Daughter Refuses To Sacrifice Home For Mother’s $37K Debt, Mom Won’t Take No For An Answer

Although one should never feel entitled to inherit, a parent’s inheritance could be a foundation for the future, a final gift to help you get a little ahead in life. It’s the last thing they can do to protect you. You never imagine you’ll have to spend your adult life protecting that gift from your other parent.

It’s a bizarre role reversal where the child becomes the responsible adult and the parent becomes the one needing a bailout. For one woman the dreaded inheritance battle became a fight to save the only thing her father left her from the mountain of debt her mother created.

More info: Reddit

A child should never have to be the parent, but sometimes, life forces a role reversal

Image credits: freepik / Freepik (not the actual photo)

After her father passed away, a woman watched her mother sink their inheritance into a failing business

Image credits: seventyfour / Freepik (not the actual photo)

From the age of 17, she worked to pay the bills while her mother accumulated over $37,000 in debt

Image credits: wirestock / Freepik (not the actual photo)

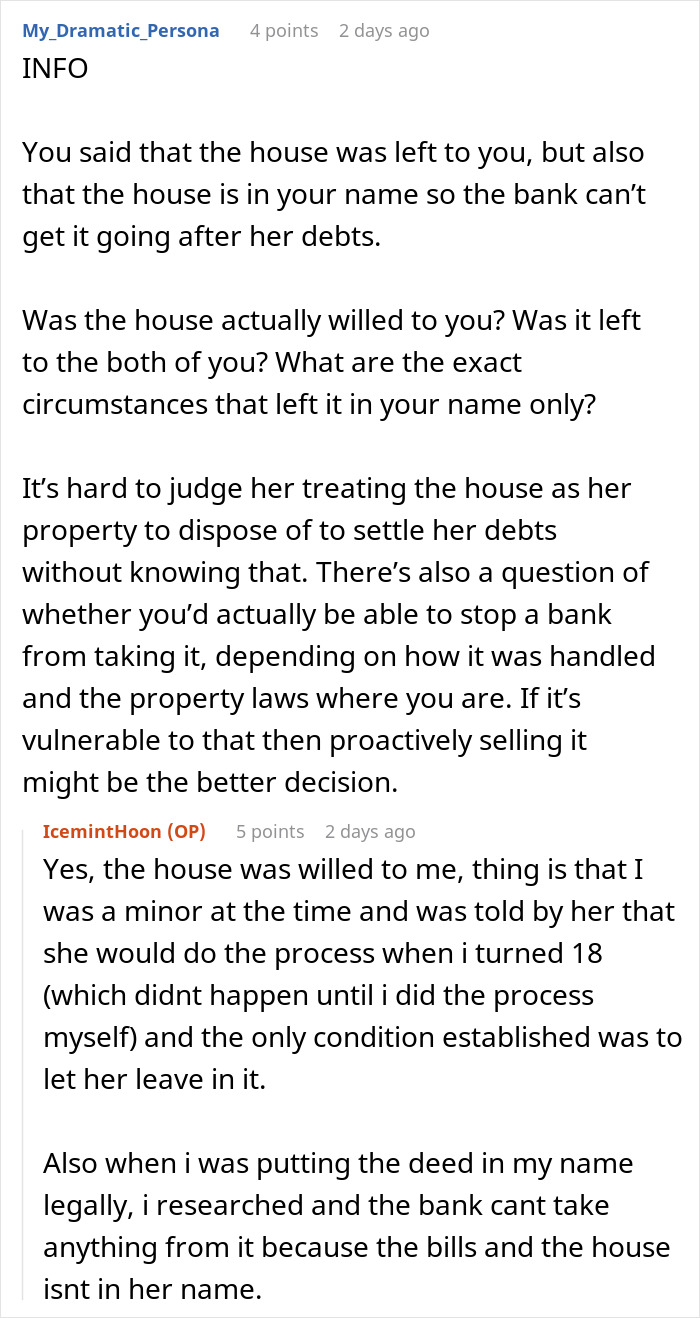

But the mother demanded that she sell the house to pay for it all, despite it being the only thing her father left her

