Man Calls Off Wedding After Learning He And Fiancée Are Financially Worlds Apart

Some couples bond over long walks on the beach. Others connect through shared playlists, favorite foods, or mutual hatred of small talk. And then there are those who discover, sometimes far too late, that their biggest incompatibility isn’t about love languages or where to live, but about money.

Today’s Original Poster (OP) was ready to get married to the love of his life until they engaged in discussions about money. What followed left him feeling greatly disappointed and questioning the future of their relationship.

More info: Reddit

Talking about money before marriage isn’t romantic, glamorous, or Instagram-worthy, but it might be one of the most important conversations a couple ever has

Image credits: Frolopiaton Palm / Freepik (not the actual photo)

The author and his fiancée began planning their wedding, but conflict arose when she revealed plans for a lavish $35K ceremony that shocked him

Image credits: pressmaster / Freepik (not the actual photo)

A deeper financial discussion exposed major differences, including her lack of savings, significant credit card debt, and reliance on his savings to fund the wedding

Image credits: The Yuri Arcurs Collection / Freepik (not the actual photo)

Tensions escalated when she demanded he stop financially supporting his brother, despite his long-standing commitment to help him recover from medical debt

Image credits: anonymous

Realizing their values around money, family, and priorities didn’t align, he called off the wedding and ended the relationship

The OP and his fiancée had been together for three and a half years and engaged for six months, seemingly on solid ground. However, during what was supposed to be an initial meeting with a wedding planner, he realized the fiancée had already envisioned and priced out the entire event and that the total cost would be around $35,000.

For the OP who lives frugally, owns a paid-off home, and values financial security, this number felt absurd, especially when he remembered that his fiancée barely made more than that a year. That then prompted a deeper financial discussion, which only made things worse. While he had savings, stability, and a clear emergency plan, he discovered that she had no savings at all.

Despite living with her parents and having minimal expenses, she was carrying credit card debt and only making minimum payments. When she suggested he could simply dip into his savings to fund the wedding, he explained those funds were intentionally set aside as an emergency buffer. However, the real tipping point came when she learned he had been covering his brother’s mortgage for over a year.

The reason for this was because his brother had paid for much of his college education and later fell into debt due to his child’s medical emergency. Helping him temporarily was both a thank-you and a promise. Instead of understanding, his fiancée demanded he stop. In all, he realized they weren’t compatible and called off the wedding while his family urged him to find a middle ground.

Image credits: syda_productions / Freepik (not the actual photo)

The financial conflicts in this couple’s story are a real-world example of a well-documented pattern in relationships. According to Chartered Capital, financial stress often signals deeper mismatches in values, beliefs, and emotional needs rather than just numbers. Couples who share similar financial values experience fewer and less severe money conflicts, even when their incomes or debts are comparable.

Supporting family members financially can further complicate these conflicts. HerMoney Media notes that if couples haven’t clearly discussed expectations about when, how much, or whether to provide financial help, tensions can arise. The reason is because partners may feel torn between loyalty to their family and loyalty to each other.

However, the long-term consequences of such conflicts are significant. Research from Tend Task shows that couples who argue about money early and frequently are more likely to divorce than those who disagree mainly about other topics. Financial disagreements tend to be more intense, last longer, and involve harsher language than other disputes.

Because they touch on security, trust, and fairness, repeated financial conflicts erode overall marital satisfaction, which increases the likelihood of divorce. In this case, the clash over wedding costs, debt, and family obligations reflects exactly how financial misalignment can make a relationship unsustainable.

