Guy Dumps Girlfriend With “Massive Debt”, Is Mad When He Finds Out He Had It Wrong All Along

One of the most fundamental things in any serious romantic relationship is to be on the same page when it comes to your finances. To put it bluntly, you don’t want there to be any secrets between you two. So, you’ve got to have maximum transparency about your income, spending, savings, investments, and debt.

Redditor u/gjrunner5 went viral after asking the AITAH online group for an impartial verdict about a messy misunderstanding between her and her (now ex) boyfriend that got out of hand. She shared how he misinterpreted a spreadsheet of her finances and believed that she had taken on massive debt. After delivering an ultimatum, he broke up with her, and only later realized that he’d been completely wrong. Scroll down for the full story and the internet’s reactions.

Bored Panda has gotten in touch with the author of the story, and we’ll update the article once we hear back from her.

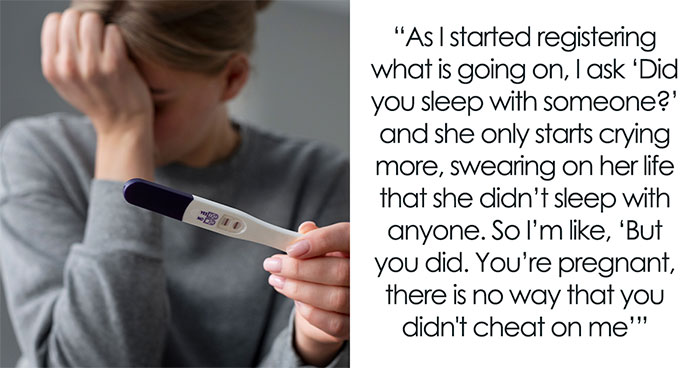

Couples need to be transparent about their finances. However, you shouldn’t make any rash assumptions until you take the time to learn the full context

