Family Loses Six Figures To A Scam After Spouse Chose To Stupidly Not Say Anything

Interview With ExpertMoney is one of the many touchy issues among married couples. A 2024 survey by Fidelity Investments revealed that 45% of partners argue about their finances “at least occasionally,” while more than 1 in 4 couples resent being left out of decisions related to money.

The couple in this story is part of that statistic, after one spouse fell for a scam that cost them their entire life savings. However, what made matters worse was that they seemingly chose not to disclose the situation to their partner, resulting in massive debt that could have been avoided in the first place.

You may want to have a bowl of popcorn nearby as you read, because this lengthy narrative has quite a few twists and turns. As you scroll through, you will also find our brief conversation with a few experts regarding financial infidelity.

No one wants to be left in the dark with their spouse’s financial activity

Image credits: New Africa/Freepik (not the actual photo)

This is what happened to a couple after one of them fell for a scam

Image credits: benzoix/Freepik (not the actual photo)

To make things worse, the erring partner kept their spouse in the dark the entire time

Image credits: natali_brill/Freepik (not the actual photo)

The situation left the couple in massive debt

Image credits: Freepik (not the actual photo)

The story’s author ended with a valuable piece of advice for readers

Image credits: SlaughteredPiggy

Financial infidelity rarely starts with deception

Image credits: Camandona/Freepik (not the actual photo)

Unlike when a spouse has an illicit affair, financial infidelity isn’t getting as much shine. One of the reasons is that it rarely begins with deception, according to BatSheva Goldstein, a financial communication strategist and licensed financial advisor. As she tells Bored Panda, it starts with discomfort.

“It begins when someone feels anxious about spending, guilty about debt, or afraid of being judged. That discomfort turns into silence, and silence turns into secrecy. By the time it’s uncovered, the emotional damage often exceeds the financial one,” Goldstein explained.

Goldstein further explained how money isn’t just about the dollars. Instead, it’s about what those dollars represent. And when money conversations ignore values, guilt and fear tend to take over. As she noted, “silence does more harm than any spreadsheet mistake.”

Of course, financial infidelity, like all forms of betrayal, erodes trust. But in this case, it also causes severe anxiety about the future. According to clinical psychologist Dr. Nancy Iwrin, couples may begin worrying about things like their children’s college fund and their retirement.

Baltimore Therapy Center director Raffi Bilek, LCSW-C brought up an important point regarding financial anxiety, stating that even after the relationship ends, the victim’s financial situation may still be in tatters.

Financial infidelity can easily lead to massive debt, as the couple in the story went through. And as expected, they went into panic mode.

Moving forward from financial infidelity must be about understanding rather than throwing blame

Image credits: cookie_studio/Freepik (not the actual photo)

But in such situations, Goldstein shared a rather unique and practical tip: focus on understanding and gaining insight rather than finger-pointing.

“Have financial conversations that begin with questions about values, not just. Ask, ‘What money story did you grow up with, and does that still shape our decisions today?’ or ‘What are we trying to protect?’” she advised, stating that this approach helps couples reconnect with purpose before they tackle practical details.

Bilek advises speaking with both a couples counselor and a financial advisor. This two-pronged approach not only helps repair the relationship but also enables the couple to develop a plan for managing their financial situation.

However, if all else fails, the couple may need to rethink their marriage.

“(A divorce may be necessary) When the two cannot let their guards down and agree upon a doable approach to money: earning it, saving it, spending it, respecting it, and most importantly, talking about it,” Dr. Irwin said.

It may take a while for the couple to climb out of their hole and get back to where they were before they lost the significant sum of money. They may need to undergo many counseling sessions and disclose everything they spend.

