Woman Takes Care Of Wife’s Grandma, Everything Falls Apart Once They Get Her Will

Money is a touchy subject, but you have to be able to discuss it with your spouse. After all, the two of you are running a household together, and if you can’t agree on where your dollars go, tensions might spill over into other areas of life as well.

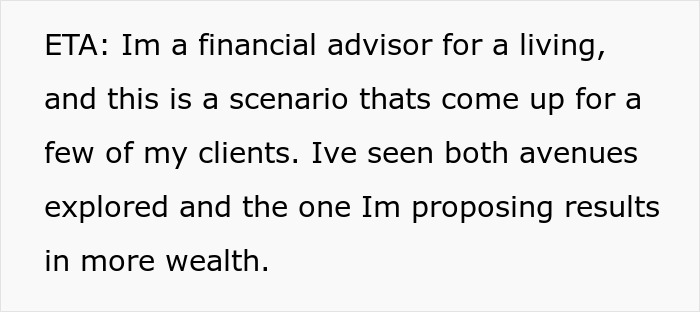

Reddit user AutomaticEast8697 thought she and her wife had been on the same page about managing money. But after her partner inherited a “sizeable chunk” from a family member, disagreements began to surface, and what could have been a simple financial choice grew into a test of their relationship.

This woman had cared for her wife’s grandma, and after the lady passed away, she was also included in her will

Image credits: LightFieldStudios/Envato (not the actual photo)

However, her partner does not want to share the inheritance

The main issue is how to spend the money

Image credits: stockasso/Envato (not the actual photo)

Image credits: AutomaticEast8697

To some extent, financial disagreements are unavoidable. The key is how you handle them

One survey from 2024 revealed that engaged couples are already thinking about their financial future:

- More than one-quarter (28%) start sharing a joint bank account with their partner before marriage;

- 75% are very comfortable discussing money matters with their partner;

- 40% disagree about finances at least sometimes;

- Only 14% are considering a prenup;

- Nearly a fifth (18%) have postponed their wedding to save more money.

However, tying the knot doesn’t automatically take care of everything.

Image credits: thananit_s/Envato (not the actual photo)

According to another survey by WalletHub, 38% of Americans say they have a bank account, investment, credit card, or loan that their partner doesn’t know about.

“Disagreements about how to manage money can put cracks in the foundation of a relationship, leading to resentment, lots of arguments, and a breakup in many cases. A desire to avoid conflict or a lack of trust can also lead to financial secrecy, which is further evidence of a flawed relationship,” WalletHub analyst Cassandra Happe said about the findings.

Sooner or later, the uncomfortable conversation has to happen, and strong emotions only make it harder.

