Man Protects His Son’s Savings From His Late Wife At All Costs Against Current Wife

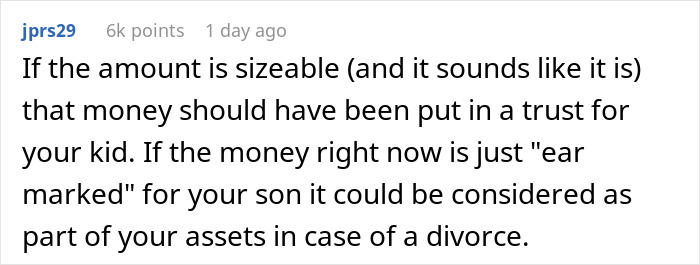

Losing a parent can be one of the most traumatic things a child experiences. Shockingly, one in 12 children in the U.S. loses a parent before they’re 18, according to Judi’s House. If the parents are terminally ill, they might set up a trust fund or other types of savings to ensure the child gets the best future possible.

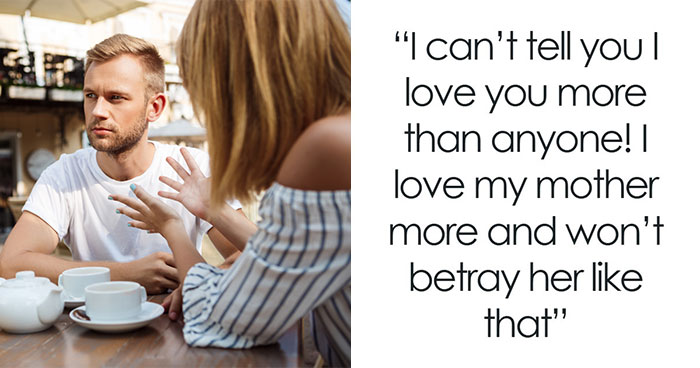

This man’s deceased wife did exactly that. However, when he remarried, his wife suddenly felt like all of their children were entitled to the savings. After the father refused, a huge fight broke out. So, he was left wondering: should he disclose to his wife how much money his teenage son has in savings?

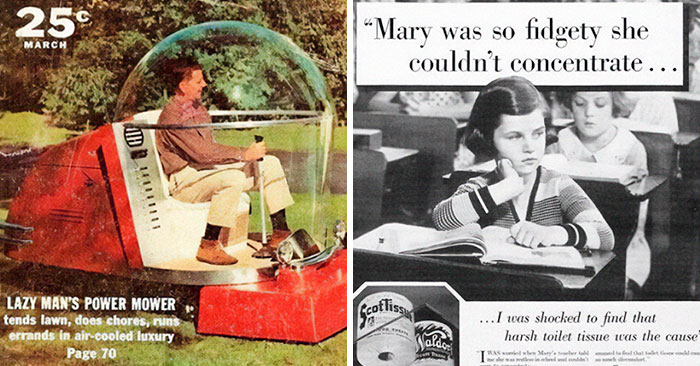

A teenage son had savings that his deceased mother and his dad had pooled together before his second marriage

Image credits: freepik (not the actual photo)

Yet, his new wife demanded to know how much there was in the account so that all the kids would get the money

Image credits: drobotdean (not the actual photo)

Image credits: user21155762 (not the actual photo)

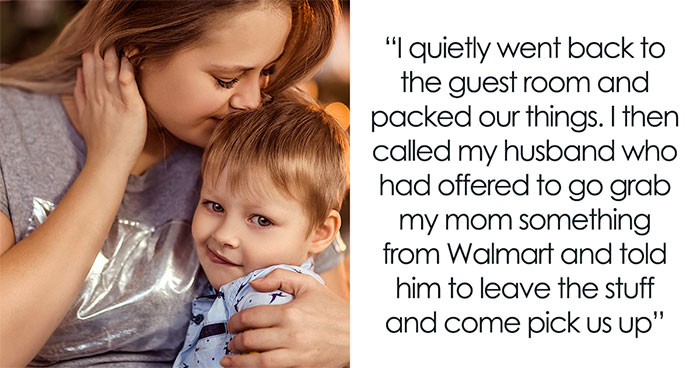

Image credits: Jimverseen (not the actual photo)

When stepparents don’t contribute to stepchildren’s lives financially, it can strain the couple’s relationship

The stepmother might press her husband to know how much her stepson has inherited because she thinks it’s unfair to her children. By that logic, why should she contribute to his future at all? However, such a mindset can negatively affect the parents’ relationship.

