“Wants It For Herself”: Person Asks For Advice After Grandma Goes After Their Inheritance

Interview With ExpertFamilies are supposed to stick together through thick and thin, but, as with so many things in life, money often ends up causing its fair share of issues. Entitlement, jealousy and just plain, old pettiness can very quickly get in the way and create its fair share of drama and intrigue.

A netizen discovered that they had inherited over six figures from their grandfather, only to learn that their grandmother wanted them to sign it all over. So they asked the internet for some advice. We got in touch with financial specialist Nick Loper to learn more about managing new income. We reached out to the person who made the original post via private message and will update the article when they get back to us.

Getting a sizable inheritance is generally a pretty good thing

Image credits: rfaizal707 (not the actual photo)

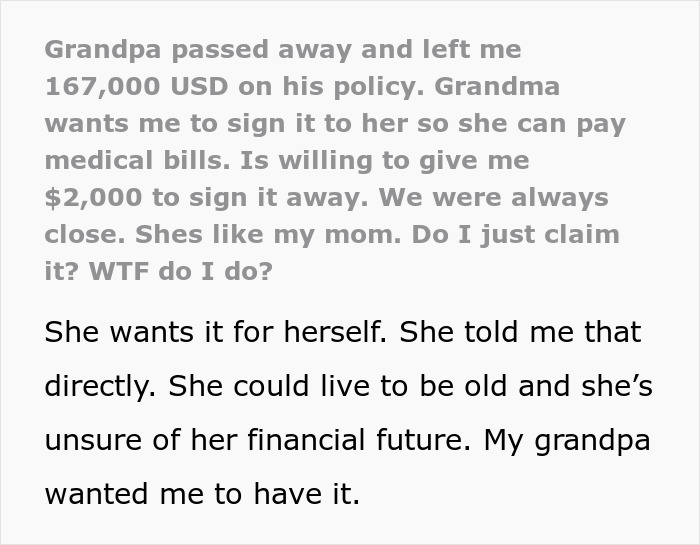

But one person ended up wondering what to do after their grandmother asked them to give over their inheritance

Image credits: AboutImages (not the actual photo)

Image source: gill_flubberson

Inheritances can often cause a lot of stress when not managed properly

Image credits: Mikhail Nilov (not the actual photo)

Bored Panda got in touch with Nick Loper from Sidehustlenation.com to learn more about unexpected windfalls. We wanted to hear some common mistakes he has seen. “I imagine the most common mistake would be spending too much, too fast. And beyond big-ticket purchases, beware of committing yourself to lifestyle inflation with ongoing maintenance costs. For example, maybe you can afford that bigger house, but along with it comes increased maintenance, utilities, and tax costs that never go away.”

“USA Today reports that nearly a third of lottery winners end up bankrupt within 3-5 years, which is hard to believe, but perhaps shows that even large amounts of money don’t solve bad spending habits,” he shared. Naturally we wanted to hear what he would suggest. “Make an allocation plan and stick to it, prioritizing future planning. Maybe that means paying down debt, funding college accounts for your kids, or investing for long-term cash flow.”

Attitudes towards money can vary, but generally, when struck with a major windfall, most folks simply do not know what to do. After all, the taxes, risks and even relational issues of money might all come at once and be entirely new. Many people sort of panic and start making impulse decisions without evaluating the risks.

This is why the number one piece of advice is to take a deep breath, slow down and then make a plan. Stories like this are also more evidence as to why it can be smart to keep quiet about a windfall. While the grandmother would no doubt find out about the inheritance, the person asking for advice should prepare themselves for more folks to come out of the woodworks if they start flaunting around six figures. Too often, family members start to see one person’s money as, somehow, their money and they develop a feeling of entitlement.

The average inheritance in the US comes out to be about $46,200, according to the Federal Reserve. However, this might be heavily skewed by some folks inheriting massive, generational wealth and assets, so the real number for an average, working class person is most likely to be considerably lower.

Getting rid of debt is pretty often the best move one can make

Image credits: Andrea Piacquadio (not the actual photo)

It doesn’t take a genius to realize that $167,000 is considerably higher than even the upper estimate for an average. Importantly, even when the line of inheritance is very clear, the actual movement of funds can take months or even years, as it goes through something called probate. This is simply the court making sure everything is in order before money is sent one way or another.

