Greedy Landlord Expects This Man To Pay $12k Upfront To Move Into A Rental, Doesn’t Know His Letter Is Going To End Up Igniting An Important Discussion

Few things in life are as irritating as apartment hunting. With rent prices skyrocketing to numbers unimaginable before and citizens’ trust in landlords falling downwards every year (only 16% of London tenants would recommend their landlord to a friend or relative), it’s not hard to understand why that is.

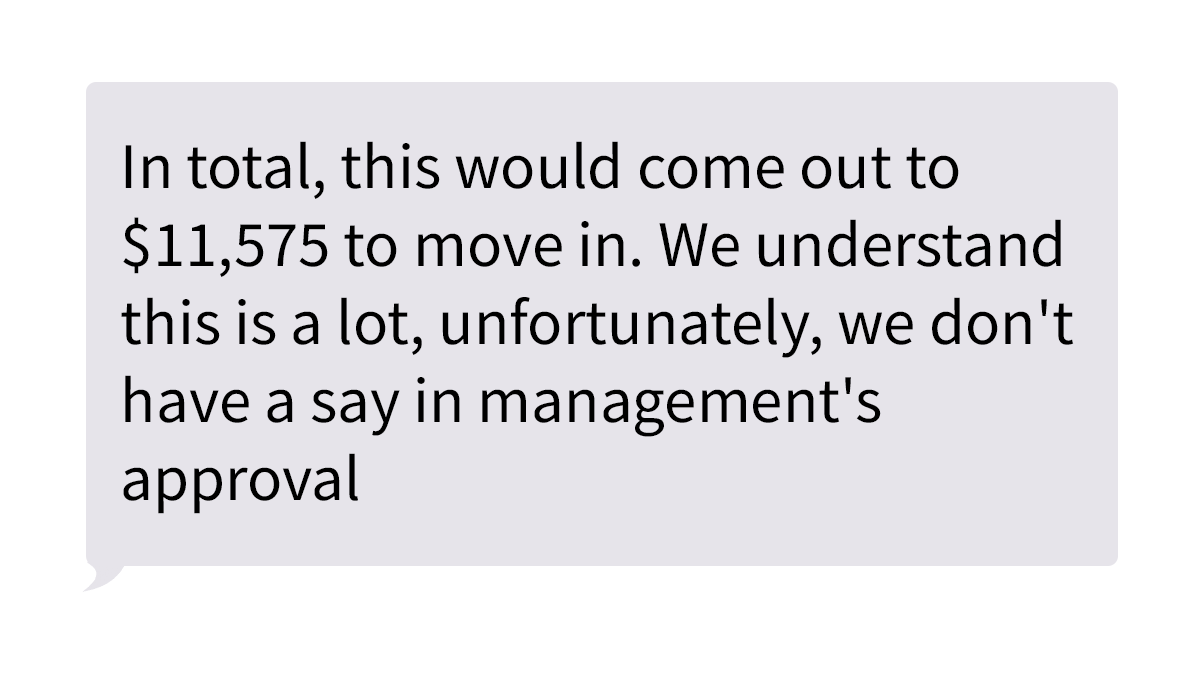

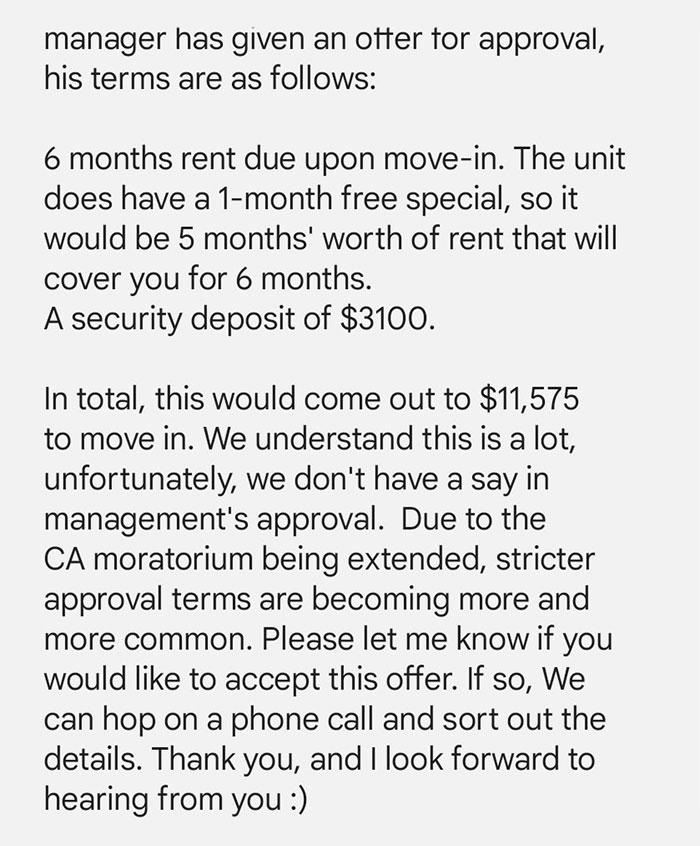

To prove just how broken the rental property market is today, Jeong Park, LA Times’ Asian American communities correspondent, shared his latest offer from the rental company in what quickly caught the attention of the masses. “If someone has $12,000 to drop for rent,” he wrote in his now-viral tweet, “more power to them.”

In a now-viral Tweet, a journalist looking for a place in LA shared the bewildering deposit conditions he was expected to live up to before settling in

Image credits: JeongPark52

It’s been a couple of difficult years for those trying to find their own corner under the sun. Housing and rental prices have been rising at the fastest pace in 40 years. Demand has shot through the roof, supply slumped accordingly. Which explains why “the overall rental vacancy rate (in the US) dropped to just 5.8 percent,” according to the newest data published by Harvard University’s Joint Center for Housing Studies. The lowest reading since the mid-1980s.

