Woman Asks Husband To Cover All Of Her Financial Loss When Caring For Their Baby, He’s Shocked And Lost

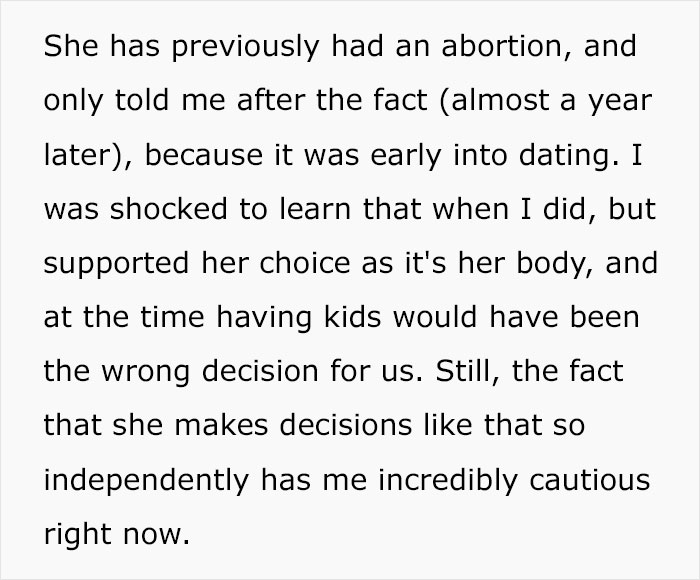

InterviewExpecting a baby is no easy task. There is a crazy amount of medical bills, changes to your body, as well as lifestyle and mental health. On top of that, caring for a whole new human being, however rewarding this experience may be for both parents, requires some sacrifices. And, of course, you want your partner to be there with you, taking on an equal share of the year-long burden.

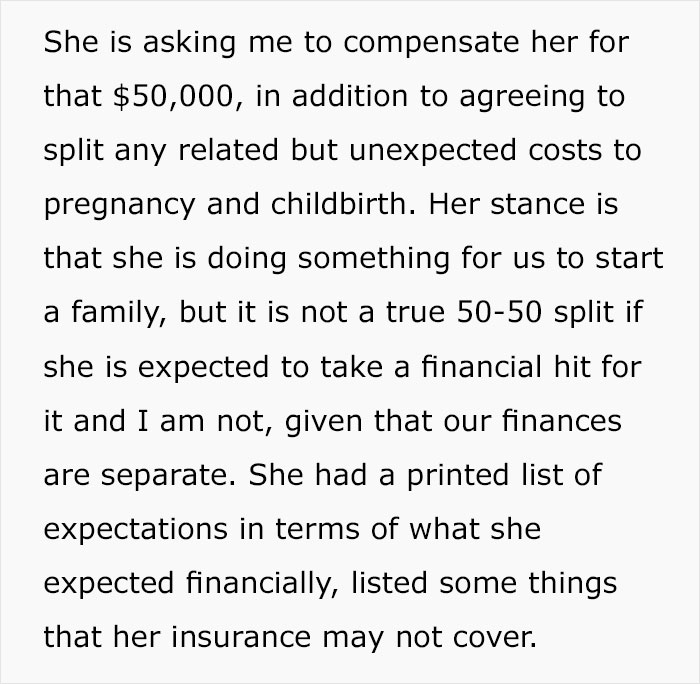

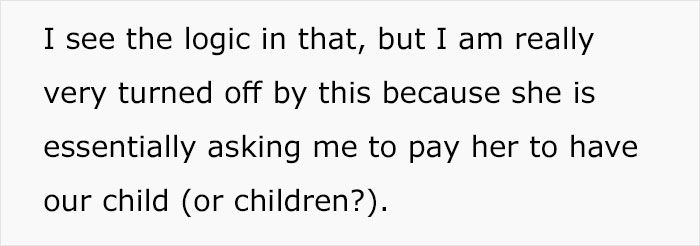

When a possibly expecting woman decided to propose a fully-baked financial plan to her husband, getting down to the brass tacks of pregnancy costs, it naturally left him baffled. After all, celebrating this little miracle by negotiating finances isn’t the most romantic way of doing things. However, considering how taxing this whole period can be for soon-to-be mothers, taking extra precautions shouldn’t be all that surprising; on the contrary — it should be admired.

