Guy Makes It Very Inconvenient For This Company After It Tried To Charge Him $14.95 ‘Convenience’ Fee For Online Payments

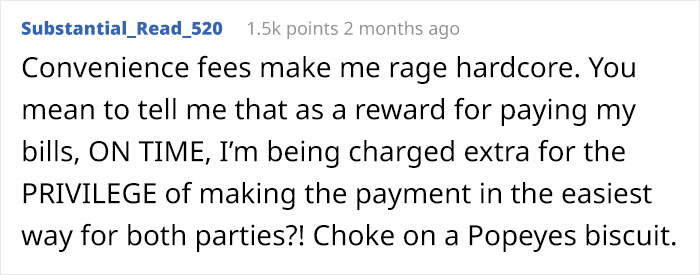

Revenge is truly sweet when you know for a fact that someone was trying to pull a fast one on you. And among the hierarchy of dumb and evil things that exist out there in the world, ‘convenience’ fees sit comfortably in the top 100.

Put simply, convenience fees are a company’s way to cover the cost of processing certain types of payments. And some even charge them for making payments online. These can quickly add up over many months.

Redditor u/TheUncleBob shared how the company that bought his mortgage tried to get him to pay a $14.95 convenience fee for making the monthly payments online. Frankly, that was ridiculous. So instead, he got some revenge by making things far more inconvenient for them. Scroll down for the full story, dear Pandas.

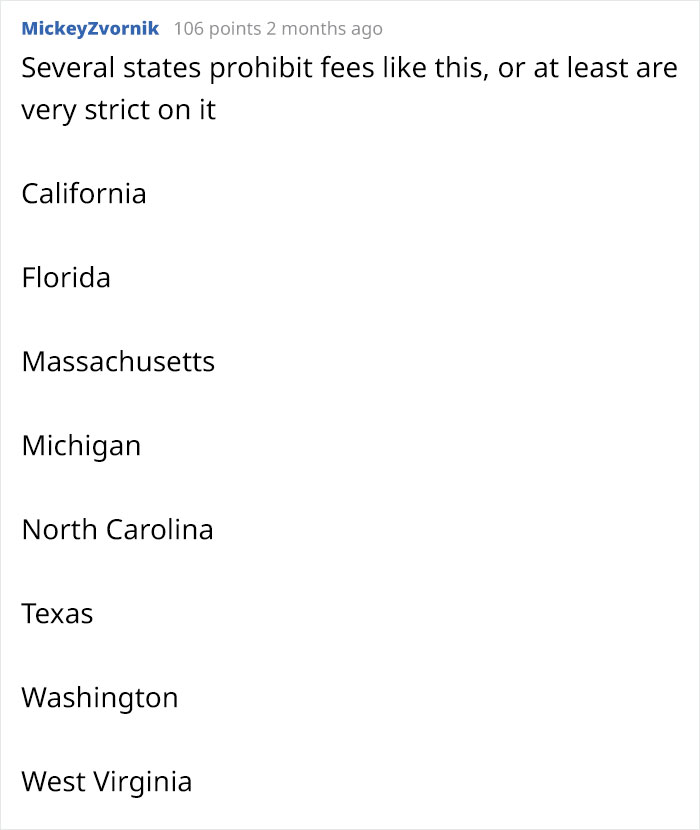

Some companies charge ‘convenience’ fees to cover their processing costs. In some states, this is illegal; in others, it’s perfectly legal

Image credits: CardMapr (not the actual photo)

One redditor shared how he got back at a company that bought up his mortgage when they wanted him to pay a fee for making payments online

The redditor’s story on r/MaliciousCompliance went viral and got over 24.1k upvotes. What’s more, u/TheUncleBob’s tale inspired other internet users to share their own experiences with mortgage payments.

