“What In The World?”: This Couple With $1,000,000 In Debt Calls Into A Finance Show, Leaves Everyone Including The Host Speechless

InterviewAmerican household debt hit a record $16.9 trillion at the end of 2022, according to the Federal Reserve data. If you had to write that check, it would read $16,960,000,000,000. Yep, it somewhat resembles a phone number.

$11.92 trillion is owed on mortgages, while car loan debts make up $1.55 trillion, making it slightly less than student loans, which equal $1.60 trillion. Now, credit card debts surpassed the pre-pandemic high of $927 billion with people owing a whopping $986 billion.

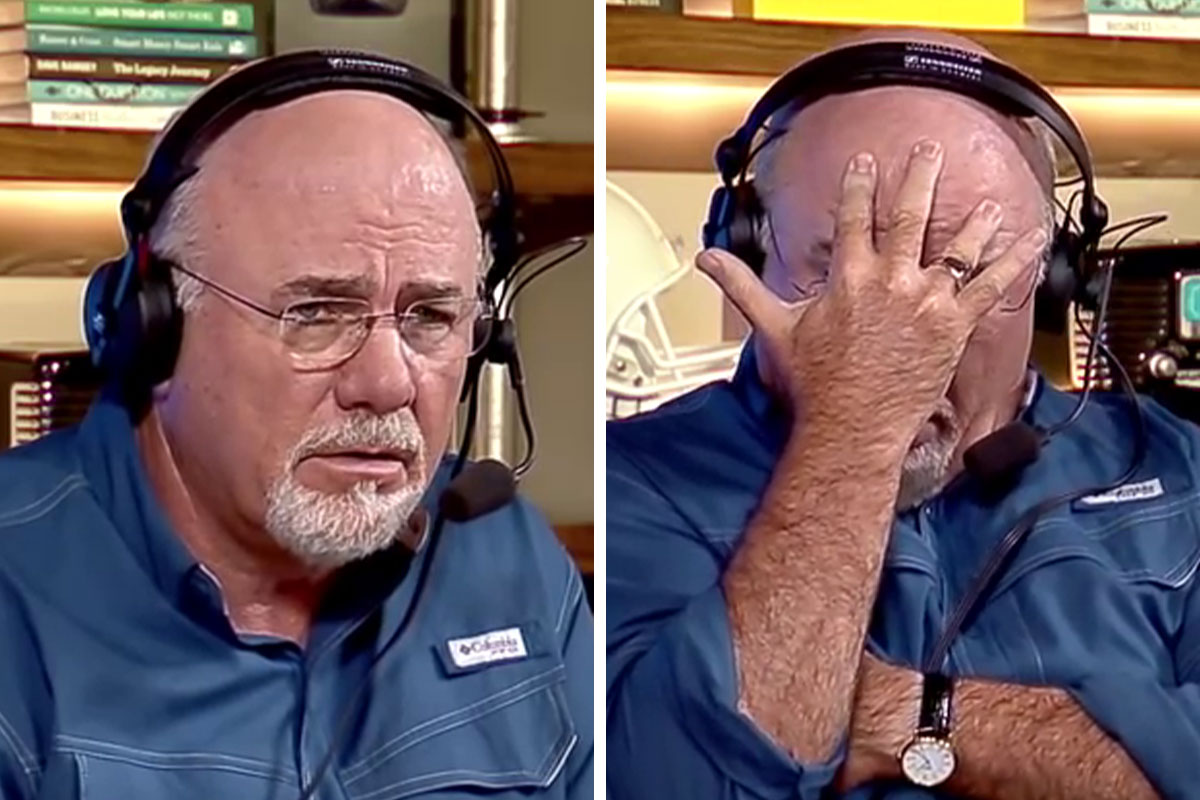

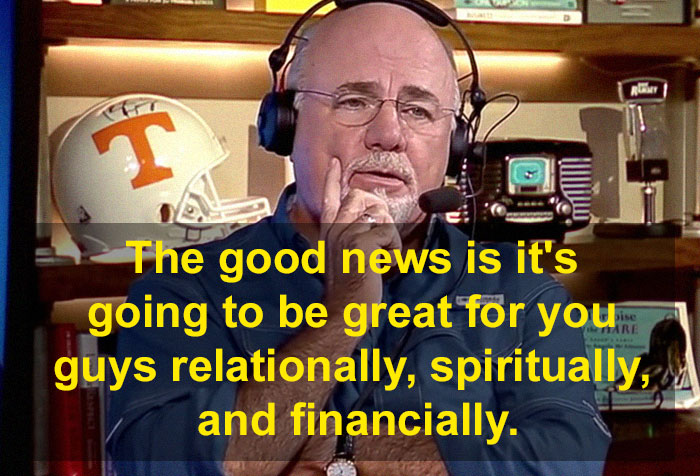

This viral video shared on the TikTok channel of Dave Ramsey, the famous personal finance personality, serves as a real-life testimony of the state of American debt.

The video clip taken from Ramsey’s radio program shows a 29-year-old woman calling in to ask for advice for dealing with a spine-chilling debt of $1,000,000. The video has since gone viral, amassing an impressive 22.6M views on the platform, leaving people on social media just as stunned as Ramsey himself.

A 29-year-old woman called in to Dave Ramsey’s show for advice on tackling a $1,000,000 debt she shared with her husband, leaving people speechless

Image credits: Emil Kalibradov (not the actual photo)

– The caller: We have probably just under a million dollars in debt and we wanna know how to get debt-free without filing for bankruptcy.

Image credits: daveramsey

– Dave Ramsey: Okay. How much of that is your mortgage?

– Uh, the mortgage is about $210,000.

– So you have $600,000 in what?

– $335,000 is about in student loans. We both have advanced degrees, and then a lot, the rest is really credit cards and personal loans.

– So you have $300,000 of credit cards and personal loans?

– We have about $335,000 in student loans and then about $136,000 in credit cards, $44,000 personal loans, and $35,000 car loans.

– Okay. Um, how old are you?

– I’m 29.

Image credits: daveramsey

– Okay. So what in the world?

– So, yeah, so we, uh…

