30 Crazy Stories Of People Not Realizing They Can’t Afford The Lifestyle They Lead

Interview With ExpertEffective budgeting requires having a clear understanding of your income and expenses, setting realistic goals for yourself, and developing good money habits.

But some people, for one reason or another, skip on all the work and when the results aren't what they would like them to be, they become frustrated, blaming circumstances or external factors rather than addressing their own choices.

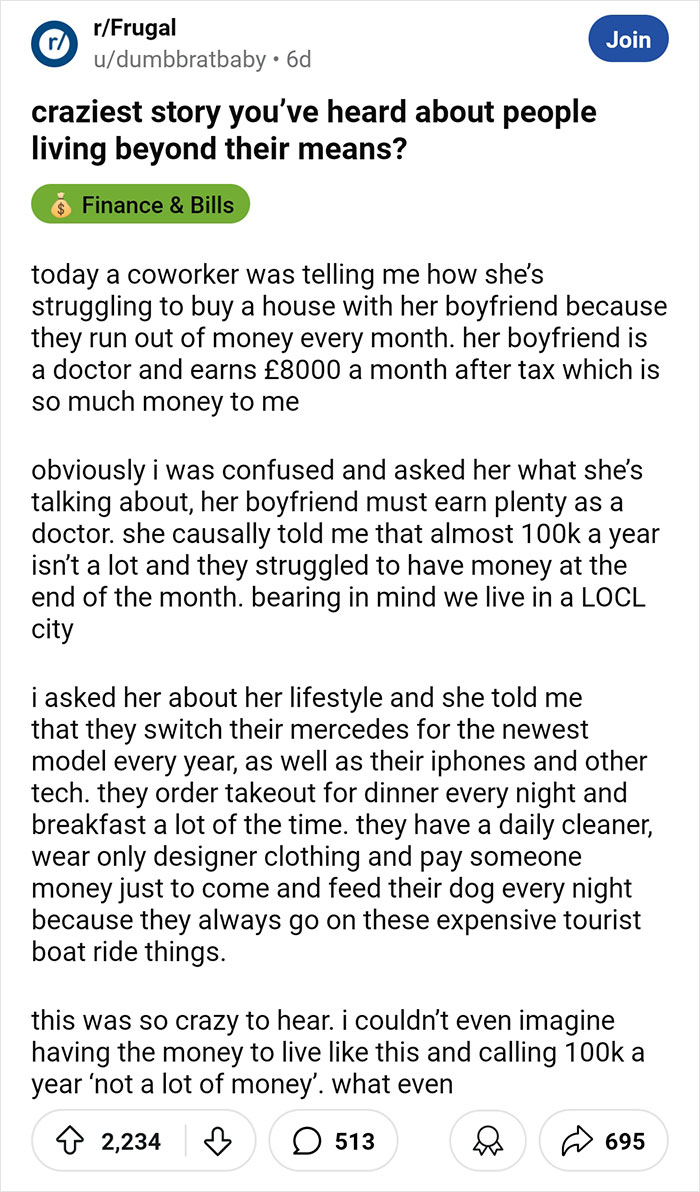

So Reddit user Dumbbratbaby made a post on the platform, asking its 'Frugal' community to share the craziest stories they've heard about folks living beyond their means.

This post may include affiliate links.

This reminds me of something I read years ago where someone on a huge salary was complaining that they had nothing left over when you factored in private schools for their kids, expensive and prestigious extracurriculars, tutors, maintenance costs of their luxury home and cars, etc, ie that the rich lifestyle was leaving them paycheck to paycheck.

This reminds me of something I read years ago where someone on a huge salary was complaining that they had nothing left over when you factored in private schools for their kids, expensive and prestigious extracurriculars, tutors, maintenance costs of their luxury home and cars, etc, ie that the rich lifestyle was leaving them paycheck to paycheck.

And someone said "yeah it's amazing how little money is left over when you choose to spend it all."

Michelle Schroeder-Gardner, the founder of Making Sense of Cents, a platform where she helps readers make smarter decisions about earning, saving, spending, and investing, told Bored Panda, "Some of the most common signs [that someone is living beyond their means] include regularly using credit cards for non-emergencies and only paying the minimum balance, having little to no savings or emergency fund, and spending more than what they earn."

"Another sign is feeling the need to maintain appearances by purchasing expensive items, like an expensive new car or designer clothes, even when it’s not the smartest financial choice for that person," she added.

