Woman Confesses To Having A Crippling Debt The Day After The Wedding, Gets Dumped

Interview With ExpertWhen you and your partner decide to get married, you agree to be with one another “for better, for worse, for richer, for poorer, in sickness and in health,” but what about in debt?

One newlywed recently shared on Reddit that the honeymoon stage didn’t last very long with his wife because she dropped a bombshell about her finances on him right after their wedding. Now, he’s wondering what the best course of action will be for their relationship. Below, you’ll find the full story, as well as a conversation with Julia Rodgers, Esq., CEO of Hello Prenup.

Right after getting married, this man’s wife dropped a bombshell on him regarding her finances

Image credits: RDNE Stock project / pexels (not the actual photo)

Now, he’s wondering what the best course of action would be

Image credits: Karolina Grabowska / pexels (not the actual photo)

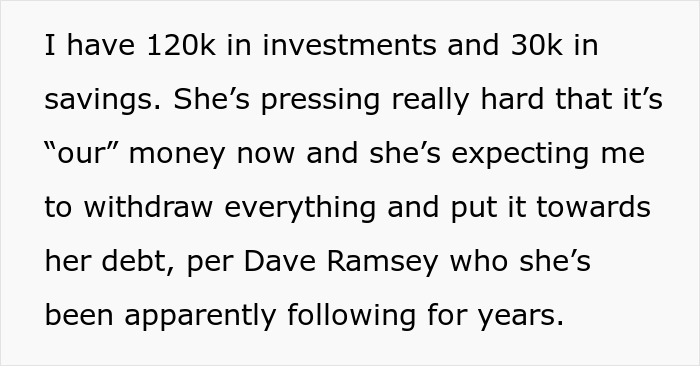

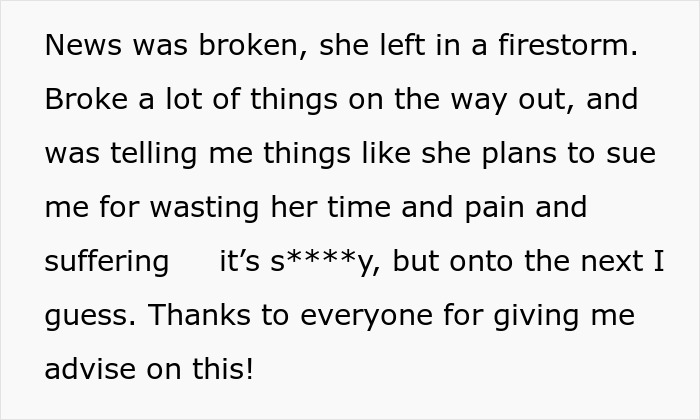

Image credits: Ready_Cash9333

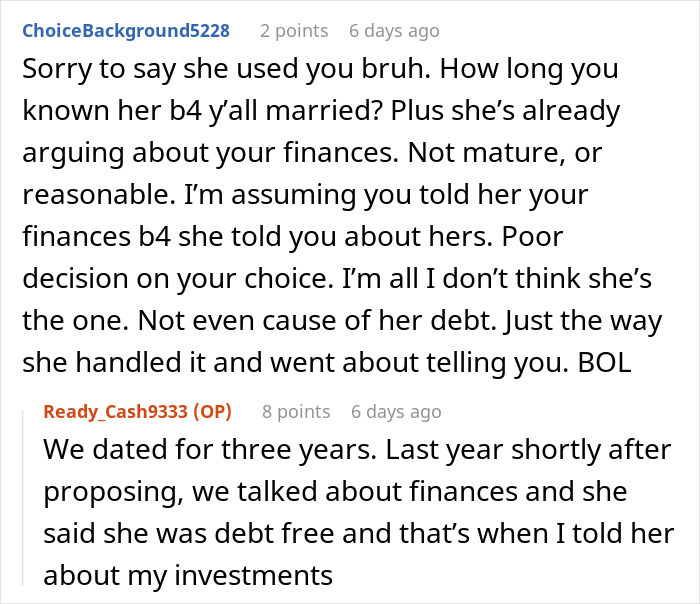

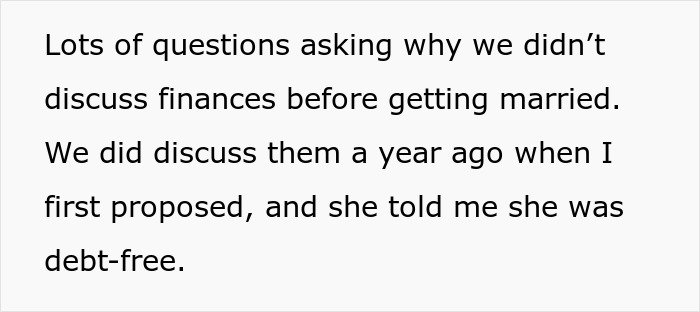

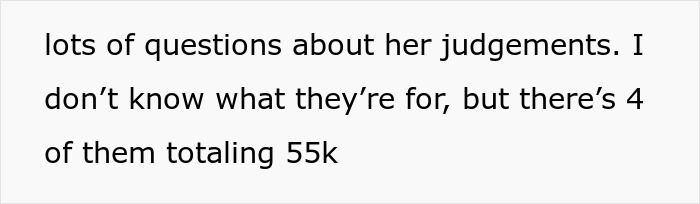

Later, the man provided some background information on the relationship

“By discussing finances early on, you prioritize talking about any differences in money management styles and begin to create a plan for your shared financial future”

To gain more insight on this situation, we reached out to Julia Rodgers, Esq., CEO of Hello Prenup. Julia was kind enough to have a chat with Bored Panda and discuss when the right time to start talking about finances with a partner is.

“Couples should start discussing finances as early as possible in their relationship, and certainly before making any major life commitments like moving in together or getting engaged,” Julia shared. “By talking about money early on, couples are able to understand each other’s financial habits and values, making way for better communication.”

“Transparency is key to good communication in a relationship. By discussing finances early on, you prioritize talking about any differences in money management styles and begin to create a plan for your shared financial future,” she continued.

