Guy Hints He Won’t Propose Until GF Hands Over Her Bank Password, Gets Icy When She Says “No Way”

Money has a way of exposing fault lines in relationships long before anyone expects them to appear. Conversations that seem practical on the surface like budgets, savings, future plans, can quickly turn emotional when trust, autonomy, and control enter the picture.

For today’s Original Poster (OP), what began as a discussion about preparing for marriage escalated into a disagreement over privacy and access, leaving her questioning whether setting a boundary was reasonable or unfair.

More info: Mumsnet

Money has a funny way of sneaking into relationships, and it grows into deeper questions about security, trust, and your future

Image credits: Getty Images / Unsplash (not the actual photo)

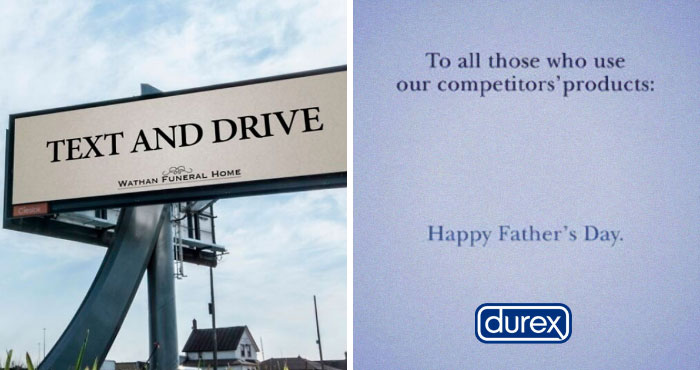

The author was caught off guard when her boyfriend asked for her online banking login, saying he wanted full financial transparency before getting engaged

Image credits: Mikhail Nilov / Pexels (not the actual photo)

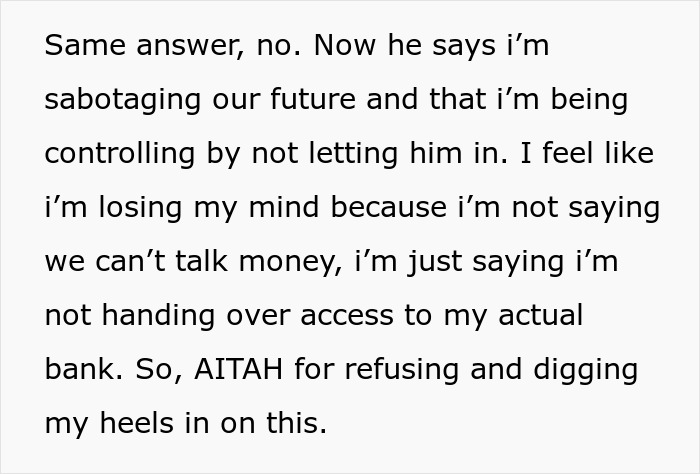

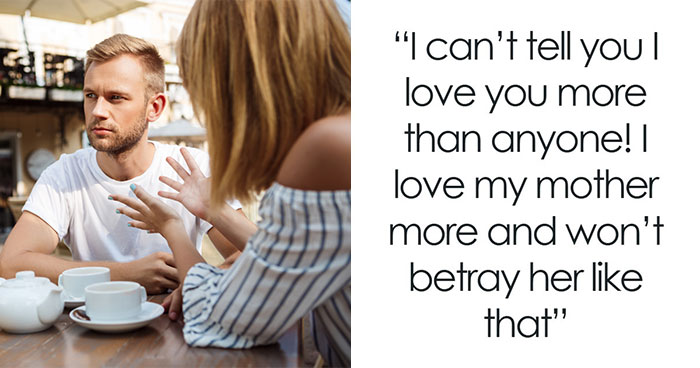

She explained she was open to discussing finances but refused to share passwords, offering compromises like statements, spreadsheets, or a joint account for shared bills

Image credits: karlyukav / Freepik (not the actual photo)

