Man Asks For Access To Monitor Wife’s Inheritance, Is Denied, Get Left With Nothing In Months

Being on the same page when it comes to the most important questions is vital to the long-term success of any romantic relationship. It means having similar goals and values when it comes to family and finances. When there’s a disconnect, it can lead to a lot of frustration and resentment.

One redditor recently turned to the AITA online community for advice on a very intense situation at home, and his post went viral on the internet. He shared how his wife, an “emotional spender,” squandered the inheritance she received from her father in a matter of months. The situation was so bad he considered monitoring her spending. The OP later shared a couple of incredibly important updates about what happened next. Read on for the full story.

Bored Panda reached out to the author via Reddit, and we’ll update the article as soon as we hear back from him.

Everyone must be on the same page about expenses and savings in order for a relationship to work

Image credits: wayhomestudioo (not the actual image)

One man asked the internet for advice after seeing how his wife’s spending went completely out of control. Here’s what he shared

Image credits: davidgyung (not the actual image)

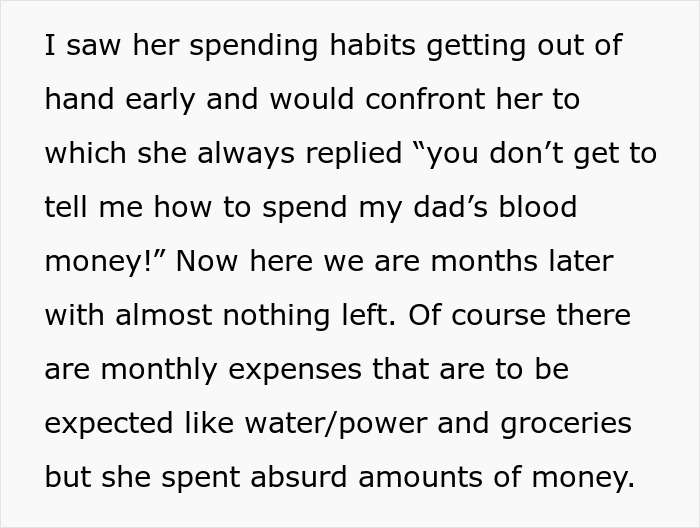

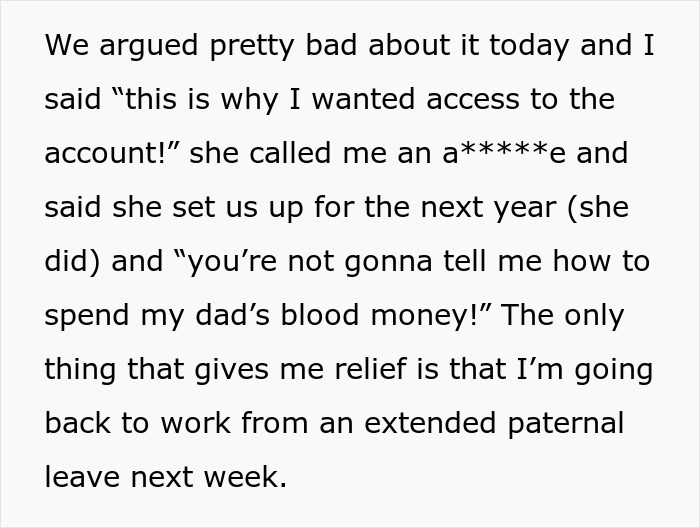

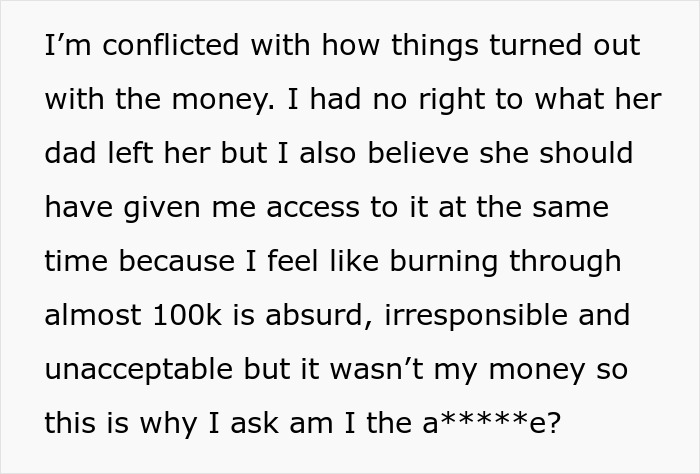

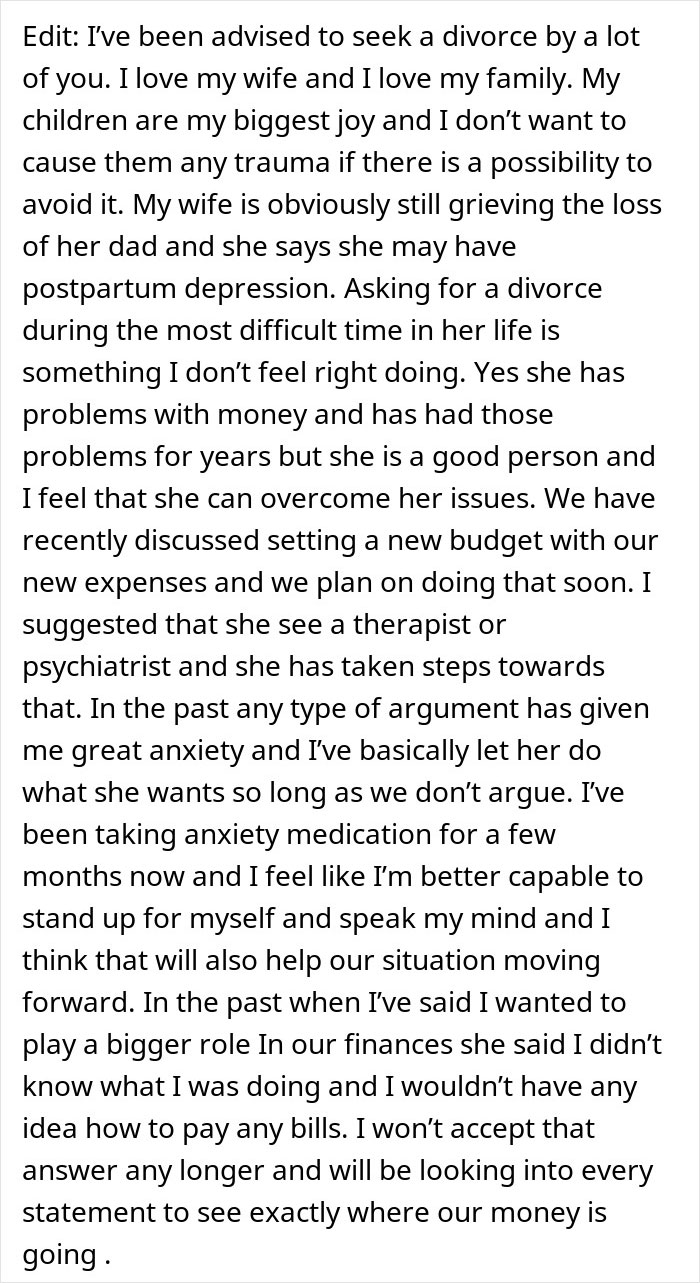

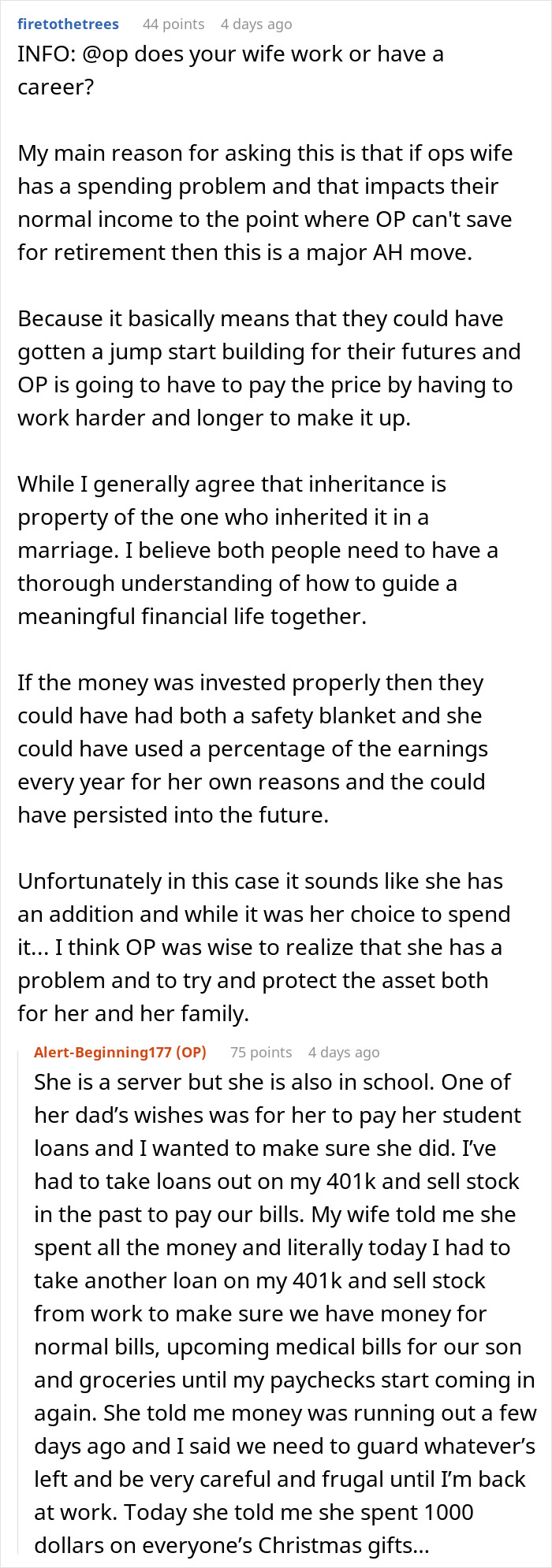

Image credits: Alert-Beginning177

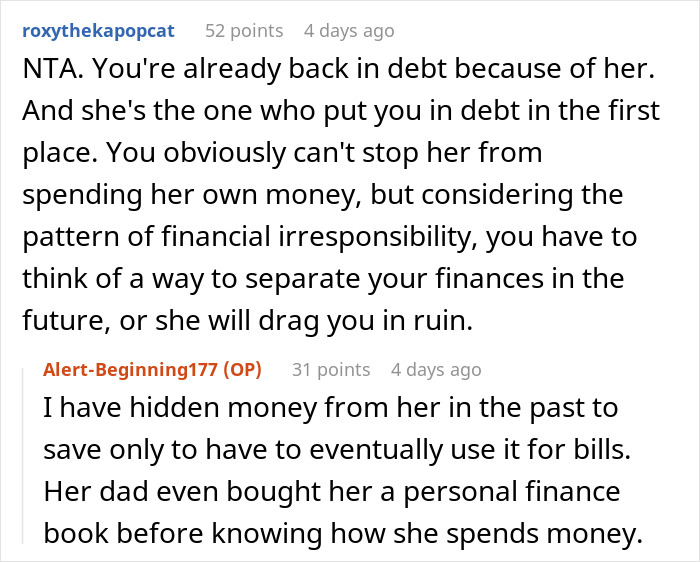

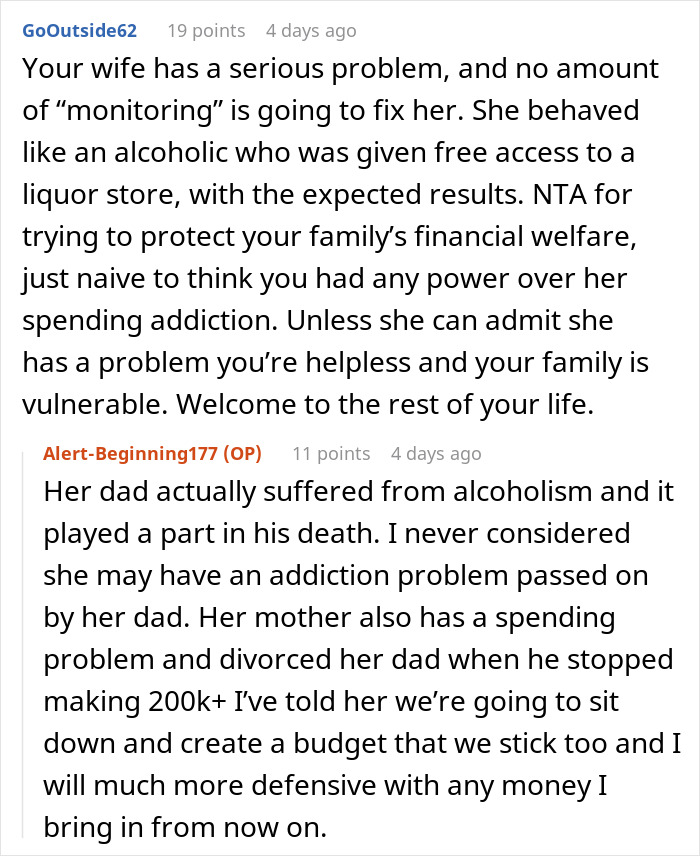

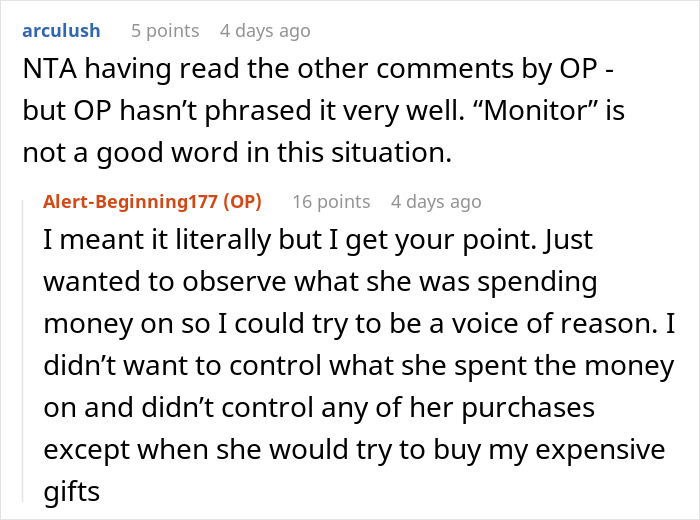

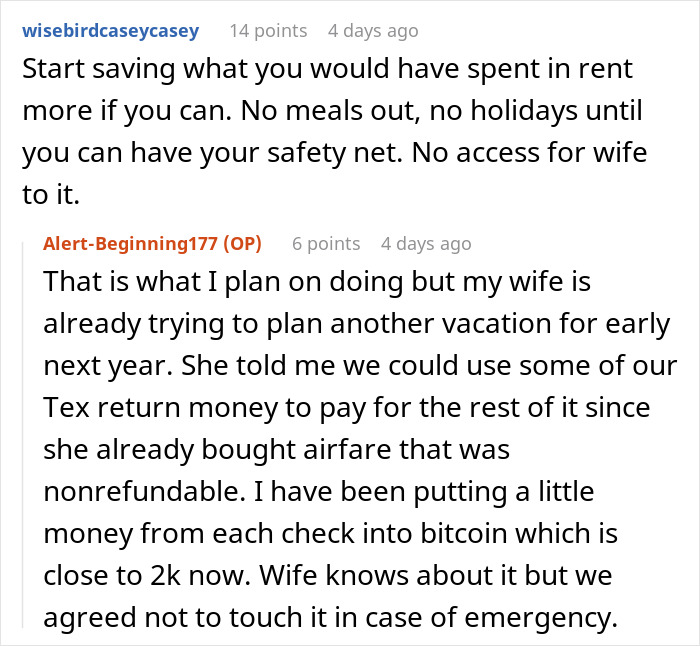

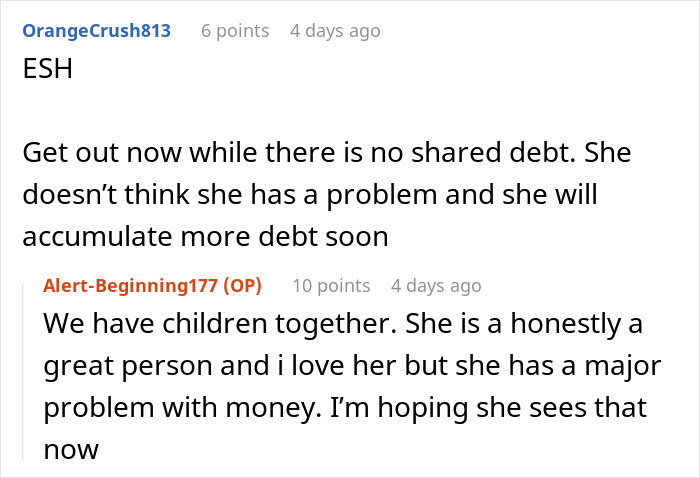

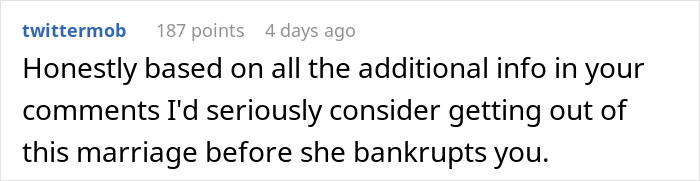

In his post and follow-up comments, the author revealed a lot of information about his and his wife’s spending habits, debt, and work situation, in order to establish the full context of what exactly happened.

