“Is That Legal?”: Woman Can’t Believe Her Neighbor With The Same Floor Plan Pays $600 More Than Her In Rent

Rental prices across America have been soaring, with some cities like Austin, Texas, experiencing average hikes of up to 40%, leaving many with a lose-lose decision of either having to find a cheaper place or pay significantly more to remain in their homes.

In a now-viral video, TikToker Callie (@cal_cifer_2.0) explains how she discovered that her neighbor, who had just moved in, was shocked to hear what other tenants are paying—the new renter’s contract has much, much worse conditions. Unfortunately, the story serves as the perfect illustration of the broader context, where so many have to dig deeper and deeper into their pockets just to have a roof over their head.

In this market, finding out you’re getting a bargain on your rent sounds pretty much like winning the lottery

Image credits: Cytonn Photography (not the actual photo)

But when TikToker Callie found out she was paying 46% less than her neighbor living in an apartment with the exact same floor plan, she really felt for the woman

And decided to share the story online

Image credits: Maria Ziegler (not the actual photo)

Image credits: cal_cifer_2.0

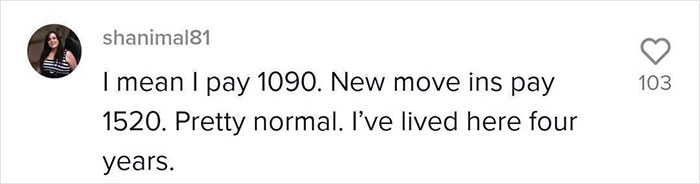

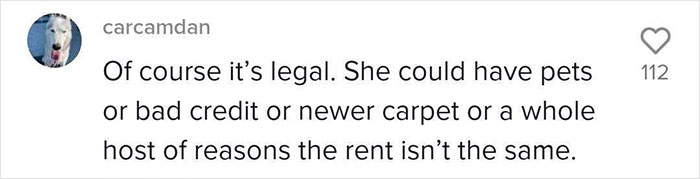

There can be many reasons behind different rates for the same floor plan, including pets, the number of people living on the property, smoking, or, as is in Callie’s case, how long some of the tenants have been there.

For example, if you have a pet, this adds wear and tear so you are likely to pay more.

But if you’ve been there for years, you are likely locked into a cheaper contract. (Landlords sometimes also reward people who sign long-term leases with lower rent.)

The price isn’t based just on cost, and market conditions can drastically alter it. The landlord is balancing several factors, and the bottom line is they want to make as much as they can on their property.

Some aren’t sparing even their existing tenants. “Renters who originally received pandemic pricing are now experiencing steep rent increases at renewal – sometimes upward of 40%,” Allia Mohamed, CEO of openigloo, which allows renters in New York City to review landlords, told CNBC. “I’m amazed this is legal.”

“When it comes to how much a landlord can raise rent, anything flies,” said Robert Pellegrini, president of PK Boston, a real estate and collections law firm with offices in the Greater Boston area. “There are no rules, and it’s totally at their discretion.” Except, of course, if you’re living in a rent-stabilized or rent-controlled apartment, in which case there are strict government provisions in place.

@cal_cifer_2.0 Can they do that?! #badlandlord#rentingproblems#inflation#monopoly#landlordsfromhell♬ original sound – Callie 2.0

Sadly, Callie’s neighbor is just one of many who find themselves in this exact situation. Renters looking for new homes all across the United States are facing dizzying double-digit rent increases. However, you probably wouldn’t get that from the official federal tally of inflation data.

In the last eight months, the rate of change in annual rental costs for new tenants has more than doubled, reaching its highest level on record, according to data from the Bureau of Labor Statistics (BLS) reviewed by The Times. (The data isn’t in the public domain.)

In its latest consumer price index inflation report, BLS said that annual inflation in shelter costs stood at 5.4% in May, which was the highest level since 1991. That figure is a weighted average meant to reflect the rate of inflation affecting new and continuing renters and homeowners alike.

But the non-public numbers show a gulf between the prevailing conditions affecting those who moved residences and those who didn’t. Annual rental costs for new tenants jumped from 4.3% in July 2021 to 11.1% in March 2022. For existing tenants, on the other hand, inflation was lower and grew at a slower pace over the same period, increasing from 1.5% to 2.7%. For residents of owner-occupied units, the trend was similar.

The fact that existing tenants — those who are renewing their leases instead of moving into a new place — pay considerably less might suggest that the cost of housing will continue to climb.

With housing representing both the biggest contributor to core inflation and a lagging indicator, the recent escalation of rents points to overall inflation continuing to rise as well, even as it shows signs of retreating in other sectors.