This might seem surprising at first, as the number of renter households increased by almost 1 million (or 870,000, to be precise) since 2020. The problem then is that the supply doesn’t meet the demand — the housing shortage crisis that was further fueled by the pandemic, with those below the middle-income suffering the most.

“The need for a permanent, fully funded housing safety net is more urgent than ever,” warns Housing Studies’ paper, stating not only the skyrocketing rental prices across the country as the main cause; but also the ravaging impacts of climate change, already visible from the wildfires raging across California.

Here is the full letter Jeong received from the rental company as shared on his Twitter account

Image credits: JeongPark52

Image credits: JeongPark52

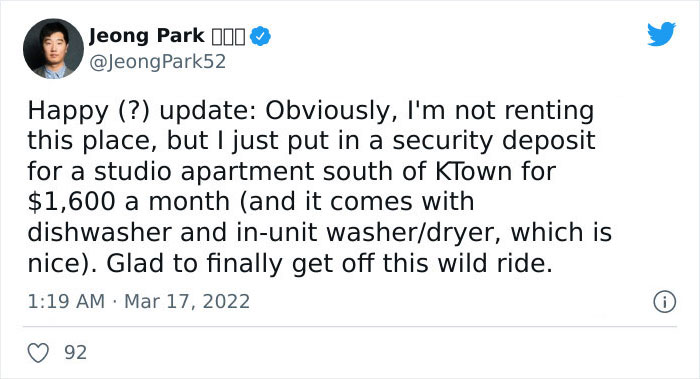

In the end, Jeong was able to find a decent offer and shared the news with his followers

Image credits: JeongPark52

According to research conducted by RedFin, rents in the US jumped 14% in 2021, the largest rise in more than two years. It seems, even the rent control policies placed by the government (in specific states) to stabilize the widening gap between those who can and those who can’t afford to rent — weren’t the solution to this decades-old issue.

To put this into perspective: in 2019, the average household in the US had $2,400 each month to cover expenses other than housing. Today, the cost-burdened households (spending more than 30% of income on rent and utilities) with incomes below $30,000 had just $360 to spend each month — an amount that would not cover basic needs in even the most affordable areas of the country. Which doesn’t really scream “the American Dream,” right?

