Teen Faces Family’s Guilt Trip Over His Inheritance, Refuses To Share It With “Random Kids”

Setting up a trust fund is a great way to ensure that your loved ones are financially supported and protected, no matter the circumstances. However, when a lot of money suddenly comes into the picture, other family members often feel entitled to a share of it, even though the person who left it in the first place didn’t include them for a reason.

When this redditor’s family tried convincing him to share the money his dad set up in a trust fund, he firmly refused. Since he wasn’t going to college, he planned to use it to secure a good future and wasn’t going to risk losing it all to support his half and stepsiblings.

Having a trust fund is a very fortunate situation to be in

Image credits: KATRIN BOLOVTSOVA (not the actual photo)

However, when this teen was about to receive his, he struggled to fend off other family members from it

Image credits: Kindel Media (not the actual photo)

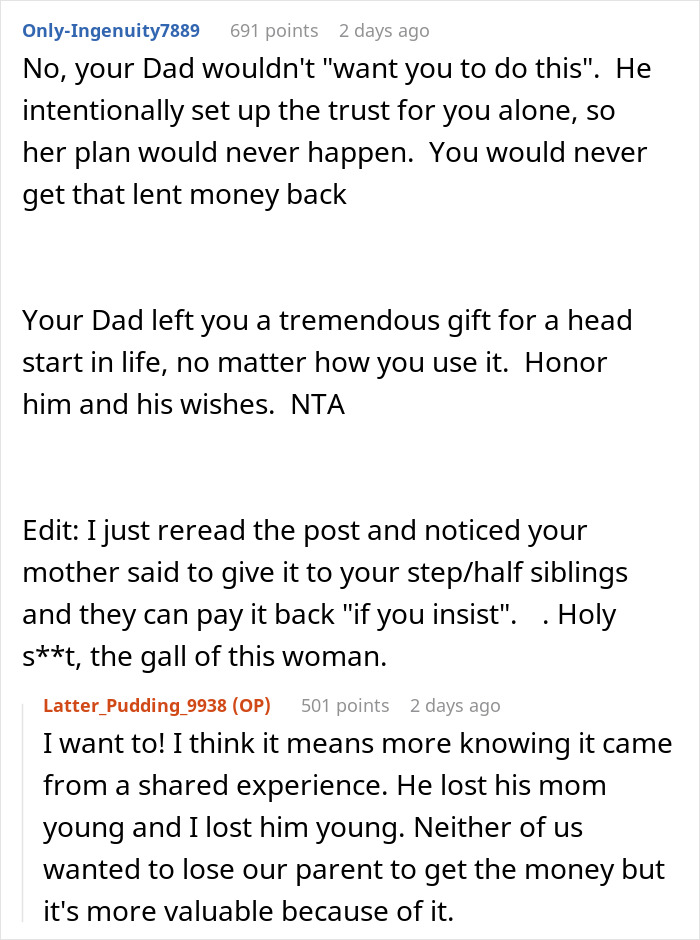

Image source: Latter_Pudding_9938

The main reason people set up trust funds is to control who receives their assets

Image credits: Kampus Production (not the actual photo)

According to Nationwide, an insurance and financial services company, “Trust funds are legal arrangements that allow individuals to place assets in a special account to benefit another person or entity.”

The main reason people set up trust funds is to control who receives their assets. For instance, they might want to help with a family member’s education or the purchase of their home.

Trust funds come in various forms and their types can differ depending on their purpose and beneficiary. If the grantor (person who wants to pass down their assets) wants a straightforward way to set up a trust fund, they can choose between revocable and irrevocable trusts. Both are created when a person is alive. The difference between them is that revocable can be changed, whereas irrevocable can’t be altered or dissolved.

There’s also a testamentary trust that comes into existence when the grantor passes away. And a charitable trust passes down assets to charity or the general public. It’s worth mentioning that there are many other sub-types that constitute trust funds so it’s important to analyze each one or reach out to a professional before deciding on one.