– I mean, are you both on this or is this just one of you that’s completely lost your mind?

– Well, I have the majority of the student loans and he has the majority of the credit cards. My credit card debt is not great…

– Okay. So why has he, at 29 years old, run up a hundred grand in credit card debt?

– Well, he’s 32, but I think it’s one of those things where just making really poor financial decisions, thinking you’ll be able to pay it down as you go and then it doesn’t happen.

– Yeah. Okay. So you both have advanced degrees. What are your degrees in?

– We do. Both of ours are advanced degrees. No, he has an MBA and I have an advanced degree in Policy. I work in the government. We actually both do now at this point, actually.

Image credits: daveramsey

– Okay. So your household income is?

– Our household income is about $230,000.

– Okay. All right. Is there recognition on both of your parts how absurd this situation is?

– Uh, yes. Yes, there is. So I think we’re both scared and wanna do anything we can to avoid bankruptcy.

– Okay, great. Then I’m on your team. I can skip that step. Okay, good. Well, you’re scared and you should be. You’re disgusted and you should be.

– We are.

Image credits: daveramsey

– You’re in the early stages of being sick and tired of being sick and tired, and you should be. Here’s the thing. You guys have been living at, across the board from your education choices to your car purchases, to your whatever, you’ve been living at about 10x where you’re gonna get to live for the next three years.

– Okay. Yep, that’s true.

Image credits: daveramsey

– So I’m getting ready to destroy your life as you know it because your lifestyle is considerably above your extremely good income and has been for a period of time. And so you’ve gotten used to spending like you’re in Congress, right? This is gonna be very emotional for y’all, and you’re gonna have to look at it through that lens and through a spiritual lens, or you’re not gonna make it. You’re gonna have to not care what anyone thinks, including each other, because you’re not gonna spend any money on anything ever, for the next three years.

