Husband Said No To Wife’s Personal Expenses After She Got A Huge Inheritance, But Didn’t Want To Share It To Pay Off His Student Loans

It’s not often that we talk about conflict stories where folks online decide that there is no good guy/bad guy in the conflict and everyone just sucks in that situation.

But it still provides an opportunity for debate, fosters understanding and allows folks to learn something from those situations.

A story of such nature has been circulating the internet, originally posted on the Am I The A-Hole? subreddit, where a husband asked the community for some perspective on him asking his stay-at-home-mom wife to use her inheritance to pay off his student loans, and because she refused, he decided to separate their personal finances, hence cutting her off from his income, which is, mind you, the family’s sole income.

More Info: Reddit

An inheritance is bound to stir up some drama, but it’s not often that both sides are both right and wrong in such a situation

Image Credits: Warren LeMay (not the actual photo)

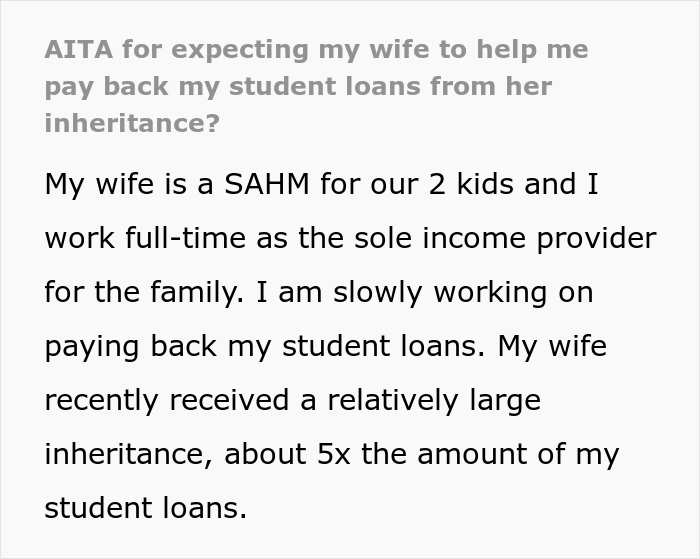

So, Reddit user u/sloanaita posted a quick story on the Am I The A-Hole? subreddit, asking folks in the community to explain if he’s wrong to expect his wife to help him to pay his student loans using her recent inheritance.

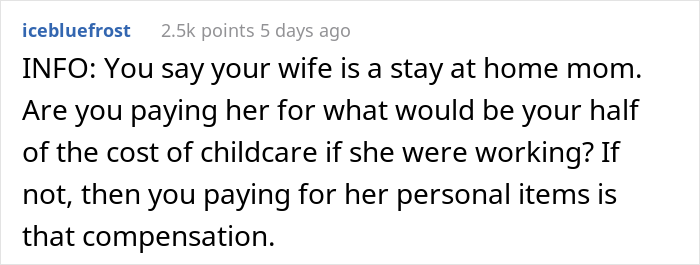

OP is a father of 2 and the sole source of income in the family, while his wife is a stay-at-home mother who spends her days caring for the kids and the household. He is slowly, but surely, working towards paying off his student loans.

And while his wife is not participating in the job market, she has recently come into a large inheritance, one that OP specified is 5 times the amount of his student loan (which would take 20% of the inheritance). And once the dust following the formalities of the inheritance had settled, he approached the Mrs. about whether she could use it to pay off his debt.

A Redditor recently asked folks online if he was wrong to expect his wife to help pay off his student debt using her inheritance

Image Credits: u/sloanaita

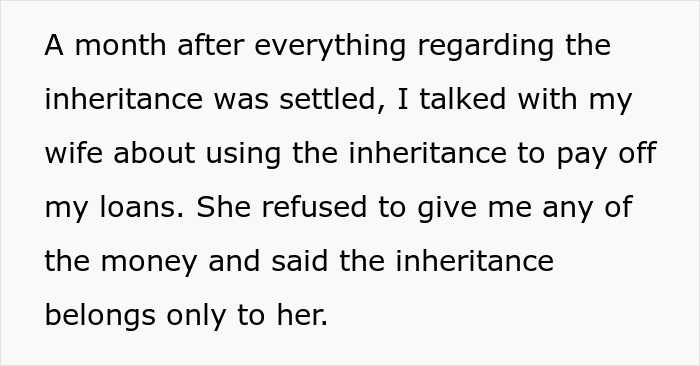

OP argued that the family would benefit from it as it would make the family’s burden lighter, and, besides, they’re a family and resources ought to be shared for the betterment of the family. However, the wife refused, saying the inheritance is hers, and that his student loans pre-date the marriage and thus are OP’s sole responsibility.

In response to this, feeling like it’s unfair to their relationship and family, OP decided that splitting the finances would be the fairest thing to do. The next day, he told his wife that he is cutting her off on personal expenses—i.e. clothes, eating out, flight, personal hygiene and other personal necessities will no longer be funded from his money, since she has her own.

On the one hand, it was her inheritance, but on the other, the husband argued that it would help the family as a whole

Image Credits: u/sloanaita

It quickly turned into a fight when OP decided he’d cut the wife off from him funding her personal necessities

Image Credits: t.ohashi (not the actual fight)

Instead, he will redirect this money to paying off the student loan faster, and, as an assumption, he will still provide for the family as a whole. The wife didn’t like this one bit, saying he’s being controlling with his position as the sole earner in the family.

This conflict ended up finding its way to the Am I The A-Hole? community on Reddit, asking the folk’s verdict on who was wrong here. And… well, they ruled that everyone was wrong here.

Folks explained that both of them are acting childishly, which is not good in a marriage. And while they saw rights on both sides, there was still the issue that one is throwing an ultimatum while the other isn’t thinking about what’s best for the family.