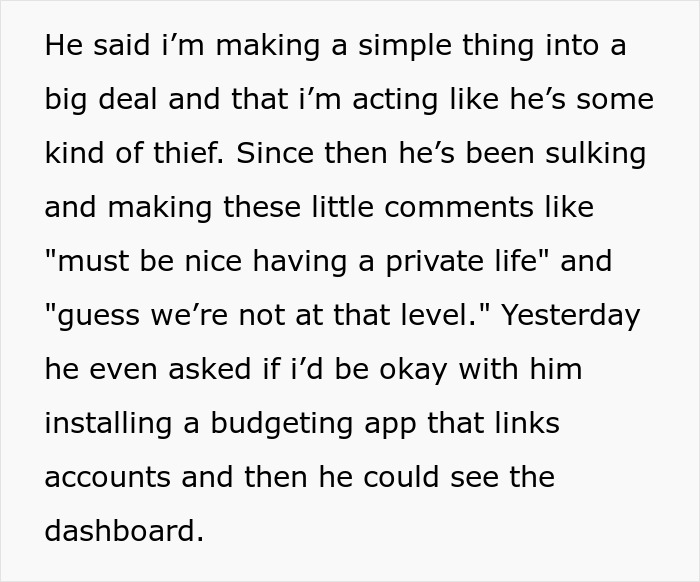

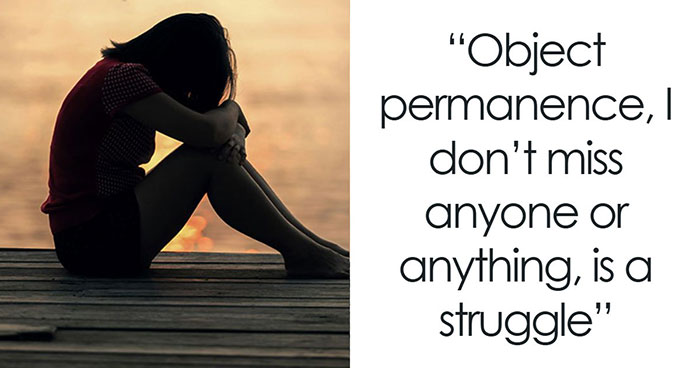

Her boyfriend became defensive and accusatory, implying she was hiding something and making comments about monitoring her spending and wanting “receipts”

Image credits: CopperFieldNote

After she firmly said no, he accused her of sabotaging their future, leaving her questioning whether she’s wrong for holding her boundary

The OP and her boyfriend have been dating for just over two years. She noted that they live together and split bills evenly, and that even though she earns more than him annually, he has reliable income and pays his share on time. However, one day, he brought up this idea and told her he wanted them to “be fully transparent” financially because they plan on getting engaged this year.

The OP assumed this meant talking goals and maybe reviewing credit reports together, but he clarified that what he actually meant was accessing her online banking login credentials so he could watch every deposit, withdrawal, and grocery purchase in real time. He then added that couples planning a future shouldn’t have “private money” and if she refused to share logins, that must mean she’s hiding something.

She offered alternatives for compromise, suggesting she would rather share a spreadsheet tracking expenses, review bank statements together monthly, opening a joint account strictly for rent and shared bills, however, he told her the options were just her “keeping a wall up”. He claimed he wouldn’t touch anything, and that he just didn’t want to “find out later” about hidden debt, mysterious payments, or financial issues.

She told him that she had no hidden debts beyond student loans, yet he kept insisting he needs “receipts”. Still, she refused and he went cold, doling out passive-aggressive statements. He even proposed installing a budgeting app linked to her accounts so he could see a dashboard view, but again when she refused again, he accused her of “sabotaging the future” and being controlling for not letting him in.

Image credits: EyeEm / Freepik (not the actual photo)

Money in relationships is rarely just about numbers, it’s deeply tied to security, values, and trust, which can amplify emotional conflicts, as noted by My LA Therapy. They highlight that financial disagreements are a leading cause of divorce, and that money stress can distort how partners perceive each other, leaving them feeling less supported during arguments.

