Woman Has Cancer And Will Die Soon, Takes Out Several Credit Cards Before She Goes

One of the worst things that can happen to anyone is hearing from their doctor that they have cancer. In some situations, medication, treatments, and therapies are available that can help patients beat the disease. Unfortunately, this isn’t the case for everyone.

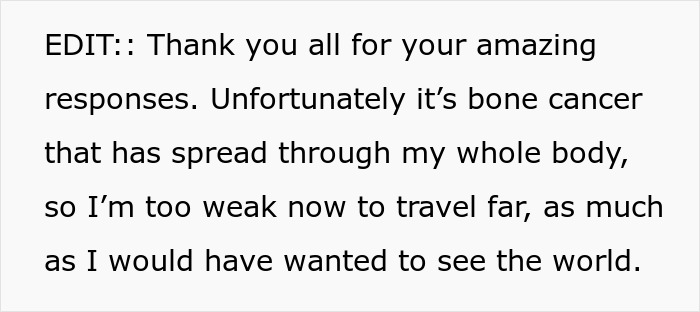

Redditor u/UnderstandingThis430 went massively viral on the ‘Confession’ online group after revealing that she is terminally ill with bone cancer. So, she decided to get a credit card and take on debt to buy whatever she wants during her remaining time on Earth. Read on for the full story, including how the internet reacted to the post. Bored Panda has reached out to the author for comment, and we’ll update the article as soon as we hear back from her.

It would be a devastating shock for anyone to find out that they have cancer

Image credits: Kateryna Hliznitsova / Unsplash (not the actual photo)

A woman who is terminally ill with bone cancer opened up online about how she’s taking on credit card debt to splurge on everything she wants

Image credits: CardMapr.nl / Unsplash (not the actual photo)

Image credits: Markus Winkler / Unsplash (not the actual photo)

Image credits: UnderstandingThis430

The sad reality is that bone cancer often affects young people

The NHS explains that primary bone cancer is a rare type of cancer, with around 550 new cases diagnosed in the United Kingdom each year. Primary bone cancer begins in the bones, while secondary bone cancer spreads to the bones after developing in another part of the body.

Some of the main symptoms of bone cancer, which most often develops in the long bones of your legs or upper arms, include:

- Persistent bone pain that gets worse over time and continues into the night;

- Swelling and redness (inflammation) over a bone, which can make movement difficult if the affected bone is near a joint;

- A noticeable lump over a bone;

- A weak bone that breaks (fractures) more easily than normal;

- Problems moving around—for example, walking with a limp.

Osteosarcoma, the most common type of bone cancer, mostly affects children and young adults under 20 years old.

Ewing sarcoma most commonly affects people aged 10 to 20 years old. And chondrosarcoma tends to affect adults aged 40 and over.

There are various factors that increase the risk of developing this type of cancer

Image credits: Kateryna Hliznitsova / Unsplash (not the actual photo)

People who are at a higher risk of developing bone cancer include individuals who have had previous exposure to radiation during radiotherapy, have Paget’s disease, or have Li-Fraumeni syndrome. This type of cancer often affects young people because of their rapid growth spurts during puberty.

Bone cancer treatment often involves a combination of surgery, chemotherapy, and radiotherapy. “Generally, bone cancer is much easier to cure in otherwise healthy people whose cancer hasn’t spread,” the NHS writes.

“Overall, around 6 in every 10 people with bone cancer will live for at least 5 years from the time of their diagnosis, and many of these may be cured completely.”