So this is one more reason the person in this story should perhaps stick to their guns. The grandmother is already 81, albeit healthy, according to the second update. Signing the inheritance over only for them to quickly pass would just lock up the money in the courts for even longer. Furthermore, as some commenters noted, there must be a reason the grandfather wanted the money to go to his grandchild. We don’t know the details, but family drama and money are a very normal combination, unfortunately.

However, one thing nearly every bit of financial advice agrees upon is the importance of paying off debt quickly and efficiently. The person in the story is still working on a mortgage. The grandmother neither has any real debt, nor has any medical debt. There is nothing against wanting to live comfortably for the rest of one’s days, but she seems to already have a decent pension.

After all, allowing this person to just own their home without a mortgage (or at least a significantly reduced one) seems like a better long-term investment for the entire family. However, the real sticking point is that she “threatens” to no longer be a maternal figure if she is not given the money. This is a red flag of red flags. This bears all the hallmarks of a truly terrible relationship.

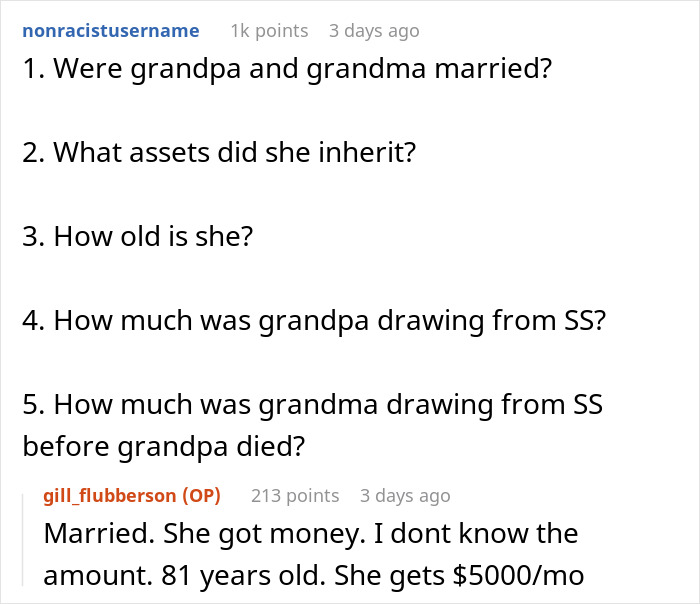

Some folks needed more information

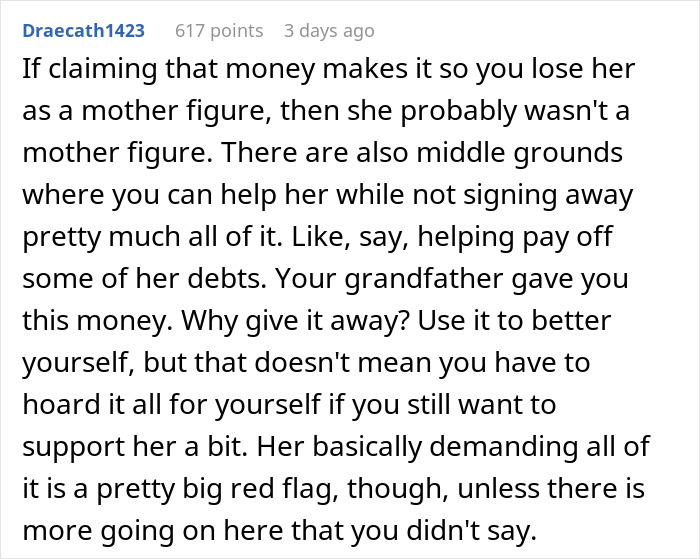

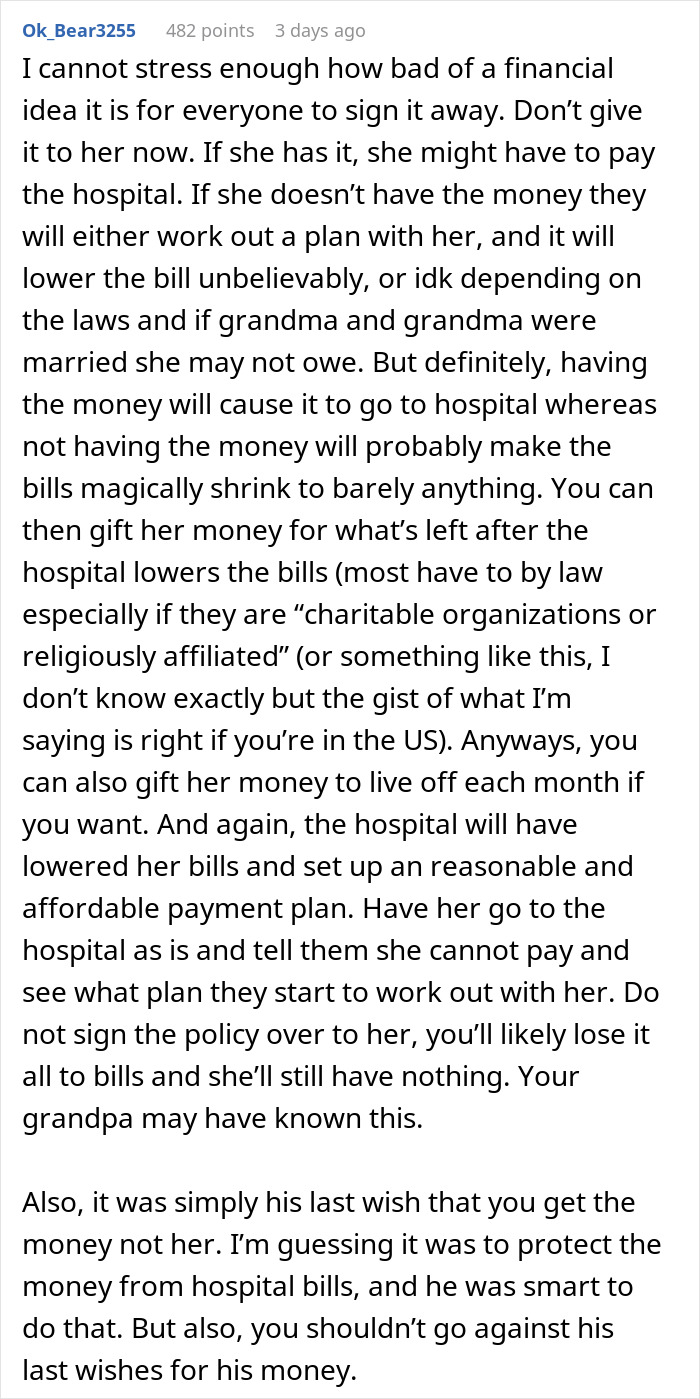

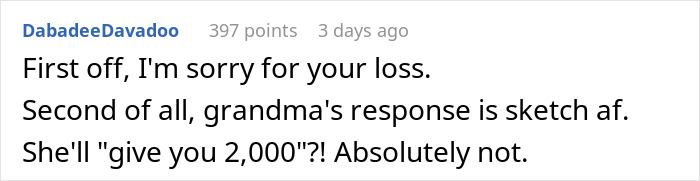

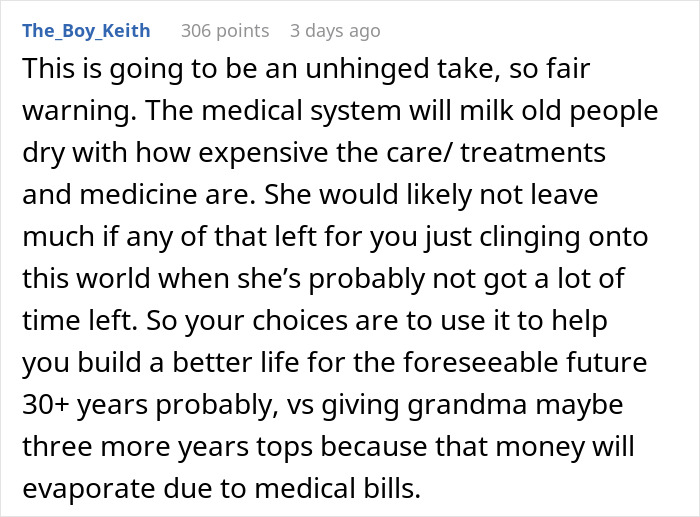

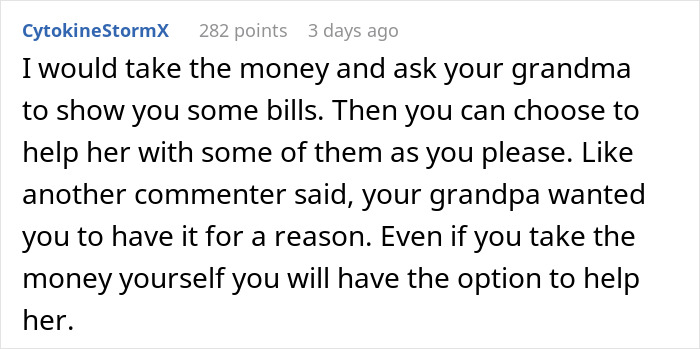

Many readers were surprised at the grandmother’s demands

Poll Question

Thanks! Check out the results:

Explore more of these tags

If your grandma is willing to fight for that money you've already lost her as a mother figure.

She could have the early stages of dimentia. My mom started getting really paranoid about money near the end

Load More Replies...There's clearly a reason why Grandpa left the inheritance to OP and not to his wife...