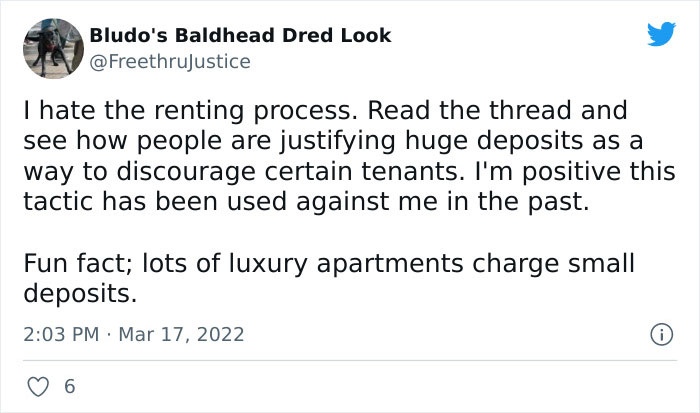

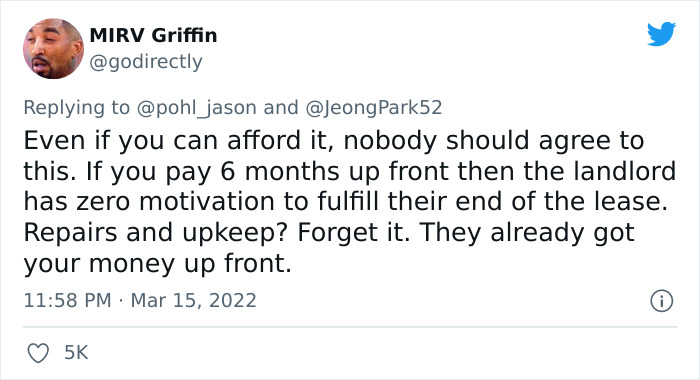

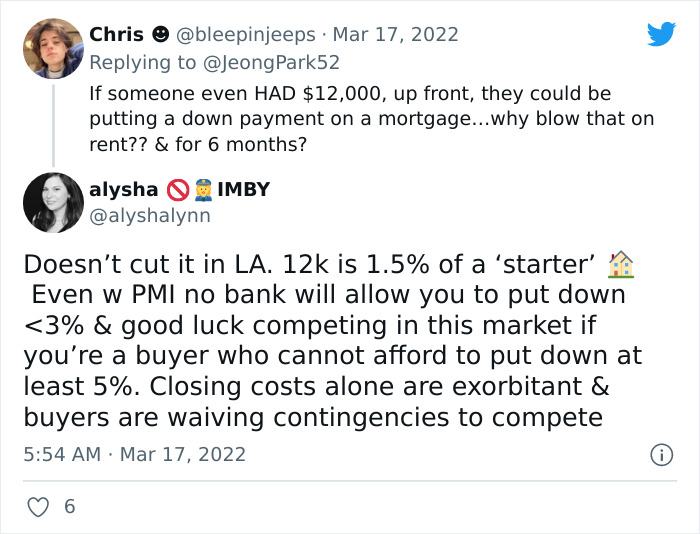

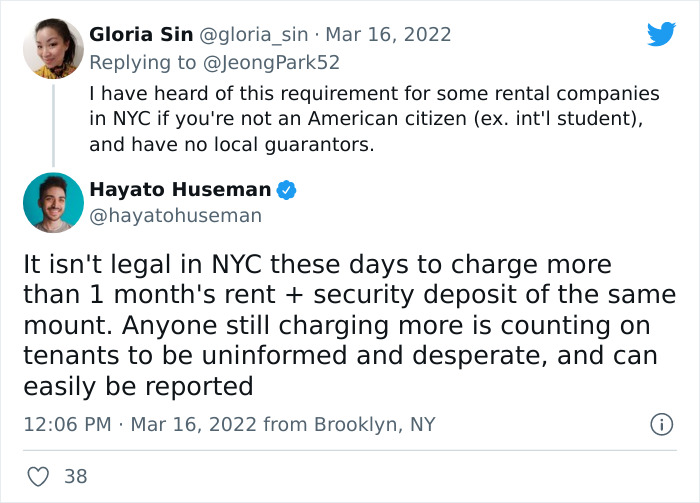

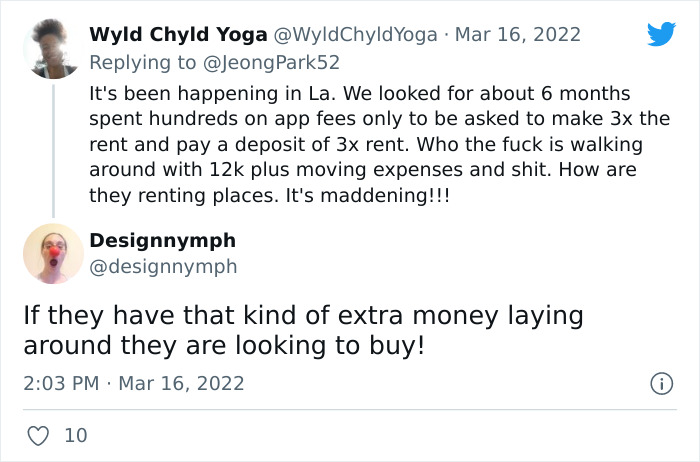