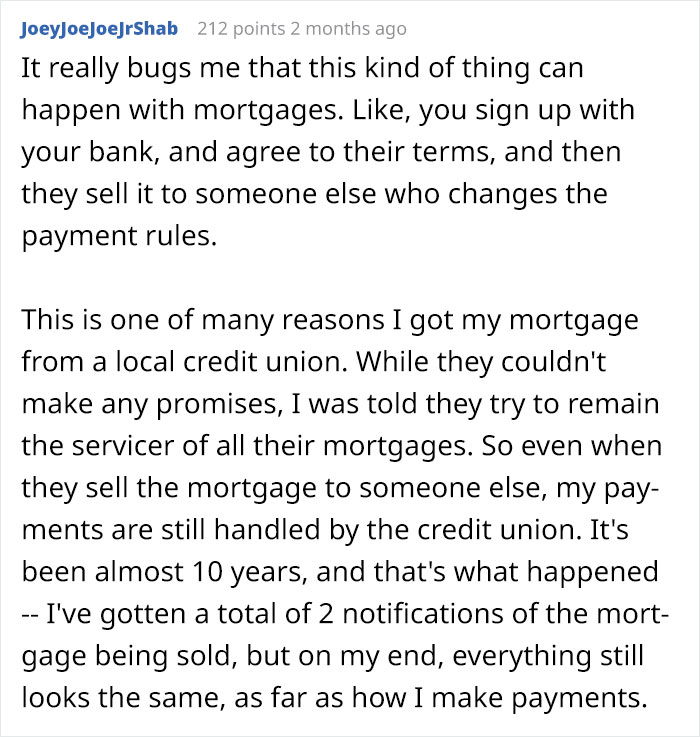

To say that there’s a dark side to some companies that buy up mortgages would be an understatement. Emperor Palpatine could take lessons from them. It is vital to read the fine print before agreeing to anything. And even then you might miss something if you don’t have some insider info on how these companies operate. Luckily, Reddit is more than up to the task and gladly shared some insights.

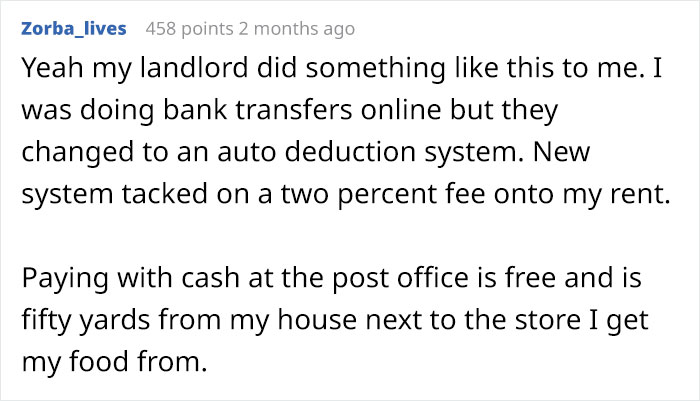

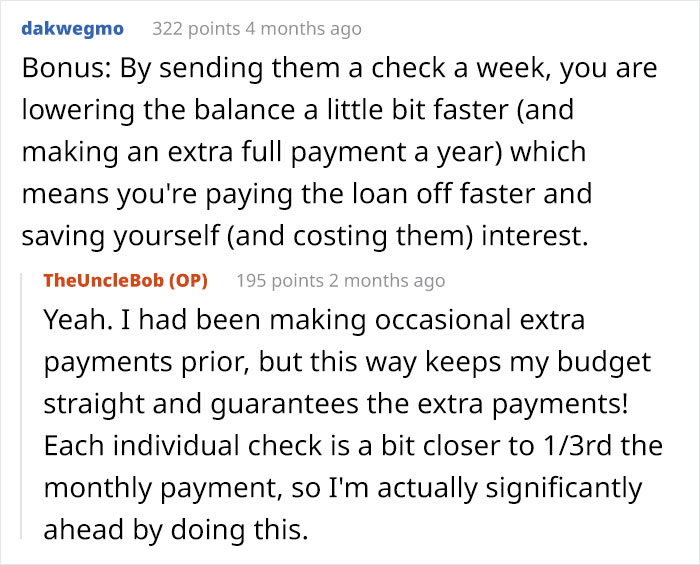

The redditor made things marginally more inconvenient for the company by sending them weekly checks instead of one monthly one. He also mentioned that he would’ve sent them a small check every single day of the month if he could get away with it.

A convenience fee is usually charged by businesses for payments that are made through alternative channels rather than by cash, check, or ACH (Automated Clearing House, an electronic network for financial transactions in the United States).

Convenience fees are typically charged for payments for taxes and tuition and can either be flat fees or a percentage of the total amount paid.

“Convenience fees are charged by businesses to cover the cost they pay to payment processing companies for when a customer pays by credit card. A convenience fee is different from a surcharge, which is a charge simply for just using a credit card. Surcharges are illegal in some states. All businesses have to follow the policies of payment processing providers and government laws when it comes to convenience fees and surcharges,” Investopedia explains.

“Convenience fees can help a business cover some of the costs imposed through electronic payment processing. Businesses have to pay a merchant fee every time one of their customers uses a credit card.”

