Teen’s First Car Turns Out To Be A Debt Trap Set By Mom, He Sends Her $40k Loan Right Back To Her

We all know the sting of a bad gift. That ugly sweater from an aunt, the fruitcake that could double as a doorstop, or the tacky photoframe you never asked for. You smile, say thank you, and quietly shove it in the back of your closet. It’s a harmless, if awkward, human ritual.

But some gifts can’t be so easily discarded. They come with strings attached, a hidden price tag that turns a generous act into a long-term burden. On one teen’s 16th birthday, the “gift” was a shiny new car that came with a secret, crippling $40,000 loan.

More info: Reddit

A gift from a parent shouldn’t come with a hidden, life-altering price tag

Image credits: korrawinj / Freepik (not the actual photo)

One teen was “gifted” a new car at 16, only to discover it came with a crippling $40,000 loan that he would have to pay for

Image credits: Getty Images / Unsplash (not the actual photo)

For years, he was stuck paying for his mother’s terrible financial decision, one which they agreed would be a split cost, but that turned out to be an empty promise

Image credits: freepik / Freepik (not the actual photo)

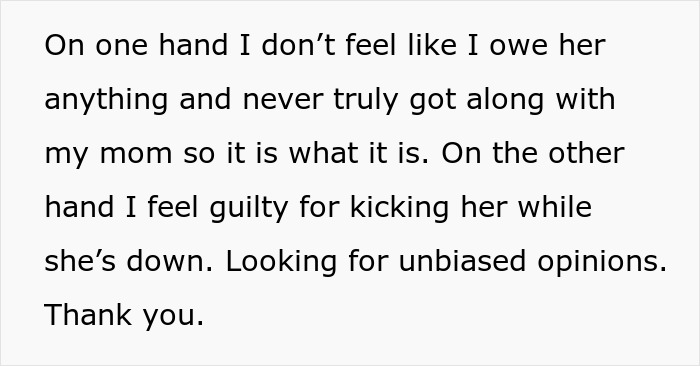

When he finally found a way to escape the debt, his mother turned to anger and tried to guilt him into continuing the payments

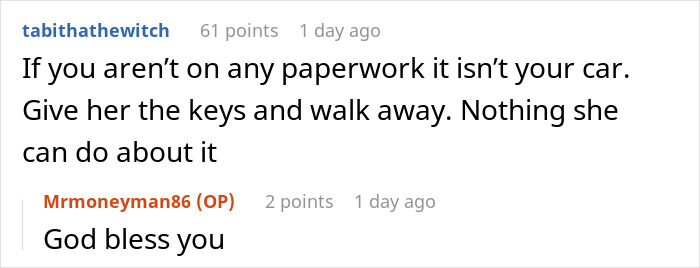

Image credits: Mrmoneyman86

She demanded he drain his savings to pay for her mistake, calling the predatory loan his “responsibility”

The teenage dream is nothing but a brand new car for your 16th birthday. But for the OP, this dream gift from his mom was a Trojan horse. A shiny Nissan Sentra was hiding a secret—a crippling $40,000 loan for a $20,000 car. The original deal was that he’d split the $510 monthly payment between him, his mom, and her boyfriend, who turned out to be terrible with finances.

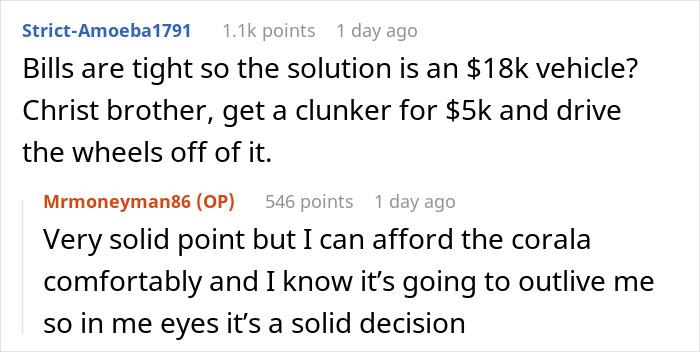

This grand scheme lasted a full 3 months, leaving him to foot the whole bill for years. But, as adulthood and all its extra financial responsibilities crept closer, the burden became too much. His girlfriend’s mom suggested a revolutionary idea: just buy a cheaper car. He found a better, used Corolla for a fraction of the price, a perfectly logical, adult solution to his financial woes.

