Education is one of the most powerful tools for building a better future, and most people are willing to work hard to get it. But for many, it comes at a cost: literally. Student loans often make higher education possible for those who can’t afford it outright. They bridge the gap between dreams and tuition fees. But while loans can open doors, they can also bring long-term burdens, especially when the repayment process becomes overwhelming.

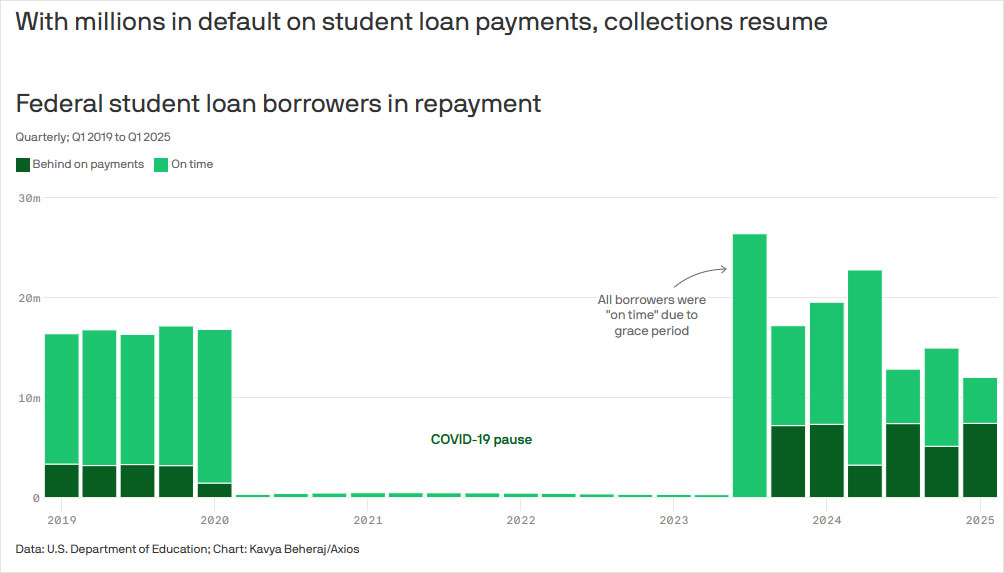

As of June 2024, student loan debt in the U.S. reached an all-time high of $1.6 trillion. That’s a 42% increase compared to ten years ago. This rise is linked to more students attending college and the ever-climbing cost of tuition. Normally, many borrowers would’ve had options to avoid default, like negotiating repayment plans. But everything changed when student loan payments and interest were paused in March 2020 by President Trump due to the COVID-19 pandemic. President Biden extended the freeze several times before it ended in October 2023.

However, after a five-year pause, students in default are now being asked to resume repayment

Image credits: jcomp/Freepik (not the actual photo)

The Biden administration attempted to cancel portions of student debt. However, those efforts faced repeated legal roadblocks, including a Supreme Court ruling in 2023. Still, during Biden’s term, over 5 million borrowers had their debts canceled through various relief programs.

Recently, GOP lawmakers proposed new legislation to revamp student loan repayment structures. A key part of this would be eliminating the SAVE plan, an income-driven repayment option introduced by the Biden administration in 2023.

On April 21, the Department of Education announced that loan collections would resume in full. For the first time since March 2020, the Office of Federal Student Aid is collecting on defaulted loans. “American taxpayers will no longer be forced to serve as collateral for irresponsible student loan policies,” said U.S. Secretary of Education Linda McMahon in the release.

Image credits: Kavya Beheraj/Axios

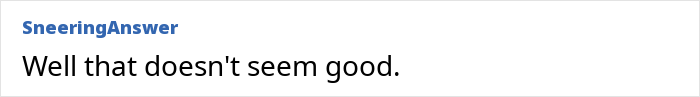

This change came into effect on May 5. After a five-year break, 5.3 million borrowers in default are being asked to repay. The government has resumed reporting these defaults to credit bureaus. This move could cause serious damage to credit scores nationwide. It may also impact loan approvals for mortgages, cars, or small businesses. Even renters and job seekers may feel the effect. Financial recovery just became even more challenging for millions.