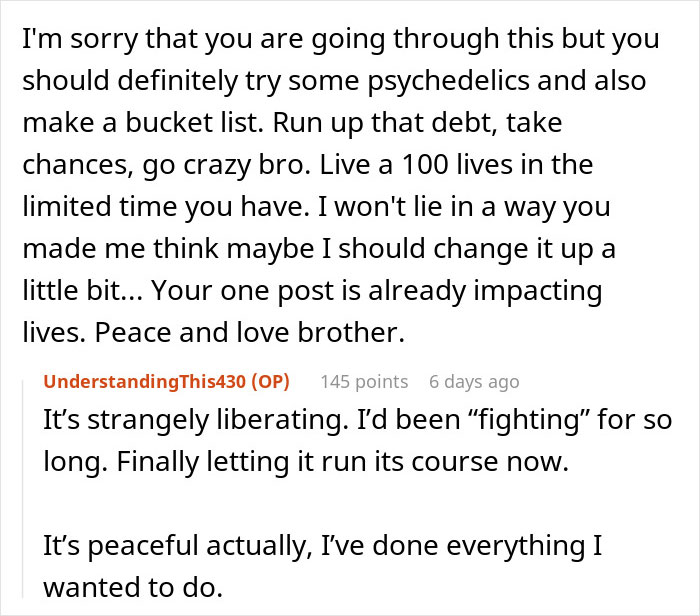

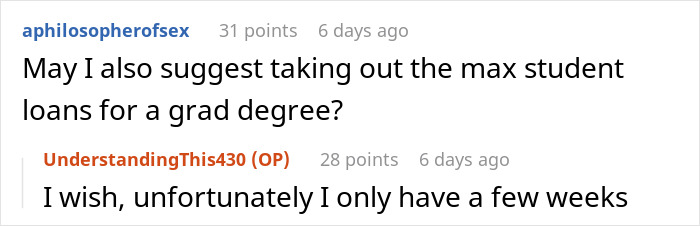

The author’s story reached a ton of people around the globe. At the time of writing, her post about her bone cancer and credit card debt had 95k upvotes and garnered 8.3k comments.

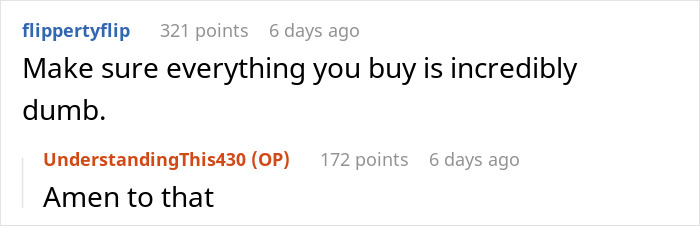

Many internet users had encouraging comments for u/UnderstandingThis430, as well as advice for what else she could do, including getting more credit cards and ideas for what she could buy with all the money that she has available.

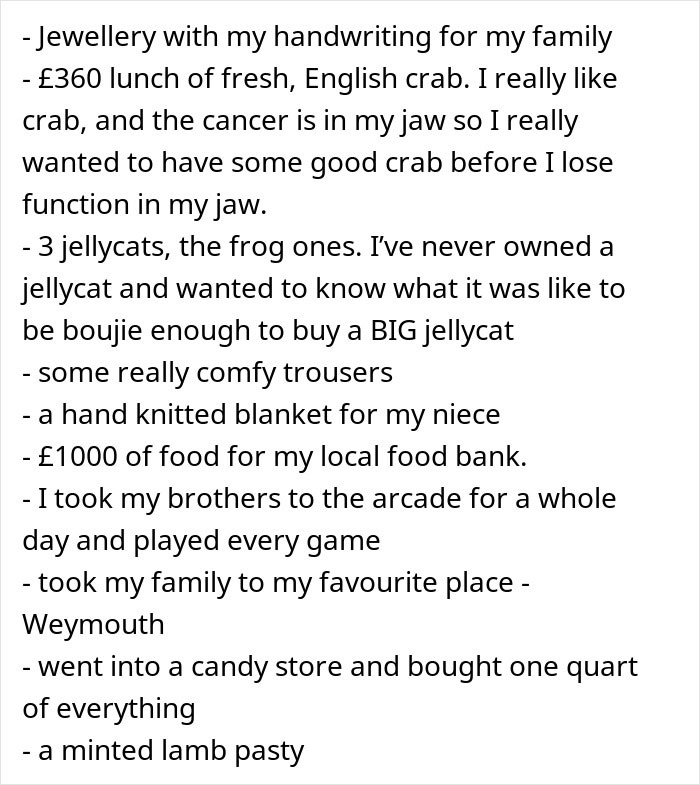

The author later shared online how she made lots of “random purchases,” including jewelry with her handwriting for her family, lots of delicious food, jellycats, clothes, candy, etc. She also found other ways to treat her relatives. On top of that, she donated lots of food to her local food bank and is looking for ways to thank the cancer charities in her area.

What are your thoughts about taking on credit card debt after finding out that you’re terminally ill, dear Pandas? What advice would you give the author of the viral post if you could talk to her directly? Has someone close to you ever had cancer? What did you do to support them during that difficult time? If you feel like sharing, you can open up in the comments section at the bottom of this post.

