Woman Explains How Millennials Are Systematically Infantilized By Previous Generations And It’s Spot On

According to the Pew Research Center, today roughly 24% of young adults could be deemed financially independent by 22 years old, compared to 32% in 1980. It was also found that almost half (45%) the adults between the ages of 18 to 29 receive financial help from their parents. Pew Research Center further reports that young adults today are staying in school longer and marrying and establishing their own households later compared to the previous generations.

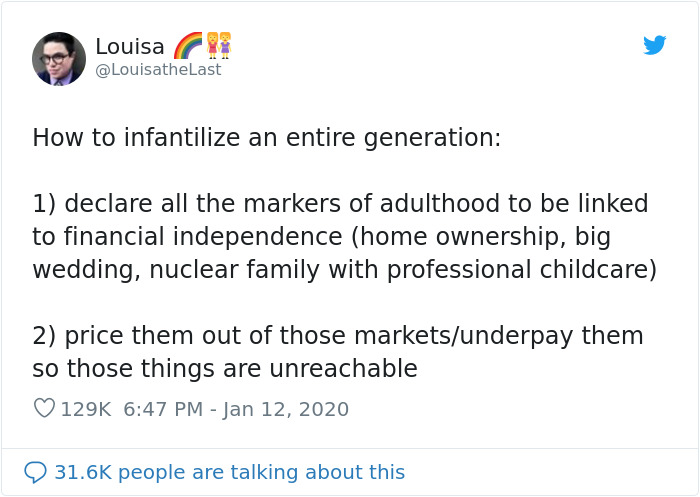

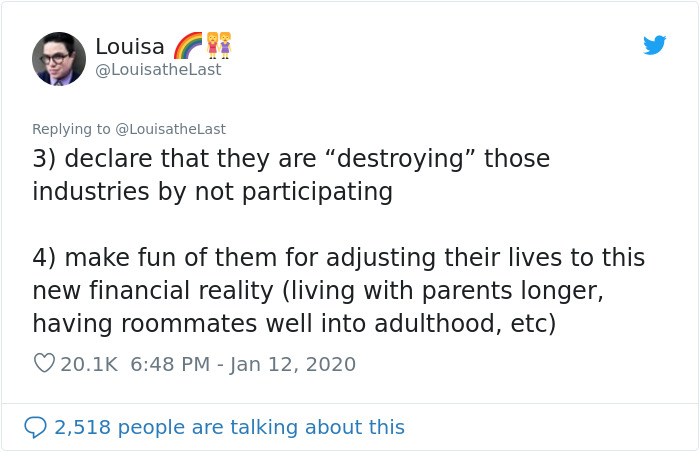

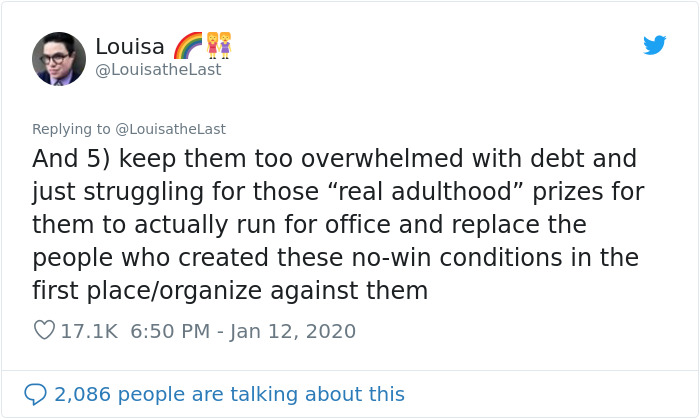

While it’s easy to jump to reductive claims and say that the current generation is lazy and entitled, the financial independence and other adulthood markers are not so easy to reach for today’s youth. The point was proven perfectly by a young woman on Twitter – Louisa shared her opinion on the so-called adulthood markers. According to her, the system is built to keep people just barely above water while at the same time bullying them for not conforming to the standards set by previous generations. Scroll down below to read Louisa’s tweets and don’t forget to tell us what you think in the comment section.