If you are moving in with a partner or starting to share financial responsibilities, Julia says it may be helpful to plan a “money date” once a month to sit down and discuss your budget, goals, and debt management. “A regular cadence can help avoid any gaps in communication,” she shared.

When it comes to dealing with debts, Julia says being is essential. “Hiding it will erode trust,” she told Bored Panda. “The Reddit post highlights the importance of full disclosure, as the poster felt blindsided by his wife’s debt revelation.”

Image credits: Mikhail Nilov / pexels (not the actual photo)

“Being open about financial matters can help you steer clear of any surprises and ensure fairness for both spouses”

“By openly discussing debt and working together towards a debt management plan together, couples can use this vulnerability to strengthen their bond, rather than doing what this wife did – lie, and then demand their partner pay for this debt, the night after their wedding,” the expert continued. “This underscores the importance of a prenup, which forces clear boundaries and expectations regarding financial decisions within the relationship.”

Julia also noted that debts are bound to impact both partners after they get married. “Even though marrying into debt does not automatically make it your problem, it will affect how you manage your finances as a couple,” she explained. “Money plays a big role in our lives – it determines where we live, how often we can splurge on a vacation, and more. Just like the Reddit post, deception like this can destroy a relationship.”

Instance of a divorce, Julia says judges often have the power to split debts between both partners, regardless of whether it was racked up before or during the marriage. “Laws vary state by state, but this situation can be scary for couples who entered marriage without a prenup, because they will be subject to state divorce law, and they may not like the outcome,” she shared.

Julia also pointed out that this can include various types of debt, such as credit card debt, business debt, and student loans, which most millennials and Gen Zers have. “For example, if one partner has significant student loan debt or credit card debt (without a prenup), it could become a shared responsibility in a divorce,” she warns. “Take the Reddit situation, for instance – the newlywed was staring down the barrel of possibly sharing the burden of his new wife’s $160k debt.”