There wasn’t just one single issue to consider: there were many interconnected ones. Some readers on Reddit rushed to judge the author without getting the full context of why exactly he wanted to monitor his wife’s spending. After he went into detail about everything, many internet users finally understood the predicament he was in.

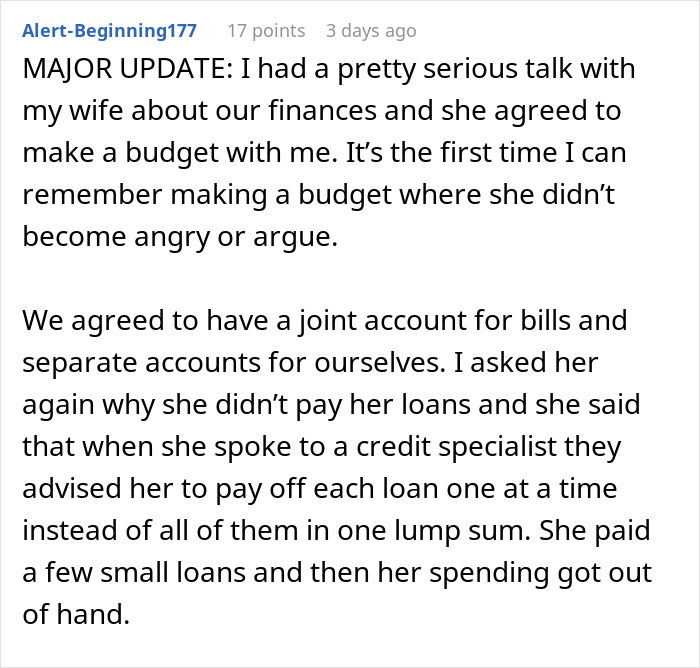

Luckily, after the entire drama with the inheritance, the OP made some progress. He spoke to his wife about their finances and made a budget together. Not only that, he helped her curb large parts of her spending. She also agreed to go back to work.

These are all huge strides to the situation the author described before. In a follow-up comment to his post, he explained that his wife rarely worked, had access to the money he earned, and applied for loans in his name. This has made the author become far stricter where the family’s finances are concerned.

What the author demonstrated here was the importance of discussing these awkward and sensitive issues, instead of shying away from them. A large part of healthy conflict revolves around the idea that you’re not blaming your partner: you’re looking for a solution together.

