Man Maliciously Complies After Being Told “Call A Lawyer”, Wins $80 Thousand Over Insurance Claim

Interview With AuthorDealing with insurance is always a testy thing. Sometimes it may seem that they’ll pay out for something you thought had 0% chances of going through. Other times they’ll fight tooth and nail not to reimburse you for something that they obviously should.

Reddit user u/JoephNightwolf details the story of not taking it lying down when his insurance company decided to stop covering for an extremely cheap but very important medication.

More info: Reddit

Dealing with insurance companies is such a complex hassle, especially when you need the money

Image credits: Pixabay (not the actual image)

The poster of the story had a workplace accident, which left him with nerve damage and an important medication prescription

Image credits: u/JosephNightWolf

After his $81 per year prescription was cancelled by his insurance, he took them to court, eventually winning $84 thousand plus legal fees

The poster’s (OP) story is brief but compelling. He suffered a serious workplace injury, during and after which his insurance did not “cut corners”. Nerve damage was found during hospitalization and it was unsure whether it would heal naturally or last years, but the doctors recommended taking medicine to provide relief.

OP completed therapy, returned to work and ending up needing to take fewer pills than he was prescribed, allowing him to save them for the future. Eventually, the prescription ran out and the insurance company refused to refill it, repeating that the case was closed to him.

Turns out, the case could be reopened by the court, so he did just that. OP sued them and won $84 thousand plus legal fees. The most ironic thing about this story is that the medication only cost $81 dollars a year, but the insurance firm couldn’t resist skimping out on them.

For this Article, Bored Panda got in touch with the original poster, JoephNightwolf. Asked about how hands-on the process was, he mentioned that the process was handled entirely by lawyers, save for the final calls to appear in court and with news that the settlement was done.

The most difficult thing for Joeph throughout the entire process was “finding a parking spot for court.”

JoephNightwolf continued with more information about his story. The pills that were prescribed after surgery had to be taken regularly, or else he’d need spinal surgery. Although the surgery would have been covered by the insurance, OP didn’t want to undergo surgery for small nerve damage.

“They paid for the best doctors and therapists. I felt secure with the doctors’ informed opinion that the nerve damage was minor and because of my excellent health and physical activity, the damage would be repaired.”

The entire case sprang from the fact that OP needed the pills to avoid unnecessary surgery, and insurance seeks to close workers’ compensation cases as fast as possible. And, as they had finished physical therapy, the case had been closed, and the insurance company was immovable.

The original doctor wouldn’t give out a prescription as the claim was closed, and a new one would have needed to perform his own diagnosis, which would also cost unnecessarily.

OP resonantly finished their interview with: “I asked the agent to reopen the case. Nope. What do I do? You will have to ask a lawyer, she said. I did.”

Image credits: Alexander Schimmeck (not the actual image)

There may be many reasons why insurance companies may deny compensation, especially when related to medication. It may not be covered by the plan, the plan may only cover generic drugs, and so much more. The Patient Advocate Foundation provides possible reasons for why a prescription may be denied and what you can do about it.

Before we go into it, keep in mind that your mileage may vary widely, depending on where you live, your insurance provider, and many other factors. The most straightforward way to find out about what’s going on with your insurance is to contact the firm you are assigned to.

With that said, the insurer may provide the pharmacist with a specific reason why your prescription isn’t being covered. If you’ve got that information, you can find out whether your doctor hasn’t prescribed the medication, whether the pharmacy does not carry it in stock or perhaps something else is awry.

If this happens, you should attempt to contact your doctor and find out what the issue is. In some cases, the pharmacy may suggest generic alternatives to your prescription.

It is also prudent to check if your insurance information entered correctly, whether it is updated, because there may be a tiny mistake preventing you from getting your prescription. You should make sure that the pharmacy you’re in is covered by your plan and whether that hasn’t changed as well.

As nearly all European countries have a universal health care system, you most often hear stories of US citizens dealing with healthcare issues. A lot of the time people may receive a prescription, but have no money to refill it, which drastically affects quality of life.

Many people have Medicare, but then they also need to pay for additional insurance plans to get the coverage they need. Furthermore, the generic version of their medication may be covered, but it could simply not work for everybody.

Image credits: Nenad Stojkovic (not the actual image)

An interesting phenomenon that stems from similar issues is defined by the Japanese term karoshi. It can be translated as “death from overworking” referring to sudden deaths related to work. This phenomenon has been studied extensively, examining the underlying social and physical causes.