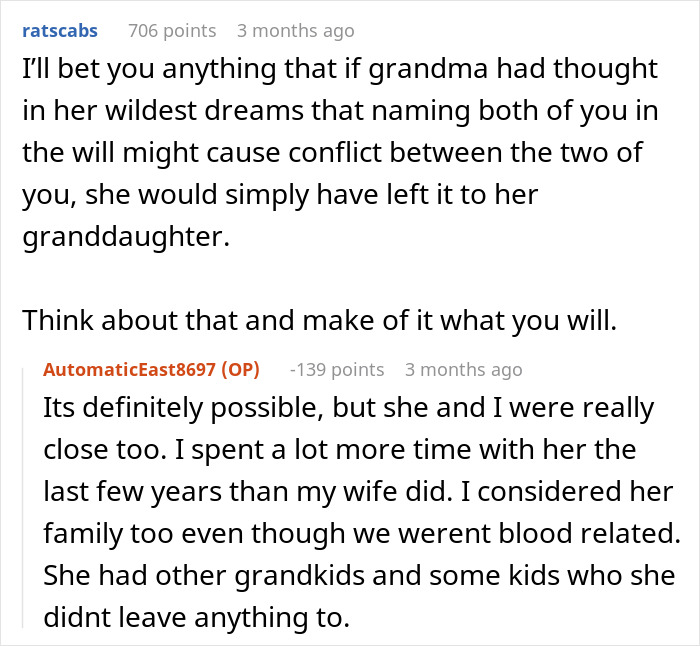

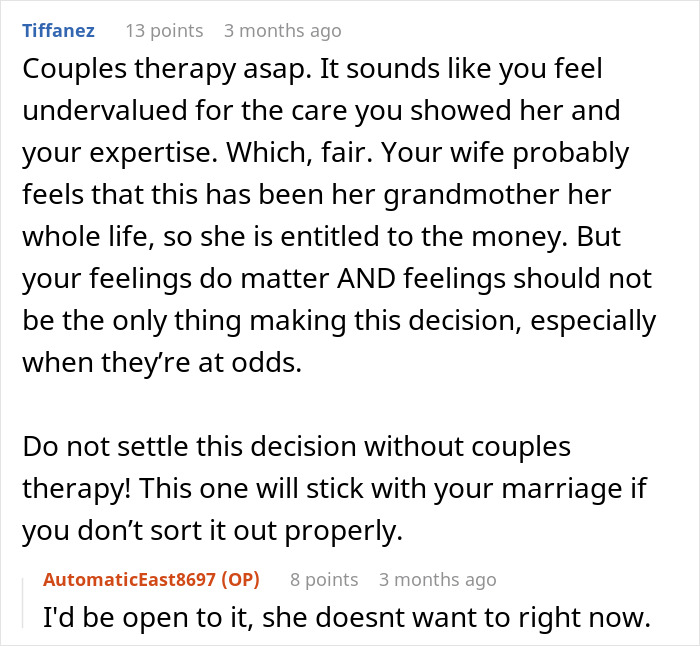

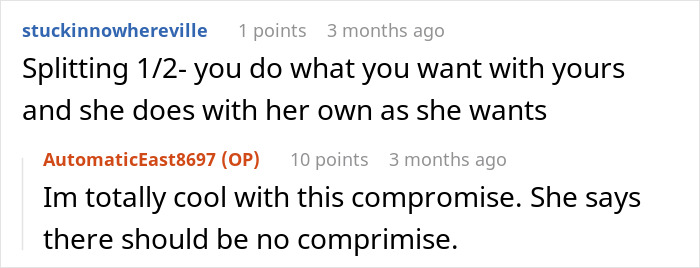