Here’s what some redditors had to say. Some of them shared their own experiences with mortgage payments

I am guessing this is in the US? It really shocks me that you guys actually still use checks! It seems so crazy. I've had my own bank account for about 23 years now, and never had (or needed) a check... (talking about Europe)

The US banking system is pretty primitive and is less protective of customers. A simple bank transfer between two accounts is quite difficult. I am trying to remember the last time I wrote a cheque - must be several years ago - though I receive them quite often, as my parents and MIL do not do online banking. I can pay them in through the bank's app on my phone.

Load More Replies...This is great!! Convenience fees are a rip off, not to mention unethical. But I'm still curious as to why America still uses cheques - I haven't used a cheque in years!

Pretty much only old people use checks in the day to day, but there are rare situations where you end up still having to use a check.

Load More Replies...I really don’t see the difference in this vs having set up auto pay. It’s not the mortgage company can decide to take more out. Also, I highly doubt the mortgage company cares at all that this guy is doing this. They probably haven’t even noticed since it more than likely just comes through as an e-check which is the same as setting up auto pay. People are weird and they think they are being so clever but really they are just showing extreme stupidity

Wondered at first why he's not going with auto-pay as it is common to do so in Germany. But than I got stopped by the "our mortgage got sold for the sixth time" and wtf banana republic is he living in that mortgages get sold? I'd go solid if my Bank sold my mortgage! ò.ó

Don't you have direct debits?? All my bills are debited on the 1st of every month, job done

He said in the post he didn't want to give his account info to the mortgage company

Load More Replies...I really do not understand how "selling loans" works. I sort of get the concept of selling bad debt, as I've read about it a bit(and still think it's super f****d up), but I don't understand how you can sell a loan. So you sign a contract with the creditor, and they're allowed to unilaterally change who your contract is with without consulting you about it? Am I understanding that right? Like, absolutely nowhere in contract law would that be allowed where I live.

It's probably just another business over there. Here in Belgium the bank you get your loan from handles it 100% of the time for 100% of the amount, except if you or them go bankrupt but banks already make more than enough money when they can lend at almost 0% from the national or central bank and you have to pay them for almost everything now. Banks only like clients with loads of money because it allows them to earn more but ordinary people are a cost for a bank and if they weren't legally obliged to accept us as clients they'd never want us.

Load More Replies...The xenophobia against the USA is staggering on bored panda comments. It's kind of embarrassing for the people who post those comments. I feel bad for you.

Well people in the US seem to get shafted a lot by business and most of it seem to find it normal and politically nothing is done for the people, money and companies always come first. Perhaps they need a revolution and a reality check because it only seems like a good place for rich people.

Load More Replies...I detest companies that try to force you to let them auto debit from your bank account.

The "convenience" fee is actually a fee to recoup some of the costs that the mortgage company is charged by the bank to accept the credit card. It actually hurts the mortgage company more to use the credit card and pay the $15 because the mortgage company is probably paying the credit card company $60.

Ya I'm not a fan of "convenience" fees either, the only person gaining from said fees are the ones charging the fees... My internet and phone provider is Arvig and they too charge a very very convenient fee (for them) of $3 dollars for making a payment by phone and I think so online as well (not 100% entirely sure) which is horse doody because it has to be paid (at least it was in my situation). What exactly is a "convenience fee" anyways? as it seems to be convenient only for the company issuing it ammiright?

We've moved past online payments as being a convenience for the customer. It is a convenience for the business, it's their turn to pony up. With convenience fees so prevalent, I'm using cash and checks far more frequently in recent years. Need to transfer money from one bank to another $25 fee, nope I'll write a check and use my phone to deposit it into my account, faster too.

Thanks everyone for your answers. I didn't think banking would be that behind in the US and it appears it's not. And I do agree that sometimes a cheque is needed (we call them bank cheques, they're cut by your bank), like buying a house or car. Any really big ticket item, I guess. And for paper trail!!!

My former employer used to issue paper checks every week. And on top of that would charge me $10 a week to process my deductions.

You think that's bad? If I get an income tax check for a hundred some dollars and I owe a little bit on child support it goes towards that with a $29 fee.

I have a monthly bill that charges a convenience fee to pay online. Their office is on my way to work, so I write a check and drop it in the overnight slot. I don't even pay for a stamp.

I thought this is what everyone does! I've had my credit union pay my mortgage and all other bills in the same way for at least 15 years. Who has the mental bandwidth to go online and remember to pay all your bills manually?

