Woman Becomes A Mom, Decides Her Parents’ Financial Mistakes Are No Longer Her Responsibility

It’s generally true that our parents are in much better financial situations than our generation is. However, more than four million U.S. adults still provide financial support to their parents. According to the Census Bureau, adult children provided $17.6 billion in support for their parents in 2020.

This woman did the same for her parents, but once she had her own family and started having kids, it just became unfeasible. Irked by thoughts that she’s being selfish and the unending phone calls asking for money, she decided to ask for opinions online. Was she right to fund her parents’ retirement when they spent their whole lives squandering any savings away?

These parents expected their 32-year-old daughter to support them after retirement

Image credits: freepik (not the actual photo)

Yet she refused, saying she had her own family and kids to take care of

Image credits: pexels (not the actual photo)

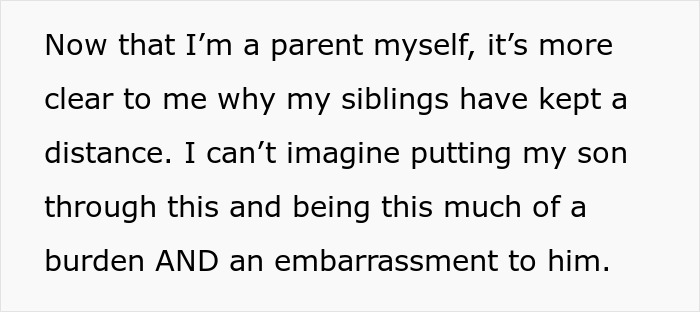

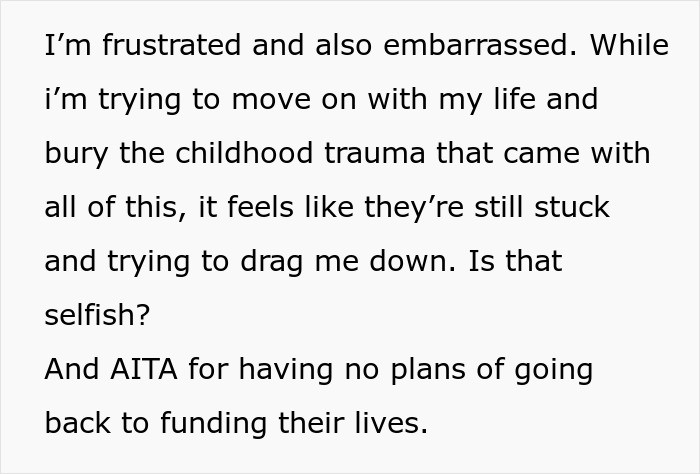

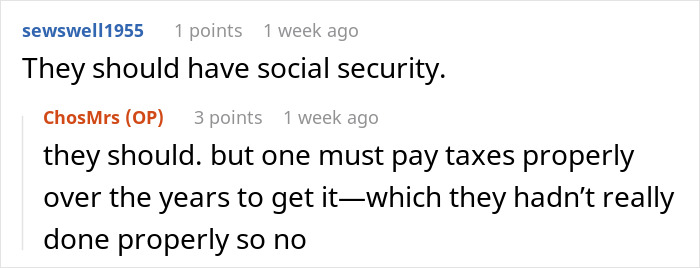

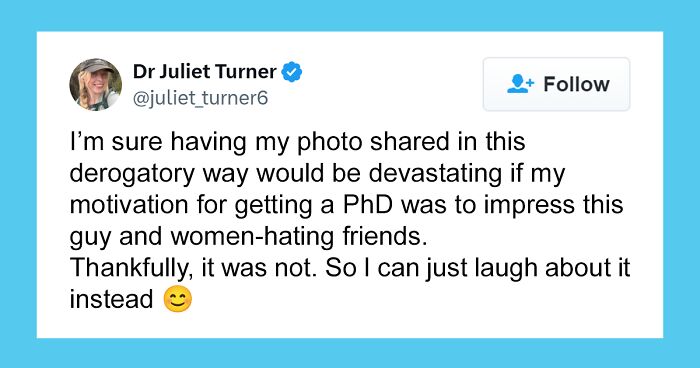

Image credits: ChosMrs

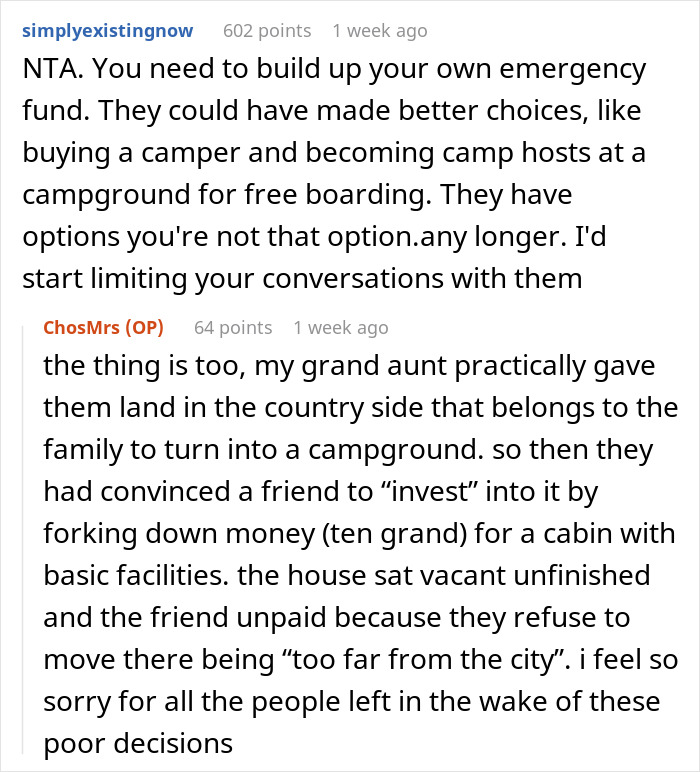

Some adult children even get into debt when they have to financially support their retired parents

Image credits: pexels (not the actual photo)

People tend to criticize the notion that people should have kids to have someone take care of them in old age. Yet the reality today is exactly that: almost half of American adults are providing financial support for their parents or expecting to do so in the near future.

According to a recent survey by LendingTree, 23% of Americans are currently financially supporting their parents or in-laws. 23% expect to soon be involved in their parents’ or in-laws’ financial well-being.

Americans are helping their older parents with basic everyday expenses like:

- buying groceries (69%),

- other personal purchases (49%),

- housing (44%),

- utilities (43%),

- and medical bills (42%).

Like the daughter in this story, some adult children experience strains in their finances when they have to dedicate a portion of their earnings to their parents’ well-being. According to the research from LendingTree, 58% of those who provide their parents with financial support say they’re now in debt. 74% admit that it keeps them from reaching their financial goals.

In some cultures, it’s expected to help parents financially when you’re an adult

Image credits: freepik (not the actual photo)