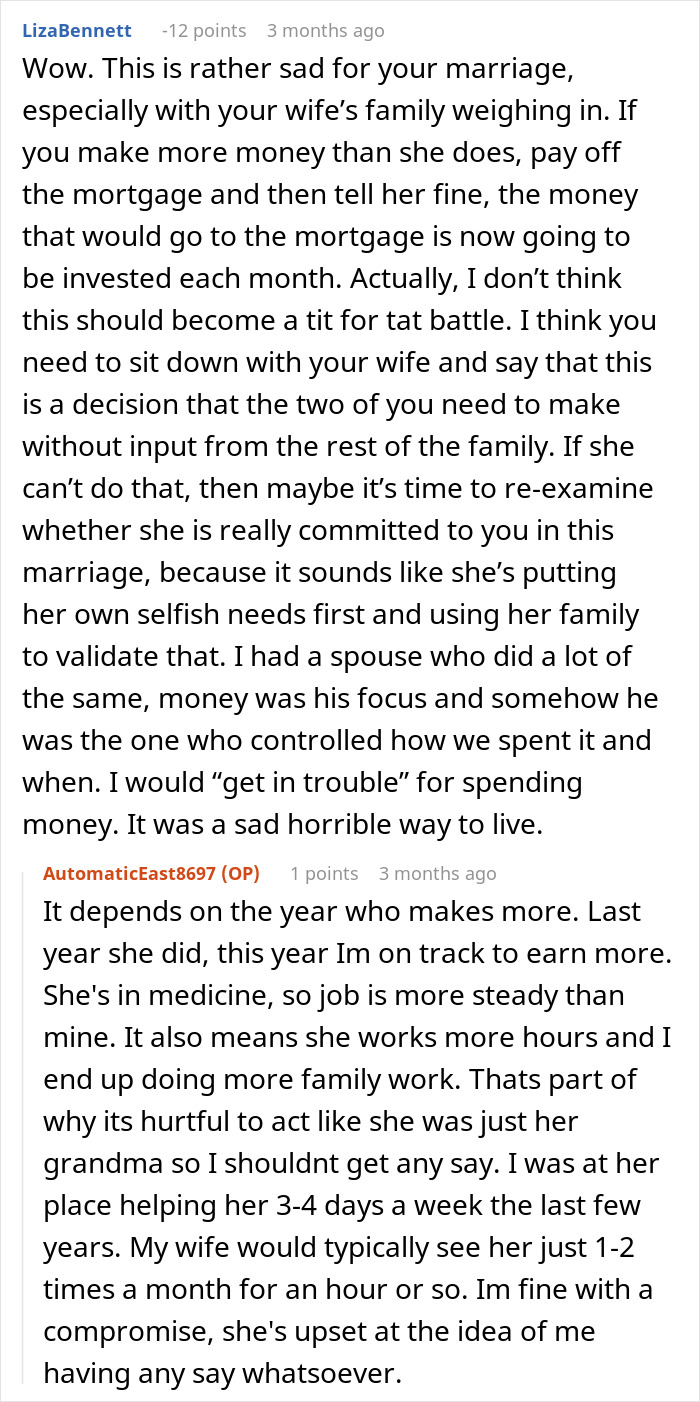

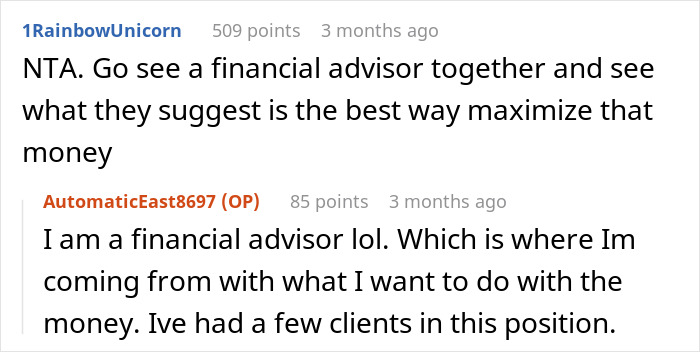

As the woman’s story gained traction online, she interacted with the commentators