In a previous interview for Bored Panda, Associate Marriage and Family Therapist Christopher Underwood explained that there is no one-size-fits-all answer to whether or not a stepparent should contribute to a stepchild’s financial well-being because every situation is unique.

“The question of whether a stepparent is morally obligated to support their stepchildren financially is complex and depends on various factors, including cultural, religious, economic, and personal considerations.”

“When a stepparent is contemplating providing financial support to their stepchildren, it is crucial to engage in open and honest discussions with their partner,” Underwood added. “This not only ensures alignment on financial goals but also strengthens the relationship by fostering a collaborative approach.”

Money topics, especially concerning stepchildren, can really put a strain on a couple’s relationship. “By maintaining open communication, stepparents and their partners can reach a decision that is both ethically sound and beneficial for the family,” Underwood said.

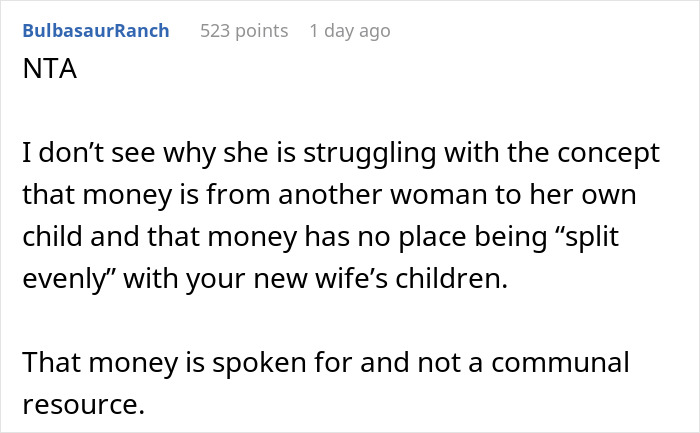

A new wife should never aim to replace the deceased mother

Entering into a marriage with a widowed person comes with many challenges. The biggest one could be that the deceased spouse might never really go away. That’s especially true when there are children in the picture. The stepson and the dad might perceive what the stepmom in this story is doing as disrespectful to the memory of the mother.

In most cases, a woman marrying a widower should never aim to replace the deceased wife. In turn, the husband, family, and friends shouldn’t expect the new wife to be a substitute for the late wife. That’s why the healthiest way to deal with it is to avoid comparing and competing with the deceased spouse.

Of course, hearing about what a great mother and wife she was might not be that pleasant. However, it’s important to remember that the new wife knows what she signed up for and should accept her spouse’s past.

Experts advise educating yourself on grief in these cases. Just because the dad got married doesn’t mean he forgot his deceased wife. It’s important to understand the stages of grief and the fact that a person can grieve for a deceased spouse while simultaneously falling in love with someone else.

That doesn’t mean that the widower is not committed or is not all in on the marriage. “Many other widows and widowers still grieve a deceased spouse, even when they are very happily and successfully remarried,” grief coach Iris Arenson-Fuller writes.

Moving forward should be about creating new memories together. For example, if the husband and his late wife used to vacation in Hawaii, suggest going to Italy. Creating new traditions can be a great way to move forward appropriately. “You must accept each other and forge a new path together that doesn’t dwell on the past but that recognizes and even honors it,” Arenson-Fuller claims.