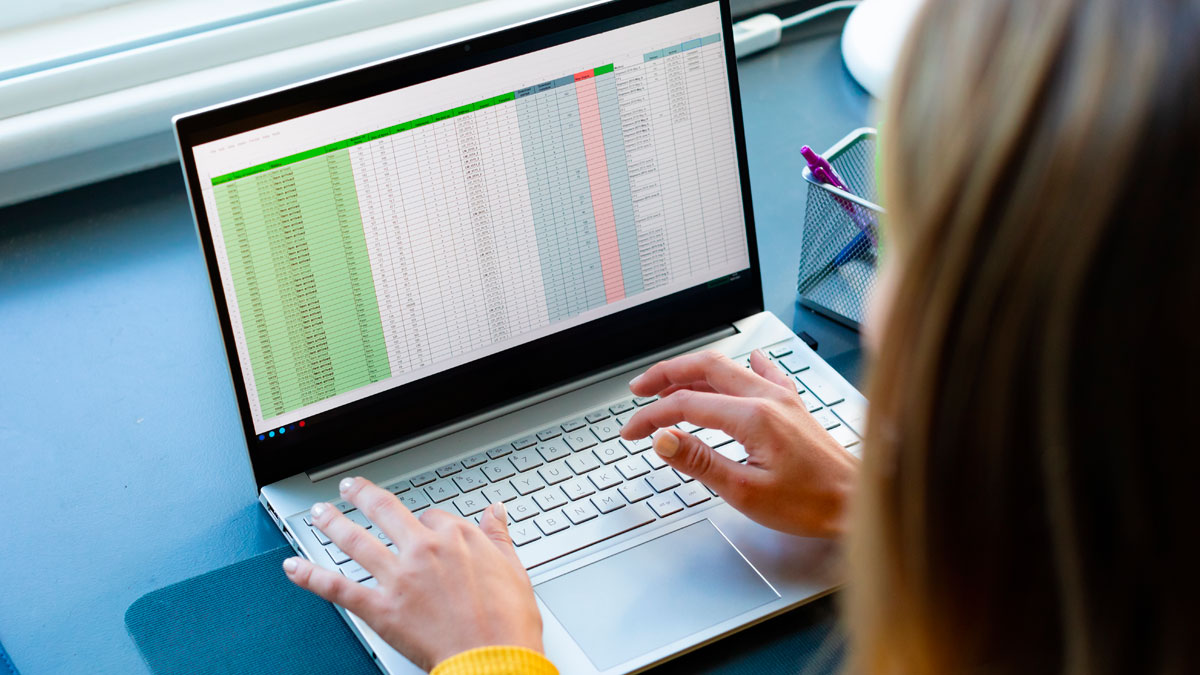

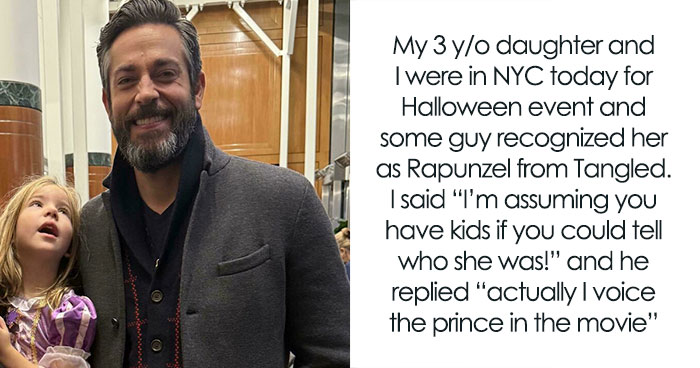

Image credits: Wavebreakmedia (not the actual photo)

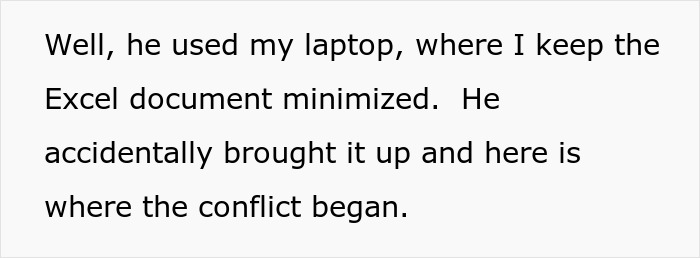

A woman shared how her (now ex) boyfriend issued her an ultimatum after completely misinterpreting her personal finance spreadsheet

Image credits: LightFieldStudios (not the actual photo)

Image credits: svitlanah (not the actual photo)

The author later shared a quick update once her story spread across the web

Image credits: gjrunner5

Giving your partner an ultimatum without even so much as listening to their side of things is unhealthy and arrogant

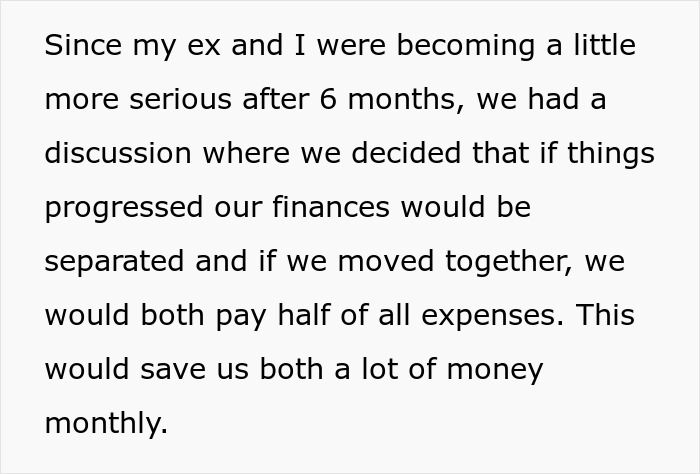

Personal finances are a very sensitive topic. So, if you suspect that your partner might be keeping secrets from you (e.g., about debt and expenses) that potentially impact you both, it’s definitely the right thing to have a conversation about it. However, it matters how you broach the topic.

Look, we know that spreadsheets can be hard to read if you’re not used to them. However, that’s not an excuse to start doling out ultimatums left and right. Especially when you’re talking with your significant other.

Nobody’s perfect; we all make mistakes, and communication can be a tricky thing to get right. But if you’re unwilling to hear your partner’s side of things, then something’s clearly gone wrong.

Thinking that you’re always right and everyone else is wrong is no way to go through life.

In short, you have to be willing to hear out your partner’s side of things. It’s best to set aside any judgment and your holier-than-thou attitude. Actively listen to what they’re saying.

You might have made a mistake. Or you might not know the full context. Sometimes, we’re not as smart as we think we are.

Image credits:Afif Ramdhasuma (not the actual photo)

It doesn’t matter how much or little you earn, so long as you keep your lifestyle in check and your expenses don’t exceed your income

The golden rule of budgeting and personal finance is to earn more than you spend. And, vice versa, you should be spending less than you earn. No matter how rich you are, if you’re burning through your savings without filling up your coffers, eventually, you’ll run out of doubloons.

Healthy finances require discipline, clarity, and transparency. You don’t necessarily need to track your spending in a massive spreadsheet, but you need to know, very specifically, how much metaphorical bacon you’re bringing home every month. That’s alongside your exact expenses, savings, investments, and debt. The more specific you are, the clearer your strategies for a better lifestyle can be.