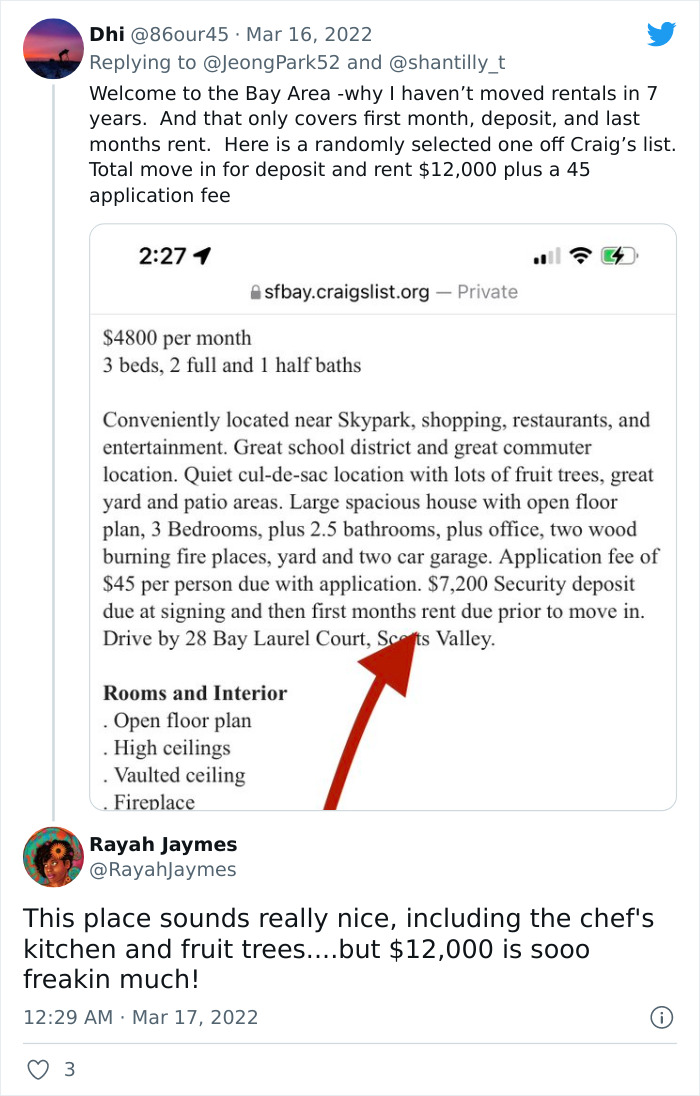

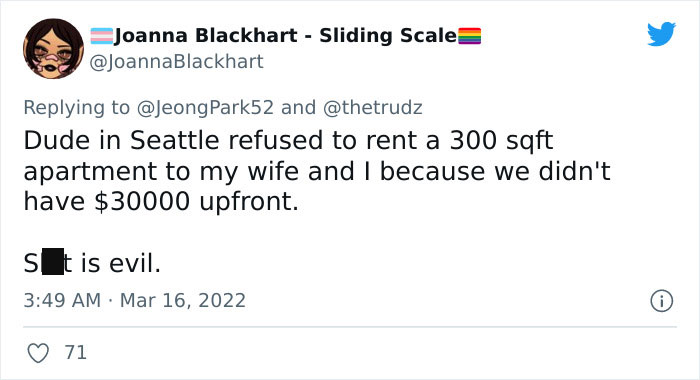

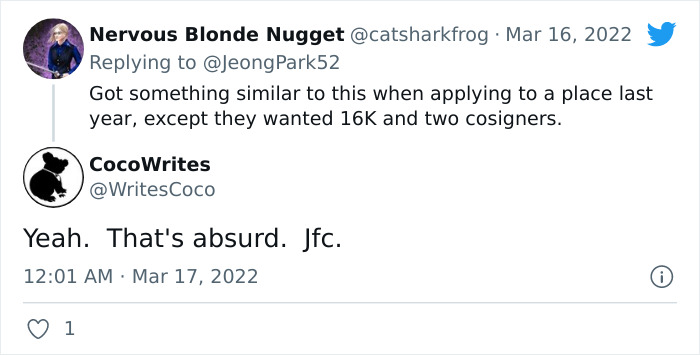

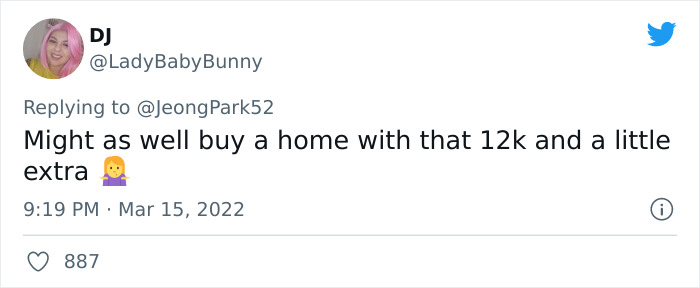