I had a coworker (teacher) tell me one day that she was gonna have to quit teaching and try to find a better paying job because her family wasn't making enough money to support themselves. They had a household income of $120k. This was 10 years ago in the rural south.

I had a coworker (teacher) tell me one day that she was gonna have to quit teaching and try to find a better paying job because her family wasn't making enough money to support themselves. They had a household income of $120k. This was 10 years ago in the rural south.

They had a huge house, over $100k worth of vehicles, designer clothes and were constantly going on foreign vacations.

I made half of their income and was able to buy a house, have a car payment, fund retirement, take a decent vacation or two and still save money.

Its not what you make, its what you keep.

But it's also what you make 'cause some people can't even afford to keep a single dime

I went to college in Texas in the early 80s and some students had parents who were in the oil business. The oil business has a pronounced boom bust business cycle. So you’d see kids who one semester are living in the most expensive dorm and have a brand new car and wasting money like crazy going to Cancun on weekends and stuff like that, and then the next semester, their dad’s broke and they’re working in the dorm cafeteria and struggling to get by.

I went to college in Texas in the early 80s and some students had parents who were in the oil business. The oil business has a pronounced boom bust business cycle. So you’d see kids who one semester are living in the most expensive dorm and have a brand new car and wasting money like crazy going to Cancun on weekends and stuff like that, and then the next semester, their dad’s broke and they’re working in the dorm cafeteria and struggling to get by.

That definitely influenced me to never assume my income level was going to last forever. Always plan for the next recession, because it’s coming sooner or later.

Worked automotive for 18 years. After the 1st downturn and the adjustments needed from working 7 days/wk, double time on Sundays, to 40 hrs was jarring. Never had to sell anything, but it was close. Supporting 4 people makes one creative on expenses.

One in-depth barometer of finance knowledge is 28 questions given annually to Americans, known as the P-Fin Index.

The index explores eight functional areas across finance and data from the 2024 index reveals that financial literacy in the US has been hovering around 50% for eight consecutive years, with a 2% drop in the past two years.

The results also show that Americans appear most comfortable with financial knowledge on borrowing, saving, and consuming and the least confident around understanding financial risk.

I lived through it with my ex husband. After turning a certain age he started to get a monthly settlement of $1200 for the rest of his life from a lawsuit involving circumstances surrounding his birth. There had also been a lump sum when the suit was settled but his mother squandered that (mental illness and spending issues).

I lived through it with my ex husband. After turning a certain age he started to get a monthly settlement of $1200 for the rest of his life from a lawsuit involving circumstances surrounding his birth. There had also been a lump sum when the suit was settled but his mother squandered that (mental illness and spending issues).

This was over ten years ago and we had just left college. $1200/month was more than I was making a month and would have nearly covered all our rent/bills a month, meaning anything we made over that would have been perfect for saving, vacations, etc.

But we never had anything extra. We had a shared bank account for bills but also separate accounts, and he never had anything to save. I could see he bought a lot of video games and tech like new phones, but otherwise I didn't know where the money was going and he wouldn't say/said he didn't know. We managed but never got ahead of bills or went on trips.

It wasn't long before he finally told me he was looking into how to sell something like 10 years of the settlement payments for a lump sum to "get out of debt and start fresh." I stressed that was an AWFUL idea and he said he wouldn't do it.

Then he revealed a gambling addiction. I knew he liked scratch tickets and won often but had no idea the extent of it. He was using rent and bill money for gambling and putting bills on credit cards. I told him he needed to get into therapy and we had to work on this and if he lied to me again about it I would leave. A year later he still wasn't in therapy, and he revealed he lost the monthly settlement because it turned out the payment loan (that he was still looking into) invalidated the settlement. And also he was even deeper in debt because the gambling was ongoing behind my back. So I left.

My cousin works at walmart and her husband is on disability. but some how they're able to take their family of four on a cruise every year..Yet they were b***hing about not making ends meet during the month because they ran out of food stamps.

My cousin works at walmart and her husband is on disability. but some how they're able to take their family of four on a cruise every year..Yet they were b***hing about not making ends meet during the month because they ran out of food stamps.

