Man Expects GF’s Help So He Can Work Less For His Mental Health, Gets Told It’s Unfair

In many parts of the world, young people complain about how hard it is to afford a home.

So, when a Reddit user from the United Kingdom, Uengoshi1, inherited a huge sum of money from his grandfather, he decided to buy a house.

Eventually, he picked out a property, part of which he could also rent for additional income, and poured all of the £450K (or about $600K) he received into it.

He now wants his long-time girlfriend to move in and start creating the future they’ve been dreaming of. However, they immediately started having disagreements: the man wants her to contribute half of their expenses, and she thinks it’s unfair because she makes only minimum wage.

So the new homeowner turned to the subreddit r/AITAH to ask for advice on how to settle their differences.

This man’s grandfather had left him a life-changing amount of money, so he bought a house with it

Image credits: bugphai / freepik (not the actual photo)

However, he and his girlfriend can’t seem to agree on who pays what

Image credits:Hans / Unsplash (not the actual photo)

Image credits: Camandona / freepik (not the actual photo)

Image credits: uengoshi1

How couples are managing their money

Many of today’s couples have questions that their elders can’t always help them with.

“With our parents’ generation, 70% of the time, they were single-income households, whereas with our generation, 70% of the time, we’re dual-income households,” Aditi Shekar, CEO and founder of Zeta, a fintech platform designed for couples, tells CNBC Select.

The way that we earn and spend money has fundamentally shifted, and it affects our relationships.

According to Zeta’s data, more than one-third of couples (39%) keep their finances in separate accounts. Another 39% have theirs fully merged, or “all in” with sharing joint bank accounts, credit cards, and bills. And the remaining 22% chose a “yours/mine/ours” approach with partially merged finances, trying to strike a balance between individual needs and their joint goals.

Zeta’s numbers also suggest that:

- Of the 39% who were fully merged or “all in,” 80% were married, and 16% were living together;

- Of the 22% who chose a “yours/mine/ours approach,” 54% were married and 35% were living together;

- Of the 39% who keep separate finances, 30% were married, and 46% were living together.

So, as we can see, there’s no one magical solution, but if they are serious about the future, the Redditor and his girlfriend need to develop a plan that works for them

Shekar says that at least in terms of averages, couples who team up to achieve financial goals have more successful relationships. The number-one way to get on the same team as your partner, especially when they have a different money management style than you, is to unite around a common goal or value.

This might be buying a home, saving up for a car, planning for a child, or opening a business together. Setting your eyes on something greater than you both as individuals can be a powerful motivator, plus it makes you both feel like any compromises are well worth it.

The 50/50 doesn’t always work

Image credits: Getty Images / Unsplash (not the actual photo)

Seattle-based money expert and author of the New York Times bestseller Financial Feminist Tori Dunlap is a self-made millionaire and her boyfriend makes $60,000, and they don’t split their expenses equally because she says it’s not equitable.

“We’ve had tons of conversations about money—we talked about it on the first date! I know how much he has in his Roth IRA, and he knows my brokerage account balance,” Tori writes in her blog Her First $100K. “I’m a huge fan of transparency in relationships when it comes to money. I think we should all be having money dates regularly, especially if you share accounts.”

To figure out who contributes what, Dunlap says couples need to start by determining their individual vs joint spending.

This will be different for every relationship, and is likely to change throughout the course of your time together, too,” she says.”

“For folks who are in long-term relationships, the joint spending category might be more involved. If you’re living together, things like rent, groceries, utilities, and random [stuff] for the house typically count as ‘ours.'”

Then, couples should review their income levels and compare them to their joint spending costs.

For example, if you earn $100,000 per year and your partner earns $60,000 per year, here’s how you can do this:

[Your salary] divided by [your salary + your partner’s salary] = [your percentage of joint expenses]

This then leads to: $100,000 / $160,000 = 0.625 or 62.5%

That would mean that you would pay roughly 60% of the joint expenses.

To figure out your exact share of your expenses, here’s what you do:

[Total cost of joint expenses] x [your percentage of joint expenses] = [your share of joint expenses]

Let’s play it out, using an example of $1,000 as your joint expenses and assuming you’re paying 60% of them.

