Fiancé’s ‘Latest’ Financial Disaster Is The Final Straw, And The Bride Is Ready To Call It All Off

Clawing your way out of “survival mode” is a victory like no other. It’s a slow, brutal climb from a world of counting every dollar to a place where you can finally breathe. You can eat out, you can save, you can dream. That first taste of financial stability feels like a superpower.

But that feeling is incredibly fragile. You live with the constant, nagging fear that one unexpected bill could shatter your new reality and send you tumbling right back to where you started. For one woman, that bill just arrived, and it was attached to her fiancé.

More info: Reddit

Clawing your way out of poverty is a brutal fight, and just one setback can feel like a knockout punch

Image credits: Bizon / Freepik (not the actual photo)

After years of struggling, a woman finally landed her dream job and a taste of financial stability

Image credits: gpointstudio / Freepik (not the actual photo)

But her fiancé’s “minor” car accident resulted in a $500 monthly insurance hike that will eat his entire paycheck

Image credits: diana.grytsku / Freepik (not the actual photo)

Just like that, she was back in “survival mode,” forced to carry all the bills and look for a second job

Image credits: PurpleYoghurt16

She was exhausted and angry, trapped in the cycle of poverty she fought so hard to escape, and considering calling off their relationship

A woman has spent the last few years engaged in a brutal, hand-to-hand combat with poverty. She dragged herself out of a low-wage fast-food job, hustled at a call center, and finally landed her dream job as a marketing specialist. For the first time in her life, she felt “normal.” She could eat out, plan a wedding, and even dream of visiting her family in Asia.

But that dream was just shattered by a very expensive reality check. Her fiancé’s car insurance is skyrocketing by $500 a month due to a “minor” at-fault accident. This inconvenience became a financial catastrophe that would “eat his entire paycheck.” Just like that, all the progress she fought so hard for has “evaporated,” and they are right back in “survival mode.”

She is now facing a future where she will have to carry the entire financial load with more rent, more bills, and more groceries, all while her own job security is in question, as her contract ends in a few months. Instead of planning a wedding, she’s scrambling to find a second, part-time retail job on top of her full-time role just to stay afloat. She’s “exhausted and angry” that one mistake has completely unraveled her life.

Now, she’s “spiraling.” The dream of a wedding, of visiting her family, has been replaced by the nightmare of a life spent working herself “into the ground just to barely survive again.” She’s trapped in a cycle of poverty she thought she had escaped, and for the first time, she is admitting a heartbreaking truth to herself: she “just wants out.”

Image credits: user11472009 / Freepik (not the actual photo)

The woman’s feeling of being trapped in an endless loop is a real phenomenon known as the “cycle of poverty.” As EBSCO explains, this is a pattern where one financial shock creates a cascade of new problems, making it nearly impossible to achieve stability. Her description of being “shoved right back down” every time things get better is a perfect, heartbreaking summary of this soul-crushing cycle she’s desperate to escape.

Her desire to “just want an out” is a statistically common reaction to intense financial pressure. A recent study from Experian on the “cost of loving” found that financial stress is one of the leading causes of relationship breakdowns. The strain of one partner’s mistake forcing the other to work two jobs just to survive puts an immense and often unsustainable burden on the relationship’s foundation.

This crisis also highlights a fundamental crack in their pre-marital planning: the lack of a shared financial strategy. Financial institutions like CNB strongly recommend a “pre-wedding financial checklist” for this exact reason. Engaged couples need to have open, honest conversations about debt, savings, and how they will handle a financial emergency together.

This event has exposed that they were operating without a real safety net. Without this shared strategy, they defaulted to individual survival modes. He is trapped by his debt, and she is scrambling for a second job to protect herself. This lack of a unified “we’re in this together” approach is the real threat to their future. Her feeling of being alone is a reality, and that is what is pushing her to want out.

Do you think there is a way out of this hole for them? Share your advice below!

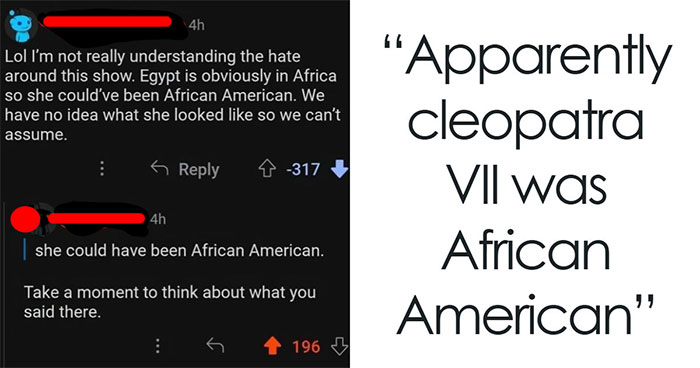

The internet was left with more questions than answers, wondering why he can’t make some sacrifices, trade in his car, or get another job

Poll Question

Thanks! Check out the results:

If the person in front of him stopped suddenly and *he* couldn't stop in time, he was tailgating, which *is* his fault. Also: where in the world do insurance companies charge $500 per month for insurance for one incident? How bad is his driving record? Our insurance is paid every 6 months and it goes up every 6 months and we're old as dirt with no tickets or accidents!

If the person in front of him stopped suddenly and *he* couldn't stop in time, he was tailgating, which *is* his fault. Also: where in the world do insurance companies charge $500 per month for insurance for one incident? How bad is his driving record? Our insurance is paid every 6 months and it goes up every 6 months and we're old as dirt with no tickets or accidents!

Dark Mode

Dark Mode

No fees, cancel anytime

No fees, cancel anytime

34

6