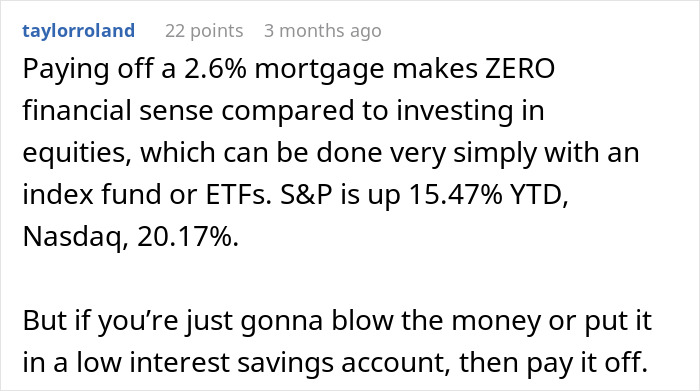

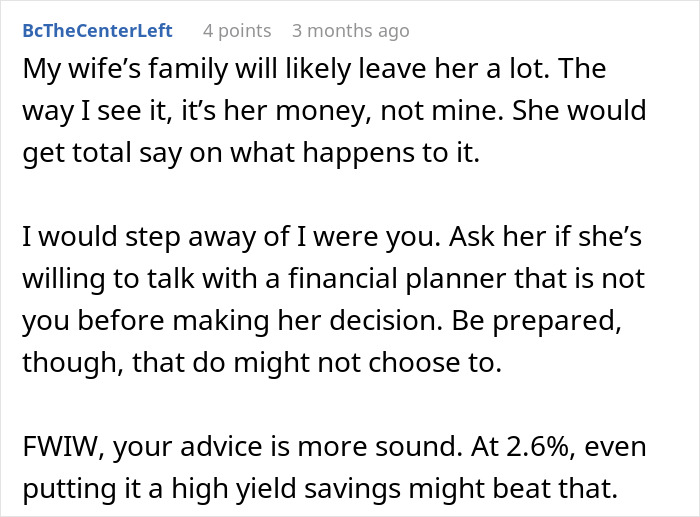

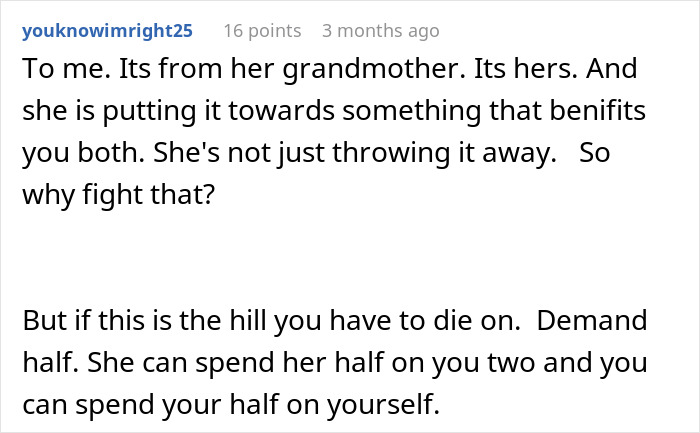

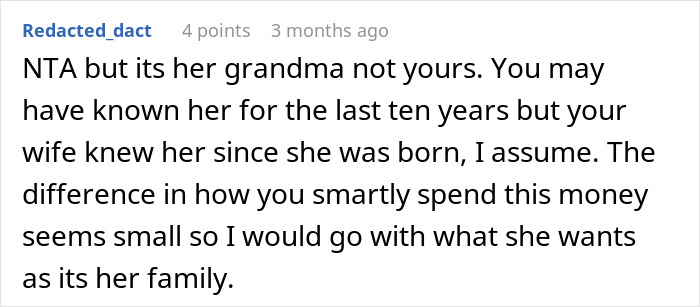

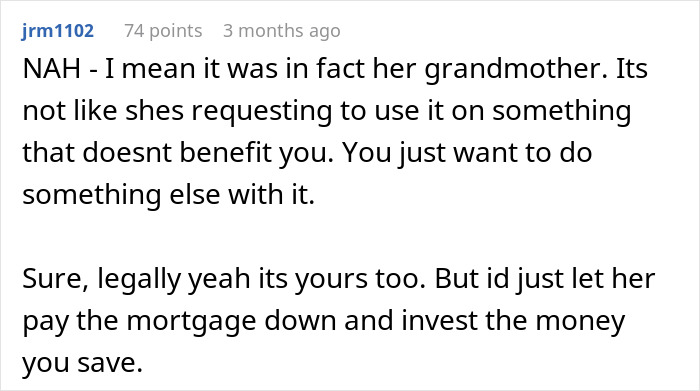

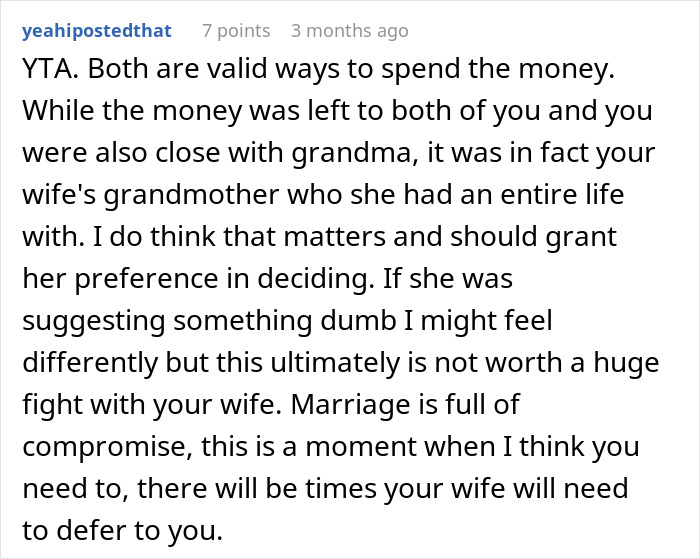

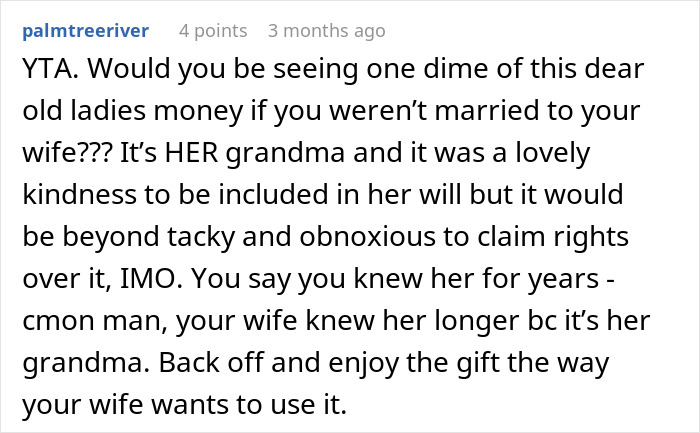

People have shared all kinds of reactions to the couple’s disagreement

Many believe the woman can’t be blamed for the situation

But a few did

Poll Question

Thanks! Check out the results:

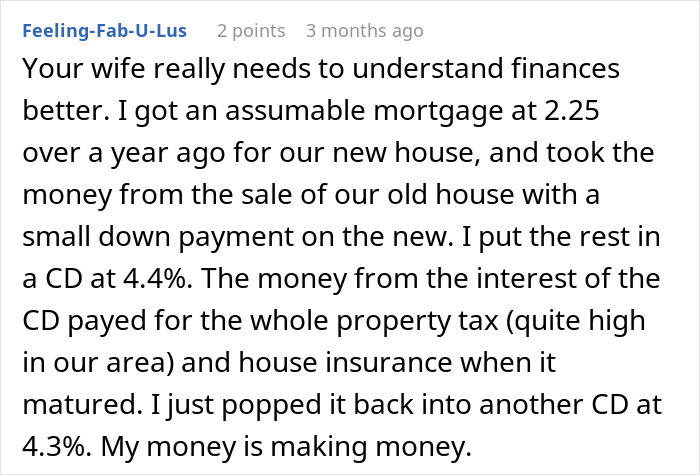

I'm not a financial advisor so my opinion is worth exactly what you paid for it, but what I would do is put the money into a low risk but safe place where it can earn some interest but won't lose anything and then forget about it for a year. Revisit the situation when minds are clearer and perhaps the grief isn't so fresh. As far as OP's situation is concerned, I don't think the fact that the money originally "belonged" to the partners family means the partners opinion should carry more weight. If my FIL gives me $20 for some birthday wine it doesn't mean my wife gets to select the grape variety.

As a queer woman myself, I got a chuckle out of the fact that both ladies in the picture had the same "stereotypical" lesbian hair cut. I wonder if Ai did that 🤣

In my opinion, you should pay off the mortgage and then invest that extra money. Both win :)

That might be a compromise, but isn't the best thing financially. They have a loan for 2.6% interest, but could get at least 4% in a safe investment. It would be silly to pay off the mortgage unless there are concerns other than money.