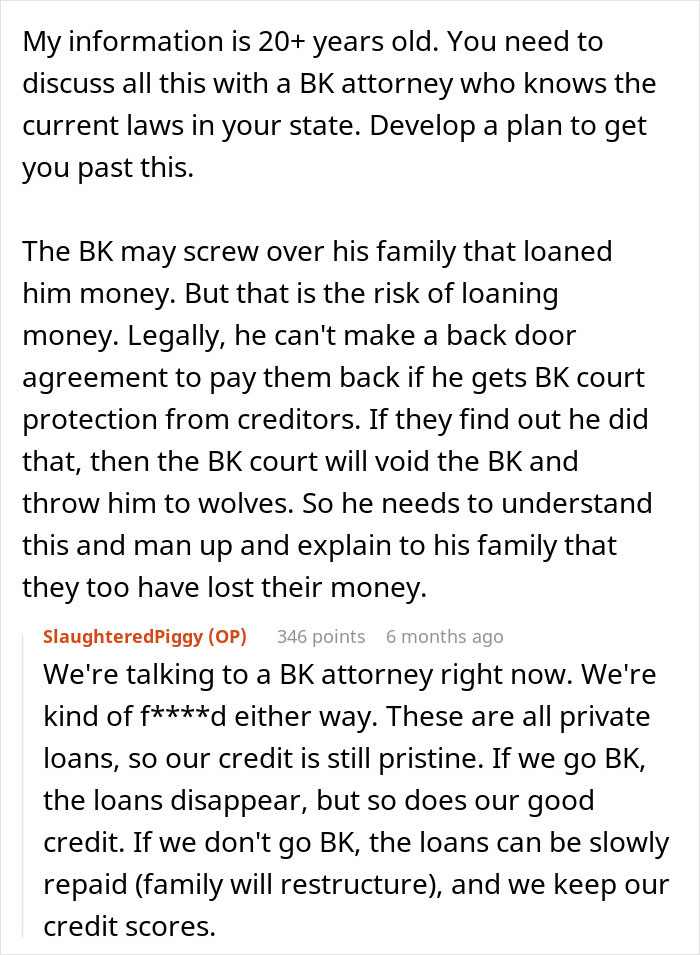

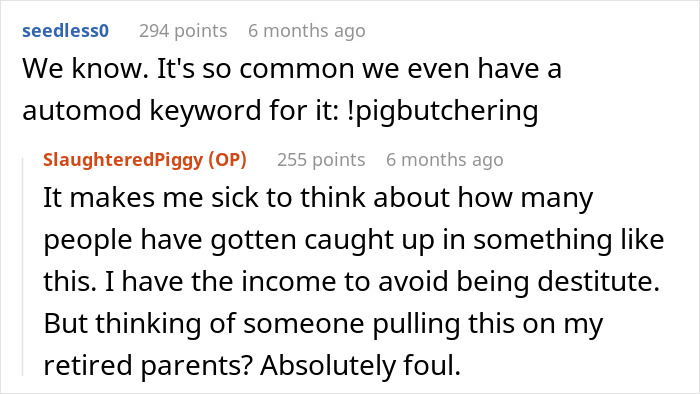

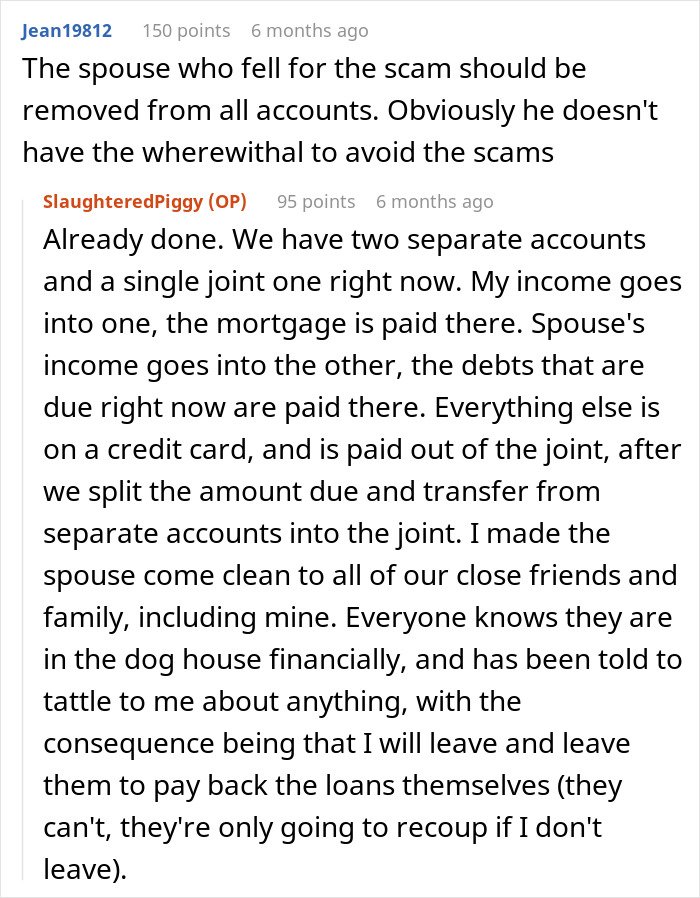