On the earnings side, you can ask for a raise or promotion, look for a better-paying job (hopefully, with better benefits and a healthier work/life balance), do overtime, pick up a second job, or focus on monetizing a hobby or side hustle.

Meanwhile, on the expenses side of things, you can cut back on (some) non-essential spending. For instance, you might have a few subscriptions for digital or physical services that you don’t use as often as you’d like. End them.

Or you might be dining out and ordering in far more often than your budget allows. Scale back. Make going out into something that’s special again. Meanwhile, cooking at home can be a ton of fun if you’re willing to try new things.

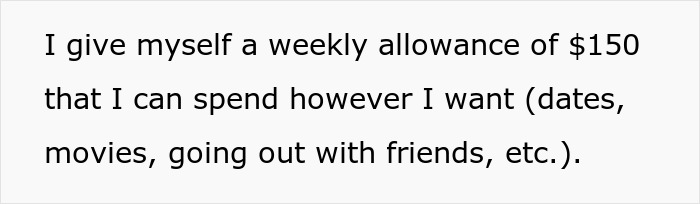

Obviously, where else you can cut back will depend a ton on your lifestyle. Maybe you travel too much, spend far too much dough on concerts and entertainment, or your hobbies are eating into your savings. The key isn’t to eliminate everything that you love to do. Quite the contrary, it’s vital that you enjoy life. But you have to set a budget for those activities so you don’t feel guilty afterward.

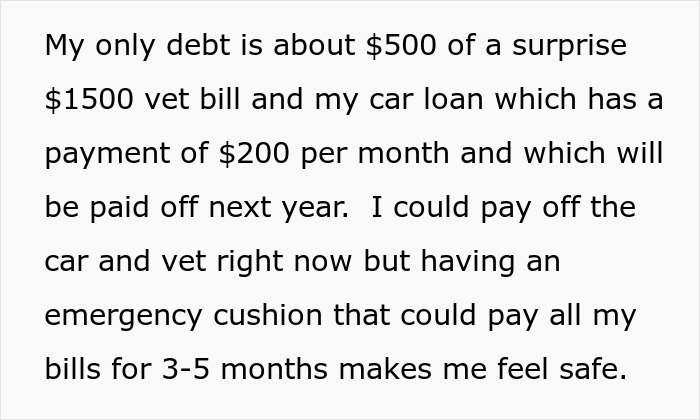

The author of the AITAH post mentioned that she could easily pay off her remaining debt. However, she chooses to use the extra savings as an ‘emergency cushion’ that could last her a few months. This makes her feel financially safe. And it’s sound advice.

Image credits:Jakub Żerdzicki (not the actual photo)

A cornerstone of healthy personal finances is having a sizeable emergency fund you can fall back on in case of an emergency

One of the fundamentals of good personal finance is to build up an emergency fund. That way, you have a safety net to fall back on in case there’s an emergency (medical expenses, home repairs, your car breaking down) or you lose/quit your job.

Essentially, an emergency fund is meant to cover your basic costs, from food and transportation costs to rent and utilities. That way, you don’t have to make financially risky moves in an emergency, like taking on extra debt, asking for quick loans, or cashing out your investments (if you have any).

While most people would probably agree that you need to have an emergency fund, they have different ideas about how big it should be. Broadly speaking, it should be as big as you can make it. At some point, you may want to consider investing some of your savings instead of keeping your cash static in your bank account so that you’re more efficient.

According to Lloyd’s Bank, it’s recommended that you set aside at least 3 months’ worth of essential outgoings to be your financial buffer.

HSBC also recommends having at least 3 months’ worth of living expenses to fall back on. “The more you can save, the better. A bigger emergency fund can help make sure you’re able to handle a large financial shock, so you may want to aim for 6 months’ worth of living expenses.”

Meanwhile, as Investopedia notes, some experts actually suggest going as far as having 12 to 18 months’ worth of living expenses in your emergency fund.

So, dear Pandas, what do you think about the relationship drama that was all sparked by a single spreadsheet? What would you have done if you were in the woman’s shoes? Has anyone ever given you an ultimatum after learning about your finances? Why do you think the author’s boyfriend was unwilling to listen to her side of things? Share your thoughts in the comments section below!

