“Kids Don’t Get To Be Kids Anymore”: Parents Are Conflicted About This Family’s “Hygiene Budgets”

A weekly allowance is a common tool for teaching kids the value of money, but one couple is going viral for their new, unorthodox approach to childhood finances.

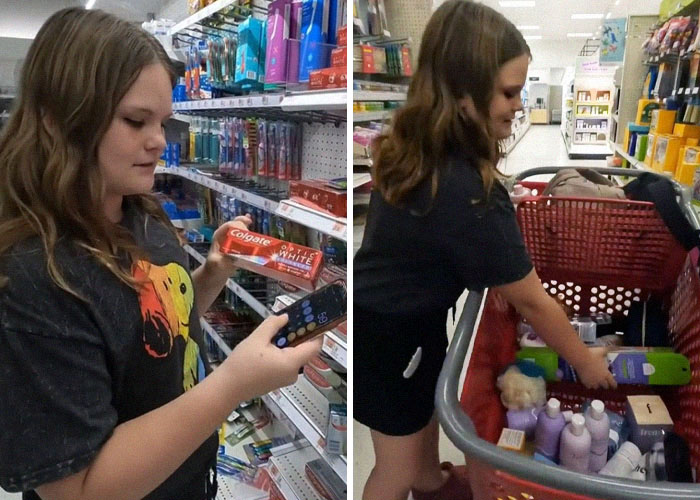

Jess and Dub McCorkle, or @family.of.nomads, document their everyday life with their kids from the comfort of their RV.