As someone with a disability. I btch about not having enough money at the end of the month too. But thats cuz I stick to a budget and save $50-100 a month so that once a year I can go on a little trip, sometimes with my sister who works at Walmart lol. I sacrifice too. I haven't had proper new clothes/shoes in years. I save so I have one thing to look forward to in my sht life. And in general ebt never gives enough to people who need it but will supply scammers with more than they deserve. Which is frustrating. I get people want to believe we are leaches who don't deserve to exist or at the minimum enjoy our existence. But we try. Maybe the people in this story try their best to have one pick up a year too. Or I guess we should all just kl ourselves since our lives are so poor and meaningless we don't deserve any happiness or fun. Same classist, ableist energy I fear getting from a Karen for using ebt to buy myself a birthday cupcake. Maybe they have legal side hustles. I have family who belittle me too. Don't judge when you're an outsider looking in.

Like any learning, getting familiar with the ins and outs of mortgages, investments, risk profiles, and other financial areas takes time. But Michelle Schroeder-Gardner of Making Sense of Cents suggests these tips and strategies to develop your financial toolkit more efficiently:

- Create a real budget. "Start by tracking your income and expenses to understand exactly where your money is going. A clear budget helps you see how much you can really spend and save each month. So many people don't do this and don't realize what they can and can't afford."

- Focus on your needs over wants. "Focus on important expenses like housing, food, and transportation first, and limit spending on wants until you can afford them."

- Set specific, measurable goals. "Break down large financial goals into smaller, more achievable steps. For example, instead of saying 'I want to save more,” aim for “I want to save $1,000 in the next 3 months.'"

- Build an emergency fund. "I highly recommend that everyone set aside a small amount of money each month into a savings account for emergencies. This can prevent you from turning to credit cards or loans when unexpected expenses arise (like a car repair or an unexpected medical bill)."

- Avoid lifestyle inflation. "As your income increases, it can be tempting to spend more money. Instead, keep your expenses steady and use the extra income to save or invest for the future. Of course, you can spend money on wants, but just make sure you can afford them and are still able to stick to your money goals!"

Watch Caleb Hammer youtube channel. Completely broke people go into debt to buy stuff on amazon and order takeout multiple time a week. I had to stop watching because of how rage inducing some episodes were.

Watch Caleb Hammer youtube channel. Completely broke people go into debt to buy stuff on amazon and order takeout multiple time a week. I had to stop watching because of how rage inducing some episodes were.

Mum ringing me up this morning asking me to transfer money because she ran out of her depression/anxiety pills..after meeting a new man and going in daily car trips to cafes and shops all over the state..and not working because she’s going to pull the ‘mental health card’. I said no, I’m not enabling her and for her to ask my older brother because he lived with her rent free for 10 years and got everything paid for so he ‘owes’ her a bit which will pay for the pills.

Mum ringing me up this morning asking me to transfer money because she ran out of her depression/anxiety pills..after meeting a new man and going in daily car trips to cafes and shops all over the state..and not working because she’s going to pull the ‘mental health card’. I said no, I’m not enabling her and for her to ask my older brother because he lived with her rent free for 10 years and got everything paid for so he ‘owes’ her a bit which will pay for the pills.

A friend just told me that she’s in “debt” right now because of too many Uber Eats orders……. I don’t even know what to say lol.

A friend just told me that she’s in “debt” right now because of too many Uber Eats orders……. I don’t even know what to say lol.

This story is all too common.

This story is all too common.

I live in Chicago and I’m astounded by the number of luxury cars I see driving around… statistically speaking, those cars are way out of budget for the majority of people driving them.

When you compare the average national income against the average national car payment it paints a stark reality. Most people are living way above their means. A persons car reflects how they see themselves and their attitude towards spending… it’s not a big leap to think someone driving a luxury car is also shelling out on other luxury goods or experiences.

$100k a year isn’t bad in a city center like Chicago, it’s above the average, but it’s not enough to sustain a luxury lifestyle like that. I make around that, and live comfortably, but I don’t drive anything crazy and I don’t spend like crazy either.

A majority of the people I see driving range rovers or Mercedes are probably a couple missed paychecks away from having to downgrade their lifestyle drastically.

I know a wealth manager who doesn't name names, but talks about clients having a net worth of 8 figures who, if they don't change their spending habits, will run out of money at some point. When he suggest they drop one of their country clubs or sell a 3rd home that they rarely use, they claim they just can't because they're afraid of what their friends would think of them. It's nuts.