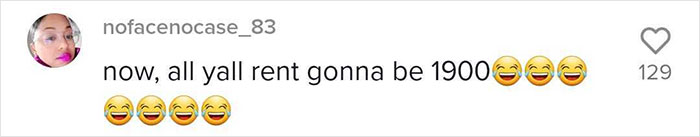

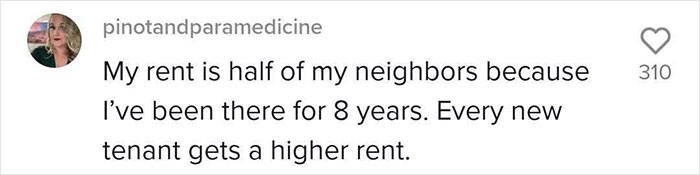

People sided with the woman, criticizing today’s renting market

Some even think you should never disclose your rent

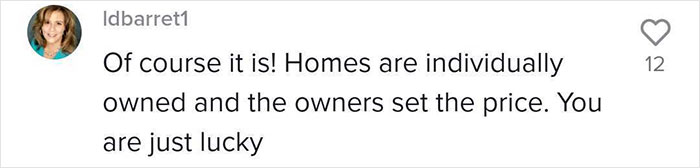

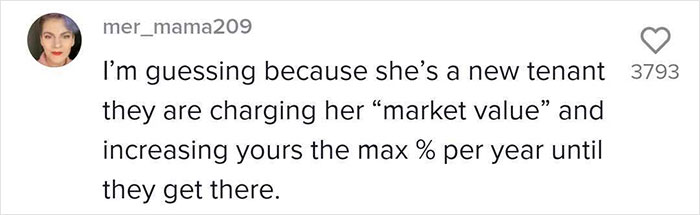

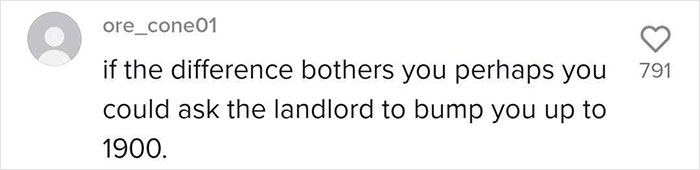

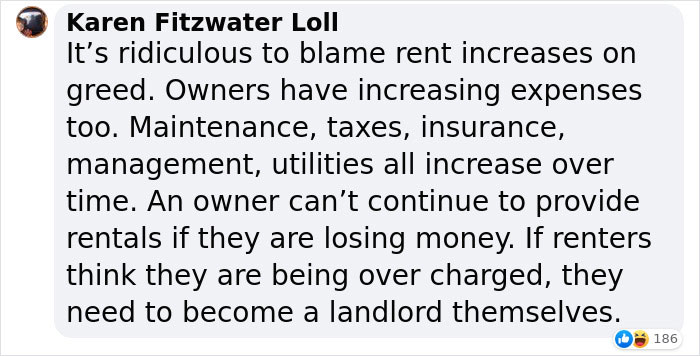

Many also pointed out that while this sounds sad, it’s absolutely legal and landlords have the right to set the price

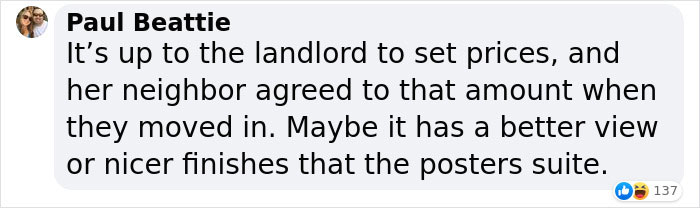

And defended the landlords

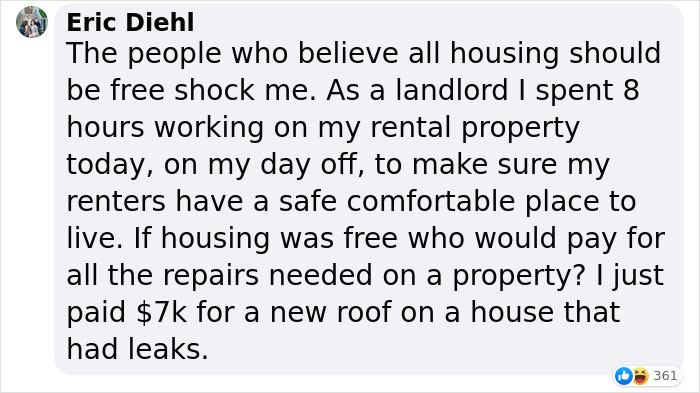

To whom Callie had this response

Image credits: cal_cifer_2.0

She also responded to those saying her neighbor should move out

@cal_cifer_2.0 Reply to @chellbarlet It’s WAY more complicated than that 😳 #rentalmarket#housingcrisis#homelessness#homelessnessawareness#generationalpoverty#cycleofpoverty♬ original sound – Callie 2.0

It really bugs me that we've be taught to not talk about money. We're not allowed to know how much a co-worker makes or how much a neighbour pays in rent, so the people in charge can do unfair things without being called out on!