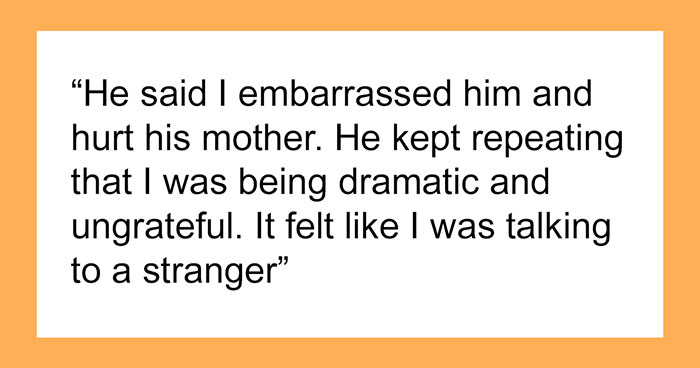

When he presented this escape plan to his mother, she lost it. She deployed all the gaslighting classics, insisting the predatory loan was his “responsibility,” that the original debt was a “gift,” and that she had even “saved” him money by not transferring the loan to his name. Her grand finale was a demand that he drain his personal savings to continue paying for her mistake.

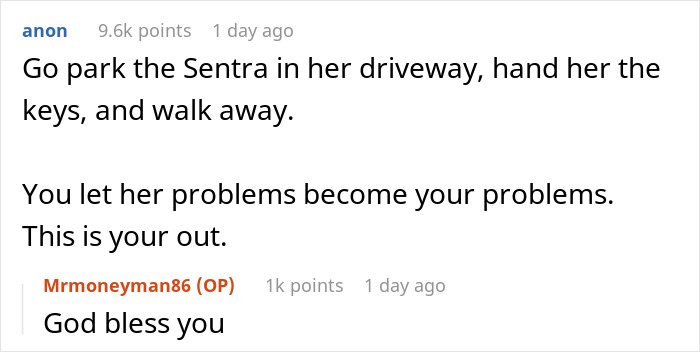

He found himself caught between a rock and a hard place. On one side, he had the logical, self-preserving desire to escape a financial trap he never agreed to. On the other, he had the guilt of “kicking his mom while she’s down,” as she was newly divorced and jobless. He’s now asking the internet if he’s the jerk for wanting to walk away from a “gift” that has been draining his bank account since he was 16.

Image credits: Esmihel Muhammed / Pexels (not the actual photo)

The “gift” the son received was actually a predatory auto loan with a bow on top. The Center for Responsible Lending explains that a key sign of a predatory loan is when the amount financed is significantly higher than the vehicle’s actual value, often packed with unnecessary add-ons.

The fact that a $20,000 car was financed for $40,000, combined with a high 10% interest rate given to someone with “bad credit and no job,” shows that this was a financial trap from the very beginning. One that the mom and her then-boyfriend fell for hook, line, and sinker.

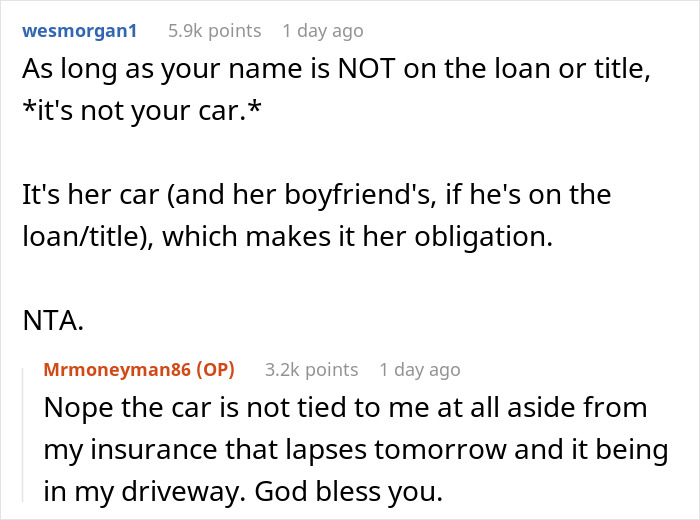

Legally and financially, the son has absolutely zero obligation to continue paying for this car. According to legal experts at National Debt Relief, children are not responsible for their parents’ debts, especially when the loan is solely in the parent’s name, as is the case here. His mother’s argument that he has a “responsibility” is based on an outdated cultural expectation, not legal reality.

Ultimately, his guilt is a natural emotional response, but his decision to walk away is the only financially sound one. He has spent years paying for his mother’s “terrible financial decision.” His plan to buy a more affordable car and return the over-leveraged one to her might seem harsh, but it is the only reasonable outcome. He is simply refusing to continue being the solution to a problem he did not create.

Do you think he should suck it up and pay, or is he acting reasonably? Share your thoughts in the comments below!

Dark Mode

Dark Mode

No fees, cancel anytime

No fees, cancel anytime

23

1