I know a wealth manager who doesn't name names, but talks about clients having a net worth of 8 figures who, if they don't change their spending habits, will run out of money at some point. When he suggest they drop one of their country clubs or sell a 3rd home that they rarely use, they claim they just can't because they're afraid of what their friends would think of them. It's nuts.

When I talked to my supervisor at the time about why I was looking for another job, explaining that I couldn’t afford to start a family without either a much higher wage or employer-sponsored health insurance, she told me not to worry about my excel spreadsheet and that she is still paying credit card debt from when her kids were young.

When I talked to my supervisor at the time about why I was looking for another job, explaining that I couldn’t afford to start a family without either a much higher wage or employer-sponsored health insurance, she told me not to worry about my excel spreadsheet and that she is still paying credit card debt from when her kids were young.

Her oldest was 10.

Uuuummmm yeah that is EXACTLY why I will continue to worry about my excel spreadsheet. No way in hell I’d put myself in that kind of financial situation.

My two credit cards have great rewards schemes. They offer great protection for both online and in-store purchases. And they both have direct debits linked to my current account to be paid in full every month. Never pay for something over a longer period than that for which you benefit from the purchase.

I used to work in a bank. I saw someone once with 100K in credit card debts, mainly due to his poker addiction. High income but he was pissing it down the drain by trying to become a pro poker player.

I used to work in a bank. I saw someone once with 100K in credit card debts, mainly due to his poker addiction. High income but he was pissing it down the drain by trying to become a pro poker player.

Edit: I also remember the clients who would regularly want to withdraw hundreds in cash and spend it without a trace. Nearly everyone accepts card or cheque here in France, besides d**g dealers and prostitutes...

Edit again: I just remembered someone spending 3K per month on a Lamborghini lease whilst living in rental accommodation. Some of these people driving around in super cars don't own s**t.

I work at a factory and know for a fact 95% of the employees make between $21.50 and $25.50. The number of brand new $80,000 - $100,000 trucks in the parking lot astonishes me every single morning.

I work at a factory and know for a fact 95% of the employees make between $21.50 and $25.50. The number of brand new $80,000 - $100,000 trucks in the parking lot astonishes me every single morning.

Just wait until the next recession...even with both people working, there WILL be adjustments.

I know of a couple where the man owned a very successful and innovative company and the wife stayed home with their kid. They both drove fancy cars, dressed really well, their kid was in all brand-name clothing, they lived in a beautiful house on a mountain that was nicely furnished, went out to fancy restaurants and flashed money.

I know of a couple where the man owned a very successful and innovative company and the wife stayed home with their kid. They both drove fancy cars, dressed really well, their kid was in all brand-name clothing, they lived in a beautiful house on a mountain that was nicely furnished, went out to fancy restaurants and flashed money.

Well, turns out, he was using his company CC to pay for a lot of personal things, so much so that he eventually got kicked out of his own company by the shareholders. They eventually separated and she told me that everything was a facade. All the nice things were bought on credit, the cars were a lease, the house they scoped up for cheap rent from some foreign investors.

They built up this image that was fake and eventually divorced due to money and alcoholism that started when he got booted from his company.

A friend recently shared the following TRUE story of his family's finances:

A friend recently shared the following TRUE story of his family's finances:

My friend makes a little over $100k per year.

My friend has contributed to his IRA for many years.

My friend received a moderately large (over $100k) inheritence a few years ago.

In the last 5 years my friend has squandered everything! The inheritance is spent. The IRA has been drained. My friend spent about $700k over the last 10 years on (too many) vacays and other financially questionable things. My friend wants to retire but cannot.

We bought a cheap fixer upper a few years ago. A guy in the family inherited more money than our house was right after we bought. He blew it all, had some kids. We showed him several houses he could have paid cash for. He said they weren't good enough and his kids were recently in a homeless shelter with his ex. His grandmother leased new cars that were about what our house cost. Saved zero for retirement. Just blew all her money. Now when they get together they talk about the economy and my head almost explodes because neither has an understanding of how money works.

We bought a cheap fixer upper a few years ago. A guy in the family inherited more money than our house was right after we bought. He blew it all, had some kids. We showed him several houses he could have paid cash for. He said they weren't good enough and his kids were recently in a homeless shelter with his ex. His grandmother leased new cars that were about what our house cost. Saved zero for retirement. Just blew all her money. Now when they get together they talk about the economy and my head almost explodes because neither has an understanding of how money works.