Fortunately, healthy couples can navigate finances without sacrificing privacy. Monarch emphasizes that transparency doesn’t require sharing passwords or fully merging accounts; instead, partners can have open discussions about income, debts, savings, and goals. Regular check-ins, shared budgets, and honest conversations help build trust and accountability while maintaining personal boundaries.

On the other hand, when a partner pushes for constant access to accounts or demands justifications for spending, it can signal controlling behavior, according to Diana Legal. Tactics like insisting on reviewing receipts or setting allowances may limit autonomy and even lead to financial harm, undermining trust and independence.

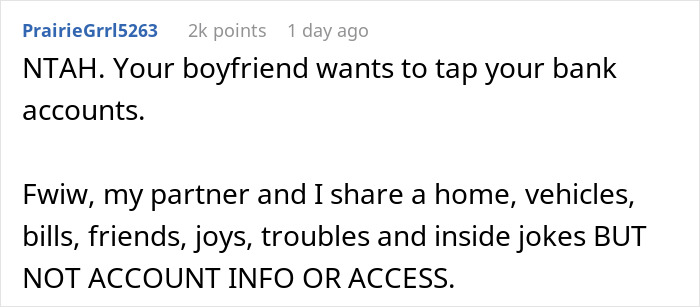

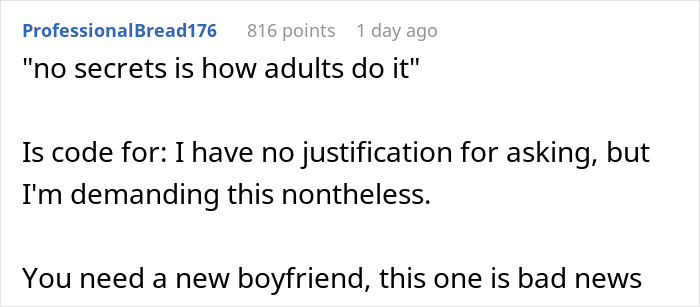

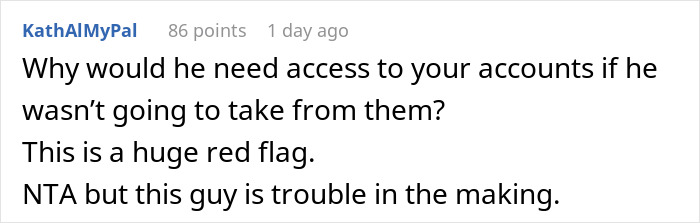

Netizens were firmly on the OP’s side, agreeing that the boyfriend’s request crossed a serious boundary and went beyond “transparency” into control, especially since he framed her refusal as suspicious. What do you think? Where do you draw the line between financial transparency and privacy in a relationship? We would love to know your thoughts!

Netizens pointed out the red flags in his language and noted how he flipped the narrative by calling her controlling

It's good that they are not married. It makes it slightly easier to disentangle. Because this is the red flag of all red flags. Not only does he want completely unnecessary access to her accounts, he's suggesting that in future he should hold sway over her every financial choice. That would be, not just no, but f no for me, hard stop. On the plus side, at least they figured this out before getting married and having kids.

He's not suggesting. He's outright stating.

Load More Replies...On, nonono! You're not married + he doesn't need to know. A joint account sounds like a good idea. I hope OP dumped this guy cuz there are red flags all over. And for him to get pissy + make snide comments? Nah, ain't happening, dude.

Someone telling me im not “allowed” to buy things “shouldn’t” would be gone before getting the entire sentence out. That’s terrifying all by itself! NO ONE is the arbiter of what I buy but me.

Load More Replies...Even married couples don't have access to each other's accounts. Women have learned the hard way that letting a man take control of everything leaves you with nothing when you realize you need out. I don't know if these joker is trying to isolate her like that, or if he's trying to steal from her, but I hope she dumps him.

If he isn't putting money INTO the account, he has no right to know the password or what is IN the account.