Claim the money because it's yours. It was left to you. She has no right to it, not even morally. She's blackmailing you if she gives you the impression that she will have nothing to do with you anymore if you don't do as she says. By asking for this money, she disrespects her deceased husband's will. If you feel particularly bad, offer her an amount you feel comfortable with, but I think your grandfather wanted you to be able to carve out a life for yourself and this inheritance will help you to do that.

I wonder if the grandma has a gambling problem that the OP is unaware of. Many old people have problems with gambling if they have medications that affects the opioid receptors.

This sounds like 1. Grandpa felt his wife was sufficiently provided for by everything else he left her. 2. Wanted grandchild to get a head start in life by leaving grandchild the policy. And 3. Maybe he knew Grandma isn't to be trusted with very large lump sums of money, for whatever reason. Overall verdict: claim the policy, don't sign over any amount to Grandma, and set a sum aside in a trust account for her possible medical bills that can't be touched for any other reason. If that's not good enough for Grandma, she has ulterior motives for wanting that money.

I wonder if the attempt to buy out is a run around a contest clause. If that's the case ( honestly I just skimmed the text) then Gramps had some inkling that this might a problem. Let the Lawyers handle it.

At today's rates that money could make 5-600$ a month interest, before taxes. Put it in savings or a CD.

OP could also pay down/off their mortgage, and/or student loans, and/or other large bills, which would then free up a nice size chunk of of their paycheck per month to help Grandma IF she actually needs it. Demanding the lion's share of the lump sum tells me she's got something very expensive planned for herself; a long and expensive vacation, or some gambling, or wasting