Different cultures have different attitudes towards financial assistance for family members. The author mentions that they’re from an Asian family, and some commenters observed that this is typical in many Asian households.

However, Europeans have similar attitudes as well. Research by Pew shows that Italians are the most likely to say that adult children should help out a parent financially if they need it. In fact, 87% of Italians believe so, while 76% of Americans and only 58% of Germans think the same. Similarly, most Italians (73%) also think that parents should financially support their adult children.

Ironically, Americans are the most likely to say that financial support for older parents should come from adult children and other family members. Only 24% believe that the government should take care of retired parents. In contrast, 58% of Italians and 48% of Germans think the same.

Experts advise individuals to start saving for retirement as soon as possible

Image credits: unsplash (not the actual photo)

In the U.S., 45% of adults aged 65+ agree that they themselves should be responsible for their financial well-being after retirement. The reality is that it’s never too early to start preparing for retirement so that you’re not a burden to your kids later in life.

Here are some things individuals should keep in mind if they want to be ready for retirement:

- Estimate how much you will need after retirement. According to some experts, people usually need 70%-90% of their pre-retirement income to live like they’re used to when they stop working.

- Take advantage of your employer’s retirement plan. Whether that’s a 401(k) or some kind of a simplified plan, familiarize yourself with it. Also, learn more about your spouse’s pension plan.

- Consider investing. Investments can contribute to retirement savings a great deal. This may require more financial knowledge and experience, but diversifying your retirement money can be beneficial.

- Don’t withdraw from retirement savings. A retirement savings account should remain untouched until your actual retirement, no matter how tempting it might be. The U.S. Department of Labor cautions that if a person withdraws their retirement money, they’ll lose principal and interest, and they may even lose tax benefits or be ordered to pay penalties.

- Consider opening an Individual Retirement Account (IRA). An IRA is a great choice for those whose employers don’t offer a 401(k), want more control over their investments, or for those who’ve maximized their 401(k) contributions.

“You can’t get a loan for retirement,” Chuck Simms CLU®, ChFC®, RICP® notes. “Your future is up to you. Here’s what it comes down to – you need to put money away and keep saving.”