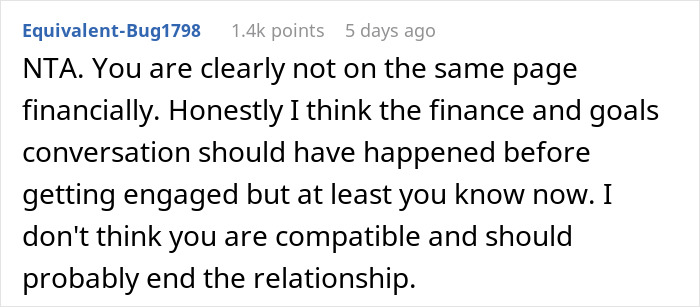

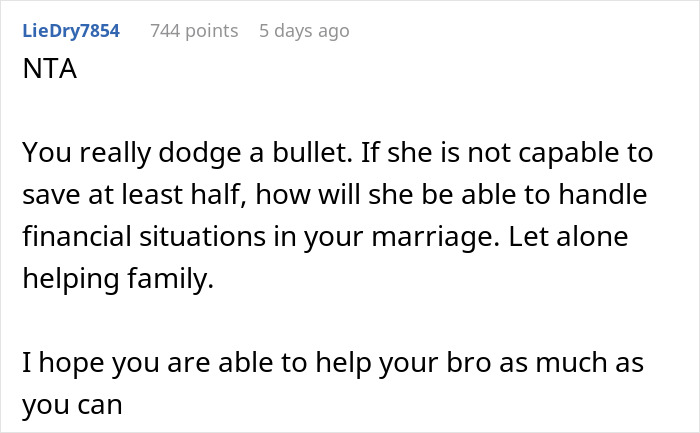

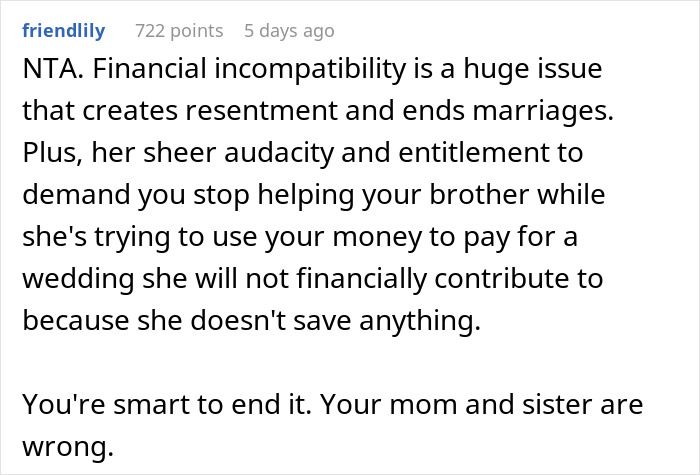

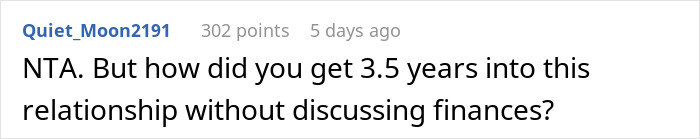

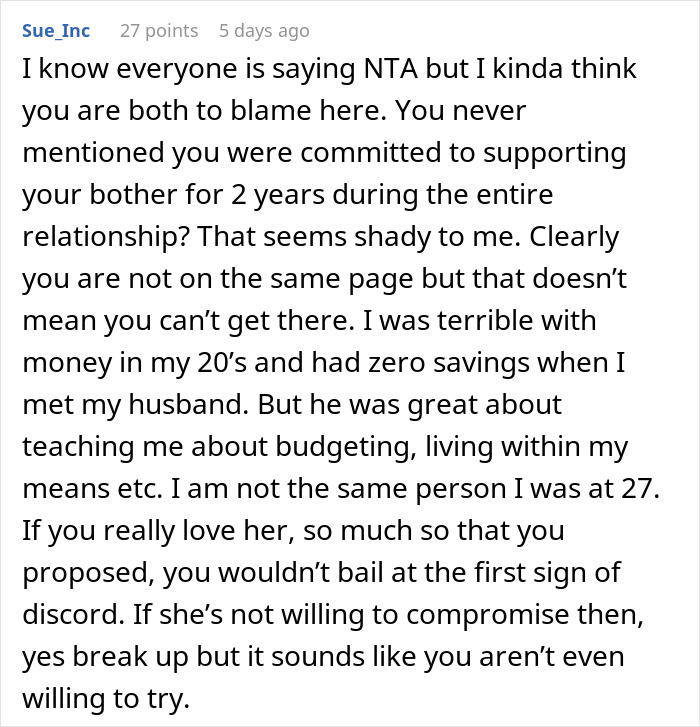

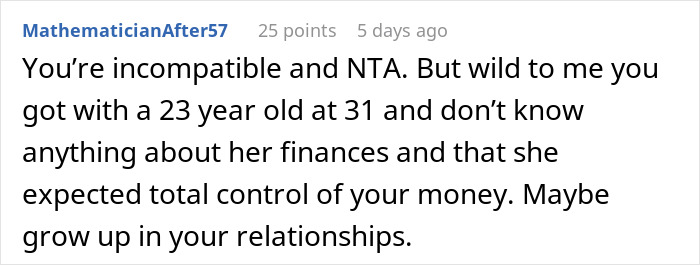

Netizens supported the OP’s decision to call off the wedding, with many highlighting financial incompatibility as a dealbreaker. They also pointed out the fiancée’s lack of savings and sense of entitlement, framing the breakup as a smart move and suggesting it avoided future resentment and potential marital conflict.

