GF Won’t Commit $100K To BF’s Home Without A Ring First, Sparks Relationship Drama

Relationships are often a balance between love and practical decisions, and sometimes the lines between romance and responsibility can become complicated. In fact, for couples thinking about marriage, family, or shared investments, financial decisions, especially large ones, can bring underlying tensions to the surface.

Today’s Original Poster (OP) was looking forward to renovating the home she shared with her boyfriend. However, she began to feel uneasy about going ahead with it especially without them being engaged. So when she brought it up, her boyfriend’s response left her feeling as though she ruined the relationship.

More info: Reddit

Before diving into life-changing expenses, especially ones tied to property or shared assets, many experts agree that a solid commitment is essential

Image credits: Vitaly Gariev / Unsplash (not the actual photo)

The author and her boyfriend have been living together for a year, with him owning the house and her covering utilities, groceries, and maintenance

Image credits: Independent_Stage741

Image credits: Vitaly Gariev / Unsplash (not the actual photo)

They discussed future plans, including marriage and children, and considered a $100k renovation as her “buy-in” to the house, although she began to feel uneasy about it

Image credits: Independent_Stage741

Image credits: Freepik / Freepik (not the actual photo)

She then requested that they get engaged before she invests in the renovations, seeking commitment before making a major financial decision

Image credits: Independent_Stage741

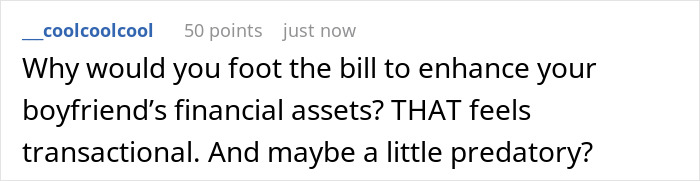

Her boyfriend insisted that it made the process transactional, leading to a cold morning after, and uncertainty about the state of their relationship

For nearly two years, the OP and her boyfriend had been building a life together, and for the past year they had also been living together in a house he owned. To keep things fair, he handled the mortgage while she took on utilities, maintenance, and groceries.

They both knew they wanted to get married and start a family, however for that to happen, the house would need major renovations. Their long-standing idea had been that her financial contribution which would be roughly $100k would be her “buy-in” to the home.

As the renovations grew closer to reality, the OP started feeling uneasy. Not about their life together, but about the logic of putting life-changing money into a property that legally belongs only to her boyfriend. Due to this feeling, she mentioned to him that she would be more comfortable going ahead with the process if they were at least engaged.

Her boyfriend didn’t take it well, though. He told her that adding such a condition to an engagement made the whole thing feel transactional. When she tried to explain her stance better, he was still upset, and the next morning was cold and tense that she’s now left wondering if she has juts blown up her relationship.

Image credits: Getty Images / Unsplash (not the actual photo)

Financial experts and relationship advisors consistently emphasize the importance of aligning major financial decisions with marital commitment. According to ReachLink, linking significant financial choices to marriage helps partners feel secure and provides clarity about their shared future.

However, caution is advised when combining finances before formal commitments. BBC reports that without clear dedication to the future, financial entanglement can create complications if the relationship ends.

For example, differences in spending habits or financial priorities may lead to conflict, and dividing assets can become legally and emotionally complex. They emphasize that transparency, trust, and communication are essential when money is involved, and being deliberate about financial arrangements can prevent misunderstandings while protecting both partners’ interests.

For unmarried couples planning significant financial investments, formal agreements are often recommended. Progeny explains that a cohabitation agreement is a written contract outlining each partner’s rights, responsibilities, and financial contributions, including property ownership and shared expenses. These agreements clarify how assets are owned and what happens if the relationship ends.