$1,000 x 0.6 = $600

So, if you split your joint expenses equitably in the scenario above, you would pay $600 of your joint expenses and your partner would contribute $400.

When it comes to splitting the bills, the British public generally tends to think that they should be based on how much each partner earns.

Almost half say so (48%), compared to 37% who say that they should just be 50-50.

These results are almost identical among cohabiting couples where both partners work.

However, when it comes to what couples actually do, these figures are largely reversed. When asked how their bills are split in practice, 46% of couples where both partners work say that they and their partner pay a 50-50 split, while 38% say it is split proportionate to their relative income.

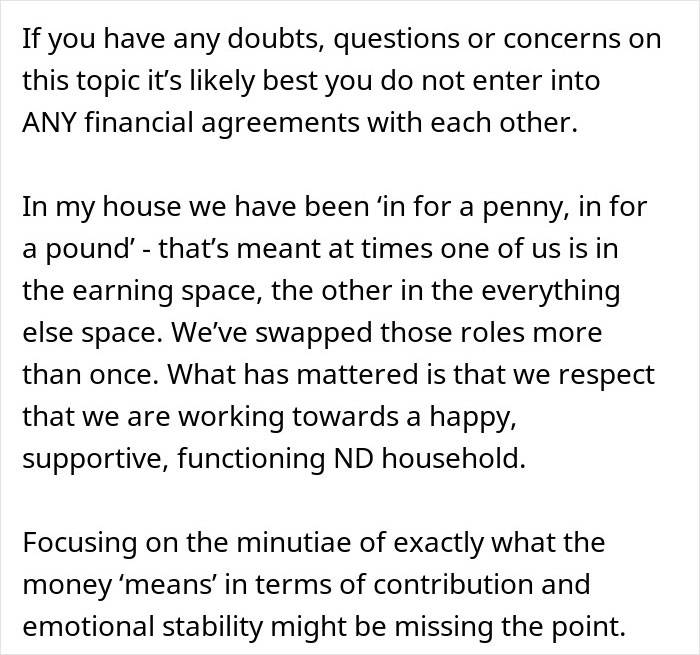

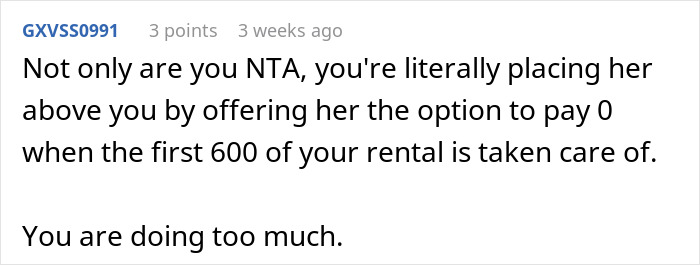

People who read his story believe the man needs to reevaluate his plans for the future

Poll Question

Thanks! Check out the results:

Explore more of these tags

I would only pay for utilities and groceries in a house that isn't in my name. The promise to house her even if they break up is as flimsy as it gets.

Why even buy such an expensive house now if you're having all these doubts? Put the money in something that will give you steady income without having to pour a ton into first. Get stable and then only consider buying anything.

Maybe don't take on duck a big expense? Also is she works part time and minimum wage in the UK, £600 is going to be most if not all her salary!

I work part time in the UK and it’s all about how many hours that means to you. £600 is certainly not most of my salary

Load More Replies...I would only pay for utilities and groceries in a house that isn't in my name. The promise to house her even if they break up is as flimsy as it gets.

Why even buy such an expensive house now if you're having all these doubts? Put the money in something that will give you steady income without having to pour a ton into first. Get stable and then only consider buying anything.

Maybe don't take on duck a big expense? Also is she works part time and minimum wage in the UK, £600 is going to be most if not all her salary!

I work part time in the UK and it’s all about how many hours that means to you. £600 is certainly not most of my salary

Load More Replies...

Dark Mode

Dark Mode

No fees, cancel anytime

No fees, cancel anytime

31

24