What would you do if you were in the OP’s shoes? Would you ever call off an engagement over money issues, or try to compromise? We would love to know your thoughts!

Netizens praised the author’s priorities, but also questioned how such a major mismatch went unnoticed for over three years

Poll Question

Thanks! Check out the results:

If you're engaged to someone who cares more about the wedding than the marriage, run. Run far, run fast.

I liked the advice in the comment above about never take your spouse from their mother's house.

Load More Replies...Someone commented '35k isn't bad for a wedding'..... Living on a different planet to me!

It’s not bad if you’re rich but if you’re a regular person then you need to stop looking at wedding influencers who spend more than 10k on a luxury designer wedding dress, super fancy caterers and expensive venues. And also remember that two people are getting married so maybe consider asking, “OP, what do you want,” rather than saying, “I’ve planned it all already.”

Load More Replies...Even if she’s only making $35,000/year, after taking a third out for taxes and Social Security, she’s still got about $2,000/month leftover. W*F has she been spending her money on, if she’s living at home and not paying her parents’ bills for them? Even if you count shopping and vacations, after a while—-and remember, she’s 27, so if she got out of college at 22, she’s five years into the workforce—-there’s not a lot left you want to buy and you start saving your money instead. She’s got maxed out credit cards on top of it? She’s could throw nearly her entire salary at them to get them all paid off within a year, or two or three if they’re high balance. No, she’s looking at OP as an ATM and not a life partner. OP needs to stop playing with childish women and find himself a grownup to settle down with (even if she’s younger, she should still be mature—-and 27 is an age where you stop acting like a child and start being an adult. By 27, some people already have careers started, mortgages, and young children, or at least one child, all of which make them HAVE to grow up).

Age checks out. Because he’s 35, Mom and sis are pushing him to get married despite the financial red flag waving, accompanied by fireworks. Also, the help he is giving to his brother is him paying him back for helping him before. Paying back a debt is clearly a concept she doesn’t understand.

So she wants to spend his emergency fund for a party (because a wedding is basically a party) and she wants him to stop helping his brother, so his family, in time of needs for medical reasons, the same brother that helped him going through college by paying for it. It's not that they aren't financially aligned, it's that the fiancee is an entitled, ungrateful bîtch.

How can you be in a relationship with someone for so long and not know any of these issues? You're trying to build a life together but don't find out stuff until after your engaged...most major issues have signs that presented themselves long before you get to the "will you marry me?" part.

Yeah. my husband and I knew each other's financial situation long before we got engaged. These two haven't even lived together, so they don't know if they're financially nor domestically compatible. I don't know why he would even propose at this point. All they know is that they're fun-time compatible.

Load More Replies...It's not the wedding that makes the marriage. I have always been practical, maybe too much so. In my experience, the bride, groom and family are under so much stress - both emotional and financial, that they don't even enjoy the wedding that much. And the next day, what do they have to show for 10's of thousands of dollars spent? OP was right to break the engagement.

Run dude, run! I had my entire wedding (venue, dress, everything) for 6k, and we had over 200 people there! 35 grand? She can p**s right off

Smart man. This woman is obviously way to immature to get married. She acts like a teenager and is entirely irresponsible. You'd think he'd have ferreted that out before asking her to marry him.

Get the feeling she sees the world in very simple terms "Whats mine is mine and whats yours is mine". That aside, I'm with others in how can it be 3.5 years and all this is just coming up?

How can you be in a relationship for that long without knowing anything about each other’s finances?!

You can't compromise with someone who needs years of financial literacy before they can talk about compromises with you. It was a bad idea to wait this far into a relationship before bringing this up. Yes, this can be a line in the sand, a dealbreaker. 27, no bills, lives at home, no savings, yet credit card debt, wants you to cut your brother off-- red flag city. This is someone who doesn't budget and has never felt the need to spend wisely. They are on a different page, in a different book, in a different library than you. He's right to end it. Mom and Sis just really liked that girl, that's why they wanted things to move forward. We have no reason to believe this is the first conflict or sign of trouble, but if that first sign is a big enough red flag, yes, you can end things. Plus, if you're feeling that blindsided, then what else haven't you discussed?

35k on one day , gold digging child ! Nothing wrong what so ever with her still living at home ! As long as she’s saving money whilst there , SHES NOT ! she’s in debt up to her eyes , and hoping op still sort that out ,ie pay is off 🙄n her selfish stop paying your brothers mortgage,how entitled n vile is she ! Op is a lovely bloke , helping his bro out from something bro had no control over , ,hope he dumps her 100%

If you're engaged to someone who cares more about the wedding than the marriage, run. Run far, run fast.