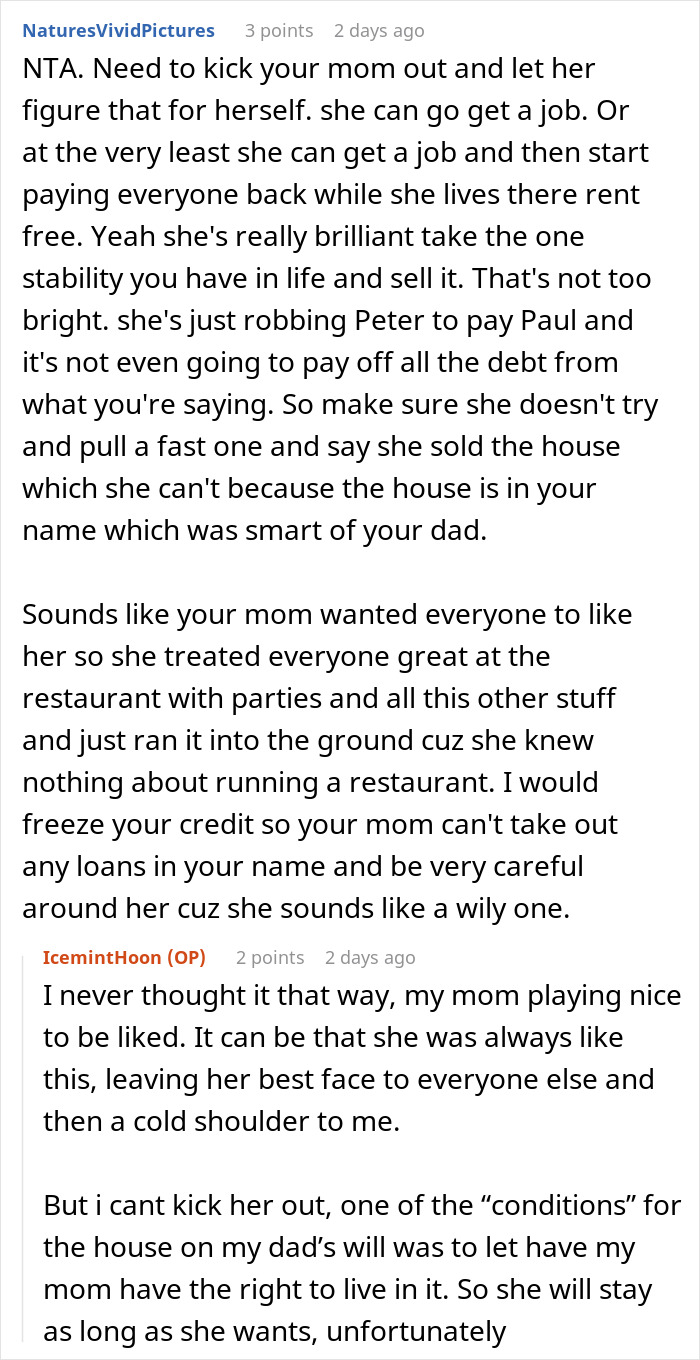

Image credits: IcemintHoon

The daughter refused, choosing to protect her home and the last piece of her father’s legacy instead

This is a story of a daughter who was forced to become the responsible adult far too young. After her father succumbed to cancer, her mother, jobless, took his life savings and invested it in a restaurant. The business was a slow-motion disaster, a money pit that the daughter was forced to support from the age of 17, working to pay for college and the household bills while her mom spent the tiny profit on staff parties.

For years, the daughter begged her mom to close the failing business. She watched her mother rack up “tons of credit cards and loans,” get robbed, and have employees steal from her, all while refusing to listen. The financial black hole grew, even consuming a $5,000 loan from her own sister. The daughter was even roped into covering shifts at the failing restaurant on top of her own job.

The restaurant finally closed, but not before accumulating a staggering $37,000 in debt. Now, the mother has a new “amazing idea” to solve her financial crisis: sell the house. The only problem? The house doesn’t belong to her. Her late husband left it to their daughter, a legal move made specifically to protect it from being seized by the banks.

The mother, citing a cultural expectation that children pay their parents’ debts, has launched a campaign of emotional blackmail, asking her daughter, “how would you feel if she ended up being locked up?” She’s even started bringing potential buyers to the house against her daughter’s wishes. The daughter is caught in a battle to protect the very last piece of her father’s legacy, confused about what to do next.

Image credits: benzoix / Freepik (not the actual photo)

The mother’s expectation from her daughter, and framing it as a cultural norm, is part of a growing and often stressful trend. A study by Aegon found that the “Bank of Mom and Dad” is beginning to flip, with an increasing number of adult children now financially supporting their parents. While this can be a positive and supportive arrangement, in this case, it is being used as a tool of emotional manipulation.

The mother’s actions, from the years of financial neglect to the current pressure campaign, represent a significant financial transgression. According to experts in financial literacy from Syracuse University, this kind of behavior is a serious violation of parental trust. Instead of asking for help, the mom is demanding that her daughter abandon her own financial stability to pay for a decade of her own poor decisions.

Her refusal to sell the house is far from being “petty.” The house, which is legally in her name, is her only remaining asset from her father and her only source of stability. Her decision to protect this asset from her mother’s creditors is a rational financial choice and a powerful boundary-setting moment. She is finally breaking a cycle of financial irresponsibility and refusing to allow her mother’s mistakes to dictate her future.

Do you think she is making the right move? Share your thoughts in the comments!