Sharing every cent and account is not something that is automatically a good practice. I've seen some couples that I'm very close with do this both ways and honestly, it seems to cause more problems when everything is combined. I applaud couples who can make this work but there's also that risk of resentment that I've seen many times when shared money goes to fund things that everyone isn't in agreement to. Or worse; taking out debt individually and expecting it to be paid with joint funds. 😰

I think it depends on when you get together. My husband and I have been together since high school, so everything we've made, we've made together. We also have similar financial goals, and while I do shop/want more than he does, I don't go overboard, so he doesn't resent me. All of our accounts are joint, including credit cards, savings, etc. I know his login info, and he knows mine (but since we both have access to everything, there usually isnt a reason to go into the other's login in).That being said, for a couple that gets together later in life, after they've established their financial situations, it might make more sense for them to keep things separate and have one joint account for joint expenses. Or if they have vastly different ideas of how to manage their money, keeping separate accounts makes sense.

Load More Replies...Shared finances can work, but it has to be a mutual agreement. My husband and I have been married for almost 17 years, and we always had only joint accounts. Fortunately it works for us. But it's something we discussed and decided together when we decided to get married. It was the option we picked, not a request or even worse a demand from one to the other.

This is how controlling and a*****e relationships start. "If you really loved me, you'd let me check your phone/email/social media/bank account, etc." A perpetrator will want control over the victim's finances so that they find it much harder to escape and so they become dependent on them.

It's good that they are not married. It makes it slightly easier to disentangle. Because this is the red flag of all red flags. Not only does he want completely unnecessary access to her accounts, he's suggesting that in future he should hold sway over her every financial choice. That would be, not just no, but f no for me, hard stop. On the plus side, at least they figured this out before getting married and having kids.

He's not suggesting. He's outright stating.

Load More Replies...On, nonono! You're not married + he doesn't need to know. A joint account sounds like a good idea. I hope OP dumped this guy cuz there are red flags all over. And for him to get pissy + make snide comments? Nah, ain't happening, dude.

Someone telling me im not “allowed” to buy things “shouldn’t” would be gone before getting the entire sentence out. That’s terrifying all by itself! NO ONE is the arbiter of what I buy but me.

Load More Replies...Even married couples don't have access to each other's accounts. Women have learned the hard way that letting a man take control of everything leaves you with nothing when you realize you need out. I don't know if these joker is trying to isolate her like that, or if he's trying to steal from her, but I hope she dumps him.

If he isn't putting money INTO the account, he has no right to know the password or what is IN the account.

Sharing every cent and account is not something that is automatically a good practice. I've seen some couples that I'm very close with do this both ways and honestly, it seems to cause more problems when everything is combined. I applaud couples who can make this work but there's also that risk of resentment that I've seen many times when shared money goes to fund things that everyone isn't in agreement to. Or worse; taking out debt individually and expecting it to be paid with joint funds. 😰

I think it depends on when you get together. My husband and I have been together since high school, so everything we've made, we've made together. We also have similar financial goals, and while I do shop/want more than he does, I don't go overboard, so he doesn't resent me. All of our accounts are joint, including credit cards, savings, etc. I know his login info, and he knows mine (but since we both have access to everything, there usually isnt a reason to go into the other's login in).That being said, for a couple that gets together later in life, after they've established their financial situations, it might make more sense for them to keep things separate and have one joint account for joint expenses. Or if they have vastly different ideas of how to manage their money, keeping separate accounts makes sense.

Load More Replies...Shared finances can work, but it has to be a mutual agreement. My husband and I have been married for almost 17 years, and we always had only joint accounts. Fortunately it works for us. But it's something we discussed and decided together when we decided to get married. It was the option we picked, not a request or even worse a demand from one to the other.

This is how controlling and a*****e relationships start. "If you really loved me, you'd let me check your phone/email/social media/bank account, etc." A perpetrator will want control over the victim's finances so that they find it much harder to escape and so they become dependent on them.

Dark Mode

Dark Mode

No fees, cancel anytime

No fees, cancel anytime

30

18