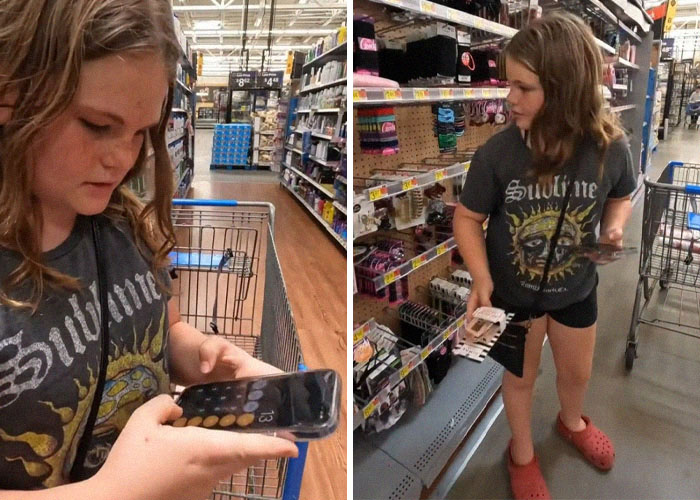

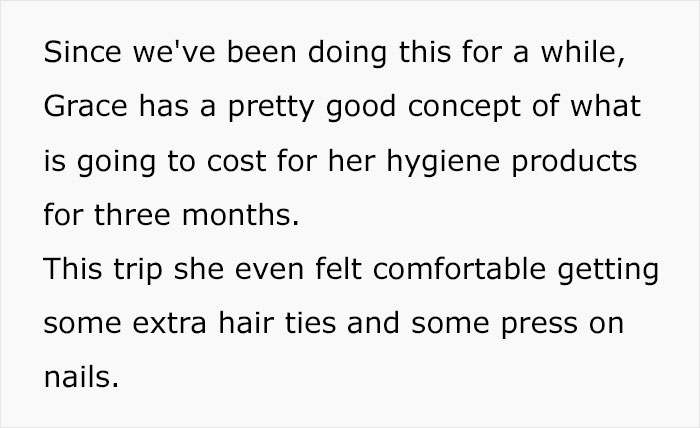

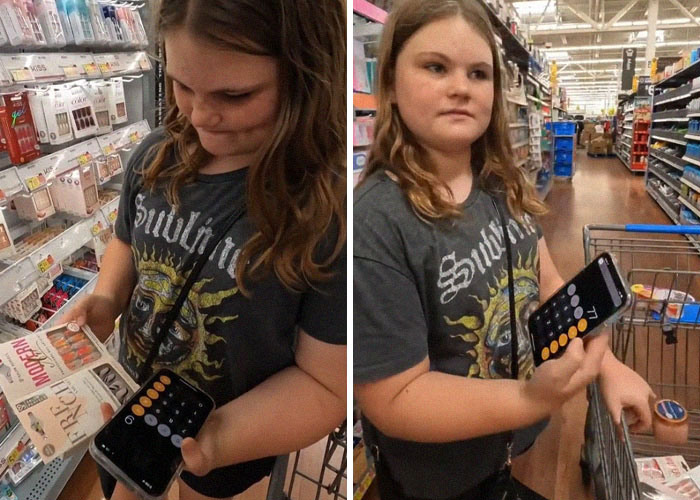

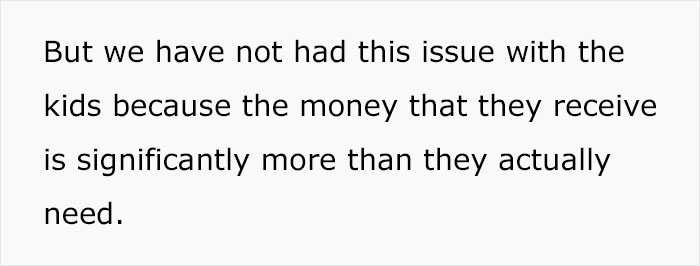

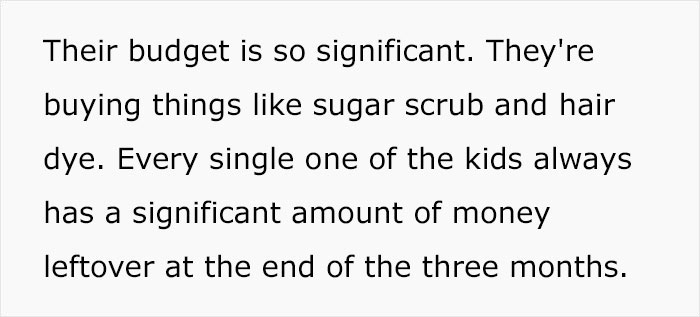

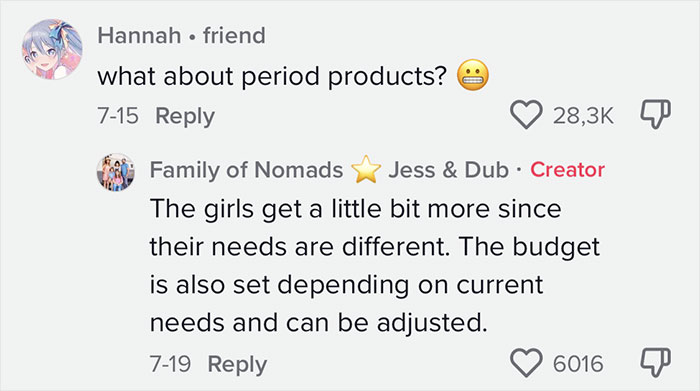

Recently, they made headlines on the internet after they shared that their children, as young as nine years old, have quarterly budgets for hygiene products.

“I knew too many young adults with anxiety about money and other basic life skills because they were never taught,” Jessica McCorkle told Bored Panda. “I want the best for my kids and teaching them about finances and other areas of life in practical ways is just one way we approach this.”

Follow the McCorkles on Facebook | Instagram | TikTok | Snapchat | YouTube

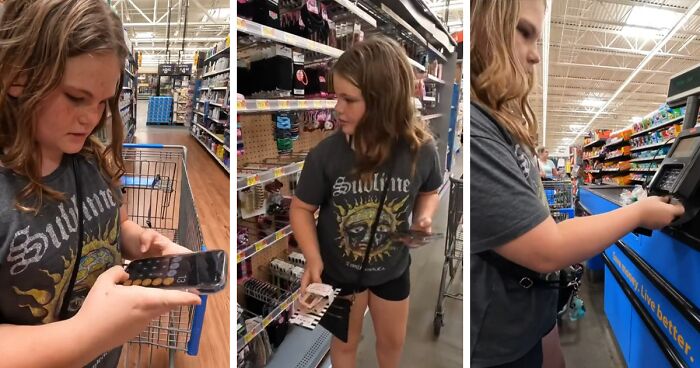

Jess and Dub McCorkle have three kids and they really want them to learn how to manage their finances