At the end of the day, you’re still a team. But some couples need reminding of this. The important thing here is to look for a practical compromise that gets the family out of the situation they’re in. Being ‘right’ doesn’t matter much if the core problems remain unresolved.

Whenever couples argue about specific questions, it’s best not to dredge up the past, unless it’s directly related to the current situation. So if you’re arguing about spending habits, it wouldn’t be fair for anyone to bring up their relationship with the in-laws, or vice versa. The couple needs to stay on point.

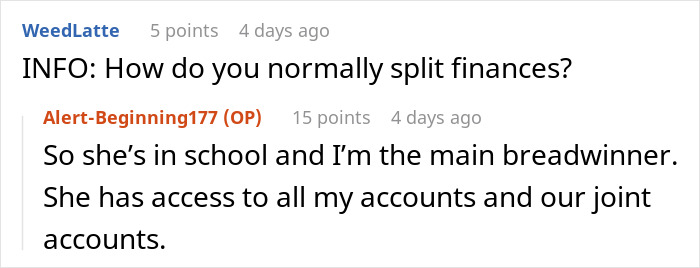

He later revealed the full context of the financial situation at home after some readers misinterpreted him

Something else to remember is the power of active listening. Most of us aren’t actually listening to what other people are saying: we’re simply waiting for our turn to speak. However, when we fight against this instinct, we show that we care about the other person’s perspective. We’re considering their thoughts and feelings. We’re respecting their logic.

Even if you know that you’re in the right and doing the healthy thing for your family, it’s still essential to show that it’s not just your opinion that matters. Mutual respect is incredibly healthy. When it crumbles, so does the relationship. But this respect really does need to work both ways. Your partner also has to be open to your perspective, instead of ignoring it.

We’ve covered on Bored Panda before that if you find that you’re spending more than you’re earning, you have two main strategies to work with.

The first is increasing your income by getting a raise, working on a side hustle, or even jumping to a higher-paying. The second strategy is all about decreasing your expenses, whatever they might look like.

And it all starts with creating a budget. That’s the easy part! Next, you have to stick with it. Essentially, you need to control your expenses by dividing up your income between your needs and your wants.

Your needs are things that you absolutely need to survive: your rent, food, insurance, fuel, and others. Your wants, on the other hand, are things that are nice to have: like eating at fancy restaurants, various subscriptions, and going shopping for luxury goods.

Later, the man shared what happened when he confronted his wife about her spending habits

The author actively answered his readers’ questions about his family life

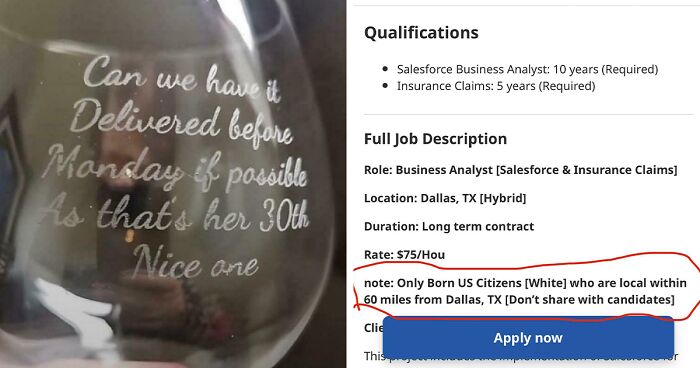

Dude! This woman will ruin you financially. If you don’t want to divorce her, put a freeze on your credit, and take away any access to any accounts that y’all share. Attempting to take out loans in your name is a huge, huge, huge red flag. You better take measures now… Otherwise, she will definitely ruin you financially

Dude! This woman will ruin you financially. If you don’t want to divorce her, put a freeze on your credit, and take away any access to any accounts that y’all share. Attempting to take out loans in your name is a huge, huge, huge red flag. You better take measures now… Otherwise, she will definitely ruin you financially

Dark Mode

Dark Mode

No fees, cancel anytime

No fees, cancel anytime

57

33