Son Left Out Of Father’s Will Leaves Stepmother And Stepbrothers With Massive Debt

Parents seldom discuss inheritance with their adult children. According to a survey conducted by Irwin Mitchell, only 30% of parents over the age of 55 have talked to their children about how they will be dividing their estate. And they really ought to do it more often, since disputes and disagreements can cause a lot of headaches for the inheritors.

This man found out that his father didn’t leave him any financial assets and made his wife and three other sons the beneficiaries. So, he sold all the loans his father had taken out from him and essentially drowned his stepfamily in debt. Still, he wondered whether he was the jerk in this situation and if he could have handled it differently.

A father wrote his first son out of his will and left everything to his second family

Image credits: lovelyday12 / freepik (not the actual photo)

So, the son decided to sell the loans his father had taken out from him and left the stepfamily to fend for themselves

Image credits: freepik (not the actual photo)

Image credits: armmypicca / freepik (not the actual photo)

Image credits: jet-po / freepik (not the actual photo)

Image credits: Boring_Tower3399

Research shows that the number of parents who treat adult children unequally in their wills has risen

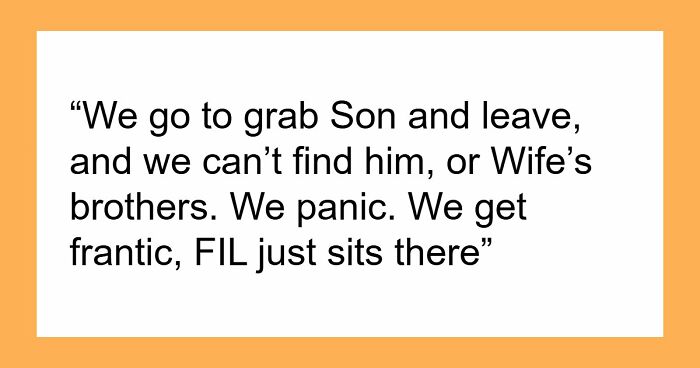

Inheritances are tricky to get right. There’s a big chance that some family members will be unhappy even if a person divides their assets equally among everyone. However, family history often complicates things.

Compared to the 1990s, more parents are leaving their children different amounts in their wills. According to a study by the National Bureau of Economic Research, the number of parents who treated their children unequally in their wills rose by 35% between 1995 and 2010.

One of the predictors for unequal treatment is often whether the parent has stepchildren. The co-author of the NBER study, Robert A. Pollak, explained to The New York Times that stepchildren often get the upper hand. “Parents without stepchildren were much more likely to treat all their kids equally than parents with stepchildren.”

Of course, the three sons in this story weren’t stepchildren, but they were still a blended family. And that, according to experts, is one of the main things that complicates dividing one’s estate equally.

Interestingly, divorced individuals are more likely to have conversations with their kids about inheritance, according to the Irwin Mitchell survey. 28% of the respondents said they had done so, while the average was 18%. However, from this story, it seems that the same rule might not apply to those who have remarried.

Parents may choose to disinherit children for many different reasons, most commonly because of a lack of contact

Image credits: Sincerely Media / Unsplash (not the actual photo)

Finding out that your parent has excluded you from the will is never easy. Although in this story, the son doesn’t seem to hold any ill will against his father, being disinherited can sometimes hurt emotionally far more than financially.

In most cases, parents disinherit children they’ve had little or no contact with during the last years of their lives. Denise Jones, the director of Lovingly Managed, a business helping to manage the financials after losing a loved one, reiterates that.

“It’s often because the kids don’t bother with them and usually because there’s been a huge falling out and they don’t speak any more,” she told The Guardian. “Sometimes it’s because the child has married someone they don’t like. I also get quite a few people wanting to give it to their neighbours because they feel their children have neglected them.”

Other times, parents choose to leave the bigger portion (or all, as was the case in this story) of their inheritance to children who aren’t doing so well financially. There’s a big chance that’s the reason the father in this story left no money for his first son as well. He knew that the author was a good businessman and could take care of his financial well-being. And judging from his description of his half-siblings, they probably wouldn’t be able to do the same.