More info: Twitter

Recently, one woman shared her opinion on the ‘infantilized generation’

Image credits: Can Pac Swire

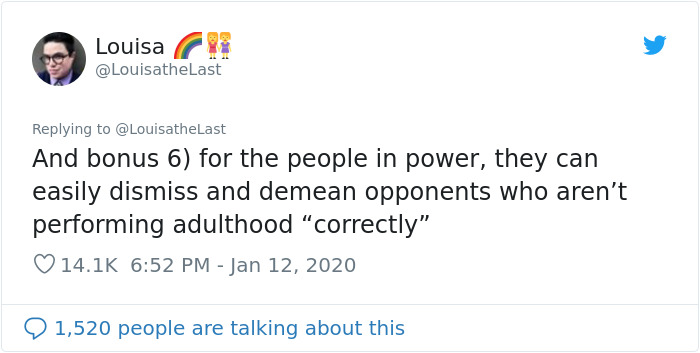

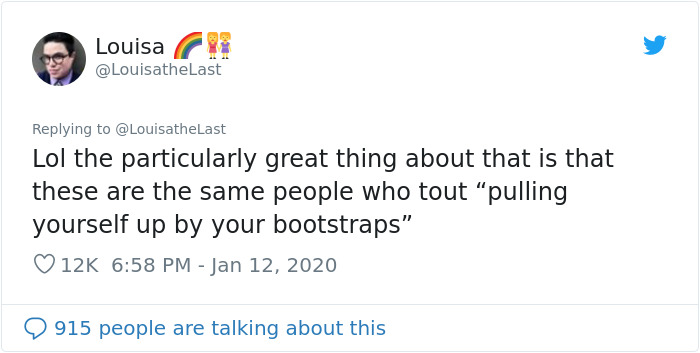

Louisa argues that today’s young adults are infantilized against their own will and then mocked for not being able to meet the expectations of adulthood. She says that people in power price the youth out of the aforementioned adulthood markers (a house, wedding, nuclear family) and makes them unreachable. Quickly enough, Louisa received praise for her on-point thread, but not everyone was agreeing with her. “Being financially independent is not hard. Pay off your debt. You can easily do this by living without using a credit card and living within your means. Then once your debt is paid off, build wealth. Budgeting will save your life,” one person wrote. Another man argued that the secret is, “kids as soon as you have room in your heart,” and then, “the money works itself out.”

Soon enough, Louisa’s thread on Twitter went viral

Image credits: LouisatheLast

Image credits: LouisatheLast

Image credits: LouisatheLast

Image credits: LouisatheLast

Image credits: LouisatheLast

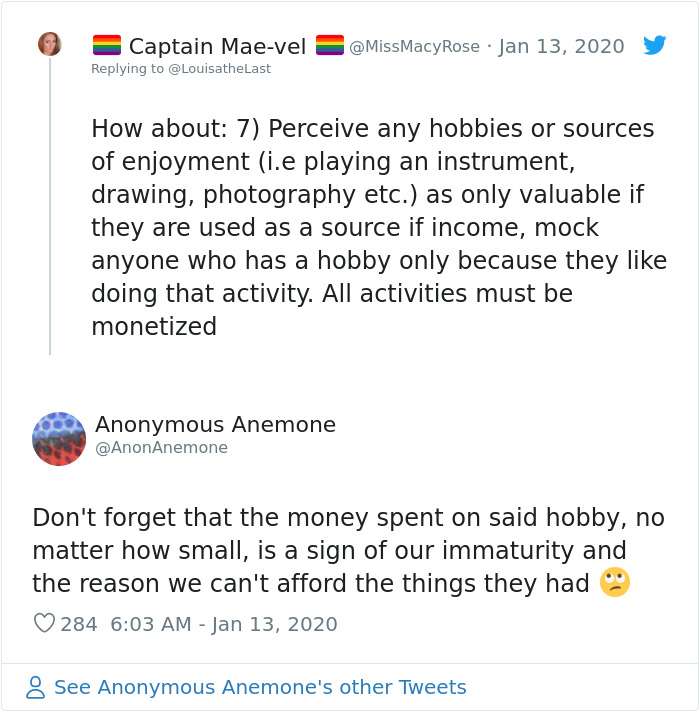

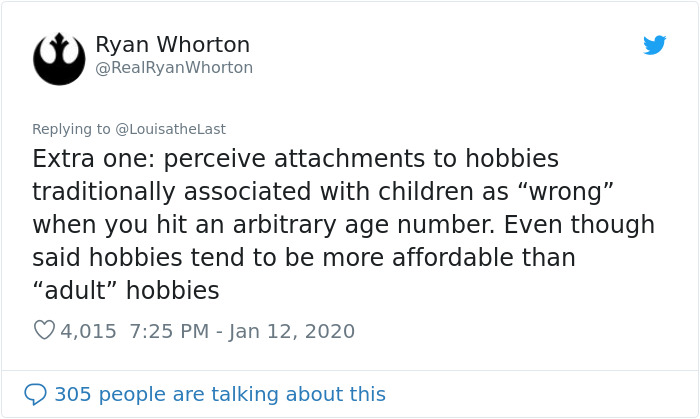

People chimed in by offering a further extension of Louisa’s list

Image credits: AnonAnemone

Image credits: RealRyanWhorton

Image credits: MadvilNE

Image credits: BigGayYeen

People were particularly annoyed by the forced monetization of one’s hobbies and argued that “any hobbies or sources of enjoyment (i.e playing an instrument, drawing, photography, etc.) [are] only valuable if they are used as a source of income.”