“The Department of Education, in conjunction with the Department of Treasury, will shepherd the student loan program responsibly and according to the law, which means helping borrowers return to repayment — both for the sake of their own financial health and our nation’s economic outlook,” Education Secretary Linda McMahon said in a statement last month, adding, “There will not be any mass loan forgiveness.”

What does this all mean for borrowers already in default?

The consequences can be harsh. The federal government may garnish wages, seize tax refunds, or reduce Social Security payments. These penalties are triggered if borrowers don’t resume payments. And once collections start, it’s much harder to reverse the damage. It’s a situation many hoped to avoid but now it’s back in full force.

Wage garnishment is one of the most serious consequences. It’s a legal action where an employer is ordered to withhold part of a person’s paycheck to repay a debt. This includes overdue child support or student loans. Borrowers will be given a 30-day warning before garnishment begins. A loan is officially in default after 270 days without a single payment. By then, options become limited and stress levels high.

Image credits: Stanley Morales/Pexels (not the actual photo)

According to the Education Department, only 38% of borrowers are currently making regular payments. That means most others are either in deferment, forbearance, or already behind. Many haven’t returned to full repayment after the pandemic pause. With repayment now active again, the numbers may shift but the risk of delinquency remains. And that affects not just individuals but the broader economy as well.

Some borrowers are in an especially uncertain place. About 20% are classified as delinquent but haven’t yet crossed into full default. That means they’re more than 270 days late, but technically still within reach of catching up. Back in February 2020, that number was just 11.5%. The increase reflects how hard it’s become to stay on track. Financial stress is rising, and fast.

The broader impact of loan collection could ripple through the economy in many ways. Consumer spending may decline as borrowers redirect income toward debt. Credit card defaults may increase as people juggle payments. Younger generations could delay milestones like buying homes or starting families. The mental health toll is real, too, with anxiety and burnout on the rise. Small businesses may see reduced demand, and local economies could take a hit. The effects go beyond individual bank accounts.

With student loan repayment back in full swing, the situation is anything but simple. The economic outlook is already shaky, with concerns over inflation and job growth. Layering loan collections on top of that adds even more strain. Many fear the fallout will be larger and messier than expected. For millions of borrowers, the road ahead feels uncertain. And the conversation around student loans is far from over.