it all some other way. I don't know if Grandma worked or was a SAHM, but if she worked, she has Grandpa's $5000/month plus her own social security and any other retirement plans she was part of. She's living in a house that's paid for, so that huge bill is non-existent. She can also negotiate down any hospital costs from Grandpa's death so they're affordable. She'll be just fine, and can afford to travel and do other fun stuff for herself without the extra $165000. OP has WAY more need for that lump sum than she does, and I can't see how a genuine "mother figure" could ever get so greedy they'd resort to taking candy (the inheritance) out of their grandbaby's (OP) mouth in the first place---and then getting threatening when told no in the second place. The whole idea would never even cross the mind of a genuine mother figure. All a genuine mother figure would want is for her grandchild to have a better and way less stressful life, which $167000 can help to happen. OP should step back, reassess the relationship, keep the inheritance IN FULL, and tell Granny to go pound sand.

Load More Replies...I would venture to say what Grandma meant when she said the grandchild being the beneficiary was a mistake that Grandma didn't know Grandpa did that and Grandma's mad. Nothing like a funeral to pull a family apart. Its grandma, not the grandchild that is willing to let money destroy their relationship and to me, that means it's already eroded. Keep the money and let Grandma cope.

Granny is Greedy!!! Girl your 81 leave the kid alone Grandpa wanted OP to have that money. What do you need it for Dentures??

My father in law willed our home to me and my husband not his wiife or younger son. But he told us why. Niether his wife or younger son can mannage money. And he knew they would loose the house. Poor old fellow died in 94. me and my husband inherited it. We took care of His mother and Brother. His reason was valid. Your grandpa had his reasons trust his memory.