“Don’t forget that the money spent on a said hobby, no matter how small, is a sign of our immaturity and the reason we can’t afford the things they had,” someone added.

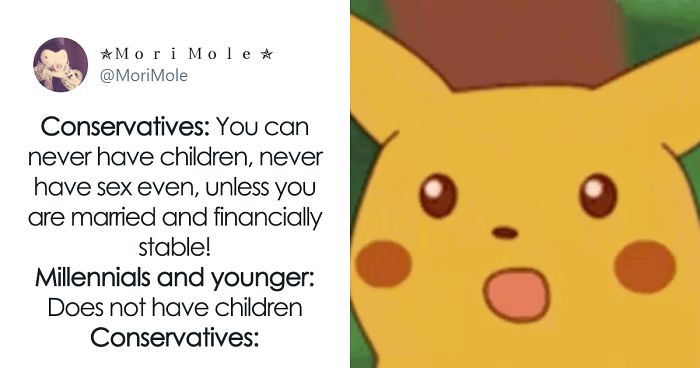

People found Louisa’s thread relatable and some even responded with memes

Image credits: MarcCapeMay

Image credits: theladydharma

Image credits: MoriMole

116Kviews

Share on FacebookGenX here and this article is correct. Except! These rules apply to ALL of us. Yes, my generation got a head start. I do have wealthy friends but most of my friends are like me: struggling to keep up and get by every month, and knowing the system is stacked against EVERYone but the wealthy. Many Boomers and Silent Generations are also feeling this pain, if they were working class, if they did not save enough, if they are ill or in an accident (in the U.S., where illness can make you homeless) if they were not rich to begin with. So it's idiotic for anyone to knock Millennials when we are all in the same boat that pits us against each other and is perfectly unbalanced to favor the rich. We need to join forces and take down the systems that harm decent, hardworking people.

Gen X was the beginning of the end, thanks to Reagan. I kept wondering when companies would realize that the less they paid their employees, the less money they spent at those companies. However, I didn't count on the same people not worrying about their companies making money, but just gambling with stocks prices & bailing with their golden parachutes. Individual CEOs were making money even as the companies were crashing & burning & laying off people. Then they'd start the next round. I was born in 1963, on the cusp between Boomers & Gen X, so I had a bit of insight on both & was affected somewhat by the financial crisis. I started out okay, then in the late 80's & early 90's, our basic 7% annual raise was changed to 3%. It's now 0%. I did get a pension, but since my salary hasn't gone up much, it won't be much, but I'm still better off than most millenials. However, it wasn't just Boomers who did this. Too many Gen X took the Reagan mythology & greed is good to heart.

Load More Replies...Every generation since Moses has complained about the generation before/after them. In about 25 years there will be 20-somethings telling GenX that they are old, out of touch and clueless. And GenX will be telling those 20-somethings how they are ruining everything with their attitude and ethics. To quote Sir Elton, it's the circle of life.

GenX here and this article is correct. Except! These rules apply to ALL of us. Yes, my generation got a head start. I do have wealthy friends but most of my friends are like me: struggling to keep up and get by every month, and knowing the system is stacked against EVERYone but the wealthy. Many Boomers and Silent Generations are also feeling this pain, if they were working class, if they did not save enough, if they are ill or in an accident (in the U.S., where illness can make you homeless) if they were not rich to begin with. So it's idiotic for anyone to knock Millennials when we are all in the same boat that pits us against each other and is perfectly unbalanced to favor the rich. We need to join forces and take down the systems that harm decent, hardworking people.

Gen X was the beginning of the end, thanks to Reagan. I kept wondering when companies would realize that the less they paid their employees, the less money they spent at those companies. However, I didn't count on the same people not worrying about their companies making money, but just gambling with stocks prices & bailing with their golden parachutes. Individual CEOs were making money even as the companies were crashing & burning & laying off people. Then they'd start the next round. I was born in 1963, on the cusp between Boomers & Gen X, so I had a bit of insight on both & was affected somewhat by the financial crisis. I started out okay, then in the late 80's & early 90's, our basic 7% annual raise was changed to 3%. It's now 0%. I did get a pension, but since my salary hasn't gone up much, it won't be much, but I'm still better off than most millenials. However, it wasn't just Boomers who did this. Too many Gen X took the Reagan mythology & greed is good to heart.

Load More Replies...Every generation since Moses has complained about the generation before/after them. In about 25 years there will be 20-somethings telling GenX that they are old, out of touch and clueless. And GenX will be telling those 20-somethings how they are ruining everything with their attitude and ethics. To quote Sir Elton, it's the circle of life.

128

110