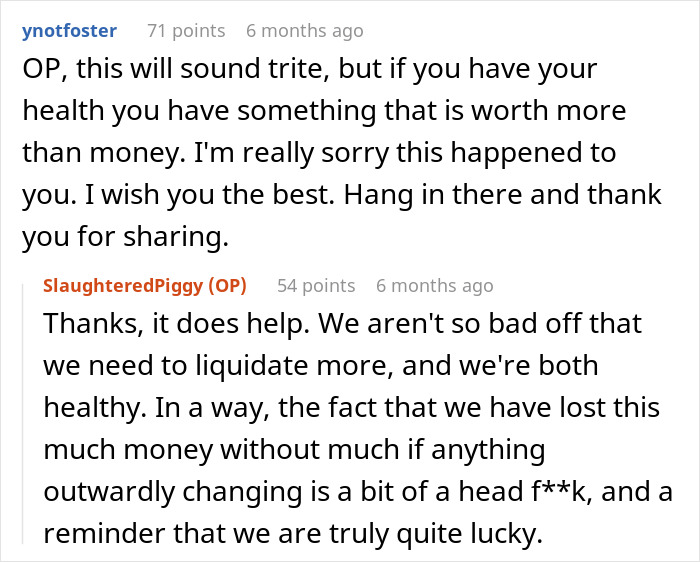

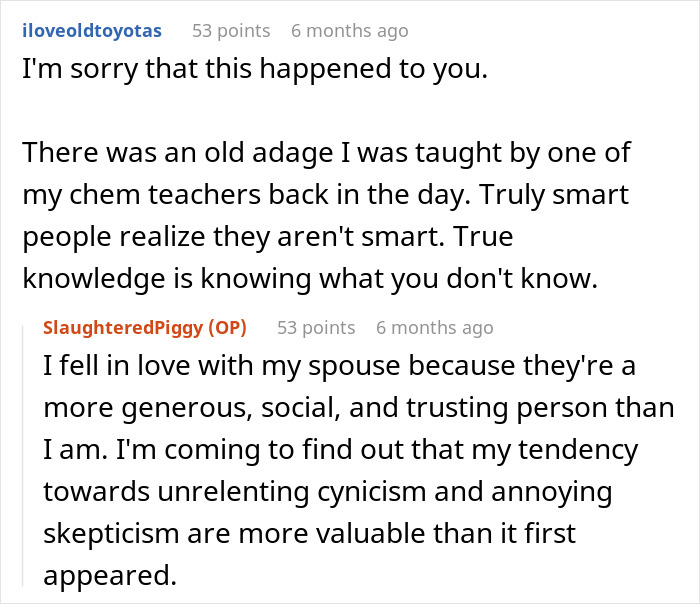

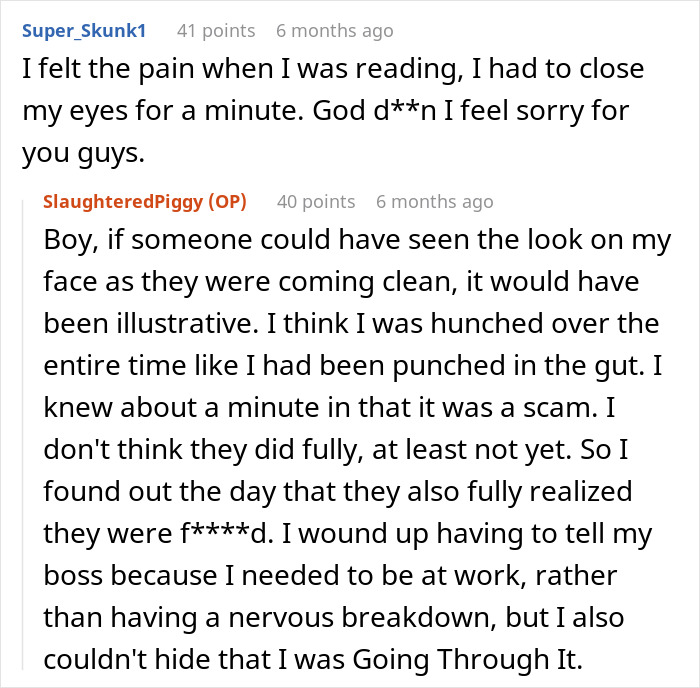