The receiver or the beneficiary of the trust fund can become the so-called trust fund baby if their parents or grandparents decide to pass down their assets to them. Normally, they can start using the money once they reach 18. In the meantime, the trust is managed by the trustee, who can be a neutral third party like an individual or a bank.

Trust funds aren’t just for the wealthy

Image credits: Mikhail Nilov (not the actual photo)

Despite common belief, trust funds aren’t just for the wealthy. Sure, there was a time when that was the case but now it has become a more common tool for everyone to plan their estate.

Since more and more people choose to pass down their assets in this way, it may be more important than ever to discuss the mistakes to avoid.

According to attorney Ronald D. Payne, selecting the wrong trustee (the third party that manages the trust fund) is the biggest misstep parents can make while setting up a trust fund. The trustee has immense power over it and when parents name a close family member as one, it can be a very risky move. For instance, an unqualified trustee who recklessly invests or fails to file taxes can significantly reduce the size of the trust.

Reviewing the trust annually is also important, as laws and family situations might change. Unfortunately, an outdated financial plan can be as good as having none at all. So it’s crucial to review the trust and reassess if the trustee is still eligible for this role, if every beneficiary you want is included, and so on.

To prevent the money from falling into the wrong hands, it’s vital to make sure that all possible protection is in place. The best way to do that is to consult with a legal professional who can help find the trust that will meet all of your needs and ensure that all the documents are created properly.

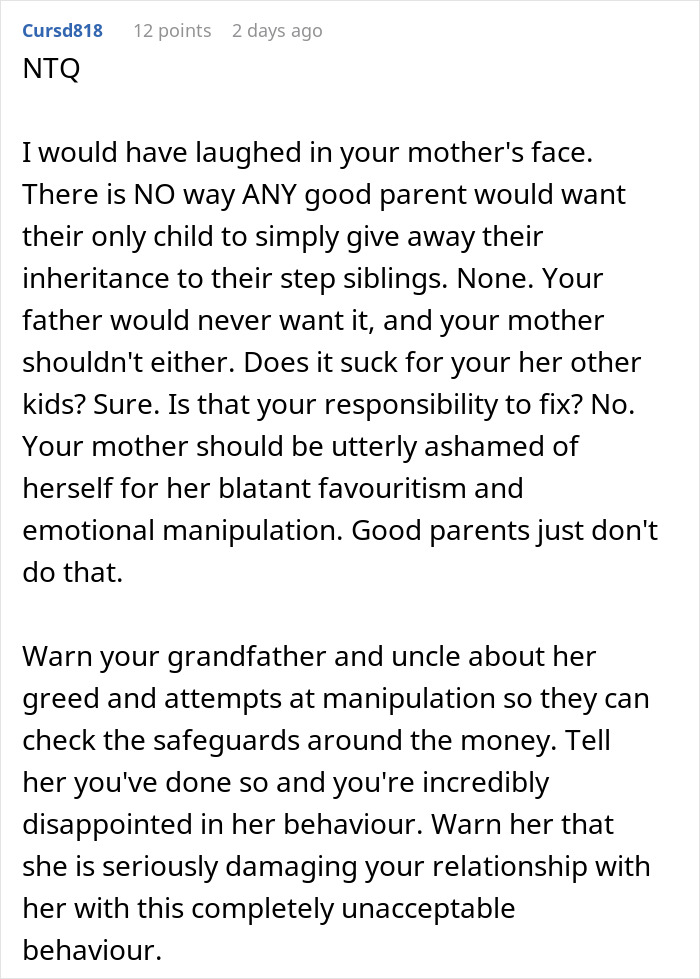

Readers supported the teenager’s decision to keep the trust fund to himself

Poll Question

Thanks! Check out the results:

Explore more of these tags

Wow - it's rare to not see some sub-IQ not throw a YTA in there because "family/sick/you've got enough". His mother is being a bitter cow and is going to end up pushing him far away.

Wow - it's rare to not see some sub-IQ not throw a YTA in there because "family/sick/you've got enough". His mother is being a bitter cow and is going to end up pushing him far away.

Dark Mode

Dark Mode

No fees, cancel anytime

No fees, cancel anytime

28

23