The AITA community were mostly of the opinion that everyone should grow up and act like partners as it is a marriage, after all

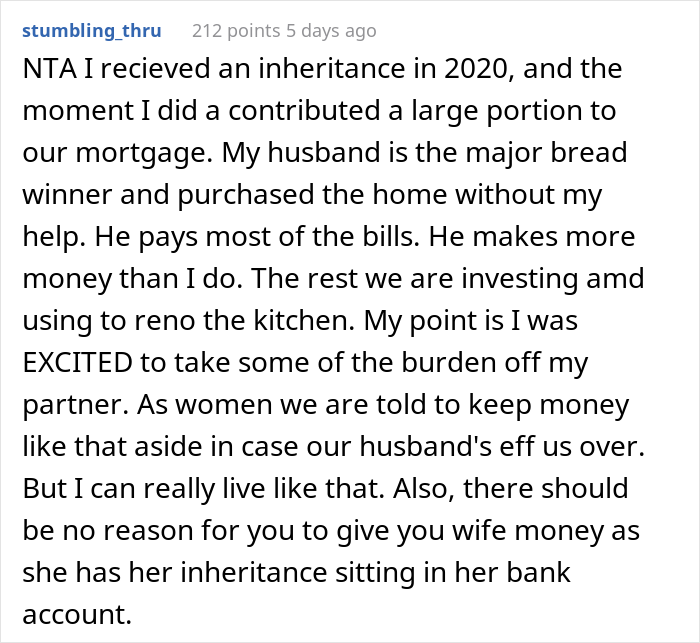

There were some who agreed with OP, saying he’s actually right to act the way he did. Some saw her as a bit selfish as she can’t reciprocate giving money, but above all, folks pleaded that they stay civil and understand that it is a partnership and there is no more I, there is only Us.

There were some who agreed with OP, arguing that if anything, the wife wasn’t willing to reciprocate giving money

Regardless, the post garnered nearly 10,000 upvotes and a handful of Reddit awards, as well as made some headlines online. Besides that, it did also generate some discussion in the comment section, which you can find here.

But we would love to hear your thoughts on who’s right and who’s wrong and what would be the optimal solution in this situation in the comment section below!

What's missing from this story is WHY the wife is "keeping the money". He doesn't say what she wants to do with it. Do they have a mortgage? Does she want to buy a family home? Is she putting it aside for the kids? For retirement? All he says is "I want it and she wont give it to me". Maybe she's the arsehole, but he's withholding relevant information.

Ever since we married over 40 years ago, we've shared finances. All income, including inheritances and gifts no matter the giver or recipient, goes into the family funds. We only have joint bank accounts and the mortgage is in both our names. We've always paid off debts, student loans, car loans, even a mortgage (twice) because paying interest is anathema to me. There's a lot more to this story than OP is telling us.

Yes, my husband and I are also sharing everything. Family is way more important than money.

Load More Replies...ESH. What they need to do is to have an honest and open discussion about finances, their relationship, their future, and how each of them sees each of these. If I were in either of their positions, I think I would expect that (a) some of the inheritance would be put to paying down the student loans; (b) some of the inheritance could be set aside for the wife's discretionary spending (that is, it's none of the husband's business what she spends it on); and (c ) MOST of the inheritance would go toward a retirement fund for the wife. How they do it is up to them, but they both need to stop thinking selfishly and consider the needs of their partnership. I get that each needs to consider that the partnership may not last so they want to protect 'their fair share', but that is part of the discussion that has not happened. A trusted financial advisor and estate planner might be very helpful here.

Very sensible advice, including to get some outside advice. A good marriage counselor might also help them with how they view money and marriage. I knew one couple who were helped by a course on money that looked at what it symbolized to each person, how family of origin influenced their money habits, etc. The insights allowed them to understand each other and then compromise (in their case, the saver gave the spendthrift a small allowance to spend on themselves and the spender came to appreciate the saver's thriftiness).

Load More Replies...What's missing from this story is WHY the wife is "keeping the money". He doesn't say what she wants to do with it. Do they have a mortgage? Does she want to buy a family home? Is she putting it aside for the kids? For retirement? All he says is "I want it and she wont give it to me". Maybe she's the arsehole, but he's withholding relevant information.

Ever since we married over 40 years ago, we've shared finances. All income, including inheritances and gifts no matter the giver or recipient, goes into the family funds. We only have joint bank accounts and the mortgage is in both our names. We've always paid off debts, student loans, car loans, even a mortgage (twice) because paying interest is anathema to me. There's a lot more to this story than OP is telling us.

Yes, my husband and I are also sharing everything. Family is way more important than money.

Load More Replies...ESH. What they need to do is to have an honest and open discussion about finances, their relationship, their future, and how each of them sees each of these. If I were in either of their positions, I think I would expect that (a) some of the inheritance would be put to paying down the student loans; (b) some of the inheritance could be set aside for the wife's discretionary spending (that is, it's none of the husband's business what she spends it on); and (c ) MOST of the inheritance would go toward a retirement fund for the wife. How they do it is up to them, but they both need to stop thinking selfishly and consider the needs of their partnership. I get that each needs to consider that the partnership may not last so they want to protect 'their fair share', but that is part of the discussion that has not happened. A trusted financial advisor and estate planner might be very helpful here.

Very sensible advice, including to get some outside advice. A good marriage counselor might also help them with how they view money and marriage. I knew one couple who were helped by a course on money that looked at what it symbolized to each person, how family of origin influenced their money habits, etc. The insights allowed them to understand each other and then compromise (in their case, the saver gave the spendthrift a small allowance to spend on themselves and the spender came to appreciate the saver's thriftiness).

Load More Replies...

70

83