Image credits: Jakub Żerdzicki (not the actual photo)

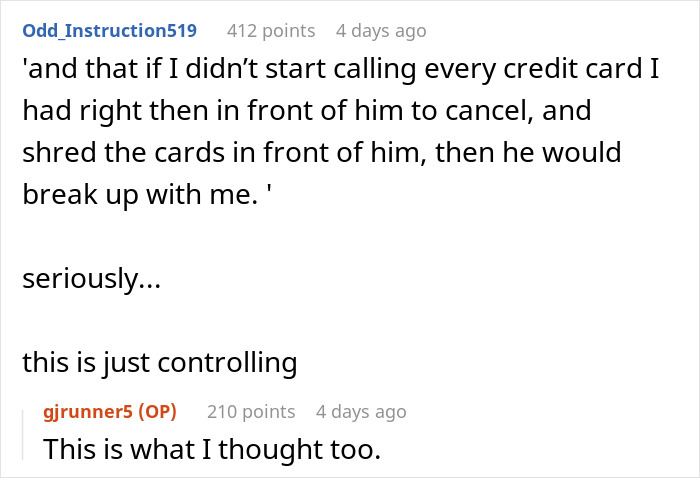

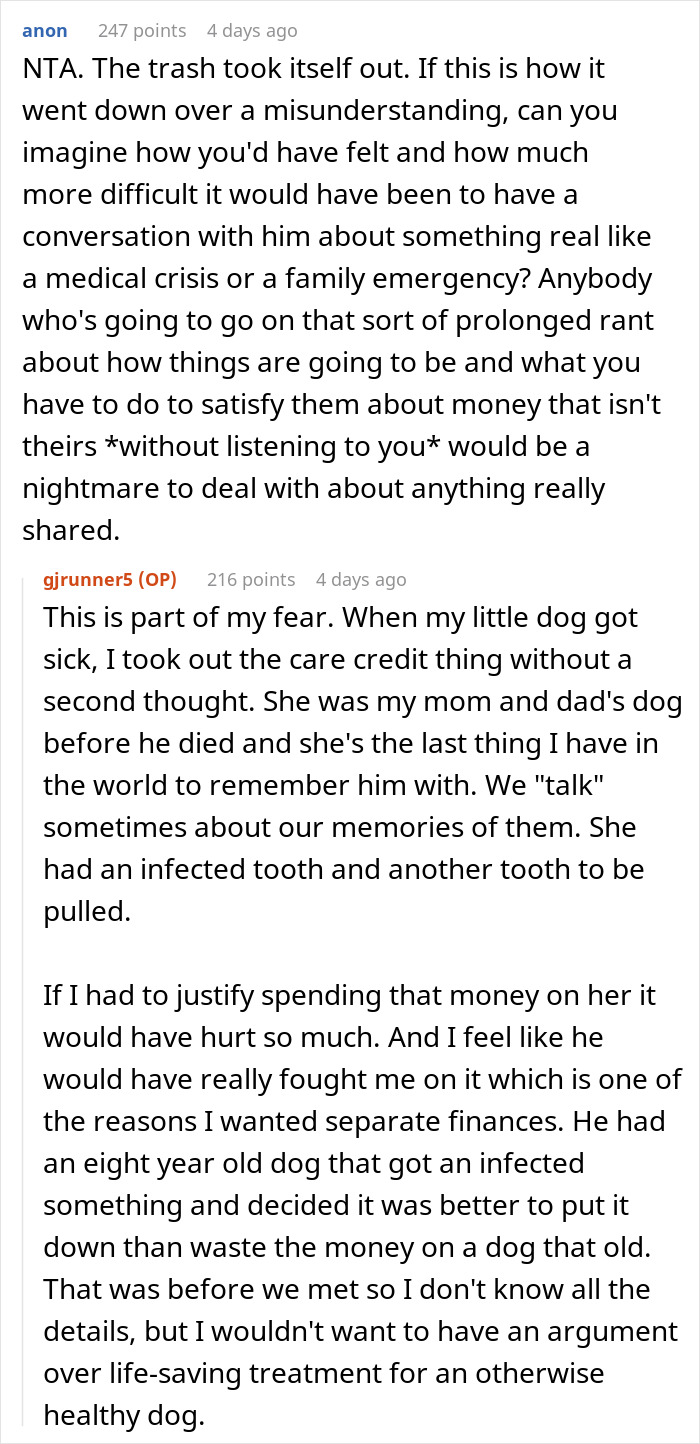

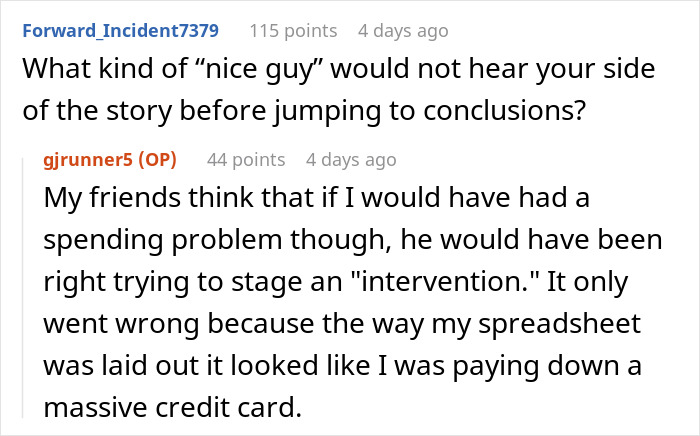

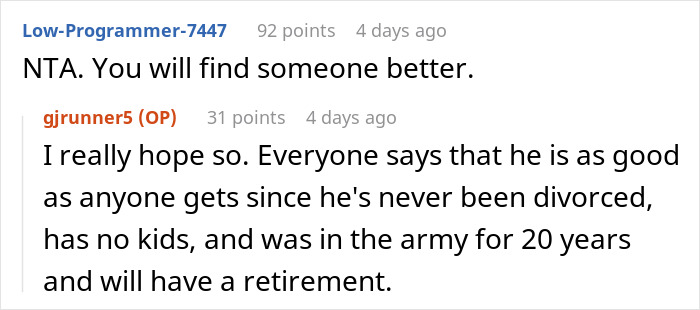

The author interacted with some of her readers in the comments, sharing more context

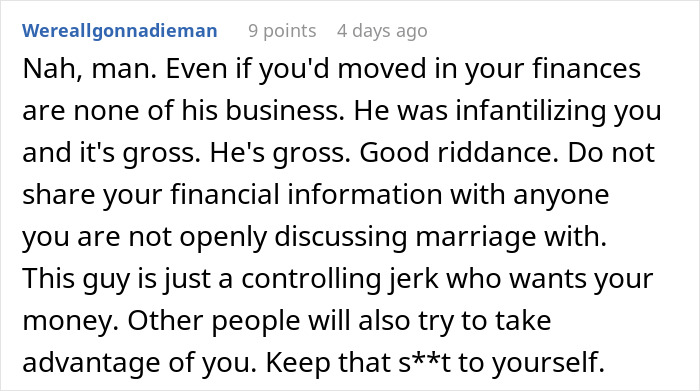

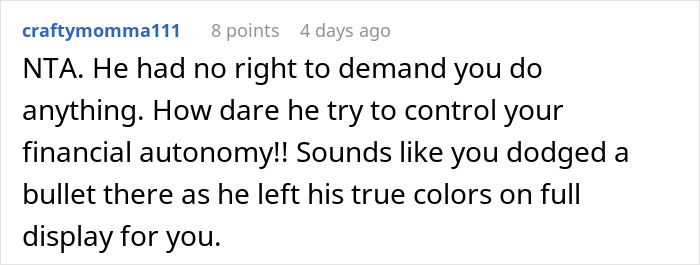

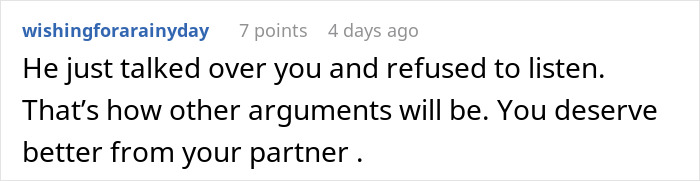

Most internet users were completely on the woman’s side. Here are their thoughts about the relationship drama

Poll Question

Thanks! Check out the results:

Explore more of these tags

To the friends who said she would be passing over a nice guy over a misunderstanding, that was 100% incorrect. She'd be passing over a "nice guy". The moment he suspected something, he sat her down, demanded she cancel and destroy all her cards, dumped her when she refused, and called her a liar. Then he got annoyed that she "let" him dump her (which would be fine - it's always great when the trash takes itself out). That is a pennant streamer of red flags right there. ETA - it wasn't the moment he found out, it was a few days later, but that doesn't take away from anything I've said in this comment. In fact, there's an argument that it makes things worse.

That was the first thing I thought when I read he'd dumped her. "Love it when the trash takes itself out." Wish my stuff in the kitchen did the same thing. 😆

Load More Replies...He blamed her for letting him break up with her. That's all you need to know. He ITAH. If he would have apologized for overreacting, for not listening, for digging in her laptop or took literally ANY of the blame, I would say there is a chance for a good relationship. Fk that gaslighting POS.