Not sure what should be an appropriate reaction to the wife’s extra-detailed proposition, the husband turned to the internet to seek the perspective of others.

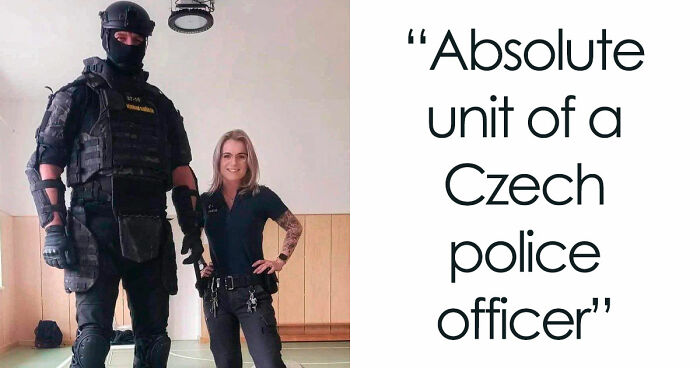

Becoming a mother is no walk in the park — there are physical and emotional transformations, let alone the excessive amount of medical bills

Image credits: cottonbro (not the actual photo)

By now, it’s no secret that the second richest nation in the world, America, has one of the worst maternity leave deals — four paid weeks, while 185 countries provide new mothers with 29 paid weeks on average. So, besides having to worry about the medical bills, spending a big chunk of your savings on baby clothing, cribs, nappies and whatnot — there’s also the anxiety that comes with not knowing how to navigate the financial labyrinth that pregnancy presents.

This is the worry that more than 50% of soon-to-be mothers share. The worst part: financial anxiety can also cause indirect harm to the baby, as it increases the odds of bringing a child with a low birth-weight, which can cause some serious health issues in the long run.

To find out how parents can reduce financial anxiety before bringing their little bundle of joy into the world, Bored Panda has reached out to Dee Lee, the founder of Harvard Financial Educators. She says the most common mistake an expecting parent makes has an effect on their IRAs or 401k plans. “They stop saving for their retirement,” Lee told us. Although the recently established SECURE Act allows parents in the US to withdraw up to $5,000 out of their retirement funds following the birth of a child without there being any financial penalty, Dee thinks there are better ways to prepare for parenthood without sacrificing the financial stability of your future-self.

And it shouldn’t be surprising why some soon-to-be mothers expect to split the load equally with their partners

Image credits: husbandmaybefather

Image credits: husbandmaybefather

Being a mother herself, Dee knows very well how financially challenging being a parent of a newborn is. According to her, in order to navigate this sleepless and expensive chapter of your life without breaking into million little pieces, it’s important to change your spending habits. “Give up the [regular] stop to get coffee in the morning and take public transportation. Small things can make a difference,” Lee suggested.

Among her many recommendations, Dee highlights the importance of having a support system that lies on the shoulders of your friends and family. She then gave a perfect example of what she means by that: “[Once] I traded babysitting with a friend — she worked days and I worked 3 to 11 at a hospital. Childcare solved!” As we argued in our post about babysitting, nowadays it’s a very costly affair. Using your friend or a relative as a babysitter can save that extra money for your child’s college funds. Plus, you’ll know your little munchkin is in good hands.

Finally, there are the hand-me-downs. According to Dee, parents should start looking at second-hand shops and yard sales if they want to save some money. “Look for friends willing to give you their old stuff. A baby doesn’t know if their clothes are from a thrift shop,” she explained. After all, this is the way Dee helped her siblings when the time was right. “I had my children first, so the baby crib and [other] furniture I passed down to the families of my siblings.”

So before you start losing your hair over finances or drain your retirement funds, look around you first — there’ll be many sleep-deprived couples in the same situation. And if there’s one thing we know about stressful situations — there isn’t a better incentive to share and support one another.