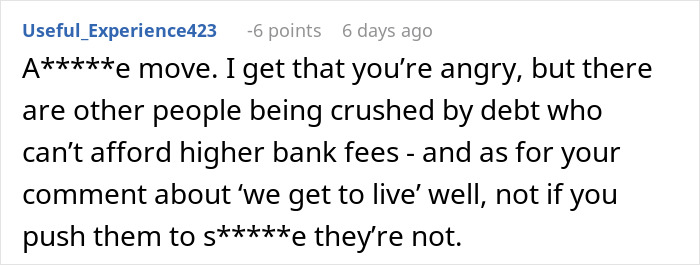

The post reached lots of people all over the internet. Here’s what some of them said about the young woman’s situation

Poll Question

Thanks! Check out the results:

Explore more of these tags

After my mother in law passed, we'd get collection calls regarding her debts. "You'll have to take it up with her" my wife would tell them. "But she's dead!" "Not my problem."

My bank fees go less up because one dying person has a shopping and donation fee, and more because big companies waste money and pay big bonuses when they are close to bankruptcy. Nice of OP to donate, may she enjoy the time she's got left.

As greedy and outright predatory financial institutions are, this is a great way to get something back. It won't hurt them in the slightest but if it makes an unbelievably hard situation just a tiny, tiny bit better then it's absolutely worth it.

I did something very similar to this when my original oncologist told me I only had a few months to live. I racked up credit card debt, traveled while I felt like it, bought stupid stuff for family and friends, death-cleaned my home and gave almost everything away. I went for a doctor's appointment and my doctor wasn't there so I had to see someone else and he had a different take on my cancer. So 10 years later I am still here. It took a while for me to pay everything back and rebuild my credit, but I have ZERO regrets for living the way I wanted to for those few months. I will definitely do it again.

Die in debt, it’s the only way to go. Even if we can’t take it with us, we can leave it behind for others to enjoy. Screw the banks. Anyone who complains about rising fees for the rest, screw them, too. I just got a new cc yesterday and I’m waiting for the right time, but this one has Croatia written all over it.

My dad, who’s 94, lives in fear that my cousin won’t make sure all his bills are paid after he’s gone. Can you imagine worrying that your cable bill is paid after you’re dеad? 😳 Dеad people don’t need flawless credit. I don’t understand it, unless it’s something as simple as old age is messing with this cognitive abilities. There’s no reasoning with him about it. I’d rather he spreads the cash among us kids, but I’m certainly not gonna make a peep about that. Instead, it’s “Sure, dad; make sure the cable company has your money after you go. 🤔🙄😰

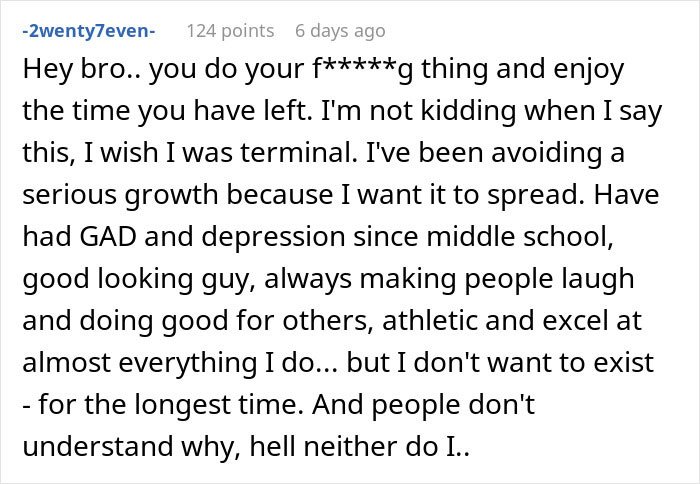

Load More Replies...I hope the first commenter gets help. I am genuinely worried about you 2wenty7even. Whatever it is my dude, just hang on.

It makes me feel sad because I know exactly how that commenter feels. I have been su!cidal for most of my life and have actively tried to unalive myself twice (chickened out at the last second, once induced vomiting with literal seconds to spare before the stuff I took made me unconscious and then subsequently dead.) I've had chronic migraine for most of my adult life and used to hope it was a brain tumor. Had scans done, turned out I DO have a pituitary tumor! So I hoped for a long time that it was malignant. I just wanted so badly to die but was mostly too cowardly to actually go through with su!cide. I'm not sparkles and rainbows nowadays by any means, but I have pets that I love dearly now and I do my best to stick around for them, because I'm their world and they are mine. But I can absolutely - down to my very bones - understand the exact thing that -2wenty7even- is going through. I think I'll go send them a note on Reddit giving them an internet hug. Hugs to you as well <3

Load More Replies...Holy balls did that get dark fast. I hope that commenter -2wenty7even- gets help. Edit: The good kind of help, not the Kevorkian kind.