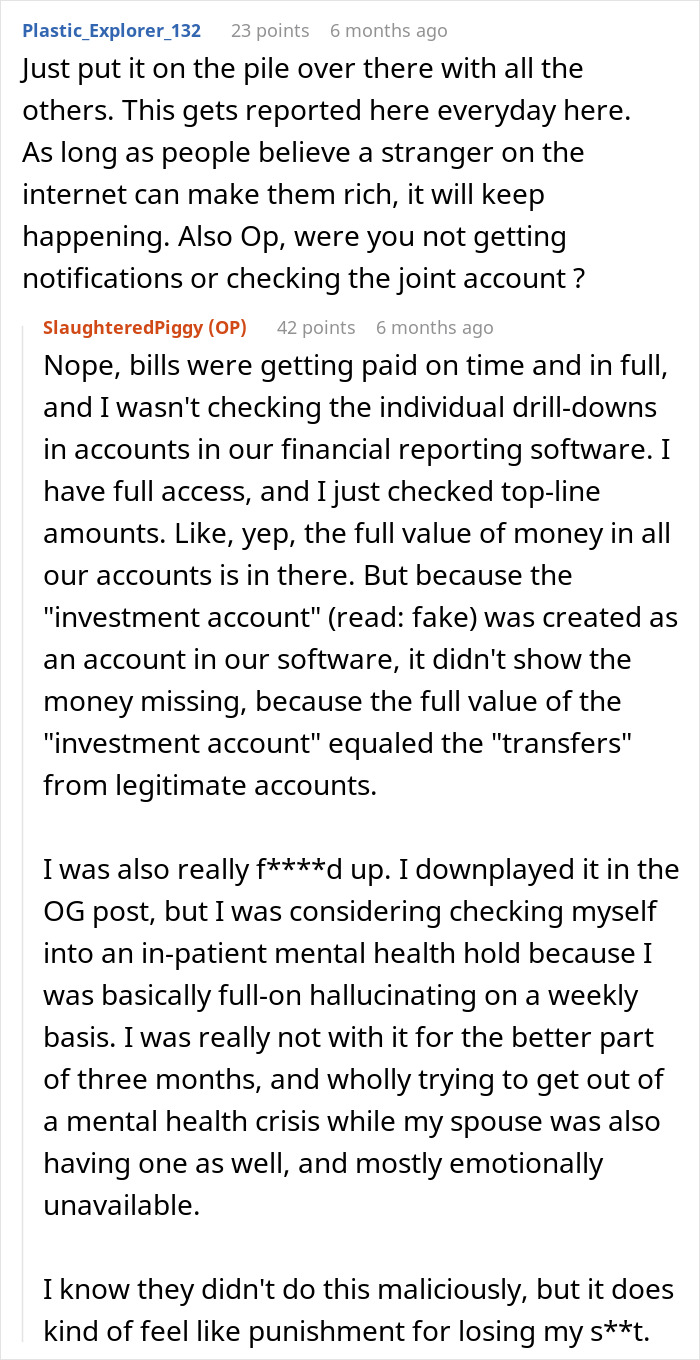

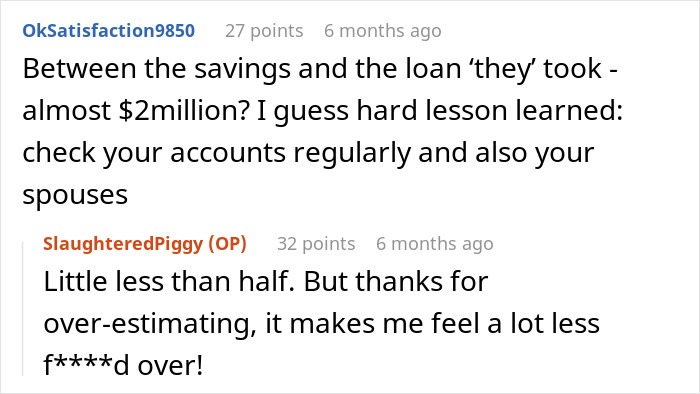

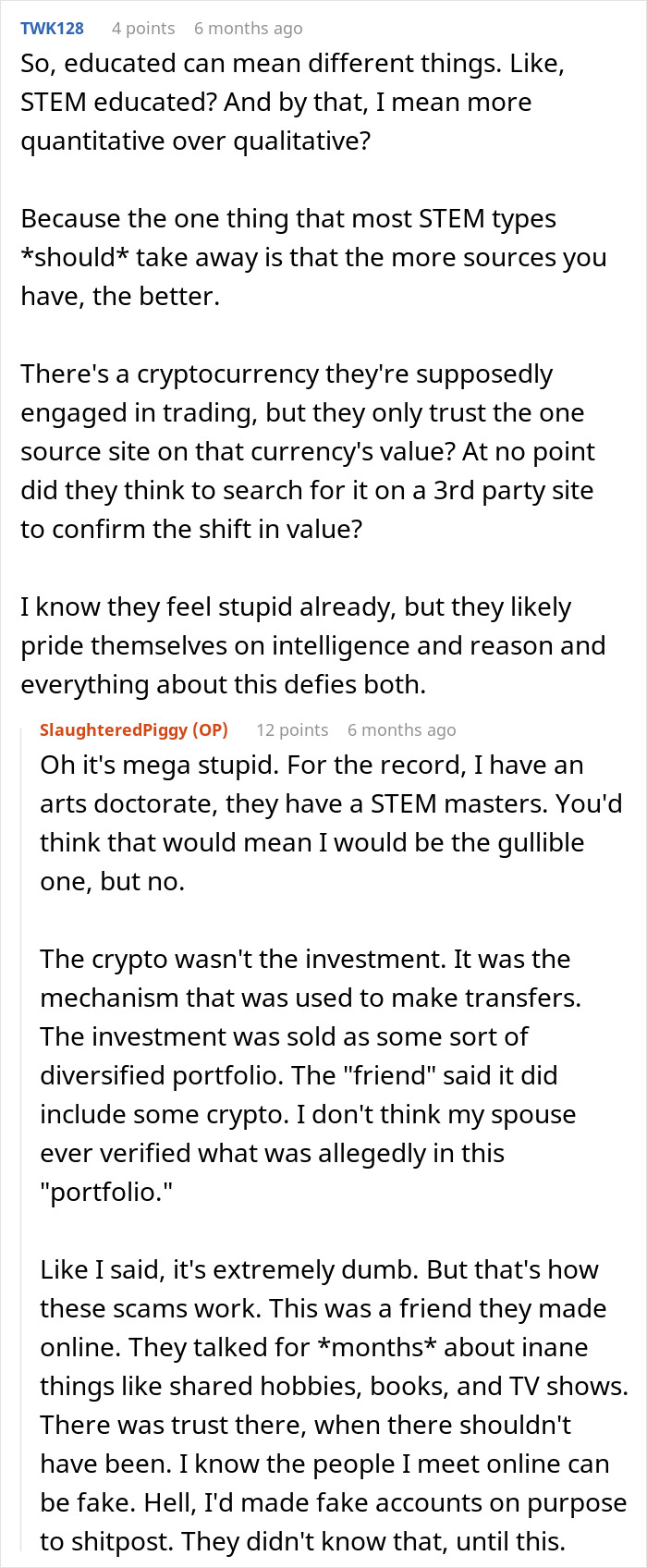