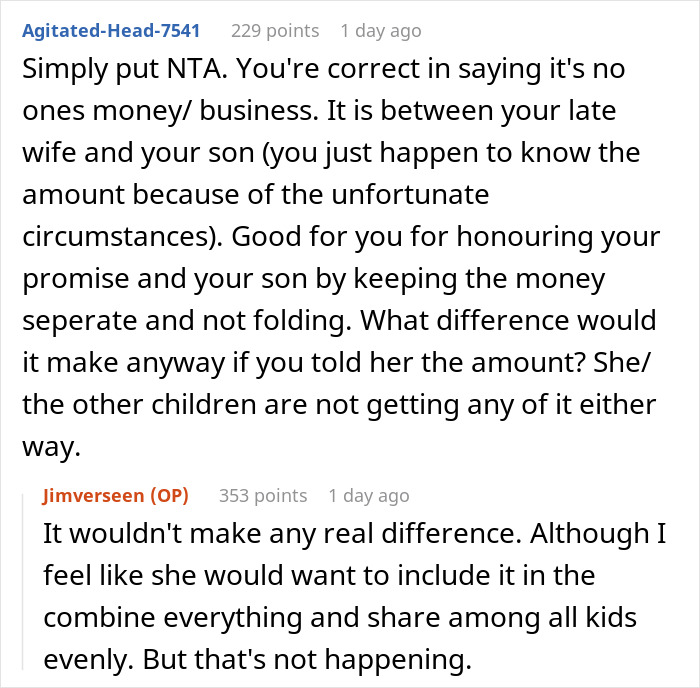

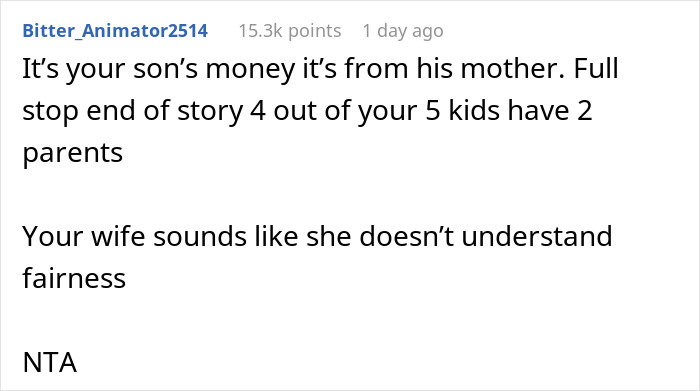

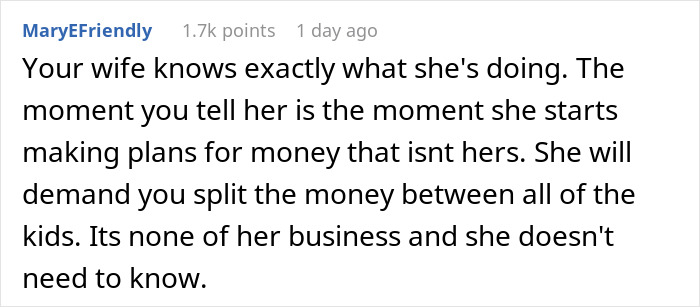

The husband believed the wife didn’t yet know exactly how much his teenage son had in savings