Dave Ramsey shared the clip on his TikTok channel, amassing a whopping 22.6M views

@daveramsey This couple is a million dollars in debt. #moneytok #broke #debt #debtpayoff #nomoney #studentloans #creditcarddebt ♬ original sound – Dave Ramsey

In this longer video, the host explained just how humbling the following years are going to be for the couple

Image credits: The Ramsey Show

– Let’s pretend you’re making $210,000, and I know you just got married, but let’s pretend you’ve been doing this as a couple as you went along. You’ve been making $210,000 and spending $310,000. I’m getting ready to put you on $30,00. You’re not gonna see the inside of a restaurant unless it’s your extra job or you’re waiting on some of the people you work with during the day. This is how humbling it’s gonna be. It’s gonna crush a lot of cr*p in your soul that caused you to do this. So the bad news is it’s gonna be really rough. The good news is it’s gonna be great for you guys relationally, spiritually, and financially.

Image credits: The Ramsey Show

But you’re not gonna make the financial unless you make the relational and the spiritual move. Because I know that. I know you guys ’cause I was you guys. This is exactly what I did in my twenties. I bought and purchased a lifestyle that was 5x to 10x what I had. And it was all because of cr*p inside of me that caused me to do that. And all of that has to be destroyed to fix it.

– Absolutely.

– Is this making any sense or is this too brutal?

– No, it’s making a lot of sense and it’s brutal.

– I’m warning you what’s coming, okay. This is not a math problem. The math problem is the symptom. The problem is what’s going on inside of you guys. So the great news is you’re very smart people. And if you apply that intellect to solving this problem as if it were a policy problem or a business problem, you can solve the problem. But the lens by which the problem will be solved is through spiritual contentment. Godliness with contentment is a great gain. Translation: You’re gonna pull up at a stoplight driving a piece of cr*p car next to people that have an income a fourth of yours and have a nicer car than yours. And you’re not gonna care. That’s gonna be the cool part. You’re gonna reach the point you don’t care what other people think. And that might be a far journey for you or him, I don’t know which one it is, but one of you guys has been purchasing a lot of stuff for a lot of reasons that are gonna change. They have to. They have to because you’re on a suicide mission right now.

Image credits: The Ramsey Show

– What’s the home worth?

– Let’s see, according to Zillow, the home is worth about $300,000.

– Okay, so you have a little bit of equity there, but not enough to save you. I always say that the home is the last resort, unless it’s the problem and it’s not the problem. Ratio-wise, it’s nothing compared to this other stuff. I mean, you have $330,000 in student loan debt, $200,000 on your house. It’s not the problem, you know, when the credit cards are almost as much as the stinkin’ house. So I don’t think we gotta sell it. You probably may need to sell a car. The big thing is, is just this shock to the system of your lifestyle where you go from really living what we call in Tennessee ‘high on the hog’ to you’re gonna be living ‘beans and rice, rice and beans’. Your friends are gonna think you’ve lost your mind and your mother’s gonna think you need counseling.

– We actually live with my parents now. After we got married we offered to stay with them to help us with transitioning to the new life which has definitely been helpful renting out the condo.

Image credits: Alexander Mils (not the actual photo)

Student loan consultant and financial expert Jan Miller believes that the couple may want to look into total student loan forgiveness under the Public Service Loan Forgiveness program

Bored Panda reached out to Jan Miller, a student loan consultant and the president of Miller Student Loan Consulting, LLC to ask whether there’s a way to resolve a $1,000,000 debt without filing for bankruptcy. Miller told us that there are indeed other ways to sort out this amount of debt, though bankruptcy should still be considered as a partial solution.

“Starting with student loans, and as it relates to the video referenced, this is likely the easy part for these borrowers, relatively speaking,” Miller explained. “Making the assumption that they work directly for the government, as stated in the video, and the assumption that a majority of their debt consists of federal student loans, both husband and wife likely qualify for total student loan forgiveness under the Public Service Loan Forgiveness program,” he added.

Having said that, Miller noted that “this program will still require them both to make a combined payment of up to $1,600/mo to complete the 10-year requirement of the program before the loans are forgiven, but then the rest of the federal debt will be forgiven tax-free.”

According to him, despite what borrowers may hear, this is a reliable program which has forgiven hundreds of millions of dollars of debt in 2022 alone.

Image credits: Mikhail Nilov (not the actual photo)

“It is possible to manage this amount of debt without bankruptcy but it would create a massive deficit in their quality of living”

Moreover, according to Miller, “based on the stated income, it is possible, depending on their other expenses and the interest rates of the existing debt, to manage this amount of debt without bankruptcy.” However, it will come at a considerable cost, he added. “This process would create a massive deficit in their quality of living, cash flow and ability to invest for retirement for decades to come.”