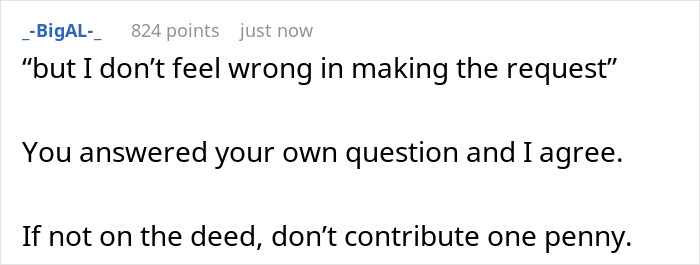

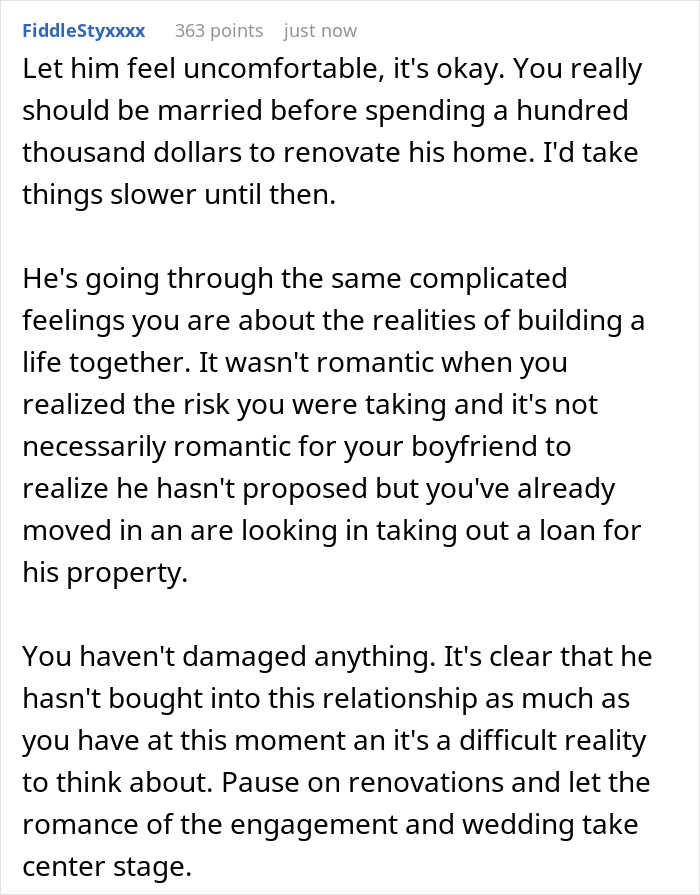

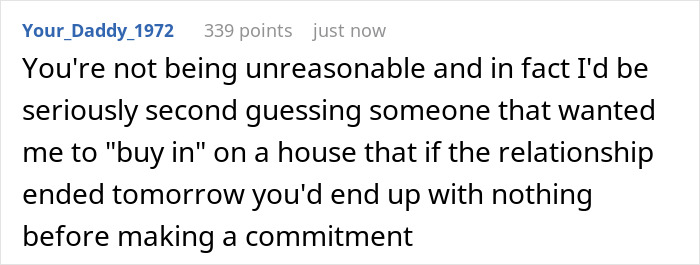

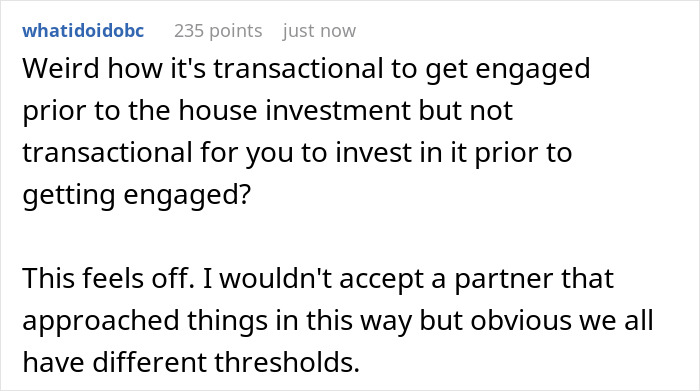

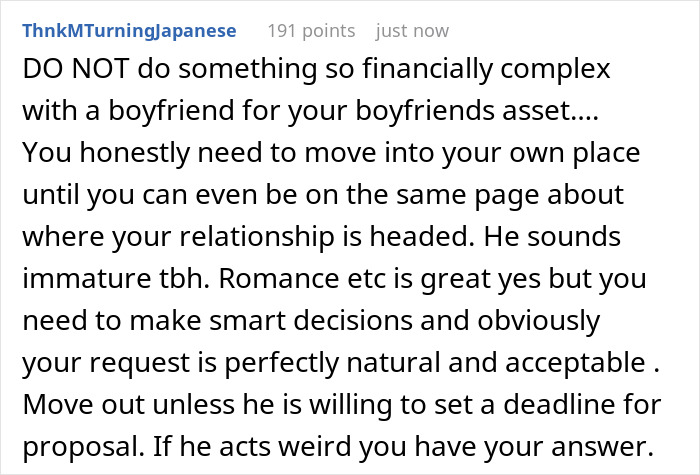

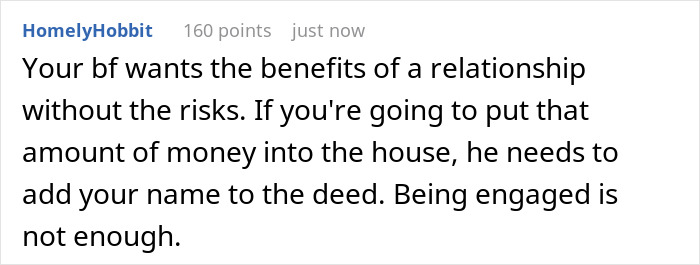

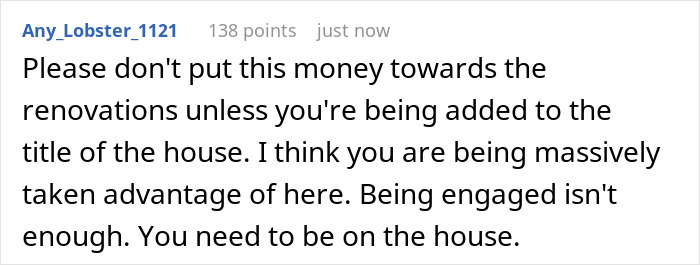

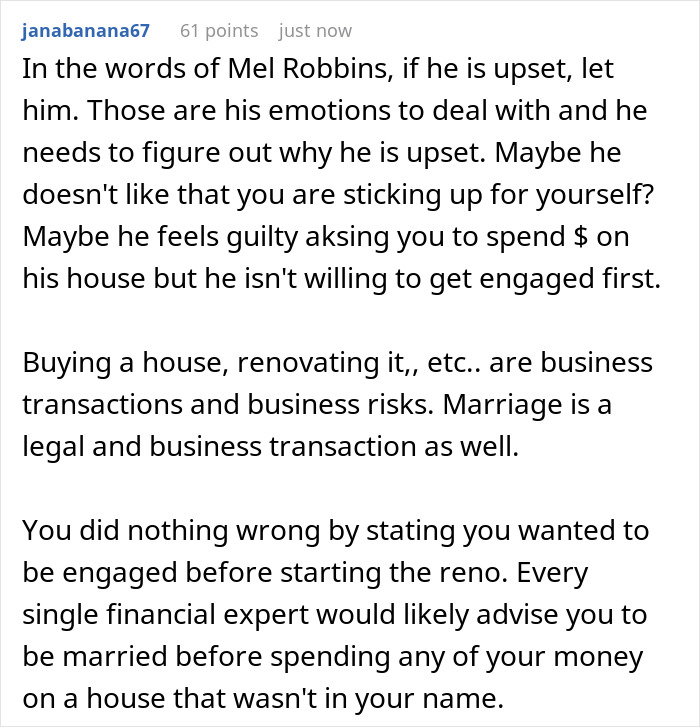

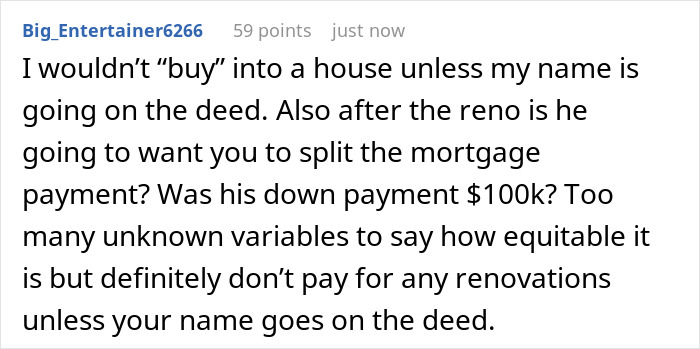

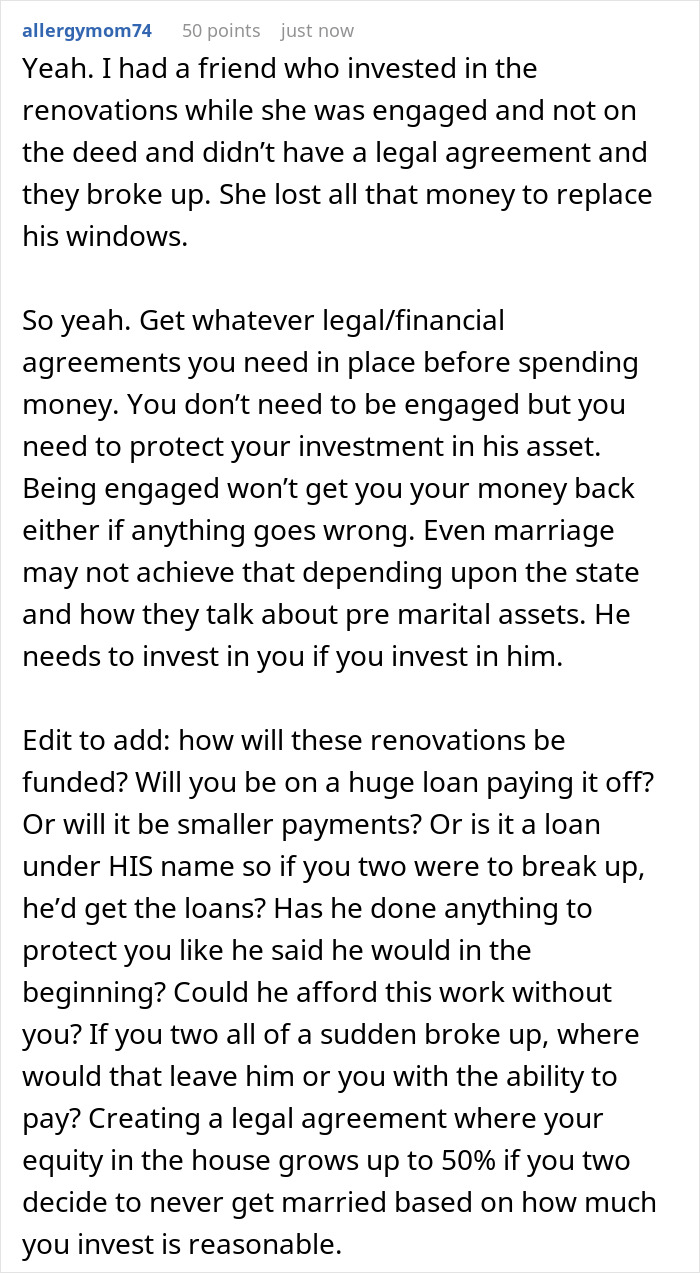

Netizens strongly advised the OP to exercise caution, emphasizing that investing large sums of money into a property you don’t legally own is risky. They also noted that she wasn’t wrong to request engagement before committing financially.

What do you think about this situation? Do you think it’s reasonable to ask for a proposal before making a major financial investment in a relationship? We would love to know your thoughts!

Netizens warned that that the boyfriend would benefit from building his wealth while she might have to assume the financial burden