Load More Replies...Very different context (people get family money?) but I made the decision to get out of my mortgage instead of investing. It's really hard to describe, let alone monetize, but escape from the subtle pressure of 'gotta make rent' was, indeed, priceless. It was as if a hand that had always been pressing against my back quietly withdrew.

Is the financial gain worth the conflict? Grief means inheritance isn't all logic. Would getting your way be worth the I told you so? I'm guessing no, but my partner and I have hard and fast rules about family stuff.

The discounting of OPs time and experience would be causing conflict either way. Wifey handled this poorly. Your partner spends years of their time caring for your relative at the end of their life, so much so that Grandma now considers her family. Grandma dies, makes it clear she is fond of OP and her end of life efforts in her will, and the FIRST THING wifey goes and does is breaks her wishes, says "no you're not family." Just a little selfish and gross in my opinion. Like people have forgotten what "partnership" is supposed to mean.

Load More Replies...One thing missing here is the fact that the OP spent all the time with the grandmother, and this is probably why the couple got more money than the other relatives. The OP was named in the will, and some blood relatives were not. The grandmother wanted her to have something. Seeing as her wife could only visit 2 times a month or less, she might have gotten much less money in the will. Honor the grandmother and carry out her wishes. All that extra help at the end of her life was important to her.

Your wife doesn't want to share with you. Send her a bill for all the hours you spent caring for her Grandma.

I am so bad with money, so I have no dog in this fight. I am just sad that something like this is becoming such a problem.

It really does seem to me like the wife is undervaluing both OP's expertise as a financial planner and the labor she's contributed over the years. If she doesn't have a good reason for why paying off the mortgage is the better investment other than it's the plan she came up with, she should listen to the expert and not let family feelings get in the way.

Never mind what works out best financially, OP's wife is basically saying she doesn't count as family and that is going to eat away at their marriage unless they deal with it head on.

How sad. Though perhaps for the best to know the truth about your relationship rather than go on without the knowledge of where you really stand. I think in this case, if it was me, I'd let her pay off the mortgage. It would be quite a bitter pill to swallow, that my wife apparently completely devalues my financial expertise, in addition to everything I did for her grandmother, but in the end, if anything, her response to this whole thing reveals it's not really worth fighting about. Lesson learned. It would make me realize that my wife and I saw things very differently and seems to have different values. It would make me less trustful of the relationship overall, and much less secure about it's future. So I'd plan accordingly.

Grandma left it to both for a reason. She wanted both to have it, not just her granddaughter. She probably should’ve divided it up properly by saying half to my granddaughter and half to her husband but she didn’t. It would seem that was her intention, otherwise she would have just left it all to granddaughter. If I leave whatever I have to my son and his husband, I would intend for both of them to benefit. Marriage being as tricky as it is, perhaps grandma was afraid wife wouldn’t share with her husband. Is the house in both of their names? If it’s paid off and they divorce how does that impact the inheritance?

"I spent more time with her the past few years". Yeah, a "few years". OP's wife has known her for her whole lifetime. Being closer than the wife for a small portion of Granny's life isn't nearly the same. So, while Granny left it 50/50, I personally might be disappointed that my wife would decide 100% what we did with it, ultimately paying off the mortgage that is in both of your names, benefits both wives equally. So why argue about it? Just take what you were paying the mortgage and invest that, FFS. Yeah, your initial investment would be piecemeal compared to the inheritance but you'd also be out of a mountain of debt. Seems like OP cared more about making a quick, short term buck with large capital. Because ultimately both benefit equally long term and it's not like the wife is claiming 100% for herself to use selfishly. So, ultimately, who cares that OP can't use it to make a buck?

Is op really a financial advisor? She seems to be struggling with the basics like KYC and risk tolerance. I’m seeing that op has a much higher risk tolerance than her wife. Paying off the mortgage is significantly less risky and results in a more tangible asset (often a significant emotional factor in inheritances) than putting it into the market. Convincing a risk adverse client to assume more risk than they are comfortable with can cause a financial advisor problems with regulators so she shouldn’t be doing it to her spouse either. I am not an advisor but I think they should pay off the mortgage and then set up systematic investing for an amount equivalent to their old payment every month.