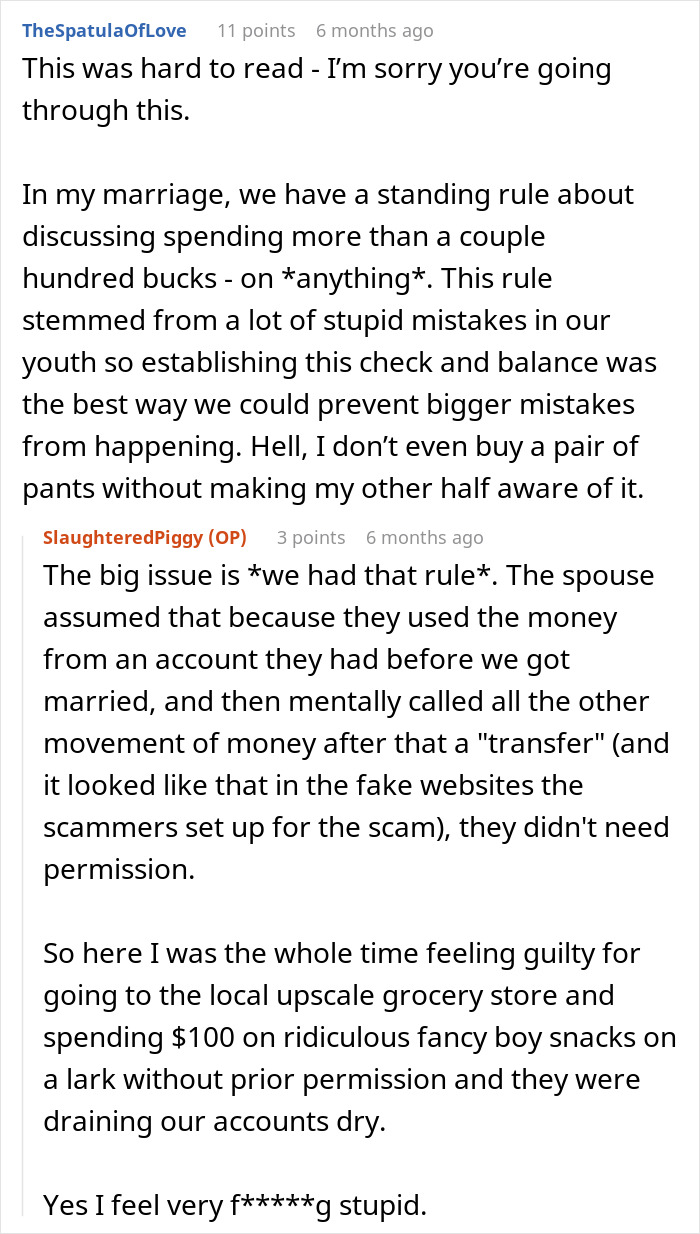

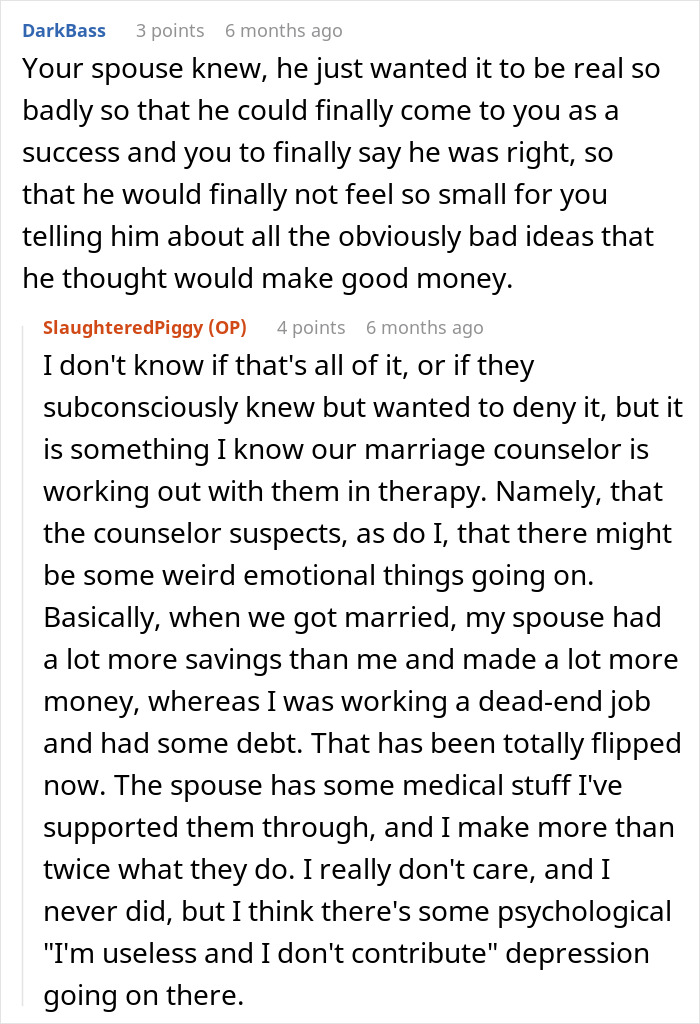

The author provided more information as reader comments poured in

The author shared an update

Image credits: The Yuri Arcurs Collection/Freepik (not the actual photo)

