Person Who Ate Only Beans And Rice After The ’08 Collapse Pens A Powerful Open Letter To Billionaire Jerks Running Hedge Funds, Explains Why They Won’t Sell

The surge of stocks like GameStop, which we all have seen a lot of in the headlines lately, is most often attributed to the use of leverage by hedge funds. But the r/WallStreetBets subreddit has got small investors coming together and using this leverage against what they call big, rich, and greedy guys.

The case is unprecedented because, in most Wall Street fights, common members of the public like you and me have no rooting interest, nor any effect on what’s going on. But this one is the exact opposite. And while independent WallStreetBets traders continue purchasing GameStop stocks, they’re essentially betting against the hedge fund giants. And they’re nowhere near stopping.

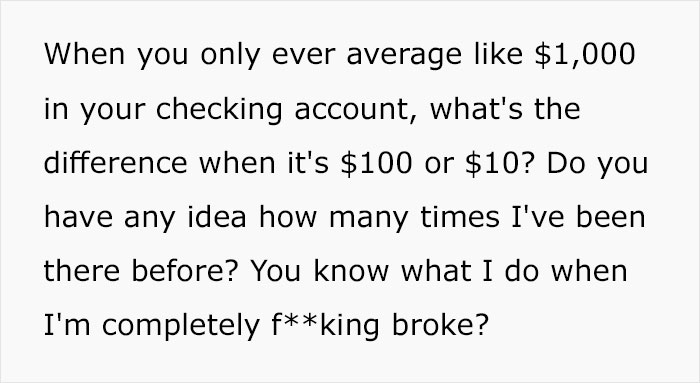

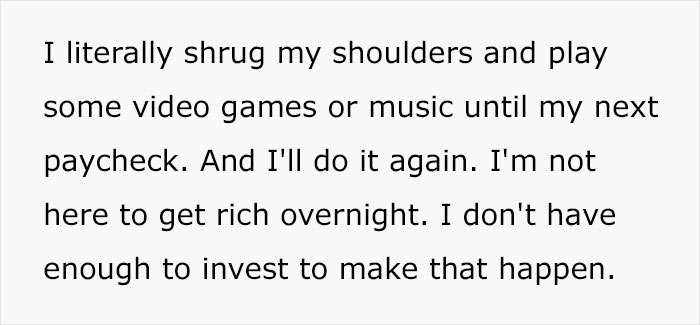

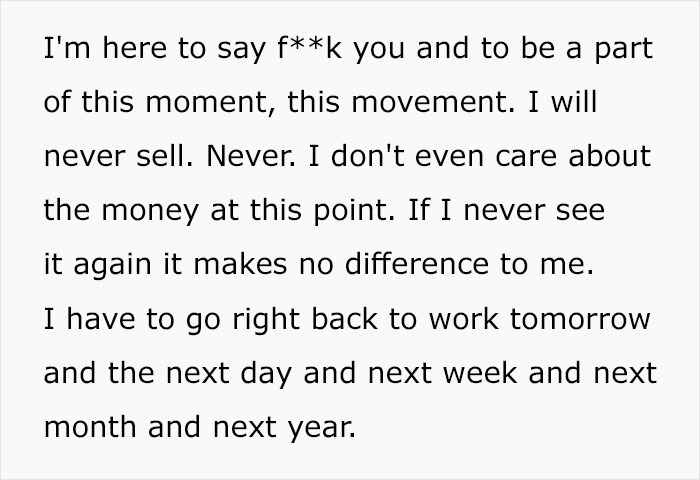

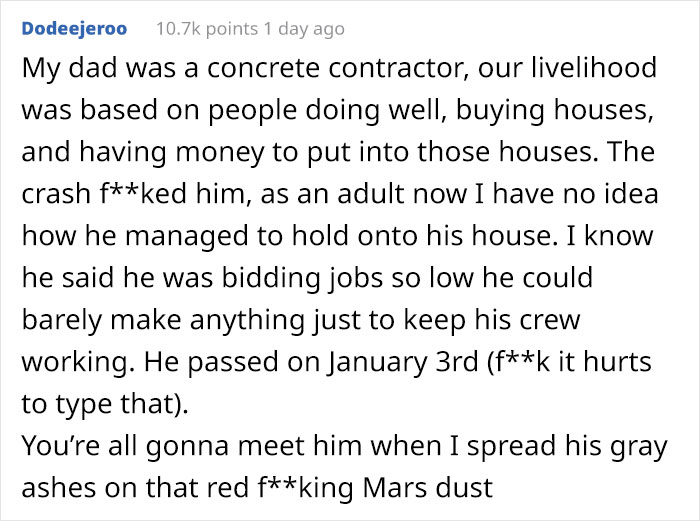

And a trader who goes by the handle u/ssauronn has just penned a powerful open letter and laid out all the reasons, black on white, why the independent traders are not backing down and selling. Turns out, the shared resentment for the major Wall Street investors came as a result of the financial crisis of 2008.