Wow. It sounds like you all use some pretty crappy banks. I have been with my credit union for years and never had any of these troubles. Transfers, easy! Bill pay, Done! The only time I have to write a check is for those antiquated contractors.

Fema tried to charge my mom more than the balance due on her deed. She went to the bank. Paid the house off. Sent a copy to fema that since she owns the property, which isn't even in a flood zone but fema decided it was, she doesn't need them. Because fema tries to cover the people owing on properties for loss against the bank. But when it goes from $300 to $900 in 6 months an she owed like $1000 to the bank, she got her property free and clear. Still no floods 15 years later.

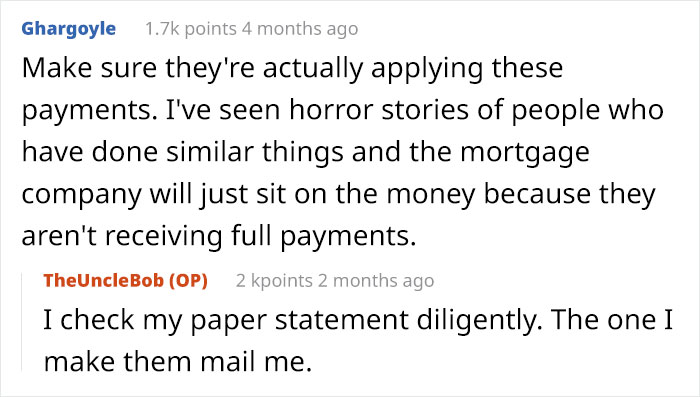

From one of the commenters named Gargoyle who was talking about how the bank 'sits' on payments if it isn't the full amount... I work for a bank and we can't apply a partial payment to a full payment due. The bank will place it into what's called 'excess' or apply it to principle, depending on how you send it in. Laws are very strict about how we need to report late payments-- making a partial payment will not stop late fees or credit reporting after 30 days. If you want to split your payment then you, as the person who chose to do that, will have to call or send a message to us asking to please apply both payments to the bill dated ___ to cover the full amount. It's not a big deal a lot of people do that. But it's the customer's responsibility to pay their bill in full by the due date including giving us time apply the 2 partial payments. Keep it simple and set up an autopay.

The small American city in which I live taxes us at a rate of three times what the surrounding townships tax their residents. Included in our hefty tax bill is the 2% "administrative fee" which covers the cost of city employees registering our taxes, and a 2% convenience fee, to cover the expense of their computer receiving our taxes.

Dude, you need to get a hobby, or volunteer, or whatever interests you. While I agree about the convenience fee being ridiculous, no one cares how you pay just that it is in on time so you are wasting your time and efforts.

Nobody forced you to read this. Maybe you should get a hobby, or volunteer, or whatever interests you instead of taking the time to read it and comment.

Load More Replies...I am guessing this is in the US? It really shocks me that you guys actually still use checks! It seems so crazy. I've had my own bank account for about 23 years now, and never had (or needed) a check... (talking about Europe)

The US banking system is pretty primitive and is less protective of customers. A simple bank transfer between two accounts is quite difficult. I am trying to remember the last time I wrote a cheque - must be several years ago - though I receive them quite often, as my parents and MIL do not do online banking. I can pay them in through the bank's app on my phone.

Load More Replies...This is great!! Convenience fees are a rip off, not to mention unethical. But I'm still curious as to why America still uses cheques - I haven't used a cheque in years!

Pretty much only old people use checks in the day to day, but there are rare situations where you end up still having to use a check.

Load More Replies...I really don’t see the difference in this vs having set up auto pay. It’s not the mortgage company can decide to take more out. Also, I highly doubt the mortgage company cares at all that this guy is doing this. They probably haven’t even noticed since it more than likely just comes through as an e-check which is the same as setting up auto pay. People are weird and they think they are being so clever but really they are just showing extreme stupidity

Wondered at first why he's not going with auto-pay as it is common to do so in Germany. But than I got stopped by the "our mortgage got sold for the sixth time" and wtf banana republic is he living in that mortgages get sold? I'd go solid if my Bank sold my mortgage! ò.ó

Don't you have direct debits?? All my bills are debited on the 1st of every month, job done

He said in the post he didn't want to give his account info to the mortgage company

Load More Replies...I really do not understand how "selling loans" works. I sort of get the concept of selling bad debt, as I've read about it a bit(and still think it's super f****d up), but I don't understand how you can sell a loan. So you sign a contract with the creditor, and they're allowed to unilaterally change who your contract is with without consulting you about it? Am I understanding that right? Like, absolutely nowhere in contract law would that be allowed where I live.