In Germany and the Netherlands there are no "credit scores" like this. Borrowing money is, with a very few exceptions, bad for your score, no matter how good your pay back behaviour is. You balance every month your credit card debt. In case you die in debt, your family has only one chance to escape being held responsible for your debt: Declining heritance, so everything, even of sentimental value, has to be given up. And even then it can happen that they get them, or the parties the donations went to. Credit cards and loans come with strict vetting. So in case you plan the same: Be sure what the small letters say in your specific circumstances.

In the USA your family can inherit that debt too. The lender can go after all assets of your next of kin, and any donations made can be considered fraudulent, and would require repayment to the lender.

Load More Replies...This is something that i think alot of people would do. just have fun, and go out with a huge a*s bang. And also, most banks have built in insurance against dread disease and death, so i do not understand the big boo ha

Maybe in the USA this is possible? In my country we can't take a huge credit unless you have a guarantor.

As Cee Cee says - UK. Here in the UK I’ve got about 20k of CC credit without any effort on a fairly moderate salary. £6,500 for someone with a decent credit file wouldn’t be difficult at all.

Load More Replies...That's what I would do. Most don't know that banks often already build for this in the interest rates. They actually get mad when people pay off their cards, it means less profit. They also sell the junk debt to collectors for an amount. Of course the collectors often don't know the person is dead. But they are a rather shady business.

Be sure to prepay for your funeral. And let all your relatives know that they have NO obligation to pay your debts - creditors will try to guilt them into paying after you pass.

In the US, debt at death follows your relatives. I went to close my mother's bank account and they took out the $ that I was going to use for cremation due to having credit card debt with them. Had to pay out of pocket and I'm lucky I had it. Understand her philosophy, however, so I am not being critical of her choices.

This woman is a pile of garbage. Someone has to pay for it. If it's not you or your estate it goes to next of kin. If no next of kin it goes to a family member regardless if they were asked. Worked in credit industry for a decade. These people are awful.

PenguinEmp, she is stealing from the credit card companies, but this is not a debt that will be passed along to her family or next of kin. The debt will stop at her death. This is what the law in the UK, where she lives, stipulates. The money will not be a burden to her family. It will be a loss to the credit card company.

Load More Replies...Go ahead and pay for those final expenses while you're at it OP if you have a preference for how you want your remains handled. I'm terminal as well but have a daughter and hope to make things as easy as possible for her when I'm gone otherwise I would be right there with OP. Do what you can while you can.

If this is in the USA, her family may be in for a rude surprise. Credit card companies can report delinquent accounts to the IRS as untaxed income (ask me how I know). OP may not be around to pay it off, but someone may end up paying it off, one way or another.

Looks like UK. Debt dies with the estate. https://www.legalandgeneral.com/insurance/over-50-life-insurance/later-life-planning/what-happens-to-debt-when-you-die/

Load More Replies...After my mother in law passed, we'd get collection calls regarding her debts. "You'll have to take it up with her" my wife would tell them. "But she's dead!" "Not my problem."

My bank fees go less up because one dying person has a shopping and donation fee, and more because big companies waste money and pay big bonuses when they are close to bankruptcy. Nice of OP to donate, may she enjoy the time she's got left.

As greedy and outright predatory financial institutions are, this is a great way to get something back. It won't hurt them in the slightest but if it makes an unbelievably hard situation just a tiny, tiny bit better then it's absolutely worth it.

I did something very similar to this when my original oncologist told me I only had a few months to live. I racked up credit card debt, traveled while I felt like it, bought stupid stuff for family and friends, death-cleaned my home and gave almost everything away. I went for a doctor's appointment and my doctor wasn't there so I had to see someone else and he had a different take on my cancer. So 10 years later I am still here. It took a while for me to pay everything back and rebuild my credit, but I have ZERO regrets for living the way I wanted to for those few months. I will definitely do it again.

Die in debt, it’s the only way to go. Even if we can’t take it with us, we can leave it behind for others to enjoy. Screw the banks. Anyone who complains about rising fees for the rest, screw them, too. I just got a new cc yesterday and I’m waiting for the right time, but this one has Croatia written all over it.

