Guy Hints He Won’t Propose Until GF Hands Over Her Bank Password, Gets Icy When She Says “No Way”

Money has a way of exposing fault lines in relationships long before anyone expects them to appear. Conversations that seem practical on the surface like budgets, savings, future plans, can quickly turn emotional when trust, autonomy, and control enter the picture.

For today’s Original Poster (OP), what began as a discussion about preparing for marriage escalated into a disagreement over privacy and access, leaving her questioning whether setting a boundary was reasonable or unfair.

More info: Mumsnet

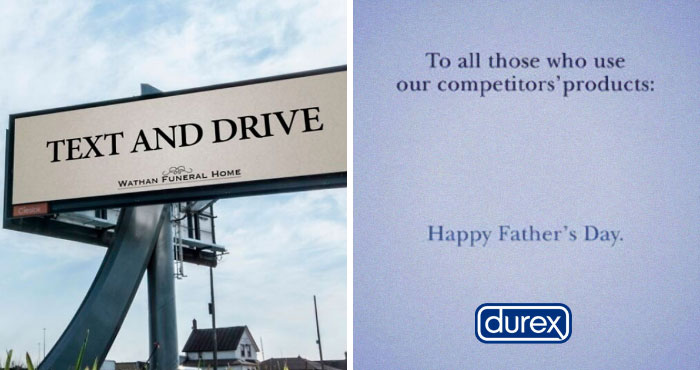

Money has a funny way of sneaking into relationships, and it grows into deeper questions about security, trust, and your future

Image credits: Getty Images / Unsplash (not the actual photo)

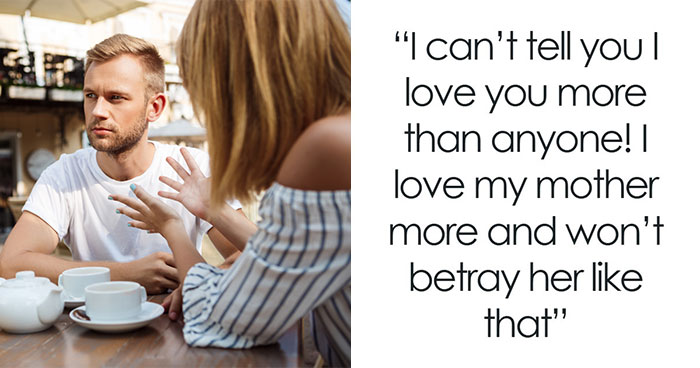

The author was caught off guard when her boyfriend asked for her online banking login, saying he wanted full financial transparency before getting engaged

Image credits: Mikhail Nilov / Pexels (not the actual photo)

She explained she was open to discussing finances but refused to share passwords, offering compromises like statements, spreadsheets, or a joint account for shared bills

Image credits: karlyukav / Freepik (not the actual photo)

Her boyfriend became defensive and accusatory, implying she was hiding something and making comments about monitoring her spending and wanting “receipts”

Image credits: CopperFieldNote

After she firmly said no, he accused her of sabotaging their future, leaving her questioning whether she’s wrong for holding her boundary

The OP and her boyfriend have been dating for just over two years. She noted that they live together and split bills evenly, and that even though she earns more than him annually, he has reliable income and pays his share on time. However, one day, he brought up this idea and told her he wanted them to “be fully transparent” financially because they plan on getting engaged this year.

The OP assumed this meant talking goals and maybe reviewing credit reports together, but he clarified that what he actually meant was accessing her online banking login credentials so he could watch every deposit, withdrawal, and grocery purchase in real time. He then added that couples planning a future shouldn’t have “private money” and if she refused to share logins, that must mean she’s hiding something.

She offered alternatives for compromise, suggesting she would rather share a spreadsheet tracking expenses, review bank statements together monthly, opening a joint account strictly for rent and shared bills, however, he told her the options were just her “keeping a wall up”. He claimed he wouldn’t touch anything, and that he just didn’t want to “find out later” about hidden debt, mysterious payments, or financial issues.

She told him that she had no hidden debts beyond student loans, yet he kept insisting he needs “receipts”. Still, she refused and he went cold, doling out passive-aggressive statements. He even proposed installing a budgeting app linked to her accounts so he could see a dashboard view, but again when she refused again, he accused her of “sabotaging the future” and being controlling for not letting him in.

Image credits: EyeEm / Freepik (not the actual photo)

Money in relationships is rarely just about numbers, it’s deeply tied to security, values, and trust, which can amplify emotional conflicts, as noted by My LA Therapy. They highlight that financial disagreements are a leading cause of divorce, and that money stress can distort how partners perceive each other, leaving them feeling less supported during arguments.

Fortunately, healthy couples can navigate finances without sacrificing privacy. Monarch emphasizes that transparency doesn’t require sharing passwords or fully merging accounts; instead, partners can have open discussions about income, debts, savings, and goals. Regular check-ins, shared budgets, and honest conversations help build trust and accountability while maintaining personal boundaries.

On the other hand, when a partner pushes for constant access to accounts or demands justifications for spending, it can signal controlling behavior, according to Diana Legal. Tactics like insisting on reviewing receipts or setting allowances may limit autonomy and even lead to financial harm, undermining trust and independence.

Netizens were firmly on the OP’s side, agreeing that the boyfriend’s request crossed a serious boundary and went beyond “transparency” into control, especially since he framed her refusal as suspicious. What do you think? Where do you draw the line between financial transparency and privacy in a relationship? We would love to know your thoughts!

Netizens pointed out the red flags in his language and noted how he flipped the narrative by calling her controlling

It's good that they are not married. It makes it slightly easier to disentangle. Because this is the red flag of all red flags. Not only does he want completely unnecessary access to her accounts, he's suggesting that in future he should hold sway over her every financial choice. That would be, not just no, but f no for me, hard stop. On the plus side, at least they figured this out before getting married and having kids.

He's not suggesting. He's outright stating.

Load More Replies...On, nonono! You're not married + he doesn't need to know. A joint account sounds like a good idea. I hope OP dumped this guy cuz there are red flags all over. And for him to get pissy + make snide comments? Nah, ain't happening, dude.

Someone telling me im not “allowed” to buy things “shouldn’t” would be gone before getting the entire sentence out. That’s terrifying all by itself! NO ONE is the arbiter of what I buy but me.

Load More Replies...It's good that they are not married. It makes it slightly easier to disentangle. Because this is the red flag of all red flags. Not only does he want completely unnecessary access to her accounts, he's suggesting that in future he should hold sway over her every financial choice. That would be, not just no, but f no for me, hard stop. On the plus side, at least they figured this out before getting married and having kids.

He's not suggesting. He's outright stating.

Load More Replies...On, nonono! You're not married + he doesn't need to know. A joint account sounds like a good idea. I hope OP dumped this guy cuz there are red flags all over. And for him to get pissy + make snide comments? Nah, ain't happening, dude.

Someone telling me im not “allowed” to buy things “shouldn’t” would be gone before getting the entire sentence out. That’s terrifying all by itself! NO ONE is the arbiter of what I buy but me.

Load More Replies...

Dark Mode

Dark Mode

No fees, cancel anytime

No fees, cancel anytime

30

18