Image credits: family.of.nomads

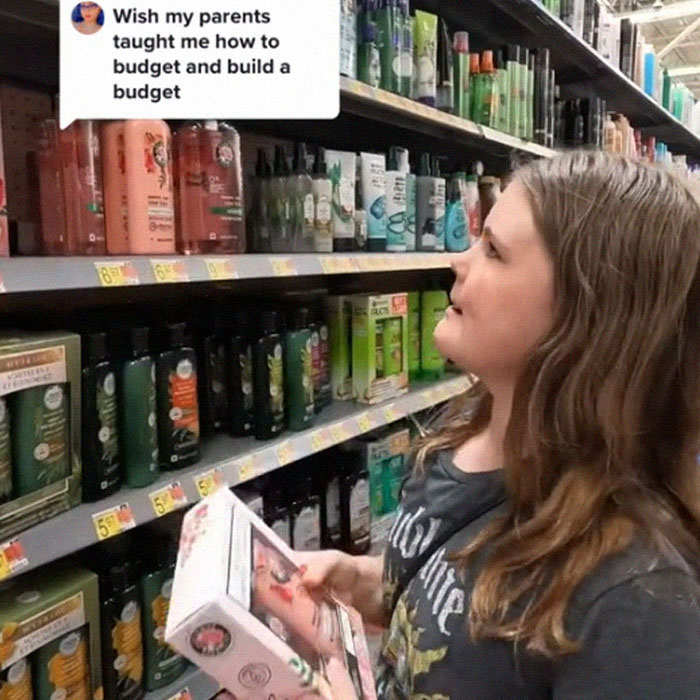

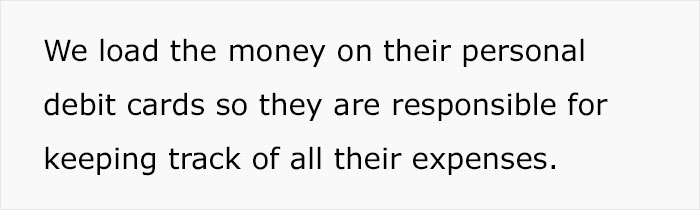

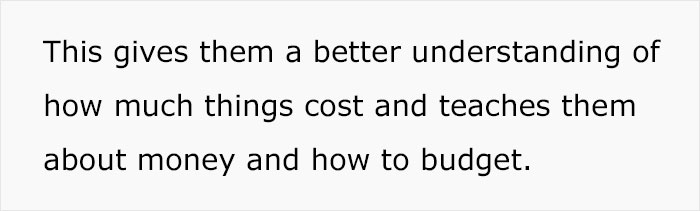

So they set up “hygiene budgets” for their little ones

Image credits: family.of.nomads

Image credits: family.of.nomads

Image credits: family.of.nomads

Image credits: family.of.nomads

Image credits: family.of.nomads

Image credits: family.of.nomads

Jessica said her family is living a nontraditional life and they use social media to share everything that might speak to other people who are burned out of the “normal” way of doing things and simply want to find alternatives.

“We live in a tiny home, are kind of minimalists, homeschool our kids, love to travel, and teach our kids practical life situations in a way in which they understand,” she explained.

The parents developed these monetary assignments for kids on their own. “We don’t search for this information anywhere. It’s just what we came up with when trying to find practical ways to help teach our kids about finances,” Jessica said. “The kids loved the idea and we ran with it. It started out with allowance and evolved over time to include more practical monetary applications.”

After their first video went viral

@family.of.nomads Replying to @ladysnowlefloreadoptee i don’t want my kids to grow up and be stressed over learning how to spend money. #budgetingtips#budgetingtiktok#financetiktok#teachingkidsaboutmoney♬ Here Comes the Sun – Relaxing Instrumental Music

The parents released a few more to explain their idea in greater detail

@family.of.nomads Replying to @Claudia clearing up ‘concerns’ from the previous video #budgeting#personalfinanceforkids♬ Funny Song – Cavendish Music

And while their clips have gone viral, people on the internet had mixed reactions

@family.of.nomads Replying to @avafuoco ♬ Good Day – Nappy Roots

Experts on the subject should love Jess and Dub’s parenting style.

According to a study published by the UK government’s MoneyHelper service, the early experiences children have with money can shape their financial behavior as adults.

By the age of seven, the University of Cambridge study discovered, most children are capable of grasping the value of money, delaying gratification, and understanding that some choices are irreversible or will cause them problems in the future. The findings suggest that children who are allowed to make age-appropriate financial decisions and experience spending or saving dilemmas can form positive habits of the mind when it comes to money.

This can lead to a lifelong improvement in their ability to plan ahead and be reflective in their thinking about money, or they may learn how to regulate their impulses and emotions in a way that promotes positive financial behavior later in life.

Juliette Collier, a national director of the charity Campaign for Learning, thinks it’s absolutely worth giving children as young as three or four their own coins to handle, spend, and save.

“Once they are old enough not to put it in their mouth, then give them some money,” she told The Guardian. “If, for example, they end up wanting to spend that money on sweeties, then make it clear they can’t spend the money on something else. Let them make choices and experience the consequences.”

Taking it even further, Collier also recommends parents talk with their kids about costs that may be hidden – such as heating, electricity and water – and involving them in various attempts to save money.

For example, you could challenge them to help you do a “no spend” day or make a recipe from the Love Food, Hate Waste website, using only ingredients you have in the cupboard.

You could then use these activities as a stepping stone for discussions about how adults need to prioritize what they spend money on and how difficult that can be if you feel tempted to buy something you cannot afford.

But a shop is one of the best places to teach children about finances. “Being able to handle money and buy something yourself is very special: it builds up your confidence with money,” Dr. Ems Lord, the director of the NRICH maths project at the University of Cambridge, also told The Guardian.

This way, you can introduce kids to the whole system. (Step by step, in a manner they can understand, of course.) For instance, if you pay with a contactless card, explain how it works – that although you are not using coins, the money is still coming out of your bank account – and discuss the groceries you buy.