Dude completely misread a spreadsheet and broke up with OP. Okey dokey then! The trash just took itself out. P.S. OP is NOT missing out on a "nice guy." She's avoiding a bigger problem down the road, from someone who wants/needs to control her.

Well, calling her a liar and not listening to her explanation was sufficiently bad, but "wasting money on a dog that old" can never be excused.

That bit really angered me to ! I don’t care how old my dogs are or how little I live on , they are insured , n I will take them to the vets no matter what , him putting one down for being under 8 n just needing a tooth op would make me put him in icu ! LITTERALLY right , my then 14 yr old staffie had same issue , wasn’t insured as to old by then , but hell I took her to the vets n got it sorted she lived almost 18 mths after that , while blind ! Had been for two yrs , dam that bloke is NO CATCH , nor a nice guy is he he’s vile ! Cruel n controlling x

Load More Replies...Sounds like she dodge a bullet being with someone so butt stupid who apparently is unable to listen.

I was so irresponsible with money when young. Not that I spent a lot, just that I didn't keep track well. Impressed with this woman's efforts to save and know what she spends. Bet the loser boyfriend didn't do the same.

Financial anxiety is real. I only feel comfortable if I have at least $5000 in my savings account. Now I'm thinking of getting a miles credit card.

They're great as long as you can handle having the line of credit (and not everyone can, so no judgement. I'm guessing if you maintain $5k minimum for savings you'd be fine, though). Just put everything you can on the card, pay it off in full before it's due and voila! Points/miles/other shiny things. CCs can be a boon if used correctly.

Load More Replies...If he'd started with - "hey, I accidentally opened that spreadsheet you had minimised, and I'm worried. Is this a creditcard debt you haven't told me about?" That would be a reasonable approach to a reasonable, if misplaced, concern. Financial compatibility is an important factor in relationship success. The problem is how he approached it, and what that says about him - he was aggressive and controlling, and threatened breaking up with her, because he jumped to conclusions rather than asking for clarification.

HES A GASLIGHTING GOLD DIGGER, JUST LIKE ONE OF THE COMMENTS SAID. GOOD RIDDANCE.

He clearly does not see her as an equal. Breaking up with him was the correct decision. He wasn't even talking to her as if she was one of his junior enlisted soldiers -he was talking to her as if she was a recalcitrant adolescent. Also, if this man has never married/no children, and has a 20-year length-of-service retirement from the Army -plus whatever he gets after he files his claim with the VA- he should be quite well-off financially (I'm an army Veteran). He should be debt free except for maybe a car payment and a home mortgage.

Wow your now ex is a real pos ! that bit where he put his dog down for something that was easy sorted ,instead of paying a vets bill is disgraceful inhuman sick and twisted!! before we even get to his reaction about your very good handling of money , I live on practically nothing now , so I’m very a**l. about money ,as my anxiety is ten times worse if I’m worrying which in turn makes the rest of the health n pain issues worse , so I get where you are coming from totally , you have a brilliant way of dealing with money ,so you are always prepared for anything , but can at least live some what normally , where as HIM , is an entitled controlling THICK pos !! nothing nice about him what so ever , you most defo dodged a bullet !! n yup your so much better than him , isnt your fault he’s thick now is it ! xx

Is there an update on this? I really want to know she didn't go back to him.

OP needs new and better friends. Are women really this desperate for men? Take it from me, a man, we’re not worth losing your self-respect. Neither is having kids, which I reckon is one reason women put up with so much cow c**p

Hang on… he put down an otherwise healthy 8 year old dog due to an infection because “its old”???? 8 isnt old, not even for a dog. The whole “call to cancel your card and cut them up in front of me” thing was seriously controlling. And then when he found out he was wrong he twisted it to make her the bad guy again by saying she “let” him dump her??? What was she supposed to do, he wouldnt let her talk and explain and he was just yelling at her. He blames her for debt she didnt even have as the reason fir a break up and when he was wrong he said she was to blame again because she let him break up with her???? What the actual f**k? The mental gymnastics that takes to avoid any and all accountability. And what “intervention” does her friends think he was staging? He didnt offer her any help or understanding just “cancel the cards or I’ll break up with you”. “If the situation had been different he would have been right” is an absolutely ridiculous mentality to have and from the way he acted he is clearly not “a nice guy”

D*****s just lost himself a responsible (breaad)winner because he was so adamant he was right. I did a spreadsheet last year to illuminate why I had no money at the end of the month. Deliveroo, alcohol and vapes were the clear winners. I do one periodically - like this month where I am out every weekend to get a basic projection of what possible disposable money I can just blow on amazon or something more recreational...