Poll Question

Thanks! Check out the results:

Whether OP was going to be on the hook for $50,000 or the whole $100,000, she shouldn’t pay a dime until they see a lawyer and get her name on the deed. She’s essentially paying the equivalent of a down payment on her own house to renovate his. She should just buy her own house and tell her boyfriend to go f**k himself.

I have a relative whose boyfriend put her on the deed. They're not married, but he knows that if she outlives him, she'll take good care of the property (unlike his siblings, who borrowed money and never paid it back - luckily a much cheaper lesson than a $50,000).

Load More Replies...You'd have to sign a prenup anyway to keep the house from being jointly owned. Even if you aren't married the investment in the house has legal weight and can give you a stake in ownership. but the bottom line is that if you are incapable of discussing finances , you shouldn't even be living together, let alone married

Whether OP was going to be on the hook for $50,000 or the whole $100,000, she shouldn’t pay a dime until they see a lawyer and get her name on the deed. She’s essentially paying the equivalent of a down payment on her own house to renovate his. She should just buy her own house and tell her boyfriend to go f**k himself.

I have a relative whose boyfriend put her on the deed. They're not married, but he knows that if she outlives him, she'll take good care of the property (unlike his siblings, who borrowed money and never paid it back - luckily a much cheaper lesson than a $50,000).

Load More Replies...You'd have to sign a prenup anyway to keep the house from being jointly owned. Even if you aren't married the investment in the house has legal weight and can give you a stake in ownership. but the bottom line is that if you are incapable of discussing finances , you shouldn't even be living together, let alone married

Dark Mode

Dark Mode

No fees, cancel anytime

No fees, cancel anytime

38

15