While Miller would prefer a deeper analysis to give a more informed and precise answer, he continued, “I’d likely recommend that they first see through Public Service Loan Forgiveness till the student loan balance is forgiven, then file bankruptcy for the rest, but only after the student loans are forgiven.” According to him, this process will limit their financial progress temporarily, but for a far shorter time period.

Massive federal student loans exceeding more than $1M are more common than we’d think, an expert says

“Federal student loans have the greatest repayment flexibility and forgiveness potential and credit cards are usually unsecured and can be swept under the rug with minimum payments. Mortgage loans are usually secured against the property, giving the bank more leverage, thus making them more difficult to negotiate.”

Miller, who’s a professional student loan consultant, told us he talks to borrowers every day who owe hundreds of thousands in student loan debt alone. “I have husband and wife borrowers who combine for up to 1.5 million in federal student loan debt in the most extreme cases. The maximum amount of student loan debt you can take out for graduate school is just over $138,000 per year. Grad school/med school can create massive student loan debt. The student loans get this high because the cost of education in the U.S. is this high,” he explained.

Image credits: Karolina Grabowska (not the actual photo)

Michella Allocca, the author of “Own Your Money,” believes the couple should reduce their annual cash outflows to $50k or less if they don’t want to file for bankruptcy

We also spoke with Michela Allocca, a personal finance expert and author of the book “Own Your Money,” which features real-life examples, tactical tips, colorful art, and unlocks the fun of money fundamentals.

Michela believes that the only route to pay this debt off without filing for bankruptcy would be to put themselves on a strict budget. “I didn’t hear the entire interview, but they noted they have a high household income of around $230K. My best advice would be for them to find a way to reduce their annual cash outflows to $50k or less.”

This, Michela explained, “may require downsizing their home, which would help reduce their overall debt right away, and they can use the additional income they are not spending on paying off their credit card debt first.”

Image credits: energepic.com (not the actual photo)

The couple’s huge credit card debt shows there’s clearly a spending problem, the financial expert says

However, a huge red flag to Michela is their credit card debt. “That signals there is clearly a spending problem, so if they’re able to reduce their spending considerably, they can put their high incomes to work.”

Michela explained that credit cards are the most difficult to pay off because the interest rates are so high. “Many credit cards have interest rates starting at 15% APY, which can be incredibly difficult to pay off if you’re carrying a balance that you can’t afford. My advice to this couple would be to stop using their credit cards and switch to cash immediately.”

Image credits: Andrea Piacquadio (not the actual photo)

Soaring credit card debts come down to the fact that young people are often irresponsible

We also asked what are the reasons why such young people get into gigantic debts. The finance expert explained that many factors may be at work.

“From a real estate perspective, we are fed that buying real estate is always a good decision, and this leads people to purchase homes they really can’t afford before they’re actually financially ready. From a student loan perspective, we are told that student loans are good debt and when we are young, we have no perspective on just how much we are taking out.”

Meanwhile, from a credit card perspective, Michela said that young people are irresponsible. “They think that their spending will never catch up to them, they aren’t paying attention, or they think they have a handle on it but don’t realize just how much they’ve actually spent.”

She concluded by saying that “this sounds like a situation that snowballed from every direction and this couple likely didn’t realize the gravity of the situation until it was too late.”