The takeaway should be that it’s crucial to lay all your cards on the table and talk about money early on in your relationship. “Legal safeguards like prenuptial agreements allow couples to talk about money early and often, and decide for themselves how assets or debt should be managed,” Julia noted. “Being open about financial matters, unlike the wife in this Reddit post, can help you steer clear of any surprises and ensure fairness for both spouses.”

Image credits: Ketut Subiyanto / pexels (not the actual photo)

“I cannot see how, after this level of deception, the relationship could progress forward in a healthy manner”

If you plan on getting married while you or your future spouse has significant debt, Julia says that open communication and proactive planning are key for the success of the relationship. “You must have honest discussions about the debt and how it might impact both of your financial futures,” she explained.

And as for whether or not it’s a bad idea to start a marriage under circumstances like this, Julia notes that it’s relevant whether or not your partner was forthcoming about the debt. “If they tried to hide it, this is a major red flag that could be indicative of bigger issues,” the expert says. “In this situation, the wife lied about debt until after the couple was married, and then demanded her new husband pay for her debt. I cannot see how, after this level of deception, the relationship could progress forward in a healthy manner.”

“The question that anyone in the husband’s situation has to ask is: If your partner has significant debt, are they receptive to creating a plan to mitigate the debt?” Julia told Bored Panda. “Are they willing to work together to address the financial challenges, or do they seem resistant or avoidant or expect you to just handle it for them?”

“You have to ask yourself these questions, because how they respond to this situation can provide valuable insight into their approach to working as a team in other aspects of life,” the expert pointed out. “It is clear that the wife in this Reddit post was not interested in working as a team.”

Image credits: Tima Miroshnichenko / pexels (not the actual photo)