Unequal inheritances can aggravate difficult half-sibling relationships and cause resentment toward the parent

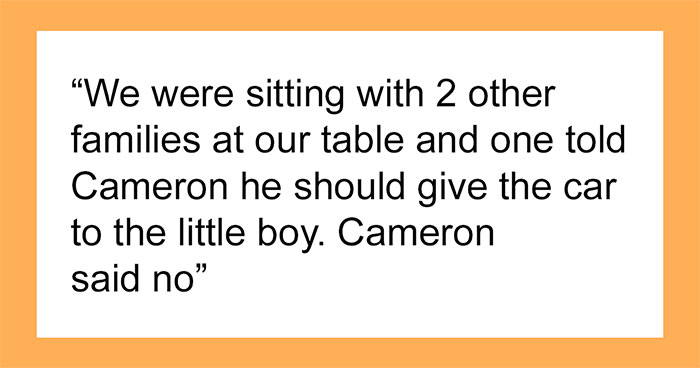

Estate solicitors say that disinheriting a child can be hurtful even when they’re better off financially than other siblings. To avoid family conflicts and potential resentment, the parents ought to explain their reasoning.

A certified executor advisor and founder of NEXsteps recommends writing a letter that accompanies the will. “While not legally binding, it can provide closure and reduce the emotional impact on those left out,” she writes.

Attorney Thomas Fortenberry at Silverleaf Legal Group notes that letters can sometimes feel impersonal and advises talking face-to-face. If that seems too difficult or emotionally charged, video messages might be the way.

“I’ve had feedback from families that these videos were incredibly meaningful – they captured the parent’s personality and made the explanation feel more intimate and sincere,” he writes. “Plus, there’s less room for misinterpretation when you can hear tone and see facial expressions.”