When i was a low-level manager. Even though it was NOT in my job description, i developed a new system and saved them thousands of dollars. At my two year evaluation I got a big pat on the back, a "you're awesome", a plastic plaque, and a 13 CENT hourly increase. I was instructed not to talk to anyone about my salary. So I made a huge sandwichboard and hung it around my neck. Front and back. "Administration says I'm awesome. I got a plastic plaque. And a 13 CENT raise. So now i make $13.33 an hour. Impressive, right? Management told me I can't *talk* about it. Guess they're as ashamed as I am." MY employees loved it.

Load More Replies..."Her neighbour should move out"... -- Yeah, and find the exact same square footage in a worse location for $200 more than what she's paying now. -- has the poster NOT checked rental postings since she moved in? Her neighbour knew what she would be paying when she moved in. If she wanted it for less, she could have made a counter offer (which likely would have been refused), or kept looking.

Right. It's the housing market. Rent prices are directly effected by real estate prices, unfortunately. Inflation is up. Prices for everything have gone up. It's more expensive to fix things because materials cost more. 40% increase overall is a little much, though. Everybody charges what they can get.

Load More Replies...Rent is out of hand and as another poster said, a house payment is almost always lower than renting a similar space. That didn't used to be true. I find it understandable on one hand and somewhat predatory on the other that people with low credit scores pay more in rent--the very same people who can't get a mortgage or at least an affordable rate because of their low credit score. Talk about catch 22. And off topic but what's the deal with a low credit score meaning higher car insurance premiums? If people don't pay, they get canceled immediately (not like a down time to evict someone) and I've never seen any data proving that being good with money or having a good job makes you a better driver. I don't think there's any correlation between the 2.

Exactly. Shouldn't your driving record have a factor in car insurance premiums? I can understand having to pay a little extra because you have bad credit but not having any credit is nonsense. I stopped using credit cards and now I have no credit so can't get credit. WTF?

Load More Replies...It really bugs me that we've be taught to not talk about money. We're not allowed to know how much a co-worker makes or how much a neighbour pays in rent, so the people in charge can do unfair things without being called out on!

When i was a low-level manager. Even though it was NOT in my job description, i developed a new system and saved them thousands of dollars. At my two year evaluation I got a big pat on the back, a "you're awesome", a plastic plaque, and a 13 CENT hourly increase. I was instructed not to talk to anyone about my salary. So I made a huge sandwichboard and hung it around my neck. Front and back. "Administration says I'm awesome. I got a plastic plaque. And a 13 CENT raise. So now i make $13.33 an hour. Impressive, right? Management told me I can't *talk* about it. Guess they're as ashamed as I am." MY employees loved it.

Load More Replies..."Her neighbour should move out"... -- Yeah, and find the exact same square footage in a worse location for $200 more than what she's paying now. -- has the poster NOT checked rental postings since she moved in? Her neighbour knew what she would be paying when she moved in. If she wanted it for less, she could have made a counter offer (which likely would have been refused), or kept looking.

Right. It's the housing market. Rent prices are directly effected by real estate prices, unfortunately. Inflation is up. Prices for everything have gone up. It's more expensive to fix things because materials cost more. 40% increase overall is a little much, though. Everybody charges what they can get.

Load More Replies...Rent is out of hand and as another poster said, a house payment is almost always lower than renting a similar space. That didn't used to be true. I find it understandable on one hand and somewhat predatory on the other that people with low credit scores pay more in rent--the very same people who can't get a mortgage or at least an affordable rate because of their low credit score. Talk about catch 22. And off topic but what's the deal with a low credit score meaning higher car insurance premiums? If people don't pay, they get canceled immediately (not like a down time to evict someone) and I've never seen any data proving that being good with money or having a good job makes you a better driver. I don't think there's any correlation between the 2.

Exactly. Shouldn't your driving record have a factor in car insurance premiums? I can understand having to pay a little extra because you have bad credit but not having any credit is nonsense. I stopped using credit cards and now I have no credit so can't get credit. WTF?

Load More Replies...

Dark Mode

Dark Mode

No fees, cancel anytime

No fees, cancel anytime

39

119