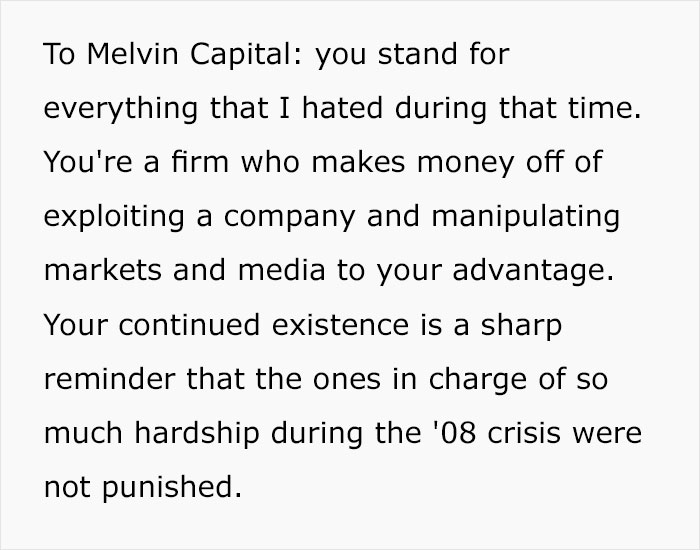

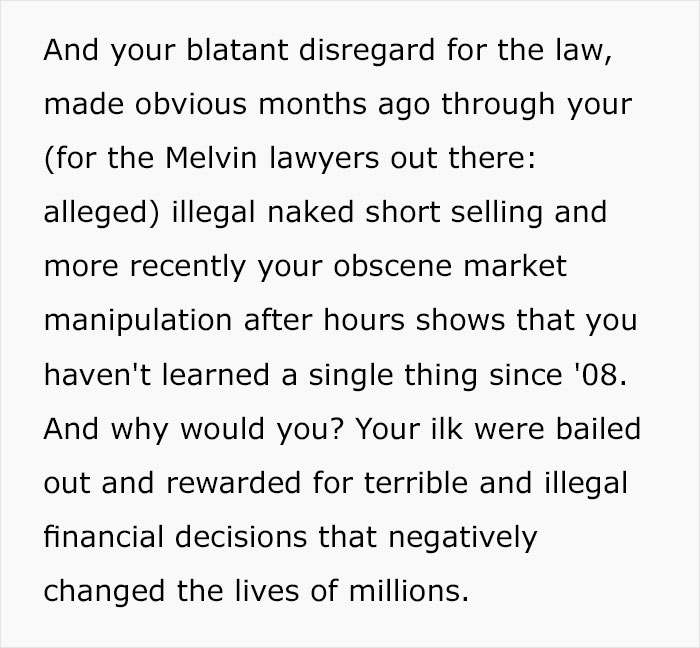

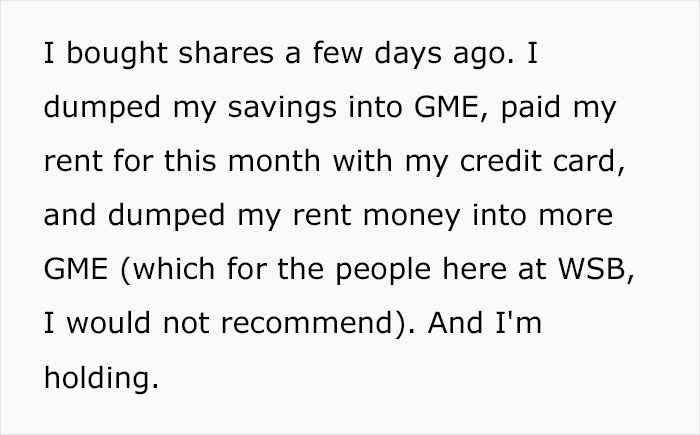

“When that crisis hit our family, we were able to keep our little house, but we lived off of pancake mix, and powdered milk, and beans and rice for a year,” u/ssauronn wrote. The Redditor also addressed Melvin Capital in particular, stating that “you stand for everything that I hated during that time.”

Read the full letter down below, which should shed an illuminating light on the much deeper motives that fuel the current wave of independent GameStop traders.

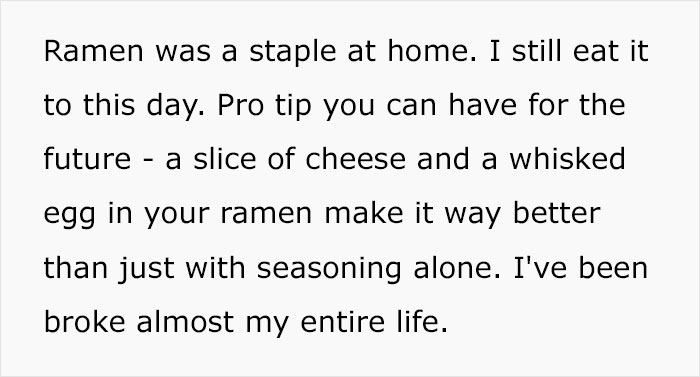