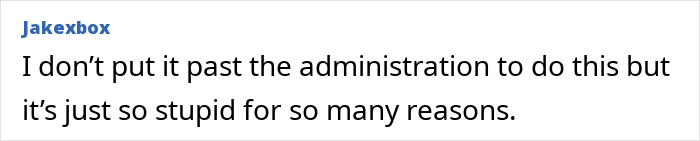

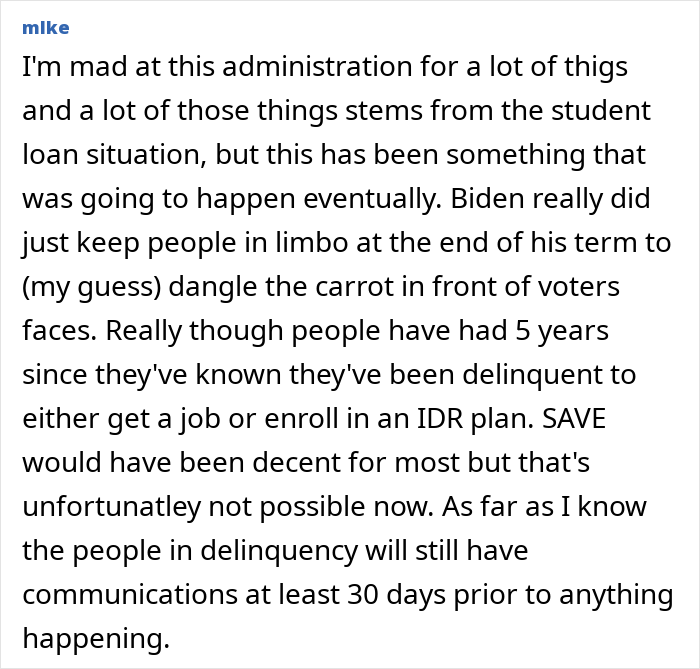

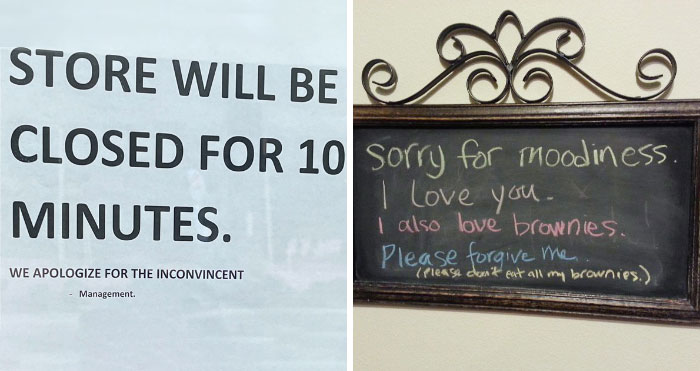

Both students and others expressed dissatisfaction with the changes introduced by the Trump administration

Image credits: Stanley Morales/Pexels (not the actual photo)

Image credits: @SimplySatiracal

Image credits: @sergii_dxb

Image credits: @RickWMiller1

Poll Question

Thanks! Check out the results:

In civilized countries, education is seen as a public good, and it’s free or low-cost. In the U.S., all anyone cares about is making corporations and the wealthy even richer as fast as possible. Capitalism is killing the goose that lays the golden eggs. The U.S. is not really a country; it’s three corporations in a trench coat.

Here's an interesting twist my son in law took out a six figure loan to start a tow company rather than go to college is his loan going to be forgiven too?

Yes, I'd like if the state helped those not favoured by rich parents, like you son in law. Same struggle.

Load More Replies...Dude, it is the interest. Federal loans to promote a educated and skilled workforce should be seen as an investment for America to continue to have doctors and engineers that are a big part of our global economic dominance. It isn't like America isn't getting something back from this. Our export is our advanced technology in energy, agriculture, and pharmaceuticals, even manufacturing exports in the USA are based on engineering skills to create more advance machinery/technology. Biden invested 2 trillion into building manufacturing here and these companies can't fill the positions because they require a 4 year degree. So fine, people can pay back their loans, but there should be no interest charged for federally provided student loans since the pay-off is America has an advanced economy and the government gets more in taxes from people who have college degrees. Reagan decided to make college loans for profit to keep college an exclusive club reserved for the privileged and upper class.

In civilized countries, education is seen as a public good, and it’s free or low-cost. In the U.S., all anyone cares about is making corporations and the wealthy even richer as fast as possible. Capitalism is killing the goose that lays the golden eggs. The U.S. is not really a country; it’s three corporations in a trench coat.

Here's an interesting twist my son in law took out a six figure loan to start a tow company rather than go to college is his loan going to be forgiven too?

Yes, I'd like if the state helped those not favoured by rich parents, like you son in law. Same struggle.

Load More Replies...Dude, it is the interest. Federal loans to promote a educated and skilled workforce should be seen as an investment for America to continue to have doctors and engineers that are a big part of our global economic dominance. It isn't like America isn't getting something back from this. Our export is our advanced technology in energy, agriculture, and pharmaceuticals, even manufacturing exports in the USA are based on engineering skills to create more advance machinery/technology. Biden invested 2 trillion into building manufacturing here and these companies can't fill the positions because they require a 4 year degree. So fine, people can pay back their loans, but there should be no interest charged for federally provided student loans since the pay-off is America has an advanced economy and the government gets more in taxes from people who have college degrees. Reagan decided to make college loans for profit to keep college an exclusive club reserved for the privileged and upper class.

Dark Mode

Dark Mode

No fees, cancel anytime

No fees, cancel anytime

23

11