What we do for a living is a big part of our identity. Luckily, for Reddit user Similie5, when she found a new part-time job (after spending the prior 12 years as a stay-at-home mom), she really enjoyed it.

However, the woman’s husband had been growing increasingly dissatisfied with it. So much so that he even issued her an ultimatum: either quit or the marriage is over. She pushed back, but he wouldn’t drop it, which led the woman to post her story on the internet and ask strangers to help her decide what to do next.

This woman had been having all sorts of conflicts with her husband

Image credits: Luciana Studio / Freepik (not the actual photo)

But when he demanded she quit her job, she began to question whether she could continue to sacrifice her happiness for the sake of the marriage

Image credits: stockmaker / Freepik (not the actual photo)

Image credits: prostock-studio / Freepik (not the actual photo)

Soon after she published her story, the woman added a few details to clarify it

Image credits: similie5

Image credits: Getty Images / Unsplash (not the actual photo)

Although this case is quite extreme, financial disagreements are common among modern couples

Georgina Sturmer (BACP), a counselor based in the UK, says, “Our approach to finances is often shaped by our upbringing and personal history, in the same way that our approach to relationships is shaped by these factors. If we have conflicting approaches to financial management, it can lead to anxiety, frustration, resentment, anger, mistrust, and fear.”

For couples, having conversations about these things can be especially important when (rigid) gender roles come into play, for example, if a man has been socialized to believe that he must be the sole breadwinner—or if one of them comes from a culture where sending money to your family is expected if you are in the position to do so.

Sturmer says that the new norms of the modern workplace also have a part to play when people talk about financial expectations and gender roles.

“Modern life feels quite different now. Dual income families, freelancing, zero-hours contracts, credit cards, disposable spending, consumer culture. I would imagine that this means that there is more scope for conflict over spending decisions, as our roles and incomes are constantly shifting.”

That’s probably why some studies suggest that as many as 64% of couples are “financially incompatible” with their partners, with different philosophies on spending, saving, and investing their money.

Furthermore, 1 in 5 couples identify money as their greatest relationship challenge. Judging from the post (and the fact that they are already in therapy but still cannot settle their differences), these two seem to be becoming part of that statistic as well.

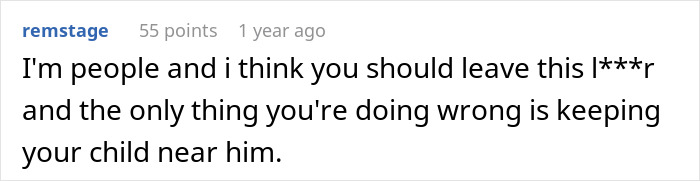

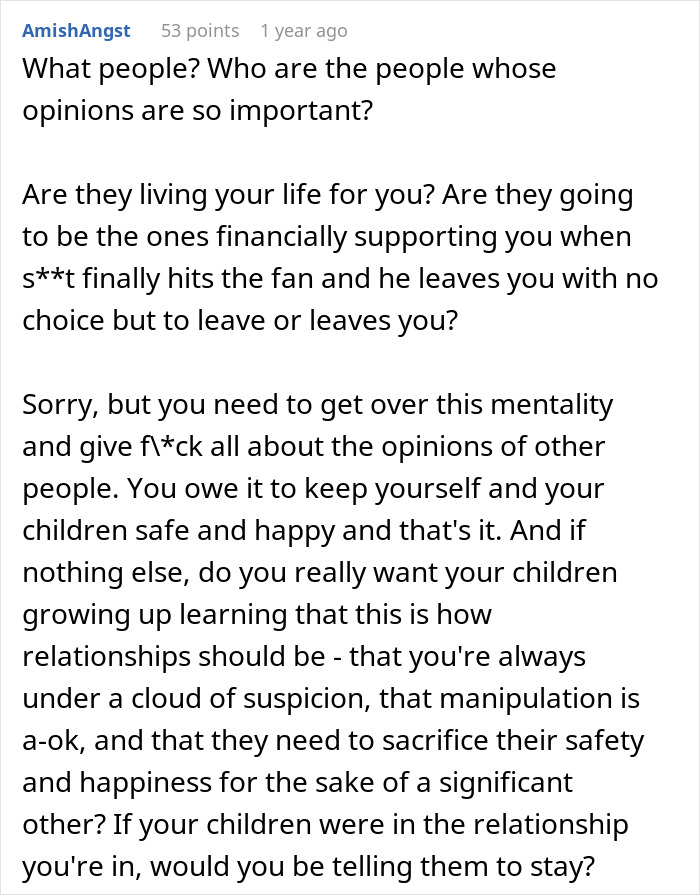

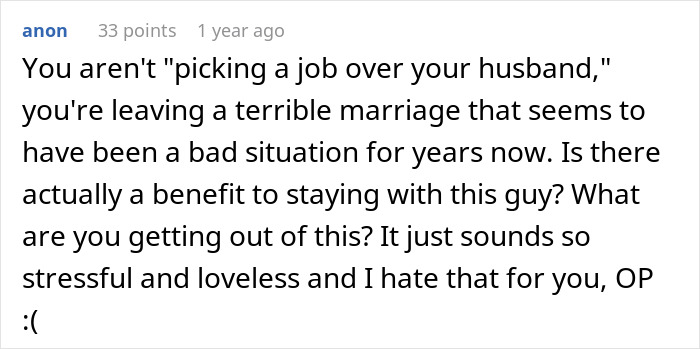

People had a lot to say about what happened between the two of them

Poll Question

Thanks! Check out the results:

It's a year old, but the husband sounds unhinged. Divorce the only option.

Sounds like you have lost yourself be abuse of husband. but by getting that job you are capable of becoming stronger. You’ve made the first big step so it’s in you - determination and self worth. But improve on it and leave him

It happens I’ve been there mental abuse hits you hard took me 14 yrs to wake up n run she’s woken up now it’s time to run x

Load More Replies...It's a year old, but the husband sounds unhinged. Divorce the only option.

Sounds like you have lost yourself be abuse of husband. but by getting that job you are capable of becoming stronger. You’ve made the first big step so it’s in you - determination and self worth. But improve on it and leave him

It happens I’ve been there mental abuse hits you hard took me 14 yrs to wake up n run she’s woken up now it’s time to run x

Load More Replies...

Dark Mode

Dark Mode

No fees, cancel anytime

No fees, cancel anytime

46

25