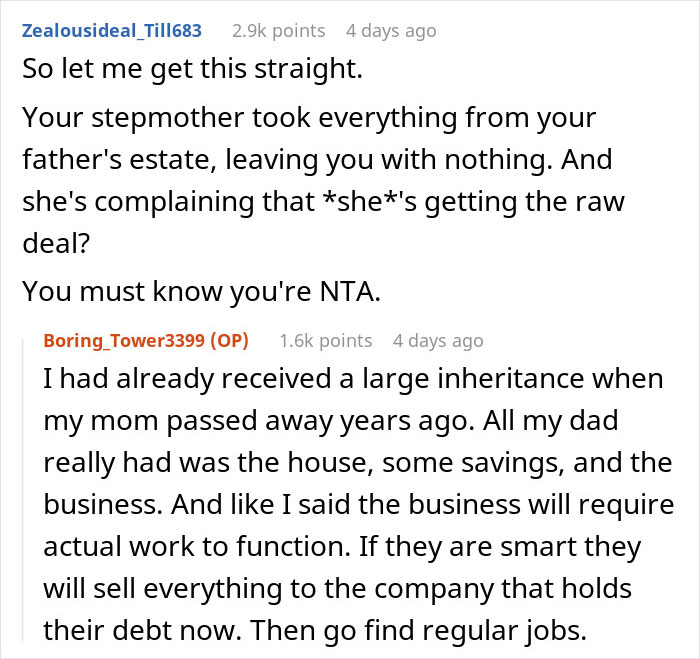

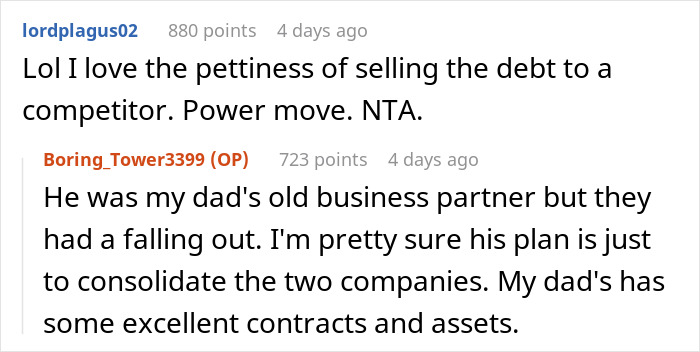

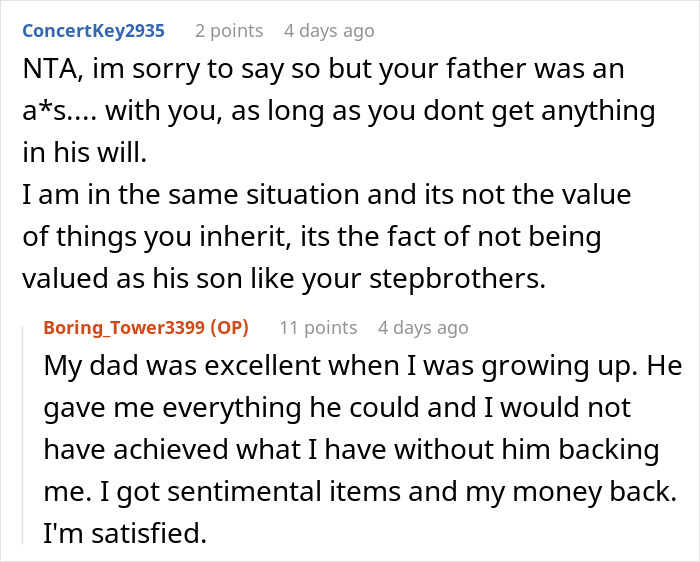

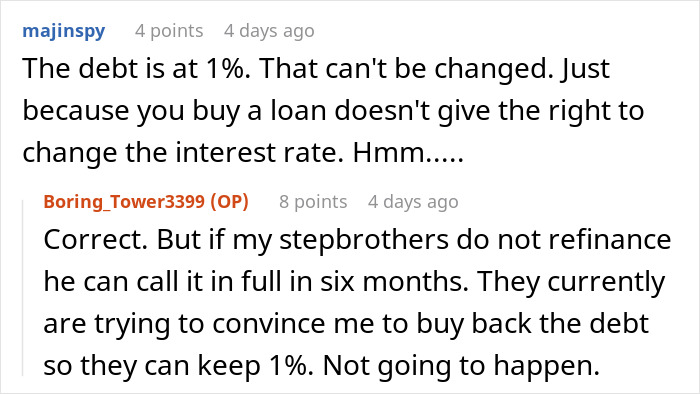

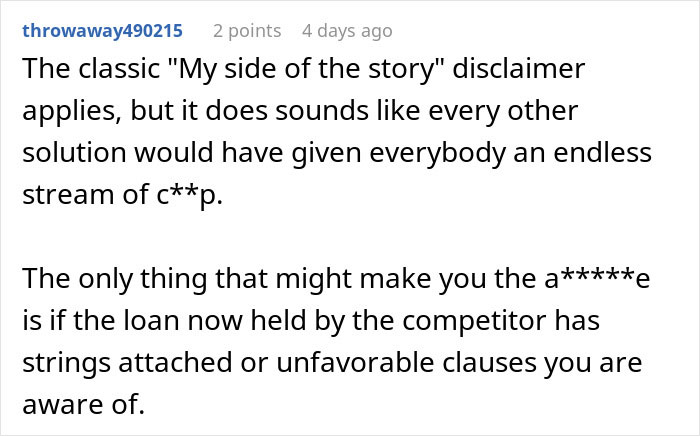

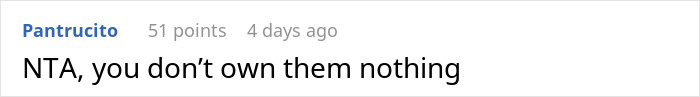

In the comments, the son clarified he didn’t do this out of revenge and is grateful to his father for everything

Commenters absolved the son, since, with his father no longer in the picture, it was purely a business decision

Poll Question

Thanks! Check out the results:

Explore more of these tags

I love the bit where he says "to put your minds at rest the debt is in the mid 7 figures". So something like 5 million, dollars, presumably. That is not an insignificant amount, the way he dismisses it as trivial says more about him than the rest of the post.

Mid 7 figures, could be like 5. yes. but jesus. this is money that could feed so many people. this is rich people problems.

Load More Replies...A lot of this just doesn’t ring true . Like the author has no idea how loans work. Interesting attempt at creative writing.

I love the bit where he says "to put your minds at rest the debt is in the mid 7 figures". So something like 5 million, dollars, presumably. That is not an insignificant amount, the way he dismisses it as trivial says more about him than the rest of the post.

Mid 7 figures, could be like 5. yes. but jesus. this is money that could feed so many people. this is rich people problems.

Load More Replies...A lot of this just doesn’t ring true . Like the author has no idea how loans work. Interesting attempt at creative writing.

Dark Mode

Dark Mode

No fees, cancel anytime

No fees, cancel anytime

18

10