Friend of a friend makes six figures in the computer science industry. Lives with parents doesn’t pay rent. Very little bills. Somehow she overspends SO MUCH every month that at 23 she’s 50k in debt and complains that she never has money. Genuinely f*****g mind boggling.

Friend of a friend makes six figures in the computer science industry. Lives with parents doesn’t pay rent. Very little bills. Somehow she overspends SO MUCH every month that at 23 she’s 50k in debt and complains that she never has money. Genuinely f*****g mind boggling.

Needs clarification: at 23 the debt could be student loans and the complaints about never having money could be due to trying to pay them off quickly. Private college can easily cost over $200K for 4 years and while the top tier schools (I'm guessing top 30) usually have large endowments that they use to ensure their students leave with small debts, many others are excellent but will leave students with over $200K in debt. If she got a great education at a high - but unfortunately typical - cost and in only ~2 years has paid her loans down to $50K, she deserves none of this lambasting.

Not to go into too much detail but my wife is a Dr, 2 of her colleagues on the same level as her cannot afford to retire (67 & 74) both are miserable. Spent every dime, go to Europe twice a year etc etc, when I met them and they asked what I do just said I retired at 40, that went over like a lead balloon.

Not to go into too much detail but my wife is a Dr, 2 of her colleagues on the same level as her cannot afford to retire (67 & 74) both are miserable. Spent every dime, go to Europe twice a year etc etc, when I met them and they asked what I do just said I retired at 40, that went over like a lead balloon.

My brother went to an extremely expensive/ exclusive high school on scholarship in SoCal. (I believe tuition was around $30,000 a year at some point back in 2008-2012).

My brother went to an extremely expensive/ exclusive high school on scholarship in SoCal. (I believe tuition was around $30,000 a year at some point back in 2008-2012).

At the beginning of the his freshman year (August of 2008), whenever we dropped him off there were so many “luxury” cars in the parking lot, he came home with stories of parents with huge mansions vacations blah blah blah. At the end of the year (after the recession hit) there were nothing but Toyotas and a reduced student body population. 😬😬😬.

There was a family in my neighborhood who had a nice house and nice cars and clothes, went on nice vacations, etc, and one day, they told us they were moving in with her parents because the house was being foreclosed on. I was shocked I didn’t see any austerity measures ahead of the foreclosure. I never heard them say something like, “ We are having a staycation this year to save money” or “We can’t go out for dinner tonight” or “We are selling one of the cars”. Nothing like that. They just spent like usual until they hit a wall. Crazy.

There was a family in my neighborhood who had a nice house and nice cars and clothes, went on nice vacations, etc, and one day, they told us they were moving in with her parents because the house was being foreclosed on. I was shocked I didn’t see any austerity measures ahead of the foreclosure. I never heard them say something like, “ We are having a staycation this year to save money” or “We can’t go out for dinner tonight” or “We are selling one of the cars”. Nothing like that. They just spent like usual until they hit a wall. Crazy.

One of my friends has a dad who is well paid, really high up in a tech company. He makes a lot of money and her family spends a lot of money. They eat out almost every night, have a vacation home, his wife has so much clothing she uses the 6 closets in her house to store it all, they give vehicles away and always buy brand new ones, & buying people insanely expensive gifts. But her dad is lost why his coworkers (who are more frugal) are retiring but he cannot afford to. (Lucky my friend took after her aunt/godmother who is very frugal so she won’t be unlearning all those bad behaviors).

One of my friends has a dad who is well paid, really high up in a tech company. He makes a lot of money and her family spends a lot of money. They eat out almost every night, have a vacation home, his wife has so much clothing she uses the 6 closets in her house to store it all, they give vehicles away and always buy brand new ones, & buying people insanely expensive gifts. But her dad is lost why his coworkers (who are more frugal) are retiring but he cannot afford to. (Lucky my friend took after her aunt/godmother who is very frugal so she won’t be unlearning all those bad behaviors).

There is this girl i know. she's almost 30. quits jobs after a few months cause they are all "toxic" (they ask her to come in on time), she moves in with each boyfriends she dates within 2-3 months, then breaks leases and moves again. all of that costs money she doesn't have. she always goes on trips, right now is in Italy for 4 weeks (while unemployed since summer) and puts it all on her credit card. while also buying a huge amount of clothes and brand stuff.