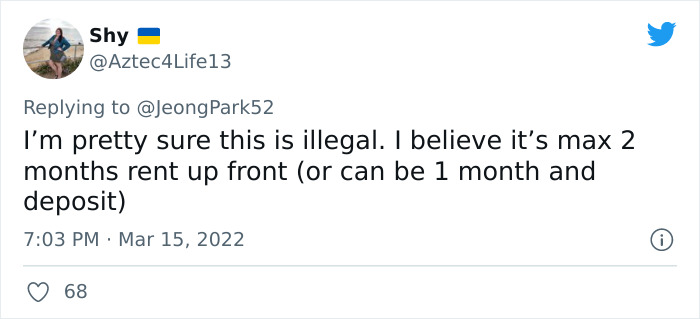

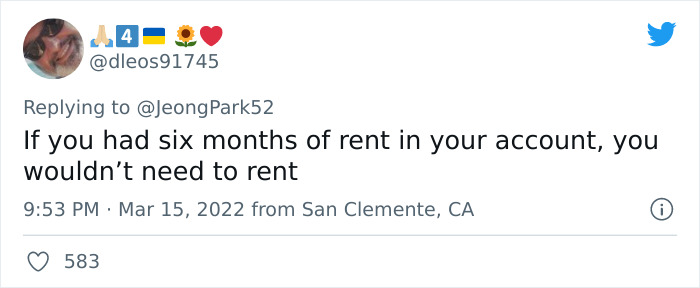

People couldn’t believe someone would actually agree to these outrageous terms and shared similar experiences