$5000 a month and home paid off. PLEASE. most of us working don't even make $5000 per month. Grandma can kick rocks with her manipulative self.

She'll give him $2000 in exchange for $167,000? Hell, I'll give him $5000 for it. 🤣🤣

If grandpa didnt want her to have it there was a reason....dont sign it to her

I wonder if grandma got hit by a scammer who took all her saving in the form of gift cards

There's often an unstated social rule that everything goes to the surviving spouse except for smaller sentimental things and then when the spouse dies, THAT's when the big inheritance money is doled out. It's seen as bad form to be splitting major assets your widow/widower could still use to give things to the kiddos, unless it's a step parent situation. I'm guessing Grandma is salty Grandpa was leaving big chunks to other people when she has an uncertain future and likely views all of their assets as shared by this point, so her husband had no right to be passing her stuff out. I'm also guessing grandpa never told her he did this so it was a nasty surprise. The LW is in a bit of a dilemma. She can take the cash, which is guaranteed. But she will likely lose her relationship with her grandma, do some damage to the one with her dad, and possibly lose out on an even bigger payday when grandma dies. If she hands it over, she loses the 100% guaranteed money, but keeps the relationship (albeit in a damaged form), and could possibly make bank if Grandma leaves her even more, later.

$5k a month might be fine for now for her income, but it may be way to little for quality long term care and then nursing care should she ever need it as she deteriorates in her final years. I understand her insecurity as a 77 year old with only $30k in savings. Don't be too quick to judge her. Do get lots more information about all of her resources. I would advise investing the money, enjoying some of the interest to set yourself up better, pay off credit cards and pay down your mortgage, while reserving the bulk of it to be available should she ever actually need extra financial support for her care. (I have a sister, and know of several other lonely old women who have been scammed for big money, yet refuse to face up to the reality of a con-artist love interest online.)

Yes, don't be so quick to judge but also... To receive $5,000 a month from retirement means that she/grandpa made A LOT of money over the course of their lives. Even if they only saved/invested a little, they would still have a lot for their later years. Additionally, OP said that she doesn't have any debt, which means that she could still invest a lot of money now. One person with little bills can invest the vast majority of $5,000/month. Additionally, if she needs help later she can ask at that point. Asking now isn't necessary. Lastly, I wonder how much she got from the life insurance? It seems like OP was paid a percentage, which makes me think that grandma already got some funds from the life insurance.

Load More Replies...Take it and say goodbye to your family as you wave from a plane or a cruise

If your grandma is willing to fight for that money you've already lost her as a mother figure.

She could have the early stages of dimentia. My mom started getting really paranoid about money near the end

Load More Replies...There's clearly a reason why Grandpa left the inheritance to OP and not to his wife...

Claim the money because it's yours. It was left to you. She has no right to it, not even morally. She's blackmailing you if she gives you the impression that she will have nothing to do with you anymore if you don't do as she says. By asking for this money, she disrespects her deceased husband's will. If you feel particularly bad, offer her an amount you feel comfortable with, but I think your grandfather wanted you to be able to carve out a life for yourself and this inheritance will help you to do that.

I wonder if the grandma has a gambling problem that the OP is unaware of. Many old people have problems with gambling if they have medications that affects the opioid receptors.

This sounds like 1. Grandpa felt his wife was sufficiently provided for by everything else he left her. 2. Wanted grandchild to get a head start in life by leaving grandchild the policy. And 3. Maybe he knew Grandma isn't to be trusted with very large lump sums of money, for whatever reason. Overall verdict: claim the policy, don't sign over any amount to Grandma, and set a sum aside in a trust account for her possible medical bills that can't be touched for any other reason. If that's not good enough for Grandma, she has ulterior motives for wanting that money.

I wonder if the attempt to buy out is a run around a contest clause. If that's the case ( honestly I just skimmed the text) then Gramps had some inkling that this might a problem. Let the Lawyers handle it.

At today's rates that money could make 5-600$ a month interest, before taxes. Put it in savings or a CD.