And this is how people reacted to the now-viral video

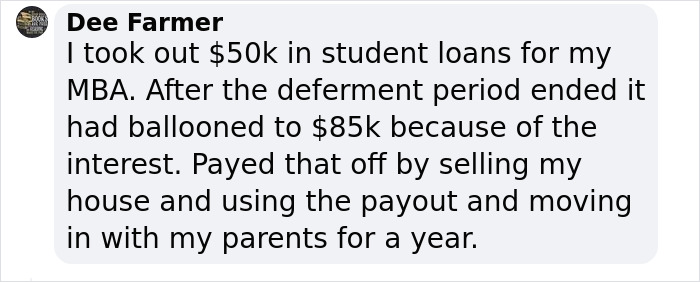

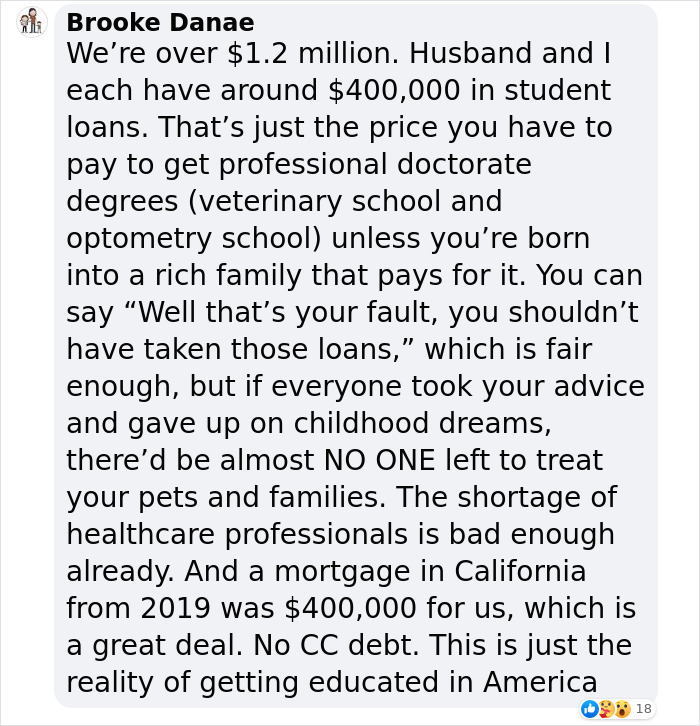

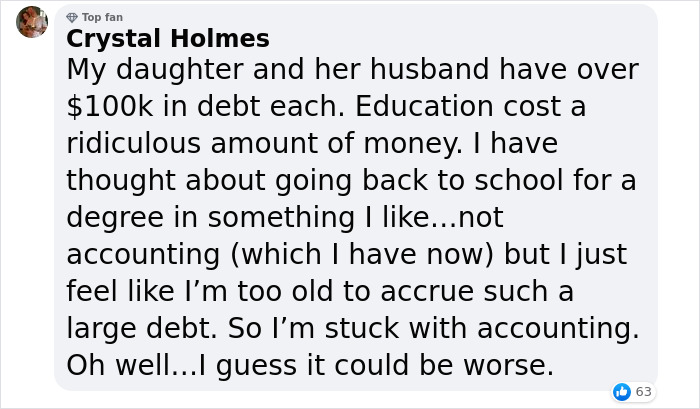

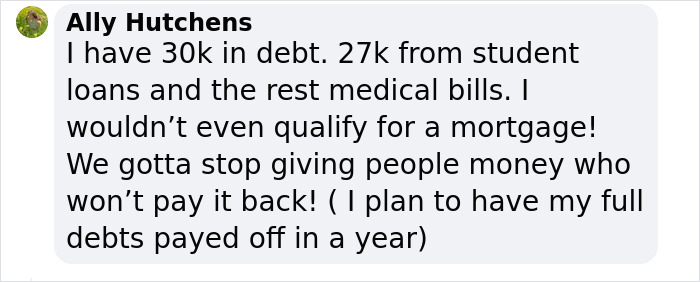

Others opened up about their own debts in the comments

Some people, however, were not happy with how the host handled the situation

This Dave guy isn't exactly giving advice is he? He is just making noises that sound really dramatic.

So wait... they are renting out their condo and staying with their parents and STILL IN DEBT.. I'm sorry someone just needs to go slap them!

I think someone needs to slap the cants who kept lending them money. That wasn’t in error, that was deliberate

Load More Replies...He’s helped countless people get out of debt and learn financial life skills. That’s not a scam.

Load More Replies...This Dave guy isn't exactly giving advice is he? He is just making noises that sound really dramatic.

So wait... they are renting out their condo and staying with their parents and STILL IN DEBT.. I'm sorry someone just needs to go slap them!

I think someone needs to slap the cants who kept lending them money. That wasn’t in error, that was deliberate

Load More Replies...He’s helped countless people get out of debt and learn financial life skills. That’s not a scam.

Load More Replies...

57

87