My dad, who’s 94, lives in fear that my cousin won’t make sure all his bills are paid after he’s gone. Can you imagine worrying that your cable bill is paid after you’re dеad? 😳 Dеad people don’t need flawless credit. I don’t understand it, unless it’s something as simple as old age is messing with this cognitive abilities. There’s no reasoning with him about it. I’d rather he spreads the cash among us kids, but I’m certainly not gonna make a peep about that. Instead, it’s “Sure, dad; make sure the cable company has your money after you go. 🤔🙄😰

Load More Replies...I hope the first commenter gets help. I am genuinely worried about you 2wenty7even. Whatever it is my dude, just hang on.

It makes me feel sad because I know exactly how that commenter feels. I have been su!cidal for most of my life and have actively tried to unalive myself twice (chickened out at the last second, once induced vomiting with literal seconds to spare before the stuff I took made me unconscious and then subsequently dead.) I've had chronic migraine for most of my adult life and used to hope it was a brain tumor. Had scans done, turned out I DO have a pituitary tumor! So I hoped for a long time that it was malignant. I just wanted so badly to die but was mostly too cowardly to actually go through with su!cide. I'm not sparkles and rainbows nowadays by any means, but I have pets that I love dearly now and I do my best to stick around for them, because I'm their world and they are mine. But I can absolutely - down to my very bones - understand the exact thing that -2wenty7even- is going through. I think I'll go send them a note on Reddit giving them an internet hug. Hugs to you as well <3

Load More Replies...Holy balls did that get dark fast. I hope that commenter -2wenty7even- gets help. Edit: The good kind of help, not the Kevorkian kind.

In Germany and the Netherlands there are no "credit scores" like this. Borrowing money is, with a very few exceptions, bad for your score, no matter how good your pay back behaviour is. You balance every month your credit card debt. In case you die in debt, your family has only one chance to escape being held responsible for your debt: Declining heritance, so everything, even of sentimental value, has to be given up. And even then it can happen that they get them, or the parties the donations went to. Credit cards and loans come with strict vetting. So in case you plan the same: Be sure what the small letters say in your specific circumstances.

In the USA your family can inherit that debt too. The lender can go after all assets of your next of kin, and any donations made can be considered fraudulent, and would require repayment to the lender.

Load More Replies...This is something that i think alot of people would do. just have fun, and go out with a huge a*s bang. And also, most banks have built in insurance against dread disease and death, so i do not understand the big boo ha

Maybe in the USA this is possible? In my country we can't take a huge credit unless you have a guarantor.

As Cee Cee says - UK. Here in the UK I’ve got about 20k of CC credit without any effort on a fairly moderate salary. £6,500 for someone with a decent credit file wouldn’t be difficult at all.

Load More Replies...That's what I would do. Most don't know that banks often already build for this in the interest rates. They actually get mad when people pay off their cards, it means less profit. They also sell the junk debt to collectors for an amount. Of course the collectors often don't know the person is dead. But they are a rather shady business.

Be sure to prepay for your funeral. And let all your relatives know that they have NO obligation to pay your debts - creditors will try to guilt them into paying after you pass.

In the US, debt at death follows your relatives. I went to close my mother's bank account and they took out the $ that I was going to use for cremation due to having credit card debt with them. Had to pay out of pocket and I'm lucky I had it. Understand her philosophy, however, so I am not being critical of her choices.

This woman is a pile of garbage. Someone has to pay for it. If it's not you or your estate it goes to next of kin. If no next of kin it goes to a family member regardless if they were asked. Worked in credit industry for a decade. These people are awful.

PenguinEmp, she is stealing from the credit card companies, but this is not a debt that will be passed along to her family or next of kin. The debt will stop at her death. This is what the law in the UK, where she lives, stipulates. The money will not be a burden to her family. It will be a loss to the credit card company.

Load More Replies...Go ahead and pay for those final expenses while you're at it OP if you have a preference for how you want your remains handled. I'm terminal as well but have a daughter and hope to make things as easy as possible for her when I'm gone otherwise I would be right there with OP. Do what you can while you can.

If this is in the USA, her family may be in for a rude surprise. Credit card companies can report delinquent accounts to the IRS as untaxed income (ask me how I know). OP may not be around to pay it off, but someone may end up paying it off, one way or another.

Looks like UK. Debt dies with the estate. https://www.legalandgeneral.com/insurance/over-50-life-insurance/later-life-planning/what-happens-to-debt-when-you-die/

Load More Replies...

Dark Mode

Dark Mode

No fees, cancel anytime

No fees, cancel anytime

54

74