There is this girl i know. she's almost 30. quits jobs after a few months cause they are all "toxic" (they ask her to come in on time), she moves in with each boyfriends she dates within 2-3 months, then breaks leases and moves again. all of that costs money she doesn't have. she always goes on trips, right now is in Italy for 4 weeks (while unemployed since summer) and puts it all on her credit card. while also buying a huge amount of clothes and brand stuff.

I feel like this is very common in the social media age...and it's not gonna end well.

My first housemate in college. It was student housing, you basically got a room with a small kitchen and then a bathroom shared with one other person, two rooms + bathroom per floor, 6 rooms per house. She rented two units so she wouldn’t have to share a bathroom (the second room was in use as a closet). She told me she got 1000€ per month allowance but racked up 1-2k € in credit card debt each month as well (which her parents threatened every month to stop paying, but they never did).

My first housemate in college. It was student housing, you basically got a room with a small kitchen and then a bathroom shared with one other person, two rooms + bathroom per floor, 6 rooms per house. She rented two units so she wouldn’t have to share a bathroom (the second room was in use as a closet). She told me she got 1000€ per month allowance but racked up 1-2k € in credit card debt each month as well (which her parents threatened every month to stop paying, but they never did).

For context: I lived off 600€ a month and paid for everything myself (rent/food/utilities etc). That was a rather tight budget but I managed. She didn’t even have to pay rent (her parents did that), the 1000€ was only for food & fun. Absolutely broke my brain because I had weeks where I wasn’t sure if I had enough food for the week (I always managed somehow, but barely) and then she was complaining to me that her dad threatened to cut her off again but ‘it was so unreasonable and unrealistic to expect her to live off only 1k per month’. She never got why I couldn’t join her for whatever frivolous spending spree she had planned (‘just ask your parents for more money’) and then couldn’t grasp that not every parent has 3k€ (or any amount really) to throw away each month :’)).

I remember as a teenager walking past someone's really big and fancy house in a neighborhood my rich friend lived in. In the driveway was a very expensive car. One of the curtains was halfway open and I saw milk cartons and bare cable spools around the living room. No decor, no nothing. Just a big house and a fancy car with almost nothing inside. The people had lived there for quite some time so it wasn't that they'd just moved it.

I remember as a teenager walking past someone's really big and fancy house in a neighborhood my rich friend lived in. In the driveway was a very expensive car. One of the curtains was halfway open and I saw milk cartons and bare cable spools around the living room. No decor, no nothing. Just a big house and a fancy car with almost nothing inside. The people had lived there for quite some time so it wasn't that they'd just moved it.

That stuck with me.

My in-laws make more than both my husband and I and they have 3 kids, have 3-4 atv’s (replace every few years and get loans for them), have a pop-up camper trailer (still have loan on it), pay thousands for sport events for the kids a year (fine ok the kids enjoy the sports stuff), spend money on tons on firearms and ammunition to go hunting as well as licenses and processing fees, have 3 vehicles (2 which are on loans and 1 they owe us money for), buy name brand of most things and even custom order things.

My in-laws make more than both my husband and I and they have 3 kids, have 3-4 atv’s (replace every few years and get loans for them), have a pop-up camper trailer (still have loan on it), pay thousands for sport events for the kids a year (fine ok the kids enjoy the sports stuff), spend money on tons on firearms and ammunition to go hunting as well as licenses and processing fees, have 3 vehicles (2 which are on loans and 1 they owe us money for), buy name brand of most things and even custom order things.

They live way above their means and had the audacity to ask us for $11k for their oldest kids second semester. Absolutely did not save anything over the last 19 years.

I'm often reminded of back when my daughter started taking band when she was in school. When we got to the store my ragged old pickup looked out of place parked there with the fancy new cars and shiny pickups, but when we picked out her clarinet I wrote a check to pay for it, and when we left most of those fancy vehicles were still there. The owners were inside filling out the paperwork to buy their children's instruments on credit, with monthly payments. I was not, am not, and likely will never be rich, but I could pay for a $300.00 clarinet.

I have an aunt who is going through a divorce and moved into a retirement community.

I have an aunt who is going through a divorce and moved into a retirement community.

Some of her money is still tied up in the divorce process, and she lives on social security for income. She goes to the local food bank for food, and hasn't had internet service installed because she says she can't afford it.