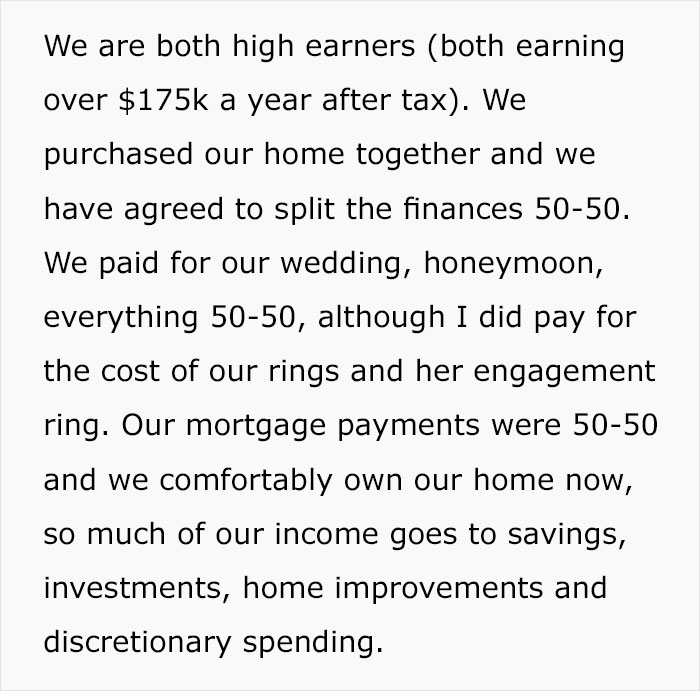

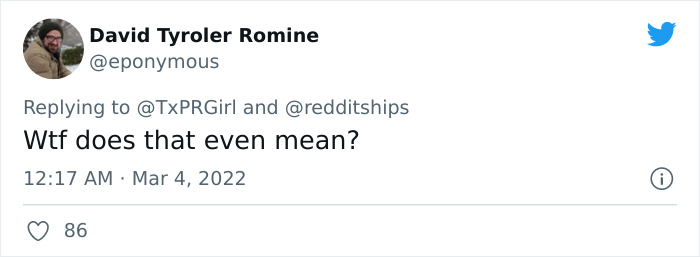

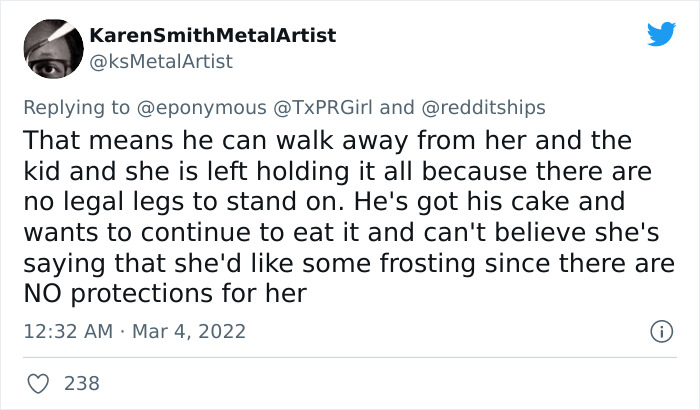

People couldn’t believe how carefree and immature the author is

Image credits: TxPRGirl

Image credits: eponymous

Image credits: ksMetalArtist

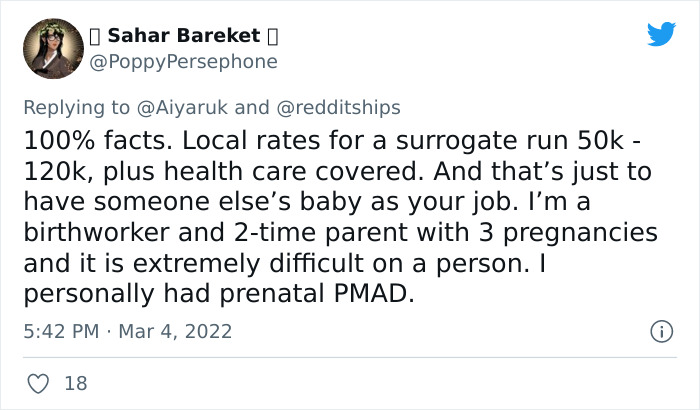

Image credits: PoppyPersephone

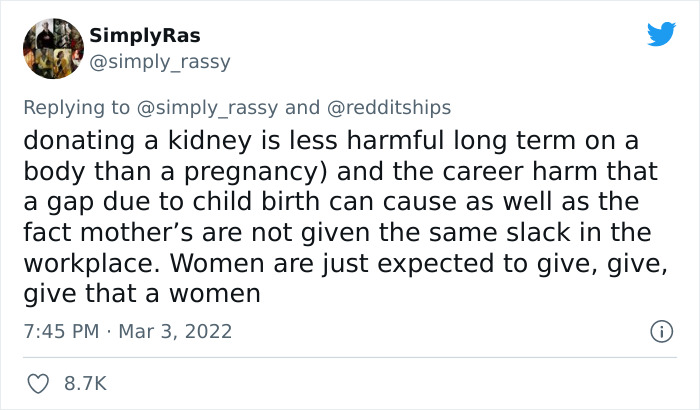

Image credits: simply_rassy

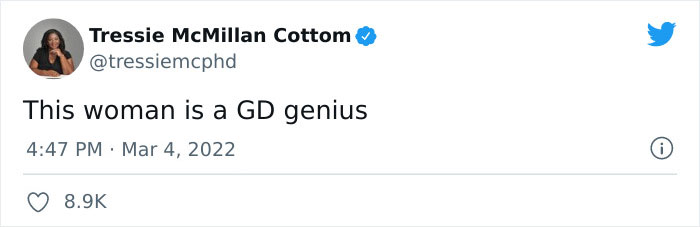

Image credits: tressiemcphd

Image credits: AvDoesWhat

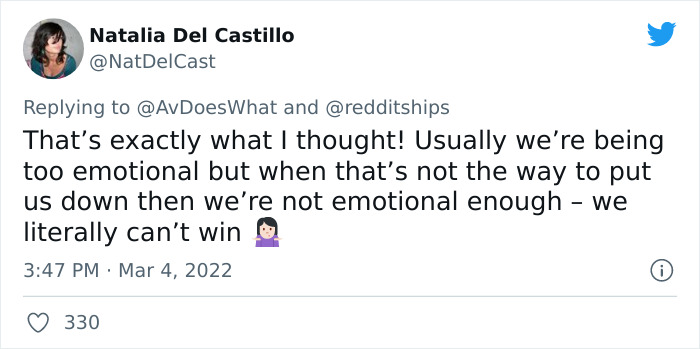

Image credits: NatDelCast

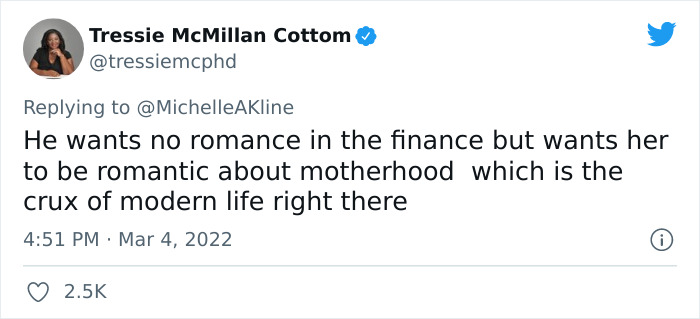

Image credits: tressiemcphd

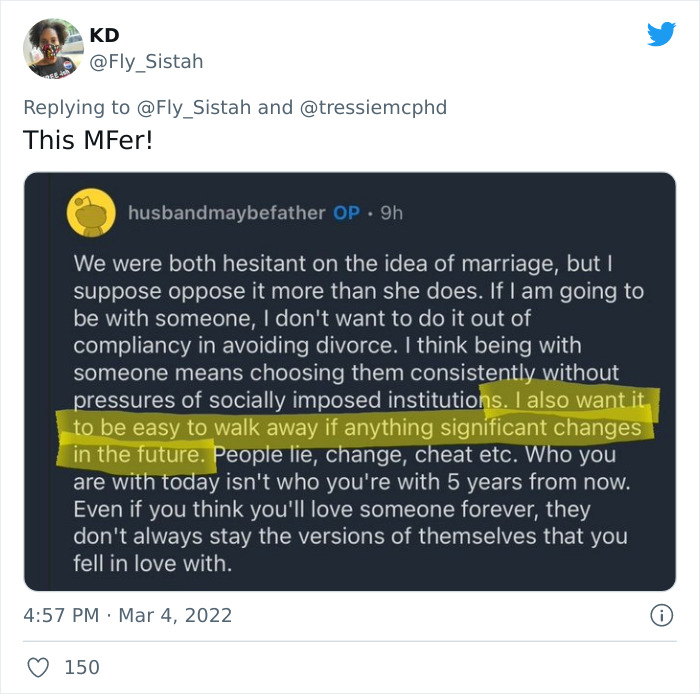

Image credits: Fly_Sistah

Image credits: ProteanIntl

Image credits: DiannetheWriter

Image credits: cynthiasaysboo

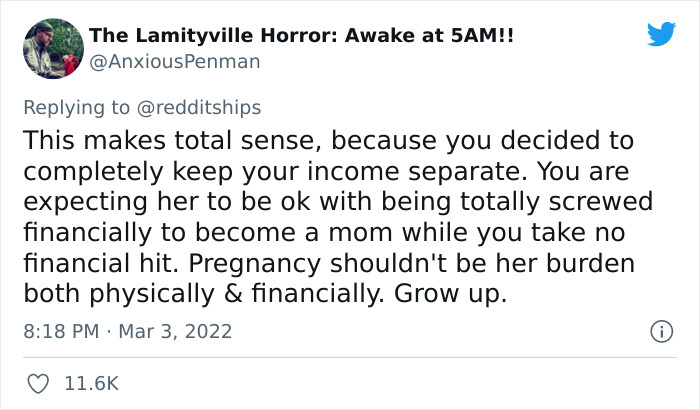

Image credits: AnxiousPenman

Image credits: AnxiousPenman

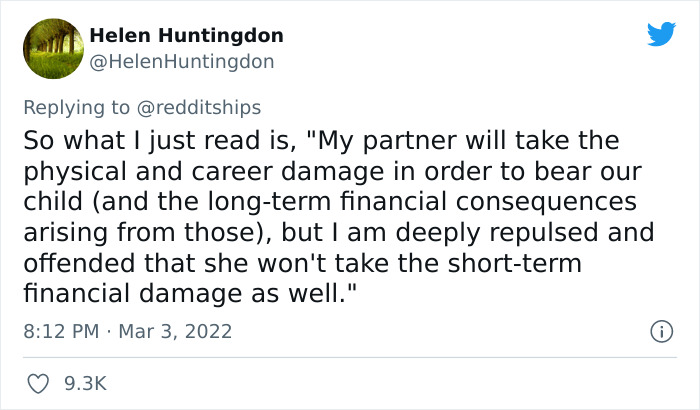

Image credits: HelenHuntingdon

Image credits: EmmyLou117

Image credits: Snailchick

Explore more of these tags

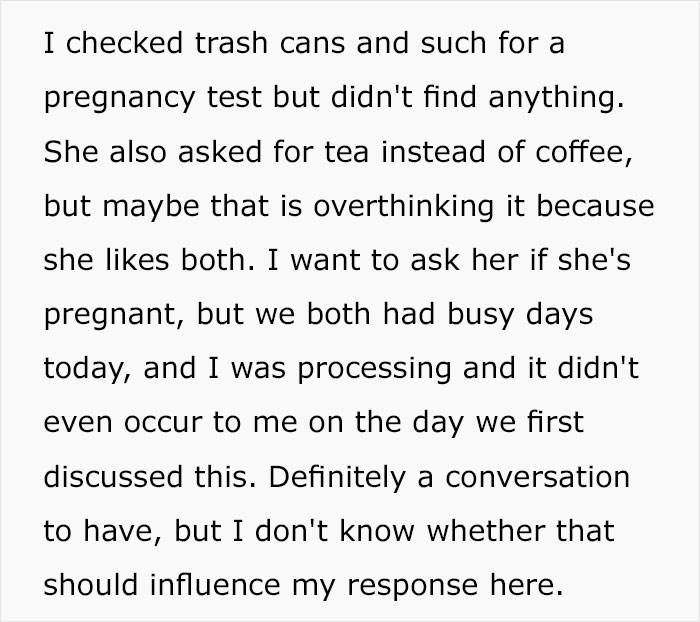

She's right! If they're splitting all expenses then they should split the cost of the pregnancy, including medical expenses, and whatever income is lost. If she loses 50% of her salary then he should turn over half of what she's losing, so the difference is shared, and if