OP could also pay down/off their mortgage, and/or student loans, and/or other large bills, which would then free up a nice size chunk of of their paycheck per month to help Grandma IF she actually needs it. Demanding the lion's share of the lump sum tells me she's got something very expensive planned for herself; a long and expensive vacation, or some gambling, or wasting it all some other way. I don't know if Grandma worked or was a SAHM, but if she worked, she has Grandpa's $5000/month plus her own social security and any other retirement plans she was part of. She's living in a house that's paid for, so that huge bill is non-existent. She can also negotiate down any hospital costs from Grandpa's death so they're affordable. She'll be just fine, and can afford to travel and do other fun stuff for herself without the extra $165000. OP has WAY more need for that lump sum than she does, and I can't see how a genuine "mother figure" could ever get so greedy they'd resort to taking candy (the inheritance) out of their grandbaby's (OP) mouth in the first place---and then getting threatening when told no in the second place. The whole idea would never even cross the mind of a genuine mother figure. All a genuine mother figure would want is for her grandchild to have a better and way less stressful life, which $167000 can help to happen. OP should step back, reassess the relationship, keep the inheritance IN FULL, and tell Granny to go pound sand.

Load More Replies...I would venture to say what Grandma meant when she said the grandchild being the beneficiary was a mistake that Grandma didn't know Grandpa did that and Grandma's mad. Nothing like a funeral to pull a family apart. Its grandma, not the grandchild that is willing to let money destroy their relationship and to me, that means it's already eroded. Keep the money and let Grandma cope.

Granny is Greedy!!! Girl your 81 leave the kid alone Grandpa wanted OP to have that money. What do you need it for Dentures??

My father in law willed our home to me and my husband not his wiife or younger son. But he told us why. Niether his wife or younger son can mannage money. And he knew they would loose the house. Poor old fellow died in 94. me and my husband inherited it. We took care of His mother and Brother. His reason was valid. Your grandpa had his reasons trust his memory.

$5000 a month and home paid off. PLEASE. most of us working don't even make $5000 per month. Grandma can kick rocks with her manipulative self.

She'll give him $2000 in exchange for $167,000? Hell, I'll give him $5000 for it. 🤣🤣

If grandpa didnt want her to have it there was a reason....dont sign it to her

I wonder if grandma got hit by a scammer who took all her saving in the form of gift cards

There's often an unstated social rule that everything goes to the surviving spouse except for smaller sentimental things and then when the spouse dies, THAT's when the big inheritance money is doled out. It's seen as bad form to be splitting major assets your widow/widower could still use to give things to the kiddos, unless it's a step parent situation. I'm guessing Grandma is salty Grandpa was leaving big chunks to other people when she has an uncertain future and likely views all of their assets as shared by this point, so her husband had no right to be passing her stuff out. I'm also guessing grandpa never told her he did this so it was a nasty surprise. The LW is in a bit of a dilemma. She can take the cash, which is guaranteed. But she will likely lose her relationship with her grandma, do some damage to the one with her dad, and possibly lose out on an even bigger payday when grandma dies. If she hands it over, she loses the 100% guaranteed money, but keeps the relationship (albeit in a damaged form), and could possibly make bank if Grandma leaves her even more, later.

$5k a month might be fine for now for her income, but it may be way to little for quality long term care and then nursing care should she ever need it as she deteriorates in her final years. I understand her insecurity as a 77 year old with only $30k in savings. Don't be too quick to judge her. Do get lots more information about all of her resources. I would advise investing the money, enjoying some of the interest to set yourself up better, pay off credit cards and pay down your mortgage, while reserving the bulk of it to be available should she ever actually need extra financial support for her care. (I have a sister, and know of several other lonely old women who have been scammed for big money, yet refuse to face up to the reality of a con-artist love interest online.)

Yes, don't be so quick to judge but also... To receive $5,000 a month from retirement means that she/grandpa made A LOT of money over the course of their lives. Even if they only saved/invested a little, they would still have a lot for their later years. Additionally, OP said that she doesn't have any debt, which means that she could still invest a lot of money now. One person with little bills can invest the vast majority of $5,000/month. Additionally, if she needs help later she can ask at that point. Asking now isn't necessary. Lastly, I wonder how much she got from the life insurance? It seems like OP was paid a percentage, which makes me think that grandma already got some funds from the life insurance.

Load More Replies...Take it and say goodbye to your family as you wave from a plane or a cruise

Dark Mode

Dark Mode

No fees, cancel anytime

No fees, cancel anytime

46

38