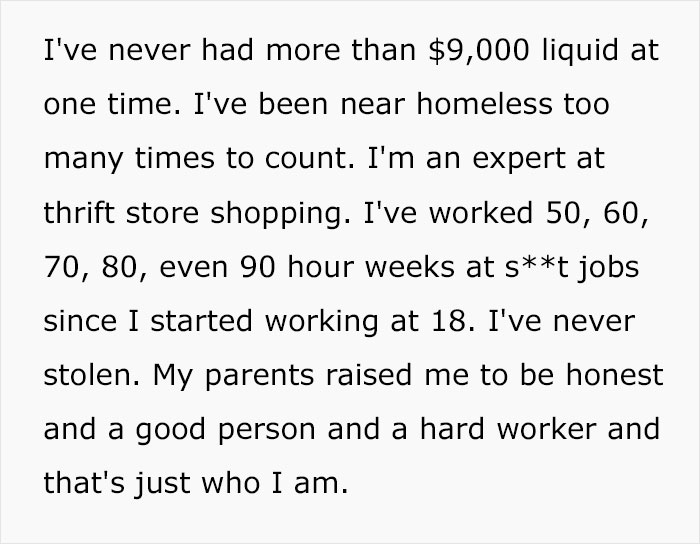

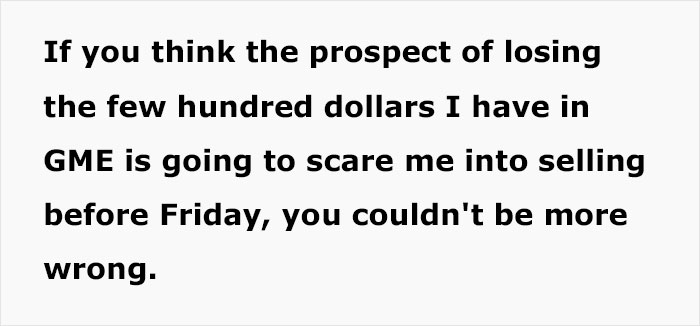

One r/WallStreetBets trader has penned this powerful open letter which explains the resentment for Wall Street investment firms

Image credits: ssauronn

On Tuesday, the investor Michael Burry called trading in GameStop as “unnatural, insane, and dangerous.” In his now-deleted tweet, and said that “legal and regulatory repercussions” should be made accordingly. But it’s not just GameStop that’s getting a boost from a gang of small Reddit investors, though. The chain AMC is also having its stocks reach heights, among other companies.