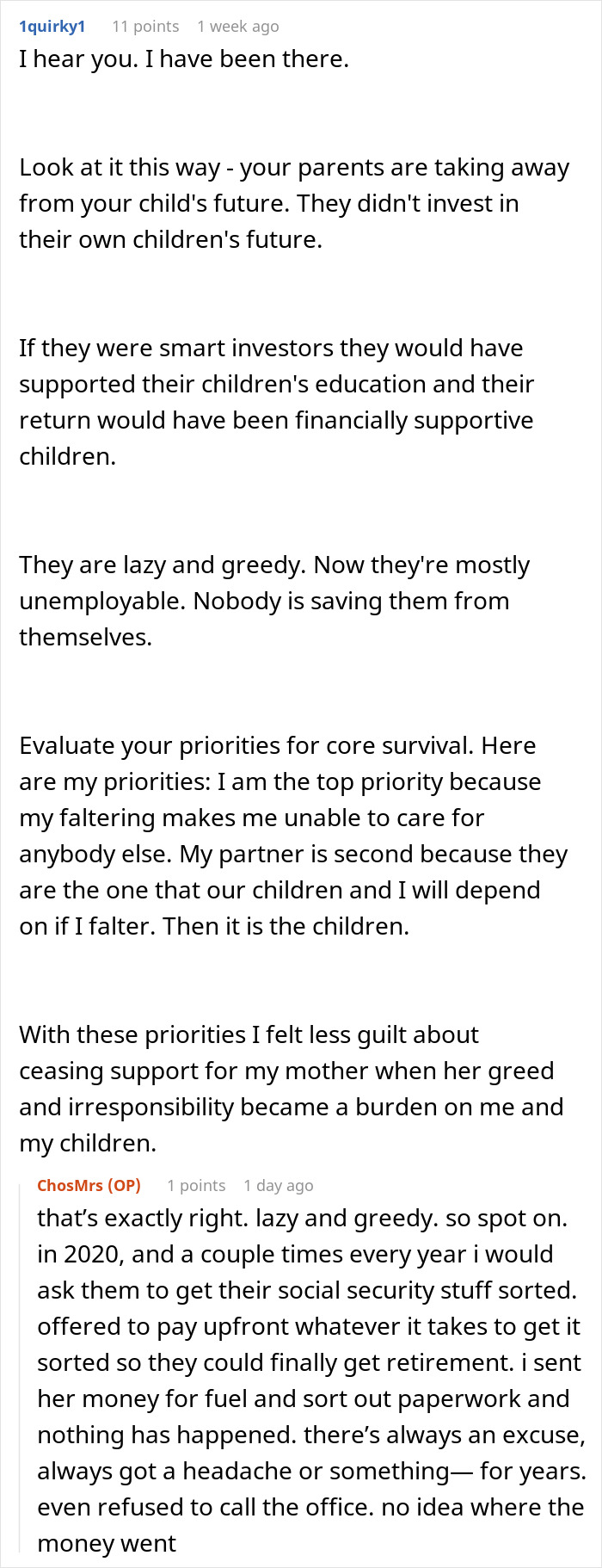

“The moment my folks got money, they went on an overseas vacation instead of [paying] rent”: She gave an example of how irresponsible the parents are

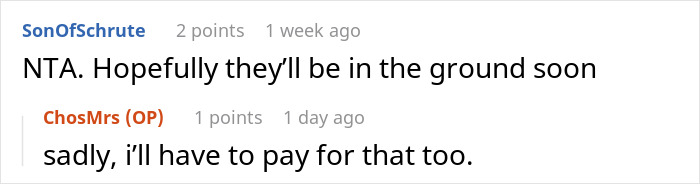

People in the comments sided with the daughter: “Blood doesn’t make the family. Love does”

Poll Question

Thanks! Check out the results:

45Kviews

Share on FacebookExplore more of these tags

Usually I'd say elderly people falling for scams are showing signs of dementia but these two have been blowing money for decades. At this point it likely they're just both stupid and gullible and those aren't traits that are going to change at 70+. The OP should start asking her parents for money as that's the generally accepted direction this thing goes in when a child is unemployed with a baby. I bet they stop calling real fast once it's obvious the taps run dry. They aren't parents so much as gaping maws of selfish hunger that steals from future generations to feed their decay.

"Owned 3 homes before 40" !?!! I bought my first flat at 51 with the help of my late Aunt... And nah, i'll get lost in the forest & die before i become a burden to my child.

Amen! I have said the same thing to my kids. They have their own lives, their own responsibility, and dependants ... I am NOT one of them.

Load More Replies...Guaranteed Basic Income is a concept I think would solve many of societies problems. A strong safety net so that people can always afford the necessities. The western democracies can easily afford this - just return the upper tax brackets to what they used to be before the wealthy were able to buy access/politicians.