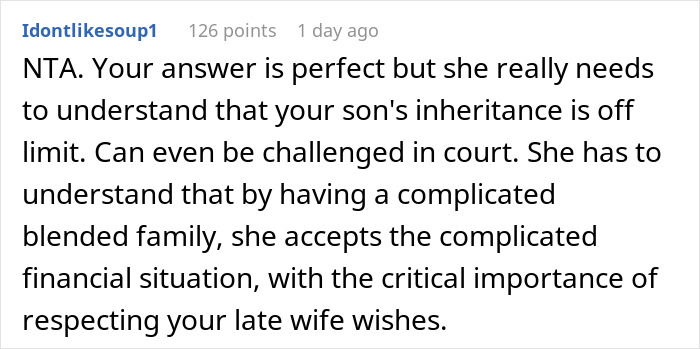

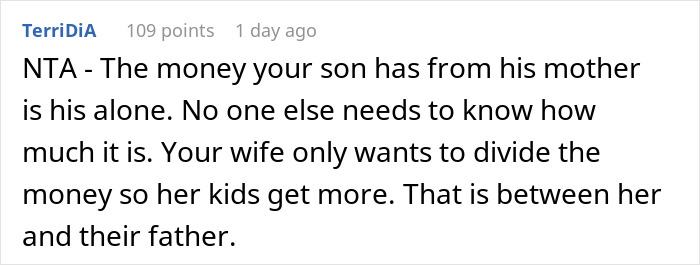

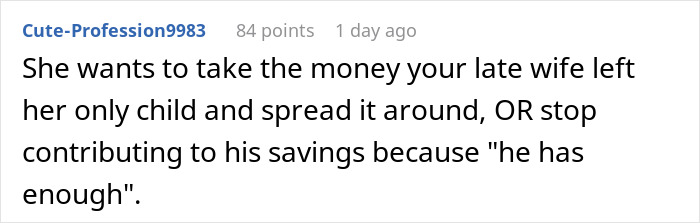

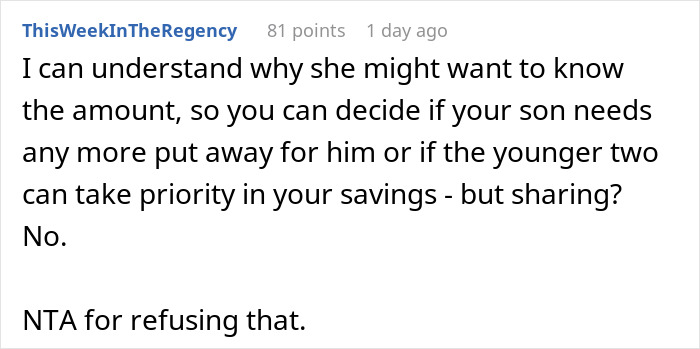

But most people urged him not to tell her: “Whatever money his mother left to him is only for him”

Poll Question

Thanks! Check out the results:

37Kviews

Share on FacebookExplore more of these tags

You need to see a lawyer to protect first son's assets. Don't wait until you might die before he comes of age.

An estate and trust lawyer might be the one. But a divorce lawyer looks like more of a long term solution.

Load More Replies...It is not knowledge of the amount that is that holding her back from making decisions, just her nosiness and potential greed. So she left him $10, hands off, it's nothing to do with her. So she left him $10million, again hands off, it's nothing to do with her.

OP's son's money has zero to do with his current wife, her kids and kids she + OP have together. It was earmarked for OP's son by his MOM. SHE set it all up for him.

I guarantee you she set it up in the form of a secured trust. What sounds like was the unfortunate mistake is that she made her husband and the child’s father the trustee. It’s always a good idea that that be a non-involved, third-party.

Load More Replies...He should put the money in a trust fund like someone suggested. So that no one except the kid has ANY access to it. The wife sounds like kind of a witch. And a gold digger.

I’m wondering if it IS in a trust fund and he is just a trustee that has access to it and the distribution. Sounds like the child’s mother knew what she was doing when she wanted to set aside the money specifically for him and no one else. A logical next line of reasoning when you think something like that is to secure the money. Where emotions get involved is that she probably designated her husband and the boys father as the trustee.

Load More Replies...I'm sorry you are married to this type of person. When you 1st said "no", she shouldn't have again brought up your son's money.

TBH, she shouldn’t have brought it up in the first place. It’s nothing she has any claim to, so it shouldn’t even cross her mind to suggest it be shared. Besides, as OP wrote, her ex comes from money, so there’s probably a bundle waiting for his kids. The only two kids whose savings they should be the most concerned about are the two they had together. They can discuss that as part of the planning, that three of the five kids have other sources of money in place for them, but the youngest two don’t. That should be the priority. If money has ever been an issue, they should’ve stopped at the kids they came into the marriage with, and not added two more. If you can’t afford them, don’t have them. If you need up having them when you can’t afford them, then you better work your a*s off and put yourself second to providing for them.

Load More Replies...I'll be charitable, perhaps the wife wants to know how much so she can say "your child #1 now has enough money for college etc. that you don't need to save any more money for *them* but can divert any future savings earmarked for them into your younger kids accounts". I'm aware I might be reaching.

If that is so, the OP could tell her that the eldest son is set (for life) and that the savings they have accumulated together can be divided equally between the other 4 (although if their dad (ex)- father of two older ones- is minted, as alleged, the savings should be preserved for the two youngest children they had together).

Load More Replies...Wife should get her own money situation with ex fixed for good before she even starts wondering about other people's money.

I don't think we're getting the whole story here. Even in what OP writes, she first said that she wants to focus on ensuring that everyone is provided for equally. And that's a respectable request: if the oldest is already well provided for, it would be unfair to give him the same as the others. The fact that she is ‘open’ to sharing everything does not mean that we insist on it, but that she is open to all possibilities. This is the first post where I think counselling might be useful.

It isn't unfair to continue to provide equally. She basically wants to give the older son (the only one "not hers") less and is warping the idea of fairness. What his mother left him should not be in the equation. I bet if the wife's parents gave money to her kids she wouldn't split it with her stepson "evenly".

Load More Replies...The fact that she's not letting this go says everything. It's not her nor his money and her knowing the amount or not literally does not change anything regarding their situation nor how they plan for their kids. She wants to know so she caan whine and complain and force OP to split it with her kids. That's the only reason to "need" to know something that doesn't have to do with her or OP.