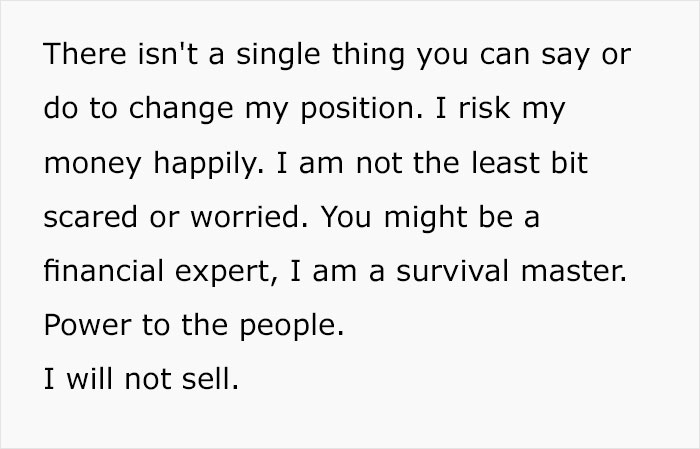

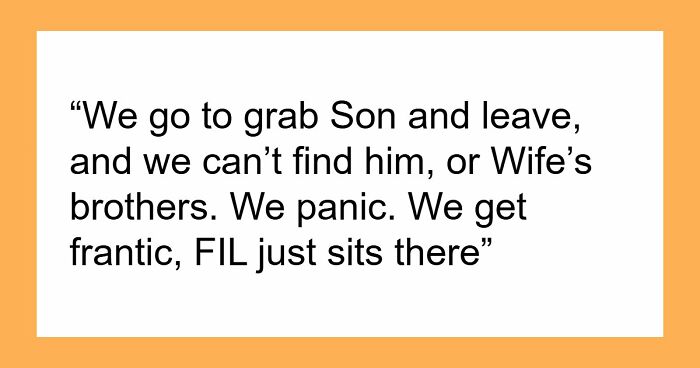

Another similar letter on how the 2008 crisis affected an entire generation has also been circulating online

Image credits: Hungry_Freaks_Daddy

According to a member of the subreddit WallStreetBets, the stock trading frenzy has nothing to do with the organized attempts to occupy Wall Street. “There’s no targeting going on—WSB is far less organized than all the articles are making it out to be,” a member of the subreddit, Lucas Severyn, commented. “From time to time, WSB gets obsessed with some stock, now it’s GME, and for the first time ever, this stock just keeps giving.”

Meanwhile, the co-founder of Reddit, Alexis Ohanian, told CNBC that the stock buying was instigated by the “challenges against the mainstream media, threads of this in the rise of the populist right… there is this sentiment that cannot be escaped. It is clear to me this is a gesture.”

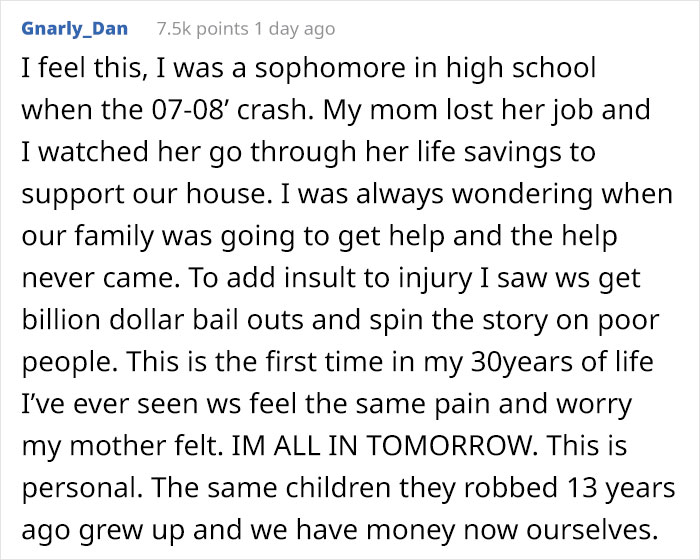

Many people felt touched by the letters and this is what they commented

I'm Gen X. We all get it. My generation is on its fourth or fifth economic crisis right now (depending on luck). We are all burned and scarred. By the 1980s, the early 1990s, 2008, Covid-19, and for a few of us oldies, even the 1970s! This isn't new, it isn't just one generation, can we please stop "claiming" victimhood? We're all screwed by the so-called "free market capitalism" that costs so much. Peace, and unity, b/c if we poor folks get together, we can scare teh bejeepers outta Wall Street :-)