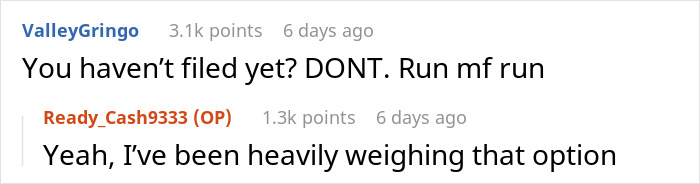

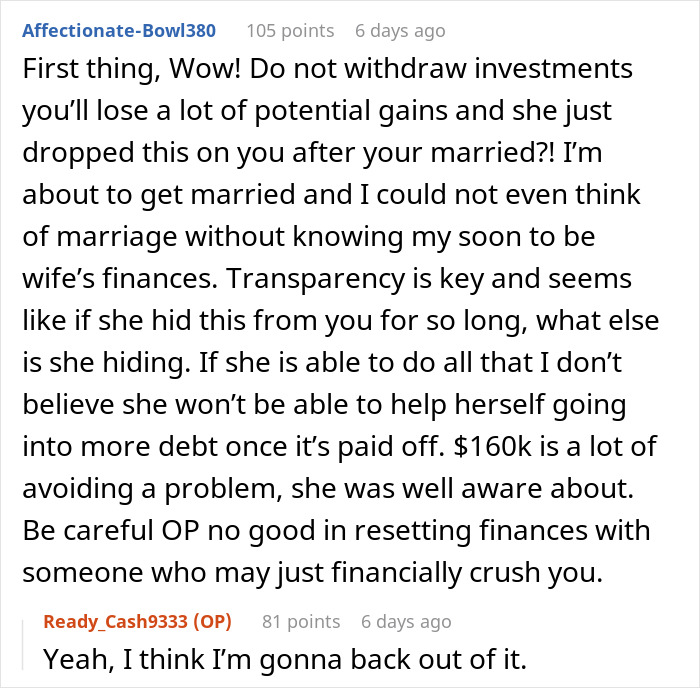

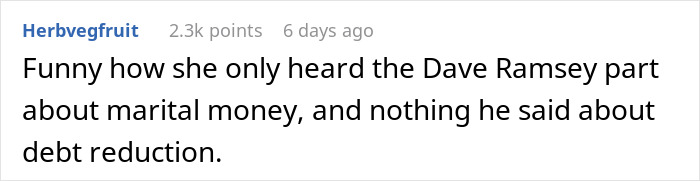

Readers were quick to share their thoughts and provide advice for the man

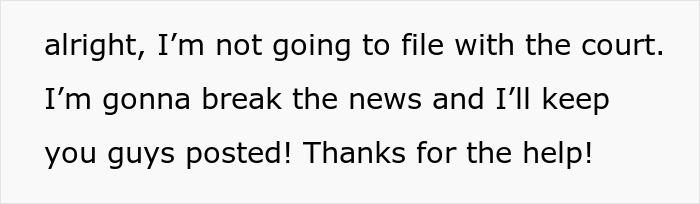

Later, the OP provided an update on how he’s decided to handle the situation

Poll Question

Thanks! Check out the results:

You May Also Like

Woman Refuses To Chip In For Babysitting Because She Doesn’t Even Have Kids, Asks If She’s A Jerk

Do you think childless individuals should be expected to chip in for group babysitting costs during friend gatherings?

17 Y.O. Is Done Sharing Her Birthday With Her Late Twin, Parents Are Not Having It

Do you think the girl should be allowed to celebrate her birthday without the remembrance of her deceased twin?

I married into debt (medical and veterinary), but she was honest from the start. The debt itself isn’t important; the lying is.

I also married into debt. First student loans and then full-on medical school, which was at my insistence. However, I wasn’t transparent about my assets. I was not only vague about my inheritance, but refused to give him the specific numbers. He was aware I have a HEMS & inherited my home free of mortgage . I’m certain he wasn’t gold digging & was rather hesitant with me being the sole provider whilst he was in school. Still, he knew the exact amount of my HEMS & I felt he was knowledgeable that my investments & assets would be enough for us to financially plan our future without him needing dollar amounts. While honestly is paramount, transparency isn’t. Sometimes it’s important to opaque with it comes to actual numbers.

Load More Replies...I wouldn’t have broke it off because of the debt, but because of the withholding/lying about the real state of her finances. She tried to keep it secret until that money was ‘theirs’. That’s a lot of trust gone.

Withholding would be bad enough, but she lied big time a year ago. I would be gone in a blink for such a life altering lie.

Load More Replies...They hadn’t filed the marriage certificate. It was issued, assuming it was officiated, witnesses & signed, but he made it very clear 4 times they haven’t yet filed it. Neither a divorce or annulment.

Load More Replies...I married into debt (medical and veterinary), but she was honest from the start. The debt itself isn’t important; the lying is.

I also married into debt. First student loans and then full-on medical school, which was at my insistence. However, I wasn’t transparent about my assets. I was not only vague about my inheritance, but refused to give him the specific numbers. He was aware I have a HEMS & inherited my home free of mortgage . I’m certain he wasn’t gold digging & was rather hesitant with me being the sole provider whilst he was in school. Still, he knew the exact amount of my HEMS & I felt he was knowledgeable that my investments & assets would be enough for us to financially plan our future without him needing dollar amounts. While honestly is paramount, transparency isn’t. Sometimes it’s important to opaque with it comes to actual numbers.

Load More Replies...I wouldn’t have broke it off because of the debt, but because of the withholding/lying about the real state of her finances. She tried to keep it secret until that money was ‘theirs’. That’s a lot of trust gone.

Withholding would be bad enough, but she lied big time a year ago. I would be gone in a blink for such a life altering lie.

Load More Replies...They hadn’t filed the marriage certificate. It was issued, assuming it was officiated, witnesses & signed, but he made it very clear 4 times they haven’t yet filed it. Neither a divorce or annulment.

Load More Replies...

61

55