Sadly, the wealthy have always been able to buy politicians. And the politicians are eager to be bought.

Load More Replies...Just reverse every convo you have with them. When they ask if you have found a new job, ask them how their job hunt is going. If they say they are struggling and need money, say you are as well and ask them for money.

When I saw a caller with the same last name as me, I led the call with "I don't loan relatives money." It was a salesman and we had a chuckle but I didn't buy anything.

You not unemployed ! You are a stay at home mum ,that in itself is a full time job , bloody older asians are deadly for this shite , they only have kids to look after them in their dotage , WRONG SO VERY VERY WRONG , I cant work anymore due to disability (dont blame me blame the drunk drive as hit me 14 yrs ago which put the nail in the coffin so to speak , other health issues as I get older ) but I’m now 60 ,I’ve got two kids 21-24 ,they live at home , do they pay for me HELL TO THE NO !!im not far off retirement age n i will get a pension ,plus pip , its not down to the kids ,i didnt have my kids for that ffs , loath parents as do this ,its inhuman, your priorities now YOUR FAMILY X not them pfft from what I’ve read they are bloody con artists 🤬NTA OPX

NTA I have a hard time allowing my kids who make a ton more money than me pay for a Dinner out . I could never burden my kids like that. In the back of my mind it makes me nervous the day I am no longer dependant . My kids have always told me I would live with them rather than be in in a nursing home. I terrifies me that one day I may be dependant on them.

I'm going to go against the grain and say that everyone who supported them financially until they were in their 70's is KTA. They have nothing because they have always been allowed to get by with nothing. Boundaries aren't just important for you. They are also there to protect the person on the other side from themselves.

It's not the children's job to protect their parents from themselves.

Load More Replies...Usually I'd say elderly people falling for scams are showing signs of dementia but these two have been blowing money for decades. At this point it likely they're just both stupid and gullible and those aren't traits that are going to change at 70+. The OP should start asking her parents for money as that's the generally accepted direction this thing goes in when a child is unemployed with a baby. I bet they stop calling real fast once it's obvious the taps run dry. They aren't parents so much as gaping maws of selfish hunger that steals from future generations to feed their decay.

"Owned 3 homes before 40" !?!! I bought my first flat at 51 with the help of my late Aunt... And nah, i'll get lost in the forest & die before i become a burden to my child.

Amen! I have said the same thing to my kids. They have their own lives, their own responsibility, and dependants ... I am NOT one of them.

Load More Replies...Guaranteed Basic Income is a concept I think would solve many of societies problems. A strong safety net so that people can always afford the necessities. The western democracies can easily afford this - just return the upper tax brackets to what they used to be before the wealthy were able to buy access/politicians.

Sadly, the wealthy have always been able to buy politicians. And the politicians are eager to be bought.

Load More Replies...Just reverse every convo you have with them. When they ask if you have found a new job, ask them how their job hunt is going. If they say they are struggling and need money, say you are as well and ask them for money.

When I saw a caller with the same last name as me, I led the call with "I don't loan relatives money." It was a salesman and we had a chuckle but I didn't buy anything.

You not unemployed ! You are a stay at home mum ,that in itself is a full time job , bloody older asians are deadly for this shite , they only have kids to look after them in their dotage , WRONG SO VERY VERY WRONG , I cant work anymore due to disability (dont blame me blame the drunk drive as hit me 14 yrs ago which put the nail in the coffin so to speak , other health issues as I get older ) but I’m now 60 ,I’ve got two kids 21-24 ,they live at home , do they pay for me HELL TO THE NO !!im not far off retirement age n i will get a pension ,plus pip , its not down to the kids ,i didnt have my kids for that ffs , loath parents as do this ,its inhuman, your priorities now YOUR FAMILY X not them pfft from what I’ve read they are bloody con artists 🤬NTA OPX

NTA I have a hard time allowing my kids who make a ton more money than me pay for a Dinner out . I could never burden my kids like that. In the back of my mind it makes me nervous the day I am no longer dependant . My kids have always told me I would live with them rather than be in in a nursing home. I terrifies me that one day I may be dependant on them.

I'm going to go against the grain and say that everyone who supported them financially until they were in their 70's is KTA. They have nothing because they have always been allowed to get by with nothing. Boundaries aren't just important for you. They are also there to protect the person on the other side from themselves.

It's not the children's job to protect their parents from themselves.

Load More Replies...

Dark Mode

Dark Mode

No fees, cancel anytime

No fees, cancel anytime

38

15