Boomer here- Survived the OPEC crisis, 18-19% mortgage rates, the 1986 Market crash, the dot com bubble, the housing bubble and many other crises. ALL generations have been or will be screwed. It's a fact of life living in the USA. My generation has f****d over the next generations to come. We know it and some of us actually give a s**t. But this isn't a Boomer vs. Millenial vs Gen X issue. This is a people vs the system that is rigged to serve everyone BUT the people. Until the majority of the country understands this, we will continue to get f****d like we are in every election regardless of who wins.

Load More Replies...Hello downvotes, but I have a genuine question (because I'm not US-based). Do some people have their 401k's linked to some hedge fund companies? So more people WILL lose their pensions when these Wall Street giants fall?

401k, is the way most people lost "everything" in 08. We had options for investment - possible large returns or steady small returns. Most people want to gamble on the big payout (hedge fund) but don't realize the possibilities of total loss. I see the stock market as a rich mans casino. It is all gambling with "our" money.

Load More Replies...I'm pulling for the retail investors in this case but I fear that most will be burned badly by what will prove to be a pump & dump play by the Reddit leaders. And even if the origins of this movement are purer than I suspect then basic game theory (think "tragedy of the commons") predicts large-scale defections which eventually will mean those in early on GME and out first will profit at the expense of those slower to see the falling knife. Man the barricades, comrades, but don't gamble more than you can afford to lose.

exactly; there's no way to know what the real position of those posting is, and just as the shorts put out papers trying to get others to sell their long positions, many stock and call buyers are hoping they can convince people to push up the price for their own gains

Load More Replies...I'm Gen X. We all get it. My generation is on its fourth or fifth economic crisis right now (depending on luck). We are all burned and scarred. By the 1980s, the early 1990s, 2008, Covid-19, and for a few of us oldies, even the 1970s! This isn't new, it isn't just one generation, can we please stop "claiming" victimhood? We're all screwed by the so-called "free market capitalism" that costs so much. Peace, and unity, b/c if we poor folks get together, we can scare teh bejeepers outta Wall Street :-)

Boomer here- Survived the OPEC crisis, 18-19% mortgage rates, the 1986 Market crash, the dot com bubble, the housing bubble and many other crises. ALL generations have been or will be screwed. It's a fact of life living in the USA. My generation has f****d over the next generations to come. We know it and some of us actually give a s**t. But this isn't a Boomer vs. Millenial vs Gen X issue. This is a people vs the system that is rigged to serve everyone BUT the people. Until the majority of the country understands this, we will continue to get f****d like we are in every election regardless of who wins.

Load More Replies...Hello downvotes, but I have a genuine question (because I'm not US-based). Do some people have their 401k's linked to some hedge fund companies? So more people WILL lose their pensions when these Wall Street giants fall?

401k, is the way most people lost "everything" in 08. We had options for investment - possible large returns or steady small returns. Most people want to gamble on the big payout (hedge fund) but don't realize the possibilities of total loss. I see the stock market as a rich mans casino. It is all gambling with "our" money.

Load More Replies...I'm pulling for the retail investors in this case but I fear that most will be burned badly by what will prove to be a pump & dump play by the Reddit leaders. And even if the origins of this movement are purer than I suspect then basic game theory (think "tragedy of the commons") predicts large-scale defections which eventually will mean those in early on GME and out first will profit at the expense of those slower to see the falling knife. Man the barricades, comrades, but don't gamble more than you can afford to lose.

exactly; there's no way to know what the real position of those posting is, and just as the shorts put out papers trying to get others to sell their long positions, many stock and call buyers are hoping they can convince people to push up the price for their own gains

Load More Replies...

Dark Mode

Dark Mode

No fees, cancel anytime

No fees, cancel anytime

266

64