Why might you choose to spend more on Fairtrade chocolate or free-range eggs? Are the more expensive products always better quality? There are plenty of questions for interesting dialogues. You can even ask them whether they would like to do a blind taste test at home to check whether they can tell the difference between different-priced brands, and then debate if it’s worth the difference in price.

All of this helps children to develop a real feel for numbers so that they can avoid making costly mistakes.

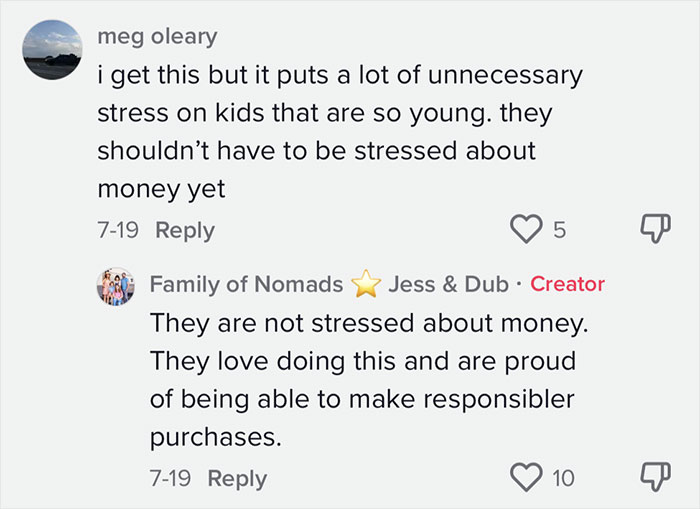

Some questioned the method:

“As content creators, when that many people view a video, we know there will always be a variety of opinions,” Jessica added. “Some people disagree, which we expected but others love the idea and they have implemented the idea with their own families. We are just sharing what we do, and what works for our family. The kids love it and I know other families have said it’s been an awesome application for their own children.”

The mom pointed out that there are many things kids learn in school, but practical life situations “don’t really seem to fit into school schedules.”

“As parents, it’s our job to make sure our kids have the life skills they need to feel comfortable functioning in real-world situations. When they grow up and move out, it will be scary enough trying to figure out the world, anything I can do to take away some of that stress and make their transition to their adult lives easier, I’m going to do it.”

According to her, an important part of parenting is slowly helping your children gain independence and become confident in their own abilities. “I don’t want all of these stressors to hit them at once, so we do this in a fun way now. The kids love doing this and are always excited to go shopping. They even count down the days until their 3 months start over again.”

“It may not work for everyone, but our family and especially the kids love it,” Jessica said.

Others believed it was a great idea:

127Kviews

Share on FacebookExplore more of these tags

Teaching basic economics to your kids is great. E.g., how to budget. That said, bragging about it online is unnecessary. IMO.

This doesn't seem like bragging. I see it as sharing parental things that worked for them and perhaps can inspire other parents on ideas for learning financial disciplines and awareness.

Load More Replies...I'm more horrified by a homeschooling family that uses the word "responsibler". Seems like they should focus less on going viral and more on education.

For some people "proper grammar" isn't one of their strengths, but they have others. But also, let them who are without [sic] cast the first stone

Load More Replies...I think this is a great thing and I feel like the people who are opposed are misreading or not understanding. The woman said multiple times they aren't choosing crappy stuff, they're making good decisions but they get to see how far money can go and how to make good choices. They are not punished for a bad month or anything. It's a great lesson in financial discipline that kids NEED to understand as young as possible. I see so many kids turning 18 and they end up bankrupt by the time they're 22 because they just don't understand how to budget or how to control their spending because they've never had to before. This is wonderful and I wish my parents had done it, honestly!

Teaching basic economics to your kids is great. E.g., how to budget. That said, bragging about it online is unnecessary. IMO.

This doesn't seem like bragging. I see it as sharing parental things that worked for them and perhaps can inspire other parents on ideas for learning financial disciplines and awareness.

Load More Replies...I'm more horrified by a homeschooling family that uses the word "responsibler". Seems like they should focus less on going viral and more on education.

For some people "proper grammar" isn't one of their strengths, but they have others. But also, let them who are without [sic] cast the first stone

Load More Replies...I think this is a great thing and I feel like the people who are opposed are misreading or not understanding. The woman said multiple times they aren't choosing crappy stuff, they're making good decisions but they get to see how far money can go and how to make good choices. They are not punished for a bad month or anything. It's a great lesson in financial discipline that kids NEED to understand as young as possible. I see so many kids turning 18 and they end up bankrupt by the time they're 22 because they just don't understand how to budget or how to control their spending because they've never had to before. This is wonderful and I wish my parents had done it, honestly!

Dark Mode

Dark Mode

No fees, cancel anytime

No fees, cancel anytime

77

63