Despite having worked in accounting for decades, ironically really bad with my personal finances. Much like OP, last year I started tracking all of my income and expenses in weekly tabs in Excel and that has GREATLY helped me both manage my bills and actually have savings. I copy over the previous tab to the current week, update with that week''s paycheck amount and include all of my bills that fall into that week from the master list of bills I have each month. I then add expenses for my groceries that week, as well as a few Doordash orders for the weekend when I don't want to cook. Then I add my "savings expense", the amount that gets tranferred to savings and whatever is left over is my weekly "play money" (within reason and usually for if I got out or stop by the liquor store on the way home or whatever minor items I want/need from Amazon, etc). Whatever is leftover at the end of the week gets rolled over into the next week and usually ups the amount I save that week.

Multiple flags here. 1. He snooped. (How are people not addressing that?!) 2. He reached a judgement without asking for any clarity on what he snooped on. 3. He demanded she cut up cards and close accounts... Screams indication of financial abuse later. 4. Discusses quite personal issues outside of the relationship with 3rd parties. 5. Tries to backtrack and blame her for not explaining when HE both didn't understand the original explanation and then tried to gaslight. A world of no!

If she won't upload the spreadsheet, can we see the underwear drawer instead?!

As a guy: firstly I wouldn't start looking at other tabs, if I was curious I'd ask and see how it went from there; secondly I'd be impressed that somebody records finances in a spreadsheet, I'd ask her to explain how it works; thirdly if I felt that money control was an issue I'd talk. I certainly wouldn't ever scream and shout and demand she cut up her credit cards - if there was a huge red flag to me I'd be certain to keep our finances separate, but the sort of person that makes spreadsheets doesn't sound like the sort of person that's irresponsible. So, really, she's better off without that loser.

To the friends who said she would be passing over a nice guy over a misunderstanding, that was 100% incorrect. She'd be passing over a "nice guy". The moment he suspected something, he sat her down, demanded she cancel and destroy all her cards, dumped her when she refused, and called her a liar. Then he got annoyed that she "let" him dump her (which would be fine - it's always great when the trash takes itself out). That is a pennant streamer of red flags right there. ETA - it wasn't the moment he found out, it was a few days later, but that doesn't take away from anything I've said in this comment. In fact, there's an argument that it makes things worse.

That was the first thing I thought when I read he'd dumped her. "Love it when the trash takes itself out." Wish my stuff in the kitchen did the same thing. 😆

Load More Replies...He blamed her for letting him break up with her. That's all you need to know. He ITAH. If he would have apologized for overreacting, for not listening, for digging in her laptop or took literally ANY of the blame, I would say there is a chance for a good relationship. Fk that gaslighting POS.

Dude completely misread a spreadsheet and broke up with OP. Okey dokey then! The trash just took itself out. P.S. OP is NOT missing out on a "nice guy." She's avoiding a bigger problem down the road, from someone who wants/needs to control her.

Well, calling her a liar and not listening to her explanation was sufficiently bad, but "wasting money on a dog that old" can never be excused.

That bit really angered me to ! I don’t care how old my dogs are or how little I live on , they are insured , n I will take them to the vets no matter what , him putting one down for being under 8 n just needing a tooth op would make me put him in icu ! LITTERALLY right , my then 14 yr old staffie had same issue , wasn’t insured as to old by then , but hell I took her to the vets n got it sorted she lived almost 18 mths after that , while blind ! Had been for two yrs , dam that bloke is NO CATCH , nor a nice guy is he he’s vile ! Cruel n controlling x

Load More Replies...Sounds like she dodge a bullet being with someone so butt stupid who apparently is unable to listen.

I was so irresponsible with money when young. Not that I spent a lot, just that I didn't keep track well. Impressed with this woman's efforts to save and know what she spends. Bet the loser boyfriend didn't do the same.

Financial anxiety is real. I only feel comfortable if I have at least $5000 in my savings account. Now I'm thinking of getting a miles credit card.

They're great as long as you can handle having the line of credit (and not everyone can, so no judgement. I'm guessing if you maintain $5k minimum for savings you'd be fine, though). Just put everything you can on the card, pay it off in full before it's due and voila! Points/miles/other shiny things. CCs can be a boon if used correctly.

Load More Replies...If he'd started with - "hey, I accidentally opened that spreadsheet you had minimised, and I'm worried. Is this a creditcard debt you haven't told me about?" That would be a reasonable approach to a reasonable, if misplaced, concern. Financial compatibility is an important factor in relationship success. The problem is how he approached it, and what that says about him - he was aggressive and controlling, and threatened breaking up with her, because he jumped to conclusions rather than asking for clarification.