Our mom helped herself to our college savings accounts that our grandparents set up for us when we were small after hitting some hard times. Never paid it back; I had to pay for my own college. That was my first experience learning that most people, good people, honest people, will still take money they have access to if they need it, whether it is technically theirs or not. And they very, very rarely pay it back.

NTA. Like, I can see maybe focusing on saving more for kids who don't have as much already saved and to do that wanting to know the full amount. But her talking about combining all the funds seems like she wants more than just knowledge; she wants some control of the funds. I'll be generous and say she may genuinely be worried about all of their kids, but that's money from OP's son's mother. It's not hers. It shouldn't even be OP's to control. When the son gets old enough, it should go to him. The whole stepmom manipulating the dad to use his child's funds for her/their kids instead of saving it for the kid is literally the plot of so many fairy tales. Even if she is feeling anxiety about some kids not having enough, it's not her money to take.

Sounds like it’s secured in a trust. I inherited everything from my maternal grandparents, including their owned house & investments. Despite them having 5 adult, married children & 3 other grandchildren. For the final decade of their lives (passed 2 month apart) only my mother & I had contact with them, which was daily & consistent given the house they bought my mom was next door. Not only did they secure my two trusts & HEMS with impenetrable no contest clauses & securities, they even kept my mom out of it. Lawyers & I were/are the only ones who know what exactly I was given. Only the financial advisor could oversee distribution. Because it was a financial arrangement between my grandparents & me only. Relatives have pleaded for support from me using my inheritance, but have never received a reply. My uncle tried to sue for disclosure of my inherited assets & then tried to file to contest. He got neither but had to pay my legal fees & the legally had to desist from asking for $$$.

NTA your current wife should mind her own business. Continue saving for all the children. If necessary put your oldest son's money in an interest bearing account that cannot be accessed until he comes of age. She can pressure you to split it between the children if it is not able to be accessed.

I don't think she wants the son's inheritance, I think she just wants to stop saving for him and focus saving for the other kids. If her ex comes from money then their kids will probably be ok, so the two they have together should probably be the focus. I know that the fair thing is to save the same amount for each child, but the equitable thing is to save so the two youngest have roughly the same as the other three.

It has nothing to do with trust'; this money is none of her business. She wants to include these funds somehow in the consideration of the division of funds they have saved together - that's bonkers. She shouldn't be asking; again, it's none of her business. If when his son receives thus money and the other children feel it's unfair, well, too bad so sad. Both parents can say "His mother died, this money came from that sad situation. It's his money and life isn't fair." Full stop!

Load More Replies...You need to see a lawyer to protect first son's assets. Don't wait until you might die before he comes of age.

An estate and trust lawyer might be the one. But a divorce lawyer looks like more of a long term solution.

Load More Replies...It is not knowledge of the amount that is that holding her back from making decisions, just her nosiness and potential greed. So she left him $10, hands off, it's nothing to do with her. So she left him $10million, again hands off, it's nothing to do with her.

OP's son's money has zero to do with his current wife, her kids and kids she + OP have together. It was earmarked for OP's son by his MOM. SHE set it all up for him.

I guarantee you she set it up in the form of a secured trust. What sounds like was the unfortunate mistake is that she made her husband and the child’s father the trustee. It’s always a good idea that that be a non-involved, third-party.

Load More Replies...He should put the money in a trust fund like someone suggested. So that no one except the kid has ANY access to it. The wife sounds like kind of a witch. And a gold digger.

I’m wondering if it IS in a trust fund and he is just a trustee that has access to it and the distribution. Sounds like the child’s mother knew what she was doing when she wanted to set aside the money specifically for him and no one else. A logical next line of reasoning when you think something like that is to secure the money. Where emotions get involved is that she probably designated her husband and the boys father as the trustee.

Load More Replies...I'm sorry you are married to this type of person. When you 1st said "no", she shouldn't have again brought up your son's money.

TBH, she shouldn’t have brought it up in the first place. It’s nothing she has any claim to, so it shouldn’t even cross her mind to suggest it be shared. Besides, as OP wrote, her ex comes from money, so there’s probably a bundle waiting for his kids. The only two kids whose savings they should be the most concerned about are the two they had together. They can discuss that as part of the planning, that three of the five kids have other sources of money in place for them, but the youngest two don’t. That should be the priority. If money has ever been an issue, they should’ve stopped at the kids they came into the marriage with, and not added two more. If you can’t afford them, don’t have them. If you need up having them when you can’t afford them, then you better work your a*s off and put yourself second to providing for them.