What she said is entirely correct. Safe investments like CDs are exactly what they should be doing.

Load More Replies...Did the financial advisor take the increasing value of the house into account? I'd presume so but it's missing in the gain calculations.

What does that have to do with it? It's not like the price they pay for the house changes because the value of the house does. They get it in the end either way.

Load More Replies...Dave Ramsey would tell you to pay off the mortgage. No debt is best. And why keep making the banks richer? Plus, you just end up paying more for the house in the long run. Then take the mortgage payment and save it at the highest interest you can find.

She is selfish asf. Let the real granddaughter have the money and do what she wants with it, wow.

You're not understanding correctly - in this case the inheritance is the legal property of the parties named in the will. They could divorce today, and OP and his wife would still split that money 50-50 if OP pressed the will. I love how her wife discounted her own Grandmas wishes and everybody skirted past that. Grandma clearly had enough of a relationship with OP to feel it worthwhile writing her name down with a lawyer. Everyone saying "not your grandma" would be saying the EXACT opposite if this wasn't OPs wife, but just some random person, and OP was grandma's caretaker. We see those here all the time (family trying to steal their own inheritance from some random). I'll bet Grandma appreciated 3-4 days per week at the end of her life, while wifey only made it out 1-2 times per MONTH.

Load More Replies...I'm not a financial advisor so my opinion is worth exactly what you paid for it, but what I would do is put the money into a low risk but safe place where it can earn some interest but won't lose anything and then forget about it for a year. Revisit the situation when minds are clearer and perhaps the grief isn't so fresh. As far as OP's situation is concerned, I don't think the fact that the money originally "belonged" to the partners family means the partners opinion should carry more weight. If my FIL gives me $20 for some birthday wine it doesn't mean my wife gets to select the grape variety.

As a queer woman myself, I got a chuckle out of the fact that both ladies in the picture had the same "stereotypical" lesbian hair cut. I wonder if Ai did that 🤣

In my opinion, you should pay off the mortgage and then invest that extra money. Both win :)

That might be a compromise, but isn't the best thing financially. They have a loan for 2.6% interest, but could get at least 4% in a safe investment. It would be silly to pay off the mortgage unless there are concerns other than money.

Load More Replies...Very different context (people get family money?) but I made the decision to get out of my mortgage instead of investing. It's really hard to describe, let alone monetize, but escape from the subtle pressure of 'gotta make rent' was, indeed, priceless. It was as if a hand that had always been pressing against my back quietly withdrew.

Is the financial gain worth the conflict? Grief means inheritance isn't all logic. Would getting your way be worth the I told you so? I'm guessing no, but my partner and I have hard and fast rules about family stuff.

The discounting of OPs time and experience would be causing conflict either way. Wifey handled this poorly. Your partner spends years of their time caring for your relative at the end of their life, so much so that Grandma now considers her family. Grandma dies, makes it clear she is fond of OP and her end of life efforts in her will, and the FIRST THING wifey goes and does is breaks her wishes, says "no you're not family." Just a little selfish and gross in my opinion. Like people have forgotten what "partnership" is supposed to mean.

Load More Replies...One thing missing here is the fact that the OP spent all the time with the grandmother, and this is probably why the couple got more money than the other relatives. The OP was named in the will, and some blood relatives were not. The grandmother wanted her to have something. Seeing as her wife could only visit 2 times a month or less, she might have gotten much less money in the will. Honor the grandmother and carry out her wishes. All that extra help at the end of her life was important to her.

Your wife doesn't want to share with you. Send her a bill for all the hours you spent caring for her Grandma.

I am so bad with money, so I have no dog in this fight. I am just sad that something like this is becoming such a problem.

It really does seem to me like the wife is undervaluing both OP's expertise as a financial planner and the labor she's contributed over the years. If she doesn't have a good reason for why paying off the mortgage is the better investment other than it's the plan she came up with, she should listen to the expert and not let family feelings get in the way.