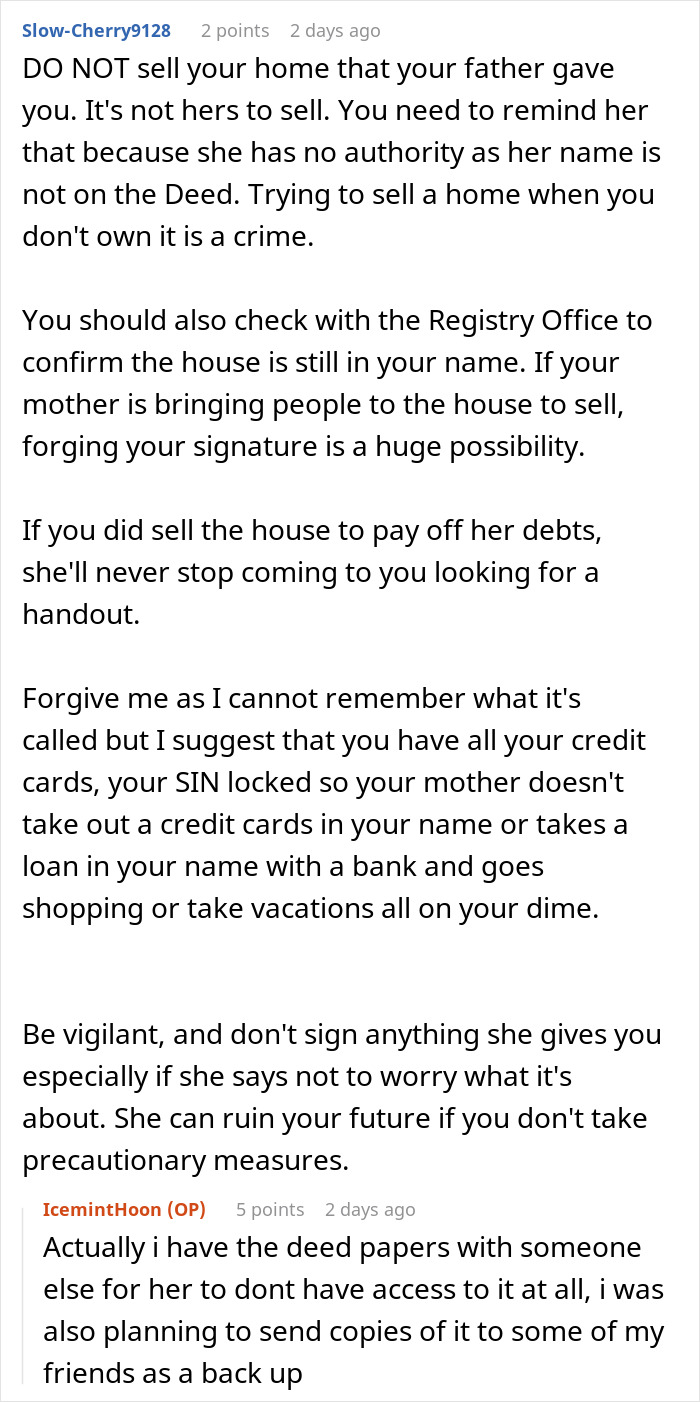

The internet unanimously supported her, declaring her mother’s debt was not her responsibility

Poll Question

Thanks! Check out the results:

I agree with the person who pointed out dear mother will forever be begging for money if the house is sold. She put all that responsibility on a child, instead of herself.

That was my mother and sister. My brother dug them out of a hole, including a massive hole in the lounge floor, moved them into nice house, my uncle got my sister a job. And yet they chose to be poor still even though at one point there were 3 sources of income. My sister blew through jobs because apparently they were beneath her. And she is racist. They tried all sorts of s**t to get money out of my brother and uncle. Uncle cut them off first. My brother got burned one too many times. We have no idea what is going on now my mother has died because we are all NC. Incidentally my uncle died less than 48 hours before my mother in 2024 so now they really are isolated. Not our problem any more. Sorry for trauma dump.

Load More Replies...Because I have horrible vindictive relatives myself, my first thought was that OP's mom might try to harm or "get rid of" OP's cats if OP keeps refusing to sell the house/pay off Mom's debts. :(

I wish you hadn't brought that up. Now I need an update, because I am scared for her and the fur babies

Load More Replies...I agree with the person who pointed out dear mother will forever be begging for money if the house is sold. She put all that responsibility on a child, instead of herself.

That was my mother and sister. My brother dug them out of a hole, including a massive hole in the lounge floor, moved them into nice house, my uncle got my sister a job. And yet they chose to be poor still even though at one point there were 3 sources of income. My sister blew through jobs because apparently they were beneath her. And she is racist. They tried all sorts of s**t to get money out of my brother and uncle. Uncle cut them off first. My brother got burned one too many times. We have no idea what is going on now my mother has died because we are all NC. Incidentally my uncle died less than 48 hours before my mother in 2024 so now they really are isolated. Not our problem any more. Sorry for trauma dump.

Load More Replies...Because I have horrible vindictive relatives myself, my first thought was that OP's mom might try to harm or "get rid of" OP's cats if OP keeps refusing to sell the house/pay off Mom's debts. :(

I wish you hadn't brought that up. Now I need an update, because I am scared for her and the fur babies

Load More Replies...

Dark Mode

Dark Mode

No fees, cancel anytime

No fees, cancel anytime

33

9