Load More Replies...I'll be charitable, perhaps the wife wants to know how much so she can say "your child #1 now has enough money for college etc. that you don't need to save any more money for *them* but can divert any future savings earmarked for them into your younger kids accounts". I'm aware I might be reaching.

If that is so, the OP could tell her that the eldest son is set (for life) and that the savings they have accumulated together can be divided equally between the other 4 (although if their dad (ex)- father of two older ones- is minted, as alleged, the savings should be preserved for the two youngest children they had together).

Load More Replies...Wife should get her own money situation with ex fixed for good before she even starts wondering about other people's money.

I don't think we're getting the whole story here. Even in what OP writes, she first said that she wants to focus on ensuring that everyone is provided for equally. And that's a respectable request: if the oldest is already well provided for, it would be unfair to give him the same as the others. The fact that she is ‘open’ to sharing everything does not mean that we insist on it, but that she is open to all possibilities. This is the first post where I think counselling might be useful.

It isn't unfair to continue to provide equally. She basically wants to give the older son (the only one "not hers") less and is warping the idea of fairness. What his mother left him should not be in the equation. I bet if the wife's parents gave money to her kids she wouldn't split it with her stepson "evenly".

Load More Replies...The fact that she's not letting this go says everything. It's not her nor his money and her knowing the amount or not literally does not change anything regarding their situation nor how they plan for their kids. She wants to know so she caan whine and complain and force OP to split it with her kids. That's the only reason to "need" to know something that doesn't have to do with her or OP.

Our mom helped herself to our college savings accounts that our grandparents set up for us when we were small after hitting some hard times. Never paid it back; I had to pay for my own college. That was my first experience learning that most people, good people, honest people, will still take money they have access to if they need it, whether it is technically theirs or not. And they very, very rarely pay it back.

NTA. Like, I can see maybe focusing on saving more for kids who don't have as much already saved and to do that wanting to know the full amount. But her talking about combining all the funds seems like she wants more than just knowledge; she wants some control of the funds. I'll be generous and say she may genuinely be worried about all of their kids, but that's money from OP's son's mother. It's not hers. It shouldn't even be OP's to control. When the son gets old enough, it should go to him. The whole stepmom manipulating the dad to use his child's funds for her/their kids instead of saving it for the kid is literally the plot of so many fairy tales. Even if she is feeling anxiety about some kids not having enough, it's not her money to take.

Sounds like it’s secured in a trust. I inherited everything from my maternal grandparents, including their owned house & investments. Despite them having 5 adult, married children & 3 other grandchildren. For the final decade of their lives (passed 2 month apart) only my mother & I had contact with them, which was daily & consistent given the house they bought my mom was next door. Not only did they secure my two trusts & HEMS with impenetrable no contest clauses & securities, they even kept my mom out of it. Lawyers & I were/are the only ones who know what exactly I was given. Only the financial advisor could oversee distribution. Because it was a financial arrangement between my grandparents & me only. Relatives have pleaded for support from me using my inheritance, but have never received a reply. My uncle tried to sue for disclosure of my inherited assets & then tried to file to contest. He got neither but had to pay my legal fees & the legally had to desist from asking for $$$.

NTA your current wife should mind her own business. Continue saving for all the children. If necessary put your oldest son's money in an interest bearing account that cannot be accessed until he comes of age. She can pressure you to split it between the children if it is not able to be accessed.

I don't think she wants the son's inheritance, I think she just wants to stop saving for him and focus saving for the other kids. If her ex comes from money then their kids will probably be ok, so the two they have together should probably be the focus. I know that the fair thing is to save the same amount for each child, but the equitable thing is to save so the two youngest have roughly the same as the other three.

It has nothing to do with trust'; this money is none of her business. She wants to include these funds somehow in the consideration of the division of funds they have saved together - that's bonkers. She shouldn't be asking; again, it's none of her business. If when his son receives thus money and the other children feel it's unfair, well, too bad so sad. Both parents can say "His mother died, this money came from that sad situation. It's his money and life isn't fair." Full stop!

Load More Replies...

Dark Mode

Dark Mode

No fees, cancel anytime

No fees, cancel anytime

53

39