Image credits: SlaughteredPiggy

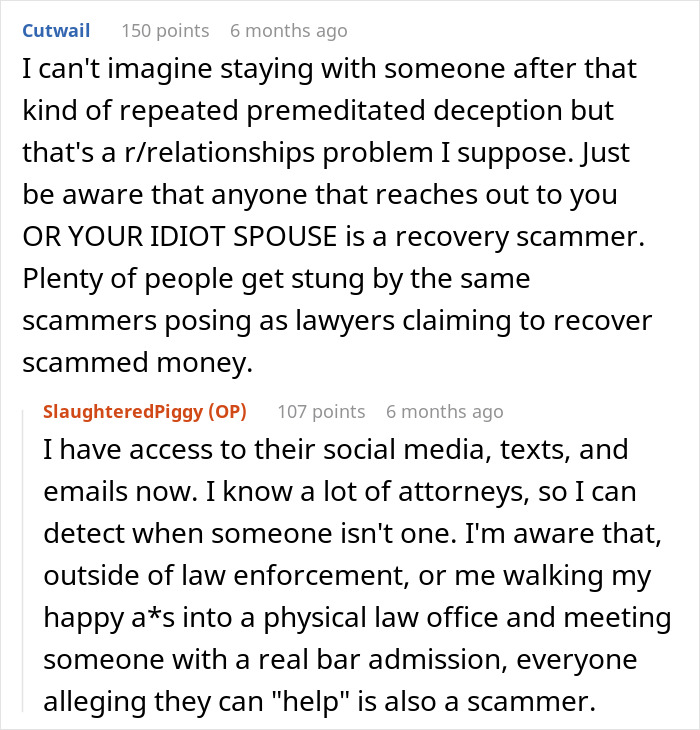

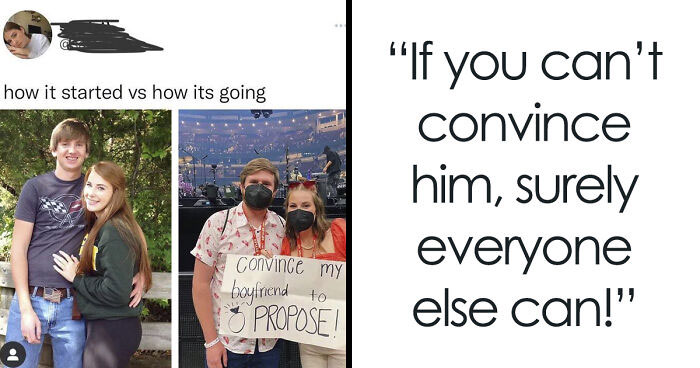

In their second update, the author provided a status on the marriage and how they’ve handled their finances since what happened

Image credits: Stockbusters/Freepik (not the actual photo)

They also admitted to having trust issues toward their spouse

Image credits: alidrian/Freepik (not the actual photo)

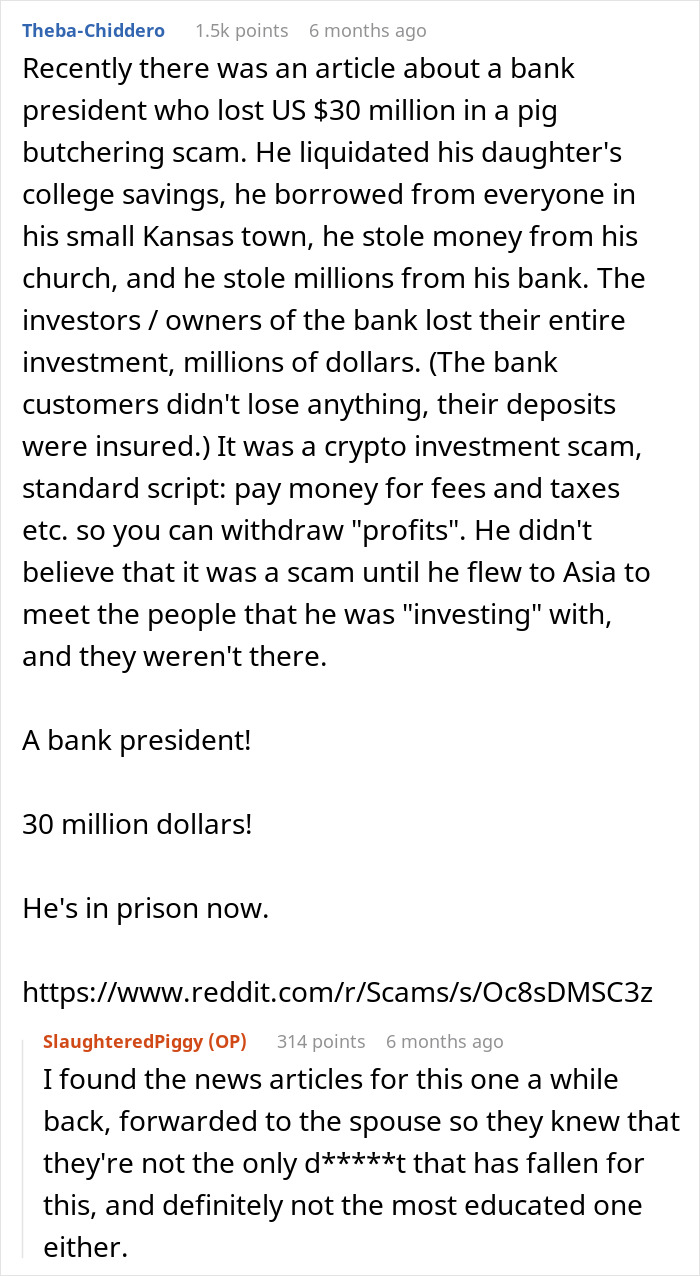

Apparently, financial losses is a trend in the author’s family

Image credits: pressphoto/Freepik (not the actual photo)

