“Stop The Madness”: Lady Bashed For Refusing To Lend Bro And SIL $15k On Top Of What They Owe Her

The reason most people advise never mixing money and family is that it can go wrong very easily and lead to conflicts. This is usually due to irresponsible borrowers who make excuses to avoid repaying their loans, and lenient lenders who lack clear boundaries.

This is exactly why a young woman found herself in a tricky situation, because her brother and sister-in-law insisted on continuing their extravagant lifestyle despite owing her a lot of money. In spite of all that, they still expected her to loan them more cash.

More info: Reddit

When it comes to family, it can be really tough to say no to helping them out financially, even if it becomes a problem

Image credits: lazy_bear / Freepik (not the actual photo)

The poster explained that over time, she had lent her brother and his wife $65,000 for their house deposit, wedding expenses, and to pay off a loan

Image credits: freepik / Freepik (not the actual photo)

Even though the woman had specified that she would not help out again financially, her brother asked for $15,000 despite living an extravagant lifestyle

Image credits: freepik / Freepik (not the actual photo)

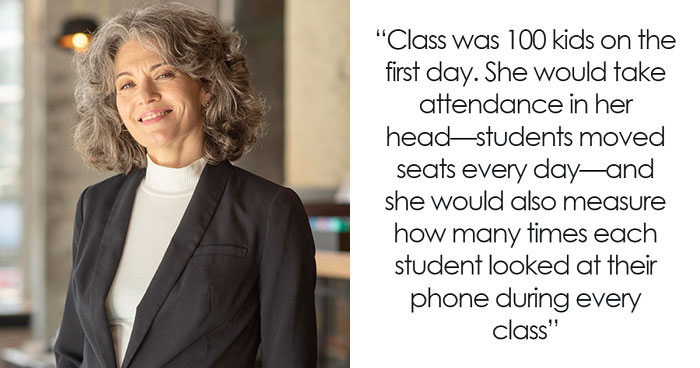

The poster refused to help the couple out and told them that they had created this problem due to their irresponsible financial behavior, which made them angry

Image credits: komok-vm / Freepik (not the actual photo)

The woman later found out that her brother was $50,000 in debt and that his wife was refusing to help him out financially, as she had already given him money before

Image credits: Routine_Doughnut2721

The woman finally decided to cut ties with her brother and sister-in-law, but got berated by her mother for setting such boundaries

It seems like the poster had been supporting her brother and sister-in-law financially for quite a while by loaning them money for their house deposits, wedding, and debts. Despite that, the man didn’t seem to recognize her sacrifice and expected her to give him more money to pay off other loans that he had.

It might seem odd for a person to loan so much money to their family, but studies have found that around 20% of adults in the U.S. receive financial support from their loved ones. The reason this is so common is that it’s often easier to borrow money from someone you know, and there is often a certain level of trust involved.

Luckily, in this situation, the woman didn’t want to help her brother out anymore, and she made it clear to him that he was being financially irresponsible. Obviously, this didn’t go down well with him or his wife, and they criticized her for saying that. In fact, the sister-in-law said that she had never spent a dollar of her husband’s money, which the OP found absolutely absurd.

It can definitely be tough to see people wasting money if they have taken a sizeable loan from you. That’s why experts advise borrowers to focus on repaying money first before spending it on unnecessary lifestyle purchases, as this might make the lender feel resentful.

Image credits: drobotdean / Freepik (not the actual photo)

Despite being called out by the poster for their spendthrift behavior, the couple didn’t seem to realize what they were doing wrong. Instead, they criticized her for not being able to loan them even more money. Even the OP’s mom took their side and said she’d be willing to lend them the cash.

According to experts, the best thing to do when you don’t want to loan money to financially irresponsible people is to be honest with them about your capacity to help. If they are truly struggling, you can guide them on ways to save, figure out where they might be overspending, and suggest resources like a credit counselor.

There are many ways to help out people who need money, without having to sacrifice your savings in the process. Luckily, the OP had finally had enough, and she didn’t want to keep using her own money to keep bailing out her brother, who wasn’t able to figure out his finances on his own.

Saying no and cutting ties with the couple must have been tough for the woman to do, but she knew that she finally had to put herself first. Obviously, this created a lot of conflict between her and her family, but hopefully, they’ll later understand why she had to draw such a line in the sand.

Do you think the woman did the right thing, or should she have handled this situation differently? Let us know your thoughts and suggestions, if any.

Folks were shocked by the couple’s behavior and felt that the woman had done the right thing by finally setting boundaries with them

Poll Question

Thanks! Check out the results:

Explore more of these tags

When anyone - especially family - asks you for a significant personal loan, your first question should be "Have you tried a bank?" When they say the bank turned them down, you immediately reply "If the bank cannot find a way to trust you, why should I?" Then walk away before they can drag out the whole "......but famileeeeee...." scam.

Both the OP and their family seem to inhabit a different world from the one I know, nay, a different universe, even. They explain things as if this sort of entitlement is normal among SE Asian families, but I find that hard to believe. Also it's not clear where their own money is coming from, or just how wealthy they are - I mean, obviously must be quite well off to write-off $65 in 'loans' for which they don't seem to have any expectation of repayment.

When anyone - especially family - asks you for a significant personal loan, your first question should be "Have you tried a bank?" When they say the bank turned them down, you immediately reply "If the bank cannot find a way to trust you, why should I?" Then walk away before they can drag out the whole "......but famileeeeee...." scam.

Both the OP and their family seem to inhabit a different world from the one I know, nay, a different universe, even. They explain things as if this sort of entitlement is normal among SE Asian families, but I find that hard to believe. Also it's not clear where their own money is coming from, or just how wealthy they are - I mean, obviously must be quite well off to write-off $65 in 'loans' for which they don't seem to have any expectation of repayment.

Dark Mode

Dark Mode

No fees, cancel anytime

No fees, cancel anytime

35

5