Yet, she leases a car for $550 a month and can't say no when her granddaughter asks for a $70 pair of leggings or $100 shoes.

Sometimes I want to help her because she's a very loving aunt, but I also wonder if I'd just be enabling her to keep spending on the wrong things.

Buying a new car every year sometimes twice a year, while taking a loss every time they trade in their 1yr “old” vehicle.

Buying a new car every year sometimes twice a year, while taking a loss every time they trade in their 1yr “old” vehicle.

If you really have the urge to burn through money as quickly as possible, buy a new car.

Knew a guy who was a shift manager of a Whataburger and somehow leased 2 Lincoln Navigators back in 2009.

Knew a guy who was a shift manager of a Whataburger and somehow leased 2 Lincoln Navigators back in 2009.

I'm pretty sure the 2008 economy collapse was due to really stupid s**t like this.

Yes, but..people were enticed by low rates and urged to borrow against rising equity. "Oh, my house just went up 20k in value. Think I'll buy a truck". SO many burned like this.

Friend of mine straight up evades tax in his exceptionally well paying job. (6 figures for 3 days a week) He has a contractor job where he’s supposed to pay his own tax but hasn’t lodged in about 5 years. Even without paying his 40% to the government, he runs out of money every month. Zero savings. Owns a huge deluxe camper trailer, a car, 2 jet skis and a motorbike. Doesn’t own a home, but has spent 3 times what our deposit was on vehicles since I met him two years ago.

Friend of mine straight up evades tax in his exceptionally well paying job. (6 figures for 3 days a week) He has a contractor job where he’s supposed to pay his own tax but hasn’t lodged in about 5 years. Even without paying his 40% to the government, he runs out of money every month. Zero savings. Owns a huge deluxe camper trailer, a car, 2 jet skis and a motorbike. Doesn’t own a home, but has spent 3 times what our deposit was on vehicles since I met him two years ago.

He spends all his money on big boy toys, luxury items for his kids and SAHM partner, and meal kits/ ready made meals instead of groceries. It’s wild.

Currently thinking of buying a big fishing boat.

The US government. $35 trillion in debt. Crazy.

The US government. $35 trillion in debt. Crazy.

I grew up in poverty, but worked and earned my way into a comfortable middle-class life. I know I can survive on far less than I have now, but still spend and save responsibly. I was forced to medically retire in my 40s, but because I have always been frugal (not cheap), I am able to maintain my same spending habits without the financial stress of excessive debt.

Paid off my mortgage some years before I retired and saved the same amount. Cleared my credit card debt, replaced the boiler, bought a quality used car and had some work done on my home. Then I retired some 5 years later with 2 pensions and a nice amount in my savings account. Seen too many floundering due to poor financial decisions.

Almost exactly what I did and I retired a few months ago. It's a little surreal but I like it!

Load More Replies...Back in the late 80's my wife worked for a finance company working with people who were struggling with their payments. She told me about one couple that was about to lose their house. She went over their bills with them and couldn't figure out why they were having problems. She asked if they were sure they had told her about all their expenses. They finally remembered about the big screen TV they were renting to buy. They were about to lose their house, but needed a big screen television.

There had to be more than just the big screen TV to blame for that mess.

Load More Replies...I grew up in poverty, but worked and earned my way into a comfortable middle-class life. I know I can survive on far less than I have now, but still spend and save responsibly. I was forced to medically retire in my 40s, but because I have always been frugal (not cheap), I am able to maintain my same spending habits without the financial stress of excessive debt.

Paid off my mortgage some years before I retired and saved the same amount. Cleared my credit card debt, replaced the boiler, bought a quality used car and had some work done on my home. Then I retired some 5 years later with 2 pensions and a nice amount in my savings account. Seen too many floundering due to poor financial decisions.

Almost exactly what I did and I retired a few months ago. It's a little surreal but I like it!

Load More Replies...Back in the late 80's my wife worked for a finance company working with people who were struggling with their payments. She told me about one couple that was about to lose their house. She went over their bills with them and couldn't figure out why they were having problems. She asked if they were sure they had told her about all their expenses. They finally remembered about the big screen TV they were renting to buy. They were about to lose their house, but needed a big screen television.

There had to be more than just the big screen TV to blame for that mess.

Load More Replies...

Dark Mode

Dark Mode

No fees, cancel anytime

No fees, cancel anytime