Image credits: FreethruJustice

Image credits: godirectly

Image credits: alyshalynn

Image credits: m3kka_

Image credits: hayatohuseman

Image credits: designnymph

Image credits: RayahJaymes

Image credits: JoannaBlackhart

Image credits: WritesCoco

Image credits: LadyBabyBunny

Image credits: Aztec4Life13

Image credits: dleos91745

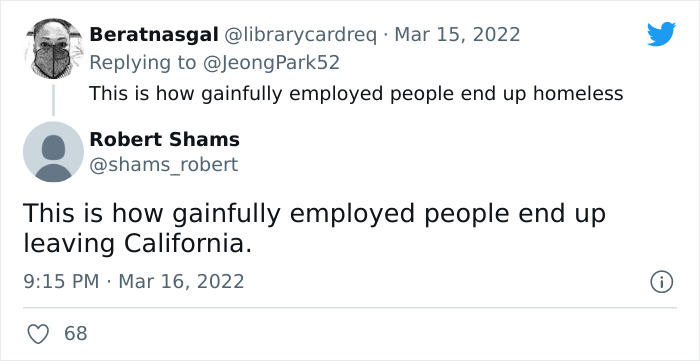

Image credits: shams_robert

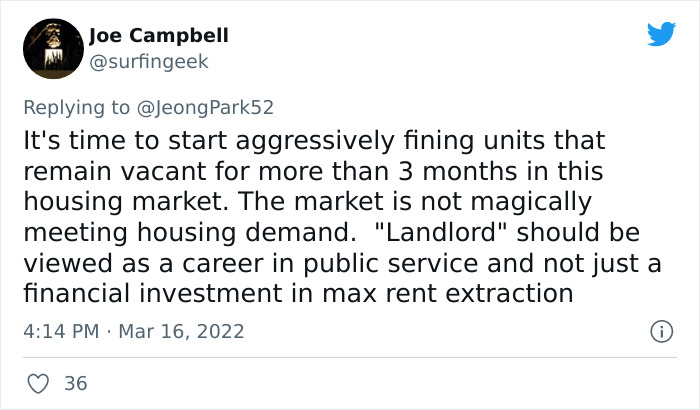

Image credits: surfingeek

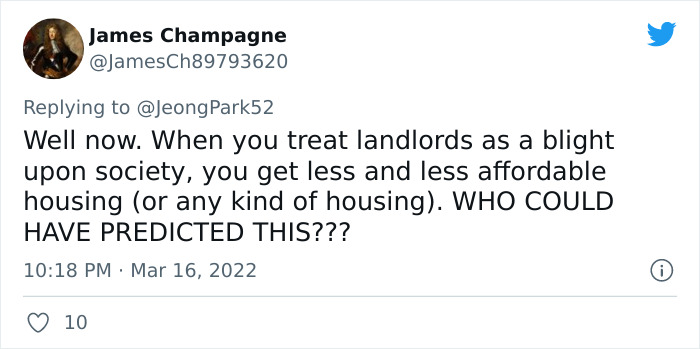

Image credits: JamesCh89793620

Image credits: tarantulaarms

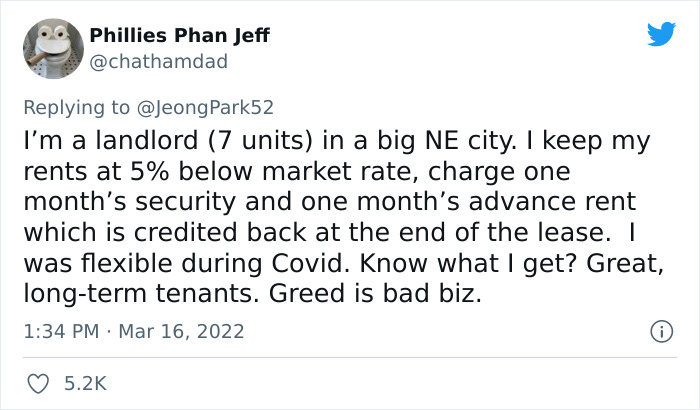

Image credits: chathamdad

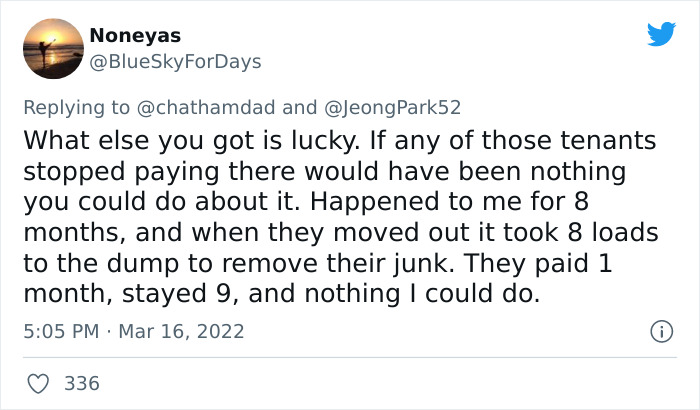

Image credits: BlueSkyForDays

Image credits: MrDre_

Image credits: 1billion_in_usa

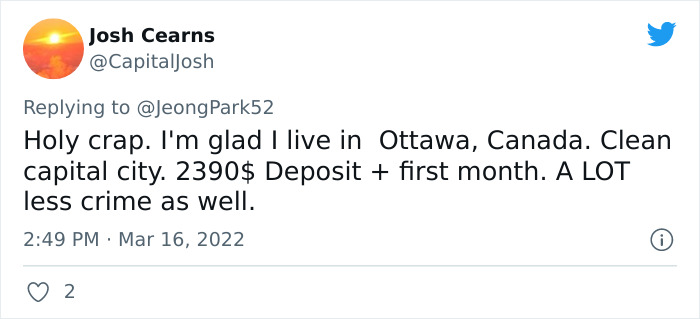

Image credits: CapitalJosh

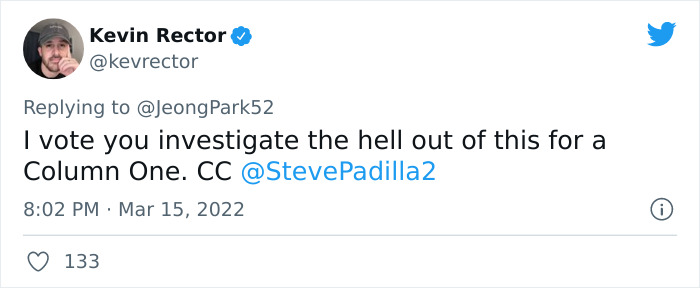

Image credits: kevrector

Image credits: TKVicious

Image credits: AlisonB916

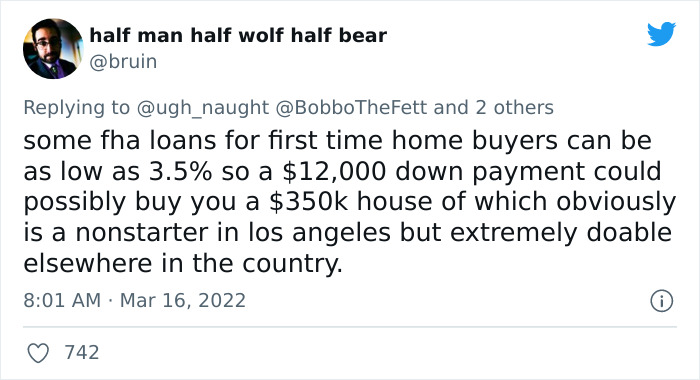

Image credits: bruin

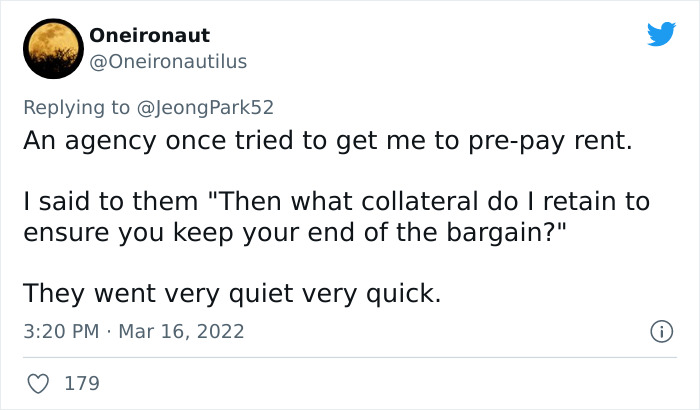

Image credits: Oneironautilus

52Kviews

Share on FacebookLove the one idiot saying "Man, this is what happens when you make landlords out to be bad guys!" No, you semi-sentient tuber, Landlords are cast as bad guys because they do s**t like this. Do you also think explosions cause bombs?

i want to slap ppl who keep shrieking BUT THEY BUILT A BAJILLION NEW HOMES LAST YEAR... yes and then speculators, investors and foreign conglomerates probably immediately swept in and bought 90% of them. so new housing isn't going to ppl who need it, it's going to greedy pricks who victimize poor people even more. and those twats pull horseshit as seen above. and the cycle continues and NOTHING gets better.

Love the one idiot saying "Man, this is what happens when you make landlords out to be bad guys!" No, you semi-sentient tuber, Landlords are cast as bad guys because they do s**t like this. Do you also think explosions cause bombs?

i want to slap ppl who keep shrieking BUT THEY BUILT A BAJILLION NEW HOMES LAST YEAR... yes and then speculators, investors and foreign conglomerates probably immediately swept in and bought 90% of them. so new housing isn't going to ppl who need it, it's going to greedy pricks who victimize poor people even more. and those twats pull horseshit as seen above. and the cycle continues and NOTHING gets better.

Dark Mode

Dark Mode

No fees, cancel anytime

No fees, cancel anytime

69

22