he loses income by taking paternity leave then that should be calculated into the differential. It's all very easy to calculate and it should be calculated, because if you're going to keep splitting finances... there's no reason in hell that she should be the only one to bear the pregnancy-related expenses. It's not "paying her to have a child", it's splitting the cost of having a child.

And you also have to factor in how pregnancy will impact her health, lost income from having her career stalled and diminished retirement/investments contributions. He's getting a good deal overall.

Load More Replies...At first, her request sound ridiculous, but her "spiritual husband" agreed to have separate finances and a business-like relationship, so I say: pay up, buddy! On a personal note, having separate finances and keeping books on everything in a relationship seems such a strange, and unhealthy concept to me.

I agree about it being strange and unhealthy but then again I'm poor. LOL! I've been with my fiance for almost 15 years, engaged for 10. Our money is our money. There is no your money or my money. It's all of our money because we are a family.

Load More Replies...Totally with the wife on this one. I don't know what the law is in the US for unmarried parents - presumably he'd have to pay some sort of upkeep for his children? But if they are not married then if they split, what would happen to the house? Other assets? This thread makes it quite clear what women have to sacrifice to have children. Laying it all out like that really makes you think - and his reaction is typical. If it was the man who had to sacrifice all this, how different it would be. There would be less kids in the world that's for sure! Huge thanks to the OP and his wife for opening people's eyes.

And what happens if her health is permanently damaged from the pregnancy? That happens.

Load More Replies...She's right! If they're splitting all expenses then they should split the cost of the pregnancy, including medical expenses, and whatever income is lost. If she loses 50% of her salary then he should turn over half of what she's losing, so the difference is shared, and if he loses income by taking paternity leave then that should be calculated into the differential. It's all very easy to calculate and it should be calculated, because if you're going to keep splitting finances... there's no reason in hell that she should be the only one to bear the pregnancy-related expenses. It's not "paying her to have a child", it's splitting the cost of having a child.

And you also have to factor in how pregnancy will impact her health, lost income from having her career stalled and diminished retirement/investments contributions. He's getting a good deal overall.

Load More Replies...At first, her request sound ridiculous, but her "spiritual husband" agreed to have separate finances and a business-like relationship, so I say: pay up, buddy! On a personal note, having separate finances and keeping books on everything in a relationship seems such a strange, and unhealthy concept to me.

I agree about it being strange and unhealthy but then again I'm poor. LOL! I've been with my fiance for almost 15 years, engaged for 10. Our money is our money. There is no your money or my money. It's all of our money because we are a family.

Load More Replies...Totally with the wife on this one. I don't know what the law is in the US for unmarried parents - presumably he'd have to pay some sort of upkeep for his children? But if they are not married then if they split, what would happen to the house? Other assets? This thread makes it quite clear what women have to sacrifice to have children. Laying it all out like that really makes you think - and his reaction is typical. If it was the man who had to sacrifice all this, how different it would be. There would be less kids in the world that's for sure! Huge thanks to the OP and his wife for opening people's eyes.

And what happens if her health is permanently damaged from the pregnancy? That happens.

Load More Replies...

Dark Mode

Dark Mode

No fees, cancel anytime

No fees, cancel anytime

108

338