Never mind what works out best financially, OP's wife is basically saying she doesn't count as family and that is going to eat away at their marriage unless they deal with it head on.

How sad. Though perhaps for the best to know the truth about your relationship rather than go on without the knowledge of where you really stand. I think in this case, if it was me, I'd let her pay off the mortgage. It would be quite a bitter pill to swallow, that my wife apparently completely devalues my financial expertise, in addition to everything I did for her grandmother, but in the end, if anything, her response to this whole thing reveals it's not really worth fighting about. Lesson learned. It would make me realize that my wife and I saw things very differently and seems to have different values. It would make me less trustful of the relationship overall, and much less secure about it's future. So I'd plan accordingly.

Grandma left it to both for a reason. She wanted both to have it, not just her granddaughter. She probably should’ve divided it up properly by saying half to my granddaughter and half to her husband but she didn’t. It would seem that was her intention, otherwise she would have just left it all to granddaughter. If I leave whatever I have to my son and his husband, I would intend for both of them to benefit. Marriage being as tricky as it is, perhaps grandma was afraid wife wouldn’t share with her husband. Is the house in both of their names? If it’s paid off and they divorce how does that impact the inheritance?

"I spent more time with her the past few years". Yeah, a "few years". OP's wife has known her for her whole lifetime. Being closer than the wife for a small portion of Granny's life isn't nearly the same. So, while Granny left it 50/50, I personally might be disappointed that my wife would decide 100% what we did with it, ultimately paying off the mortgage that is in both of your names, benefits both wives equally. So why argue about it? Just take what you were paying the mortgage and invest that, FFS. Yeah, your initial investment would be piecemeal compared to the inheritance but you'd also be out of a mountain of debt. Seems like OP cared more about making a quick, short term buck with large capital. Because ultimately both benefit equally long term and it's not like the wife is claiming 100% for herself to use selfishly. So, ultimately, who cares that OP can't use it to make a buck?

Is op really a financial advisor? She seems to be struggling with the basics like KYC and risk tolerance. I’m seeing that op has a much higher risk tolerance than her wife. Paying off the mortgage is significantly less risky and results in a more tangible asset (often a significant emotional factor in inheritances) than putting it into the market. Convincing a risk adverse client to assume more risk than they are comfortable with can cause a financial advisor problems with regulators so she shouldn’t be doing it to her spouse either. I am not an advisor but I think they should pay off the mortgage and then set up systematic investing for an amount equivalent to their old payment every month.

What she said is entirely correct. Safe investments like CDs are exactly what they should be doing.

Load More Replies...Did the financial advisor take the increasing value of the house into account? I'd presume so but it's missing in the gain calculations.

What does that have to do with it? It's not like the price they pay for the house changes because the value of the house does. They get it in the end either way.

Load More Replies...Dave Ramsey would tell you to pay off the mortgage. No debt is best. And why keep making the banks richer? Plus, you just end up paying more for the house in the long run. Then take the mortgage payment and save it at the highest interest you can find.

She is selfish asf. Let the real granddaughter have the money and do what she wants with it, wow.

You're not understanding correctly - in this case the inheritance is the legal property of the parties named in the will. They could divorce today, and OP and his wife would still split that money 50-50 if OP pressed the will. I love how her wife discounted her own Grandmas wishes and everybody skirted past that. Grandma clearly had enough of a relationship with OP to feel it worthwhile writing her name down with a lawyer. Everyone saying "not your grandma" would be saying the EXACT opposite if this wasn't OPs wife, but just some random person, and OP was grandma's caretaker. We see those here all the time (family trying to steal their own inheritance from some random). I'll bet Grandma appreciated 3-4 days per week at the end of her life, while wifey only made it out 1-2 times per MONTH.

Load More Replies...

Dark Mode

Dark Mode

No fees, cancel anytime

No fees, cancel anytime

29

43