I liked the advice in the comment above about never take your spouse from their mother's house.

Load More Replies...Someone commented '35k isn't bad for a wedding'..... Living on a different planet to me!

It’s not bad if you’re rich but if you’re a regular person then you need to stop looking at wedding influencers who spend more than 10k on a luxury designer wedding dress, super fancy caterers and expensive venues. And also remember that two people are getting married so maybe consider asking, “OP, what do you want,” rather than saying, “I’ve planned it all already.”

Load More Replies...Even if she’s only making $35,000/year, after taking a third out for taxes and Social Security, she’s still got about $2,000/month leftover. W*F has she been spending her money on, if she’s living at home and not paying her parents’ bills for them? Even if you count shopping and vacations, after a while—-and remember, she’s 27, so if she got out of college at 22, she’s five years into the workforce—-there’s not a lot left you want to buy and you start saving your money instead. She’s got maxed out credit cards on top of it? She’s could throw nearly her entire salary at them to get them all paid off within a year, or two or three if they’re high balance. No, she’s looking at OP as an ATM and not a life partner. OP needs to stop playing with childish women and find himself a grownup to settle down with (even if she’s younger, she should still be mature—-and 27 is an age where you stop acting like a child and start being an adult. By 27, some people already have careers started, mortgages, and young children, or at least one child, all of which make them HAVE to grow up).

Age checks out. Because he’s 35, Mom and sis are pushing him to get married despite the financial red flag waving, accompanied by fireworks. Also, the help he is giving to his brother is him paying him back for helping him before. Paying back a debt is clearly a concept she doesn’t understand.

So she wants to spend his emergency fund for a party (because a wedding is basically a party) and she wants him to stop helping his brother, so his family, in time of needs for medical reasons, the same brother that helped him going through college by paying for it. It's not that they aren't financially aligned, it's that the fiancee is an entitled, ungrateful bîtch.

How can you be in a relationship with someone for so long and not know any of these issues? You're trying to build a life together but don't find out stuff until after your engaged...most major issues have signs that presented themselves long before you get to the "will you marry me?" part.

Yeah. my husband and I knew each other's financial situation long before we got engaged. These two haven't even lived together, so they don't know if they're financially nor domestically compatible. I don't know why he would even propose at this point. All they know is that they're fun-time compatible.

Load More Replies...It's not the wedding that makes the marriage. I have always been practical, maybe too much so. In my experience, the bride, groom and family are under so much stress - both emotional and financial, that they don't even enjoy the wedding that much. And the next day, what do they have to show for 10's of thousands of dollars spent? OP was right to break the engagement.

Run dude, run! I had my entire wedding (venue, dress, everything) for 6k, and we had over 200 people there! 35 grand? She can p**s right off

Smart man. This woman is obviously way to immature to get married. She acts like a teenager and is entirely irresponsible. You'd think he'd have ferreted that out before asking her to marry him.

Get the feeling she sees the world in very simple terms "Whats mine is mine and whats yours is mine". That aside, I'm with others in how can it be 3.5 years and all this is just coming up?

How can you be in a relationship for that long without knowing anything about each other’s finances?!

You can't compromise with someone who needs years of financial literacy before they can talk about compromises with you. It was a bad idea to wait this far into a relationship before bringing this up. Yes, this can be a line in the sand, a dealbreaker. 27, no bills, lives at home, no savings, yet credit card debt, wants you to cut your brother off-- red flag city. This is someone who doesn't budget and has never felt the need to spend wisely. They are on a different page, in a different book, in a different library than you. He's right to end it. Mom and Sis just really liked that girl, that's why they wanted things to move forward. We have no reason to believe this is the first conflict or sign of trouble, but if that first sign is a big enough red flag, yes, you can end things. Plus, if you're feeling that blindsided, then what else haven't you discussed?

35k on one day , gold digging child ! Nothing wrong what so ever with her still living at home ! As long as she’s saving money whilst there , SHES NOT ! she’s in debt up to her eyes , and hoping op still sort that out ,ie pay is off 🙄n her selfish stop paying your brothers mortgage,how entitled n vile is she ! Op is a lovely bloke , helping his bro out from something bro had no control over , ,hope he dumps her 100%

Dark Mode

Dark Mode

No fees, cancel anytime

No fees, cancel anytime

42

22