The first case was reported in the 1960s, when a 29-year-old died from a stroke while at work. Major causes of karoshi are stroke and heart attack, but they are not the only ones. The International Labor Organization describes 4 typical cases of karoshi:

- Mr A worked at a major snack food processing company for as long as 110 hours a week (not a month) and died from a heart attack at the age of 34.

- Mr B, a bus driver, whose death was also approved as work-related, worked more than 3,000 hours a year. He did not have a day off in the 15 days before he had a stroke at the age of 37.

- Mr C worked in a large printing company in Tokyo for 4,320 hours a year including night work and died from a stroke at the age of 58. His widow received a workers’ compensation 14 years after her husband’s death.

- Ms D, a 22-year-old nurse, died from a heart attack after 34 hours’ continuous duty five times a month.

In 2018, the former Prime Minister of Japan presented a Work Style Reform bill, which meant that employers could now be forced to make employees go on holiday, somewhat alleviating the situation.

Currently, the WHO recommends implementing laws and bargaining agreements which would ensure maximum limits on working hours. Poverty-reducing measures are also important, as they improve the general quality of life, allowing people not to stress so much about their work performance.

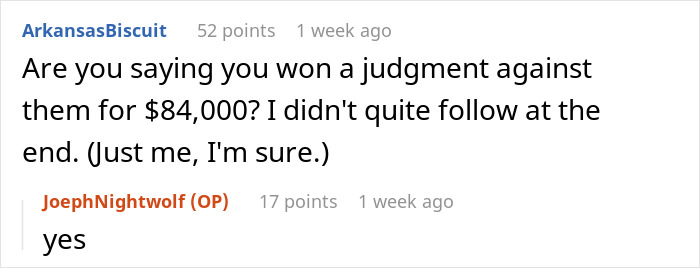

OP’s story collected nearly 13 thousand upvotes and almost 400 comments. The commenters celebrated OP, praising him for his endurance seeing the case to the end. The community emphasized that insurance companies hope that others won’t be as patient as OP and will give up at an earlier stage. Seeing as the thing that can protect workers from overworking themselves to death could be labor unions, you may be interested in this article. Let us know your stories about dealing with your insurance in the comments.

Comments praised the poster for sticking it to the insurance companies and went on to share their own stories related to coverage

Yep. Idiot totaled an irreplaceable car and Allstate paid 10% of value. Woman decided to brake check my son (loaded 18 wheeler at 70mph), multiple witnesses and her own admission. $30k damages to his truck, State Farm tried to weasel out for $7k - the hood alone cost more than that. In the end, between having to pay out for repairs himself, loss of use of the rig, once they did pay it left him in the hole. I could go on and on with examples of insurance companies being complete as*****s but anyone whose ever dealt with one knows how they all are.

Load More Replies...Do companies, insurance, workman's comp, etc, sometimes hold off on purpose to cause the claimant to lose out? Not all of them and not all the time. This seems illegal to me, but I'm not sure how this stuff works.

"As nearly all European countries have a universal health care system, you most often hear stories of US citizens dealing with healthcare issues" True if you're a US citizen living in the US reading news about the US. Europe has all kinds of serious healthcare issues we just don't hear about them because we don't live in Europe. Imagine if the guy in this story was dealing with the federal government rather than a private insurance company. The answer wouldn't have been "call a lawyer" it would have been "The case is closed and there is nothing you can do to reopen it."

You’re absolutely right. I have friends, family and coworkers in Europe. It’s not all happy, shiny rainbows.

Load More Replies...Yep. Idiot totaled an irreplaceable car and Allstate paid 10% of value. Woman decided to brake check my son (loaded 18 wheeler at 70mph), multiple witnesses and her own admission. $30k damages to his truck, State Farm tried to weasel out for $7k - the hood alone cost more than that. In the end, between having to pay out for repairs himself, loss of use of the rig, once they did pay it left him in the hole. I could go on and on with examples of insurance companies being complete as*****s but anyone whose ever dealt with one knows how they all are.

Load More Replies...Do companies, insurance, workman's comp, etc, sometimes hold off on purpose to cause the claimant to lose out? Not all of them and not all the time. This seems illegal to me, but I'm not sure how this stuff works.

"As nearly all European countries have a universal health care system, you most often hear stories of US citizens dealing with healthcare issues" True if you're a US citizen living in the US reading news about the US. Europe has all kinds of serious healthcare issues we just don't hear about them because we don't live in Europe. Imagine if the guy in this story was dealing with the federal government rather than a private insurance company. The answer wouldn't have been "call a lawyer" it would have been "The case is closed and there is nothing you can do to reopen it."

You’re absolutely right. I have friends, family and coworkers in Europe. It’s not all happy, shiny rainbows.

Load More Replies...

98

21