HES A GASLIGHTING GOLD DIGGER, JUST LIKE ONE OF THE COMMENTS SAID. GOOD RIDDANCE.

He clearly does not see her as an equal. Breaking up with him was the correct decision. He wasn't even talking to her as if she was one of his junior enlisted soldiers -he was talking to her as if she was a recalcitrant adolescent. Also, if this man has never married/no children, and has a 20-year length-of-service retirement from the Army -plus whatever he gets after he files his claim with the VA- he should be quite well-off financially (I'm an army Veteran). He should be debt free except for maybe a car payment and a home mortgage.

Wow your now ex is a real pos ! that bit where he put his dog down for something that was easy sorted ,instead of paying a vets bill is disgraceful inhuman sick and twisted!! before we even get to his reaction about your very good handling of money , I live on practically nothing now , so I’m very a**l. about money ,as my anxiety is ten times worse if I’m worrying which in turn makes the rest of the health n pain issues worse , so I get where you are coming from totally , you have a brilliant way of dealing with money ,so you are always prepared for anything , but can at least live some what normally , where as HIM , is an entitled controlling THICK pos !! nothing nice about him what so ever , you most defo dodged a bullet !! n yup your so much better than him , isnt your fault he’s thick now is it ! xx

Is there an update on this? I really want to know she didn't go back to him.

OP needs new and better friends. Are women really this desperate for men? Take it from me, a man, we’re not worth losing your self-respect. Neither is having kids, which I reckon is one reason women put up with so much cow c**p

Hang on… he put down an otherwise healthy 8 year old dog due to an infection because “its old”???? 8 isnt old, not even for a dog. The whole “call to cancel your card and cut them up in front of me” thing was seriously controlling. And then when he found out he was wrong he twisted it to make her the bad guy again by saying she “let” him dump her??? What was she supposed to do, he wouldnt let her talk and explain and he was just yelling at her. He blames her for debt she didnt even have as the reason fir a break up and when he was wrong he said she was to blame again because she let him break up with her???? What the actual f**k? The mental gymnastics that takes to avoid any and all accountability. And what “intervention” does her friends think he was staging? He didnt offer her any help or understanding just “cancel the cards or I’ll break up with you”. “If the situation had been different he would have been right” is an absolutely ridiculous mentality to have and from the way he acted he is clearly not “a nice guy”

D*****s just lost himself a responsible (breaad)winner because he was so adamant he was right. I did a spreadsheet last year to illuminate why I had no money at the end of the month. Deliveroo, alcohol and vapes were the clear winners. I do one periodically - like this month where I am out every weekend to get a basic projection of what possible disposable money I can just blow on amazon or something more recreational...

Despite having worked in accounting for decades, ironically really bad with my personal finances. Much like OP, last year I started tracking all of my income and expenses in weekly tabs in Excel and that has GREATLY helped me both manage my bills and actually have savings. I copy over the previous tab to the current week, update with that week''s paycheck amount and include all of my bills that fall into that week from the master list of bills I have each month. I then add expenses for my groceries that week, as well as a few Doordash orders for the weekend when I don't want to cook. Then I add my "savings expense", the amount that gets tranferred to savings and whatever is left over is my weekly "play money" (within reason and usually for if I got out or stop by the liquor store on the way home or whatever minor items I want/need from Amazon, etc). Whatever is leftover at the end of the week gets rolled over into the next week and usually ups the amount I save that week.

Multiple flags here. 1. He snooped. (How are people not addressing that?!) 2. He reached a judgement without asking for any clarity on what he snooped on. 3. He demanded she cut up cards and close accounts... Screams indication of financial abuse later. 4. Discusses quite personal issues outside of the relationship with 3rd parties. 5. Tries to backtrack and blame her for not explaining when HE both didn't understand the original explanation and then tried to gaslight. A world of no!

If she won't upload the spreadsheet, can we see the underwear drawer instead?!

As a guy: firstly I wouldn't start looking at other tabs, if I was curious I'd ask and see how it went from there; secondly I'd be impressed that somebody records finances in a spreadsheet, I'd ask her to explain how it works; thirdly if I felt that money control was an issue I'd talk. I certainly wouldn't ever scream and shout and demand she cut up her credit cards - if there was a huge red flag to me I'd be certain to keep our finances separate, but the sort of person that makes spreadsheets doesn't sound like the sort of person that's irresponsible. So, really, she's better off without that loser.

Dark Mode

Dark Mode

No fees, cancel anytime

No fees, cancel anytime

47

40