It's probably just another business over there. Here in Belgium the bank you get your loan from handles it 100% of the time for 100% of the amount, except if you or them go bankrupt but banks already make more than enough money when they can lend at almost 0% from the national or central bank and you have to pay them for almost everything now. Banks only like clients with loads of money because it allows them to earn more but ordinary people are a cost for a bank and if they weren't legally obliged to accept us as clients they'd never want us.

Load More Replies...The xenophobia against the USA is staggering on bored panda comments. It's kind of embarrassing for the people who post those comments. I feel bad for you.

Well people in the US seem to get shafted a lot by business and most of it seem to find it normal and politically nothing is done for the people, money and companies always come first. Perhaps they need a revolution and a reality check because it only seems like a good place for rich people.

Load More Replies...I detest companies that try to force you to let them auto debit from your bank account.

The "convenience" fee is actually a fee to recoup some of the costs that the mortgage company is charged by the bank to accept the credit card. It actually hurts the mortgage company more to use the credit card and pay the $15 because the mortgage company is probably paying the credit card company $60.

Ya I'm not a fan of "convenience" fees either, the only person gaining from said fees are the ones charging the fees... My internet and phone provider is Arvig and they too charge a very very convenient fee (for them) of $3 dollars for making a payment by phone and I think so online as well (not 100% entirely sure) which is horse doody because it has to be paid (at least it was in my situation). What exactly is a "convenience fee" anyways? as it seems to be convenient only for the company issuing it ammiright?

We've moved past online payments as being a convenience for the customer. It is a convenience for the business, it's their turn to pony up. With convenience fees so prevalent, I'm using cash and checks far more frequently in recent years. Need to transfer money from one bank to another $25 fee, nope I'll write a check and use my phone to deposit it into my account, faster too.

Thanks everyone for your answers. I didn't think banking would be that behind in the US and it appears it's not. And I do agree that sometimes a cheque is needed (we call them bank cheques, they're cut by your bank), like buying a house or car. Any really big ticket item, I guess. And for paper trail!!!

My former employer used to issue paper checks every week. And on top of that would charge me $10 a week to process my deductions.

You think that's bad? If I get an income tax check for a hundred some dollars and I owe a little bit on child support it goes towards that with a $29 fee.

I have a monthly bill that charges a convenience fee to pay online. Their office is on my way to work, so I write a check and drop it in the overnight slot. I don't even pay for a stamp.

I thought this is what everyone does! I've had my credit union pay my mortgage and all other bills in the same way for at least 15 years. Who has the mental bandwidth to go online and remember to pay all your bills manually?

Wow. It sounds like you all use some pretty crappy banks. I have been with my credit union for years and never had any of these troubles. Transfers, easy! Bill pay, Done! The only time I have to write a check is for those antiquated contractors.

Fema tried to charge my mom more than the balance due on her deed. She went to the bank. Paid the house off. Sent a copy to fema that since she owns the property, which isn't even in a flood zone but fema decided it was, she doesn't need them. Because fema tries to cover the people owing on properties for loss against the bank. But when it goes from $300 to $900 in 6 months an she owed like $1000 to the bank, she got her property free and clear. Still no floods 15 years later.

From one of the commenters named Gargoyle who was talking about how the bank 'sits' on payments if it isn't the full amount... I work for a bank and we can't apply a partial payment to a full payment due. The bank will place it into what's called 'excess' or apply it to principle, depending on how you send it in. Laws are very strict about how we need to report late payments-- making a partial payment will not stop late fees or credit reporting after 30 days. If you want to split your payment then you, as the person who chose to do that, will have to call or send a message to us asking to please apply both payments to the bill dated ___ to cover the full amount. It's not a big deal a lot of people do that. But it's the customer's responsibility to pay their bill in full by the due date including giving us time apply the 2 partial payments. Keep it simple and set up an autopay.

The small American city in which I live taxes us at a rate of three times what the surrounding townships tax their residents. Included in our hefty tax bill is the 2% "administrative fee" which covers the cost of city employees registering our taxes, and a 2% convenience fee, to cover the expense of their computer receiving our taxes.

Dude, you need to get a hobby, or volunteer, or whatever interests you. While I agree about the convenience fee being ridiculous, no one cares how you pay just that it is in on time so you are wasting your time and efforts.

Nobody forced you to read this. Maybe you should get a hobby, or volunteer, or whatever interests you instead of taking the time to read it and comment.

Load More Replies...

93

52