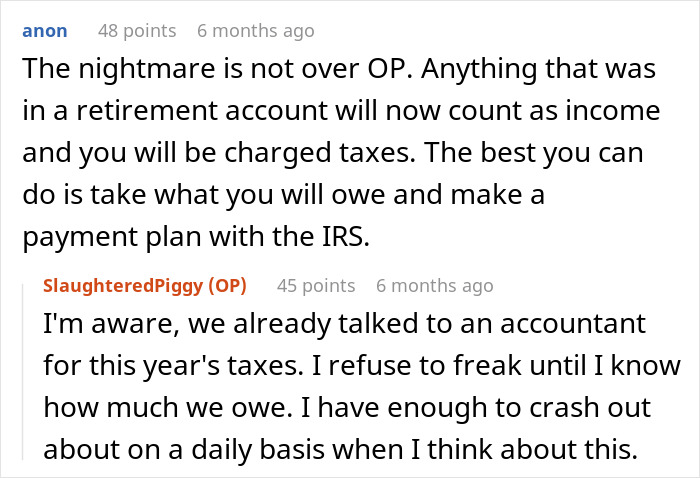

According to the final update, law enforcement has not taken action despite the couple’s multiple reports

Image credits:Adorable_Profit6044

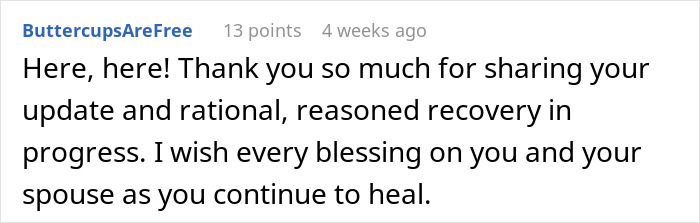

Readers had nothing but positive messages

Poll Question

Thanks! Check out the results:

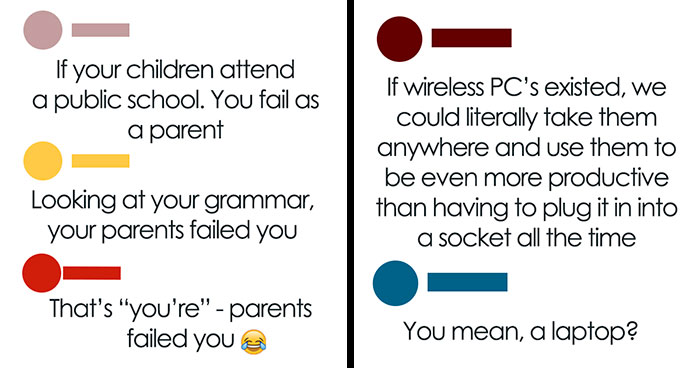

Wow. OP was far more generous than I would have been in that situation. I hate to be so blunt about it, but being that thick would turn me off to the point I would be wanting out of that relationship. I feel awful for people who fall for money scams, but I wouldn't want to be married to one. If that makes me an AH, then I'm an AH.

LOL, I guess we're all AH's because so far the comments (mine included) agree with you.

Load More Replies...Who invests EVERYTHING in one way? that's like the number one rule of common sense concerning savings.

Yeah, don’t put all your eggs in one basket. Especially a half million eggs.

Load More Replies...Wow. OP was far more generous than I would have been in that situation. I hate to be so blunt about it, but being that thick would turn me off to the point I would be wanting out of that relationship. I feel awful for people who fall for money scams, but I wouldn't want to be married to one. If that makes me an AH, then I'm an AH.

LOL, I guess we're all AH's because so far the comments (mine included) agree with you.

Load More Replies...Who invests EVERYTHING in one way? that's like the number one rule of common sense concerning savings.

Yeah, don’t put all your eggs in one basket. Especially a half million eggs.

Load More Replies...

Dark Mode

Dark Mode

No fees, cancel anytime

No fees, cancel anytime

33

27