initiated discussions, engaging in debates about the price, while some even attempted to calculate its equivalent value in today’s market.

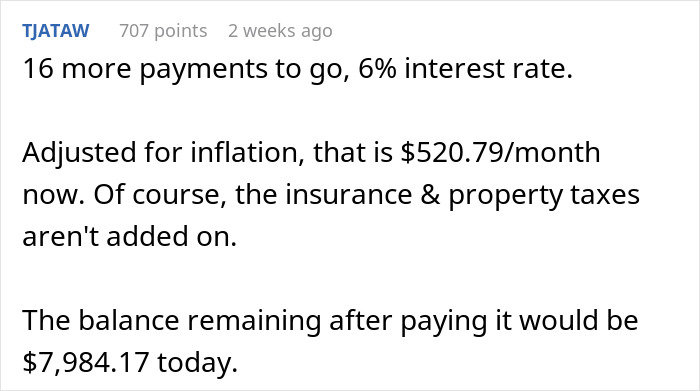

A person commented: “16 more payments to go, 6% interest rate. Adjusted for inflation, that is $520.79/month now. Of course, the insurance & property taxes aren’t added on. The balance remaining after paying it would be $7,984.17 today.”

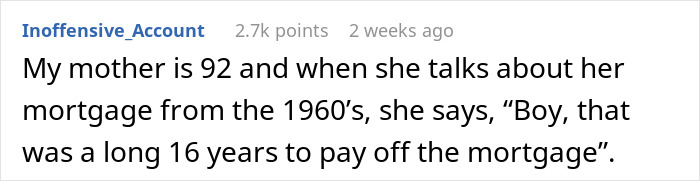

Someone else wrote: “My mother is 92 and when she talks about her mortgage from the 1960’s, she says, ‘Boy, that was a long 16 years to pay off the mortgage.'”

“No wonder the population exploded. People could actually afford to live and raise a family,” a separate individual commented. “Well this is depressing,” another Redditor chimed in.

Image credits: u/1stumbler

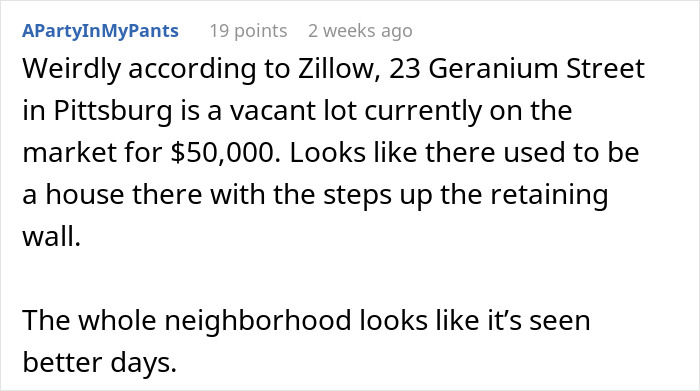

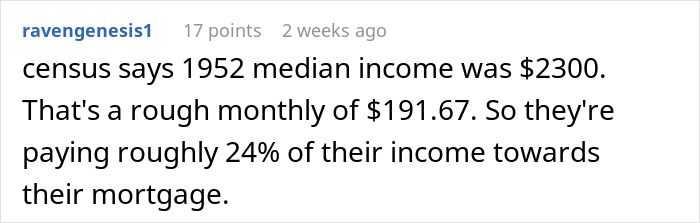

However, some pointed out that incomes were considerably lower seven decades ago.

The average family income in 1950 was just $3,300, according to estimates issued by Roy V. Peel, Director, Bureau of the Census, Department of Commerce.

Subsequently, this figure decreased to approximately $2,300 in 1954, and it wasn’t until the 1960s that wages started to exhibit a more positive trend.

“Wage Growth in the United States averaged 6.19 percent from 1960 until 2023, reaching an all-time high of 15.28 percent in April of 2021 and a record low of -5.89 percent in April of 2020,” Trading Economics reported.

The post revealed that a property owner in Pennsylvania made a monthly payment of merely $45.29 for their mortgage, sparking outrage

A Redditor recalled: “My dad managed to be the single working parent as an auto detailer in the 1980s. They bought a house which we stayed in forever. Mom still lives there. I couldn’t imagine an auto detailer in the year 2023 being able to buy a 3 bedroom, 1200 square foot house, as the sole income. And there was no inheritance of any kind.”

“Right now, we’re in this cauldron of uncertainty,” Jonathan J. Miller, the president of Miller Samuel Real Estate Appraisers & Consultants told the New York Times in June.

He continued: “Housing hates uncertainty. The biggest enemy of the housing market is uncertainty, and we have buckets full of uncertainty.”

As per the publication, since December, mortgage rates have nearly doubled — rising to around 6 percent, the highest they’ve been since 2008.

Moreover, In January, a buyer reportedly would have paid around $2,100 a month in principal and interest for a $500,000 home loan. Today, that same loan would cost about $2,900 a month.

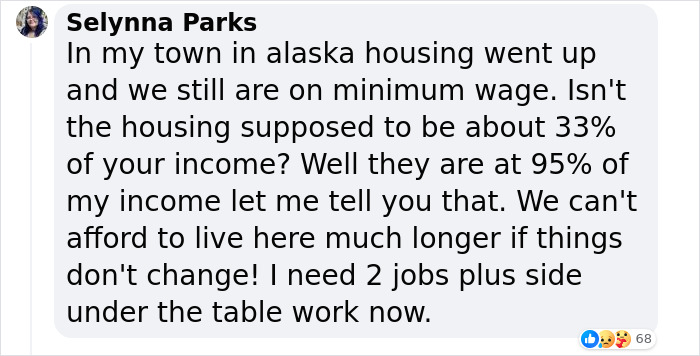

Many people agreed that housing rates are beyond reasonable nowadays

We bought our first house 30 years ago for $60,000 ‐ 3br, 1ba, 1056 sq ft... I just looked it up and it is on the market for $240,000. We didn't pay that for our current house and we are much bigger with a lake on two sides! How tf are younger people supposed to get anywhere like this, it f*****g disgusting.

We bought our first house 30 years ago for $60,000 ‐ 3br, 1ba, 1056 sq ft... I just looked it up and it is on the market for $240,000. We didn't pay that for our current house and we are much bigger with a lake on two sides! How tf are younger people supposed to get anywhere like this, it f*****g disgusting.

42

2